According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $3,000

- MT4

- FCA

- CIMA

- 2013

Our Evaluation of ATC BROKERS

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

ATC BROKERS is a moderate-risk broker with the TU Overall Score of 6.5 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by ATC BROKERS clients on our website, Traders Union expert Anton Kharitonov recommends users to thoroughly analyze pros and cons before opening an account with this broker as not all clients are satisfied with the company, according to reviews.

ATC Brokers is an STP and ECN broker targeted at clients looking for a US and UK regulated Forex broker.

Brief Look at ATC BROKERS

The ATC Brokers is an ECN and STP broker that has been operating since 2005. The company provides services for both individual traders and institutional investors. ATC is headquartered in the United States and operates under licenses issued by regulators such as FCA 591361(UK) and CIMA , 1448274 (Cayman Islands).

We've identified your country as

US

We have thoroughly analyzed all companies legally providing trading services in your country and created a ranking of the best ones. Our analysis highlights companies that offer optimal working conditions, uphold a strong reputation, and consistently receive the highest number of positive reviews from traders on our website.

Explore the 5 top-rated companies in

US :

- Spreads for EUR/USD from 0.3 pips.

- The ability to invest using the Trade Copier and PAMM accounts;

- Support for 38 Forex currency pairs.

- Availability of licenses for financial activities from reputable regulators in the USA and Great Britain.

- Direct access to liquidity providers thanks to the support of ECN and STP technologies.

- There are only two groups of trading instruments.

- There are commissions for account replenishment, withdrawal of funds, and an inactivity fee.

- Lack of bonuses.

TU Expert Advice

Author, Financial Expert at Traders Union

ATC Brokers offers trading services through the MT4 platforms, focusing on Forex with 38 currency pairs, CFDs on metals, and PAMM accounts. The broker supports individual, joint, and corporate account types with a significant minimum deposit of $3,000. Its clients benefit from tight spreads starting at 0.3 pips and leverage up to 1:200, along with direct access to liquidity providers through ECN and STP technologies. This structure is particularly beneficial for active traders seeking cost-effective and efficient trading conditions.

However, ATC Brokers presents some drawbacks, such as limited trading instruments and fees for inactivity, deposits, and withdrawals. The absence of a broad asset range and educational resources may not favor beginners or those desiring extensive market exposure. In conclusion, ATC Brokers may serve experienced traders well, especially those focusing on Forex looking for competitive spreads and execution, but it may not suit beginners or those seeking diverse investment opportunities.

ATC BROKERS Trading Conditions

| 💻 Trading platform: | МТ4 (desktop, mobile, web) |

|---|---|

| 📊 Accounts: | Individual, Joint, and Corporate |

| 💰 Account currency: | USD, EUR, and GBP |

| 💵 Deposit / Withdrawal: | Bank transfer, Skrill, debit/credit card |

| 🚀 Minimum deposit: | From USD 3,000 |

| ⚖️ Leverage: | Up to 1:100 with a trading account balance of less than USD 100,000, Up to 1:200 with an account balance of more than USD 100,000 |

| 💼 PAMM-accounts: | Yes |

| 📈️ Min Order: | 0.01 |

| 💱 EUR/USD spread: | 0,1 pips |

| 🔧 Instruments: | Currency pairs (38), CFDs on metals (2) |

| 💹 Margin Call / Stop Out: | 100%/50% |

| 🏛 Liquidity provider: | More than 20 large banks |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Order execution: | Market Execution |

| ⭐ Trading features: | There is an inactivity fee on the account |

| 🎁 Contests and bonuses: | No |

The broker specializes in providing clients with trading services in the Forex market. In particular, 38 currency pairs are available here, including the most popular pairs, cross rates, as well as some types of exotic currencies. On a standard trading account, traders are provided with leverage of up to 1:200. Clients can test the trading conditions of the company using a demo account, access to which is provided without restrictions.

ATC BROKERS Key Parameters Evaluation

Video Review of ATC BROKERS

Share your experience

- Best

- Last

- Oldest

Trading Account Opening

To start working with ATC Brokers, you need to go through the registration and verification procedure. The document verification procedure takes 1-2 business days for private traders and 3-5 business days for corporate clients. The registration procedure for private traders includes several stages.

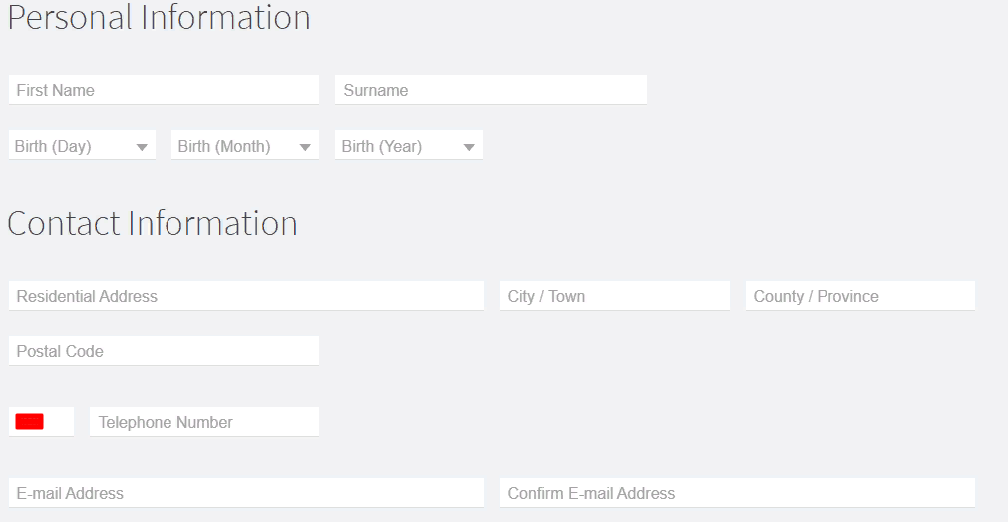

First, you need to fill out a basic registration form. It includes the following fields: country of residence, account type, account currency, type of trading terminal (online, desktop, mobile), planned investment amount.

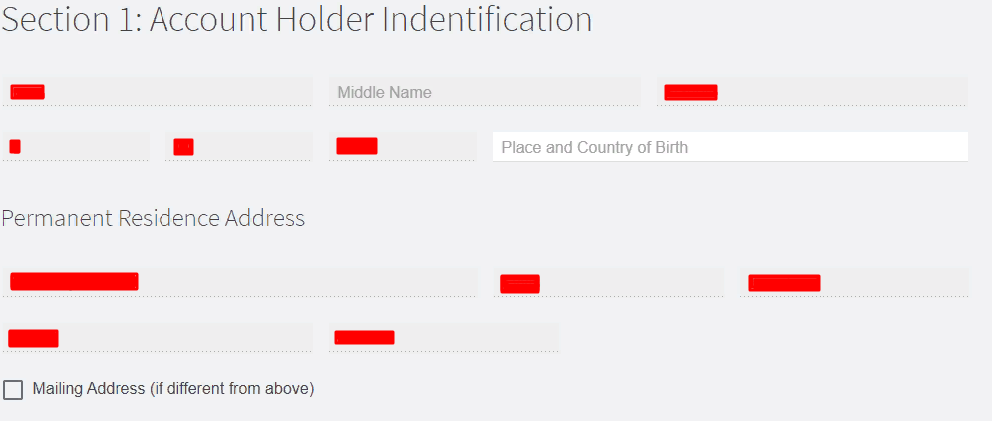

Next, the broker will ask you to provide personal data: name, surname, and date of birth. In addition, the trader will need to provide contact information such as residence address, email, and phone number.

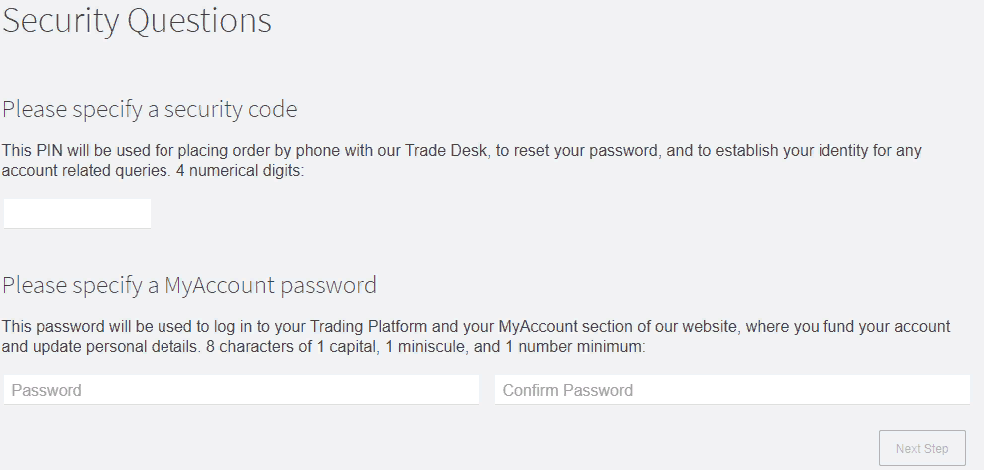

After that, the broker will ask you to set a password for your account and a four-digit pin code. The PIN code is used to reset the password, to contact the customer with technical support, etc.

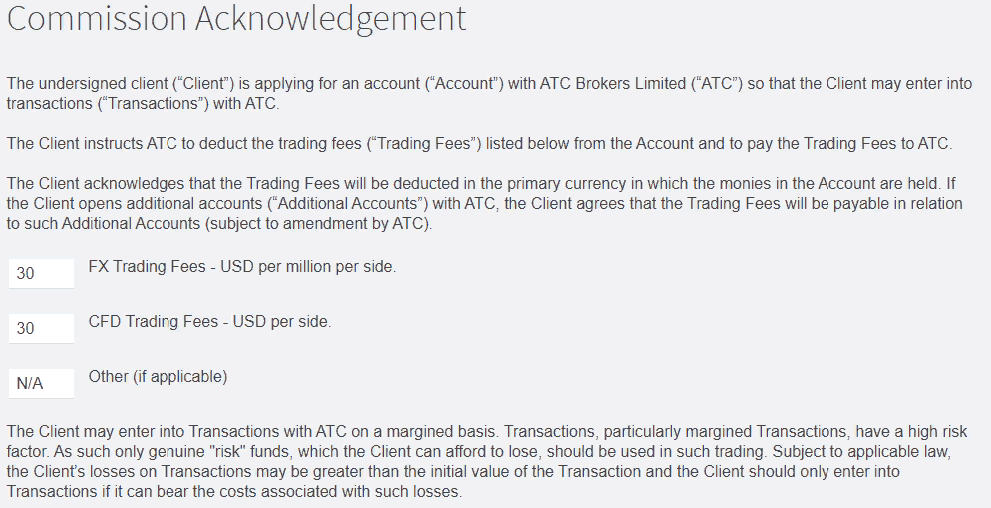

Next, the company will warn the client about the fees charged. You must confirm that you have read this information.

Next, you will be asked to fill out a large identification form. The specified data will need to be confirmed during verification. The first part includes the personal data and address of the resident.

In the second part of the identification form, you must indicate whether you are a citizen of the United States, where you were born. The third part of the identification form will require tax information. In particular, it is necessary to indicate the country of tax residence, the type of tax identification document, and its number. Finally, you need to confirm that all the information provided in the form is correct and true.

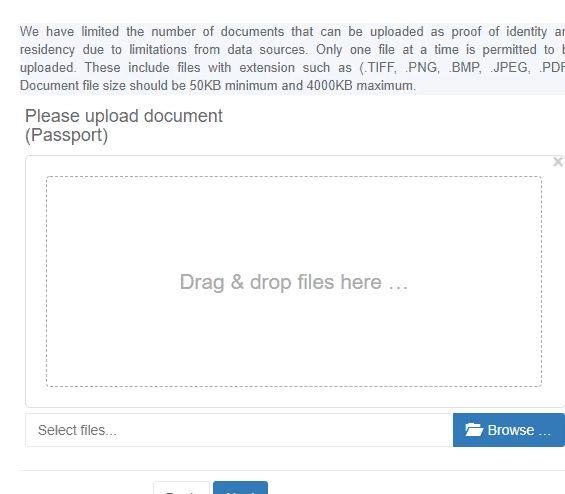

The last stage of the procedure is verification. To verify your identity, you need to upload your ID and proof of residential address.

After the approval of your documents, you will get full access to your account, you will be able to replenish your account and start trading.

Also in the personal account, the trader has access to:

-

Reports - information about the trades made by the user during the trading activity.

-

Portfolio - reports on the trader's activity for various trading instruments.

-

Swap history - information about accrued or withheld swaps during trading.

Regulation and safety

ATC BROKERS has a safety score of 9.2/10, which corresponds to a High security level. The safest brokers are those with Tier-1 regulation, a long history (over 10 years in the market), and participation in investor compensation schemes.

- Tier-1 regulated

- Negative balance protection

- Regulated in the UK

- Track record over 12 years

- Strict requirements and extensive documentation to open an account

ATC BROKERS Regulators and Investor Protection

| Abbreviation | Full Name | Country of regulation | Investor Protection Fund | Regulation Level |

|---|---|---|---|---|

FCA UK FCA UK |

Financial Conduct Authority | United Kingdom | Up to £85,000 | Tier-1 |

| CIMA | Cayman Islands Monetary Authority | Cayman Islands | No specific fund | Tier-3 |

ATC BROKERS Security Factors

| Foundation date | 2013 |

| Negative balance protection | Yes |

| Verification (KYC) | Yes |

Commissions and fees

The trading and non-trading commissions of broker ATC BROKERS have been analyzed and rated as Medium with a fees score of 5/10. Additionally, these commissions were compared with those of the top two competitors, Pepperstone and OANDA, to provide the most comprehensive information.

- Tight EUR/USD market spread

- Above-average Forex trading fees

- Inactivity fee applies

- Deposit fee applies

- Withdrawal fee applies

Trading Fees and Spread

Below, we evaluated and compared the trading commissions of ATC BROKERS with those of two competitors. We focused on the spreads and other transaction fees directly associated with executing trades (e.g commission per lot on an ECN account). This comparison aimed to provide a clear understanding of the cost efficiency of each broker.

Standard Account Spread

For Standard accounts, ATC BROKERS’s commissions are part of the floating spread, which varies with market conditions. Typical values are provided, but during high volatility, the spread may exceed these.

ATC BROKERS Standard spreads

| ATC BROKERS | Pepperstone | OANDA | |

| EUR/USD min, pips | 0,3 | 0,5 | 0,1 |

| EUR/USD max, pips | 0,6 | 1,5 | 0,5 |

| GPB/USD min, pips | 0,4 | 0,4 | 0,1 |

| GPB/USD max, pips | 0,6 | 1,4 | 0,5 |

RAW/ECN Account Commission And Spread

The spread on ECN/RAW accounts is market-based and fluctuates, with average values given during active hours. It may vary during volatility spikes. A commission per lot is also charged.

ATC BROKERS RAW/ECN spreads

| ATC BROKERS | Pepperstone | OANDA | |

| Commission ($ per lot) | 15 | 3 | 3,5 |

| EUR/USD avg spread | 0,1 | 0,1 | 0,15 |

| GBP/USD avg spread | 0,1 | 0,15 | 0,2 |

Non-Trading Fees

We conducted a detailed analysis of the non-trading fees associated with ATC BROKERS. This review offers a comprehensive overview of the additional costs that may impact traders beyond regular trading activities.

ATC BROKERS Non-Trading Fees

| ATC BROKERS | Pepperstone | OANDA | |

| Deposit fee, % | 0-1 | 0 | 0 |

| Withdrawal fee, % | 0-0,2 | 0 | 0 |

| Withdrawal fee, USD | 0-40 | 0 | 0-15 |

| Inactivity fee ($, per month) | 50 | 0 | 0 |

Account types

ATC Brokers provides clients with three types of accounts: Individual, Joint, and Corporate. There are no differences in trading conditions for these types of trading accounts. Commissions depend on the type of trading instruments the trader deals with.

Account types:

A demo account is offered for the company's clients, which is available without any restrictions. To open it, you must submit an appropriate application.

ATC Brokers is an STP/ECN broker that provides profitable trading conditions for professional traders who prefer to work with liquidity providers.

Deposit and withdrawal

ATC BROKERS received a Low score for the efficiency and convenience of its deposit and withdrawal processes.

ATC BROKERS offers limited payment options and accessibility, which may impact its competitiveness.

- Bank card deposits and withdrawals

- Low minimum withdrawal requirement

- Bank wire transfers available

- Wise not supported

- Withdrawal fee applies

- Limited deposit and withdrawal flexibility, leading to higher costs

What are ATC BROKERS deposit and withdrawal options?

ATC BROKERS offers a limited selection of deposit and withdrawal methods, including Bank Card, Bank Wire, Skrill. This limitation may restrict flexibility for users, making ATC BROKERS less competitive for those seeking diverse payment options.

ATC BROKERS Deposit and Withdrawal Methods vs Competitors

| ATC BROKERS | Plus500 | Pepperstone | |

| Bank Wire | Yes | Yes | Yes |

| Bank card | Yes | Yes | Yes |

| PayPal | No | Yes | Yes |

| Wise | No | No | No |

| BTC | No | No | No |

What are ATC BROKERS base account currencies?

A wide range of base account currencies minimizes the need for currency conversion, potentially reducing transaction costs for clients worldwide. ATC BROKERS supports the following base account currencies:

What are ATC BROKERS's minimum deposit and withdrawal amounts?

The minimum deposit on ATC BROKERS is $2000, while the minimum withdrawal amount is $30. These minimums may vary depending on the chosen account type and payment method. For specific details, please contact ATC BROKERS’s support team.

Markets and tradable assets

ATC BROKERS offers a limited selection of trading assets compared to the market average. The platform supports 55 assets in total, including 40 Forex pairs.

- Indices trading

- 40 supported currency pairs

- Copy trading platform

- Futures not available

- No ETFs

Supported markets vs top competitors

We have compared the range of assets and markets supported by ATC BROKERS with its competitors, making it easier for you to find the perfect fit.

| ATC BROKERS | Plus500 | Pepperstone | |

| Currency pairs | 40 | 60 | 90 |

| Total tradable assets | 55 | 2800 | 1200 |

| Stocks | No | Yes | Yes |

| Commodity futures | Yes | Yes | Yes |

| Crypto | Yes | Yes | Yes |

| Stock indices | Yes | Yes | Yes |

| Options | No | Yes | No |

Investment options

We also explored the trading assets and products ATC BROKERS offers for beginner traders and investors who prefer not to engage in active trading.

| ATC BROKERS | Plus500 | Pepperstone | |

| Bonds | No | No | No |

| ETFs | No | Yes | Yes |

| Copy trading | Yes | No | Yes |

| PAMM investing | Yes | No | Yes |

| Managed accounts | No | No | No |

Customer support

Support operators are available 24 hours a day (Sunday 5 pm to Friday 5 pm EST).

Advantages

- You can ask the support service even without being a client of the company

- There are 4 ways to contact support

Disadvantages

- Works 24/5

Available communication channels with customer support specialists include:

-

phone number (specified in the Contact section);

-

email;

-

feedback form;

-

online chat on the site.

A user can ask the support service a question without registering with the company.

Contacts

| Foundation date | 2013 |

|---|---|

| Registration address | 700 N Brand Blvd, Suite 1180, Glendale, CA 91203, United States |

| Regulation | FCA, CIMA |

| Official site | https://atcbrokers.com/ |

| Contacts |

+44 20 3318 1399

|

Education

Training materials for traders at ATC Brokers are very limited. Training is presented in the form of nine educational articles, which show the peculiarities of trading with various trading instruments, the functions of the MetaTrader 4 terminal, and the features of ECN technology. There is no detailed video course on the website. Educational books, reviews of trading strategies are not provided.

The broker does not have cent accounts, so you can get practice in trading only with the help of a demo account.

Comparison of ATC BROKERS with other Brokers

| ATC BROKERS | Eightcap | XM Group | RoboForex | AMarkets | InstaForex | |

| Trading platform |

MT4 | MT4, MT5, TradingView | MT4, MT5, MobileTrading, XM App | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | MT4, MT5, AMarkets App | MT4, MultiTerminal, MobileTrading, MT5, WebTrader |

| Min deposit | $2000 | $100 | $5 | $10 | $100 | $1 |

| Leverage |

From 1:1 to 1:200 |

From 1:30 to 1:500 |

From 1:1 to 1:30 |

From 1:1 to 1:2000 |

From 1:1 to 1:3000 |

From 1:1 to 1:1000 |

| Trust management | No | No | No | No | No | Yes |

| Accrual of % on the balance | No | No | No | 10.00% | No | No |

| Spread | From 0.1 points | From 0 points | From 0.8 points | From 0 points | From 0 points | From 0 points |

| Level of margin call / stop out |

120% / 100% | 80% / 50% | 100% / 50% | 60% / 40% | 50% / 20% | 30% / 10% |

| Order Execution | Market Execution | Market Execution | Market Execution | Market Execution, Instant Execution | Market Execution, Instant Execution | Instant Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | No | No | Yes | No | Yes |

Detailed Review of ATC Brokers

The ATC Brokers uses STP and ECN technologies. This gives traders direct access to liquidity providers, which helps to reduce trading costs. The company specializes in Forex trading services and offers 38 currency pairs for traders. Users can work on Individual, Joint, and Corporate accounts. A free demo account is also provided.

ATC Brokers in figures:

-

0.3 pips - the average spread in EUR/USD.

-

16 years on the market.

-

1:200 - leverage.

Automation and convenient terminal of ATC Brokers

ATC Brokers provides clients with access to the MetaTrader 4 terminal. This is a proven platform that provides clients with several options, such as the ability to customize the platform interface and charts, connect news resources, quickly open and close trades, 1-click trading, more than 50 technical tools, analyses, and many plug-ins.

The ATC Brokers MetaTrader 4 supports automated trading. Also, the company's clients can use trading advisors. The broker allows you to employ many trading strategies. Also, clients can receive passive income using copy trading. ATC Brokers provides access to Trade Copier, a partnership service for copying trades. Connection to the signal provider you are interested in is carried out through the MetaTrader 4 terminal.

Useful investment services of ATC Brokers:

-

Economic calendar. Allows you to track world economic events and trends. It contains all the events for the next two weeks and you can sort events using filters.

-

VPS for MetaTrader 4. This option allows you to keep trades open even if the trading terminal is closed. The VPS server is provided free of charge.

Advantages:

38 currency pairs for Forex.

Tight spreads, from 0.3 pips.

Negative balance protection.

Investors are allowed to work with the Trade Copier copy-trading platform.

Articles that may help you

Check out our reviews of other companies as well

User Satisfaction i