According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $30

- cTrader

- MetaTrader4

- MetaTrader5

- VFSC

- FSC

- FCA

- ASIC

- 2012

Our Evaluation of GTC

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

GTC is a moderate-risk broker with the TU Overall Score of 5.43 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by GTC clients on our website, Traders Union expert Anton Kharitonov recommends users to thoroughly analyze pros and cons before opening an account with this broker as not all clients are satisfied with the company, according to reviews.

This broker’s trading conditions are a comfortable initial deposit, a wide choice of account types, a large number of trading instruments, and optimal leverage. Its special advantage is the ability to use major trading platforms. Another obvious plus is the availability of several options for passive income. Also, this broker offers tools for technical and fundamental analyses, and training is available in the form of webinars. Unfortunately, GTC Forex has serious regional restrictions.

Brief Look at GTC

This broker's clients trade currency pairs and CFDs on stocks, indices, precious metals, and energies through MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader. There is a free demo account along with two standard and three professional accounts. Spreads are floating, starting from 0 pips, with no trading fees on most accounts. There are no fees for depositing and withdrawing funds that are available by bank transfers, bank cards, e-wallets, and crypto-wallets. This broker does not limit its clients in trading strategies and methods. Leverage can be increased up to 1:1000. Passive income options include MAM and PAMM accounts and a copy trading service. Also, this broker offers an Introducing Broker (IB) partnership program. The company is licensed by three regulators, is a member of the Financial Dispute Resolution Center (FDRC), and has a compensation fund.

We've identified your country as

US

We have thoroughly analyzed all companies legally providing trading services in your country and created a ranking of the best ones. Our analysis highlights companies that offer optimal working conditions, uphold a strong reputation, and consistently receive the highest number of positive reviews from traders on our website.

Explore the 5 top-rated companies in

US :

- Minimum deposit for standard accounts is only $30, which ensures a low entry threshold;

- Tight spreads from 0 pips and low fees up to $3.5 per lot minimize trading costs;

- Except for the demo account, there are five live account types, that provide for individualizing the offer;

- No trading restrictions combined with high leverage provide high-profit potential;

- Traders work through top-end platforms that are easy to learn and easily customized using plug-ins;

- This broker offers passive income options such as joint accounts and an integrated copy trading service;

- Technical support is multilingual and is available 24/7.

- There are many assets in this broker's pool, but they are only currency pairs and CFDs;

- This broker does not offer a standard referral program for individuals, but only an IB partnership program;

- GTC Forex does not provide its services in Germany, Italy, Belgium, Ireland, Liechtenstein, Norway, and a number of other countries.

TU Expert Advice

Financial expert and analyst at Traders Union

The GTC Forex trademark is owned by Global Trade Capital, which is licensed by regulators of Vanuatu, Mauritius, and the United Arab Emirates. The company has been operating in different regions for several years, providing brokerage services among other things. This broker fulfills its obligations, thus all arising disputes, as a rule, are resolved without involving regulators.

Due to its trading conditions, GTC Forex rightfully occupies one of the top positions in its segment. There are no trading restrictions, the minimum trade volume is 0.01 lots, and there are demo and cent accounts. These conditions don’t differ from those of this broker’s competitors. However, there are parameters that make it unique. For example, the minimum deposit for the Standard account is only $30, which is well below average.

There is a wide choice of account types, and a deep pool of assets, which includes dozens of currency pairs and hundreds of CFDs on stocks, indices, metals, and energies. Leverage of 1:1000 is not exceptional, just like having PAMM accounts. The company offers its proprietary copy trading service and does not use third-party solutions. Functional testing did not reveal any disadvantages of these systems. Thus, traders can successfully earn in many ways.

Analytical tools provided by this broker are standard. Training is provided in the form of webinars that are rated by experts as average in terms of volume and quality. But much more important is that GTC Forex works with MT4, MT5, and cTrader, which gives its clients conceptual advantages of a customized workspace and high functionality.

Indeed, this broker does not have a typical referral program for individuals and there are certain regional restrictions, but these features are not exclusive to the segment. Therefore, taking into account the above advantages, this broker can be recommended for review.

- You prefer brokers with competitive trading costs. This broker provides tight spreads from 0 pips and low fees up to $3.5 per lot, minimizing your overall trading costs.

- You prefer the MetaTrader 4 platform. GTCFX uses this popular platform known for its features and user-friendly interface.

- You belong to one of the restricted countries. GTC Forex does not provide its services in Germany, Italy, Belgium, Ireland, Liechtenstein, Norway, and other countries. If you are located in these regions, access to GTCFX might be limited.

- You value strong regulation by major financial authorities. GTCFX might not be suitable if you prioritize regulatory oversight from established authorities like the FCA or SEC.

- You require extensive educational resources and support. While some educational materials exist, they might not be as comprehensive as what other brokers offer, and personalized support might be limited.

GTC Trading Conditions

Your capital is at risk. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. A high percentage of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

| 💻 Trading platform: | MetaTrader 4, MetaTrader 5, and cTrader |

|---|---|

| 📊 Accounts: | Demo, Standard, Standard Cent, Raw Spread, Zero, and Pro |

| 💰 Account currency: | USD, AED, NGN, EUR, JPY, AUD, NZD, and PKR |

| 💵 Deposit / Withdrawal: | Bank transfers, bank cards, e-wallets, and crypto-wallets |

| 🚀 Minimum deposit: | $30 |

| ⚖️ Leverage: | Up to 1:1000 |

| 💼 PAMM-accounts: | Yes |

| 📈️ Min Order: | 0.01 |

| 💱 EUR/USD spread: | 0,2 pips |

| 🔧 Instruments: | Currency pairs, CFDs on stocks, indices, precious metals, and energies |

| 💹 Margin Call / Stop Out: | 100%/20% |

| 🏛 Liquidity provider: | No |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Order execution: | Market execution |

| ⭐ Trading features: |

Free demo account; Two standard and three professional account types; Tight spreads and low fees; No withdrawal fees; Several passive income options; Standard set of analytical tools. |

| 🎁 Contests and bonuses: | Welcome bonus and bonuses from Traders Union |

If a broker offers multiple trading account types, the minimum deposit is mostly determined by the account type selected by the trader. To open a standard account with GTC Forex, a minimum deposit of $30 is required; whereas, to open a professional account, you need to deposit $3,000 minimum. Leverage is determined by the traded asset. On all accounts, the highest trading leverage of 1:500 is available for currency pairs. However, a trader can at any time contact technical support and request increased leverage up to 1:1000. Technical support is available 24/7 by phone, email, and live chat.

GTC Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

HK

HK My trading journey with GTCFX has been smooth so far. The platform is solid, execution is fast, and the spreads are among the best I’ve seen. Their support team is helpful and usually quick to respond. 4.

none

HK

HK The performance of the GTCFX platform has been solid—fast trade execution, minimal slippage, and reliable service make it a strong choice for active traders.

none

HK

HK Trading with GTCFX has been smooth and efficient. I appreciate the low transaction costs thanks to their tight spreads, and their platform stability gives me confidence during every session.

none

HK

HK GTCFX delivers a reliable and professional trading experience. What I really like about GTCFX is their consistently tight spreads, fast trade execution, and a stable platform that I can depend on. It's clear they focus on providing value to traders. Their customer support stands out as well—it's responsive, helpful, and available through multiple channels like email and WhatsApp. Whether you're a beginner or an experienced trader, GTCFX makes sure you're supported every step of the way.

none so far

HK

HK GTCFX has proven to be a reliable and efficient trading platform. What stands out the most is their consistently low spreads, which make trading more cost-effective. The platform runs smoothly, with no issues in execution, and that adds a lot of confidence when placing trades. Their customer support is another strong point—responsive, helpful, and quick to resolve any concerns. Whether it's a small hiccup or a general query, they handle it professionally. GTCFX delivers a solid trading experience with a good balance of performance and support.

none so far

SG Singapore

SG Singapore none so far

HK

HK Overall, GTCFX stands out for its reliability, ease of use, and commitment to customer satisfaction, making it a fantastic choice for anyone looking for a trustworthy trading platform.

none so far

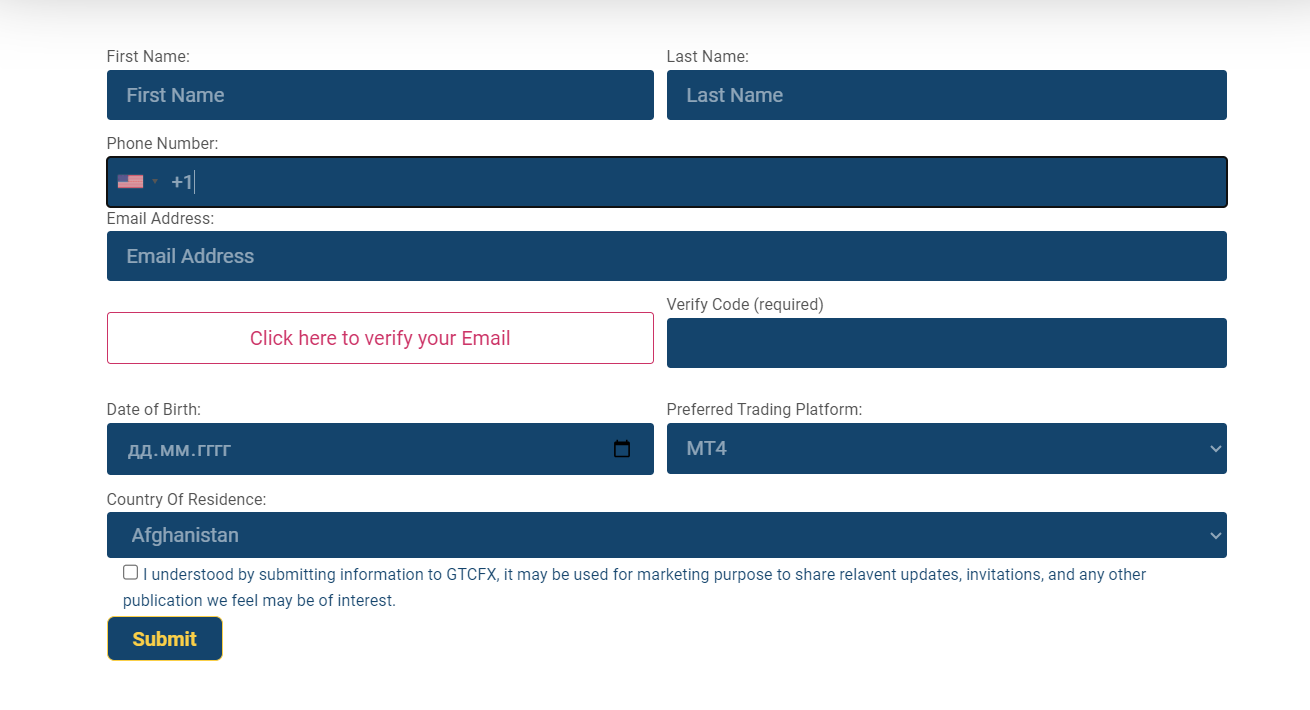

Trading Account Opening

To start working with this broker, register on its official website. Registration does not take much time. Verification, which is confirmation of your personal data, is also required. After that, traders open a demo or live account, download the trading platform, make a minimum deposit, and start trading. User accounts also provide access to joint accounts and the copy trading service. TU experts have prepared the below step-by-step guide on registration and features of the user account.

Go to this broker's website. Select the interface language in the upper right corner, and click the “Open Live Account” button in the below block.

Enter your first and last names, email address, and contact phone number. Specify your preferred account type, and select the preferred trading platform. After that, select your country of residence, agree to the terms of service by ticking the box, and click the “Next” button.

Enter your nationality and date of birth. Then enter your full registration address with the postal code. Answer a few questions about your occupation and click the “Next” button.

In the next block, answer a few questions about your trading experience. The answers will allow this broker to provide you with a more personalized offer. If you have never traded in the Forex and stock markets before, simply answer “No” and you won't have to fill out anything. In any case, click the “Next” button.

Now tell this broker about your financial capabilities, which is also necessary to individualize the offer. Unfortunately, you cannot skip this step, and have to consistently answer all the indicated questions. Once finished, click the “Next” button.

Answer a few more questions and provide scans or photos of the required documents for verification. At the bottom of the block, check each field, having previously studied the documents using the links. At the end, click the “Confirm” button.

A confirmation link will be sent to your email. Click it to activate your account and go to your user account. In your user account, you can download the trading platform and make a deposit (to do this, go to the appropriate section, select the deposit channel, and follow the instructions on the screen). After that, start trading.

Features of the user account:

Traders receive detailed information about their active accounts, also they can open and close accounts here;

Deposits, withdrawals and internal transfers are available here;

Users can correct their personal information and change security settings;

Copy trading and joint accounts services are available in the user account;

Also here is the training section and distributions of trading platforms;

Tools for technical and fundamental analyses are also provided here.

Regulation and safety

GTC has a safety score of 9.7/10, which corresponds to a High security level. The safest brokers are those with Tier-1 regulation, a long history (over 10 years in the market), and participation in investor compensation schemes.

- Tier-1 regulated

- Negative balance protection

- Regulated in the UK

- Track record over 13 years

- Strict requirements and extensive documentation to open an account

GTC Regulators and Investor Protection

| Abbreviation | Full Name | Country of regulation | Investor Protection Fund | Regulation Level |

|---|---|---|---|---|

FCA UK FCA UK |

Financial Conduct Authority | United Kingdom | Up to £85,000 | Tier-1 |

VFSC VFSC |

Vanuatu Financial Services Commission | Vanuatu | No specific fund | Tier-3 |

ASIC ASIC |

Australian Securities and Investments Commission | Australia | No specific fund but has stringent consumer protection | Tier-1 |

GTC Security Factors

| Foundation date | 2012 |

| Negative balance protection | Yes |

| Verification (KYC) | Yes |

Commissions and fees

The trading and non-trading commissions of broker GTC have been analyzed and rated as Medium with a fees score of 7/10. Additionally, these commissions were compared with those of the top two competitors, Pepperstone and OANDA, to provide the most comprehensive information.

- Tight EUR/USD market spread

- No deposit fee

- No withdrawal fee

- Above-average Forex trading fees

- Inactivity fee applies

Trading Fees and Spread

Below, we evaluated and compared the trading commissions of GTC with those of two competitors. We focused on the spreads and other transaction fees directly associated with executing trades (e.g commission per lot on an ECN account). This comparison aimed to provide a clear understanding of the cost efficiency of each broker.

Standard Account Spread

For Standard accounts, GTC’s commissions are part of the floating spread, which varies with market conditions. Typical values are provided, but during high volatility, the spread may exceed these.

GTC Standard spreads

| GTC | Pepperstone | OANDA | |

| EUR/USD min, pips | 0,3 | 0,5 | 0,1 |

| EUR/USD max, pips | 0,8 | 1,5 | 0,5 |

| GPB/USD min, pips | 0,5 | 0,4 | 0,1 |

| GPB/USD max, pips | 0,9 | 1,4 | 0,5 |

RAW/ECN Account Commission And Spread

The spread on ECN/RAW accounts is market-based and fluctuates, with average values given during active hours. It may vary during volatility spikes. A commission per lot is also charged.

GTC RAW/ECN spreads

| GTC | Pepperstone | OANDA | |

| Commission ($ per lot) | 3,5 | 3 | 3,5 |

| EUR/USD avg spread | 0,2 | 0,1 | 0,15 |

| GBP/USD avg spread | 0,2 | 0,15 | 0,2 |

Non-Trading Fees

We conducted a detailed analysis of the non-trading fees associated with GTC. This review offers a comprehensive overview of the additional costs that may impact traders beyond regular trading activities.

GTC Non-Trading Fees

| GTC | Pepperstone | OANDA | |

| Deposit fee, % | 0 | 0 | 0 |

| Withdrawal fee, % | 0 | 0 | 0 |

| Withdrawal fee, USD | 0 | 0 | 0-15 |

| Inactivity fee ($, per month) | 5 | 0 | 0 |

Account types

The account type is of great importance. The Standard Cent account is aimed specifically at novice traders so that they can gain experience by trading on the real market, but without significant risks, as trading is executed in micro lots. Standard is a universal account, suitable for most users, and it has fairly tight spreads and no fees. Raw Spread offers a raw spread (i.e., the lowest) and a fixed fee per lot. On the Zero account, spreads are higher than on Raw Spread, but fees are lower. Both accounts are professional, as they require an increased initial deposit of $3,000, while on Standard Cent and Standard accounts, you need only $30. Finally, the Pro account has a rather small spread and no fee and is aimed at experienced traders. Except for the account type, trading platforms are also important. MT4, MT5, and cTrader are quite different, although they are all convenient, easy to learn, and perfectly customizable.

Account types:

As a rule, if traders have never worked with a broker, they first open a demo account. Conditions on the demo correspond to those of a live account, thus users get access to real quotes but work with virtual currency. This helps novice traders to get used to the platform, and study its advantages and features. Moreover, a demo account provides for testing a particular strategy without risk. If traders are satisfied with everything on the demo, they open one of the live account types in accordance with their available budget and trading preferences.

Deposit and withdrawal

GTC received a Medium score for the efficiency and convenience of its deposit and withdrawal processes.

GTC provides a reasonable range of deposit and withdrawal options with moderate fees, in line with industry standards.

- No deposit fee

- Bank card deposits and withdrawals

- Supports 5+ base account currencies

- Bank wire transfers available

- Limited deposit and withdrawal flexibility, leading to higher costs

- PayPal not supported

- Wise not supported

What are GTC deposit and withdrawal options?

GTC provides a basic range of deposit and withdrawal options, covering essential methods in line with industry standards. This set of options is sufficient for most traders, with available methods Bank Card, Bank Wire, Neteller, BTC, USDT.

GTC Deposit and Withdrawal Methods vs Competitors

| GTC | Plus500 | Pepperstone | |

| Bank Wire | Yes | Yes | Yes |

| Bank card | Yes | Yes | Yes |

| PayPal | No | Yes | Yes |

| Wise | No | No | No |

| BTC | Yes | No | No |

What are GTC base account currencies?

A wide range of base account currencies minimizes the need for currency conversion, potentially reducing transaction costs for clients worldwide. GTC supports the following base account currencies:

What are GTC's minimum deposit and withdrawal amounts?

The minimum deposit on GTC is $30, while the minimum withdrawal amount is $1. These minimums may vary depending on the chosen account type and payment method. For specific details, please contact GTC’s support team.

Markets and tradable assets

GTC offers a wider selection of trading assets than the market average, with over 27000 tradable assets available, including 150 currency pairs.

- Indices trading

- 27000 assets for trading

- 150 supported currency pairs

- Bonds not available

- No ETFs

Supported markets vs top competitors

We have compared the range of assets and markets supported by GTC with its competitors, making it easier for you to find the perfect fit.

| GTCFX | Plus500 | Pepperstone | |

| Currency pairs | 150 | 60 | 90 |

| Total tradable assets | 27000 | 2800 | 1200 |

| Stocks | Yes | Yes | Yes |

| Commodity futures | No | Yes | Yes |

| Crypto | No | Yes | Yes |

| Stock indices | Yes | Yes | Yes |

| Options | No | Yes | No |

Investment options

We also explored the trading assets and products GTC offers for beginner traders and investors who prefer not to engage in active trading.

| GTCFX | Plus500 | Pepperstone | |

| Bonds | No | No | No |

| ETFs | No | Yes | Yes |

| Copy trading | Yes | No | Yes |

| PAMM investing | Yes | No | Yes |

| Managed accounts | Yes | No | No |

Customer support

Technical support is crucial for any company. Brokers need it because traders sooner or later face trading-related situations that they cannot resolve on their own. Which means they need help. If technical support is not fast or competent enough, clients may well become disappointed with a broker and leave for a competitor. GTC Forex understands this perfectly, so this broker's technical support works 24/7. All major communication channels such as phone, email, live chat, and social media profiles are available. Thus, clients have no complaints about support.

Advantages

- Non-clients of this broker can contact technical support

- Support is available 24/7

Disadvantages

- Responses via email are not prompt

Whether you are this broker’s client or just intend to become one, do not hesitate to contact its technical support if you have any trade-related questions. Use the following channels to get in touch with experts:

-

call center;

-

email;

-

tickets on the website;

-

live chat on the website and in the user account.

This broker has its profiles on Facebook, Twitter, YouTube, LinkedIn, and Instagram. You can contact managers through any of these platforms. It is also recommended to subscribe to any of the company's profiles so as not to miss its latest news.

Contacts

| Foundation date | 2012 |

|---|---|

| Registration address | First-floor B&P House, Kumul Highway Port Vila, Vanuatu |

| Regulation | VFSC, FSC, FCA, ASIC |

| Official site | https://gtcfx.com/ |

| Contacts |

800 667788

|

Education

A solid theoretical background, along with active trading, is very important for trader success. Traders can improve their knowledge by reading special literature, communicating with colleagues, attending webinars held by experts, etc. Brokers understand this and provide training materials to their clients. Considering that many users come to brokerage companies with no experience at all, training is most often aimed specifically at them, that is, it provides only basic information. GTC Forex constantly holds webinars, which are available online or traders can download the content as a text file with infographics. At webinars, this broker's experts review a variety of issues ranging from the basics of technical analysis to specific strategies and methods using their own life hacks.

Thus, training webinars of GTC Forex are really useful for traders of any level. However, in-depth candlestick analysis techniques, for example, are more aimed at experienced traders, and novice market participants should return to it later. And the basics of technical and fundamental analyses are unlikely to bring much benefit to a professional, but they will be of interest to a novice trader. The nuisance is that webinars are held in the corresponding section in a continuous stream, which is constantly growing. Therefore, it is quite difficult to find a specific topic.

Comparison of GTC with other Brokers

| GTC | Eightcap | XM Group | RoboForex | NPBFX | FBS | |

| Trading platform |

cTrader, MetaTrader4, MetaTrader5 | MT4, MT5, TradingView | MT4, MT5, MobileTrading, XM App | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | MT4 | MT4, MobileTrading, MT5, FBS app |

| Min deposit | $30 | $100 | $5 | $10 | $10 | $5 |

| Leverage |

From 1:1 to 1:1000 |

From 1:30 to 1:500 |

From 1:1 to 1:30 |

From 1:1 to 1:2000 |

From 1:200 to 1:1000 |

From 1:1 to 1:3000 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | 10.00% | No | No |

| Spread | From 0 points | From 0 points | From 0.8 points | From 0 points | From 0.4 points | From 1 point |

| Level of margin call / stop out |

No / 50% | 80% / 50% | 100% / 50% | 60% / 40% | No / 30% | 40% / 20% |

| Order Execution | STP | Market Execution | Market Execution | Market Execution, Instant Execution | Instant Execution, Market Execution | Market Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | Yes | No | No | Yes | No | No |

Detailed review of GTC Forex

This broker has an extensive infrastructure, uses an advanced technology stack, and provides high security and fast order execution. This is not surprising, since the parent company of the project has been on the market for a long time, is highly experienced, and has sufficient resources. The conceptual advantage is that this broker is licensed by three regulators and is a member of the Financial Dispute Resolution Center. Client funds are insured, and if necessary, all losses will be covered with up to €20,000 per trader. This approach is not common among brokerage companies. This broker’s activities are transparent, all regulatory documents are available on its website, regulators’ licenses can be checked, and there are no hidden or transaction fees. Moreover, any question can be clarified with client support 24/7.

GTC Forex by the numbers:

-

5 live account types (plus demo);

-

Minimum deposit is $30;

-

Maximum fee is $3.5 per lot;

-

15 deposit/withdrawal options;

-

Withdrawal fee is $0.

GTC Forex is a broker for active and passive income

Traders who aim to trade independently have a deep pool of assets at their disposal, which include currency pairs and CFDs on stocks, indices, metals, and energies. A wide range of instruments is an advantage, as it promotes the diversification of investment portfolios and not being limited in choosing a trading strategy. This is especially important, as GTC Forex allows scalping, hedging, trading news, and using expert advisors. For those who want to earn passively, MAM and PAMM accounts and copy trading are available. Both services are implemented at a high-quality level, and have no problems with functionality and performance.

Useful services offered by GTC Forex:

-

Joint accounts. Traders can register as managers or investors. Managers receive additional profit due to fees charged from investors, and investors themselves earn passively with reduced risks;

-

Copy trading. Signals providers trade on their own terms and, when trading successfully, receive some fees from investors who copy their trades. Investors, for their part, can count on income without active trading and a unique experience;

-

Autochartist. It is a comprehensive analytical service that includes a range of automated tools. It scans markets, gives volatility indicators, and provides expert opinions;

-

Signal center. This service examines the newsfeeds and filters them, eliminating the so-called "noise". The result of the analysis allows you to understand how successful this or that strategy can be.

Advantages:

Novice traders can get a low initial deposit and good training;

Work with hundreds of trading instruments without restrictions, top trading platforms, and current analytics;

Competitive spreads, objectively low trading fees, and impressive leverage up to 1:1000;

The company's clients can earn passively using joint accounts and its copy trading service;

Technical support is multilingual and is available 24/7 via all many communication channels, such as phone, mail, and live chat.

Latest GTC News

Articles that may help you

Check out our reviews of other companies as well

User Satisfaction i