Interactive Brokers Canada - Is It a Good Broker in 2024?

Established in 1978, Interactive Brokers has grown to become one of the most popular brokers globally. Currently, it offers its services to clients in 135 markets, 33 countries, and 23 currencies. For these clients, it gives them the opportunity to invest globally in stocks, options, futures, currencies, ETFs, and bonds, all from a single account.

It provides these services through a variety of entities around the world. In turn, these entities are all regulated within the jurisdiction they operate. For example, the subject of this post, Interactive Brokers Canada Inc., is a member of the Investment Industry Regulatory Organization of Canada (IIROC) and a member of the Canadian Investor Protection Fund.

But what does Interactive Brokers Canada offer? In this post, we’ll look at this question in more detail and delve a little deeper into what products it offers, its fees, and more.

Interactive Brokers Canada - General Information

As mentioned earlier, Interactive Brokers provides its services in Canada through its entity Interactive Brokers Canada Inc. This company was established in 1998 as part of the Timber Hill Group. The name of the group was changed to Interactive Brokers Group LLC in 2001.

Photo: Interactive Brokers trading platform

Through its Canadian subsidiary, Interactive Brokers promises to provide investors with global access to several investment instruments, low fees, and intuitive and sophisticated trading platforms. With that in mind, let's look at what Interactive Brokers Canada has to offer.

-

💰 Account currency:

USD, EUR, GBP, AUD, CAD, CZK, DKK, HKD, HUF, ILS, JPY, MXN, NZD, NOK, PLN, SGD, SEK, CHF, CNH

-

🚀 Minimum deposit:

No

-

⚖️ Leverage:

Depending on the asset

-

💱 Spread:

From 0 pips

-

🔧 Instruments:

Stocks, options, futures, currency, metals, bonds, ETF, mutual funds, CFD, EPF, Robo-portfolios, hedge funds

-

💹 Margin Call / Stop Out:

Depending on the asset

Interactive Brokers Canada Pros and Cons

Now that we've seen a broad overview of what Interactive Brokers Canada offers, let's look at some of the advantages and disadvantages of using the broker’s services.

👍 Pros

• Massive variety of trading instruments

• A wide range of training material and resources

• Offers a free trial

• Feature-rich trading platforms

👎 Cons

• Inactivity fees

• No card deposits

Interactive Brokers Canada Review

As mentioned earlier, one of the main advantages of investing and trading through Interactive Brokers Canada is the sheer variety of trading assets it offers. This means, no matter what your trading goals or risk appetite, you’ll likely find a trading asset that suits your unique needs and preferences.

In addition, the broker also offers its intuitive mobile and desktop trading platforms. Here, its desktop platform, Traders Workstation, gives you access to a variety of trading, chart, order management, and portfolio tools in a single easy-to-use platform.

Learn more about Interactive Brokers minimum depositInteractive Brokers Canada - Fees

Interactive Brokers Canada offers both fixed-rate pricing and tiered pricing. As the name suggests, with fixed-rate pricing, you’ll pay a fixed-rate commission per share or as a percentage of the trade value. This fixed rate includes all exchange and regulatory fees.

In contrast, with the tiered pricing structure, your commission on trades will decrease as your trading volume increases. Here, the commission does not include exchange, regulatory, and other clearing fees.

With that in mind, let’s look at the commissions in more detail.

US Stocks and ETFs

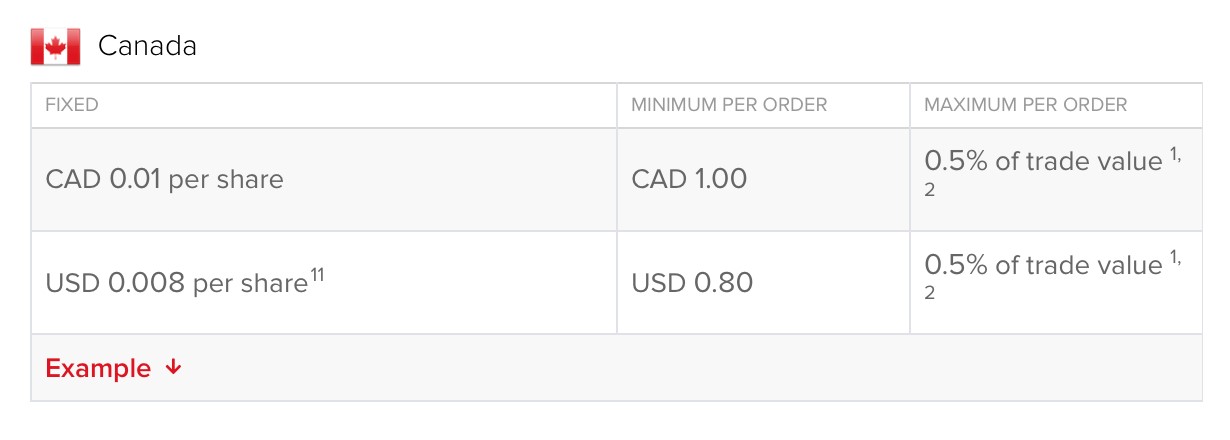

On the fixed-rate pricing structure, Interactive Brokers Canada charges a commission of CAD 0.01 per share with a minimum commission of CAD 1 and a maximum of 0.5% of the trade value for US stocks and ETFs.

Photo: Interactive Brokers pricing

On the tiered pricing structure, the commissions when trading US-denominated stocks vary from USD 0.006 when you trade less than 300,000 shares to USD 0.002 when you trade more than 100,000,000 shares.

In all instances, there’s a minimum commission of USD 0.08 and a maximum of 0.5% of the trade value. Also, remember that, here, you’ll need to pay exchange, clearing, and transaction fees,

Canadian Stocks

For Canadian stocks, the fixed-rate pricing is exactly the same as for US stocks. So, when trading Canadian stocks, you’ll pay a commission of CAD 0.01 per share with a minimum of CAD 1.00 and a maximum of 0.5% of the trade value.

When trading Canadian stocks using the tiered pricing structure, the commissions will range from a low of CAD 0.008 when trading less than 300,000 shares and goes down to CAD 0.003 when trading more than 100,000,000 shares. As is the case with US-based stocks, you’ll also need to pay exchange, clearing, and transaction fees.

Photo: Interactive Brokers pricing

Options

When trading options, you’ll pay commissions of CAD 1.25 per contract when you trade less than 10,000 contracts per month. When you trade more than 100,001 contracts per month, this commission will go down to CAD 1.00 per contract. In both cases, the minimum commission is CAD 1.50 per order.

Photo: Interactive Brokers Tiered Commissions

Forex

When trading forex, you’ll also pay the spread based on your trading volume. Here, you’ll pay a spread equal to 0.20 basis points times the trade value with a minimum of USD 2.00 per order if you trade less than USD 1,000,000,000. If you trade more than USD 5,000,000,000, the spread will go down to an amount equal to 0.08 basis points times the trade value with a minimum of USD 1.00.

Photo: IBKR Commissions

Interactive Brokers Canada - Trading Assets

Now that we’ve seen what Interactive Brokers Canada’s fees and commissions are, let’s take a closer look at the trading assets it has available for trading.

These assets include:

Stocks and ETFs. The platform gives you the ability to trade stocks on over 80 global markets. As such, you’re able to trade on the New York Stock Exchange (NYSE), NASDAQ, the London Stock Exchange (LSE), the Frankfurt Stock Exchange (FWB), the Australian Stock Exchange (ASX), the Tokyo Stock Exchange (TSEJ), and many others. In Canada specifically, you can trade on the Alpha ATS, Chi-X Canada, Omega ATS, TSX Venture, and the Toronto Stock Exchange (TSE).

Forex. With Interactive Brokers Canada, you’ll be able to trade in over 100 currency pairs with 23 base currencies including USD, CAD, CHF, AUD, GBP, EUR, JPY, and others.

Options. With the platform, you’ll be able to trade options on all the major exchanges globally. In Canada specifically, you’ll be able to trade options on the Montreal Exchange (CDE).

Future. As is the case with options, the platform allows you to trade options on all the major exchanges globally including the Montreal Exchange.

Learn more about major currency pairs to trade

Apart from these trading assets, the Interactive Brokers Canada platform also gives you access to mutual funds, metals, indices, and more.

Is Interactive Brokers Canada Regulated? Is This Сompany Safe?

As mentioned earlier, Interactive Brokers Canada Inc. is a member of and is regulated by the IIROC. This body oversees all the investment dealers and trading activity on Canada’s debt and equity markets.

As also mentioned, the broker is a member of the Canadian Investor Protection Fund. This fund protects Canadian investors in the event that a broker becomes insolvent up to a maximum of $1 million for all the accounts combined.

Apart from this, Interactive Brokers Canada has also implemented the necessary security measures to keep clients’ funds safe. These measures include, for instance, holding all client funds in segregated accounts.

How to avoid scam? Learn more about itInteractive Brokers Canada - Best for Low Cost Investing in Various Trading Assets

If you want access to a large variety of trading assets while still being able to trade with low commissions, you don’t need to look any further than Interactive Brokers Canada. Here, with its low commissions and access to global stocks, ETFs, options, futures, currencies, and bonds, it’s the perfect option.

What is paper trading? Read moreSummary. Is Interactive Brokers Canada a Good Broker?

Ultimately, considering everything mentioned above, Interactive Brokers is a good broker, especially if you’re looking for a massive variety in trading assets, low fees, and you want the peace of mind that your money will be safe.

For more broker reviews like these or for more insights into trading strategies, why not join Traders Union today.

FAQs

In addition to the information provided above, we’ve also compiled a list of frequently asked questions relating to Interactive Brokers Canada.

What deposit methods does Interactive Brokers Canada offer?

The platform offers direct deposits, electronic funds transfers, and Canadian Bill Payment among others.

How long will it take for the funds to appear in my account?

It depends on the specific deposit method used.

Will my money be safe?

Yes, your money will be safe. Interactive Brokers Canada is reputable, trusted, and properly regulated.

What is the minimum deposit requirement?

There is no minimum deposit requirement at Interactive Brokers Canada.

Team that worked on the article

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

The topics he covers include trading signals, cryptocurrencies, Forex brokers, stock brokers, expert advisors, binary options. He has also worked on the ratings of brokers and many other materials.

Dr. BJ Johnson’s motto: It always seems impossible until it’s done. You can do it.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO). Mirjan is a cryptocurrency and stock trader. This deep understanding of the finance sector allows her to create informative and engaging content that helps readers easily navigate the complexities of the crypto world.