IC Markets Minimum Deposit And Payment Methods

When you want to start trading forex, you’ll often need to consider a few brokers to find the right one that meets your specific needs and requirements.

During this process, among other things, you’ll need to consider the broker’s minimum deposit requirements and what deposit methods it has available. Ultimately, you’ll want to find a broker that has a minimum deposit requirement that fits your budget and deposit methods that make it convenient for you to deposit funds into your account.

With that in mind, we’ll now look at the different deposit methods that IC Markets offers as well as its minimum deposit requirements.

Is Forex profitable? Learn more about itWhat is IC Markets Minimum Deposit?

IC Markets offers three different account types. These are:

Raw Spread (cTrader).

Raw Spread (MetaTrader).

Standard (MetaTrader).

The minimum deposit to open an account with IC Markets across all its accounts is $200 or the equivalent in the trader’s local currency. So, the Raw Spread and IC Markets Standard Account minimum deposit is $200.

IC Markets Minimum Deposit ZAR

Now the question is: What is the minimum deposit requirement for South African traders? For these traders, the IC Markets minimum deposit in ZAR is still $200. This means, for anyone opening an IC Markets account from South Africa, they'll need to convert $200 into South African rand using the current exchange rate.

IC Markets Minimum Deposit vs Competitors

Considering the above, let's compare IC market to its competitors when it comes to their minimum deposit amounts.

| IC Markets | AvaTrade | Exness | |

|---|---|---|---|

| Minimum Deposit | $ 200 | $ 100 | $ 10 |

IC Markets Deposit Methods and Fees

IC Markets offers a variety of deposit methods that traders can use to fund their accounts. In fact, it offers over 15 different payment methods in 10 different base currencies.

Here, the deposit methods IC Markets offers include:

Credit and debit cards

PayPal

Neteller

Neteller VIP

Skrill

UnionPay

Wire Transfer

Bpay

FasaPay

Broker to Broker

POLI

Thai Intenet Banking

Rapidpay

Klarna

Vietnamese Internet Banking

Now, let’s compare IC Markets to its competitors in respect of its deposit methods.

IC Markets Deposit Methods vs Competitors

| IC Markets | AvaTrade | Exness | |

|---|---|---|---|

Bank Transfer |

Yes |

Yes |

Yes |

Debit/Credit Card |

Yes |

Yes |

Yes |

Payment Apps |

Yes |

Yes |

Yes |

Cryptocurrencies |

No |

No |

Yes |

IC Markets Deposit Fees

IC Markets does not charge any fees for deposits or withdrawals. It's important to keep in mind, however, that there might be banking fees involved when making a withdrawal or deposit to IC Markets.

Read more about brokerage feesHow Long Does it Take to Deposit Money on IC Markets

Once again, how long it takes to deposit money on IC Markets depends on the specific payment method used. Here, the duration for the different payment methods are the following:

Credit and debit cards - Instant

PayPal - Instant

Neteller - Instant

Neteller VIP - Instant

Skrill - Instant

UnionPay - Instant

Wire Transfer - 2 to 5 business days

Bpay - 12 - 48 hours

FasaPay - Instant

Broker to Broker - 2 to 5 business days

POLI - Instant

Thai Intenet Banking - 15 to 30 minutes

Rapidpay - Instant

Klarna - Instant

Vietnamese Internet Banking - Instant

IC Markets Account Currencies vs Competitors

Now, let’s look at what currencies IC Markets has available. Here, for instance, traders can fund their account using:

Credit and debit cards using AUD, USD, JPY, EUR, NZD, SGD, GBP, and CAD.

PayPal using AUD, USD, JPY, EUR, NZD, SGD, GBP, CAD, HKD, and CHF

Neteller using USD, AUD, GBP, EUR, CAD, SGD, and JPY

Skrill using AUD, USD, JPY, EUR, SGD, GBP

Wire transfer using AUD, USD, JPY, EUR, NZD, SGD, GBP, CAD, and CHF

It’s important to remember that these are just some of the funding options that IC Markets offers. There are, as mentioned earlier, others like Union Pay, Rapidpay, and FasaPay. All these offer different currencies, but most include the popular currencies like USD, EURO, GBP, and RMB.

With that in mind, let’s see how IC Markets compares to its competitors based on the currencies it offers.

| IC Markets | AvaTrade | Exness | |

|---|---|---|---|

| Account Currencies | All major currencies including USD, AUD, EUR, GBP, JPY, and NZD | USD, EUR, and GBP | All major currencies including USD, AUD, EUR, GBP, JPY, NZD, and others |

How to Deposit Money On IC Markets? Step by Step Guide

To deposit money into an IC Markets account, you’ll need to follow the following steps:

The first step is to go to the IC Markets homepage. On the homepage, you’ll need to click on the Client Login button. If you don’t have an IC Markets account, you’ll need to open one first.

Photo: IC Market

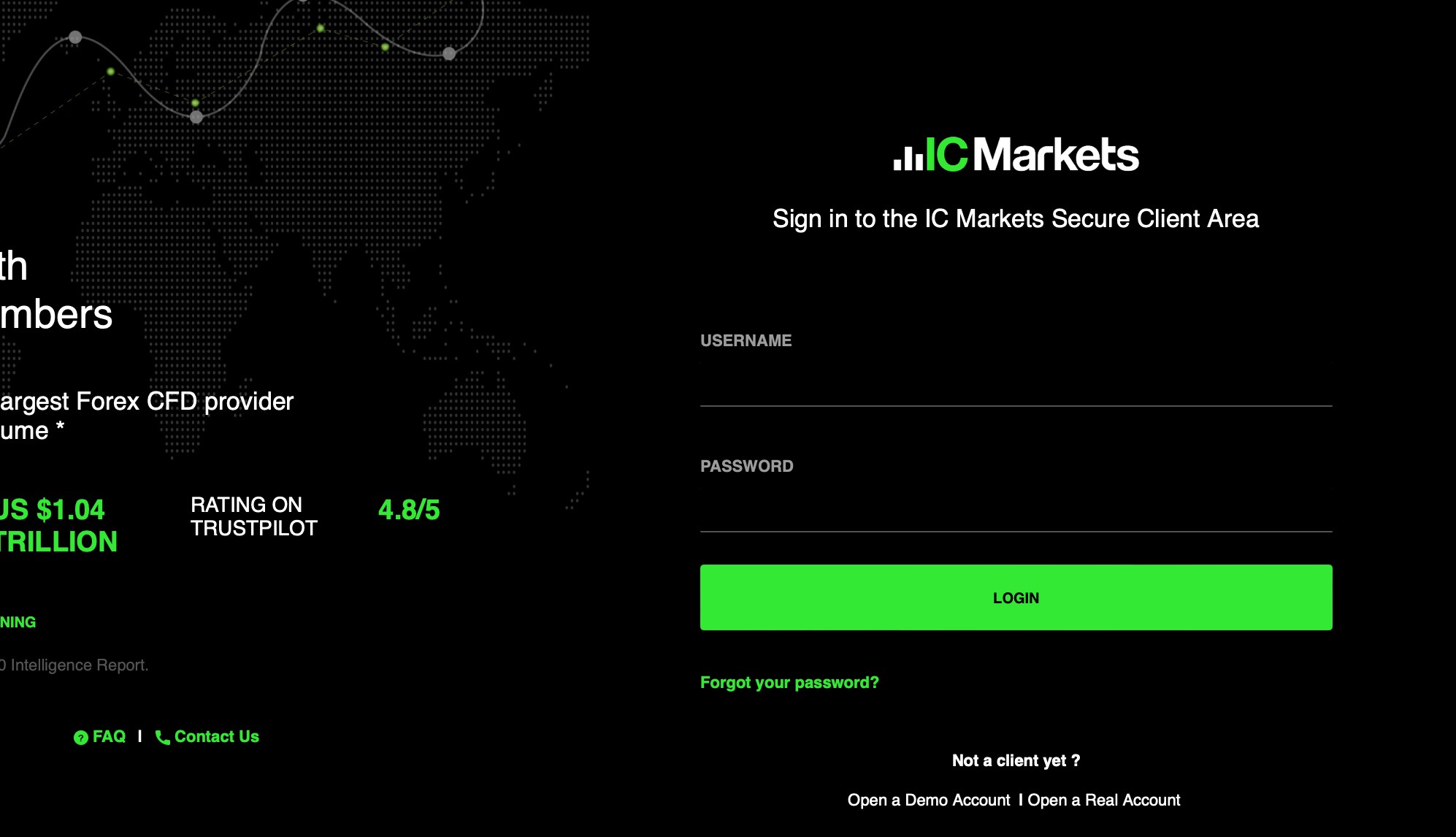

Once you’ve clicked on the Client Login button, you’ll be taken to the login page where you’ll need to enter your credentials.

Photo: IC Market

Once you’ve entered your credentials, you can click on LOGIN.

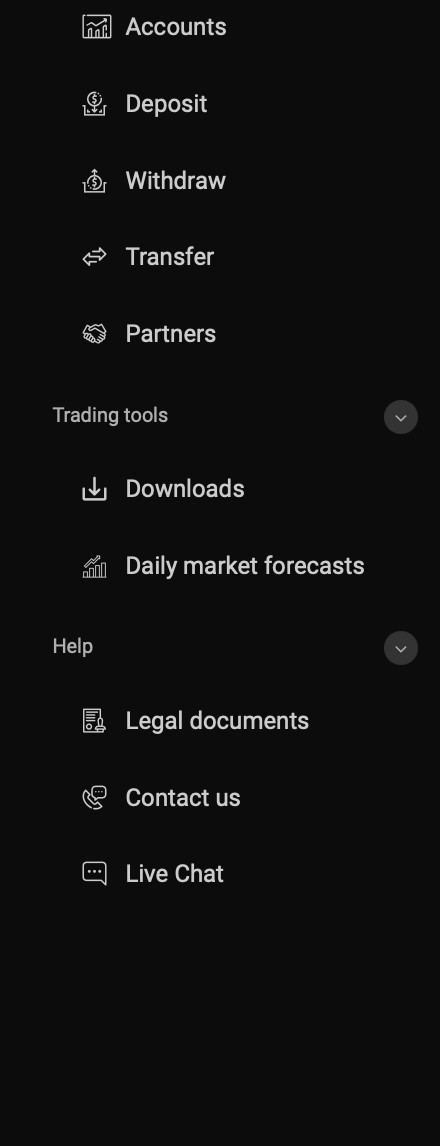

When you’ve logged in, you’ll need to select Deposit in the main menu to the left.

Photo: IC Market

On the page that opens, you’ll then be able to select the deposit method you want to use and the amount you want to deposit. Once you’ve entered this information, you can complete the deposit. As mentioned earlier, depending on the payment method you chose, the deposit can take up to a few days to complete.

FAQs

Apart from the information provided above, we’ve also compiled a list of frequently asked questions that traders often have when it comes to IC Markets’ minimum deposits.

How do I open a live account with IC Markets?

To open a live account, you’ll need to go to the IC Markets homepage and then click on START TRADING. You’ll then be taken to a page where you can complete the application form. Once your account is approved, your credentials will be emailed to you.

If I deposit money, will it be safe?

Yes, your money will be safe. IC Markets is a trusted and reputable broker and also properly regulated.

Where does IC Markets hold my money?

IC Markets holds all client funds in segregated client trust accounts.

Can I have more than one IC Markets trading account?

Yes, you can open more than one trading account.

Team that worked on the article

Oleg Tkachenko is an economic analyst and risk manager having more than 14 years of experience in working with systemically important banks, investment companies, and analytical platforms. He has been a Traders Union analyst since 2018. His primary specialties are analysis and prediction of price tendencies in the Forex, stock, commodity, and cryptocurrency markets, as well as the development of trading strategies and individual risk management systems. He also analyzes nonstandard investing markets and studies trading psychology.

Olga Shendetskaya has been a part of the Traders Union team as an author, editor and proofreader since 2017. Since 2020, Shendetskaya has been the assistant chief editor of the website of Traders Union, an international association of traders. She has over 10 years of experience of working with economic and financial texts. In the period of 2017-2020, Olga has worked as a journalist and editor of laftNews news agency, economic and financial news sections. At the moment, Olga is a part of the team of top industry experts involved in creation of educational articles in finance and investment, overseeing their writing and publication on the Traders Union website.

Olga has extensive experience in writing and editing articles about the specifics of working in the Forex market, cryptocurrency market, stock exchanges and also in the segment of financial investment in general. This level of expertise allows Olga to create unique and comprehensive articles, describing complex investment mechanisms in a simple and accessible way for traders of any level.

Olga’s motto: Do well and you’ll be well!

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO). Mirjan is a cryptocurrency and stock trader. This deep understanding of the finance sector allows her to create informative and engaging content that helps readers easily navigate the complexities of the crypto world.