8 Best Forex Options Brokers For 2024

Best Forex Options Broker For 2024 - AvaTrade

Top Forex Options Brokers For 2024:

AvaTrade – best trading platform for OTC options;

Interactive Brokers – best for US FX options;

Fidelity FX – best choice for exotic currency pairs;

IG – best choice of Forex options;

Saxo Bank – most trusted FX options brokers in Europe.

Options trading is very popular. Traders use options both for independent trading and for investing, for example, for hedging. Forex options trading is offered by a small number of brokers, and each has different conditions. Before you start trading, it is important to choose a company with the most favorable conditions. Traders Union analysts have compiled a list of the top 8 brokers that offer forex options trading.

-

How Do Forex Options Brokers Differ?

Brokers may have different execution policies, types of options, contract specifications and leverage.

-

How much capital do I need to start trading forex options?

Capital requirements vary based on position sizing, leverage, and your strategy. Generally it is recommended to have at least $1,000 to properly capitalize a forex options account.

-

Are there any demo accounts to practice forex options trading?

Many brokers offer demo accounts loaded with virtual funds.

-

What are the benefits of trading forex options?

Benefits include using options as hedging tools to limit potential losses, leveraging a small amount of capital for potentially unlimited gains, and tailoring option strategies to precise risk/reward profiles. Options also provide more flexibility than spot Forex trading.

AvaTrade – Best Trading Platform for OTC Options

Formed in 2006, AvaTrade is one of the most reputable, and trusted trading platforms. The platform won lots of awards, has excellent customer support, and has a demo trading account. There are over 40 currency pairs available as spot contracts of CFDs. Suitable education materials and low commissions and fees make AvaTrade a great all-around option.

AvaTrade Best Features:

-

Minimum deposit of just $100

-

Education tools

-

Low commissions and fees

-

Demo account

Interactive Brokers – Best For US FX Options

Interactive Brokers, AKA IBKR, was founded in 1977. It has over 100 forex pairs that can be traded as CFDs or spot contracts. It charges commission fees; however, it also gives traders access to low spreads.

With lots of research, zero minimum deposit, and demo trading account, Interactive Brokers has great options for beginner traders. However, it is more geared towards institutional or professional traders because of its monthly fees.

Interactive Brokers Best Features:

-

Research tools

-

Competitive commissions

-

Low spreads

Fidelity FX – Best Choice for Exotic Currency Pairs

Fidelity FX started in 1946. They offer 190 currency pairs but only 16 online. To access the forex pairs that you won’t get at other brokers, you’ll need to call up a Fidelity broker.

The platform places a big emphasis on education. As such, it provides great materials to help traders constantly learn. The trading tools they offer are pretty sophisticated too. Low trading fees and no minimum deposit are two other attractive features.

Fidelity FX Best Features:

-

Excellent research and education

-

Quick trade execution

-

Wide range of products

IG – Best Choice of Forex Options

IG began operating in 1974 and is considered one of the best platforms around. With more than 100 Forex pairs available and excellent web and mobile platforms, IG is a great choice for forex traders.

Because it’s a huge platform, IG can offer traders very competitive pricing. Forex direct accounts have active trader pricing, which is a big plus. IG accounts require minimum deposits of $350. Excellent research and education tools are other great features.

IG Best Features:

-

Excellent charts and research

-

Great education tools

-

Web-based, desktop & mobile app options

Saxo Bank – Most Trusted FX Options brokers in Europe

Formed in 1992, Saxo Bank is a deeply respected European broker. They offer over 180 Forex pairs that can be traded as CFDs and spot contracts. Saxo Bank is commission-free and makes its money from the spreads. Fortunately, these spreads are very competitive.

Saxo Bank’s trading software is top of the line and very easy to use. Finally, they offer very comprehensive research capabilities and good educational materials.

Saxo Bank requires an account minimum of $2000.

SaxoBank Best Features:

-

Low-fees

-

Commission-free

-

Superb web & desktop software

CMC Markets – Best For Low Spreads

CMC was founded in 1989. It has earned an excellent reputation for its phenomenal research tools and stable trusted platform. It offers almost 160 Forex pairs, as either CFDs or spot contracts. The spreads are lower than most (around 0.7 pips on EUR/USD). Additionally, the platform itself is very impressive and user-friendly.

CMC Markets Best Features:

-

First-class research tools

-

Minimum deposit $0

-

Demo account

TD Ameritrade FX – Best for Currency ETFs and Exchange-Traded Forex Futures

TD Ameritrade was formed in 1975. It has an excellent reputation as a trusted broker. It offers over 70 different forex pairs. TD Ameritrade is commission-free, but the spreads are slightly higher than other brokers on this list.

Ameritrade’s web and desktop platform, Thinkorswim, will take beginners a little time to get the hang of. However, it’s worth the time investment for its excellent charting and other advanced features.

TD Ameritrade Best Features:

-

Currency ETFs

-

Outstanding trading platform

-

No minimum deposit

Pocket Option – Best for Forex Binary Options

Formed in 2017, Pocket Option is a newer broker on the block. They offer almost 30 forex pairs on their web and smartphone platform.

Good customer support, demo accounts, and a minimum deposit of $50 make this platform a good option for newer traders. Pocket Option has zero commission or fees and fast deposits.

Pocket Option Best Features:

-

Zero fees and commissions

-

Supports several languages

-

Demo account

-

Includes tips and strategies

How Do Forex Options Work?

Forex options are contracts that give buyers the right — but not the obligation — to buy or sell currencies at a defined exchange rate on or before an agreed date. Buyers pay a premium for this right.

This process allows users to lock in a price on, for example, a currency they believe will rise in price. If the buyer’s market hypothesis is true, they can make money by buying the currency at the lower rate they locked in, even though it is now priced higher.

What are Forex Put and Call Options?

A put option gives the buyer the right to sell a specific currency.

A call option gives the buyer the right to buy a specific currency.

Basic Options Trading Terms

There are many terms associated with forex trading, some that you need to be familiar with to understand the concept. Some that you may hear a lot are terms such as 'put,' 'call,' and 'strike.' To make things easier, we've defined some of these key terms below for you:

Call = Call options give the holder the right to buy an asset at a specific price known as the strike price.

Put = Put options give the holder the right to sell an asset. This gives the holder the right to sell the shares at a specific price by a certain date.

Strike = A strike price is a price that a holder of an options contract can buy or sell a currency if they exercise their option contract. Strike prices are only valid until the contract’s expiration date.

FX Options for Beginners. Should I Trade?Different Types of FX Options

There are many different broker options out there, and it's essential to know which is right for you. Let's go through the different types of instruments available:

Over-the-counter: Over-the-counter trades (OTC) allow traders to trade without taking delivery of any asset. One of the more significant benefits is that Forex traders will have more options. They can choose prices and expiration dates which suit their profit strategy.

Exchange-traded options: An exchange-traded option is a standardized derivative contract to either buy or sell a set quantity of a specific financial product. They are also known as 'listed options' and provide many benefits that distinguish them from other options. These kinds of trade options attract and accommodate more significant numbers of traders.

MTF-listed options: A multilateral trading facility is a European term for a trading system that allows participants to gather and transfer various securities. These are often electronic systems. There are multiple advantages to MTF-listed trading, such as that the operators cannot pick and choose which trades to execute. Complete transparency in trades and pricing must be made available.

Basic FX Options Strategies

#1. Covered Call

With calls, a simple strategy is to buy a naked call option. This strategy is very popular, especially amongst beginners, because it generates income and reduces the risk of being long on the currency alone. The downside is that you must be willing to sell your shares at a set price.

To do this, you purchase the underlying asset, as normal, and simultaneously write a call option on those same shares. Investors may choose this strategy if they have a short-term position in the asset and a neutral opinion on its direction. It's possible they may be looking to generate income through the sale of the call premium.

Because the investor would receive a premium from selling the call, as the moves through its strike price, the premium they receive allows them to sell their asset at a higher level than the strike price.

#2. Married Put

Within a married put strategy, an investor would purchase an asset and simultaneously purchase put options for an equivalent number of shares. The holder of this put option has the right to sell asset at its strike price.

An investor would choose this strategy as a way of protecting their downside risk when holding an asset. This strategy is reminiscent of an insurance policy. It establishes a price floor in case the assets price falls sharply.

#3. Bull Call Spread

In this strategy, an inventory simultaneously buys calls at a specific strike price while simultaneously selling the same number of calls but at a higher strike price. Both options will have the same expiration date and asset.

This type of vertical spread strategy is used when investors are bullish on the underlying asset and expect a moderate rise in the asset price. This strategy is beneficial as investors can limit their upside on the trade while also reducing the net premium spent.

5 tips to Trade Currency Options

Set aside funds: Assess how much capital you're willing to spend on each trade. Most successful traders risk less than 1-2% of their accounts per trade.

Start small: If you're a beginner, we suggest focusing on a maxim of one to two assets during a session.

Avoid penny stocks: Stay away from penny stocks as they are often illiquid, and chances of succeeding are often slim.

Be realistic about profits: You don't need to win every time to be profitable. Most traders only win 50-60% of their trades.

Stick to your plan: follow your formula closely instead of chasing profits. Don't let your emotions get the better of you.

Are Forex Options Trading Legit?

The forex market is a legitimate trading market where the world's currencies are traded. It is not a scam. Without the forex market, it would be challenging to trade currencies needed to buy imports, sell exports and go on holiday!

Generally speaking, forex options trading is legal. However, some countries have restrictions on trade. In the following countries, options trading is unavailable:

-

1

Australia

-

2

Switzerland

-

3

Czech Republic

-

4

USA

-

5

Belgium

-

6

Canada

-

7

Iran

-

8

Israel

-

9

Japan

-

10

Latvia

-

11

North Korea

-

12

Pakistan

-

13

Palestine

-

14

Russia

-

15

Sudan

-

16

Syria

-

17

Turkey

When trying to sign up to forex trading organizations from any of the above countries, you may be met with the message, "X company does not accept traders from this country."

What are Forex Options Risks?

When it comes to assessing the risks associated with Forex Trading, it's essential to look at it compared to stock trading. Both stocks and Forex tend to move much faster than other assets, with their values constantly changing over many hours. However, the forex market is far more volatile than the stock market. Profits can come easily to an experienced and focused trader.

Forex trading comes with much higher leverage, and traders tend to focus less on risk management. This means that investments become riskier and potentially come with adverse effects.

Some common risks with forex options trading include:

-

Exchange rate risk

-

Interest rate risk

-

Credit risk

-

Country risk

-

Marginal or leverage risk

Any decision to trade stocks or Forex should be based on risk tolerance, account size, and convenience.

Should I Trade FX Options?

Although forex trading has its risks, it also reaps many attractive benefits which should be weighed up when considering if you should trade:

It's a large and global market

Forex trading's size and scale is possibly the most attractive benefit it has. To put its sheer size into perspective, $4 trillion is exchanged on average per day. Traders worldwide buy and sell currency at all hours, making Forex the marketplace with the most scope for profitability.

It's perfect for beginners

As mentioned previously, accessibility is one of the most considerable advantages. It is relatively easy to enter and does not require a large initial investment compared to other markets. However, it's important to remember that any kind of training involves some level of knowledge and skill.

You can trade 24 hours a day

Forex trading takes place OTC, meaning transactions are made directly between parties. Because of this, it is not restricted by any opening hours. Deals can take place anytime, anywhere.

Low transaction costs

Alongside having little capital for entry, the transaction costs are typically relatively low once a trader is in. Usually, brokers make money from spreads measured in pips and factored into the price of a currency pair.

High liquidity

Liquidity refers to how easily an asset can be bought or sold without affecting its value. With forex trading, you can easily exchange your assets with slight variance to their value.

How Do Forex Options Differ Across Brokers?

Forex options are vital tools for investors who want to hedge or speculate on the currency markets. While the fundamental principles of forex options remain consistent, the specific offerings can vary greatly across different brokers. Here's how:

Execution Policies

Execution policies govern how options are filled and executed once a trade is placed. These policies can vary significantly between brokers in terms of the following:

Speed of Execution: Some brokers offer faster execution of trades, which can be crucial when dealing with fluctuating currency prices.

Order Types: Brokers may provide various order types, such as market, limit, or stop orders, each with unique characteristics and purposes.

Slippage Protection: Some brokers offer protection against slippage, ensuring that the trade is executed at the desired price or better.

Fees and Commissions: The charges related to trading can vary, impacting the overall cost of executing an options trade.

Type of Option Styles and Products

Brokers may offer various types of forex options, styles and products, such as:

European Options: These can only be exercised at expiration.

American Options: These can be exercised at any time before expiration.

Exotic Options: Some brokers may offer complex and tailored options like Barrier, Asian, or Binary options.

Platforms and Tools: The tools and platforms provided to analyze, trade, and manage options could differ, affecting the trading experience.

Trading Symbols for the Same Underlying Currency

Different brokers might use various trading symbols for the same underlying currency pairs. This can lead to confusion, especially for traders who operate across multiple platforms. Understanding the specific symbols used by a broker is essential to ensuring accurate trading.

Contract Sizes and Specifications

Contract sizes and specifications can also differ among brokers, and this includes:

Contract Sizes: Some brokers offer micro, mini, and standard lots, while others may have their unique sizes.

Leverage: The leverage provided can significantly differ, affecting both the potential profits and risks.

Expiration Dates: Some brokers may offer more flexibility in choosing the expiration dates for options.

Regulatory Compliance: Different jurisdictions may impose specific rules and regulations on contract specifications, influencing the offerings across brokers.

What time is best to trade forex options?

The forex market operates 24 hours a day during weekdays, reflecting the normal business hours of four different parts of the world and their respective time zones.

The Four Major Forex Trading Sessions:

Sydney Session: Opens at 5:00 PM EST and closes at 2:00 AM EST.

Tokyo Session: Opens at 7:00 PM EST and closes at 4:00 AM EST.

London Session: Opens at 3:00 AM EST and closes at 12:00 PM EST.

New York Session: Opens at 8:00 AM EST and closes at 5:00 PM EST.

Best Time to Trade Forex Options: U.S./London Markets Overlap

The U.S. and London markets overlap between 8:00 AM and 12:00 PM EST, and this period is widely considered the best time to trade forex options for several reasons. Overlapping hours between the U.S. and London sessions see the highest trading volumes, as it brings together two of the largest financial markets in the world. With more traders active, the market also becomes more liquid, allowing for tighter spreads and quicker execution of orders.

Our Methodology

The Traders Union Team knows how important it is for traders to make the right choice of broker. Luckily for you, we have compiled a rating of brokers based on various elements such as user experience, reviews, costs, research features, and platform testing.

Experts at the Traders Union regularly analyze existing brokers and evaluate their activities against more than 120 unique evaluation criteria and methodologies. Our comprehensive and objective way of comparison makes it possible to bring you the most objective rating list of brokers' offerings.

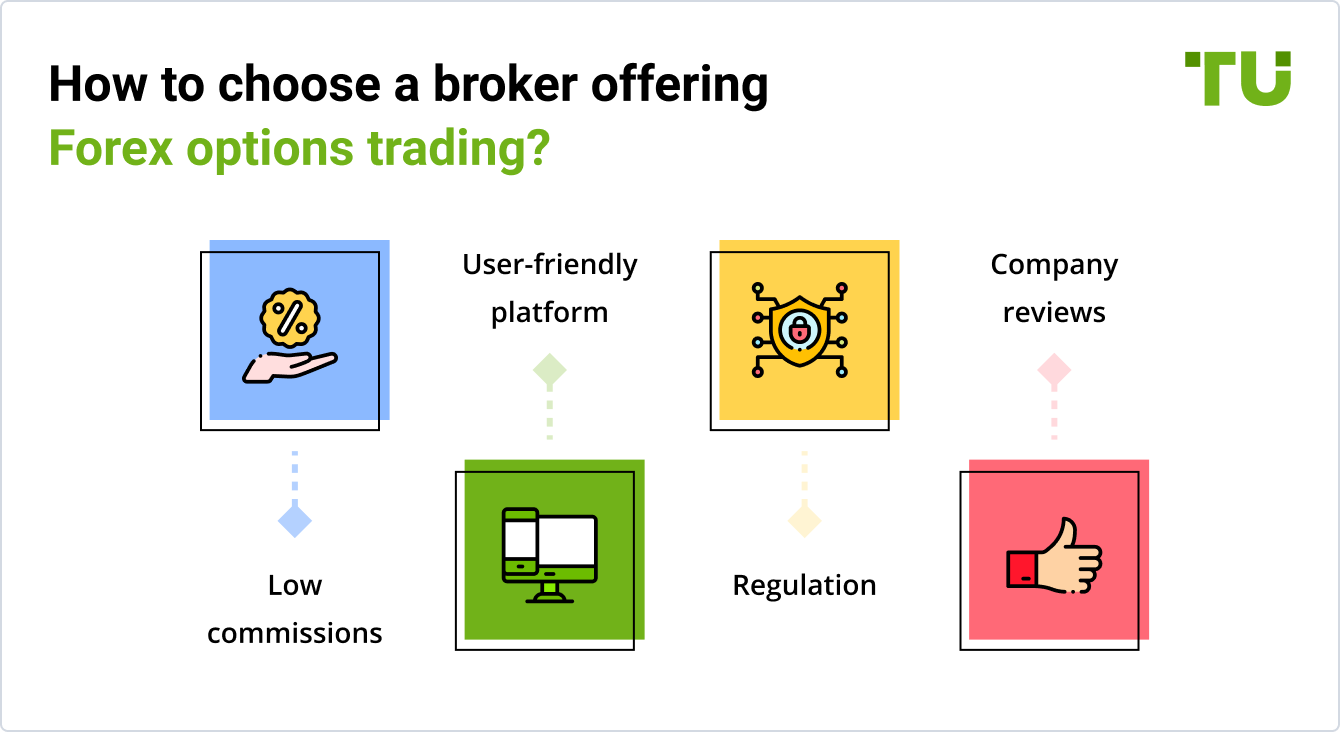

To choose the best broker, we focus on the following criteria:

Age of the broker

Companies founded 1-2 years ago are not reliable because they lack experience dealing with a crisis.

Regulation

A broker can operate without a license, but it is not best practice, and we do not recommend you choose such a broker.

Trading conditions

Each broker has its own trading and non-trading commissions. An analysis of these conditions determines whether it is right for you.

Customer service

The best brokers will carefully monitor their technical support. It's not best practice to choose a broker with non-responsive or incompetent customer service.

Customer reviews

As with any company, customer reviews are vital. It is essential only to consider reviews from independent sites such as Traders Union, as other reviews cannot be deemed trustworthy

Position in the Traders Union rating

By considering a broker's position in the Traders Union rating, you ensure you are considering the best brokers according to the above parameters. We commit to providing you with the most objective and comprehensive ratings of brokers.

Summary

To conclude, this post covers everything you need to know about forex options trading as a beginner, including the best brokers to opt for this year. There are many different types of FX options, including over-the-counter (OTC), exchange-traded options, and MTF-listed options, alongside various brokers you can use.

It's essential to understand the risks and benefits of forex options and carefully assess them in line with your current situation. Our top trading tips will help you prepare and set you up for great success when choosing the right broker.

Team that worked on the article

Andrey Mastykin is an experienced author, editor, and content strategist who has been with Traders Union since 2020. As an editor, he is meticulous about fact-checking and ensuring the accuracy of all information published on the Traders Union platform. Andrey focuses on educating readers about the potential rewards and risks involved in trading financial markets.

He firmly believes that passive investing is a more suitable strategy for most individuals. Andrey's conservative approach and focus on risk management resonate with many readers, making him a trusted source of financial information.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

The topics he covers include trading signals, cryptocurrencies, Forex brokers, stock brokers, expert advisors, binary options. He has also worked on the ratings of brokers and many other materials.

Dr. BJ Johnson’s motto: It always seems impossible until it’s done. You can do it.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO). Mirjan is a cryptocurrency and stock trader. This deep understanding of the finance sector allows her to create informative and engaging content that helps readers easily navigate the complexities of the crypto world.