According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $10-$300

- MetaTrader4

- MetaTrader5

- TradingView

- TickTrader

- FCA

- CySEC

- The Financial Commission

- 2005

Our Evaluation of FXOpen

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

FXOpen is a moderate-risk broker with the TU Overall Score of 6.9 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by FXOpen clients on our website, Traders Union expert Anton Kharitonov recommends users to thoroughly analyze pros and cons before opening an account with this broker as not all clients are satisfied with the company, according to reviews.

FXOpen is a reliable broker with years of experience in financial markets, and adjusting trading conditions for its clients based on the regulatory requirements of their jurisdiction.

Brief Look at FXOpen

FXOpen has been providing brokerage services since 2005 while offering clients STP and True ECN execution models, liquidity from reputable providers, an enviable variety of accounts, and trading instruments. The broker has global offices regulated by the financial supervisory commissions FCA (United Kingdom) and CySEC (Cyprus). FXOpen provides access to trading with over 700 instruments (Forex and CFDs) with leverage up to 1:30 or up to 1:500, depending on client status and country.

We've identified your country as

US

We have thoroughly analyzed all companies legally providing trading services in your country and created a ranking of the best ones. Our analysis highlights companies that offer optimal working conditions, uphold a strong reputation, and consistently receive the highest number of positive reviews from traders on our website.

Explore the 5 top-rated companies in

US :

- Regulation by two reputable supervisory authorities and membership in the Financial Commission;

- Compensation of up to EUR 20,000 (FXOpen EU Ltd) and up to £85,000 (FXOpen Ltd) per client in case of the broker's bankruptcy or failure to fulfill withdrawal obligations;

- Use of STP (Straight Through Processing) and ECN (Electronic Communication Network) technologies that eliminate dealing center involvement;

- The opportunity for residents of many countries to start trading on STP accounts with $10;

- Trading with leverage up to 1:30 or up to 1:500, depending on client status and country.

- Protection against negative balance for every retail trader.

- High minimum deposit for traders from the United Kingdom and EU countries, starting from $300 or equivalent;

- Limited range of educational content for beginners;

- Micro cent accounts are not available in all countries.

TU Expert Advice

Author, Financial Expert at Traders Union

FXOpen provides Forex and CFDs on stocks, indices, commodities, cryptocurrencies, and ETFs trading through MetaTrader 4, MetaTrader 5, TradingView, and TickTrader platforms. It offers a selection of account types, including STP, ECN, and Islamic accounts, as well as flexible leverage up to 1:500, depending on the client status and location. FXOpen is regulated by the FCA, CySEC, and the Financial Commission, offering robust protection measures through negative balance protection.

However, FXOpen has drawbacks, including a high minimum deposit for UK and EU traders, limited educational content, and certain account types like micro or cent not being universally available. While the broker's conditions cater well to experienced traders appreciating multiple platforms and tight spreads, novice traders may find better educational resources and beginner-friendly services elsewhere.

We checked the office of the FXOpen brokerage company in Cyprus, which is located at the following address according to the information on the company’s website:

38 Spyrou Kyprianou Street, CCS BLDG - Office N101, 4154 Limassol, Cyprus

-

The company is located at the stated address

-

We were able to speak to a company representative

-

We were able to visit the office as clients

-

-

Video of the company’s office

-

FXOpen Trading Conditions

Your capital is at risk. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. A high percentage of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

| 💻 Trading platform: | MT4, MT5, TickTrader, TradingView |

|---|---|

| 📊 Accounts: | Demo, STP, ECN, and Islamic |

| 💰 Account currency: |

Primary currencies: USD and EUR; Additional currencies (depending on the country and account type): GBP, CHF, AUD, JPY, SGD, Gold, etc. |

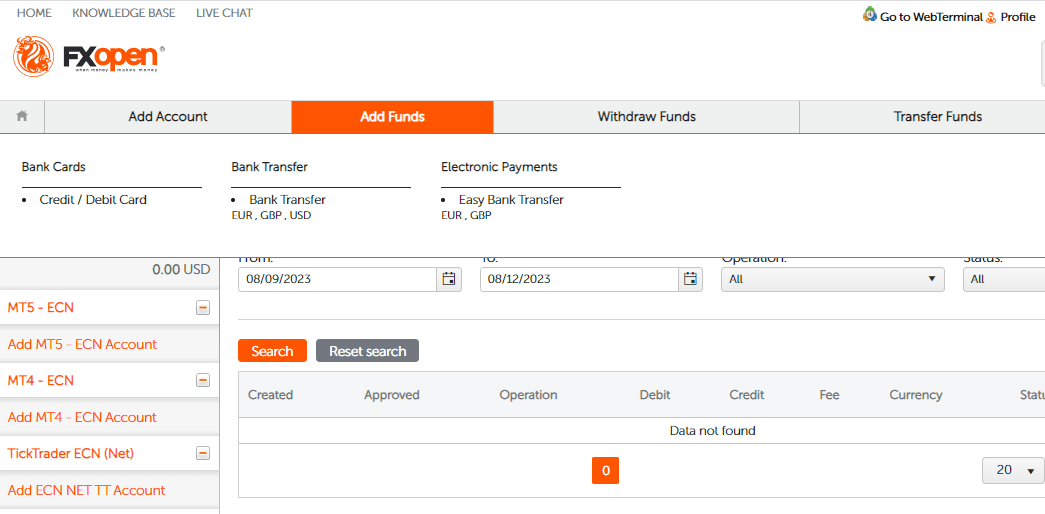

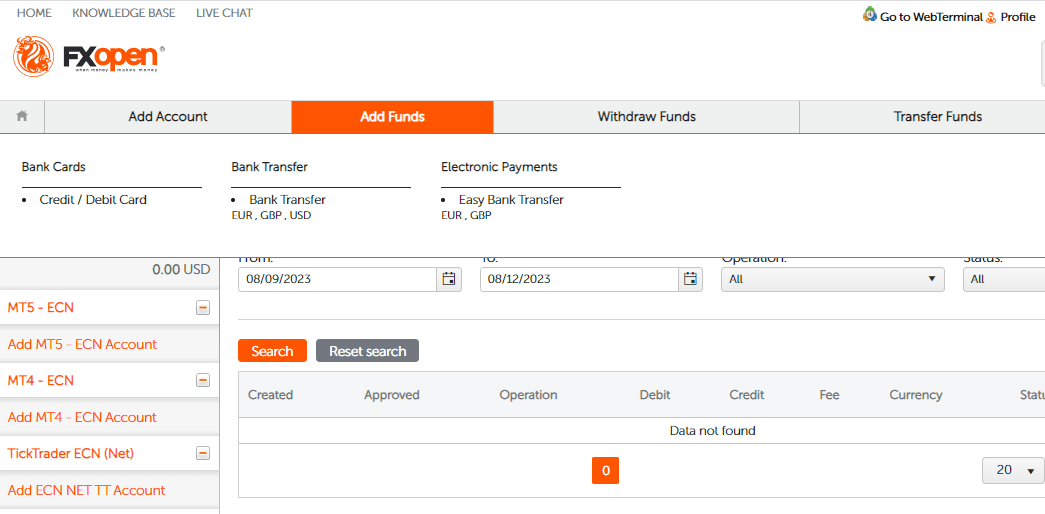

| 💵 Deposit / Withdrawal: | Credit and debit cards, bank transfer, Volet, Neteller, WebMoney, FasaPay, instant bank transfer (UK), simple bank transfer (EU), Swift (EU, UK) |

| 🚀 Minimum deposit: | $10-$300 (depending on the country) |

| ⚖️ Leverage: | Up to 1:30 and up to 1:500 (depending on client status and country) |

| 💼 PAMM-accounts: | Yes |

| 📈️ Min Order: | 0.01 |

| 💱 EUR/USD spread: | 0,1 pips |

| 🔧 Instruments: | Forex and CFDs on stocks, indices, commodities, cryptocurrencies, and ETFs |

| 💹 Margin Call / Stop Out: | 100%/50% |

| 🏛 Liquidity provider: | Real time quotes from an extensive network of liquidity providers |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Order execution: | Market Execution (STP, ECN) |

| ⭐ Trading features: | Expert Advisors (EAs), hedging, and scalping allowed |

| 🎁 Contests and bonuses: | Fee discounts on ECN accounts and Forex contests |

Broker FXOpen offers traders the MetaTrader (4 and 5), TickTrader, and TradingView platforms, each available in three versions: Desktop, WebTrader, and Mobile App. The choice of available trading instruments for the trader depends on the account type, platform, and regulating country. Over 700 instruments are available on MT4, MT5, and TickTrader trading platforms. The same instruments except cryptocurrency CFDs are available on TradingView. Accounts can be opened in 8 currencies, as well as in gold.

FXOpen Key Parameters Evaluation

Video Review of FXOpen

Share your experience

- Best

- Last

- Oldest

UA

UA Tight spreads

No

NZ Auckland

NZ Auckland Low Spreads

More Deposit options needed

EG Al Fayyum

EG Al Fayyum Offers a wide range of trading

nothing

UA Kropyvnytskyi

UA Kropyvnytskyi really regulated and fulfills the requirements of regulators

moving away from microtrading

Trading Account Opening

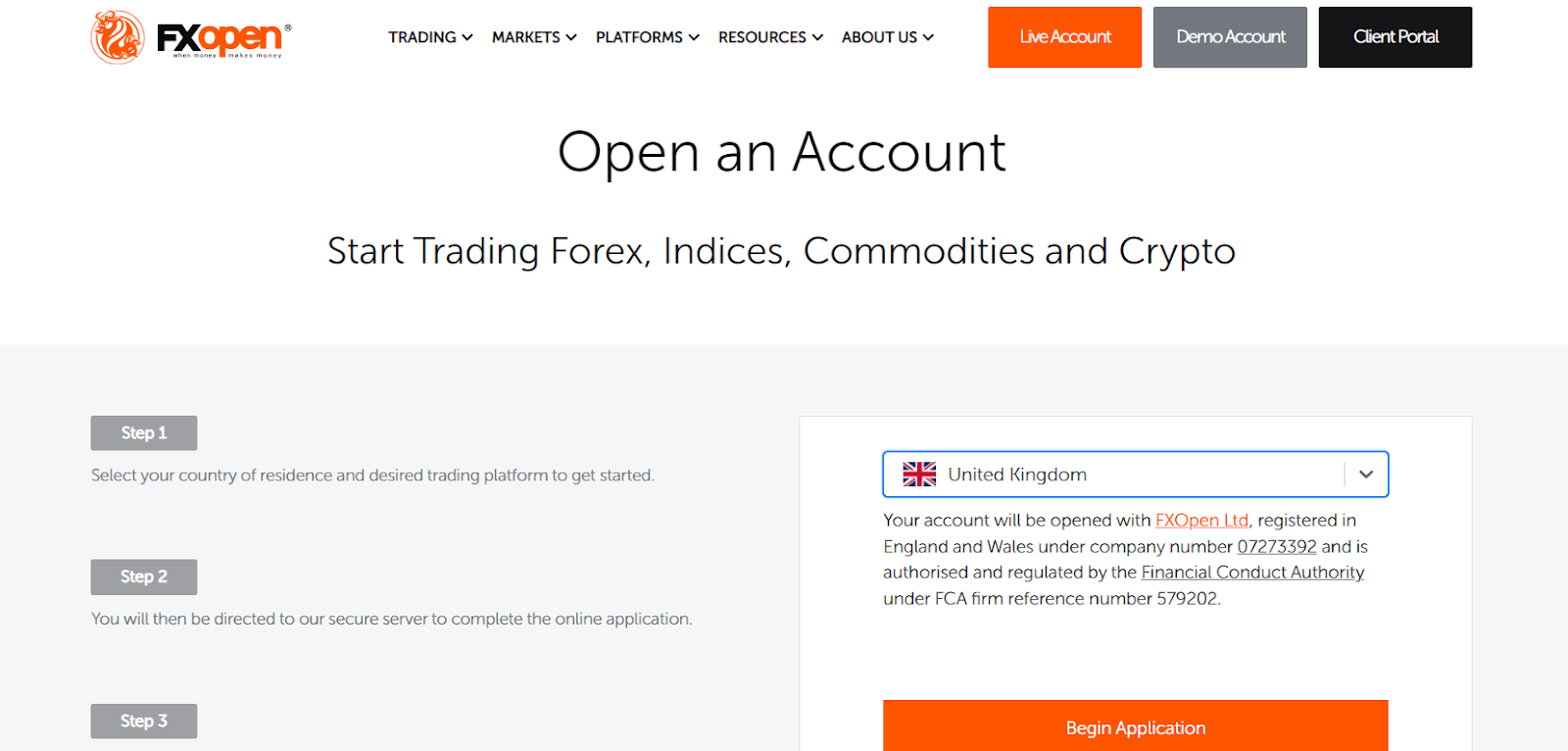

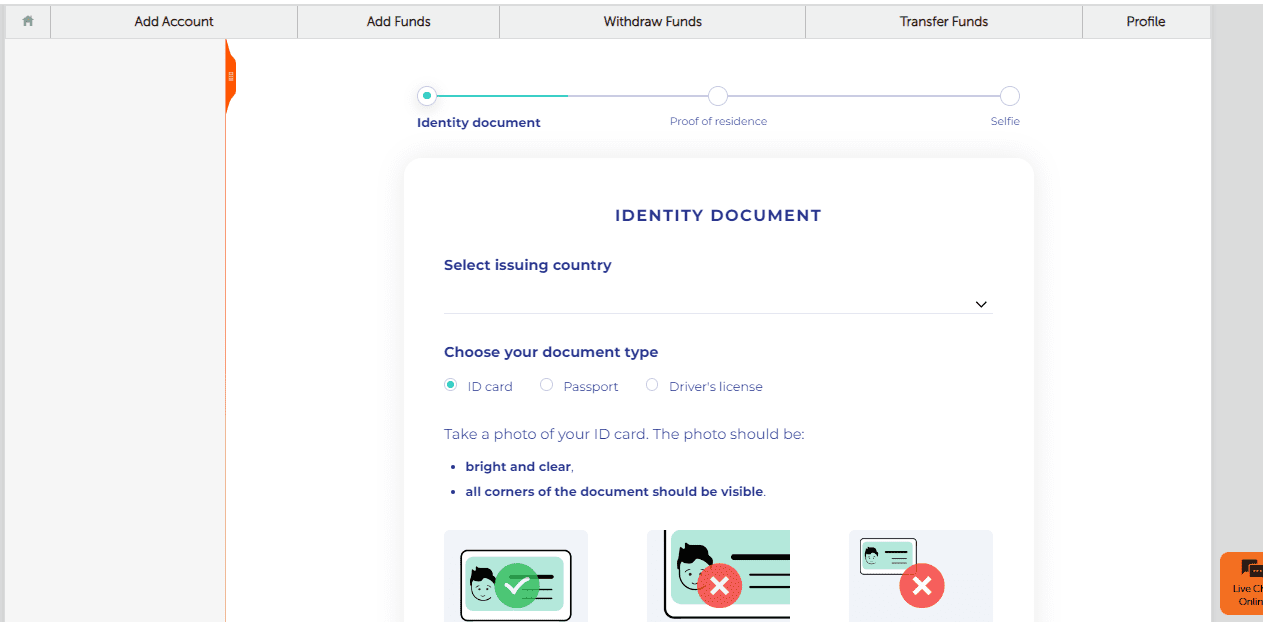

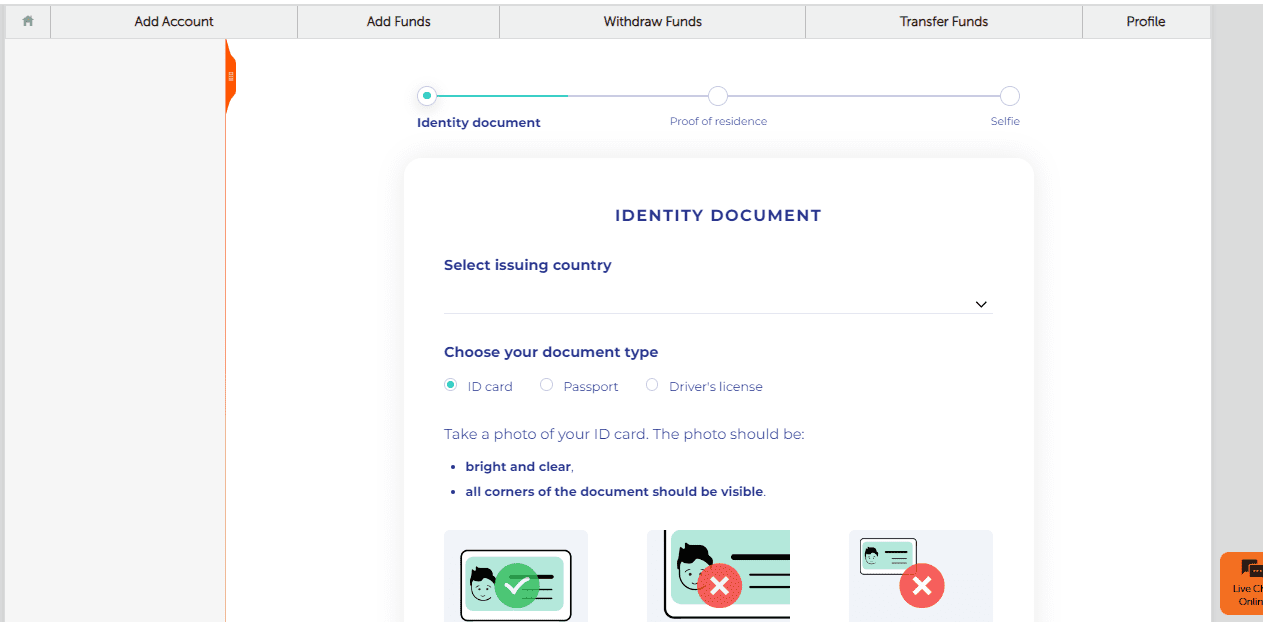

The functionality of the user account involves managing accounts and funds, configuring security settings, downloading software, etc. Below is a brief guide on how to open and use it.

After navigating to the FXOpen company website and clicking on the user account button, the system redirects to the division that serves your region. This process is automatic, and the trader cannot choose another FXOpen representation.

Next, fill out the registration form, choose the account type (user, corporate), and customize it according to your trading needs. You can select the currency, leverage level, execution model (STP/ECN), and trading platform for the primary account. Additional accounts can be opened in the user account. You also need to answer questions about CFD trading, generate a secure password, and confirm your phone number and email.

To commence trading, follow these steps in your user account:

The user account menu also allows the client to:

-

Download the desktop versions of trading platforms or access WebTrader;

-

View data on open accounts such as number, password, and server;

-

Change the login password and PIN code;

-

Enable and configure two-factor authentication;

-

View the list of IP addresses used to log into the account;

-

Withdraw funds, exchange currencies, transfer money from one account to another;

-

Communicate with technical support online in the chat.

Regulation and safety

FXOpen has a safety score of 9.7/10, which corresponds to a High security level. The safest brokers are those with Tier-1 regulation, a long history (over 10 years in the market), and participation in investor compensation schemes.

- Tier-1 regulated

- Negative balance protection

- Regulated in the UK

- Track record over 20 years

- Strict requirements and extensive documentation to open an account

FXOpen Regulators and Investor Protection

| Abbreviation | Full Name | Country of regulation | Investor Protection Fund | Regulation Level |

|---|---|---|---|---|

FCA UK FCA UK |

Financial Conduct Authority | United Kingdom | Up to £85,000 | Tier-1 |

CySec CySec |

Cyprus Securities and Exchange Commission | Cyprus | Up to €20,000 | Tier-1 |

The Financial Commission The Financial Commission |

The Financial Commission | International | Up to €20,000 | Tier-3 |

FXOpen Security Factors

| Foundation date | 2005 |

| Negative balance protection | Yes |

| Verification (KYC) | Yes |

Commissions and fees

The trading and non-trading commissions of broker FXOpen have been analyzed and rated as Medium with a fees score of 7/10. Additionally, these commissions were compared with those of the top two competitors, Pepperstone and OANDA, to provide the most comprehensive information.

- Tight EUR/USD market spread

- Above-average Forex trading fees

Trading Fees and Spread

Below, we evaluated and compared the trading commissions of FXOpen with those of two competitors. We focused on the spreads and other transaction fees directly associated with executing trades (e.g commission per lot on an ECN account). This comparison aimed to provide a clear understanding of the cost efficiency of each broker.

Standard Account Spread

For Standard accounts, FXOpen’s commissions are part of the floating spread, which varies with market conditions. Typical values are provided, but during high volatility, the spread may exceed these.

FXOpen Standard spreads

| FXOpen | Pepperstone | OANDA | |

| EUR/USD min, pips | 0,5 | 0,5 | 0,1 |

| EUR/USD max, pips | 1,2 | 1,5 | 0,5 |

| GPB/USD min, pips | 0,6 | 0,4 | 0,1 |

| GPB/USD max, pips | 1,4 | 1,4 | 0,5 |

RAW/ECN Account Commission And Spread

The spread on ECN/RAW accounts is market-based and fluctuates, with average values given during active hours. It may vary during volatility spikes. A commission per lot is also charged.

FXOpen RAW/ECN spreads

| FXOpen | Pepperstone | OANDA | |

| Commission ($ per lot) | 1,5 | 3 | 3,5 |

| EUR/USD avg spread | 0,1 | 0,1 | 0,15 |

| GBP/USD avg spread | 0,3 | 0,15 | 0,2 |

Non-Trading Fees

We conducted a detailed analysis of the non-trading fees associated with FXOpen. This review offers a comprehensive overview of the additional costs that may impact traders beyond regular trading activities.

FXOpen Non-Trading Fees

| FXOpen | Pepperstone | OANDA | |

| Deposit fee, % | 0,5 | 0 | 0 |

| Withdrawal fee, % | 0,5-2 | 0 | 0 |

| Withdrawal fee, USD | 0 | 0 | 0-15 |

| Inactivity fee ($, per month) | 10-100 | 0 | 0 |

Account types

FXOpen offers 2 types of accounts – user and demo. The demo account is an educational account where trading with real money is not available. To start earning real profits, open a trading account.

Account types:

In EU countries, and the UK two types of accounts – STP and ECN – are available. FXOpen adjusts their conditions to meet the requirements of local regulators. Also, all traders from these countries are divided into retail and professional categories. For the latter, the broker provides Pro accounts with higher leverage (up to 1:100 or up to 1:500) and a wider range of assets.

FXOpen offers STP and ECN accounts, available on different types of platforms, allowing each trader to choose the most suitable trading option.

Deposit and withdrawal

FXOpen received a Medium score for the efficiency and convenience of its deposit and withdrawal processes.

FXOpen provides a reasonable range of deposit and withdrawal options with moderate fees, in line with industry standards.

- Supports 5+ base account currencies

- Low minimum withdrawal requirement

- Bitcoin (BTC) accepted

- Bank card deposits and withdrawals

- Withdrawal fee applies

- Deposit fee applies

- PayPal not supported

What are FXOpen deposit and withdrawal options?

FXOpen provides a basic range of deposit and withdrawal options, covering essential methods in line with industry standards. This set of options is sufficient for most traders, with available methods Bank Card, Skrill, Neteller, BTC, USDT.

FXOpen Deposit and Withdrawal Methods vs Competitors

| FXOpen | Plus500 | Pepperstone | |

| Bank Wire | No | Yes | Yes |

| Bank card | Yes | Yes | Yes |

| PayPal | No | Yes | Yes |

| Wise | No | No | No |

| BTC | Yes | No | No |

What are FXOpen base account currencies?

A wide range of base account currencies minimizes the need for currency conversion, potentially reducing transaction costs for clients worldwide. FXOpen supports the following base account currencies:

What are FXOpen's minimum deposit and withdrawal amounts?

The minimum deposit on FXOpen is $1, while the minimum withdrawal amount is $10. These minimums may vary depending on the chosen account type and payment method. For specific details, please contact FXOpen’s support team.

Markets and tradable assets

FXOpen provides a standard range of trading assets in line with the market average. The platform includes 700 assets in total and 50 Forex currency pairs.

- Commodity futures are available

- 700 assets for trading

- Crypto trading

- Regional restrictions are possible

Supported markets vs top competitors

We have compared the range of assets and markets supported by FXOpen with its competitors, making it easier for you to find the perfect fit.

| FXOpen | Plus500 | Pepperstone | |

| Currency pairs | 50 | 60 | 90 |

| Total tradable assets | 700 | 2800 | 1200 |

| Stocks | Yes | Yes | Yes |

| Commodity futures | Yes | Yes | Yes |

| Crypto | Yes | Yes | Yes |

| Stock indices | Yes | Yes | Yes |

| Options | No | Yes | No |

Investment options

We also explored the trading assets and products FXOpen offers for beginner traders and investors who prefer not to engage in active trading.

| FXOpen | Plus500 | Pepperstone | |

| Bonds | Yes | No | No |

| ETFs | Yes | Yes | Yes |

| Copy trading | Yes | No | Yes |

| PAMM investing | Yes | No | Yes |

| Managed accounts | Yes | No | No |

Trading platforms & tools

FXOpen received a score of 8.35/10, indicating a strong offering in terms of trading platforms and tools. The broker provides broad access to popular platforms and supports a variety of features designed to enhance both manual and automated trading.

- API access for automated trading

- Trading bots (EAs) allowed

- One-click trading

- Trade directly from TradingView

- No access to a proprietary platform

- Strategy (EA) Builder is not available

- No access to cTrader and its advanced tools.

Supported trading platforms

FXOpen supports the following trading platforms: MT4, MT5, TradingView. This selection covers the basic needs of most retail traders. We also compared FXOpen’s platform availability with that of top competitors to assess its relative market position.

| FXOpen | Plus500 | Pepperstone | |

| MT4 | Yes | No | Yes |

| MT5 | Yes | No | Yes |

| cTrader | No | No | Yes |

| TradingView | Yes | Yes | Yes |

| Proprietary platform | No | Yes | Yes |

| NinjaTrader | No | No | No |

| WebTrader | No | Yes | Yes |

Key FXOpen’s trading platform features

We also evaluated whether FXOpen offers essential trading features that enhance user experience, accommodate various trading styles, and improve overall functionality.

Supported features

| 2FA | Yes |

| Alerts | No |

| Trading bots (EAs) | Yes |

| One-click trading | Yes |

| Scalping | Yes |

| Supported indicators | 68 |

| Tradable assets | 700 |

Additional trading tools

FXOpen offers several additional features designed to enhance the trading experience. These tools provide greater automation, deliver advanced market insights, and help improve trade execution.

FXOpen trading tools vs competitors

| FXOpen | Plus500 | Pepperstone | |

| Trading Central | No | No | No |

| API | Yes | No | Yes |

| Free VPS | Yes | No | Yes |

| Strategy (EA) builder | No | No | Yes |

| Autochartist | No | No | Yes |

Mobile apps

FXOpen supports mobile trading, offering dedicated apps for both iOS and Android. FXOpen received 8/10 in this section, reflecting strong user engagement and well-developed functionality. High ratings, solid download numbers, and the presence of advanced mobile features contributed to the high score.

- Mobile alerts supported

- Supports mobile 2FA

- Indicators supported

- Fewer charting tools

We compared FXOpen with two top competitors by mobile downloads, app ratings, 2FA support, indicators, and trading alerts.

| FXOpen | Plus500 | Pepperstone | |

| Total downloads | 100,000 | 10,000,000 | 100,000 |

| App Store score | 5.0 | 4.7 | 4.0 |

| Google Play score | 5.0 | 4.4 | 4.0 |

| Mob. 2FA | Yes | Yes | Yes |

| Mob. Indicators | Yes | Yes | Yes |

| Mob. Alerts | Yes | Yes | Yes |

Education

The education provided on the FXOpen website is introductory and is designed for a general understanding of the Forex market rather than an in-depth exploration of the subject. The basics of trading on the over-the-counter market can be found in the Resources section. Additionally, the website features a Help Center with a detailed description of FXOpen's services and conditions.

The company does not offer personalized education, advanced courses, webinars, seminars, or podcasts. To learn how to place orders correctly and calculate the margin level, FXOpen recommends that you start your trading on demo accounts.

Customer support

The working hours of different FXOpen divisions vary. The EU office is available from 9:00 to 20:00 (Eastern European Time), the UK office from 8:00 to 18:00 (London Time), and the Global office from 7:00 to 16:00 (GMT) from Monday to Friday. Chat operates 24/5.

Advantages

- Round-the-clock access to chat on weekdays

- Support in multiple languages

Disadvantages

- Traders cannot request a call back from an FXOpen representative

- Technical support is not available on Saturdays and Sundays

If a trader wishes to communicate with technical support, they can do so using the following channels:

-

Chat, available on the website and in the user account;

-

Phone call;

-

Email inquiry;

-

Request a call back from the website.

Registered clients with the broker can create a ticket in their user account.

Contacts

| Foundation date | 2005 |

|---|---|

| Registration address |

FXOpen INT: P.O. Box 590, Springates East, Government Road, Charlestown, Nevis FXOpen UK: 80 Coleman Street, London, EC2R 5BJ, United Kingdom FXOpen EU: 38 Spyrou Kyprianou Street, CCS BLDG - Office N101, 4154 Limassol, Cyprus |

| Regulation |

FCA, CySEC, The Financial Commission

Licence number: 579202, 194/13 |

| Official site | fxopen.com |

| Contacts |

+64 9 801 0123, +357 25024000, +44 (0) 203 519 1224

|

Comparison of FXOpen with other Brokers

| FXOpen | Eightcap | XM Group | RoboForex | Exness | Pocket Option | |

| Trading platform |

TickTrader, TradingView, MT4, MT5 | MT4, MT5, TradingView | MT4, MT5, MobileTrading, XM App | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | Exness Trade App (mobile), Exness Terminal (web), MetaTrader5, MetaTrader4 | Pocket Option, MT5, MT4 |

| Min deposit | $10 | $100 | $5 | $10 | $10 | $5 |

| Leverage |

From 1:1 to 1:500 |

From 1:30 to 1:500 |

From 1:1 to 1:30 |

From 1:1 to 1:2000 |

From 1:1 to 1:2000 |

From 1:1 to 1:1000 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | 10.00% | No | No |

| Spread | From 0 points | From 0 points | From 0.8 points | From 0 points | From 0 points | From 1.2 point |

| Level of margin call / stop out |

100% / 50% | 80% / 50% | 100% / 50% | 60% / 40% | 60% / No | 30% / 50% |

| Order Execution | Market Execution | Market Execution | Market Execution | Market Execution, Instant Execution | Market Execution, Instant Execution | Market Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | No | No | Yes | Yes | No |

Detailed review of FXOpen

The broker FXOpen consistently expands the range of products and services available to its clients. For passive income, PAMM accounts were developed; for advanced trading with increased leverage, the TickTrader platform was added, and for professional analysis, the TradingView platform was selected. The company ensures reliable protection of client data and funds through the use of two-factor authentication, deposit segregation, and information encryption.

FXOpen by the numbers:

-

Over 18 years of operation;

-

Over 1 million registered traders;

-

3 regional offices;

-

Over 193,000 users on the Forex forum;

-

700+ assets available for trading.

FXOpen is a broker that provides services in strict compliance with the requirements of its regulators

Trading conditions at FXOpen vary depending on the trader's country and the regulator serving its branch. For example, retail clients from the EU and the UK cannot use leverage higher than 1:30, while traders from other countries have values available up to 1:500 for MT4/MT5 accounts and up to 1:1,000 for TickTrader accounts. In addition, clients with Pro status have access to trading with leverage up to 1:500 and an extended range of assets: residents of UK can trade CFDs on cryptocurrencies only if they qualify as professional clients.

Requirements for the minimum deposit amount also differ. For residents of the UK and the EU, trading can start on any of the accounts after depositing USD/EUR 300. For other countries, more lenient conditions apply: $10 for STP and $100 for ECN.

Useful functions of FXOpen:

-

Calendar of important events in the economy and finance;

-

Market news and analysis;

-

Useful articles and tools to enhance trading quality;

-

Margin and pip cost calculators;

-

Dividend payout schedule for U.S., EU, and Asian companies with earnings per share;

-

Forum for discussing FXOpen's conditions and products.

Advantages:

Access to a virtual private server for Forex (VPS) is free or for $30 per month;

PAMM service for capital managers and investors;

Variety of trading instruments and platforms;

Trading on the TradingView platform with advanced analytical capabilities;

Partnership programs for different audiences with multi-level rewards;

Comprehensive analytics and statistics for each service, whether it's trading, partnership programs, or PAMM investments.

Latest FXOpen News

Articles that may help you

Check out our reviews of other companies as well

User Satisfaction i