According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $100

- MT4

- MT5

- WebTrader

- ASIC

- FSCA

- 2020

Our Evaluation of DBG Markets

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

DBG Markets is a broker with higher-than-average risk and the TU Overall Score of 4.92 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by DBG Markets clients on our website, Traders Union expert Anton Kharitonov recommends users to consider a more reliable broker with better conditions, as, according to reviews, many clients of this broker are not satisfied with the company’s work.

DBG Markets is a CFD broker that provides its clients with everything necessary for comfortable and successful trading. It offers a wide range of CFDs, moderate leverage, and low costs. A free demo account is available for platform exploration and strategy testing. Real accounts are conceptually standard for the genre. All typical funding and withdrawal methods are available, with no transaction fees. An important advantage is the availability of joint accounts. Traders should be aware that this broker only offers CFDs and has regional restrictions.

Brief Look at DBG Markets

DBG Markets is a CFD broker that provides access to markets for currency pairs, stocks, indices, commodities, metals, and cryptocurrencies. It offers a pool of several hundred assets, including a demo account and three real accounts. The minimum deposit is $100, with a maximum leverage of 1:500. Account base currencies include USD, EUR, GBP, AUD, JPY, and CHF. Broker clients can trade through MetaTrader 4, MetaTrader 5, and WebTrader trading platforms. Passive income options include MAM and PAMM joint accounts. Spreads are variable, starting from 0 pips. A trading commission of $5 per lot applies to 2 out of the 3 account types. There are no withdrawal fees, and withdrawal channels include bank transfers, Visa cards, Skrill, WebMoney, Union Pay, and cryptocurrency wallets. Technical support operates 24/7 and is available through multiple channels.

We've identified your country as

GB

We have thoroughly analyzed all companies legally providing trading services in your country and created a ranking of the best ones. Our analysis highlights companies that offer optimal working conditions, uphold a strong reputation, and consistently receive the highest number of positive reviews from traders on our website.

Explore the 5 top-rated companies in

GB :

- The demo account doesn't require a deposit, and real accounts can be opened with just $100.

- This broker offers hundreds of assets and doesn't limit its clients' trading choices.

- Traders can choose from three different platforms, and included are their desktop and mobile versions.

- Spreads that start from 0 pips and reasonable transaction commissions keep client costs low.

- There are various funding and withdrawal options, with no transaction fees charged by this broker.

- Users can connect to joint accounts for additional and passive profit.

- Technical support operates around the clock, seven days a week.

- While this broker offers many assets, they are all in the form of contracts for price differences (CFDs).

- Apart from joint accounts, there are no other alternative earning options, such as copy trading and referral programs.

- Residents of Iran, Afghanistan, Belgium, Japan, and several other countries cannot trade with this broker.

TU Expert Advice

Financial expert and analyst at Traders Union

DBG Markets Ltd is a company registered in Hong Kong, that entered the international market in 2007. It later established branches in the South Africa, as well as in Vanuatu and Saint Vincent and the Grenadines. It is officially registered and regulated in each of these countries, plus it holds a license from the Australian regulator. Currently, it stands as one of the most regulated brokers.

DBG Markets' trading conditions are more advantageous than those of most competitors. The spreads are variable, starting from 0-0.5 pips. The trading commission is either $0 or $5 per lot. There are no fees for deposits and withdrawals, regardless of the chosen channel. And there are quite a few channels available, including bank transfers, credit cards, electronic systems, and cryptocurrency wallets.

The leverage is 1:500, the minimum trade size is 0.01 lots, the margin call is at 100%, and the stop-out is at 50%. All of these are standard metrics. While not outstanding, they meet modern requirements, ensuring comfortable and profitable trading. One distinctive feature of this broker is the wide range of contracts for price differences (CFDs) across six asset groups comprising currency pairs, stocks, indices, commodities, metals, and cryptocurrencies.

Key advantages include the availability of six base account currencies, a choice of three trading platforms, and a complete absence of trading restrictions against scalping, hedging, news trading, and expert advisors. There's also passive income, with joint accounts like MAM and PAMM which are implemented at a high-quality level.

Regional limitations are a downside, but not critical. Essentially, they are present with most brokers nowadays. The company's website lacks any educational materials and special tools for technical and fundamental analyses. This also needs to be considered. Overall, the platform can be recommended for exploration.

DBG Markets Trading Conditions

| 💻 Trading platform: | МТ4, МТ5, WebTrader |

|---|---|

| 📊 Accounts: | Demo, STP, ECN, VIP |

| 💰 Account currency: | USD, EUR, GBP, AUD, JPY, CHF |

| 💵 Deposit / Withdrawal: | Bank transfers, Visa, Skrill, WebMoney, Union Pay, and cryptocurrency wallets |

| 🚀 Minimum deposit: | $100 |

| ⚖️ Leverage: | Up to 1:500 |

| 💼 PAMM-accounts: | Yes |

| 📈️ Min Order: | 0.01 |

| 💱 EUR/USD spread: | 0,2-0,4 pips |

| 🔧 Instruments: | CFDs on currency pairs, stocks, indices, commodities, metals and cryptocurrencies |

| 💹 Margin Call / Stop Out: | 100%/50% |

| 🏛 Liquidity provider: | Yes |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | No |

| 📋 Order execution: | Market |

| ⭐ Trading features: |

Free demo account and three real accounts; Low entry threshold, high intuitiveness, and transparency; Many CFDs from different groups; Three trading platforms from which to choose; Low costs and joint accounts are available. |

| 🎁 Contests and bonuses: | Yes |

With some brokers, the minimum deposit varies depending on the account type. DBG Markets offers several real account options, but the deposit starts at $100 in any case. Compared to other brokers, this is an average indicator. Some platforms require at least $10, while others require a minimum deposit of $500, $1,000, or more. As for leverage, a maximum value of 1:500 is considered optimal. The leverage is flexible. A trader can trade with no trading leverage at all or choose an option like 1:100. Technical support is one of the platform's strong features. It operates on weekdays and weekends, or 24/7. Moreover, different communication channels are available like a call center, email, live chat, and tickets.

DBG Markets Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

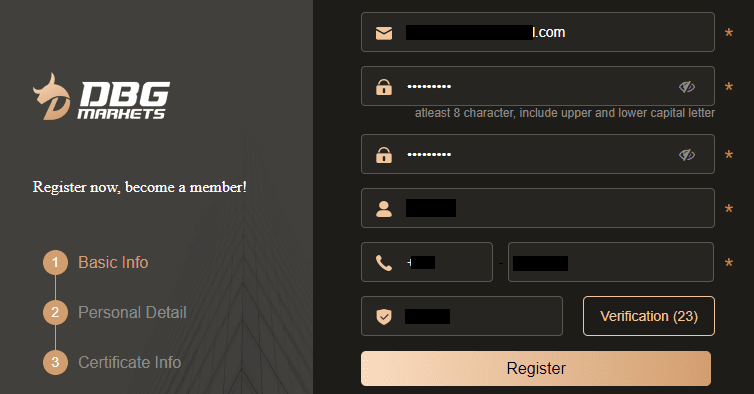

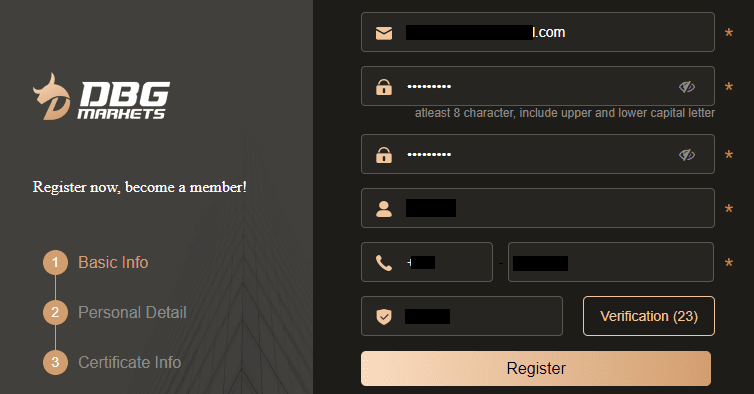

Trading Account Opening

To collaborate with this broker, register on their website, go through the verification process, open a real account, and make a deposit. Then all that's left is to download the trading platform, install it on your device, and you can start trading. TU experts have prepared the below guide with a detailed description of each step, as well as an overview of the capabilities of the user account.

Go to this broker's website. Click on “Open an Account” or “Start Trading”.

Enter your email, and create and provide a password. Enter your name and phone number. Click on the “Verification” button. A verification code will be sent to your specified email. Enter it in the corresponding field. Click “Register”.

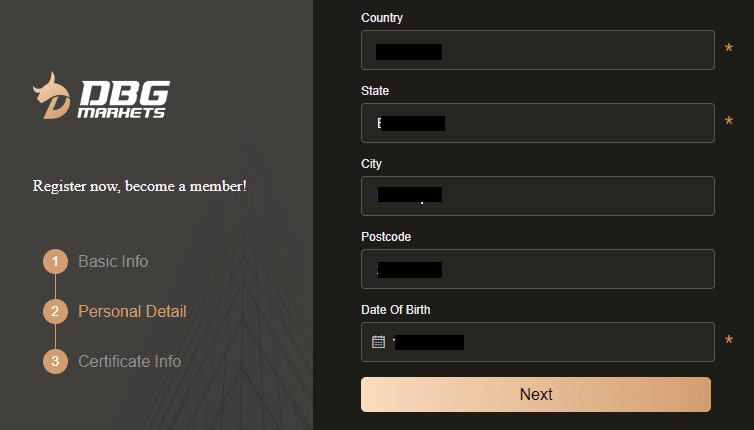

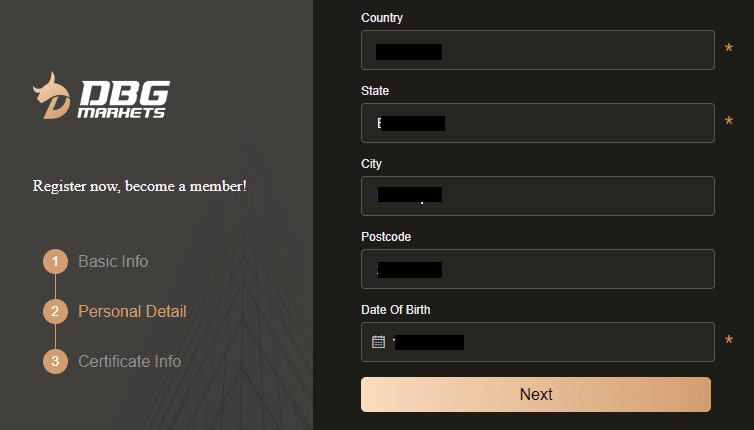

Choose your country from the list. Specify your region and city, and enter your postal code and birth date. Click “Next”.

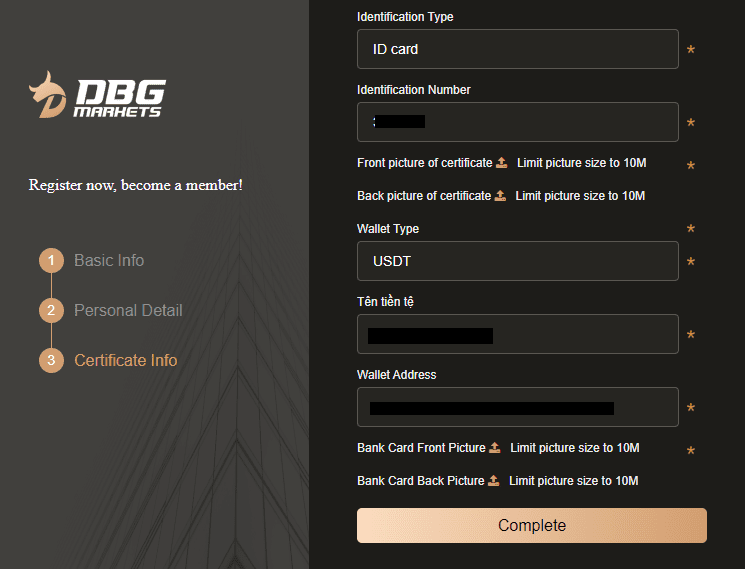

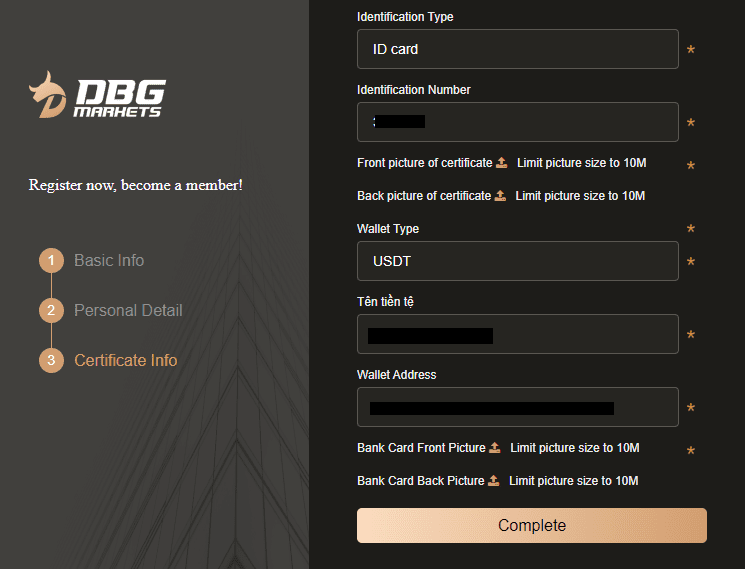

Select the type of document to verify your identity and enter its number. Upload a scan or a photo of the document. Specify the wallet type (bank account or cryptocurrency wallet). Provide details according to the selected wallet type. If you chose a bank card, upload scans/photos of its front and back sides. Click “Finish”.

An email with your registration details will be sent to your inbox. Enter these details on the login page and also provide the code that will be displayed next to the input field.

In the user account, open a real account, then select the deposit option, specify the deposit method, and follow the on-screen instructions. Next, go to the section with trading platform distributions and download the suitable one. Install it, launch the platform, and you can start trading.

Your DBG Markets’ user account also provides access to:

-

Open and close accounts (including demo).

-

Get statistics for active and archived accounts.

-

Deposit and withdraw funds, and make internal transfers.

-

Open joint accounts and join them.

-

Track their points, and exchange them for gifts.

-

Check your position in trading contests.

-

Download MT trading platform distributions.

-

Trade through the WebTrader platform.

-

Edit personal information.

-

Set account security parameters.

-

Contact client support through any available method.

Regulation and safety

DBG Markets has a safety score of 8.8/10, which corresponds to a High security level. The safest brokers are those with Tier-1 regulation, a long history (over 10 years in the market), and participation in investor compensation schemes.

- Tier-1 regulated

- Negative balance protection

- Track record of less than 8 years

DBG Markets Regulators and Investor Protection

| Abbreviation | Full Name | Country of regulation | Investor Protection Fund | Regulation Level |

|---|---|---|---|---|

ASIC ASIC |

Australian Securities and Investments Commission | Australia | No specific fund but has stringent consumer protection | Tier-1 |

FSCA SA FSCA SA |

Financial Sector Conduct Authority of South Africa | South Africa | No specific fund | Tier-2 |

DBG Markets Security Factors

| Foundation date | 2020 |

| Negative balance protection | Yes |

| Verification (KYC) | Yes |

Commissions and fees

The trading and non-trading commissions of broker DBG Markets have been analyzed and rated as Medium with a fees score of 6/10. Additionally, these commissions were compared with those of the top two competitors, Eightcap and XM Group, to provide the most comprehensive information.

- No inactivity fee

- No deposit fee

- No withdrawal fee

- Above-average Forex trading fees

- No ECN/Raw Spread account

Trading Fees and Spread

Below, we evaluated and compared the trading commissions of DBG Markets with those of two competitors. We focused on the spreads and other transaction fees directly associated with executing trades (e.g commission per lot on an ECN account). This comparison aimed to provide a clear understanding of the cost efficiency of each broker.

Does DBG Markets support RAW/ECN accounts?

As we discovered, DBG Markets does not offer RAW/ECN accounts, which might be a drawback for transparency and liquidity. However, this doesn't make the broker uncompetitive. Consider factors like spread levels, execution speed, regulation, support quality, and trading tools when choosing a reliable broker.

Non-Trading Fees

We conducted a detailed analysis of the non-trading fees associated with DBG Markets. This review offers a comprehensive overview of the additional costs that may impact traders beyond regular trading activities.

DBG Markets Non-Trading Fees

| DBG Markets | Eightcap | XM Group | |

| Deposit fee, % | 0 | 0 | 0 |

| Withdrawal fee, % | 0 | 0 | 0 |

| Withdrawal fee, USD | 0 | 0 | 0 |

| Inactivity fee ($, per month) | 0 | 0 | 10 |

Account types

Typically, if a broker offers multiple real accounts, it makes sense to focus on their parameters before making a choice. However, in the case of DBG Markets, this isn't of great significance. The deposit is the same for all accounts, as are the general trading conditions. The difference lies only in spreads and commissions, but it's not significant enough to draw attention. The trading platforms are more interesting as this broker presents three options, with mobile versions available for MT5/4 solutions, and WebTrader enables browser-based trading. As all these platforms are free, traders are advised to try each and choose the one that’s most suitable. This broker provides a free demo account, allowing users to trade in market conditions without risking their capital. Additionally, users can focus on joint accounts if passive income interests them. To become an investor, one needs nothing more than the desire and sufficient funds.

Account types:

If a trader hasn't worked with this broker before, it's advisable to start by opening a demo account. It's an excellent opportunity to explore the platform's capabilities under conditions closely resembling real ones, and the demo allows experimentation with strategies without the risk of financial loss. If the trader is satisfied, they can proceed to open a real account, deposit funds, and start executing full-fledged trades.

Deposit and withdrawal

DBG Markets received a Low score for the efficiency and convenience of its deposit and withdrawal processes.

DBG Markets offers limited payment options and accessibility, which may impact its competitiveness.

- Low minimum withdrawal requirement

- Minimum deposit below industry average

- No withdrawal fee

- No deposit fee

- USDT payments not accepted

- No bank wire option

- No bank card option

What are DBG Markets deposit and withdrawal options?

DBG Markets offers a limited selection of deposit and withdrawal methods, including . This limitation may restrict flexibility for users, making DBG Markets less competitive for those seeking diverse payment options.

DBG Markets Deposit and Withdrawal Methods vs Competitors

| DBG Markets | Eightcap | XM Group | |

| Bank Wire | No | Yes | Yes |

| Bank card | No | Yes | Yes |

| PayPal | No | Yes | No |

| Wise | No | No | No |

| BTC | No | Yes | Yes |

What are DBG Markets's minimum deposit and withdrawal amounts?

The minimum deposit on DBG Markets is $100, while the minimum withdrawal amount is $0. These minimums may vary depending on the chosen account type and payment method. For specific details, please contact DBG Markets’s support team.

Markets and tradable assets

DBG Markets offers a limited selection of trading assets compared to the market average. The platform supports 100 assets in total, including 55 Forex pairs.

- Indices trading

- 55 supported currency pairs

- Crypto trading

- Limited asset selection

- Futures not available

Supported markets vs top competitors

We have compared the range of assets and markets supported by DBG Markets with its competitors, making it easier for you to find the perfect fit.

| DBG Markets | Eightcap | XM Group | |

| Currency pairs | 55 | 40 | 57 |

| Total tradable assets | 100 | 800 | 1400 |

| Stocks | Yes | Yes | Yes |

| Commodity futures | Yes | Yes | Yes |

| Crypto | Yes | Yes | No |

| Stock indices | Yes | Yes | Yes |

| Options | No | No | No |

Investment options

We also explored the trading assets and products DBG Markets offers for beginner traders and investors who prefer not to engage in active trading.

| DBG Markets | Eightcap | XM Group | |

| Bonds | No | No | No |

| ETFs | No | No | No |

| Copy trading | Yes | No | Yes |

| PAMM investing | No | No | |

| Managed accounts | No | No |

Customer support

Can funds be deposited using an MC card? Will there be a fee for withdrawing to a BTC cryptocurrency wallet? What is the spread on the VIP account and is there a trading fee associated with it? Traders might have numerous questions. Furthermore, inquiries are sometimes prompted by real trading issues. In such moments, a trader values a prompt and knowledgeable response from the technical support team. DBG Markets' client service is available 24/7, which means that you can reach out to managers even during nights and weekends. The current communication channels include a call center, email, live chat, and tickets on the website. Clients of this broker have no complaints about the support service's performance.

Advantages

- No registration is required to contact client support

- Several communication channels are available

- Managers are available even during weekends and nights

Disadvantages

- The call center is often overloaded during peak hours

If you are already trading with this broker or considering starting a collaboration and have a question, you may contact tech support and it will provide a prompt and competent response using the following channels:

Phone.

Email.

Live chat on the website and in the user account.

Ticket on the feedback form page.

The most responsive communication options are the phone and live chat. Email responses typically arrive within 2 hours.

Contacts

| Foundation date | 2020 |

|---|---|

| Registration address |

Room 1804 Beverly House, 93-107 Lockhart Road, Wan Chai, Hong Kong Govant Building, BP 1276, Port Vila, Vanuatu First Floor, First St Vincent Bank Ltd Building, James Street, Kingstown, St. Vincent and the Grenadines |

| Regulation | ASIC, FSCA |

| Official site | https://www.dbgmarket.net/ |

| Contacts |

+27 0861888221

|

Education

Many brokers offer education to their clients. This could range from a glossary and basic FAQs to a comprehensive program. Some companies conduct webinars. However, DBG Markets does not provide any educational resources. On their platform, you can only find answers to frequently asked questions related to platform functionality. They also offer indicators for trading platforms and newsfeeds.

Regardless of a trader's skill level, they won't find any information on this broker's website that could assist them in trading. DBG Markets assumes that if a user has registered, they already possess at least basic trading knowledge and skills.

Comparison of DBG Markets with other Brokers

| DBG Markets | Bybit | Eightcap | XM Group | VT Markets | IC Markets | |

| Trading platform |

MT4, MT5, WebTrader | MetaTrader5 | MT4, MT5, TradingView | MT4, MT5, MobileTrading, XM App | MetaTrader4, MetaTrader5, VT Markets App, Web Trader+ | MT4, cTrader, MT5, TradingView |

| Min deposit | $100 | No | $100 | $5 | $50 | $200 |

| Leverage |

From 1:1 to 1:500 |

From 1:1 to 1:500 |

From 1:30 to 1:500 |

From 1:1 to 1:30 |

From 1:1 to 1:500 |

From 1:1 to 1:500 |

| Trust management | No | No | No | No | Yes | No |

| Accrual of % on the balance | No | No | No | No | No | No |

| Spread | From 0 points | From 0 points | From 0 points | From 0.8 points | From 0 points | From 0 points |

| Level of margin call / stop out |

100% / 50% | No / 50% | 80% / 50% | 100% / 50% | No / 50% | 100% / 50% |

| Order Execution | Market Execution | Market Execution | Market Execution | Market Execution | Market Execution | Market Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | No | No | No | No | No |

Detailed review of DBG Markets

The company has established itself as a reliable and stable partner, providing traders access to global financial markets. Order execution does not exceed 30 ms, which meets modern industry requirements and indicates the platform's use of advanced technological solutions. DBG Markets employs innovative approaches like virtual servers and a well-thought-out integration strategy, for instance, utilizing microservices architecture. The presence of joint accounts and 24/7 support underscores this broker's high level of client loyalty.

DBG Markets by the numbers:

The minimum spread is 0 pips.

The commission size is $0 or $5 per lot.

The minimum deposit is $100.

The maximum leverage is 1:500.

There are 3 real accounts plus a demo available.

DBG Markets is a CFD broker with favorable collaboration conditions

What conditions can be called comfortable regarding this broker? First, low trading costs, where DBG Markets outperforms many competitors with its spreads starting from 0 pips and no withdrawal commission. Second, traders appreciate the extensive pool of assets, which allows them to employ diverse trading strategies and manage risk through a diversified investment portfolio. DBG Markets doesn't face issues in this regard, offering hundreds of assets from six different groups. Third, traders boost profit potential through leverage and various instruments that promote freedom of action. DBG Markets provides flexible leverage up to 1:500 and doesn't restrict clients, allowing them to use any trading methods, including intraday, news trading, and expert advisors. Finally, the prompt and round-the-clock technical support ensures that users are never left alone with their issues.

DBG Markets’ analytical services:

MAM and PAMM accounts. Every broker client can create a joint account as a manager or join as an investor. Managers earn from commissions, while investors receive passive income.

Indicators for MT4. The MetaTrader solution offers high flexibility, allowing the integration of various indicators for streamlined technical analysis. DBG Markets provides several pro-level indicators for free.

Newsfeeds. Traders enjoy permanent access to newsfeeds that update 24 hours a day. It displays the most significant events from the world of politics and economics, aiding in fundamental analysis.

Advantages:

There is a low entry barrier. Demo accounts are free, and for a real account, there is only $100 needed.

Full transparency. All costs are known in advance, with no hidden fees.

Deposit and withdrawal of funds are available through major channels without commission.

Traders are offered three trading platforms that use flexible leverage, but without restrictions from this broker.

Joint accounts provide an opportunity for passive earnings.

Articles that may help you

Check out our reviews of other companies as well

User Satisfaction i