According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $200

- MT4

- MT5

- cTrader

- 2014

Our Evaluation of FXPIG

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

FXPIG is a moderate-risk broker with the TU Overall Score of 5.01 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by FXPIG clients on our website, Traders Union expert Anton Kharitonov recommends users to thoroughly analyze pros and cons before opening an account with this broker as not all clients are satisfied with the company, according to reviews.

The FXPIG broker offers different account types, all of which, except for Pro, are represented in two variations, which are “Raw+Commission” or “All-in”. Demo accounts can be funded without limitations upon request. The platform allows for the trading of hundreds of assets, all strategies and methods are permitted, and users can work using MT4, MT5, and cTrader. The platform supports 6 currencies, with deposit/withdrawal options that include a bank card, bank account, Skrill, Neteller, BTC wallet, and Uphold. The company implements an advanced technology stack, including the FIX API protocol (the Financial Information Exchange (FIX) algorithm speeds the flow of financial data over the networks), STP algorithm, and high-performance virtual servers. Investors can operate MAM and PAMM accounts, and there is a deposit bonus.

Brief Look at FXPIG

This broker offers three account types plus a demo. The following trading instruments are available: currency pairs, stocks, metals, energies, CFDs on cryptocurrencies, and indices. The minimum deposit is $200. Spreads start from 0 pips, and commissions start from $0. Available account currencies are USD, EUR, GBP, CAD, AUD, and JPY, and there are no fees for deposits or withdrawals. Trading is available 24/7, and all trading styles and strategies are allowed. Traders can choose to work using MT4, MT5, and cTrader platforms. The broker offers flexible income distribution for MAM and PAMM accounts.

Kevin Murcko, CEO at FXPIG, reported that he wanted to create a playful company name that is easy to remember, easily brandable, and takes some of the seriousness out of Forex trading. He deliberately chose “PIG”, which stands now for Premier Interchange Gateway, before later adding the “FX” for Forex.

FXPIG uses data from 20 liquidity providers, operates on an STP (straight through processing) algorithm, and has its own VPS hosting with a virtual dedicated server. The website offers a wide range of technical tools, from popular analytic tools like MACD (Moving Average Convergence/Divergence) and Parabolic SAR (stop and reverse) indicators that are used to draw attention to alert traders to when the price direction is changing.

We've identified your country as

US

We have thoroughly analyzed all companies legally providing trading services in your country and created a ranking of the best ones. Our analysis highlights companies that offer optimal working conditions, uphold a strong reputation, and consistently receive the highest number of positive reviews from traders on our website.

Explore the 5 top-rated companies in

US :

- Hundreds of assets across six trading groups with leverage of up to 1:500.

- Spreads from 0 pips with competitive trading commissions.

- Low entry threshold, with a deposit of $200 and a user-friendly interface.

- Trading is available at night and on weekends, and bots and advisors are welcome.

- Traders can work with the most convenient and functional platforms.

- Managed accounts with fine-tuning for successful investing.

- 100% transparent broker operations with prompt technical support.

- Affiliate program is only available for corporate clients.

- The broker is unavailable to residents of the U.S., Canada, and certain other countries.

- The broker’s technical support is not provided through a call center.

TU Expert Advice

Financial expert and analyst at Traders Union

FXPIG started its operations in 2011. It is a regulated broker that operates transparently in accordance with the Vanuatu Financial Service Commission. A retrospective analysis has shown that the platform fulfills its obligations to its clients and there are no unresolved conflicts or legal disputes. In addition to being properly regulated and the broker’s flawless reputation, modern security methods are a guarantee of reliability from SSL certificates to the separate storage of funds.

The broker offers a demo account and three live account types. The spread is floating and starts at 0 pips. Commissions depend on the trader’s choice of account and assets. They can either pay a “Raw+Commisson” or an all-in fee (for All-in account types). In the second case, the spread is higher, but the broker does not charge a trading fee for most instruments (commission is taken for stocks and cryptocurrencies in any case). This is a fairly flexible approach that allows traders to choose the optimal option for cooperation based on their own preferences.

Trading conditions are average or better. The undeniable advantage of the platform is that its pool of assets includes hundreds of instruments from six groups, and this list is constantly growing. The leverage is flexible and depends on the traded asset, with a maximum value of 1:500. There are very few verified brokers with the same leverage. Also, the fees are 100% transparent. Even without being a client of the broker, the trader knows everything about its commission policy and can calculate the cost of any transaction in advance.

There is no referral program for private traders, but there is an affiliate program for companies. As for investment options, there are MAM and PAMM accounts with standard conditions and flexible management settings. To attract new users, the broker offers deposit bonuses. Plus, there is a bonus from Traders Union, which makes trading even more profitable. There are no restrictions, scalping and hedging are available, and traders can use advisory bots. Trading is conducted continuously. The broker's drawbacks are not significant, so considering all relevant factors, FXPIG can be recommended for cooperation.

- You seek high leverage. FXPIG offers leverage of up to 1:500.

- Trading costs are a key consideration for you. This broker offers spreads from 0 pips and competitive trading commissions.

- You are an individual trader looking for an affiliate program. FXPIG's affiliate program is only available for corporate clients.

- You reside in the U.S., Canada, or certain other countries where the broker is unavailable.

- You are concerned about regulations. FXPIG is regulated by the Vanuatu Financial Services Commission (VFSC), which has less stringent regulations compared to some other jurisdictions. Consider your comfort level with this regulatory environment.

FXPIG Trading Conditions

| 💻 Trading platform: | МТ4, МТ5, cTrader |

|---|---|

| 📊 Accounts: | Demo, Standard, Premier, Pro |

| 💰 Account currency: | USD, EUR, GBP, CAD, AUD, JPY |

| 💵 Deposit / Withdrawal: | Visa/MC bank card, bank transfer, Skrill, Neteller, Uphold, BTC cryptocurrency wallet |

| 🚀 Minimum deposit: | $200 |

| ⚖️ Leverage: | Up to 1:500, depending on the asset |

| 💼 PAMM-accounts: | Yes |

| 📈️ Min Order: | 0.01 |

| 💱 EUR/USD spread: | 0,1 pips |

| 🔧 Instruments: | Currency pairs, stocks, metals, oil/energies, Index of CFDs,other indices |

| 💹 Margin Call / Stop Out: | No |

| 🏛 Liquidity provider: | 20 top-tier liquidity providers |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Order execution: | No |

| ⭐ Trading features: | Demo and three live accounts, narrow floating spreads, the option to choose a trading commission, execution up to 50 ms, many assets from 6 asset groups, high leverage, joint accounts available, three trading platforms to choose from, 24/5 technical support |

| 🎁 Contests and bonuses: | Yes (deposit bonus and rebates from Traders Union) |

As a rule, if the broker offers several types of accounts, the minimum deposit for them differs. FXPIG is no exception. To open a Standard account, traders need to deposit at least $200; whereas, to open a Premier account, they need at least $5,000. The most expensive option is the Pro account, which requires $50,000 or more to open. Note that it is not necessary to deposit exactly the minimum amount. When opening a Standard account, a trader can fund their balance, for example, with $500 or $100. As for leverage, it depends on both the platform’s conditions and the asset selected. At FXPIG, the highest leverage is available for currency pairs, which is 1:500. The platform’s technical support operates 24/5, which means that you cannot contact managers on weekend days.

FXPIG Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

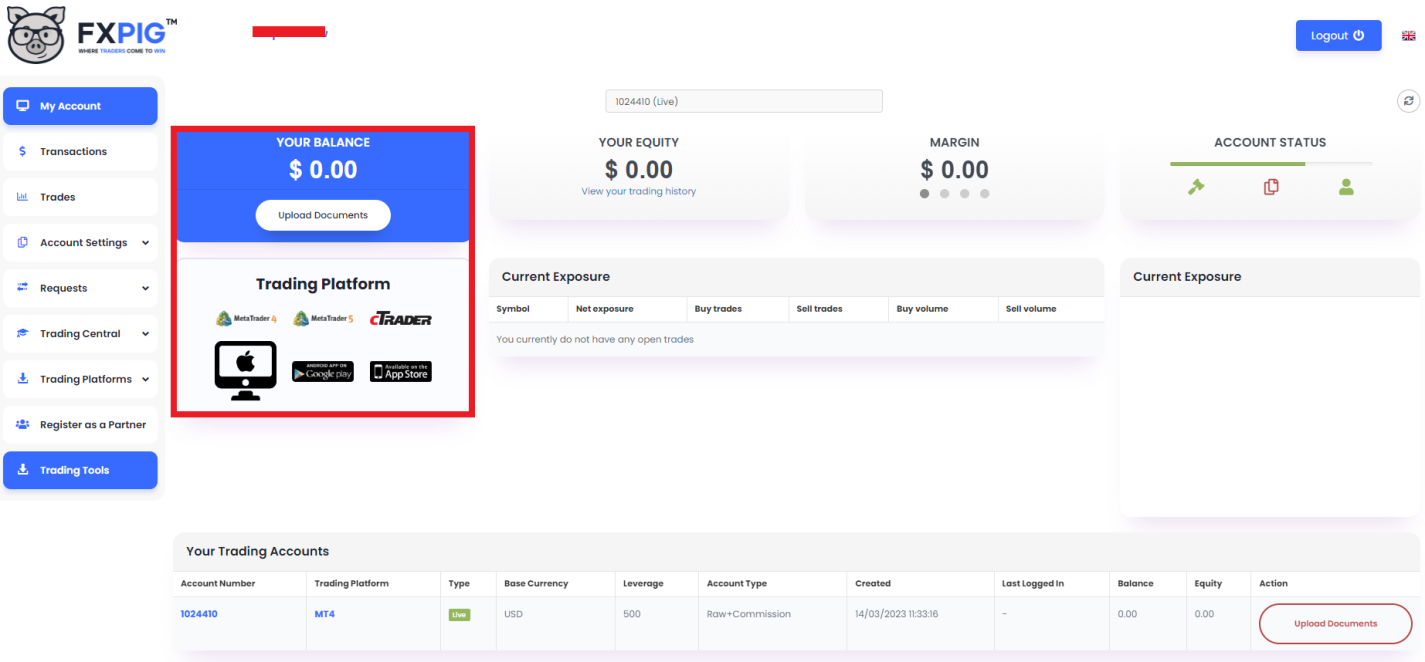

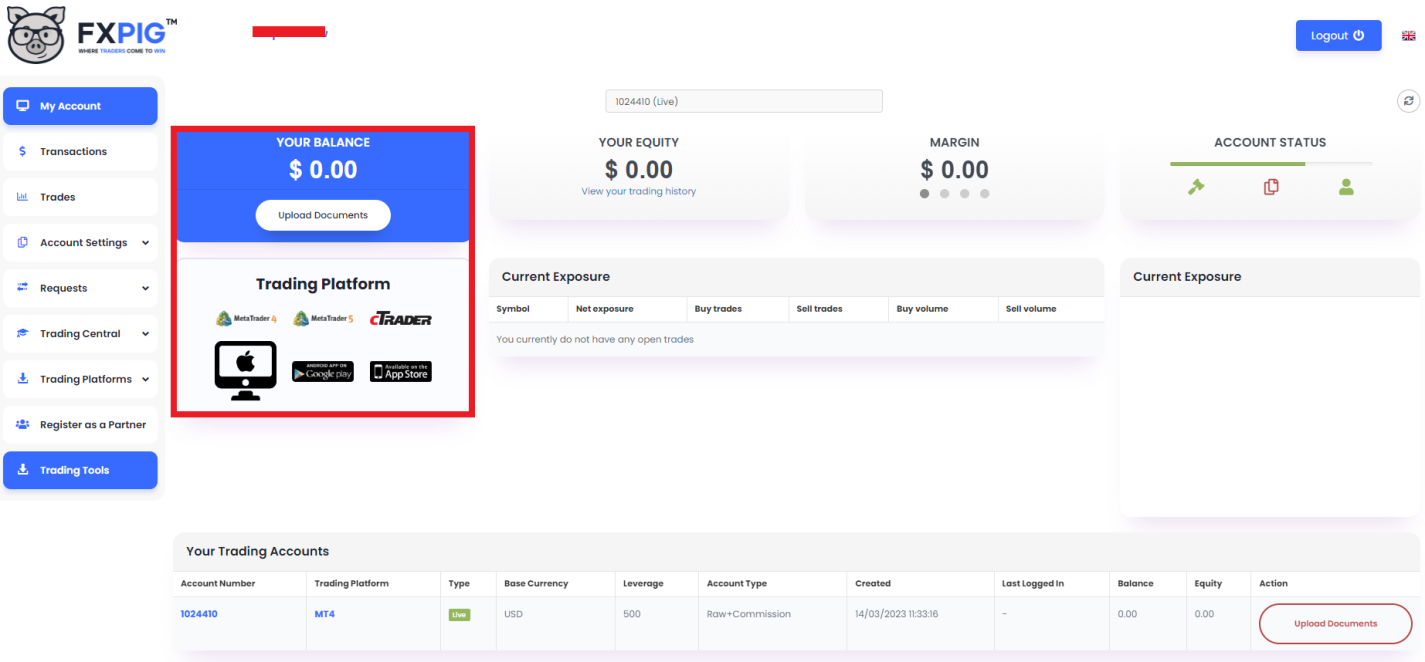

Trading Account Opening

To start working with a broker, sign up on its official website, complete verification, and make a deposit. Usually, this is not difficult. However, the TU experts have prepared this detailed guide for your convenience.

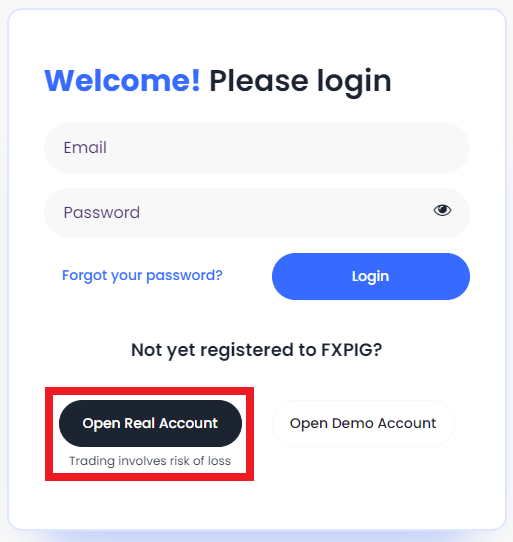

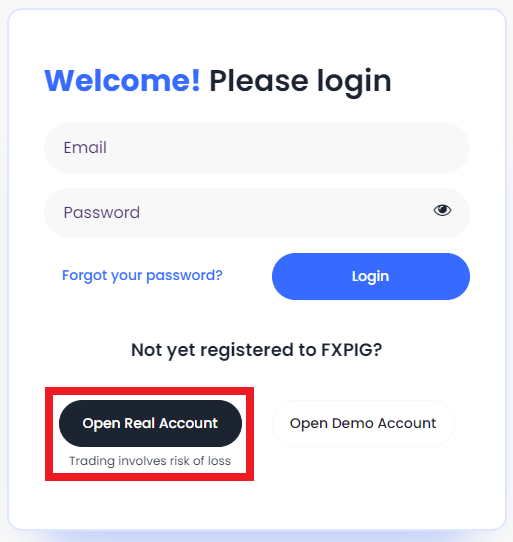

Go to the broker's website, select the interface language in the top right corner, then click the “Sign up/ Sign in” button. You can also click the “Open Live Account” button.

If you already have an account, enter your registration data and click “Sign in”. If you don't have an account yet, click “Open Live Account” or “Open Demo Account” at the bottom. In this example, TU will register a live account.

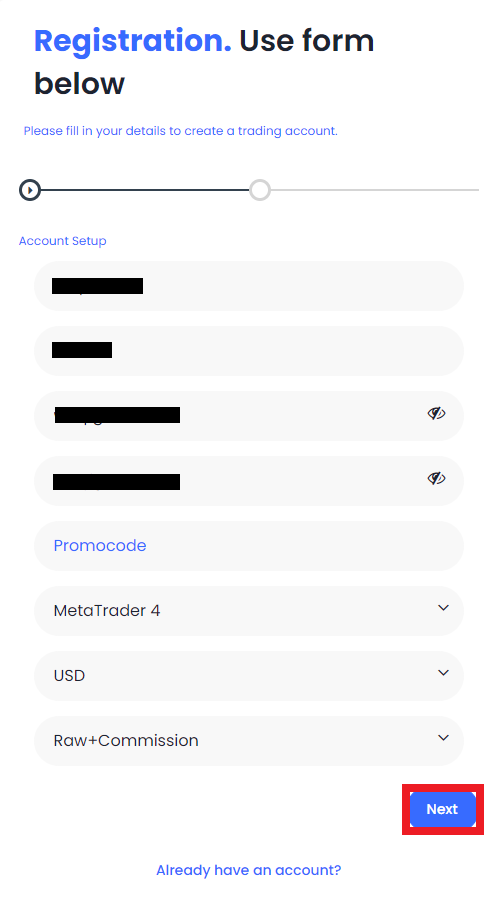

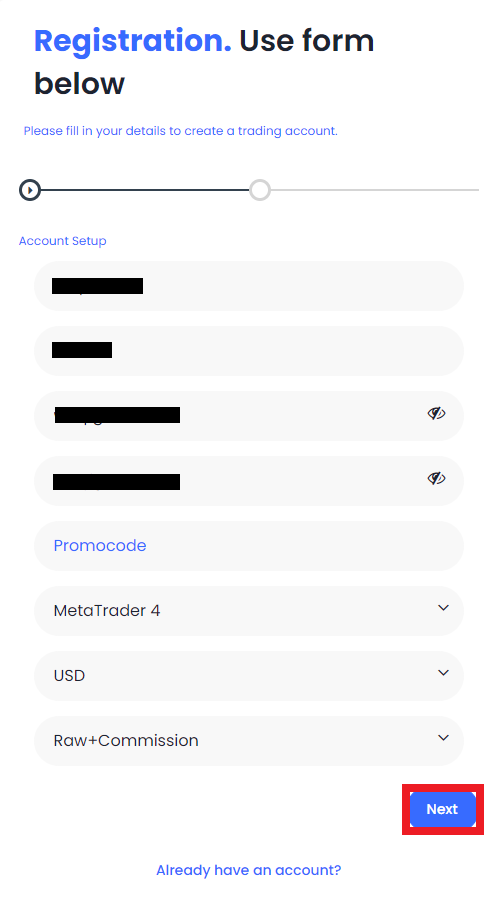

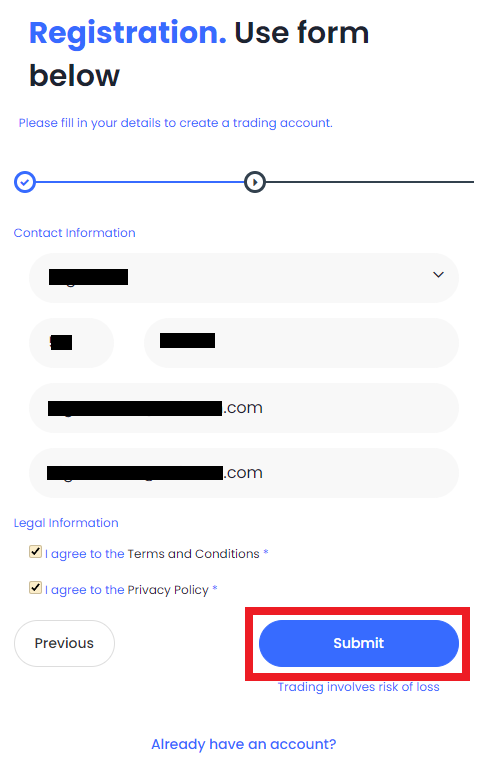

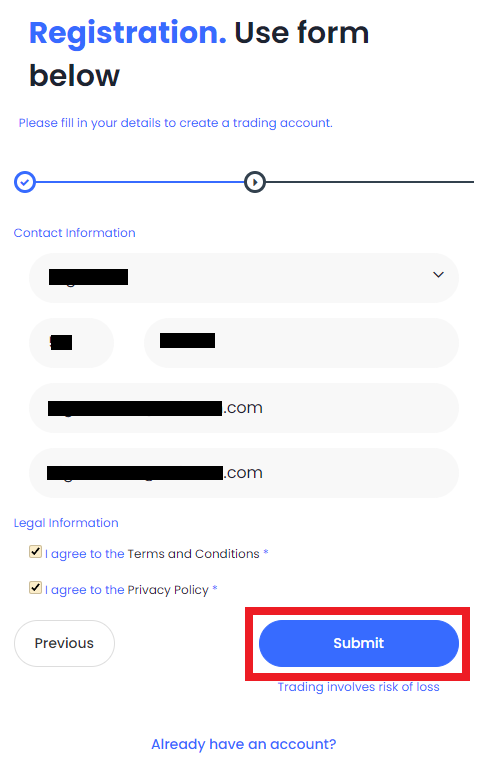

Enter your first and last name, create a password, and enter it twice. Enter a promo code (if you have one), and select a preferred trading platform, currency, and account type. Click “Next”.

On the next stage of registration, select the country of your residence, enter your phone number, and email address. Agree to the platform's terms and conditions by checking the boxes and click “Submit”.

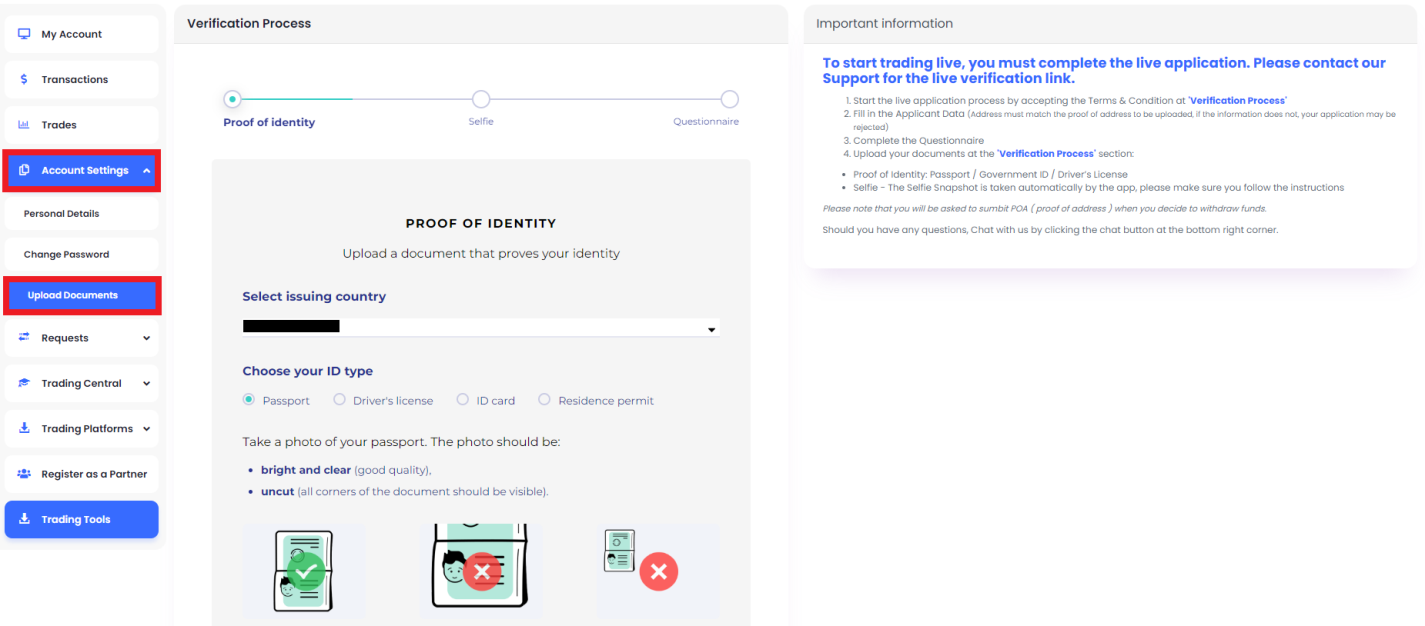

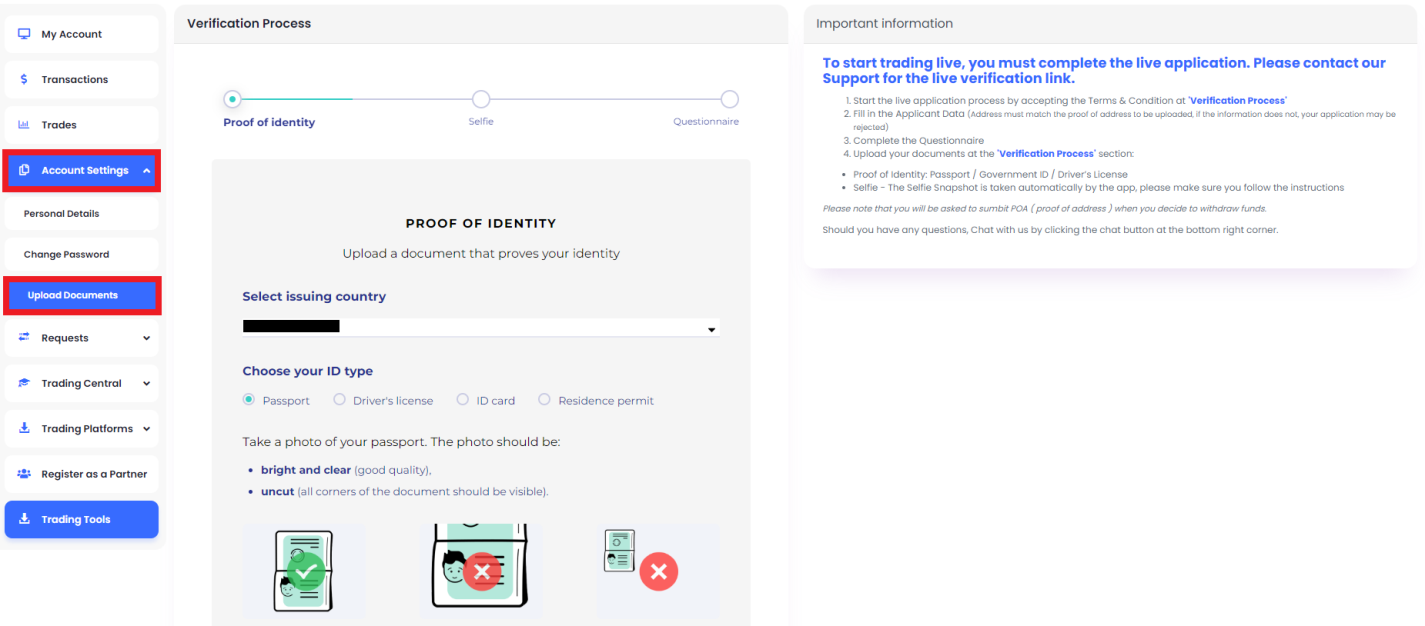

You have received your user account but cannot open a live account yet. To do so, you need to go through the verification process and confirm your identity. In the left menu, click on “Account Settings” and then select “Upload Documents”. Read the comments and upload a scan/photo of your passport or driver's license. Follow the instructions on the screen.

Once your documents pass verification, you will gain access to the full functionality of your user account. Download the selected trading platform via the link from your dashboard. Make a deposit by following the instructions on the screen. Start trading.

Your FXPIG user account also provides access to:

-

My Account. A dashboard for managing live accounts with detailed statistics for each.

-

Transactions. This section displays operations for depositing funds and withdrawing profits.

-

Trades. As the name suggests, this block shows current and completed trades.

-

Account settings. Here, the trader uploads documents and adjusts security settings.

-

Requests. Here, the broker offers several useful features, including fund withdrawals, international transfers, etc.

-

Trading Central. This block is dedicated to basic analytics and displays market status data.

-

Trading Platforms. In this section, the trader can download the installer for the MT4, MT5, or cTrader trading platforms.

-

Register as a Partner. This block is relevant only for legal entities wishing to become broker partners.

Regulation and safety

FXPIG has a safety score of 4.7/10, which corresponds to a Low security level. The safest brokers are those with Tier-1 regulation, a long history (over 10 years in the market), and participation in investor compensation schemes.

- Is regulated

- Track record over 11 years

- Not tier-1 regulated

- No negative balance protection

FXPIG Regulators and Investor Protection

| Abbreviation | Full Name | Country of regulation | Investor Protection Fund | Regulation Level |

|---|---|---|---|---|

VFSC VFSC |

Vanuatu Financial Services Commission | Vanuatu | No specific fund | Tier-3 |

FXPIG Security Factors

| Foundation date | 2014 |

| Negative balance protection | No |

| Verification (KYC) | Yes |

Commissions and fees

The trading and non-trading commissions of broker FXPIG have been analyzed and rated as Low with a fees score of 8/10. Additionally, these commissions were compared with those of the top two competitors, Pepperstone and OANDA, to provide the most comprehensive information.

- Low Forex trading fees

- Tight EUR/USD market spread

- No inactivity fee

- No deposit fee

- No withdrawal fee

- Complex fee structure

Trading Fees and Spread

Below, we evaluated and compared the trading commissions of FXPIG with those of two competitors. We focused on the spreads and other transaction fees directly associated with executing trades (e.g commission per lot on an ECN account). This comparison aimed to provide a clear understanding of the cost efficiency of each broker.

Standard Account Spread

For Standard accounts, FXPIG’s commissions are part of the floating spread, which varies with market conditions. Typical values are provided, but during high volatility, the spread may exceed these.

FXPIG Standard spreads

| FXPIG | Pepperstone | OANDA | |

| EUR/USD min, pips | 0,2 | 0,5 | 0,1 |

| EUR/USD max, pips | 0,4 | 1,5 | 0,5 |

| GPB/USD min, pips | 0,2 | 0,4 | 0,1 |

| GPB/USD max, pips | 0,6 | 1,4 | 0,5 |

RAW/ECN Account Commission And Spread

The spread on ECN/RAW accounts is market-based and fluctuates, with average values given during active hours. It may vary during volatility spikes. A commission per lot is also charged.

FXPIG RAW/ECN spreads

| FXPIG | Pepperstone | OANDA | |

| Commission ($ per lot) | 3 | 3 | 3,5 |

| EUR/USD avg spread | 0,1 | 0,1 | 0,15 |

| GBP/USD avg spread | 0,1 | 0,15 | 0,2 |

Non-Trading Fees

We conducted a detailed analysis of the non-trading fees associated with FXPIG. This review offers a comprehensive overview of the additional costs that may impact traders beyond regular trading activities.

FXPIG Non-Trading Fees

| FXPIG | Pepperstone | OANDA | |

| Deposit fee, % | 0 | 0 | 0 |

| Withdrawal fee, % | 0 | 0 | 0 |

| Withdrawal fee, USD | 0 | 0 | 0-15 |

| Inactivity fee ($, per month) | 0 | 0 | 0 |

Account types

At the start, it is important to choose the best account for you. FXPIG offers three types of accounts. All tradable assets are available immediately, with maximum leverage, minimum trade size, and a single currency for all accounts. The differences are in the minimum deposit, spread, and trading commissions. Note that a Pro account is not necessarily better than a Standard in a specific case. Yes, it has zero spread and a commission of only $2 per lot, but you will need to deposit at least $50,000. In contrast, Premier account holders receive priority technical support and only need to deposit $5,000. With this account, you can get a minimum spread of 0-0.7 pips and a commission of $0-3 per lot. The highest commission is on Standard accounts, where the spread starts at 0 pips too.

Account types:

Most traders start by opening a demo account. It is very similar to a live account, with all the same functions, options, and mechanisms. The difference is that trading is done with real quotes, but with virtual funds. If the funds on the account run out, the trader can contact technical support and request replenishment, which is free.

Deposit and withdrawal

FXPIG received a Medium score for the efficiency and convenience of its deposit and withdrawal processes.

FXPIG provides a reasonable range of deposit and withdrawal options with moderate fees, in line with industry standards.

- Low minimum withdrawal requirement

- No withdrawal fee

- Minimum deposit below industry average

- No deposit fee

- USDT payments not accepted

- Wise not supported

- PayPal not supported

What are FXPIG deposit and withdrawal options?

FXPIG provides a basic range of deposit and withdrawal options, covering essential methods in line with industry standards. This set of options is sufficient for most traders, with available methods Bank Card, Bank Wire, Skrill, Neteller, BTC.

FXPIG Deposit and Withdrawal Methods vs Competitors

| FXPIG | Plus500 | Pepperstone | |

| Bank Wire | Yes | Yes | Yes |

| Bank card | Yes | Yes | Yes |

| PayPal | No | Yes | Yes |

| Wise | No | No | No |

| BTC | Yes | No | No |

What are FXPIG base account currencies?

A wide range of base account currencies minimizes the need for currency conversion, potentially reducing transaction costs for clients worldwide. FXPIG supports the following base account currencies:

What are FXPIG's minimum deposit and withdrawal amounts?

The minimum deposit on FXPIG is $200, while the minimum withdrawal amount is $30. These minimums may vary depending on the chosen account type and payment method. For specific details, please contact FXPIG’s support team.

Markets and tradable assets

FXPIG offers a limited selection of trading assets compared to the market average. The platform supports 300 assets in total, including 80 Forex pairs.

- 80 supported currency pairs

- Indices trading

- No ETFs

- Limited asset selection

Supported markets vs top competitors

We have compared the range of assets and markets supported by FXPIG with its competitors, making it easier for you to find the perfect fit.

| FXPIG | Plus500 | Pepperstone | |

| Currency pairs | 80 | 60 | 90 |

| Total tradable assets | 300 | 2800 | 1200 |

| Stocks | Yes | Yes | Yes |

| Commodity futures | Yes | Yes | Yes |

| Crypto | No | Yes | Yes |

| Stock indices | Yes | Yes | Yes |

| Options | No | Yes | No |

Investment options

We also explored the trading assets and products FXPIG offers for beginner traders and investors who prefer not to engage in active trading.

| FXPIG | Plus500 | Pepperstone | |

| Bonds | No | No | No |

| ETFs | No | Yes | Yes |

| Copy trading | No | No | Yes |

| PAMM investing | Yes | No | Yes |

| Managed accounts | No | No | No |

Customer support

Technical support plays a crucial role for companies that provide financial services. A broker may offer the simplest and most intuitive interface, a detailed FAQs, section and comments on the website, but a trader will sooner or later encounter a question that he cannot solve on his own. In this case, he may turn to customer support. If support is unavailable, responds slowly, or offers an unintelligible response, the user may become disappointed with the platform and switch to a competitor. FXPIG understands this very well, so it provides 24/5 support via email, live chat, and tickets on the website.

Advantages

- You can contact support even if you're not registered

- Live chat managers respond promptly

- Users note the high quality of the broker's technical support and give it high ratings

Disadvantages

- Customer support is unavailable on weekends and holidays

- The broker does not have a call center

If you intend to work with FXPIG or are already a client of this broker, you can contact support using the following methods:

-

Email;

-

Online chat on the website and in the user account;

-

Ticket on the page.

FXPIG is one of the few brokers that assist via Skype; just access the manager's account named chat.fxpig. The company also has official pages on Facebook, Twitter, Instagram, and LinkedIn. You can subscribe to them to not miss the latest news from the broker.

Contacts

| Foundation date | 2014 |

|---|---|

| Registration address | Lisi Veranda, Phase 3, Building B4, Tbilisi, Georgia, 0159 |

| Official site | https://fxpig.com/ |

| Contacts |

Education

Traders will only be successful if they continuously improve their trading skills and knowledge. This requires not only regular trading, but also studying theoretical materials, communicating with experts, participating in webinars, and corresponding with colleagues. Brokers often offer clients educational systems of varying depth and coverage. FXPIG takes a different approach, the website only has a basic FAQs section and a blog with articles that can be grouped by tags.

FXPIG provides little information about money management and trading psychology. The articles posted on the blog are useful, but are not sufficient for comprehensive development of trading skills and acumen. The broker assumes that its clients study the market independently.

Comparison of FXPIG with other Brokers

| FXPIG | Eightcap | XM Group | RoboForex | Vantage Markets | LiteFinance | |

| Trading platform |

cTrader, MT5, MT4 | MT4, MT5, TradingView | MT4, MT5, MobileTrading, XM App | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | MT4, MT5, TradingView, ProTrader, Vantage App | MT4, MT5, MultiTerminal, Sirix Webtrader |

| Min deposit | $200 | $100 | $5 | $10 | $50 | $10 |

| Leverage |

From 1:1 to 1:500 |

From 1:30 to 1:500 |

From 1:1 to 1:30 |

From 1:1 to 1:2000 |

From 1:1 to 1:500 |

From 1:1 to 1:1000 |

| Trust management | No | No | No | No | No | Yes |

| Accrual of % on the balance | No | No | No | 10.00% | No | 7.00% |

| Spread | From 0 points | From 0 points | From 0.8 points | From 0 points | From 0 points | From 0.5 points |

| Level of margin call / stop out |

No | 80% / 50% | 100% / 50% | 60% / 40% | 100% / 50% | 50% / 20% |

| Order Execution | No | Market Execution | Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution, Instant Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | No | No | Yes | No | Yes |

Detailed review of FXPIG

FXPIG is the brand of the Prime Intermarket Group Asia Pacific (which also has a subdivision, Prime Intermarket Group Eurasia). The payment agent is Alchemy Prime. These structures are all jointly owned but operate independently. Each subdivision has official registration and regulation. FXPIG is a technologically advanced broker that implements modern algorithms (such as STP), uses virtual servers to increase performance, and introduces innovative solutions (including the latest version of FIX API protocol). Additionally, clients can be confident in the protection of their funds and data because FXPIG has Implemented multi-factor authentication and AML standard verification. The website is protected by an SSL certificate, and trader funds are stored separately from company funds. Also, it is necessary to note that the broker is client-oriented and supports three trading platforms, including their mobile versions.

FXPIG by the numbers:

-

Minimum deposit is $200.

-

Spread starts from 0 pips.

-

6 groups of financial instruments.

-

Maximum leverage is 1:500.

-

Trading is available 24/7.

FXPIG is a convenient broker for the diversification of risks

Many platforms focus on a specific group of assets, such as CFDs or currencies. Others offer several options, including stocks, indices, and ETFs. FXPIG clients have access to currency pairs, stocks, metals, energies, CFDs on cryptocurrencies, and indices. Why is this an advantage? Because a trader can diversify risks with relative ease by investing in different types of assets, he can offset the decline of one with stable and growing positions in others. In addition, the more assets a trader has, the more freely he can trade, and he doesn’t have to limit himself in methods and strategies.

FXPIG’s analytical services:

-

MAM and PAMM accounts. Joint accounts allow investors to earn passively. These special accounts provide investors partial control over their funds while allowing the fund manager to make discretionary trades based on his expertise and market conditions. If the trade is successful, profits are distributed in proportion to investments, and a small commission is paid to the manager.

-

Trading indicators. This is the simplest, yet most effective method of technical analysis of charts. Bollinger Bands, Ichimoku Kinko Hyo, MACD, Parabolic SAR, Stochastic Indicator, RSI, and other indicators can be integrated into any of the platform terminals. Each system is used to gauge momentum along with future areas of support and resistance.

-

Market and alert managers. The first shows a list of asset prices, basic information about it, and open tickets. It also provides a brief overview of recent activity. The second allows you to create personalized notifications about price changes, and when to enter and exit from trades. The alert manager can be connected to a news feed and any number of accounts.

Advantages:

There are several account options with maximum personalization of spread and commission payment conditions from which to choose.

Intuitive website and user account interface, and you can use one of three trading platforms.

A large number of assets from different asset groups and high leverage increase profit potential.

The broker offers dozens of various instruments, including a mini-terminal, session map, and tick charts.

There are no additional fees, only spread/commission, and withdrawals are free through all channels.

Articles that may help you

Check out our reviews of other companies as well

User Satisfaction i