According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $200

- MT4

- BVIFSC

Our Evaluation of Connoisseur Investments

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

Connoisseur Investments is a broker with higher-than-average risk and the TU Overall Score of 4.96 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Connoisseur Investments clients on our website, Traders Union expert Anton Kharitonov recommends users to consider a more reliable broker with better conditions, as, according to reviews, many clients of this broker are not satisfied with the company’s work.

Connoisseur Investments is registered in the British Virgin Islands and operates officially and transparently. The entry threshold is relatively low, and the trading conditions are comfortable. Notably, low spreads start from $10 with no additional fees. The asset pool is moderate, and the leverage is quite high, enhancing profit potential and strategic opportunities. Unfortunately, only two channels for deposit and withdrawal are available, and the company's website lacks some key information.

Brief Look at Connoisseur Investments

Clients of the broker Connoisseur Investments Ltd can open an account to access the markets of currency pairs, indices, metals, and crude oil. The minimum deposit is $200, with a maximum leverage of 1:500. Floating spreads start from $10, and there are no trading commissions or fees for deposit and withdrawal. Money can be deposited and withdrawn through bank transfers and the Neteller system. The premium account has no transaction size limits and provides a personal manager. Alternative earning options include PAMM accounts, fund management, and IB (Introducing Brokers). Trading is conducted exclusively through the MetaTrader 4 trading platform. The broker's website offers tools for technical and fundamental analyses, as well as special options like VPS.

We've identified your country as

US

We have thoroughly analyzed all companies legally providing trading services in your country and created a ranking of the best ones. Our analysis highlights companies that offer optimal working conditions, uphold a strong reputation, and consistently receive the highest number of positive reviews from traders on our website.

Explore the 5 top-rated companies in

US :

- Broker provides a free demo account for exploring the platform and refining strategies, and a Standard account can be opened with as little as $200.

- Traders can choose from three live accounts: Standard, Premium, or Islamic (swap-free trading).

- The versatile MT4 trading platform has an intuitive interface and is easily customizable with free plugins.

- Expert research, an economic calendar, and newsfeeds aid in making successful predictions about quote trends.

- Traders seeking passive income can join a joint account or fund.

- No trading commissions or additional costs for deposits, withdrawals, and other transactions, as only the spread per transaction is charged.

- Technical support is provided through a call center, email, live chat, and a callback option.

- The broker's asset pool includes four groups, but the total number of financial instruments offered is relatively low compared to its competitors.

- Funds can only be deposited and withdrawn using two methods, bank transfer and Neteller.

- While technical support is highly rated for promptness and competence, it operates only on weekdays.

TU Expert Advice

Financial expert and analyst at Traders Union

The broker has been operating for over 10 years and is properly registered and regulated. Reviews about it are predominantly positive, with no confirmed instances of failure to fulfill its obligations to clients. As for the trading conditions, they are quite competitive, allowing Connoisseur Investments to contend for top positions in certain aspects.

The demo account provides an opportunity to get to know the platform better and practice if needed, but this is unlikely to surprise anyone. There are Standard and Premium accounts, with the latter having a higher minimum deposit but no restrictions on trading volume. The broker positions the Standard account as a universal option and the Premium account as a solution for large investors. Also available is a swap-free account for those who follow Islamic principles. If desired, the platform's clients can open their own PAMM account or join an existing one as an investor. An alternative option for passive income is participation in funds.

Connoisseur Investments does not impose restrictions on trading strategies and methods such as scalping, hedging, trading on news, and the use of advisors are all allowed. For those who trade non-stop, the broker provides a virtual private server (VPS). The only thing to consider is the availability of trading markets: from 21:00 on Sunday to 21:00 on Friday according to Greenwich Mean Time (GMT). Spreads are standard, starting from $10. Trading is conducted without other fees, and there are no charges for withdrawals. However, an important point to note is that only bank transfers and Neteller are available for withdrawals.

Since the broker's clients trade through the MetaTrader 4 trading platform, they can customize working conditions with free plugins. The fact that other trading platforms are not offered should be considered a relative drawback. Traders also note in their reviews that there are fewer financial instruments compared to most of its competitors. On the flip side, there is high-quality analytics. Education is only available to registered users (the broker offers educational materials, courses, and webinars). Overall, the platform can be recommended for exploration.

Connoisseur Investments Trading Conditions

Your capital is at risk. 79.43% of retail investor accounts lose money when trading CFDs with this provider. Connoisseur Investments and its affiliates do not target EU/EEA/UK clients. It is the user's responsibility to ensure that any use of the website or services adhere to local laws or regulations. Please be aware that you are able to receive investment services at your own exclusive initiative only, ensuring you fully understand all the risks involved.

| 💻 Trading platform: | MT4 |

|---|---|

| 📊 Accounts: | Demo, Standard, Premium, Islamic |

| 💰 Account currency: | USD |

| 💵 Deposit / Withdrawal: | Bank transfer, Neteller |

| 🚀 Minimum deposit: | $200 |

| ⚖️ Leverage: | Up to 1:500 |

| 💼 PAMM-accounts: | Yes |

| 📈️ Min Order: | 0.01 |

| 💱 EUR/USD spread: | 0,5-0,8 pips |

| 🔧 Instruments: | Currency pairs, indices, metals, oil |

| 💹 Margin Call / Stop Out: | No |

| 🏛 Liquidity provider: | No |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Order execution: | Market |

| ⭐ Trading features: |

Free demo account and low entry threshold, Three live accounts (including Islamic), Acceptable costs and high leverage, Four groups of financial instruments, High-quality analytics, Several options for passive earnings, Prompt technical support |

| 🎁 Contests and bonuses: | Yes (rebates from TU) |

Typically, when a broker offers multiple accounts, the trading conditions for each differ, including the minimum deposit. To open a Standard account with Connoisseur Investments, a minimum deposit of $200 is required. For a Premium and Islamic account, the minimum is $500. The leverage is flexible, allowing traders to choose a leverage ratio ranging from 1:1 to 1:500. Regarding client support, it is available through all major communication channels and operates 24/5 on weekdays.

Connoisseur Investments Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

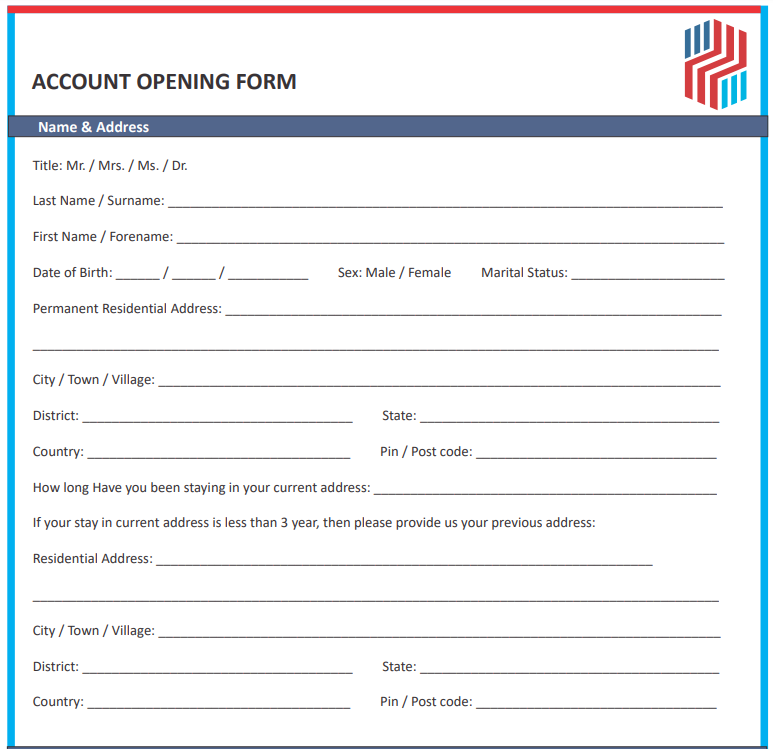

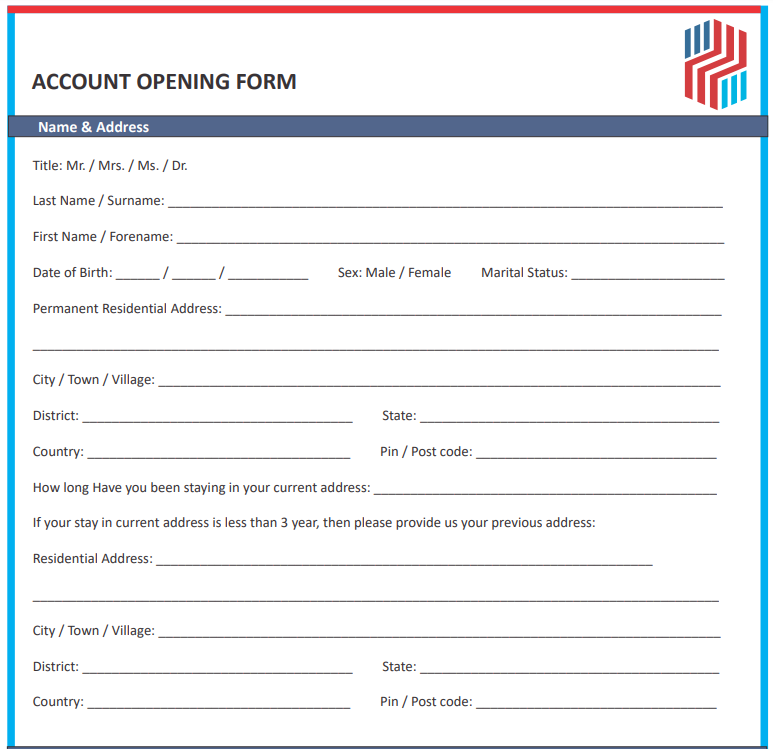

Trading Account Opening

To initiate collaboration with the broker, register on its website and open a demo or live account. Traders Union experts have prepared the below step-by-step guide. The guide will also familiarize you with the main features of the user account.

Go to the broker's official website. Click on the "Open Live Account" button on the right.

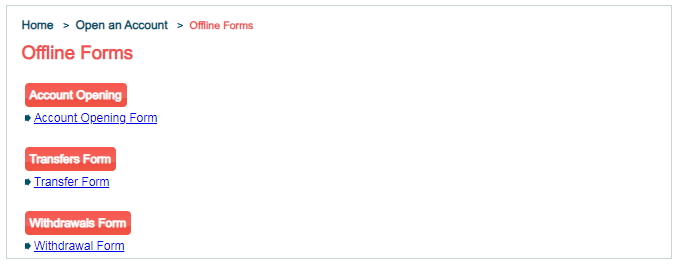

Choose the standalone "Account Opening" form from the list.

Print the PDF file and manually fill in all the sections.

Scan the completed form. Attach scans of documents confirming your identity and address. For identity verification, this could be a passport, driver's license, or an intrastate document with an ID. For address verification, you can use a bank statement with your address or a paid utility bill.

Send the specified document package to the email. Wait for the completion of the verification process. You will soon receive an email with further instructions on how to access the user account. You can download the trading platform at any time from the MT website or the broker's portal.

You can open a demo account, but you won't have access to the user account. On any page of the website, click "Open Demo Account" on the right.

Enter your name, country, email, and phone number. Complete the captcha and click “Confirm.”

An email with instructions and a link to download the trading platform will be sent to the specified email. This trading platform version allows you to operate on Connoisseur Investments accounts only in demo mode.

Regulation and safety

Connoisseur Investments has a safety score of 5.8/10, which corresponds to a Medium security level. The safest brokers are those with Tier-1 regulation, a long history (over 10 years in the market), and participation in investor compensation schemes.

- Is regulated

- Negative balance protection

- Not tier-1 regulated

- Track record of less than 8 years

Connoisseur Investments Regulators and Investor Protection

| Abbreviation | Full Name | Country of regulation | Investor Protection Fund | Regulation Level |

|---|---|---|---|---|

BVI FSC BVI FSC |

British Virgin Islands Financial Services Commission | British Virgin Islands | No specific fund | Tier-2 |

Connoisseur Investments Security Factors

| Foundation date | - |

| Negative balance protection | Yes |

| Verification (KYC) | Yes |

Commissions and fees

The trading and non-trading commissions of broker Connoisseur Investments have been analyzed and rated as Medium with a fees score of 5/10. Additionally, these commissions were compared with those of the top two competitors, Pepperstone and OANDA, to provide the most comprehensive information.

- No deposit fee

- No withdrawal fee

- Above-average Forex trading fees

- No ECN/Raw Spread account

Trading Fees and Spread

Below, we evaluated and compared the trading commissions of Connoisseur Investments with those of two competitors. We focused on the spreads and other transaction fees directly associated with executing trades (e.g commission per lot on an ECN account). This comparison aimed to provide a clear understanding of the cost efficiency of each broker.

Standard Account Spread

For Standard accounts, Connoisseur Investments’s commissions are part of the floating spread, which varies with market conditions. Typical values are provided, but during high volatility, the spread may exceed these.

Connoisseur Investments Standard spreads

| Connoisseur Investments | Pepperstone | OANDA | |

| EUR/USD min, pips | 0,5 | 0,5 | 0,1 |

| EUR/USD max, pips | 0,8 | 1,5 | 0,5 |

| GPB/USD min, pips | 0,6 | 0,4 | 0,1 |

| GPB/USD max, pips | 1,0 | 1,4 | 0,5 |

Does Connoisseur Investments support RAW/ECN accounts?

As we discovered, Connoisseur Investments does not offer RAW/ECN accounts, which might be a drawback for transparency and liquidity. However, this doesn't make the broker uncompetitive. Consider factors like spread levels, execution speed, regulation, support quality, and trading tools when choosing a reliable broker.

Non-Trading Fees

We conducted a detailed analysis of the non-trading fees associated with Connoisseur Investments. This review offers a comprehensive overview of the additional costs that may impact traders beyond regular trading activities.

Connoisseur Investments Non-Trading Fees

| Connoisseur Investments | Pepperstone | OANDA | |

| Deposit fee, % | 0 | 0 | 0 |

| Withdrawal fee, % | 0 | 0 | 0 |

| Withdrawal fee, USD | 0 | 0 | 0-15 |

| Inactivity fee ($, per month) | 50 | 0 | 0 |

Account types

Once a trader decides to trade on a live account, they need to determine their goals. The Standard account at Connoisseur Investments is suitable for most clients, offering a low entry threshold and universal conditions, but there is a limit of 50 lots on the trade volume. Therefore, the Premium account, which has no limits, is recommended for users intending to make large investments and trade in significant volumes. The Islamic account excludes swap fees, making it primarily suitable for representatives of the associated religion. The choice of a trading platform is not an issue since trading can only be done through MT4. Alternative earning options are chosen according to preference, with joining a PAMM account or fund being the easiest. Experienced market participants can become managers and earn additional income through commissions.

Account types:

Usually, if a user is unfamiliar with a platform, they start by opening a demo account. A demo account allows users to explore the broker's capabilities in market conditions, albeit with virtual funds. If the trader is satisfied, they can then choose one of the live accounts based on their strategic preferences and ambitions.

Deposit and withdrawal

Connoisseur Investments received a Low score for the efficiency and convenience of its deposit and withdrawal processes.

Connoisseur Investments offers limited payment options and accessibility, which may impact its competitiveness.

- Low minimum withdrawal requirement

- Bank wire transfers available

- Minimum deposit below industry average

- No deposit fee

- BTC payments not accepted

- USDT payments not accepted

- PayPal not supported

What are Connoisseur Investments deposit and withdrawal options?

Connoisseur Investments offers a limited selection of deposit and withdrawal methods, including Bank Wire, Neteller. This limitation may restrict flexibility for users, making Connoisseur Investments less competitive for those seeking diverse payment options.

Connoisseur Investments Deposit and Withdrawal Methods vs Competitors

| Connoisseur Investments | Plus500 | Pepperstone | |

| Bank Wire | Yes | Yes | Yes |

| Bank card | No | Yes | Yes |

| PayPal | No | Yes | Yes |

| Wise | No | No | No |

| BTC | No | No | No |

What are Connoisseur Investments base account currencies?

A wide range of base account currencies minimizes the need for currency conversion, potentially reducing transaction costs for clients worldwide. Connoisseur Investments supports the following base account currencies:

What are Connoisseur Investments's minimum deposit and withdrawal amounts?

The minimum deposit on Connoisseur Investments is $200, while the minimum withdrawal amount is $0. These minimums may vary depending on the chosen account type and payment method. For specific details, please contact Connoisseur Investments’s support team.

Markets and tradable assets

Connoisseur Investments offers a limited selection of trading assets compared to the market average. The platform supports 0 assets in total, including 50 Forex pairs.

- 50 supported currency pairs

- Indices trading

- Copy trading platform

- Futures not available

- Crypto trading not available

Supported markets vs top competitors

We have compared the range of assets and markets supported by Connoisseur Investments with its competitors, making it easier for you to find the perfect fit.

| Connoisseur Investments | Plus500 | Pepperstone | |

| Currency pairs | 50 | 60 | 90 |

| Total tradable assets | 2800 | 1200 | |

| Stocks | Yes | Yes | Yes |

| Commodity futures | Yes | Yes | Yes |

| Crypto | No | Yes | Yes |

| Stock indices | Yes | Yes | Yes |

| Options | No | Yes | No |

Investment options

We also explored the trading assets and products Connoisseur Investments offers for beginner traders and investors who prefer not to engage in active trading.

| Connoisseur Investments | Plus500 | Pepperstone | |

| Bonds | No | No | No |

| ETFs | No | Yes | Yes |

| Copy trading | Yes | No | Yes |

| PAMM investing | Yes | No | Yes |

| Managed accounts | No | No | No |

Customer support

Can I deposit money with a Visa or MC bank card? What is the current spread for the USD/EUR pair? Why was my order forcibly closed? Most trader questions arise from their inattention or the lack of necessary information on the website. Sometimes they encounter live issues with trading or deposit/withdrawal of funds. In any case, they may need assistance from client support. The client service of Connoisseur Investments is accessible through the following communication channels: call center, email, live chat, and callback. It is available 24/5 on weekdays.

Advantages

- Multiple communication channels

- Quick responses

- Maximum competence

Disadvantages

- Clients won't receive a response during weekends, as they'll have to wait until Monday.

Unregistered users can also contact Connoisseur Investments for client support.

Here are the current contact options:

-

Email;

-

Phone;

-

Live chat and callback on the website

A callback request is generated through a special form available on every page of the website.

Contacts

| Registration address | Connoisseur Investments Ltd, PO Box 173, Kingston Chambers Road, Tortola VG1110, British Virgin Islands |

|---|---|

| Regulation | BVIFSC |

| Official site | https://www.cnsinvest.com/ |

| Contacts |

+18448263022

|

Education

Brokers are not obligated to educate traders, as it is assumed that if a user registers and opens a live account, they understand what they will be working with and how. Nevertheless, Connoisseur Investments conducts closed lectures and webinars for its clients, providing educational materials.

Like most other brokers, Connoisseur Investments focuses on novices and traders with moderate experience. Professionals are unlikely to find anything useful in the provided materials.

Comparison of Connoisseur Investments with other Brokers

| Connoisseur Investments | Bybit | Eightcap | XM Group | VT Markets | Markets4you | |

| Trading platform |

MT4 | MetaTrader5 | MT4, MT5, TradingView | MT4, MT5, MobileTrading, XM App | MetaTrader4, MetaTrader5, VT Markets App, Web Trader+ | MT4, MobileTrading, MT5 |

| Min deposit | $200 | No | $100 | $5 | $50 | No |

| Leverage |

From 1:1 to 1:500 |

From 1:1 to 1:500 |

From 1:30 to 1:500 |

From 1:1 to 1:30 |

From 1:1 to 1:500 |

From 1:10 to 1:4000 |

| Trust management | No | No | No | No | Yes | No |

| Accrual of % on the balance | No | No | No | No | No | No |

| Spread | From 10 points | From 0 points | From 0 points | From 0.8 points | From 0 points | From 0.1 points |

| Level of margin call / stop out |

No | No / 50% | 80% / 50% | 100% / 50% | No / 50% | 100% / 20% |

| Order Execution | Market Execution | Market Execution | Market Execution | Market Execution | Market Execution | Market Execution, Instant Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | No | No | No | No | Yes |

Detailed review of Connoisseur Investments

The company has been operating for over 10 years, making it one of the veterans in the international brokerage market. At present, it offers a well-established mechanism for comfortable trading. The microservices architecture ensures the platform's intuitiveness and stability, while virtual dedicated servers significantly accelerate and simplify the automation of 24-hour trading. Tests have shown order execution at a level of 30 ms. A distinct advantage of the broker is its registration in the British Virgin Islands, with a verified regulator, providing traders with confidence in its reliability and transparent conditions.

Connoisseur Investments by the numbers:

-

Broker provides 1 demo and 3 live accounts.

-

The minimum deposit is $200.

-

4 groups of financial instruments are available.

-

The minimum spread is $10.

-

Trading commission is $0.

Connoisseur Investments is a reliable platform for diversified trading and investing

The conditions offered by Connoisseur Investments allow for the comfortable use of many trading strategies while maintaining risk at an optimal level. The asset pool encompasses various groups of financial instruments such as currencies, indices, metals, and commodities. This enables the formation of a diversified investment portfolio, which allows traders to explore a variety of trading strategies. Additionally, traders can use flexible leverage, adjusting it at their discretion for each account. Leverage up to 1:500 significantly enhances profit potential. Finally, alternative earning options include joint accounts and fund management, offering excellent opportunities for passive income. Experienced traders can also earn bonuses based on their professionalism.

Connoisseur Investments’ analytical services:

-

Economic calendar. A standard service for technical analysis, presenting a table of significant events from the world of politics and economics. Each event includes the affected asset and a forecast of changes in its quotes.

-

Forex News. Constantly updated newsfeeds covering not only currency pairs but also indices, metals, and other assets. Understanding the current market situation is crucial for accurate forecasting.

-

Research and analysis. The broker's experts research specific segments of the global market, analyzing news, trends, and popular trading methods. Studying this section will be beneficial for traders at any skill level.

Advantages:

Demo account is free. To open a live account, only $200 is required.

Traders can use many strategic solutions, with the only limitation being the trade volume.

The Premium account, unlike the Standard one, has no restrictions. Plus, a personal manager is provided.

Traders work through the top-rated MT4 trading platform, with the broker offering basic analytics.

Apart from floating spreads, there are no additional costs, including no fees for fund withdrawals.

Articles that may help you

Check out our reviews of other companies as well

User Satisfaction i