According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $250

- WebTrader

- MetaTrader4

- Mobile application

- Sirix

- FSCA

- FSA (Seychelles)

- 2011

Our Evaluation of CMTrading

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

CMTrading is a moderate-risk broker with the TU Overall Score of 5.94 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by CMTrading clients on our website, Traders Union expert Anton Kharitonov recommends users to thoroughly analyze pros and cons before opening an account with this broker as not all clients are satisfied with the company, according to reviews.

The broker CM Trading offers acceptable trading conditions for active traders with different trading experiences. There are no investment instruments.

Brief Look at CMTrading

The CM Trading broker has been providing financial services in the international Forex market since 2012. The company is focused on working with active traders and provides optimal trading conditions. CM Trading allows advisors, provides a vast array of instruments for market analysis, and its seasoned professionals always have your back. CM Trading is regulated by the FSCA 38782 (Financial Sector Conduct Authority of South Africa) and the FSA SD070 (Financial Services Authority of Seychelles).

The broker's portfolio of trading instruments includes currency pairs, cryptocurrencies, indices, and CFDs. There are few assets for long-term investments in the company, so the broker offers investors another way to get passive income. It can be done using the services of trade copying agencies or apps.

We've identified your country as

US

We have thoroughly analyzed all companies legally providing trading services in your country and created a ranking of the best ones. Our analysis highlights companies that offer optimal working conditions, uphold a strong reputation, and consistently receive the highest number of positive reviews from traders on our website.

Explore the 5 top-rated companies in

US :

- A vast array of trading accounts, including ECN accounts and an Islamic account.

- The presence of a service for copying transactions, which allows you to receive passive income.

- Tons of training materials and instruments for market analysis.

- Segregated accounts are used to store clients’ funds and the broker does not have access to them.

- For trading, you can use built-in advisors or those offered by the MT4 platform.

- Fast registration procedure on the site.

- Demo account availability.

- The minimum deposit amount is 250 EUR or USD, which is not always a top-tier option for beginners.

- Trading accounts can be opened in only two currencies: euros or US dollars.

- The broker offers a small number of payment systems for deposits and withdrawals.

TU Expert Advice

Financial expert and analyst at Traders Union

The CM Trading broker is under the supervision of two regulatory bodies, FSCA and FSA (Seychelles), which ensure its reliability for users. Client funds are also protected and held in segregated accounts. Thus, only the trader has access to his money, and he can only use it for trading. The management of the brokerage company has no right to dispose of this capital. Traders have no protection from compensation funds.

In CMTrading, four types of accounts are available to a trader. Trading conditions on each type of account change from the required minimum to the maximum configuration, which includes a personal assistant, additional analysis tools, etc. Each of the accounts can be transferred to ECN status, for this it is enough to contact a personal consultant or write to the broker by mail.

For users who profess Islam, there are Islamic accounts created under Sharia law.

The main page of the site contains all the information a trader needs to know about trading, including trading assets and platforms, instruments for market analysis, copy service, an affiliate program, a description of trading accounts, and answers to frequently asked questions (FAQs). There is no information on non-trading commissions on the site.

- You are looking for a broker that offers a wide range of trading accounts, including ECN accounts and an Islamic account to cater to different trading preferences.

- The presence of a service for copying transactions appeals to you, providing an opportunity for passive income through copy trading.

- You prioritize a lower minimum deposit, as the minimum deposit amount of 250 EUR or USD may not be a top-tier option for beginners.

- You prefer more flexibility in choosing account currencies. This could be a limitation as trading accounts with this broker can be opened only in two currencies (euros or US dollars).

- Regulatory oversight from established authorities like the FSA or SEC is crucial for you. CMTrading might not be suitable as it may lack such top-tier regulation.

CMTrading Trading Conditions

Your capital is at risk. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. A high percentage of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

| 💻 Trading platform: | MetaTrader 4, Sirix, mobile applications for Android and iOS, Web version for trading from a browser |

|---|---|

| 📊 Accounts: | Bronze Account, Silver Account, Gold Account, Premium Account, ECN Accounts, Islamic Account |

| 💰 Account currency: | USD, EUR |

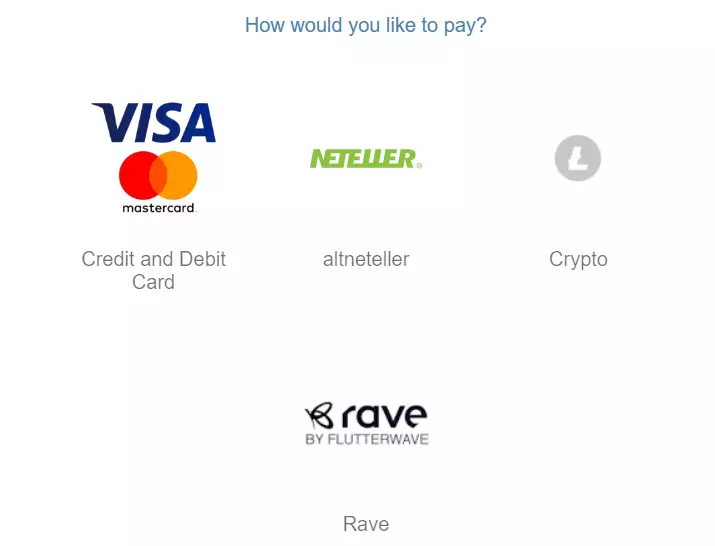

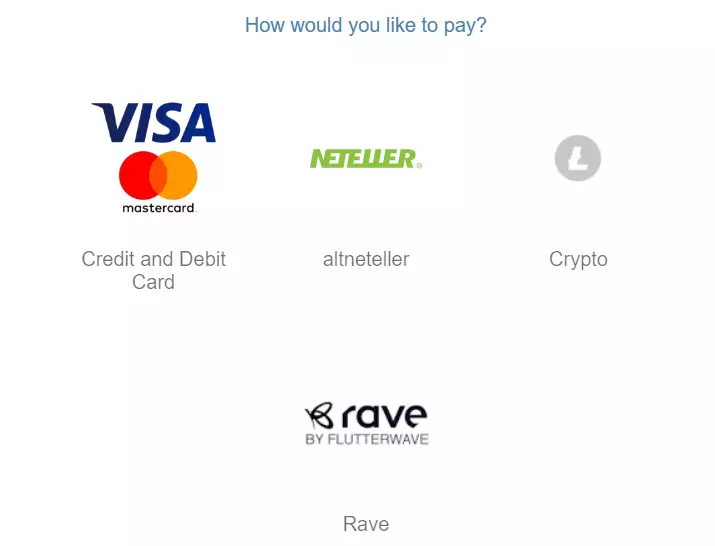

| 💵 Deposit / Withdrawal: | Credit or Debit Card, Wire Transfer, Neteller, M-pesa, Online Naira |

| 🚀 Minimum deposit: | 250 USD, EUR |

| ⚖️ Leverage: | 1:200 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.1 lot |

| 💱 EUR/USD spread: | 0,1 pips |

| 🔧 Instruments: | Currency pairs, indices, cryptocurrencies, commodities, CFDs |

| 💹 Margin Call / Stop Out: | From 20% |

| 🏛 Liquidity provider: | No |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Order execution: | Market execution (for ECN accounts) |

| ⭐ Trading features: | There is a service for copying transactions; and trading CFDs |

| 🎁 Contests and bonuses: | No |

For Forex trading, the broker allows clients to choose a convenient type of trading account and trading platform, including the standard MetaTrader 4 with pre-installed advisors. For novice traders or investors, there is a service for copying transactions called CopyKat. Among the available assets are cryptocurrencies, indices, and Forex instruments. The maximum leverage is 1:200, the minimum deposit is 250 EUR or USD. The margin-call level depends on the type of account.

CMTrading Key Parameters Evaluation

Video Review of CMTrading

Share your experience

- Best

- Last

- Oldest

Trading Account Opening

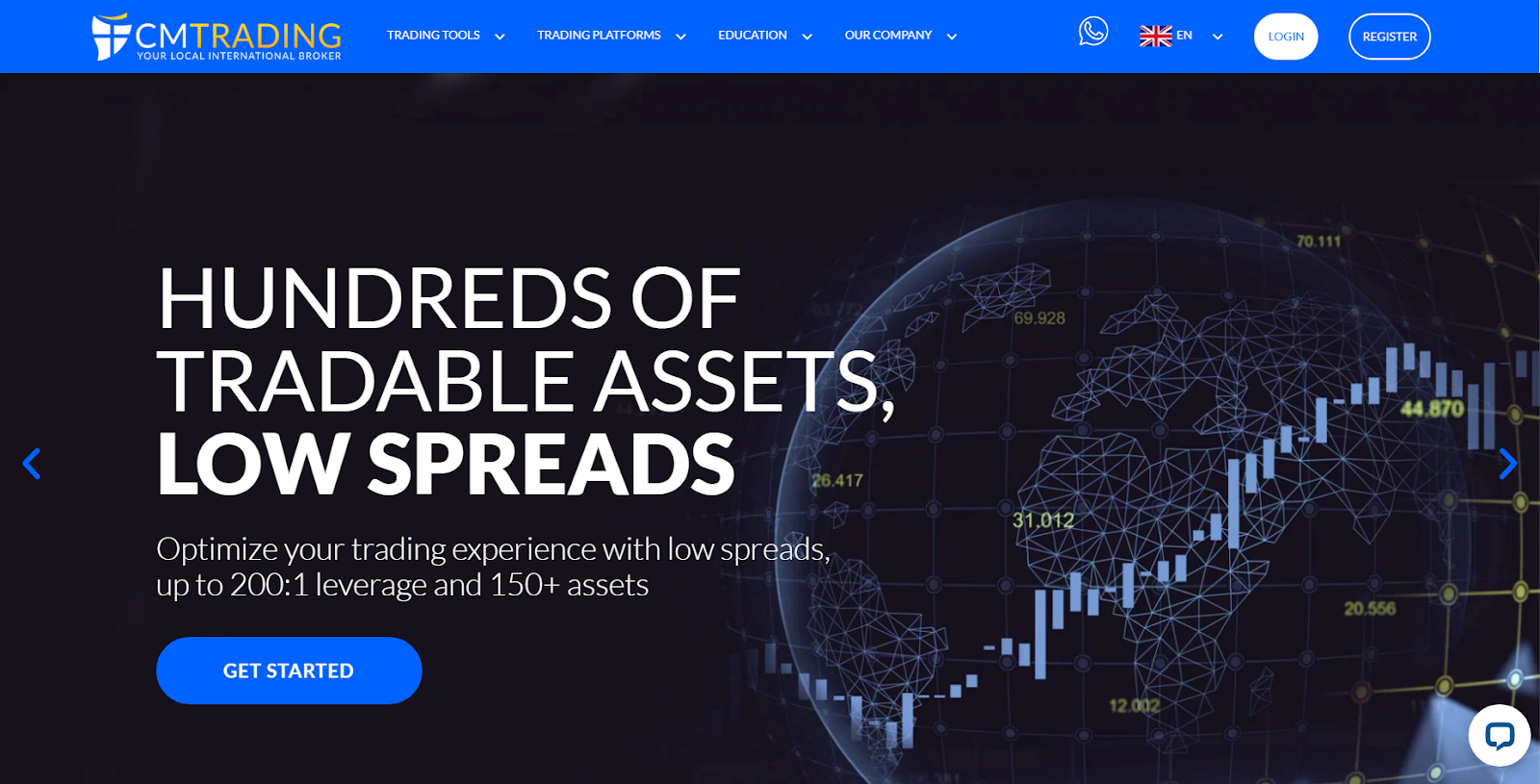

Opening a trading account with CMTrading does not take much time and takes place in three simple steps:

Open the broker's official website. There are two buttons in the upper right corner: "LOGIN" and "REGISTER".

Fill out the form with personal data. Enter your first name, last name, date of birth, email, password, and country of residence. Also select the type of account, either for personal use or corporate use.

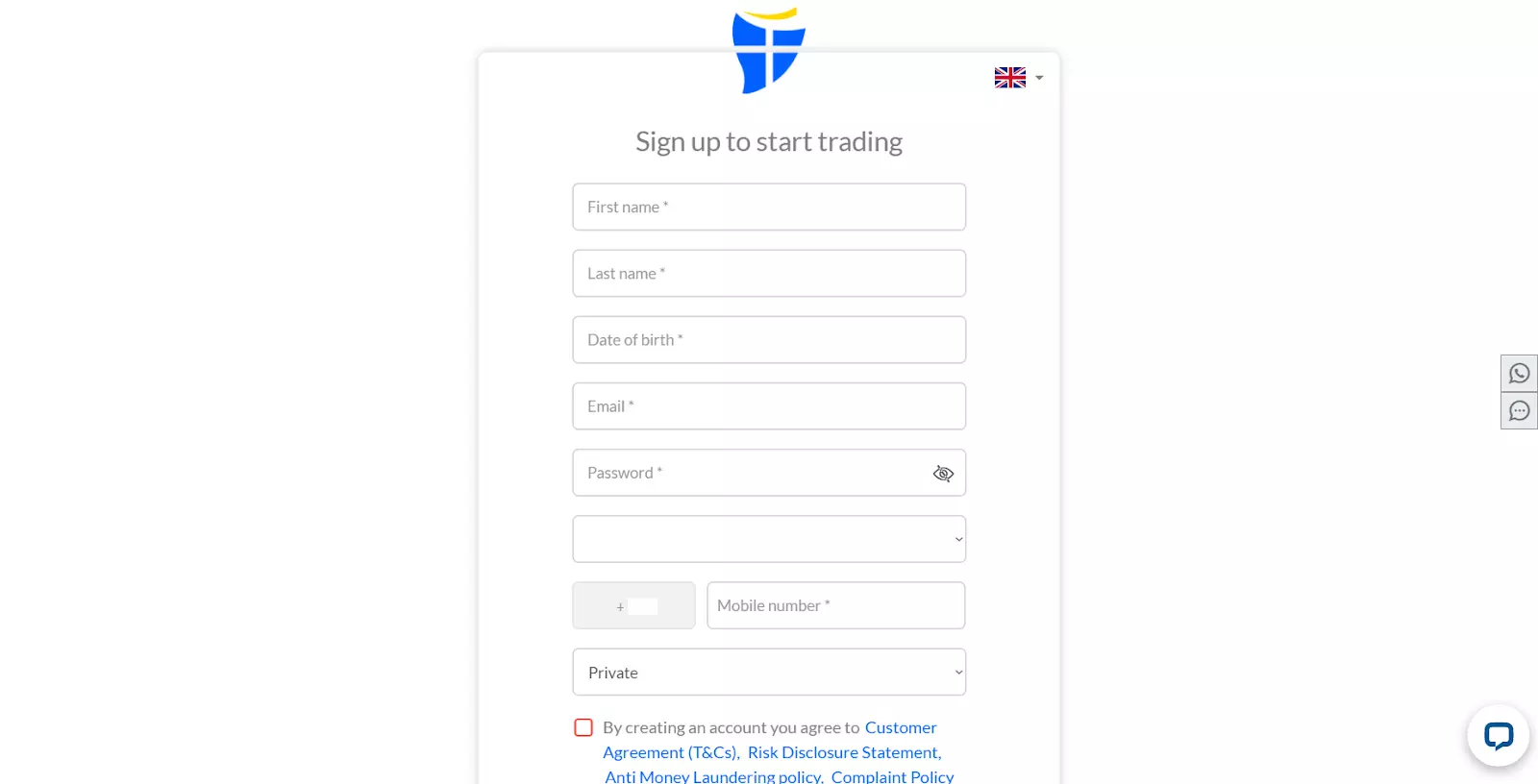

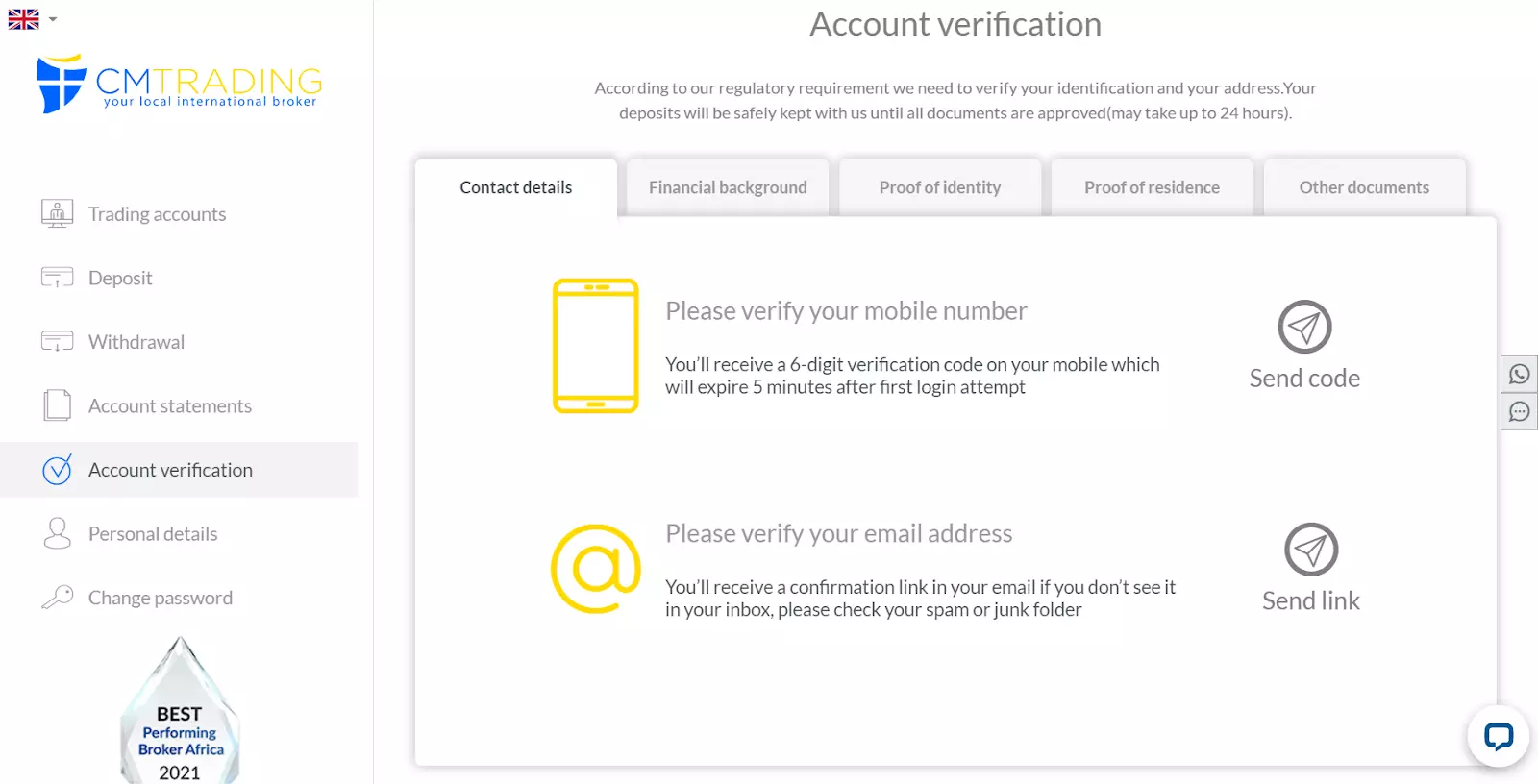

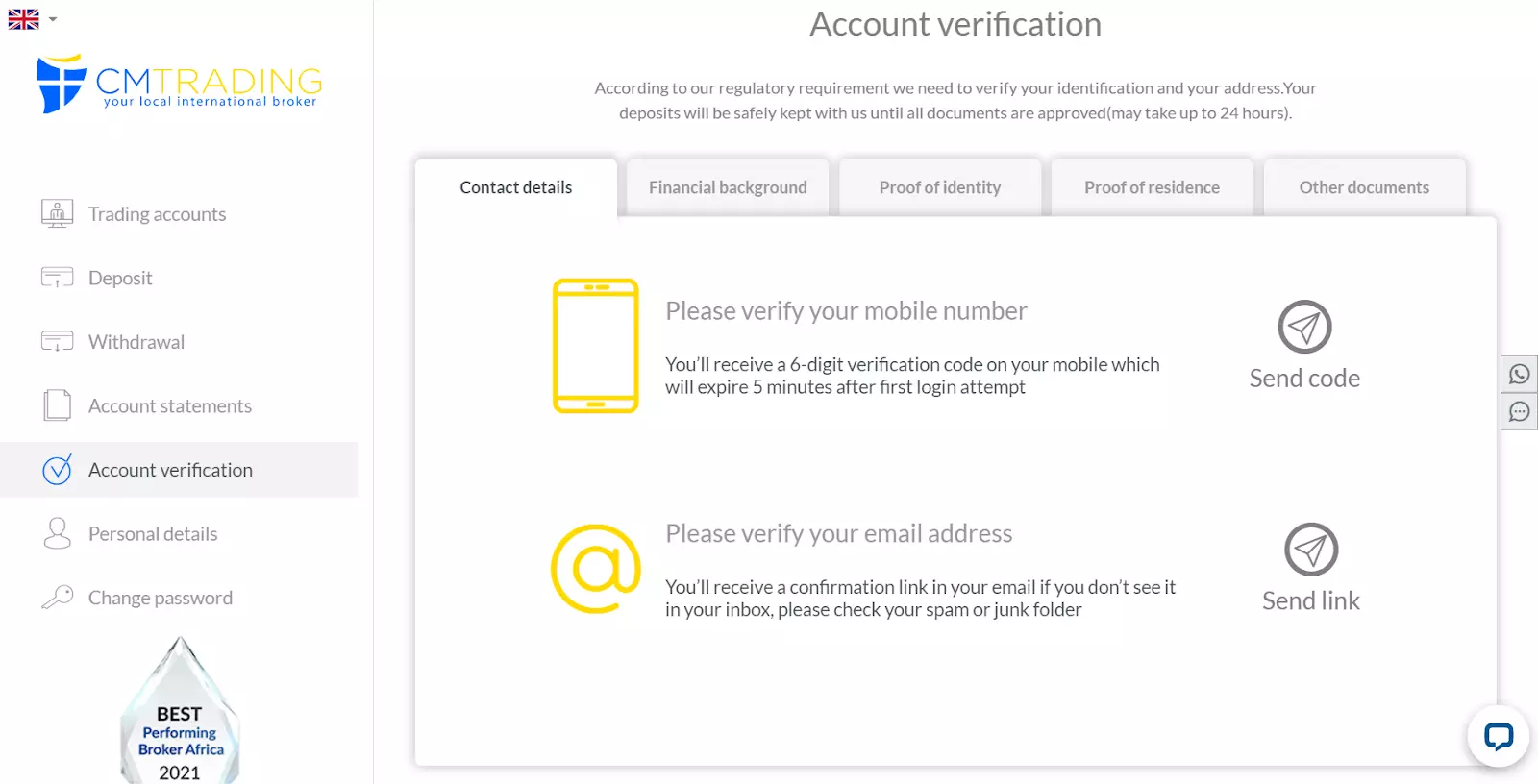

After filling out a short questionnaire, you will be taken to your personal account, where you can already expand your personal information and go through the mandatory procedures. Then you will have to replenish your deposit and verify your account before starting to trade.

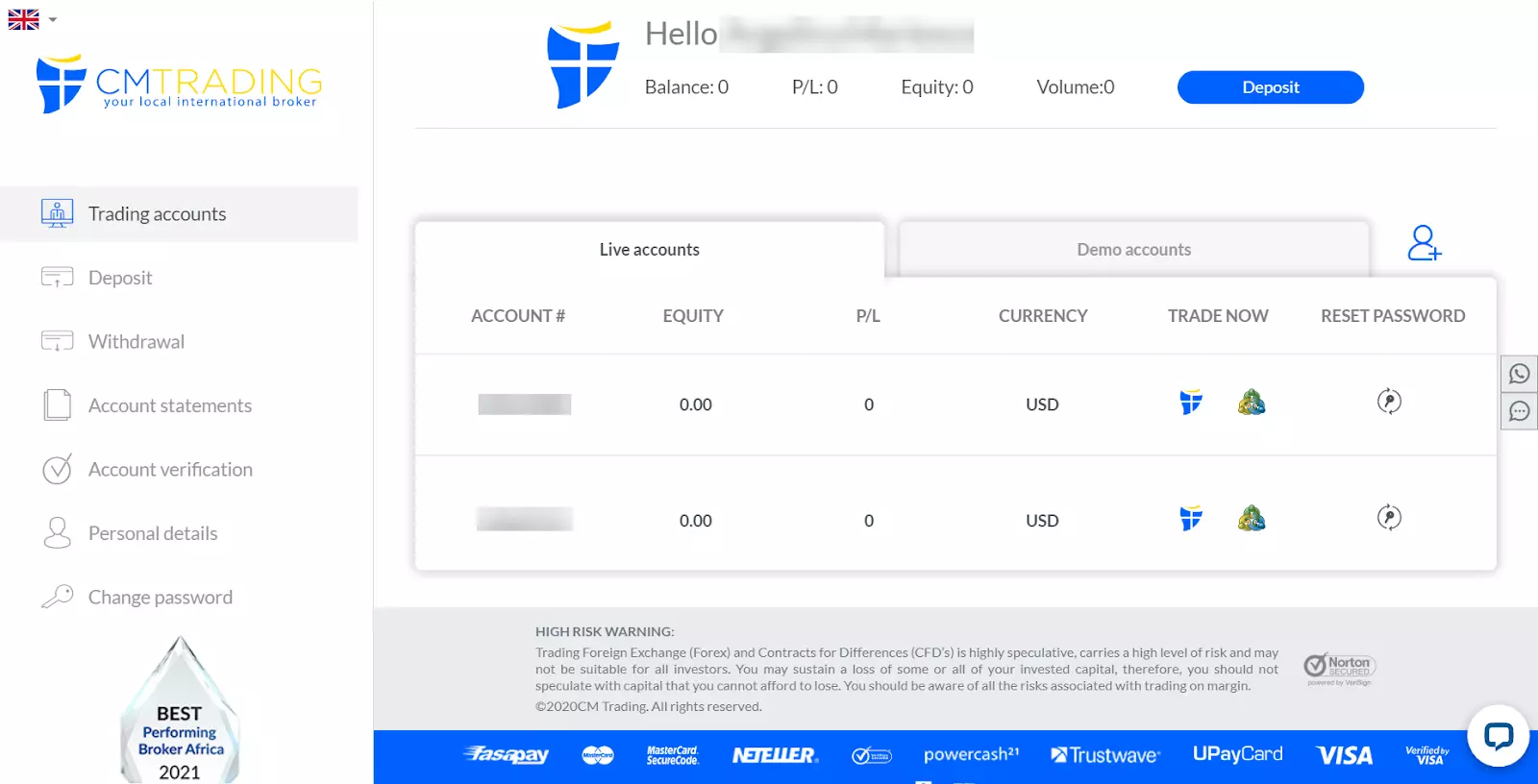

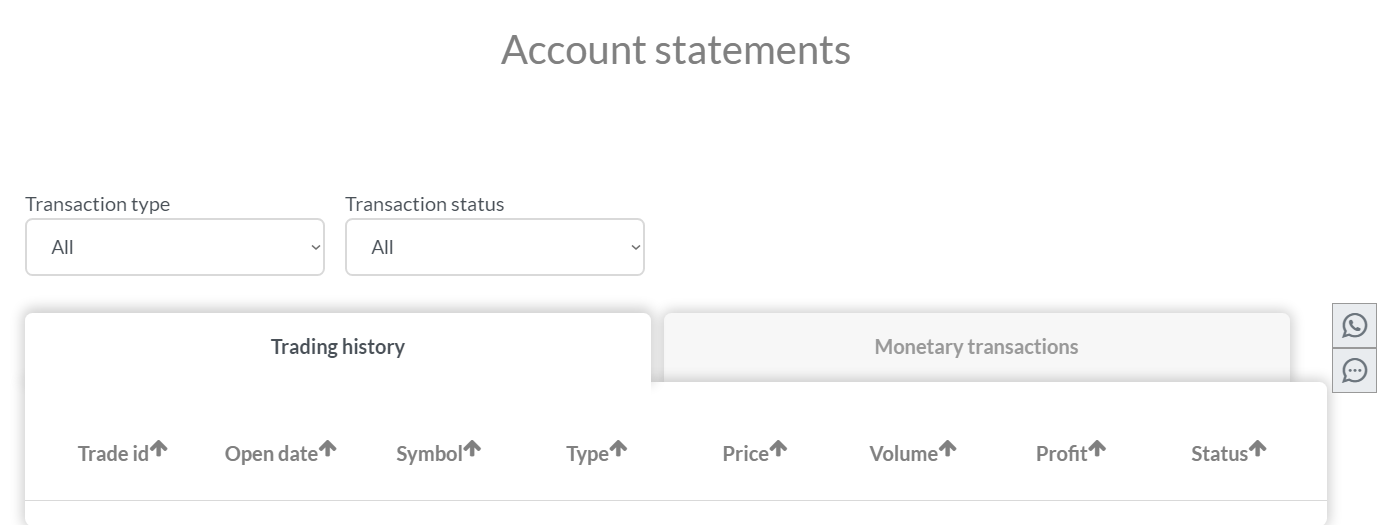

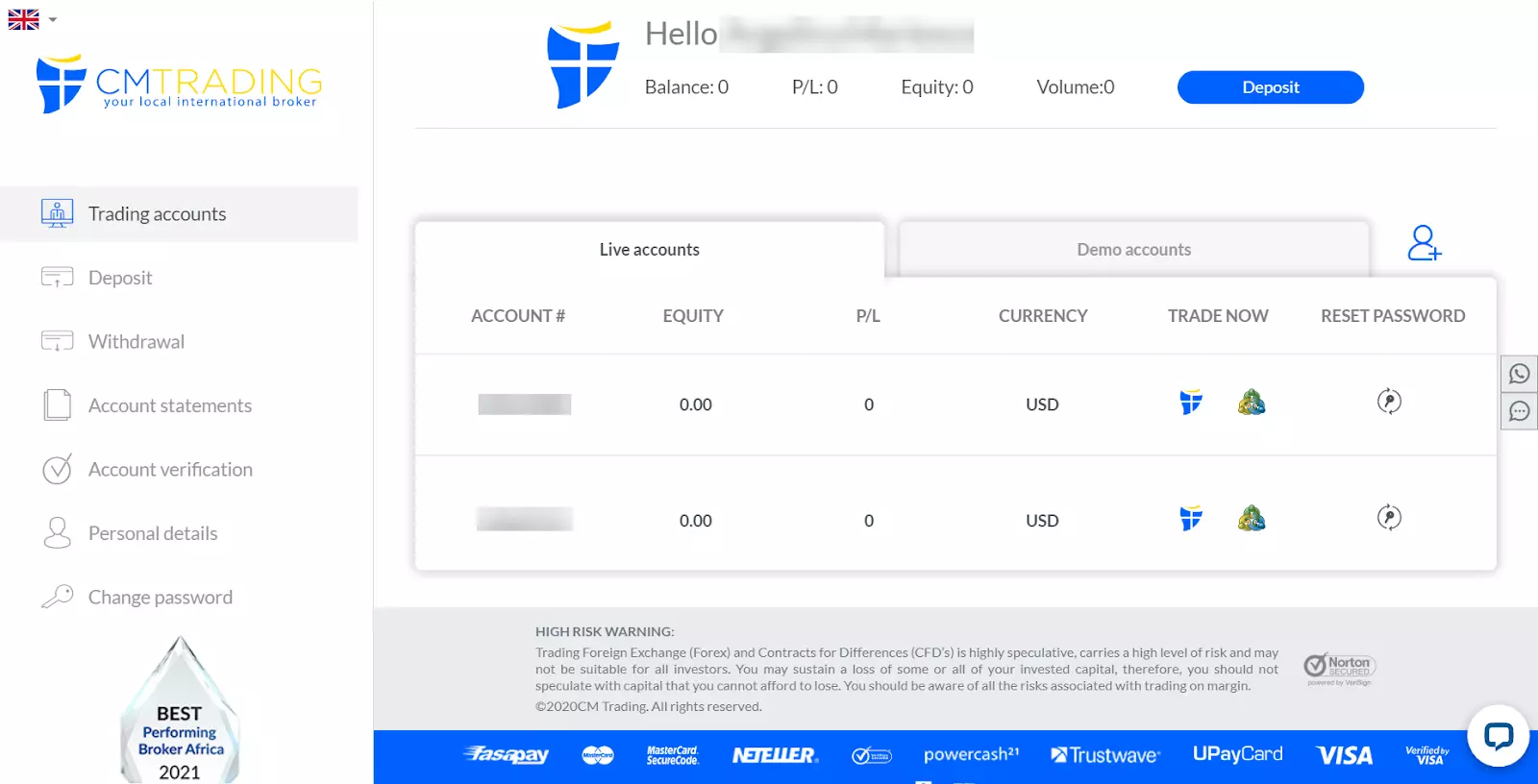

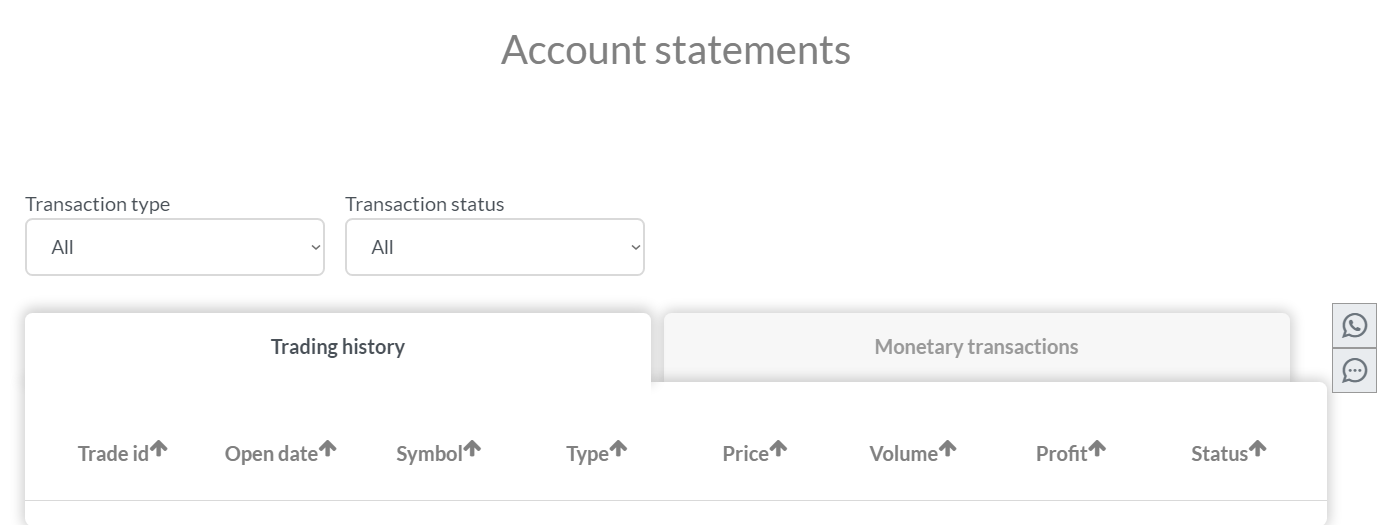

The following functions are available to the trader in the personal account:

Regulation and safety

CMTrading has a safety score of 7/10, which corresponds to a Medium security level. The safest brokers are those with Tier-1 regulation, a long history (over 10 years in the market), and participation in investor compensation schemes.

- Is regulated

- Negative balance protection

- Track record over 14 years

- Not tier-1 regulated

CMTrading Regulators and Investor Protection

| Abbreviation | Full Name | Country of regulation | Investor Protection Fund | Regulation Level |

|---|---|---|---|---|

MFSA MFSA |

Malta Financial Services Authority | Malta | Up to €20,000 | Tier-2 |

FSA (Seychelles) FSA (Seychelles) |

Financial Services Authority of Seychelles | Seychelles | No specific fund | Tier-3 |

CMTrading Security Factors

| Foundation date | 2011 |

| Negative balance protection | Yes |

| Verification (KYC) | Yes |

Commissions and fees

The trading and non-trading commissions of broker CMTrading have been analyzed and rated as Low with a fees score of 8/10. Additionally, these commissions were compared with those of the top two competitors, Pepperstone and OANDA, to provide the most comprehensive information.

- Low Forex trading fees

- Tight EUR/USD market spread

- No deposit fee

- Inactivity fee applies

- Withdrawal fee applies

Trading Fees and Spread

Below, we evaluated and compared the trading commissions of CMTrading with those of two competitors. We focused on the spreads and other transaction fees directly associated with executing trades (e.g commission per lot on an ECN account). This comparison aimed to provide a clear understanding of the cost efficiency of each broker.

Standard Account Spread

For Standard accounts, CMTrading’s commissions are part of the floating spread, which varies with market conditions. Typical values are provided, but during high volatility, the spread may exceed these.

CMTrading Standard spreads

| CMTrading | Pepperstone | OANDA | |

| EUR/USD min, pips | 0,5 | 0,5 | 0,1 |

| EUR/USD max, pips | 0,8 | 1,5 | 0,5 |

| GPB/USD min, pips | 0,7 | 0,4 | 0,1 |

| GPB/USD max, pips | 1,0 | 1,4 | 0,5 |

RAW/ECN Account Commission And Spread

The spread on ECN/RAW accounts is market-based and fluctuates, with average values given during active hours. It may vary during volatility spikes. A commission per lot is also charged.

CMTrading RAW/ECN spreads

| CMTrading | Pepperstone | OANDA | |

| Commission ($ per lot) | 2,5 | 3 | 3,5 |

| EUR/USD avg spread | 0,1 | 0,1 | 0,15 |

| GBP/USD avg spread | 0,1 | 0,15 | 0,2 |

Non-Trading Fees

We conducted a detailed analysis of the non-trading fees associated with CMTrading. This review offers a comprehensive overview of the additional costs that may impact traders beyond regular trading activities.

CMTrading Non-Trading Fees

| CMTrading | Pepperstone | OANDA | |

| Deposit fee, % | 0 | 0 | 0 |

| Withdrawal fee, % | 0 | 0 | |

| Withdrawal fee, USD | 0 | 0-15 | |

| Inactivity fee ($, per month) | 15 | 0 | 0 |

Account types

The first step to making money on trading and trading in CMTrading is opening a trading account.

Account types:

Users who profess Islam can open Islamic accounts with special conditions for fees and swaps. To open an Islamic or ECN account, contact your personal manager.

You can also check the trading conditions in CM Trading on demo (training) accounts, the conditions on which fully correspond to the conditions on real trading accounts.

Deposit and withdrawal

CMTrading received a Medium score for the efficiency and convenience of its deposit and withdrawal processes.

CMTrading provides a reasonable range of deposit and withdrawal options with moderate fees, in line with industry standards.

- Minimum deposit below industry average

- BTC available as a base account currency

- Supports 5+ base account currencies

- Bank wire transfers available

- Limited deposit and withdrawal flexibility, leading to higher costs

- PayPal not supported

- Wise not supported

What are CMTrading deposit and withdrawal options?

CMTrading provides a basic range of deposit and withdrawal options, covering essential methods in line with industry standards. This set of options is sufficient for most traders, with available methods Bank Card, Bank Wire, Skrill, Neteller, BTC, USDT, Ethereum.

CMTrading Deposit and Withdrawal Methods vs Competitors

| CMTrading | Plus500 | Pepperstone | |

| Bank Wire | Yes | Yes | Yes |

| Bank card | Yes | Yes | Yes |

| PayPal | No | Yes | Yes |

| Wise | No | No | No |

| BTC | Yes | No | No |

What are CMTrading base account currencies?

A wide range of base account currencies minimizes the need for currency conversion, potentially reducing transaction costs for clients worldwide. CMTrading supports the following base account currencies:

What are CMTrading's minimum deposit and withdrawal amounts?

The minimum deposit on CMTrading is $100, while the minimum withdrawal amount is $20. These minimums may vary depending on the chosen account type and payment method. For specific details, please contact CMTrading’s support team.

Markets and tradable assets

CMTrading offers a limited selection of trading assets compared to the market average. The platform supports 150 assets in total, including 70 Forex pairs.

- Crypto trading

- 70 supported currency pairs

- Indices trading

- Futures not available

- Limited asset selection

Supported markets vs top competitors

We have compared the range of assets and markets supported by CMTrading with its competitors, making it easier for you to find the perfect fit.

| CMTrading | Plus500 | Pepperstone | |

| Currency pairs | 70 | 60 | 90 |

| Total tradable assets | 150 | 2800 | 1200 |

| Stocks | Yes | Yes | Yes |

| Commodity futures | Yes | Yes | Yes |

| Crypto | Yes | Yes | Yes |

| Stock indices | Yes | Yes | Yes |

| Options | No | Yes | No |

Investment options

We also explored the trading assets and products CMTrading offers for beginner traders and investors who prefer not to engage in active trading.

| CMTrading | Plus500 | Pepperstone | |

| Bonds | Yes | No | No |

| ETFs | Yes | Yes | Yes |

| Copy trading | Yes | No | Yes |

| PAMM investing | Yes | No | Yes |

| Managed accounts | No | No | No |

Customer support

If a trader has problems during trading, transactions, or registration, CMTrading offers assistance, but you just need to contact the support staff and describe your problem.

Advantages

- The support service works 24/7

- The broker offers several ways to communicate with traders

- The support service is multilingual

Disadvantages

- The response rate from support specialists could be faster

- No callback function

To contact CMTrading’s support team, use one of the following methods:

-

an email to the apropos department;

-

call to international the phone numbers that are indicated on the website;

-

send a fax message;

-

send a message to the chat on the broker's website.

You don't need to have an open account with the company to get help. The broker is also represented on social networks and messengers, including Facebook, Twitter, Instagram, LinkedIn, YouTube, and WhatsApp.

Contacts

| Foundation date | 2011 |

|---|---|

| Registration address | South Africa, Johannesburg 2196, Sandton, Corner Rivonia Road, and 5th Street. |

| Regulation |

FSCA, FSA (Seychelles)

Licence number: 38782, SD070 |

| Official site | cmtrading.com |

| Contacts |

+44 203 318 2176, +27 10 500 80 26

|

Education

Successful trading is possible only if the trader constantly develops and monitors the markets. Therefore, in addition to optimal trading conditions, the broker CMTrading offers traders training materials.

To test the knowledge gained or a new trading strategy, you can use a demo account. It eliminates financial risks and is used by traders to gain experience. Profit is accrued exclusively for work on real trading accounts.

Comparison of CMTrading with other Brokers

| CMTrading | Eightcap | XM Group | RoboForex | Bybit | Vantage Markets | |

| Trading platform |

MT4 SIRIX | MT4, MT5, TradingView | MT4, MT5, MobileTrading, XM App | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | MetaTrader5 | MT4, MT5, TradingView, ProTrader, Vantage App |

| Min deposit | $250 | $100 | $5 | $10 | No | $50 |

| Leverage |

From 1:200 to 1:400 |

From 1:30 to 1:500 |

From 1:1 to 1:30 |

From 1:1 to 1:2000 |

From 1:1 to 1:500 |

From 1:1 to 1:500 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | 10.00% | No | No |

| Spread | From 1 point | From 0 points | From 0.8 points | From 0 points | From 0 points | From 0 points |

| Level of margin call / stop out |

100% / 20% | 80% / 50% | 100% / 50% | 60% / 40% | No / 50% | 100% / 50% |

| Order Execution | STP | Market Execution | Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution |

| No deposit bonus | $1 | No | No | No | No | No |

| Cent accounts | No | No | No | Yes | No | No |

Detailed Review of CM Trading

The CM Trading company is focused on cooperation with active traders, regardless of their level of professionalism. The broker's values are transparency, reliability, honesty, and innovation. The use of ground-breaking technologies allows them to offer traders not only a high degree of protection but also up-to-the-minute tools for market analysis and more accurate forecasts. In CMTrading, you can trade currency pairs, cryptocurrencies, indices, and CFDs. The broker offers the MetaTrader 4 and Sirix platforms for work. Both platforms are available for PCs and smartphones.

A few figures about the broker CMTrading that will be of interest to traders:

-

1 million clients worldwide trade with CMTrading.

-

250 EUR/USD represents the minimum deposit amount.

-

0.9 pips are the minimum spread size.

-

For more than eight years, the broker has been providing financial services in the international market.

-

there are four main types of trading accounts for clients with different needs.

-

1:200 is the unified leverage for all types of accounts.

CM Trading is the optimal broker for active trading

The broker offers traders several types of accounts, each of which has its own unique characteristics. Also in CMTrading, you can open an ECN account or an Islamic account, the trading conditions of which fully comply with the Sharia requirements.

All account types are available in the demo version, so the client can pre-test them without financial risks. Trading instruments are the same for all accounts, the size of the spread varies depending on the asset the trader uses and the type of account. The spread indicators on ECN accounts are significantly lower than on standard accounts.

CMTrading allows working from almost anywhere in the world as long as you have a smartphone and an internet connection. Trading platforms are presented both in a full-fledged version and in the form of applications. They are also available in the web version: all you need to do is open a browser and trade from it, without the need to install additional software.

Useful services of CM Trading:

-

Technical analysis. This instrument allows you to analyze the market situation using various indicators, including trend lines, support and resistance lines, Bollinger bands, moving averages, etc.

-

Daily market reviews. The broker's YouTube channel publishes daily videos with a daily news digest, in which analysts talk about global market events.

-

Fundamental analysis. With its help, traders can monitor the economic situation in the market and build a strategy based on economic indicators.

-

Economic calendar. Allows you to keep abreast of upcoming events by date, analyze the situation in different markets and make competent predictions.

-

Trading signals. The broker provides its client with free trading signals every day.

-

Social trading. The service makes it possible to observe the trade of other traders, analyze their decisions and learn from their example without the deep study of fundamental analysis.

-

Fibonacci calculator. This tool allows you to identify support and resistance levels on your own, as well as find the most profitable points for entering and exiting the market.

-

Guardian Angel or Smart Communication System. Free service for all traders who have a live account with CMTrading. This plugin gives feedback on the trader's trade and transmits signals about the market situation, market trends, and other useful information.

Advantages:

Registration on the site takes no more than a few minutes.

Vast selection of trading accounts, including ECN accounts and an Islamic account.

The broker allows the use of trading advisors.

The CopyKat service copies transactions of successful traders and allows users to receive passive income.

There are free demo accounts for testing trading conditions.

Traders have access to a range of technical and fundamental analysis tools.

The web version of trading platforms and applications for mobile phones allows trading from anywhere in the world, without being tied to a PC.

Latest CMTrading News

Articles that may help you

Check out our reviews of other companies as well

User Satisfaction i