According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- MT4

- MT5

- WebTrader

- TradingView

- BlackBull Trade

- BlackBull Shares

- FSA

- FMA

- 2014

Our Evaluation of BlackBull Markets

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

BlackBull Markets is a moderate-risk broker with the TU Overall Score of 5.87 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by BlackBull Markets clients on our website, Traders Union expert Anton Kharitonov recommends users to thoroughly analyze pros and cons before opening an account with this broker as not all clients are satisfied with the company, according to reviews.

BlackBull Markets objectively provides favorable trading conditions, including thousands of assets, tight spreads, low trading commissions, moderate leverage, and multiple account options. Key advantages include a low entry threshold (no minimum deposit requirement for the Standard account) and comprehensive education for beginners. Traders can choose from five trading platforms, including Black Bull’s proprietary solution. The broker imposes no restrictions on trading, which allows scalping, hedging, and the use of expert advisors. Passive earning options are also available. Unfortunately, the company has regional limitations, does not offer joint accounts, and the majority of instruments are CFDs (which should be taken into account as a feature, rather than a disadvantage).

Brief Look at BlackBull Markets

BlackBull Markets provides access to the markets of currency pairs and CFDs (contracts for difference). The CFDs are grouped into the following categories: stocks, indices, commodities, agricultural commodities, metals, energies, cryptocurrencies, and futures. In total, there are over 26,000 assets. Apart from the demo account, there are three real accounts: Standard, Prime, and Institutional. They differ in terms of the minimum deposit, spreads, and commissions. The Standard account has no minimum deposit requirements, while the others require $2,000 and $20,000, respectively. Spreads start from 0.8, 0.1, or 0 pips depending on the account. The commissions range from $0, $4, or $6 per lot, depending on the account selected by the trader. The maximum leverage is 1:500. Clients of the company can trade through platforms like MT4, MT5, WebTrader, and TradingView, as well as this broker's solutions such as BlackBull Trade for currency and CFD trading, and BlackBull Shares for copy trading. The company offers partnership opportunities through “Refer a Friend” and its IB (Introducing Broker) programs. The website provides educational materials for traders of different levels and offers analytical tools.

We've identified your country as

US

We have thoroughly analyzed all companies legally providing trading services in your country and created a ranking of the best ones. Our analysis highlights companies that offer optimal working conditions, uphold a strong reputation, and consistently receive the highest number of positive reviews from traders on our website.

Explore the 5 top-rated companies in

US :

- It offers a free demo account and a substantial volume of educational materials.

- Three real account types allow traders to customize their offerings, providing immediate access to the entire pool of currency pairs and CFDs.

- Spreads are below market average, and trading commissions are favorable.

- The broker offers leverage to enhance profitability and provides news and analytics to facilitate traders' forecasting.

- A wide selection of trading platforms allows users to find optimal trading conditions and work comfortably on any device.

- The broker provides three options for its partnership program, along with the “Refer a Friend” promotion and copy trading service for additional earnings.

- Various deposit and withdrawal methods are available, including bank cards, transfers, and international systems like Skrill and Neteller.

- While this broker offers a considerable number of assets, it has only 70 currency pairs, while other trading instruments are represented as CFDs.

- BlackBull Markets does not serve traders from certain regions worldwide.

- The platform does not offer MAM or PAMM joint accounts, and the “Refer a Friend” program may not be the most advantageous, while the IB partnership is primarily aimed at legal entities.

TU Expert Advice

Financial expert and analyst at Traders Union

BlackBull Markets is the trading name of BBG Ltd, founded in Auckland, New Zealand, in 2014. The company is registered in Seychelles and operates under local regulations with a confirmed license. There have been no confirmed instances of non-performance of obligations towards clients, and the platform has never been hacked. It operates transparently within the framework of the applicable legislation.

The broker offers three real accounts, with spreads starting from 0 pips, and there is no trading commission on the Standard account. On accounts where a commission is present, it does not exceed the average market rate. Thus, the trader's costs are average or below average. As for withdrawal fees, BlackBull Markets has fixed fees of 5 units of the base currency, regardless of the withdrawal method. For large transactions, this is an advantage, but it is not advantageous for withdrawing small amounts.

The minimum lot size is 0.01, and the maximum leverage is 1:500. In terms of these indicators, BlackBull Markets is on par with top competitors. Copy trading and partnership programs are available. However, there are no joint accounts, which some traders perceive as a disadvantage. On the other hand, a definite advantage is an opportunity for BlackBull Markets clients to trade through the most popular platforms, including MT4/5, WebTrader, and TradingView. Additionally, this broker offers its proprietary trading platform.

Testing did not reveal any bugs or weaknesses. It appears that the company uses advanced technological solutions, ensuring high speed and reliability by modern standards. This also applies to technical support, which operates without interruptions, even during nights and weekends. Therefore, there are no complaints regarding the client service provided by this broker.

The educational resources are good, the analytics are standard, and there are no unique tools. An important feature of BlackBull Markets is the vast number of assets available for trading. However, almost all of them are contracts for difference (CFDs) based on stocks, indices, cryptocurrencies, metals, commodities, agricultural commodities, energies, and futures. In addition to CFDs, there are 70 currency pairs available.

- You value a wide range of tradable assets. BlackBull Markets offers access to over 17,000 assets, including forex, CFDs on shares, metals, energies, indices, and cryptocurrencies, providing a diverse selection for trading.

- You prefer ECN (Electronic Communication Network) execution. BlackBull Markets primarily operates as an ECN broker, offering direct access to market liquidity and potentially tighter spreads, which can be advantageous for certain trading strategies.

- You require extensive educational materials and hand-holding. BlackBull Markets' educational resources are moderate, and personalized support might be limited. If in-depth educational materials and extensive support are crucial for your trading journey, you might need to explore brokers with more comprehensive educational offerings.

- You prioritize traditional account types. BlackBull Markets primarily offers Standard and ECN accounts, which might not cater to specific needs like IRAs or managed accounts

BlackBull Markets Trading Conditions

Your capital is at risk. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. A high percentage of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

| 💻 Trading platform: | MT4, MT5, WebTrader, TradingView, BlackBull Trade, and BlackBull Shares |

|---|---|

| 📊 Accounts: | Standard, Prime, and Institutional |

| 💰 Account currency: | USD, EUR, GBP, AUD, NZD, SGD, CAD, and JPY |

| 💵 Deposit / Withdrawal: | Bank transfer, Visa, MasterCard, Union Pay, Neteller, Skrill, and FasaPay |

| 🚀 Minimum deposit: | No |

| ⚖️ Leverage: | Up to 1:500 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.01 |

| 💱 EUR/USD spread: | 0,3 pips |

| 🔧 Instruments: | The available instruments are currency pairs, CFDs on stocks, indices, commodities and agricultural commodities, metals, energies, cryptocurrencies, and futures. |

| 💹 Margin Call / Stop Out: | No |

| 🏛 Liquidity provider: | No |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Order execution: | No |

| ⭐ Trading features: | Low entry threshold, several accounts to choose from, all popular platforms plus this broker's trading platform with integrated transaction copying service, and low trading costs |

| 🎁 Contests and bonuses: | Yes, including rebates from TU |

Usually, if a broker offers multiple account types, the minimum deposit depends on the selected account. In this case, the pattern holds: there are no minimum deposit requirements for the Standard account; it is $2,000 for the Prime account; and it is $20,000 for the Institutional account. Leverage is not dependent on the chosen account; it is determined by the asset type. The highest trading leverage is provided for currency pairs, at 1:500. You can trade with lower leverage or without it altogether. Also, this broker does not impose any restrictions. As for client support, it is available through a call center, email, and LiveChat. All communication channels operate 24/7.

BlackBull Markets Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

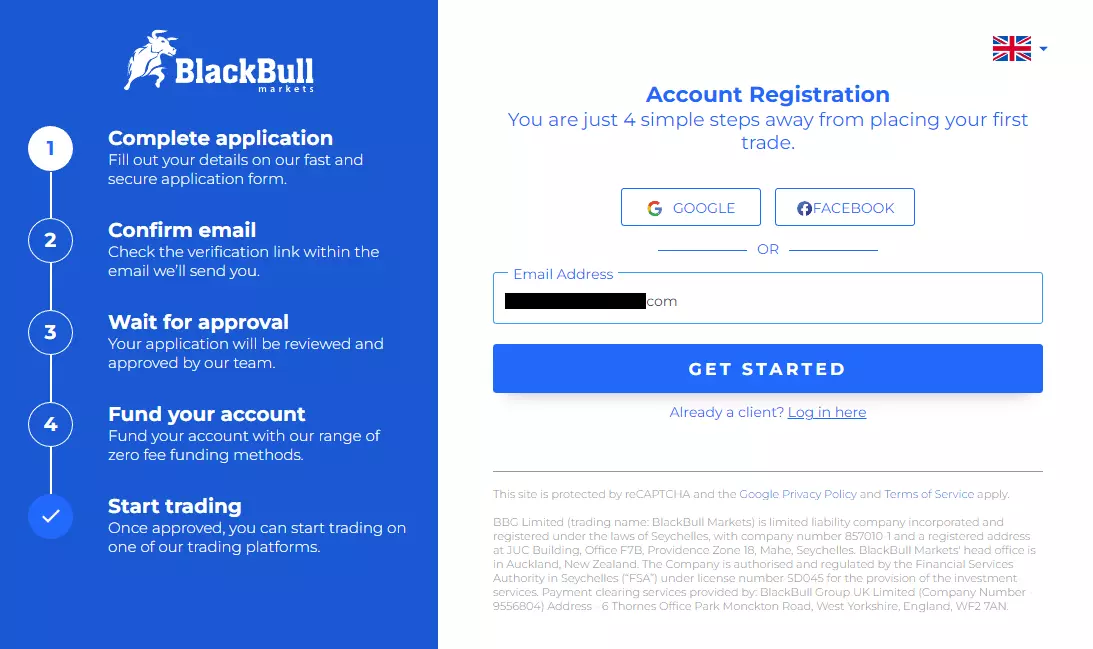

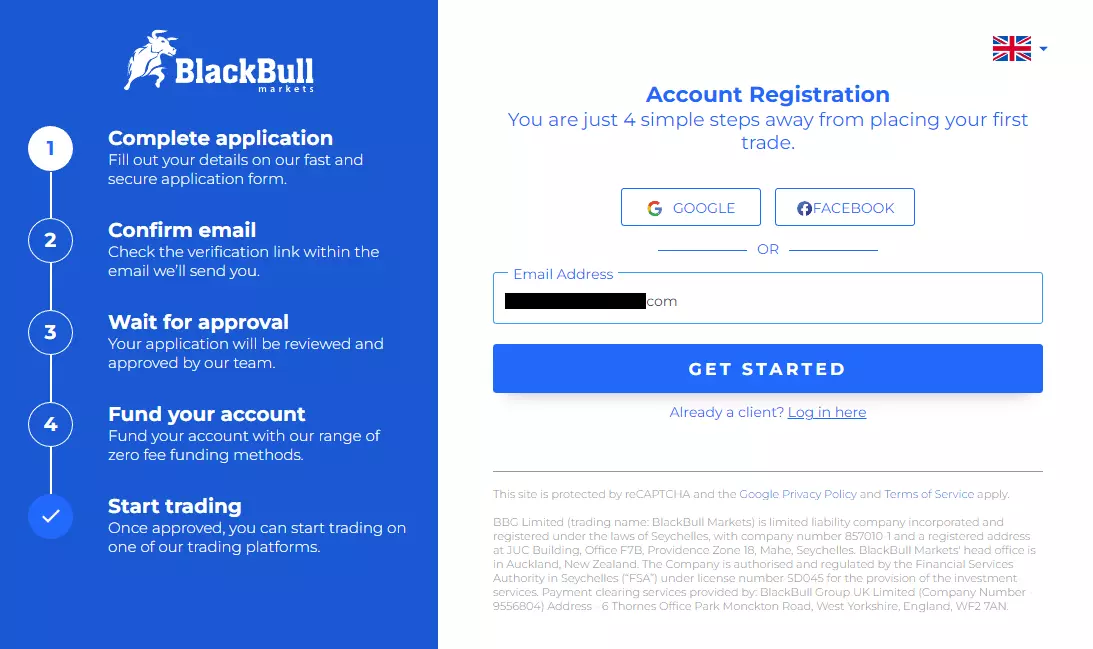

Trading Account Opening

To start collaborating with this broker, register on its official website, complete the verification process, and open a real account. After that, download the appropriate trading platform. Experts at TU have prepared a guide that will help you to complete the registration and inform you of the features of the BlackBull Markets user account.

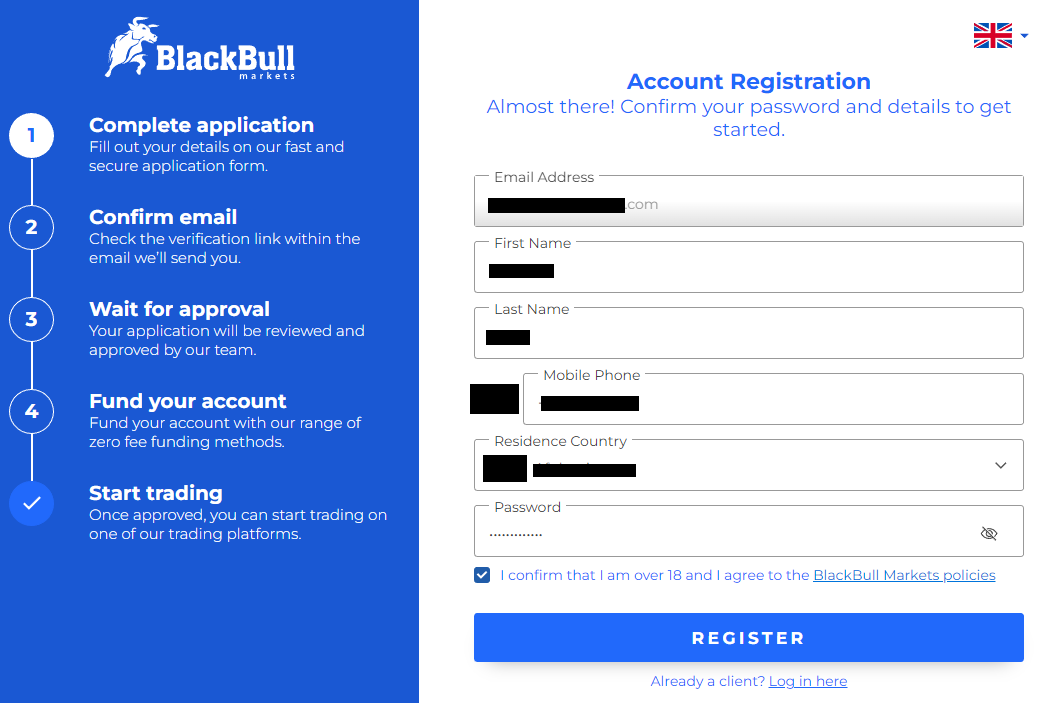

Go to this broker's website. In the upper right corner, select your preferred language. Click on the “Join Now” button.

You can log in through your Google or Facebook account. Otherwise, enter your email address.

Enter your first name, last name, and your country of residence. Provide your phone number and create a password. Check the box confirming that you are at least 18 years old. Click on “Register”.

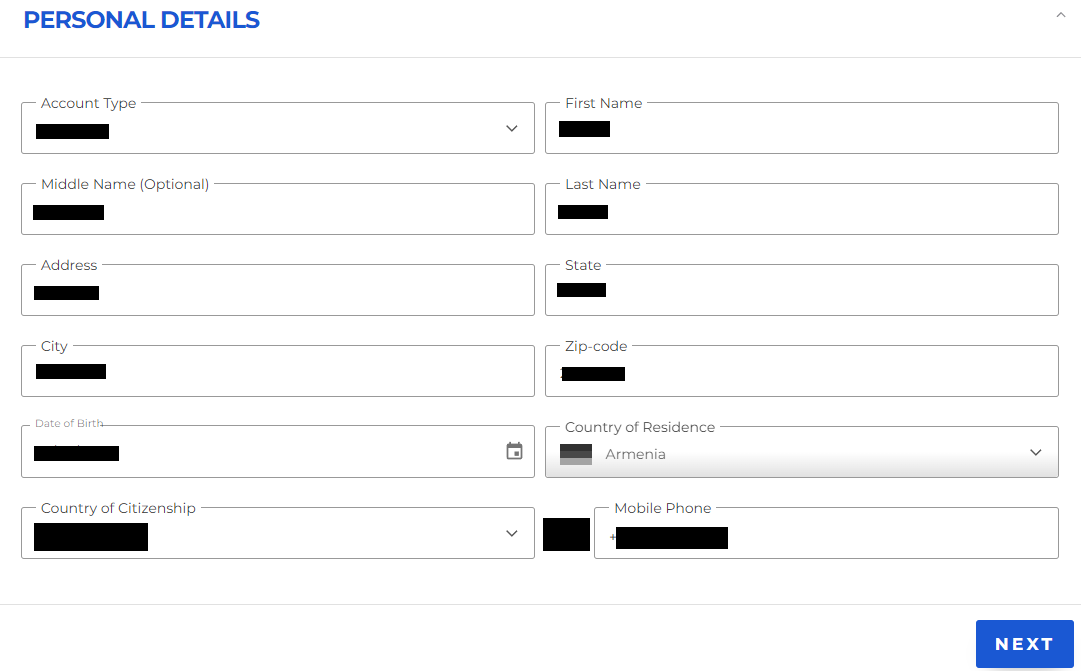

Enter your date of birth and complete address. Click on ‘Next”.

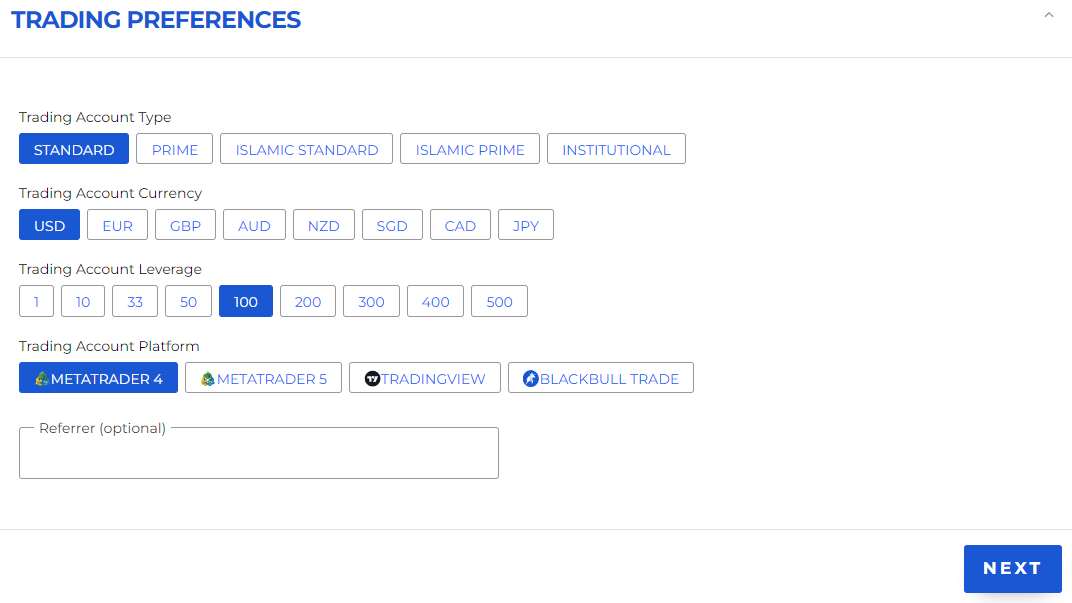

Choose the account type, base currency, leverage, and trading platform. Enter a referral code if you have one. Click on “Next”.

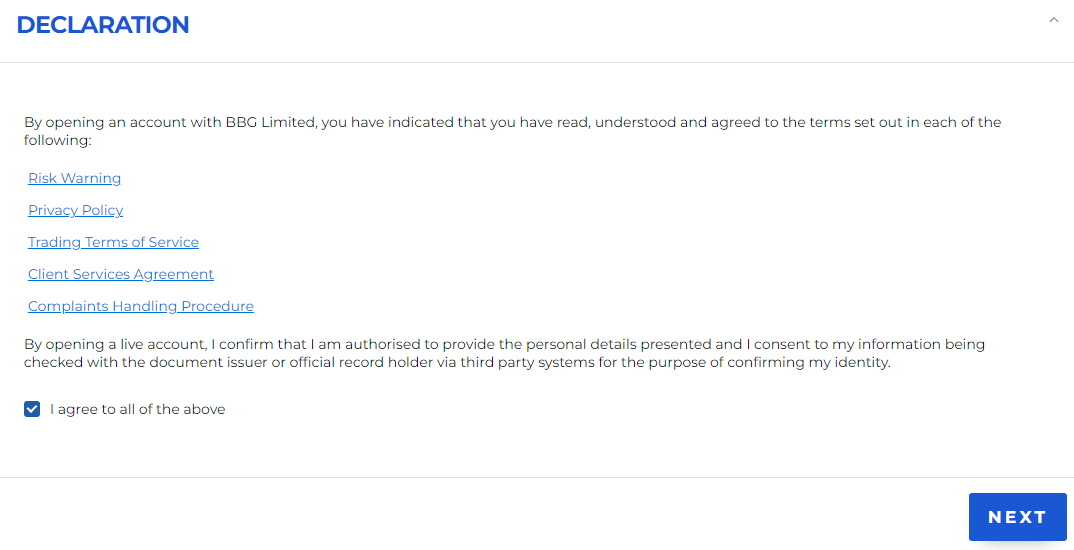

Answer a few questions. Read and agree to the terms and conditions by checking the box. Click on “Next”.

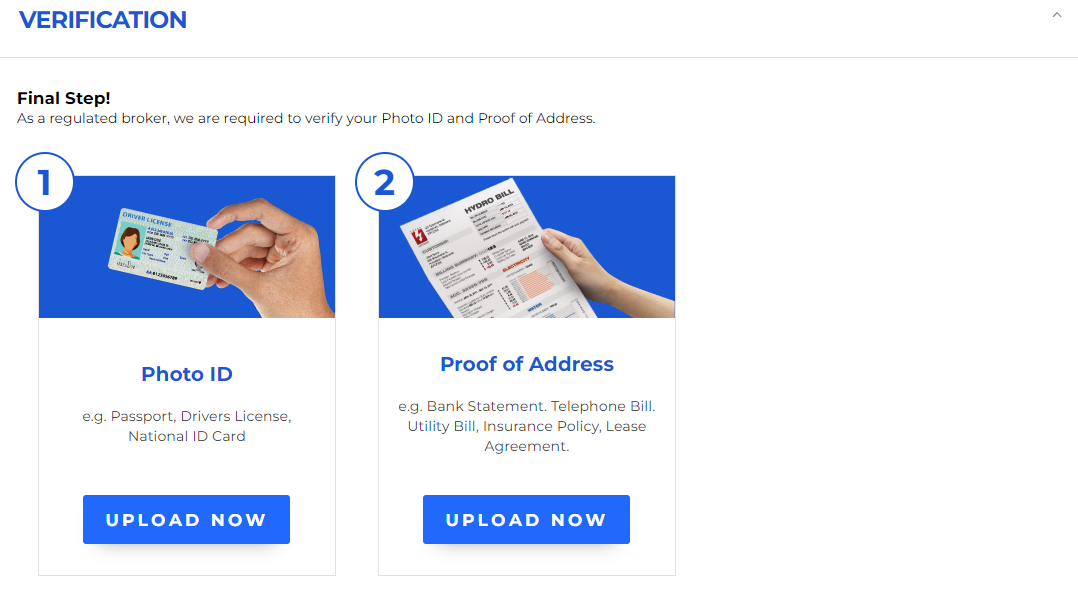

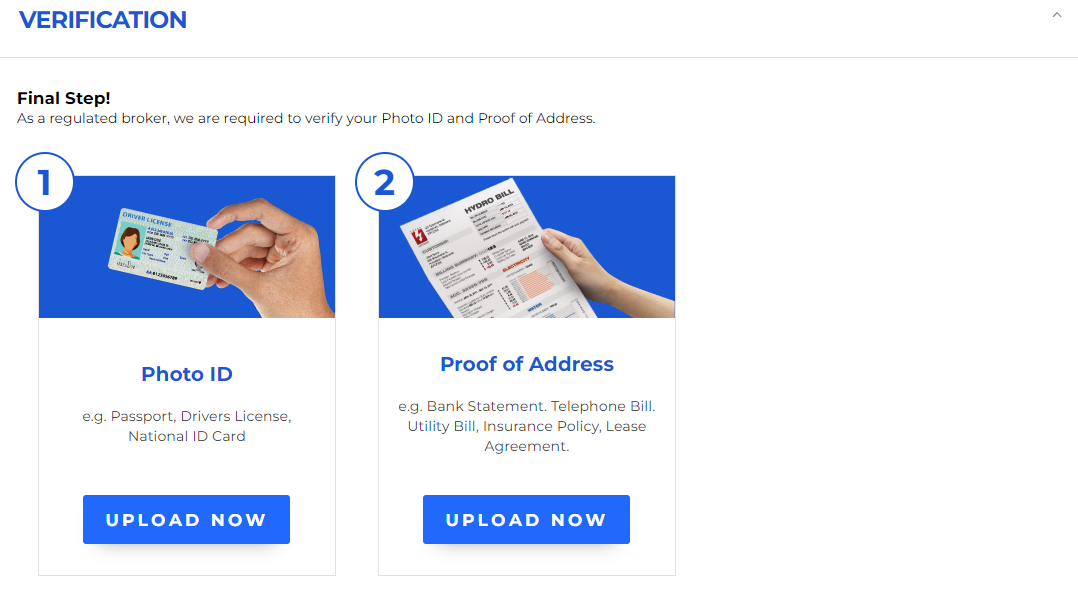

Select the document type you want to use for verification. Upload a scan/photo following the on-screen instructions. Click on “Next”. Data verification may take several days.

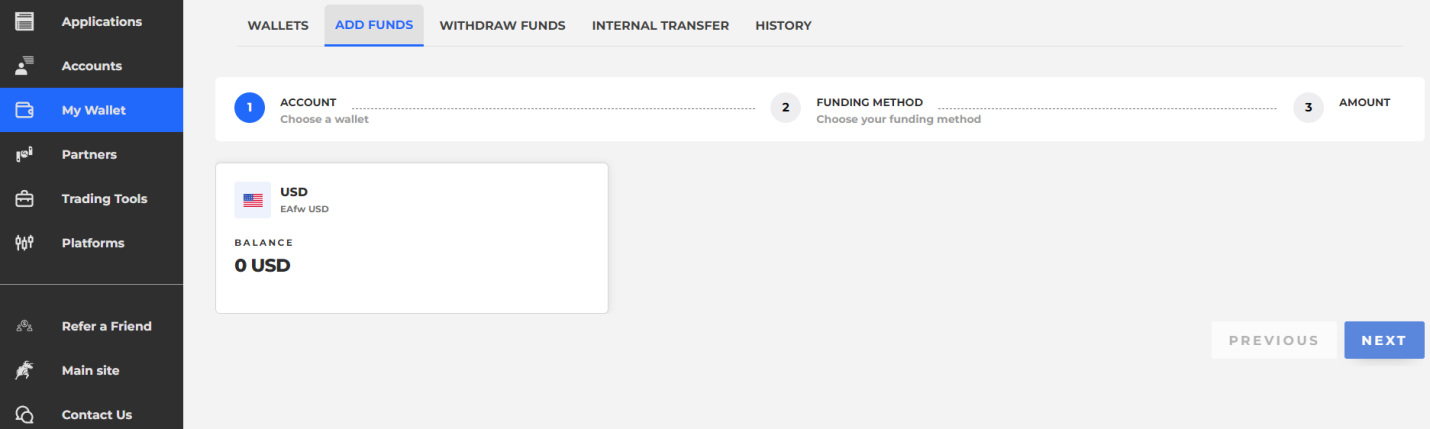

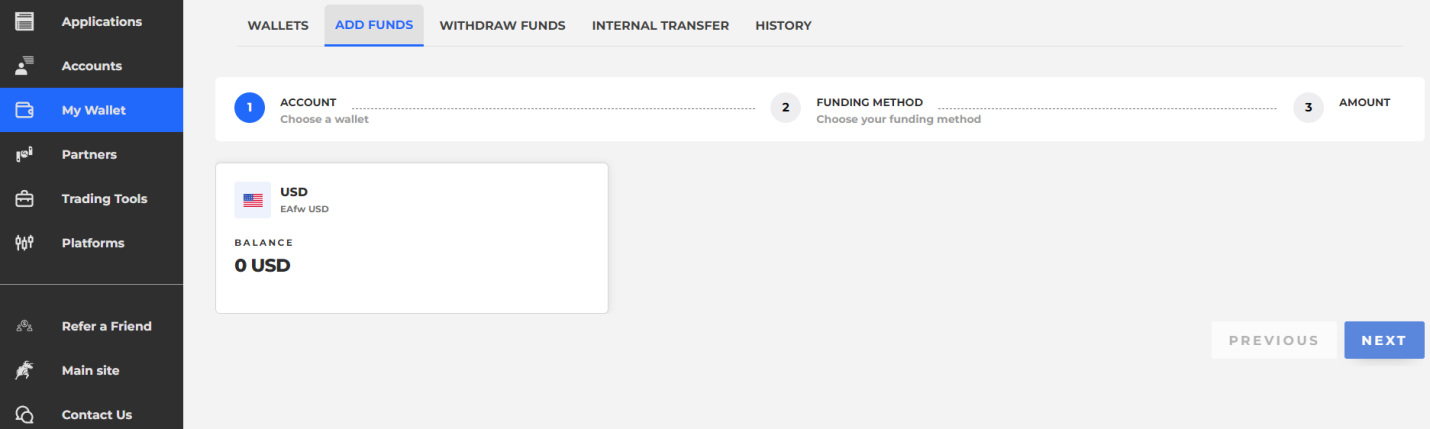

Go to the “My Wallet” menu. Choose the preferred deposit method and complete the transfer following the on-screen instructions. In the "Platforms" section, download the distribution of the suitable trading platform. Start trading.

Your BlackBull Markets user account also provides access to:

A place where traders can open/close real accounts, as well as open a demo account.

Deposits, withdrawals, and internal transfers are carried out through the respective options.

A place where traders can view detailed information about their accounts and transaction reports.

A separate section dedicated to the partner program (additional registration is required).

The "Refer a Friend" menu that pertains to the corresponding promotion, where traders can see their referrals.

Analytical tools, including Autochartist.

The copy trading service that is integrated into the user account, with no additional login required.

Traders can download distributions of supported trading platforms.

The “Contact Us” menu which provides all the communication channels to client support.

Regulation and safety

BlackBull Markets has a safety score of 7/10, which corresponds to a Medium security level. The safest brokers are those with Tier-1 regulation, a long history (over 10 years in the market), and participation in investor compensation schemes.

- Is regulated

- Negative balance protection

- Track record over 11 years

- Not tier-1 regulated

BlackBull Markets Regulators and Investor Protection

| Abbreviation | Full Name | Country of regulation | Investor Protection Fund | Regulation Level |

|---|---|---|---|---|

FMA NZ FMA NZ |

Financial Markets Authority of New Zealand | New Zealand | No specific fund | Tier-2 |

FSA (Seychelles) FSA (Seychelles) |

Financial Services Authority of Seychelles | Seychelles | No specific fund | Tier-3 |

BlackBull Markets Security Factors

| Foundation date | 2014 |

| Negative balance protection | Yes |

| Verification (KYC) | Yes |

Commissions and fees

The trading and non-trading commissions of broker BlackBull Markets have been analyzed and rated as Medium with a fees score of 7/10. Additionally, these commissions were compared with those of the top two competitors, Pepperstone and OANDA, to provide the most comprehensive information.

- Tight EUR/USD market spread

- No inactivity fee

- No deposit fee

- No withdrawal fee

- Above-average Forex trading fees

Trading Fees and Spread

Below, we evaluated and compared the trading commissions of BlackBull Markets with those of two competitors. We focused on the spreads and other transaction fees directly associated with executing trades (e.g commission per lot on an ECN account). This comparison aimed to provide a clear understanding of the cost efficiency of each broker.

Standard Account Spread

For Standard accounts, BlackBull Markets’s commissions are part of the floating spread, which varies with market conditions. Typical values are provided, but during high volatility, the spread may exceed these.

BlackBull Markets Standard spreads

| BlackBull Markets | Pepperstone | OANDA | |

| EUR/USD min, pips | 0,2 | 0,5 | 0,1 |

| EUR/USD max, pips | 0,8 | 1,5 | 0,5 |

| GPB/USD min, pips | 0,2 | 0,4 | 0,1 |

| GPB/USD max, pips | 0,8 | 1,4 | 0,5 |

RAW/ECN Account Commission And Spread

The spread on ECN/RAW accounts is market-based and fluctuates, with average values given during active hours. It may vary during volatility spikes. A commission per lot is also charged.

BlackBull Markets RAW/ECN spreads

| BlackBull Markets | Pepperstone | OANDA | |

| Commission ($ per lot) | 3 | 3 | 3,5 |

| EUR/USD avg spread | 0,3 | 0,1 | 0,15 |

| GBP/USD avg spread | 0,3 | 0,15 | 0,2 |

Non-Trading Fees

We conducted a detailed analysis of the non-trading fees associated with BlackBull Markets. This review offers a comprehensive overview of the additional costs that may impact traders beyond regular trading activities.

BlackBull Markets Non-Trading Fees

| BlackBull Markets | Pepperstone | OANDA | |

| Deposit fee, % | 0 | 0 | 0 |

| Withdrawal fee, % | 0 | 0 | 0 |

| Withdrawal fee, USD | 5 | 0 | 0-15 |

| Inactivity fee ($, per month) | 0 | 0 | 0 |

Account types

A trader needs to choose an account that meets his needs. The Standard account, according to this broker's statement, is designed for beginners. Therefore, there is no minimum deposit or trading commission (but the spreads are the highest). The Prime account is optimal for players with average experience. It requires a significant minimum deposit but offers lower spreads, and there is also a trading commission at the average market level. On the Institutional account, the spread is the lowest, and the commission is lower than that of most of its competitors. However, the minimum deposit is extremely high. The minimum lot size and leverage are the same for all account types. The broker does not impose any trading restrictions, so scalping, hedging, and the use of advisors are allowed. Therefore, when choosing, the new client should rely solely on his experience and available budget.

Account types:

It is advisable to start by opening a demo account to familiarize yourself with the platform's conditions and then transition to a real ECN account. Among other things, a demo account is used to practice trading strategies without the risk of financial losses because trading on it is conducted using virtual currency.

Deposit and withdrawal

BlackBull Markets received a Medium score for the efficiency and convenience of its deposit and withdrawal processes.

BlackBull Markets provides a reasonable range of deposit and withdrawal options with moderate fees, in line with industry standards.

- Supports 5+ base account currencies

- BTC available as a base account currency

- No deposit fee

- Bank card deposits and withdrawals

- Limited deposit and withdrawal flexibility, leading to higher costs

- Wise not supported

- PayPal not supported

What are BlackBull Markets deposit and withdrawal options?

BlackBull Markets provides a basic range of deposit and withdrawal options, covering essential methods in line with industry standards. This set of options is sufficient for most traders, with available methods Bank Card, Bank Wire, Skrill, Neteller, BTC, USDT, Ethereum.

BlackBull Markets Deposit and Withdrawal Methods vs Competitors

| BlackBull Markets | Plus500 | Pepperstone | |

| Bank Wire | Yes | Yes | Yes |

| Bank card | Yes | Yes | Yes |

| PayPal | No | Yes | Yes |

| Wise | No | No | No |

| BTC | Yes | No | No |

What are BlackBull Markets base account currencies?

A wide range of base account currencies minimizes the need for currency conversion, potentially reducing transaction costs for clients worldwide. BlackBull Markets supports the following base account currencies:

What are BlackBull Markets's minimum deposit and withdrawal amounts?

The minimum deposit on BlackBull Markets is $0, while the minimum withdrawal amount is $0. These minimums may vary depending on the chosen account type and payment method. For specific details, please contact BlackBull Markets’s support team.

Markets and tradable assets

BlackBull Markets offers a wider selection of trading assets than the market average, with over 26000 tradable assets available, including 100 currency pairs.

- Commodity futures are available

- 100 supported currency pairs

- Copy trading platform

- Bonds not available

- No ETFs

Supported markets vs top competitors

We have compared the range of assets and markets supported by BlackBull Markets with its competitors, making it easier for you to find the perfect fit.

| BlackBull Markets | Plus500 | Pepperstone | |

| Currency pairs | 100 | 60 | 90 |

| Total tradable assets | 26000 | 2800 | 1200 |

| Stocks | Yes | Yes | Yes |

| Commodity futures | Yes | Yes | Yes |

| Crypto | Yes | Yes | Yes |

| Stock indices | Yes | Yes | Yes |

| Options | No | Yes | No |

Investment options

We also explored the trading assets and products BlackBull Markets offers for beginner traders and investors who prefer not to engage in active trading.

| BlackBull Markets | Plus500 | Pepperstone | |

| Bonds | No | No | No |

| ETFs | No | Yes | Yes |

| Copy trading | Yes | No | Yes |

| PAMM investing | No | No | Yes |

| Managed accounts | No | No | No |

Trading platforms & tools

BlackBull Markets received a score of 9.5/10, indicating a strong offering in terms of trading platforms and tools. The broker provides broad access to popular platforms and supports a variety of features designed to enhance both manual and automated trading.

- Free VPS for uninterrupted trading

- Trading bots (EAs) allowed

- One-click trading

- Trade directly from TradingView

- No access to a proprietary platform

Supported trading platforms

BlackBull Markets supports the following trading platforms: MT4, MT5, cTrader, TradingView, WebTrader. This selection covers the basic needs of most retail traders. We also compared BlackBull Markets’s platform availability with that of top competitors to assess its relative market position.

| BlackBull Markets | Plus500 | Pepperstone | |

| MT4 | Yes | No | Yes |

| MT5 | Yes | No | Yes |

| cTrader | Yes | No | Yes |

| TradingView | Yes | Yes | Yes |

| Proprietary platform | No | Yes | Yes |

| NinjaTrader | No | No | No |

| WebTrader | Yes | Yes | Yes |

Key BlackBull Markets’s trading platform features

We also evaluated whether BlackBull Markets offers essential trading features that enhance user experience, accommodate various trading styles, and improve overall functionality.

Supported features

| 2FA | Yes |

| Alerts | Yes |

| Trading bots (EAs) | Yes |

| One-click trading | Yes |

| Scalping | No |

| Supported indicators | 240 |

| Tradable assets | 26000 |

Additional trading tools

BlackBull Markets offers several additional features designed to enhance the trading experience. These tools provide greater automation, deliver advanced market insights, and help improve trade execution.

BlackBull Markets trading tools vs competitors

| BlackBull Markets | Plus500 | Pepperstone | |

| Trading Central | No | No | No |

| API | Yes | No | Yes |

| Free VPS | Yes | No | Yes |

| Strategy (EA) builder | Yes | No | Yes |

| Autochartist | Yes | No | Yes |

Mobile apps

BlackBull Markets supports mobile trading, offering dedicated apps for both iOS and Android. BlackBull Markets received 8/10 in this section, reflecting strong user engagement and well-developed functionality. High ratings, solid download numbers, and the presence of advanced mobile features contributed to the high score.

- Indicators supported

- Supports mobile 2FA

- Strong Android user ratings, currently at 5.0/5

- Fewer charting tools

We compared BlackBull Markets with two top competitors by mobile downloads, app ratings, 2FA support, indicators, and trading alerts.

| BlackBull Markets | Plus500 | Pepperstone | |

| Total downloads | 100,000 | 10,000,000 | 100,000 |

| App Store score | 5.0 | 4.7 | 4.0 |

| Google Play score | 5.0 | 4.4 | 4.0 |

| Mob. 2FA | Yes | Yes | Yes |

| Mob. Indicators | Yes | Yes | Yes |

| Mob. Alerts | Yes | Yes | Yes |

Education

For a trader to achieve consistent success in trading, it is necessary to read specialized literature, communicate with colleagues and experts, and attend relevant webinars. Many brokers strive to assist their clients by offering their educational systems. On some platforms, these systems may be limited to trader glossaries and basic FAQs, while others provide comprehensive educational courses. On the BlackBull Markets website, there is no structured education system, but there are articles on various topics, market reviews, platform overviews, and current analytics.

Novice traders will find a lot of useful information in the “Education” section. However, there are fewer useful materials available for experienced players. Also, regular webinars are recommended for everyone, as they provide valuable and up-to-date information.

Customer support

Regardless of their experience, every trader occasionally encounters complex situations during trading or related processes. The broker’s clients need to receive prompt and competent assistance. If the support team takes a long time to respond or lacks sufficient competence, traders may become disappointed and switch to a competitor. In the case of BlackBull Markets, such an outcome is practically impossible. The platform's support is highly valued by clients and experts. It operates 24/7, including on Saturdays and Sundays. Specialists can be contacted by phone, email, or LiveChat.

Advantages

- You can call or write to client support

- The time of day does not matter

- Managers respond in multiple languages

Disadvantages

- During peak hours, the response may not be as prompt

If you are already trading with this broker or considering starting a collaboration and have a question, you may contact client support using the following channels:

-

Call center;

-

Email;

-

LiveChat on the website and in the user account.

You can also visit the office in Seychelles. Please note that it operates on weekdays only, from 10:00 to 23:00 local time. The company has its profiles on the following social platforms: LinkedIn, Twitter, Facebook, Instagram, and YouTube. You can also contact support there.

Contacts

Comparison of BlackBull Markets with other Brokers

| BlackBull Markets | Eightcap | XM Group | RoboForex | Markets4you | NPBFX | |

| Trading platform |

BlackBull Shares, BlackBull Trade, MT4, MT5, TradingView, WebTrader | MT4, MT5, TradingView | MT4, MT5, MobileTrading, XM App | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | MT4, MobileTrading, MT5 | MT4 |

| Min deposit | $200 | $100 | $5 | $10 | No | $10 |

| Leverage |

From 1:1 to 1:500 |

From 1:30 to 1:500 |

From 1:1 to 1:30 |

From 1:1 to 1:2000 |

From 1:10 to 1:4000 |

From 1:200 to 1:1000 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | 10.00% | No | No |

| Spread | From 0.1 points | From 0 points | From 0.8 points | From 0 points | From 0.1 points | From 0.4 points |

| Level of margin call / stop out |

70% / 50% | 80% / 50% | 100% / 50% | 60% / 40% | 100% / 20% | No / 30% |

| Order Execution | Market Execution | Market Execution | Market Execution | Market Execution, Instant Execution | Market Execution, Instant Execution | Instant Execution, Market Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | No | No | Yes | Yes | No |

Detailed review of BlackBull Markets

The broker provides free virtual dedicated servers to clients who meet certain criteria. Under standard conditions, NYC and BeeksFX servers are used, while individual parameters are available for Institutional accounts. Special attention is given to stocks, and for trading CFDs on stocks, this broker offers its solution called BlackBull Shares, as well as the BlackBull Research service with professional analytics. Clients can use this service for free for three months. The platform even offers ready-made portfolio templates that experts have been tracking since 2015.

BlackBull Markets by the numbers:

-

The minimum deposit is $0.

-

There are over 26,000 financial instruments.

-

The minimum spread is 0 pips.

-

The maximum leverage is 1:500.

-

Technical support is available 24/7.

BlackBull Markets is a Forex and CFD broker for traders of all levels

Most traders primarily consider this broker's asset pool. This is indeed important because the more trading instruments available and the more diverse they are, the wider the client's possibilities are to diversify his portfolio. Clients can use any strategy, including experimental ones. Moreover, if assets are represented in different groups, it allows for successful risk diversification. However, there is one nuisance: this broker should not impose trading restrictions. For BlackBull Markets clients, there are no limitations, and the number of available assets is sufficient to trade in comfortable conditions, successfully minimizing the probability of financial losses. Traders can work with currency pairs and CFDs on 8 groups of assets.

BlackBull Markets’ analytical services:

-

Lead and Follow. This trade copying system allows signals providers to earn commissions, while investors receive passive income and unique experience.

-

BlackBull Research. The platform's experts analyze the stock market daily. The result of a comprehensive analytical approach is well-developed forecasts for quotations.

-

Economic calendar. This is a basic analytical tool that no trader can do without. The calendar displays all the most important economic and political events capable of influencing the value of various assets.

Advantages:

The broker offers comfortable conditions for beginners such as no minimum deposit requirements on the Standard account, tight spreads, a wide range of assets, and additional earning options, including passive income.

Experienced market participants receive high leverage, and low trading costs, and can choose from five trading platforms, including this broker's own platform.

BlackBull Markets provides access to over 26,000 trading instruments, including the most popular currency pairs and CFDs on stocks, cryptocurrencies, and other asset types.

The educational system of the platform includes several levels, and even professionals can find something useful here, especially in regular webinars.

Technical support is available through all major communication channels like a call center, email, and LiveChat. Plus, specialists work 24/7.

Articles that may help you

Check out our reviews of other companies as well

User Satisfaction i