deposit:

- $50

Trading platform:

- MT4

- ASIC

- 100%

deposit:

- $50

Trading platform:

- MT4

- ASIC

- 100%

Note!

We’ve identified your country as US

Traders Union experts have analyzed all companies providing trading services in your country legally and compiled a rating of the best companies that offer the best working conditions, have reliable reputation and the highest number of positive reviews among traders on our website.

We’ve selected the Top 5 Best Brokers in US for you:

Summary of Switch Markets Trading Company

Switch Markets is a broker with higher-than-average risk and the TU Overall Score of 4.43 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Switch Markets clients on our website, Traders Union expert Anton Kharitonov recommends users to consider a more reliable broker with better conditions, as, according to reviews, many clients of this broker are not satisfied with the company’s work. Switch Markets ranks 173 among 413 companies featured in the TU Ranking, which is based on the evaluation of 100+ criteria and a test on how to open an account.

Switch Markets is a broker for traders who are just getting acquainted with Forex and are focused on relatively active trading in the future.

Switch Markets is a relatively young broker, which entered the OTC market in 2019. In addition to standard trading products, the company is developing unique technical trading solutions. The company already has its proprietary risk management system, author's trading advisors, and auxiliary calculators. All this is available to every client of Switch Markets.

| 💰 Account currency: | USD EUR AUD GBP CAD |

|---|---|

| 🚀 Minimum deposit: | From USD 50 + leverage |

| ⚖️ Leverage: | Up to 1:1000 |

| 💱 Spread: | From 0.0 pips |

| 🔧 Instruments: | Currency pairs (62), stock CFDs (82), indices (21), commodities (8), cryptocurrencies (6) |

| 💹 Margin Call / Stop Out: | 50% / 20% |

👍 Advantages of trading with Switch Markets:

- Deposit from $50.

- With leverage of up to 1:1000, you can open trades on major assets within the framework of the rules of risk management.

- High execution speed averaging 70-80 ms.

- A good range of auxiliary tools such as profit calculators, lot calculations, points, trading advisors, and a training base with practical tools for analyses.

- Free VPS-server with a delay in order execution to a maximum of 3-5 ms.

- Welcome bonus up to 5,000 US dollars.

👎 Disadvantages of Switch Markets:

- Relatively high spread on the standard account.

Evaluation of the most influential parameters of Switch Markets

Trade with this broker, if:

- You are comfortable with high leverage. Switch Markets offers leverage of up to 1:1000, allowing you to open trades on major assets within the framework of risk management rules.

- You prefer the MT4 platform. Switch Markets utilizes the popular MetaTrader 4 platform, which is familiar to many experienced traders, providing a user-friendly and feature-rich trading environment.

Do not trade with this broker, if:

- You are concerned about a relatively high spread on the standard account. High spreads can impact trading costs and potentially affect profitability.

- You require extensive educational resources. While some educational materials exist, they might not be as comprehensive as what other brokers offer.

Table of Contents

Geographic Distribution of Switch Markets Traders

Popularity in

User Satisfaction i

Share your experience

- Best

- Last

- Oldest

Expert Review of Switch Markets

When you first get acquainted with the Switch Markets broker, you get the classic impression of a "middle-of-the-road broker". Standard trading terms, a standard set of instruments, some interesting features, but nothing that’s unique. The developers focus on the ease of trading and accessibility. And in some respects they are right to so. Upon visiting the broker's website one understands in just 10 minutes what the company offers and what opportunities a trader has. Everything is transparent, brief, and to the point.

Switch Markets is a classic STP broker, focused primarily on novice traders and traders with an average level of knowledge. The company offers 2 types of accounts such as standard and professional. Spread on the standard account is from 1.4 pips, and on the Pro account it is from 0.0 points, but there is a fixed commission per lot. There are withdrawal fees. The tariff policy is relatively tough for those who do not expect to engage in active trading. But for traders who are ready for long-term cooperation, there are quite comfortable terms.

Useful features of Switch Markets are a real-time market heat map, auxiliary calculators, free in-house developed scripts, and advisors. For new clients, there is a bonus of up to $5,000 when depositing $100. My general conclusion is that you should get acquainted with this broker's offers and possibilities, and test them on a demo account in MT4.

Dynamics of Switch Markets’s popularity among

Traders Union’s traders, according to 2023 data

Investment Programs, Available Markets and Products of the Broker

Switch Markets doesn’t have its own investment programs yet. The broker's development policy implies the development of active trading technologies and the expansion of the product line for active traders. Perhaps in the future, the company will add investment programs, but for now, traders have access only to the external service MQL5.

MQL5 social trading service

MQL5 is an analytical portal of MT4/MT5 platform developer MetaQuotes Corporation. Social trading is one of the functions of the platform. Every trader can join the MQL community as a trader or an investor. The platform acts as an independent controlling body that monitors the transparency and honesty of members' relationships. Strict control eliminates "fake" one-day accounts.

Features of the MQL5 social trading service:

-

The service is available to traders of any broker, including Switch Markets, through the MT4 platform. Switch Markets investors can copy signals of any broker's trader.

-

Most of the signals are provided after the payment of a 1-month subscription. The rent amount is set by the trader.

-

MQL imposes strict requirements on traders: the existence of an account with active trading for more than 1 month, compliance with the strategy with minimum risk management requirements, etc. All trading statistics on the trader's account are available in MT4.

Register on the broker's website and install the MT4 platform to connect to the MQL5 social trading service. Verification is not required to test the service in the demo version. You also need to register on the MQL5 website, and then you can connect to any trader in MT4 in the "Signals" tab of the "Terminal" window.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Switch Markets’ affiliate program:

-

Introducing Broker (IB) is an affiliate program for everyone who wants to earn by attracting traders. The broker doesn’t limit the partner's possibilities. There are no limits on the number of accounts, no requirements on the minimum amount of trades made by referrals, etc.

To participate, you need to register on the broker's website as a partner, verify your account and send an application to the support service. The broker's representative will help to set up affiliate analytics in the cabinet and provide marketing tools such as custom landing pages, logos, links, banners, etc. Affiliate payments are monthly. According to the calculator, if each of 100 referrals makes 12 lots in a year, your reward for the year will be $2,400.

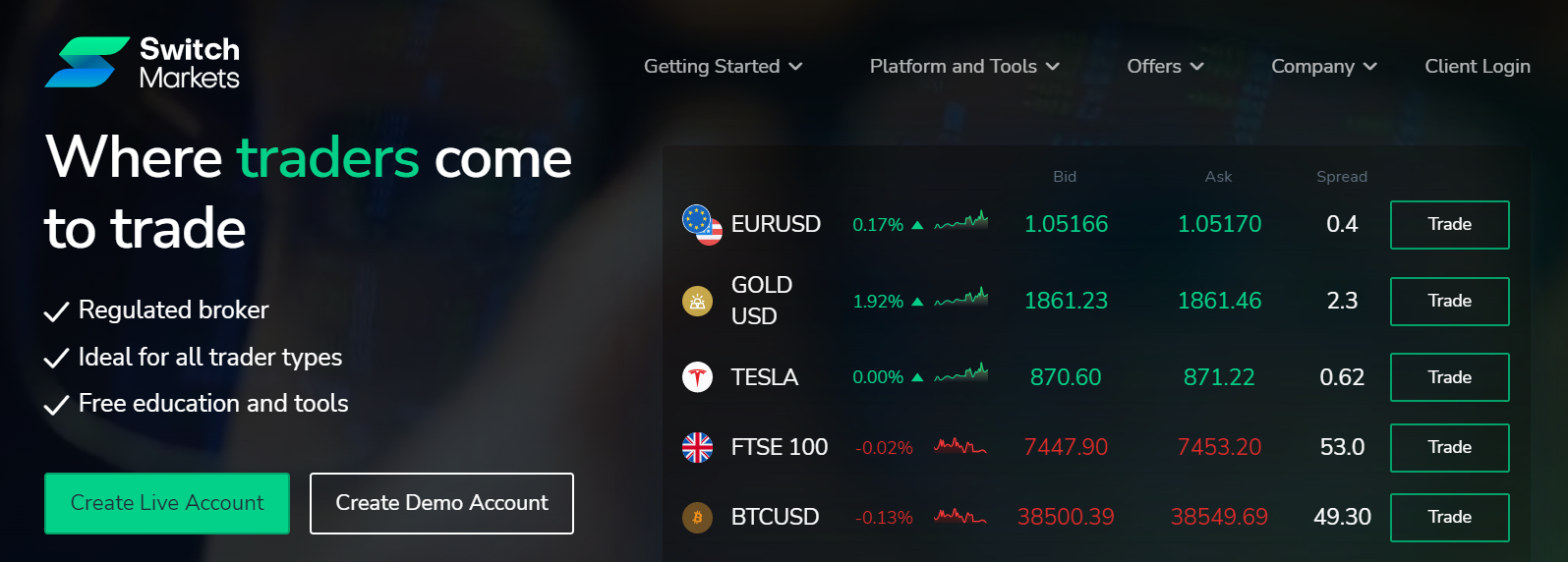

Trading Conditions for Switch Markets Users

The Switch Markets broker offers traders over 180 trading assets, including cryptocurrencies. There are 2 types of accounts, standard and high-frequency active trading. Leverage is up to 1:1000, but its size depends on the specific assets. To see the current leverage, refer to the contract specifications. A demo account is provided for practicing skills and testing instruments.

$50

Minimum

deposit

1:1000

Leverage

24/5

Support

| 💻 Trading platform: | МТ4 |

|---|---|

| 📊 Accounts: | Standard, Pro |

| 💰 Account currency: | USD EUR AUD GBP CAD |

| 💵 Replenishment / Withdrawal: | Visa/MasterCard, bank transfer, Neteller, Skrill, FasaPay, UnionPay, Perfect Money, PayTrast, Globe Pay, NganLuong.vn, Interac |

| 🚀 Minimum deposit: | From USD 50 + leverage |

| ⚖️ Leverage: | Up to 1:1000 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.01 |

| 💱 Spread: | From 0.0 pips |

| 🔧 Instruments: | Currency pairs (62), stock CFDs (82), indices (21), commodities (8), cryptocurrencies (6) |

| 💹 Margin Call / Stop Out: | 50% / 20% |

| 🏛 Liquidity provider: | n/a |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Orders execution: | Market execution |

| ⭐ Trading features: | Social trading from MQL5; Economic calendar; Liquidity aggregation technology. |

| 🎁 Contests and bonuses: | Yes |

Comparison of Switch Markets with other Brokers

| Switch Markets | RoboForex | Eightcap | Exness | FxGlory | 4XC | |

| Trading platform |

MT4 | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | MT4, MT5 | Exness Trade App (mobile), Exness Terminal (web), MetaTrader5, MetaTrader4 | MT4, MobileTrading, MT5 | MT5, MT4, WebTrader |

| Min deposit | $50 | $10 | $100 | $10 | $1 | $50 |

| Leverage |

From 1:1 to 1:1000 |

From 1:1 to 1:2000 |

From 1:30 to 1:500 |

From 1:1 to 1:2000 |

From 1:1 to 1:3000 |

From 1:1 to 1:500 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | No | 8.00% | No |

| Spread | From 0 points | From 0 points | From 0 points | From 1 point | From 2 points | From 0 points |

| Level of margin call / stop out |

50% / 20% | 60% / 40% | 80% / 50% | No / 60% | 20% / 10% | 100% / 50% |

| Execution of orders | Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution, Instant Execution | Instant Execution, Market Execution | Market Execution |

| No deposit bonus | No | No | No | No | No | $50 |

| Cent accounts | No | Yes | No | No | No | No |

Broker comparison table of trading instruments

| Switch Markets | RoboForex | Eightcap | Exness | FxGlory | 4XC | |

| Forex | Yes | Yes | Yes | Yes | Yes | Yes |

| Metalls | Yes | Yes | Yes | Yes | Yes | Yes |

| Crypto | Yes | No | Yes | Yes | No | Yes |

| CFD | Yes | Yes | Yes | Yes | Yes | Yes |

| Indexes | Yes | Yes | Yes | Yes | No | Yes |

| Stock | Yes | Yes | Yes | Yes | No | Yes |

| ETF | No | Yes | No | No | No | No |

| Options | No | No | No | No | No | No |

Switch Markets Commissions & Fees

| Account type | Spread (minimum value) | Withdrawal commission |

| Standard | from $14 | Yes |

| Pro | from $1 | Yes |

There is a commission on open trades, which are carried over to the next trading day.

The analysts also compared the average costs of Switch Markets traders with similar costs of traders of other brokers. See the comparative analysis in the table below.

| Broker | Average commission | Level |

| Switch Markets | $7.5 | Medium |

| RoboForex | $1 | Low |

| Pocket Option | $8.5 | High |

Detailed Review of Switch Markets

Switch Markets is a relatively young broker and is focused mainly on the European and Asian OTC markets. The company entered the market in 2019, offering classic trading terms and STP/ECN technologies. And although the coverage of the broker's audience is still relatively small, instead of an aggressive marketing campaign, Switch Markets attracts clients with the constant introduction and updating of unique technical trading tools.

Switch Markets by the numbers:

-

Its client list consists of traders from over 21 countries.

-

The broker's team comprises 100 technicians working on further developing the platform.

-

Over 180 CFD trading assets.

Switch Markets is a broker for novice traders

Switch Markets develops ECN-trading technology with an end-to-end liquidity delivery model. This means that traders' orders are directly matched with response orders of suppliers, thereby maintaining a stable level of liquid volumes. At the moment the broker guarantees the speed of order execution of about 80 ms while the average market speed is 150-300 ms. In the future, this figure will be reduced to 30 ms, after which Switch Markets will become one of the most attractive brokers for algorithmic trading.

The trading platform is the most popular platform for MT4 OTC markets. It is also available in a desktop version. Its standard features such as 3 types of basic charts, downloading of quotes history, testing of strategies, algorithmic trading, social trading MQL5, and working with custom tools are available to its traders.

Switch Markets' useful services are:

-

Calculators. A calculator for pip value, margin, swaps, profits, etc. Over 6 different types of calculators that allow you to calculate the optimal deal volume, risk level, and potential profit on different types of assets depending on the nature of your trading strategy.

-

Heatmap. Market sentiment for each asset depends on the timeframe in terms of instrument liquidity. There are analytics on price changes for the period.

-

Economic calendar. A list of the main news that has the greatest influence on the quotes.

-

Statistical analysis of the volatility of currency pairs.

-

A set of author's expert advisors and scripts for MT4.

Advantages:

A full range of trading currencies, including digital assets.

Loyal trading terms include a starting deposit from $50 and leverage up to 1:1000 regardless of qualified investor status.

No restrictions on applied strategies and tools. Hedging, high-frequency trading, and adding any custom indicators and scripts are available.

The high order execution speed. Up to 98% of orders are executed at speeds up to 70-80 ms.

Liquidity aggregation technology. Allows you to avoid a significant widening of the spread at moments of abnormal volatility.

There are Islamic accounts and demo accounts.

How to Start Making Profits — Guide for Traders

Before you open an account with Switch Markets, register on the Traders Union website and go to the registration window using the affiliate link. This will allow you to receive partial compensation against spreads in the future. The account options are standard and professional. Almost all trading terms are the same; the difference is in the commission policy.

Types of accounts:

Demo accounts are available for all terminals.

Bonuses Paid by the Broker

Every new client of Switch Markets gets a $5,000 bonus when making a deposit of $100 or more. The bonus doesn’t need to be worked off, but at the same time, it cannot be withdrawn. Therefore, this bonus should be perceived as additional leverage.

Investment Education Online

The Switch Markets website doesn’t have a separate section designed to introduce traders to the principles of trading in the OTC markets. The presented information refers to analytical materials, designed for experienced traders who are practicing trading on real markets.

Testing of trading systems, testing of expert advisors, and gaining experience are also possible on a demo account, which does not require verification.

Security (Protection for Investors)

Switch Markets is a relatively young broker, so the issues about obtaining licenses from regulators are still being resolved. The company has two divisions. One of the divisions is registered in Australia and has an ASIC (ABN: 30 157 780 259) license. The second division in Singapore is registered in Saint Vincent and the Grenadines through its offices and affiliated company offices.

👍 Advantages

- 24/5 Support

👎 Disadvantages

- No link to a separate physical office or ombudsman

- No information about the principles of data encryption or the protection of the account

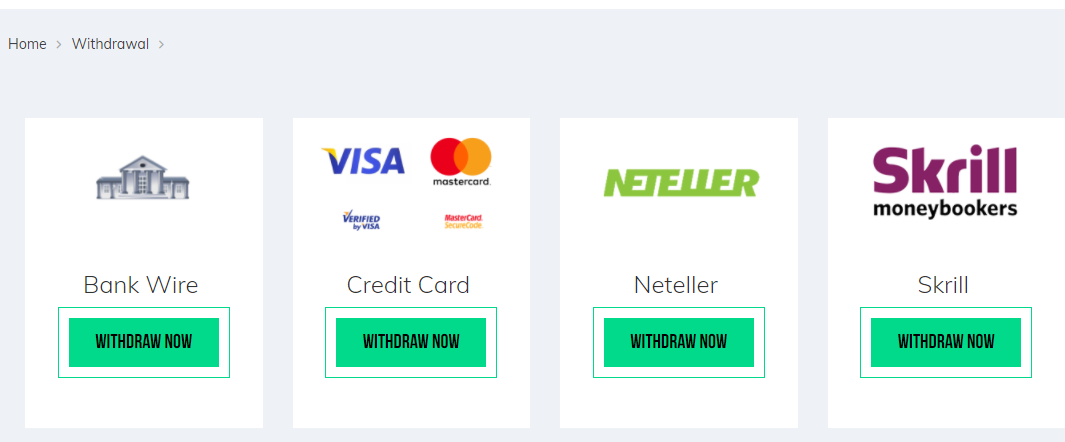

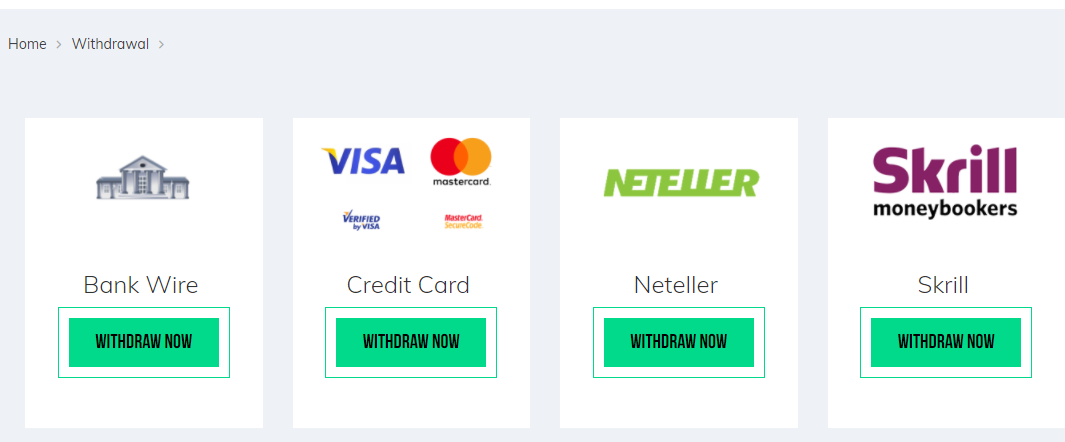

Withdrawal Options and Fees

The broker supports over 10 variants of payment methods, including bank payment systems and virtual electronic wallets. In the future, cryptocurrency payment functionality is expected to be added. Also:

-

Receipt of funds takes from 1 to 3 business days depending on the method chosen. The longest processing time is for withdrawal requests via bank systems. Requests for withdrawal to electronic wallets are processed within a few hours.

-

Payment methods and systems: Visa/MasterCard, bank transfer, Neteller, Skrill, FasaPay, UnionPay, Perfect Money, PayTrast, Globe Pay, NganLuong.vn, Interac, wire transfer.

-

Currencies for deposits and withdrawals: USD, EUR, AUD, GBP, CAD, NZD, SGD, CHF, PLN.

-

In addition to the commissions of payment systems for the withdrawal of money, there are broker's commissions from 0.5%-2%. There are no restrictions on the amount of withdrawal and the number of withdrawal requests.

Customer Support Service

The support team answers questions on business days 5 days a week, around the clock.

👍 Advantages

- Support responds quickly

👎 Disadvantages

- No contact phone numbers

- No listed physical address

There are several ways to contact client support specialists:

-

Feedback form on the broker's website.

-

Online chat.

-

Email.

-

Social networks.

Registration is not required to receive an answer to your question.

Contacts

| Foundation date | 2018 |

| Registration address | 1B Trenganu St, Сингапур 058455 2100 |

| Regulation |

ASIC |

| Official site | https://www.switchmarkets.com/ |

| Contacts |

Phone:

+44 1902 943 383

|

Review of the Personal Cabinet of Switch Markets

Start your partnership with the Switch Markets broker by pre-registering on the Traders Union's website. After registering, find the affiliate link in the broker's overview and open an account. In the future, this will allow you to receive bonuses in the form of rebates as partial compensation for the spreads.

Algorithm of registration at Switch Markets broker:

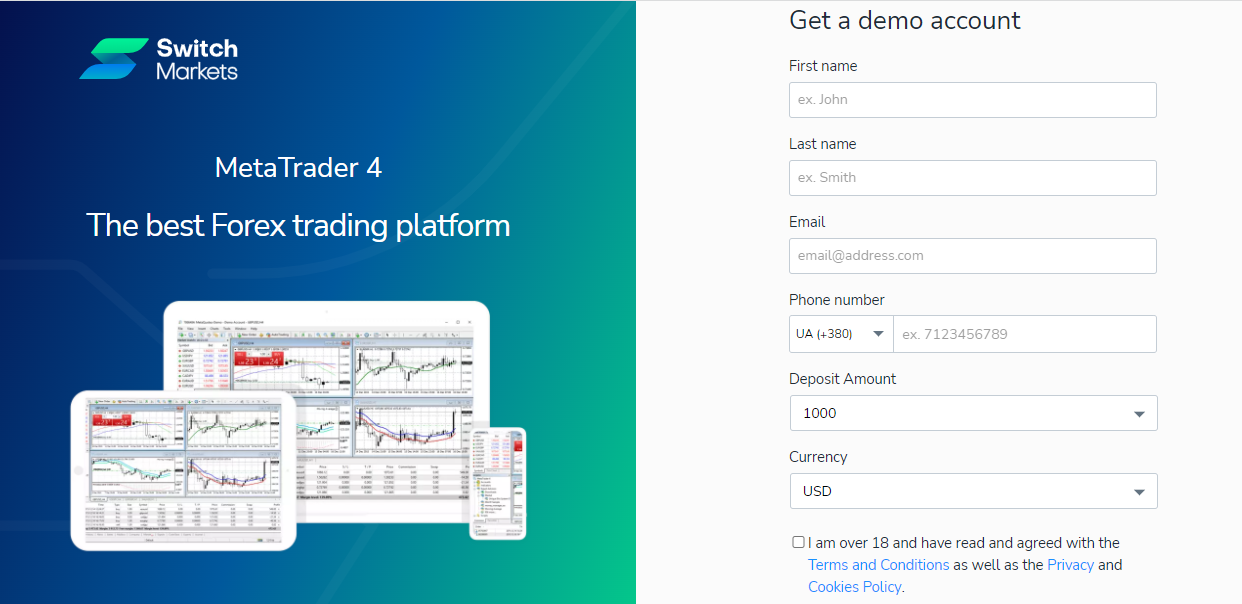

Click "Create Live Account" or "Create Demo Account” on the broker's main page. When you open a demo account, you will get information with access to the trading platform – account number, password, investment password, and server.

To gain access to your user account, opening a real account is required. Fill out the registration form.

After completing the basic registration form you will receive an email with your username and password, which will prompt you after authorization to fill out the full questionnaire data for verification. It involves 6 steps. The filled-in form must be sent for verification. And only after its confirmation the broker will provide access to your new user’s account.

Features of Switch Markets’ user account:

1. Account management. From your user account, you can open any number of real and demo accounts. There is an archive of accounts with the ability to view the history of each.

2. Transaction management. Here you can generate withdrawal requests, free internal transfers between accounts, and view movement history.

1. Account management. From your user account, you can open any number of real and demo accounts. There is an archive of accounts with the ability to view the history of each.

2. Transaction management. Here you can generate withdrawal requests, free internal transfers between accounts, and view movement history.

Also in the user account, you will have access to:

-

Trade statistics for all accounts with the ability to filter by date, assets, etc.

-

The installation files of the mobile version of MT4.

-

FAQs. Answers to basic questions on accounts and trading. You can also find the answers in the FAQs section on the broker's website. Each section has its list of the most FAQs.

Disclaimer:

Your capital is at risk. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. A high percentage of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Articles that may help you

FAQs

Do reviews by traders influence the Switch Markets rating?

Any review can raise or lower the rating of any broker in the general list of brokers. To read reviews about Switch Markets you need to go to the broker's profile.

How to leave a review about Switch Markets on the Traders Union website?

To leave a review about Switch Markets, register on the Traders Union website or you can also leave a review through Facebook.

Is it possible to leave a comment about Switch Markets on a non-Traders Union client?

Anyone can leave feedback about Switch Markets on multiple participating clients; however, Traders Union clients also receive additional payments later for working with any broker listed at the Forex market.

Traders Union Recommends: Choose the Best!

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest.