According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $50

- cTrader

- MetaTrader4

- MetaTrader5

- TradingView

- CySEC

- FSA

- 2019

Our Evaluation of Errante

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

Errante is a moderate-risk broker with the TU Overall Score of 5.17 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Errante clients on our website, Traders Union expert Anton Kharitonov recommends users to thoroughly analyze pros and cons before opening an account with this broker as not all clients are satisfied with the company, according to reviews.

Trading, deposit, and withdrawal conditions for Errante clients vary depending on their country of residence.

Brief Look at Errante

Errante is an international broker that was registered in 2019. Since March 2020 it has been regulated by the Cyprus Securities and Exchange Commission (CySEC). The company also has a subsidiary in Seychelles, which operates under a license from the Seychelles Financial Services Authority (FSA). Errante is a partner of leading banks and a member of reliable compensation and insurance funds. In 2021, Errante received an award at the Ultimate Fintech Awards, and in 2022, it was recognized as the Best ECN/STP Broker.

We've identified your country as

US

We have thoroughly analyzed all companies legally providing trading services in your country and created a ranking of the best ones. Our analysis highlights companies that offer optimal working conditions, uphold a strong reputation, and consistently receive the highest number of positive reviews from traders on our website.

Explore the 5 top-rated companies in

US :

- Regulation by the Cyprus Securities and Exchange Commission (CySEC).

- Protection of client deposits through the Investors Compensation Fund's insurance program and compensation fund.

- Minimum deposit of $50/€50.

- A good choice of currency pairs.

- Dynamic leverage.

- Wide range of trading accounts.

- Adaption of trading conditions to meet local financial regulatory requirements.

- Errante CopyTrade service is available only for non-EU nationals.

- The broker does not offer cent accounts.

- Traders from the EU cannot deposit or trade cryptocurrencies.

TU Expert Advice

Financial expert and analyst at Traders Union

Errante has been providing access to Forex and CFDs since 2019, and during this time, it has not manifested any frauds, scams, or dishonest activity. On the contrary, its activity is recognized with awards for high-quality services, fast development, and best execution of orders. Errante’s website and user accounts are available in 13 languages.

According to CySEC's policy, Errante divides clients into two groups — retail and professional. Trading conditions change depending on the qualifications, additional services, and other particulars. When opening a trade account with Errante, the trader must confirm that they are familiar with the basics of Forex and risk management. The registration form includes 12 questions that must be answered.

For retail trading, the broker offers 4 account types. The swap-free feature is available on each of them, but it can only be activated by Muslim traders. Errante also provides demo accounts that can be used without a time limit. However, if there is no activity on the demo account for 90 days, the company will block it. In the case of real accounts, inactivity without penalty sanctions is possible for up to 12 months, so they can be used for long-term strategies.

Errante Trading Conditions

Your capital is at risk. 79.43% of retail investor accounts lose money when trading CFDs with this provider. Errante Ltd and its affiliates do not target EU/EEA/UK clients. It is the user's responsibility to ensure that any use of the website or services adhere to local laws or regulations. Please be aware that you are able to receive investment services at your own exclusive initiative only, ensuring you fully understand all the risks involved.

| 💻 Trading platform: | MetaTrader 5 (for all regions), MetaTrader 4 and cTrader (for outside the EU), TradingView |

|---|---|

| 📊 Accounts: | Demo, Standard, Premium, VIP, Tailor Made |

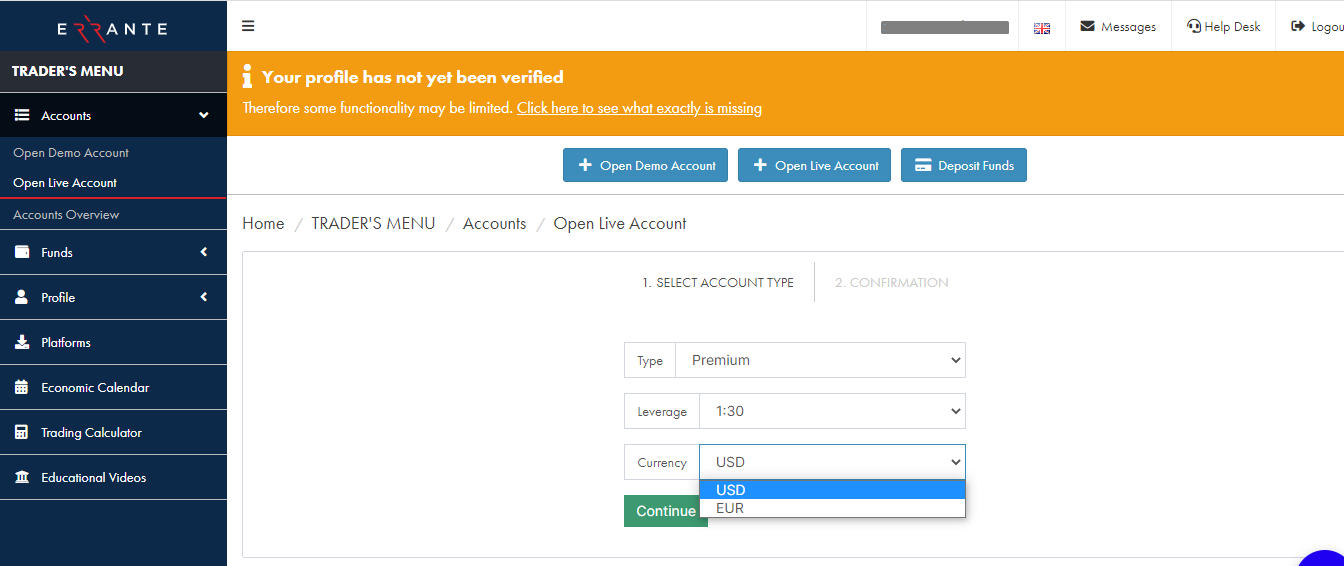

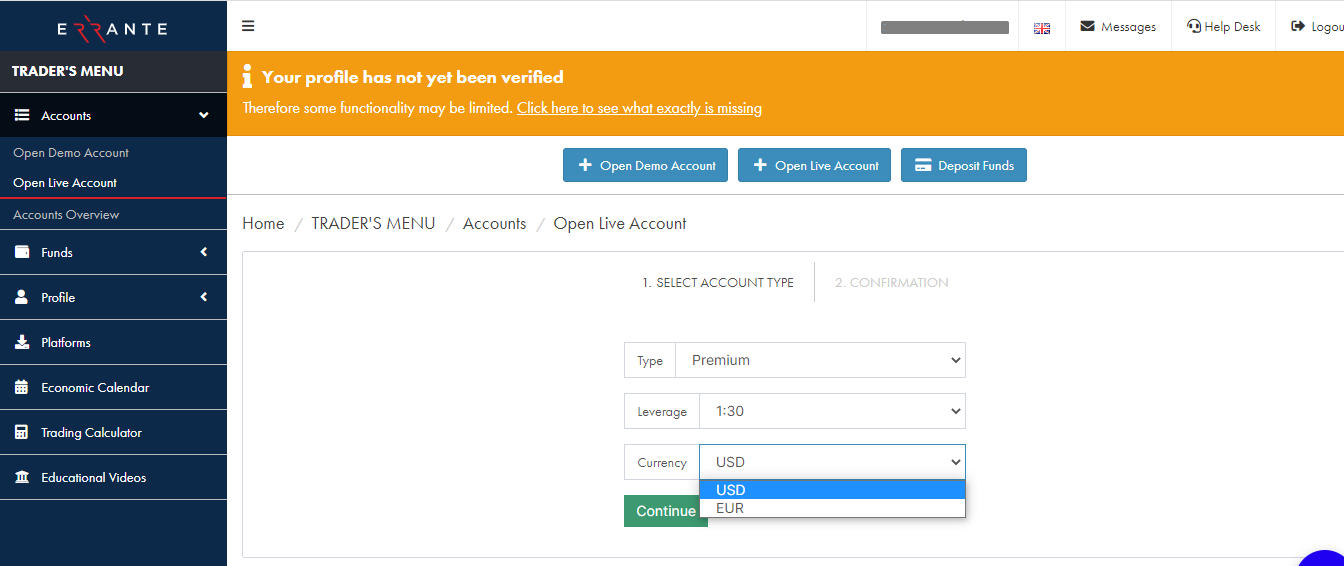

| 💰 Account currency: | EUR, USD |

| 💵 Deposit / Withdrawal: | Bank wire transfer (Swift, Sepa), debit/credit cards, e-wallets (Skrill, Neteller, SticPay, Perfect Money, Advcash, and others) |

| 🚀 Minimum deposit: | €50/$50 |

| ⚖️ Leverage: | For traders from the EU — up to 1:500 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.01 |

| 💱 EUR/USD spread: | 0,1 pips |

| 🔧 Instruments: | Forex, shares, metals, energy, commodities, indices, cryptos (available through FSA regulated division) |

| 💹 Margin Call / Stop Out: |

CySEC — 100%/50% FSA — 100%/20% |

| 🏛 Liquidity provider: | Major quote providers (not disclosed) |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Order execution: | Market execution |

| ⭐ Trading features: | The trading terms vary depending on the client’s jurisdiction |

| 🎁 Contests and bonuses: | No |

Trading conditions for traders from different regions differ. Errante has representative offices in Cyprus and Seychelles. Traders from EU countries trade under the regulation of CySEC, so they are limited in terms of leverage, choice of platforms, payment systems, services, and assets. For example, they cannot trade cryptocurrencies or copy trade. The commission rates for all Errante clients are the same, and the available account types do not differ.

Errante Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

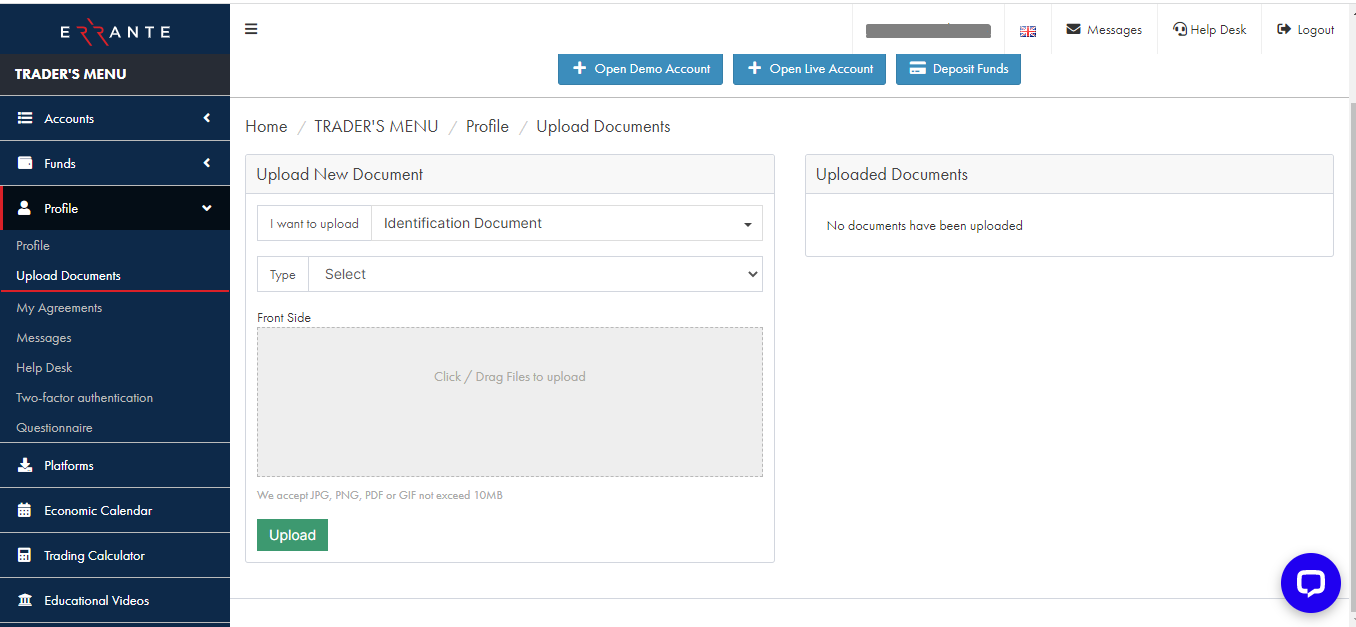

Trading Account Opening

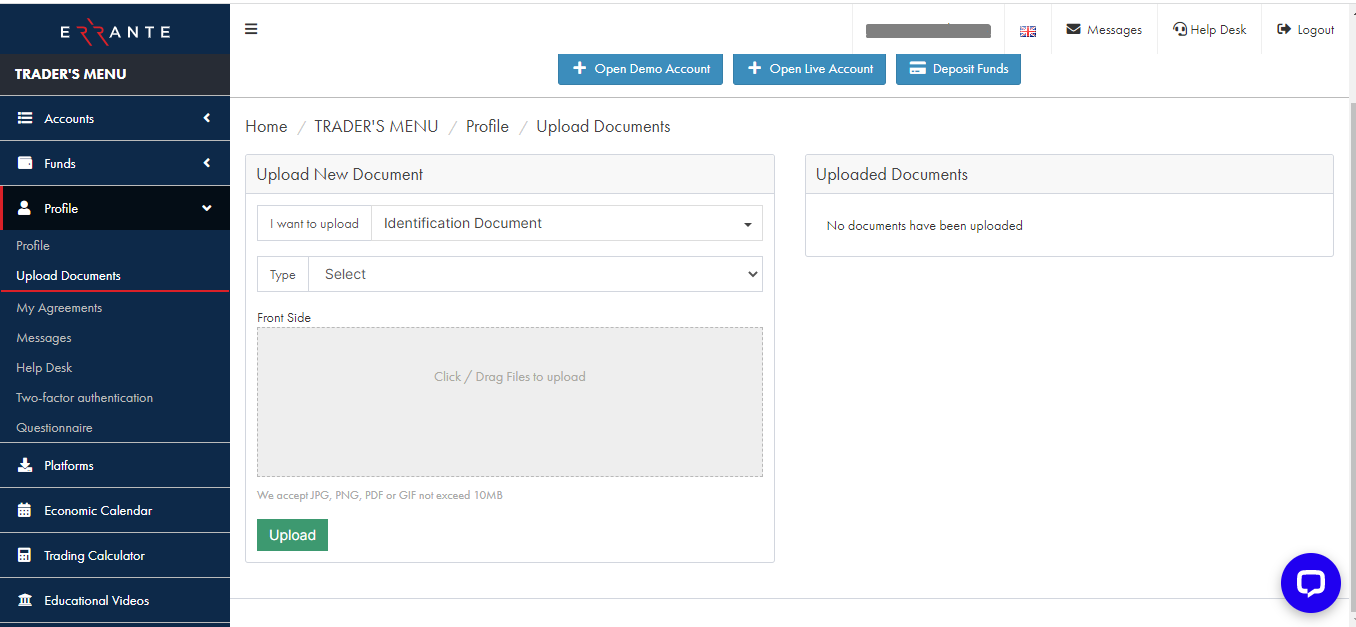

To create a user account on the Errante website, you need an account:

To open the registration form, click on Register or Join Now.

Fill in the information requested by the broker in the form, including your last name, first name, phone number, and email. Indicate your country of residence and create a password to access your user account. After that, check your email: Errante will send you a PIN code for the first authorization of your account. Enter it in the registration form and then log in to your user account using your email address and password.

The first steps after registering with Errante’s user account include:

Your Errante user account also provides access to:

-

Downloading the trading platform.

-

Opening demo accounts.

-

Making a deposit and transferring funds between accounts.

-

Submitting a request to withdraw profits.

-

Enabling two-factor authentication.

-

Creating a support ticket.

-

Viewing the Economic calendar and educational videos, using Errante calculators.

Regulation and safety

Errante has a safety score of 8.7/10, which corresponds to a High security level. The safest brokers are those with Tier-1 regulation, a long history (over 10 years in the market), and participation in investor compensation schemes.

- Tier-1 regulated

- Negative balance protection

- Track record of less than 8 years

Errante Regulators and Investor Protection

| Abbreviation | Full Name | Country of regulation | Investor Protection Fund | Regulation Level |

|---|---|---|---|---|

CySec CySec |

Cyprus Securities and Exchange Commission | Cyprus | Up to €20,000 | Tier-1 |

FSA (Seychelles) FSA (Seychelles) |

Financial Services Authority of Seychelles | Seychelles | No specific fund | Tier-3 |

Errante Security Factors

| Foundation date | 2019 |

| Negative balance protection | Yes |

| Verification (KYC) | Yes |

Commissions and fees

The trading and non-trading commissions of broker Errante have been analyzed and rated as Medium with a fees score of 7/10. Additionally, these commissions were compared with those of the top two competitors, Pepperstone and OANDA, to provide the most comprehensive information.

- Tight EUR/USD market spread

- No inactivity fee

- No deposit fee

- No withdrawal fee

- Above-average Forex trading fees

Trading Fees and Spread

Below, we evaluated and compared the trading commissions of Errante with those of two competitors. We focused on the spreads and other transaction fees directly associated with executing trades (e.g commission per lot on an ECN account). This comparison aimed to provide a clear understanding of the cost efficiency of each broker.

Standard Account Spread

For Standard accounts, Errante’s commissions are part of the floating spread, which varies with market conditions. Typical values are provided, but during high volatility, the spread may exceed these.

Errante Standard spreads

| Errante | Pepperstone | OANDA | |

| EUR/USD min, pips | 0,6 | 0,5 | 0,1 |

| EUR/USD max, pips | 1,8 | 1,5 | 0,5 |

| GPB/USD min, pips | 0,5 | 0,4 | 0,1 |

| GPB/USD max, pips | 1,8 | 1,4 | 0,5 |

RAW/ECN Account Commission And Spread

The spread on ECN/RAW accounts is market-based and fluctuates, with average values given during active hours. It may vary during volatility spikes. A commission per lot is also charged.

Errante RAW/ECN spreads

| Errante | Pepperstone | OANDA | |

| Commission ($ per lot) | 3 | 3 | 3,5 |

| EUR/USD avg spread | 0,1 | 0,1 | 0,15 |

| GBP/USD avg spread | 0,15 | 0,15 | 0,2 |

Non-Trading Fees

We conducted a detailed analysis of the non-trading fees associated with Errante. This review offers a comprehensive overview of the additional costs that may impact traders beyond regular trading activities.

Errante Non-Trading Fees

| Errante | Pepperstone | OANDA | |

| Deposit fee, % | 0 | 0 | 0 |

| Withdrawal fee, % | 0 | 0 | 0 |

| Withdrawal fee, USD | 0 | 0 | 0-15 |

| Inactivity fee ($, per month) | 0 | 0 | 0 |

Account types

Errante offers various types of accounts for real trading. Each client can open 2 trading accounts: one in USD, and the other in EUR. Muslim traders can request an Islamic account (swap free), on which no commission will be charged for carrying an open position overnight. Errante’s accounts differ in minimum deposit amounts and trading commissions.

Account types:

In addition to real accounts, the broker also offers demo accounts with an unlimited time period.

Errante allows each trader to choose an account with acceptable commissions and minimum deposit size. You can also test the broker’s trading conditions on demo accounts.

Deposit and withdrawal

Errante received a Medium score for the efficiency and convenience of its deposit and withdrawal processes.

Errante provides a reasonable range of deposit and withdrawal options with moderate fees, in line with industry standards.

- Bank card deposits and withdrawals

- Low minimum withdrawal requirement

- No deposit fee

- No withdrawal fee

- USDT payments not accepted

- Only major base currencies available

- BTC payments not accepted

What are Errante deposit and withdrawal options?

Errante provides a basic range of deposit and withdrawal options, covering essential methods in line with industry standards. This set of options is sufficient for most traders, with available methods Bank Card, Bank Wire, Skrill, Neteller.

Errante Deposit and Withdrawal Methods vs Competitors

| Errante | Plus500 | Pepperstone | |

| Bank Wire | Yes | Yes | Yes |

| Bank card | Yes | Yes | Yes |

| PayPal | No | Yes | Yes |

| Wise | No | No | No |

| BTC | No | No | No |

What are Errante base account currencies?

A wide range of base account currencies minimizes the need for currency conversion, potentially reducing transaction costs for clients worldwide. Errante supports the following base account currencies:

What are Errante's minimum deposit and withdrawal amounts?

The minimum deposit on Errante is $50, while the minimum withdrawal amount is $20. These minimums may vary depending on the chosen account type and payment method. For specific details, please contact Errante’s support team.

Markets and tradable assets

Errante offers a limited selection of trading assets compared to the market average. The platform supports 120 assets in total, including 50 Forex pairs.

- Copy trading platform

- Indices trading

- Crypto trading

- Bonds not available

- Futures not available

Supported markets vs top competitors

We have compared the range of assets and markets supported by Errante with its competitors, making it easier for you to find the perfect fit.

| Errante | Plus500 | Pepperstone | |

| Currency pairs | 50 | 60 | 90 |

| Total tradable assets | 120 | 2800 | 1200 |

| Stocks | Yes | Yes | Yes |

| Commodity futures | Yes | Yes | Yes |

| Crypto | Yes | Yes | Yes |

| Stock indices | Yes | Yes | Yes |

| Options | No | Yes | No |

Investment options

We also explored the trading assets and products Errante offers for beginner traders and investors who prefer not to engage in active trading.

| Errante | Plus500 | Pepperstone | |

| Bonds | No | No | No |

| ETFs | No | Yes | Yes |

| Copy trading | Yes | No | Yes |

| PAMM investing | No | No | Yes |

| Managed accounts | No | No | No |

Customer support

Client support is available 24/5.

Advantages

- You can quickly contact a representative of the company in chat and by phone

- Both broker's clients and guests can request support

Disadvantages

- On Saturdays and Sundays, support is not available.

- You can't order a callback.

Support can be contacted in several ways:

-

Call the numbers listed in the contact section;

-

Send an email to the company;

-

Write to the LiveChat;

-

Fill out a contact form via email.

Clients can create a ticket with a description of the problem in their user accounts.

Contacts

| Foundation date | 2019 |

|---|---|

| Registration address | 67 Spyrou Kyprianou, 4042 Limassol, Cyprus |

| Regulation |

CySEC, FSA

Licence number: 383/20, SD038 |

| Official site | https://errante.eu/ |

| Contacts |

+357 25 253300

|

Education

On the Errante website, there is an Education Centre section that features educational videos, market analysis, and webinars. Video lessons are divided into two groups: Beginner and Advanced. Videos for beginners are available to any website visitor, while advanced videos are only available to Errante clients who have deposited at least 30 USD or EUR.

To practice trading on the Forex market, Errante recommends opening a demo account. It has no expiration date, so it can be used as long as necessary to develop trading skills.

Comparison of Errante with other Brokers

| Errante | Eightcap | XM Group | RoboForex | Exness | Octa | |

| Trading platform |

cTrader, MetaTrader5, MetaTrader4, TradingView | MT4, MT5, TradingView | MT4, MT5, MobileTrading, XM App | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | Exness Trade App (mobile), Exness Terminal (web), MetaTrader5, MetaTrader4 | MetaTrader4, MetaTrader5, OctaTrader |

| Min deposit | $50 | $100 | $5 | $10 | $10 | $25 |

| Leverage |

From 1:1 to 1:500 |

From 1:30 to 1:500 |

From 1:1 to 1:30 |

From 1:1 to 1:2000 |

From 1:1 to 1:2000 |

From 1:40 to 1:1000 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | 10.00% | No | No |

| Spread | From 1.8 point | From 0 points | From 0.8 points | From 0 points | From 0 points | From 0.6 points |

| Level of margin call / stop out |

100% / 50% | 80% / 50% | 100% / 50% | 60% / 40% | 60% / No | 25% / 15% |

| Order Execution | Market Execution | Market Execution | Market Execution | Market Execution, Instant Execution | Market Execution, Instant Execution | Market Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | No | No | Yes | Yes | No |

Detailed review of Errante

The Errante broker offers individual and corporate accounts for secure trading on the interbank market. Errante applies the most advanced encryption technologies to protect its client’s personal data and funds, to collaborate with Lloyd’s of London Insurance Corporation. Errante keeps traders’ deposits in segregated accounts in major banks. It also provides services worldwide, while adapting trading conditions to the requirements of local financial market regulations.

Errante by the numbers:

-

Over 4 years of providing brokerage services.

-

2 regulated branches.

-

Over 100 trading instruments.

-

Client insurance up to €1,000,000.

Errante is a broker that takes into account the different needs and requirements of traders

Errante allows its clients to trade currency pairs, metals, energy and commodities, shares, and stock indices with leverage. The broker does not provide access to stock exchanges, so trading with assets is conducted in the form of CFDs. This means that traders earn not by buying or selling real financial instruments, but by trading contracts for differences in their prices. Trading conditions for each trader vary depending on the country of their residence and the amount of capital they have. There is no limit on the maximum number of orders. The total volume of open positions on accounts with deposits up to €5000 cannot exceed 50 lots and 80 lots for deposits of €5.000 and higher.

European traders can trade on the MetaTrader 5 platform. It needs to be installed on a device with a Mac, Windows, Android, or iOS operating system. Clients from other countries can choose from MT4, MT5, and cTrader, including the web versions of these platforms.

Errante’s analytical services:

-

Market analysis. At the beginning of every week, the company's website features a new review. The latest news that can affect the value of different assets is also regularly published.

-

Webinars. These are conducted by Errante experts in English and Italian. Any broker's client can apply to participate in the webinar. The past online sessions are available in recordings.

-

Errante calculators. With their help, a trader can compute the size of swaps for short and long positions, as well as the margin size and the cost per point for a specific asset.

Advantages:

The broker provides access to trading with more than 50 currency pairs 5 days a week.

For accounts with a deposit of €5,000 or more, a VPS server is provided free of charge.

Every Errante client can participate in educational and analytical webinars.

Accounts with individual trading conditions, a personal manager, and an extended range of educational materials are available.

Different styles and strategies are allowed, including algorithmic trading using advisors, scalping, and hedging.

Errante provides free market analysis, and trading calculators for Forex traders, and conducts online seminars to improve the professionalism of its clients.

Latest Errante News

Articles that may help you

Check out our reviews of other companies as well

User Satisfaction i