According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $200

- PAŞA Kapital

Our Evaluation of PAŞA Kapital

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

PAŞA Kapital is a moderate-risk broker with the TU Overall Score of 5.4 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by PAŞA Kapital clients on our website, Traders Union expert Anton Kharitonov recommends users to thoroughly analyze pros and cons before opening an account with this broker as not all clients are satisfied with the company, according to reviews.

PAŞA Kapital is considered a leader in the Azerbaijan market of brokerage services. It provides good trading conditions with tight spreads, low fees, a wide range of financial instruments, and moderate leverage. Also, its advantage is a demo account available for 90 days and a low minimum deposit for one of the live account types. Only one trading platform is available and its reviews on the net are rather controversial. Its significant disadvantage is that traders outside Azerbaijan are unlikely to be comfortable working with this broker.

Brief Look at PAŞA Kapital

PAŞA Kapital’s clients can trade CFDs on currency pairs, stocks, indices, metals, commodities, energies, and ETFs. In total, there are over 200 assets. The broker offers two live account types — Classic and Personal — that differ in minimum deposits and fees. Spreads start at 0.2 pips and leverage is up to 1:50. Also, the broker offers a proprietary trading platform with an average execution speed of 0.15 seconds. Technical support is available 24/5 by phone, email, and live chat. The only additional income option is a standard partnership program.

We've identified your country as

US

We have thoroughly analyzed all companies legally providing trading services in your country and created a ranking of the best ones. Our analysis highlights companies that offer optimal working conditions, uphold a strong reputation, and consistently receive the highest number of positive reviews from traders on our website.

Explore the 5 top-rated companies in

US :

- Free demo account;

- Minimum deposit for the Classic account is $200;

- Low compatible spreads and reasonable trading fees;

- Eight types of CFDs on several popular assets, and their list can be increased upon traders’ request;

- No restrictions on methods and strategies — scalping, hedging, trading on news events, and expert advisors are allowed;

- Flexible leverage that ranges from 1:2 to 1:50;

- Full transparency — transaction fees are always known in advance;

- Consulting and research services for efficient investment portfolio management.

- No educational materials or analytical tools on the website;

- No copy trading or PAMM or MAM accounts;

- Deposits and withdrawals are made only by bank transfers.

TU Expert Advice

Author, Financial Expert at Traders Union

PAŞA Kapital offers a diverse range of trading instruments, including CFDs on currency pairs, stocks, indices, metals, commodities, energies, and ETFs, all facilitated through its proprietary trading platform. The broker provides two live account types and supports a demo account. Key advantages include tight spreads starting at 0.2 pips, leverage up to 1:50, and no fees for deposits and withdrawals. Trading conditions are further enhanced by flexible strategies, including scalping and hedging, and the availability of consulting and research services.

However, PAŞA Kapital has some drawbacks, such as the absence of widely known MT4 or MT5, limited deposit and withdrawal methods restricted to bank transfers, and the lack of extensive educational resources and advanced analytical tools. These aspects may not appeal to traders outside Azerbaijan or those seeking more globally recognized platforms and versatility in payment methods. Overall, PAŞA Kapital presents viable options for local traders in Azerbaijan but may not be as suitable for those prioritizing advanced features and international reach.

PAŞA Kapital Trading Conditions

Your capital is at risk. 79.43% of retail investor accounts lose money when trading CFDs with this provider. PAŞA Kapital and its affiliates do not target EU/EEA/UK clients. It is the user's responsibility to ensure that any use of the website or services adhere to local laws or regulations. Please be aware that you are able to receive investment services at your own exclusive initiative only, ensuring you fully understand all the risks involved.

| 💻 Trading platform: | PAŞA Kapital |

|---|---|

| 📊 Accounts: | Demo, Classic, and Personal |

| 💰 Account currency: | USD |

| 💵 Deposit / Withdrawal: | Bank transfer |

| 🚀 Minimum deposit: | $200 |

| ⚖️ Leverage: | Up to 1:50 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.01 |

| 💱 EUR/USD spread: | 0,1 pips |

| 🔧 Instruments: | CFDs on currency pairs, stocks, indices, metals, commodities, cryptocurrencies, energies, and ETFs |

| 💹 Margin Call / Stop Out: | 100%/50% |

| 🏛 Liquidity provider: | Yes |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Order execution: | Market |

| ⭐ Trading features: |

Free demo account; Two live account types; Low initial threshold for the Classic account;vVaried assets; Floating tight spreads; Additional fees are market average; Reasonable leverage; No deposit/withdrawal fees. |

| 🎁 Contests and bonuses: | Rebates from Traders Union |

Account types available with PAŞA Kapital differ in their conditions and the broker sets different minimum deposits for them. The Classic account requires a minimum deposit of $200, which is acceptable. The minimum deposit for the Personal account is $10,000, which is quite significant. Leverage is the same for both account types; it ranges from 1:2 to 1:50. Users can set any leverage or trade without it. Technical support is available 24/5 by phone, email, or live chat on the broker’s website.

PAŞA Kapital Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

Trading Account Opening

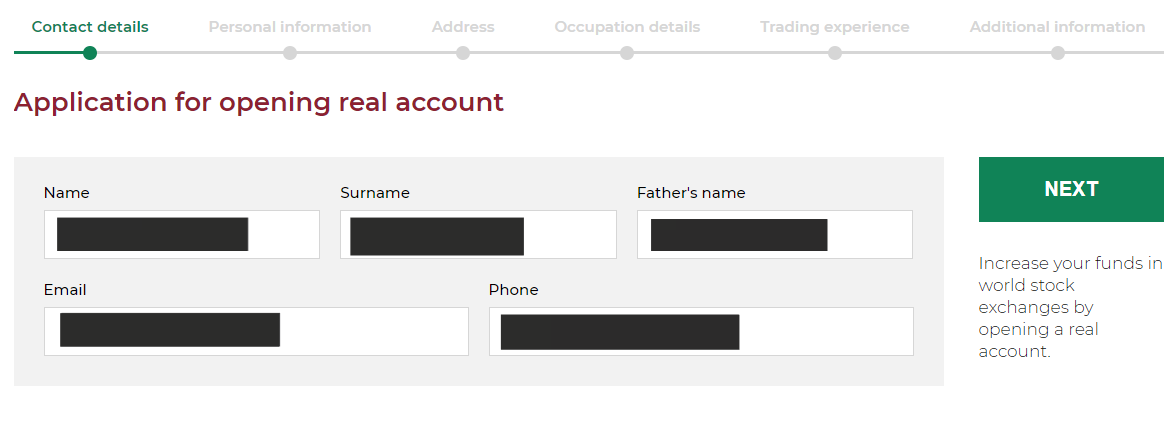

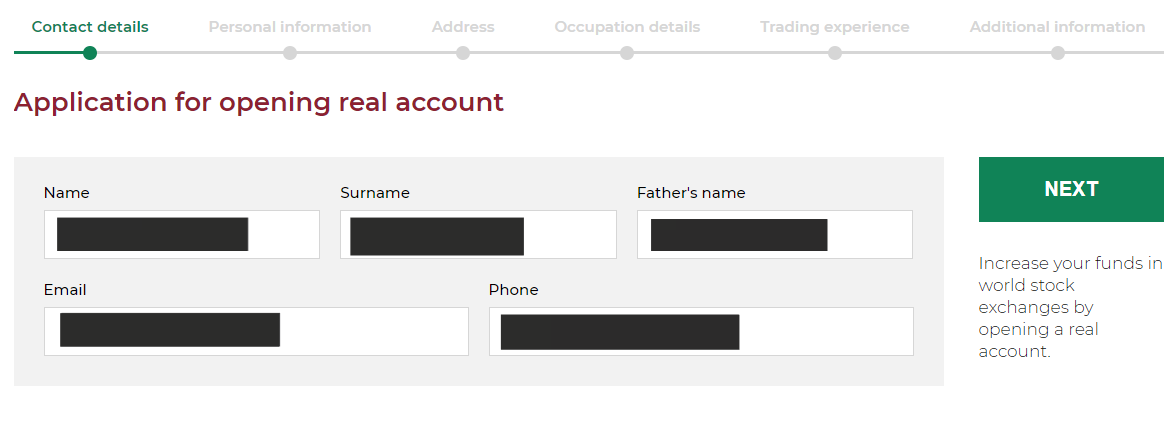

The registration process is standard and is simple even for novice traders.

Go to the broker’s website, choose the language in the right top corner, and click the “Open Real Account” button.

Start the registration process, which includes 6 steps. Upon completion, pass verification, open a Classic or Personal account, and make a deposit. Download the trading platform and start trading.

Regulation and safety

PAŞA Kapital has a safety score of 5.8/10, which corresponds to a Medium security level. The safest brokers are those with Tier-1 regulation, a long history (over 10 years in the market), and participation in investor compensation schemes.

- Is regulated

- Not tier-1 regulated

PAŞA Kapital Regulators and Investor Protection

| Abbreviation | Full Name | Country of regulation | Investor Protection Fund | Regulation Level |

|---|---|---|---|---|

| CBAR (Azerbaijan) | Central Bank of the Republic of Azerbaijan | Azerbaijan | AZN 30,000 | Tier-2 |

PAŞA Kapital Security Factors

| Foundation date | - |

| Negative balance protection | No |

| Verification (KYC) | Yes |

Commissions and fees

The trading and non-trading commissions of broker PAŞA Kapital have been analyzed and rated as Medium with a fees score of 7/10. Additionally, these commissions were compared with those of the top two competitors, Pepperstone and OANDA, to provide the most comprehensive information.

- Tight EUR/USD market spread

- No inactivity fee

- No deposit fee

- No withdrawal fee

- Above-average Forex trading fees

Trading Fees and Spread

Below, we evaluated and compared the trading commissions of PAŞA Kapital with those of two competitors. We focused on the spreads and other transaction fees directly associated with executing trades (e.g commission per lot on an ECN account). This comparison aimed to provide a clear understanding of the cost efficiency of each broker.

Standard Account Spread

For Standard accounts, PAŞA Kapital’s commissions are part of the floating spread, which varies with market conditions. Typical values are provided, but during high volatility, the spread may exceed these.

PAŞA Kapital Standard spreads

| PAŞA Kapital | Pepperstone | OANDA | |

| EUR/USD min, pips | 1,2 | 0,5 | 0,1 |

| EUR/USD max, pips | 1,6 | 1,5 | 0,5 |

| GPB/USD min, pips | 1,6 | 0,4 | 0,1 |

| GPB/USD max, pips | 2,1 | 1,4 | 0,5 |

RAW/ECN Account Commission And Spread

The spread on ECN/RAW accounts is market-based and fluctuates, with average values given during active hours. It may vary during volatility spikes. A commission per lot is also charged.

PAŞA Kapital RAW/ECN spreads

| PAŞA Kapital | Pepperstone | OANDA | |

| Commission ($ per lot) | 4,00 | 3 | 3,5 |

| EUR/USD avg spread | 0,1 | 0,1 | 0,15 |

| GBP/USD avg spread | 0,20 | 0,15 | 0,2 |

Non-Trading Fees

We conducted a detailed analysis of the non-trading fees associated with PAŞA Kapital. This review offers a comprehensive overview of the additional costs that may impact traders beyond regular trading activities.

PAŞA Kapital Non-Trading Fees

| PAŞA Kapital | Pepperstone | OANDA | |

| Deposit fee, % | 0 | 0 | 0 |

| Withdrawal fee, % | 0 | 0 | 0 |

| Withdrawal fee, USD | 0 | 0 | 0-15 |

| Inactivity fee ($, per month) | 0 | 0 | 0 |

Account types

The main task when starting trading is to choose the right account type. This is relevant if there are several options. What account type to choose with PAŞA Kapital? The Classic account is suitable for novice or experienced traders with small capital. The minimum initial deposit is $200 and trading conditions are profitable. If traders have $10,000 or more and sufficient trading experience, they can try the Personal account. Fees of $4 per lot are more profitable and there are additional benefits. The broker offers only its proprietary platform for PCs and mobile devices running on different operating systems. Other solutions cannot be integrated. Traders have to decide on leverage, and 1:10 is enough for non-aggressive trading, while leverage up to 1:50 can be used for more aggressive strategies.

Account types:

As a rule, traders open demo accounts first to explore the broker and test new strategies without financial risks. Then, if they like everything, they register live accounts according to their available funds and trading priorities.

Deposit and withdrawal

PAŞA Kapital received a Low score for the efficiency and convenience of its deposit and withdrawal processes.

PAŞA Kapital offers limited payment options and accessibility, which may impact its competitiveness.

- Bank wire transfers available

- No deposit fee

- No withdrawal fee

- Low minimum withdrawal requirement

- Limited deposit and withdrawal flexibility, leading to higher costs

- Wise not supported

- Only major base currencies available

What are PAŞA Kapital deposit and withdrawal options?

PAŞA Kapital offers a limited selection of deposit and withdrawal methods, including Bank Wire. This limitation may restrict flexibility for users, making PAŞA Kapital less competitive for those seeking diverse payment options.

PAŞA Kapital Deposit and Withdrawal Methods vs Competitors

| PAŞA Kapital | Plus500 | Pepperstone | |

| Bank Wire | Yes | Yes | Yes |

| Bank card | No | Yes | Yes |

| PayPal | No | Yes | Yes |

| Wise | No | No | No |

| BTC | No | No | No |

What are PAŞA Kapital base account currencies?

A wide range of base account currencies minimizes the need for currency conversion, potentially reducing transaction costs for clients worldwide. PAŞA Kapital supports the following base account currencies:

What are PAŞA Kapital's minimum deposit and withdrawal amounts?

The minimum deposit on PAŞA Kapital is $200, while the minimum withdrawal amount is $1. These minimums may vary depending on the chosen account type and payment method. For specific details, please contact PAŞA Kapital’s support team.

Markets and tradable assets

PAŞA Kapital offers a limited selection of trading assets compared to the market average. The platform supports 200 assets in total, including 200 Forex pairs.

- ETFs investing

- 200 supported currency pairs

- Copy trading platform

- Limited asset selection

- Futures not available

Supported markets vs top competitors

We have compared the range of assets and markets supported by PAŞA Kapital with its competitors, making it easier for you to find the perfect fit.

| PAŞA Kapital | Plus500 | Pepperstone | |

| Currency pairs | 200 | 60 | 90 |

| Total tradable assets | 200 | 2800 | 1200 |

| Stocks | Yes | Yes | Yes |

| Commodity futures | Yes | Yes | Yes |

| Crypto | Yes | Yes | Yes |

| Stock indices | Yes | Yes | Yes |

| Options | No | Yes | No |

Investment options

We also explored the trading assets and products PAŞA Kapital offers for beginner traders and investors who prefer not to engage in active trading.

| PAŞA Kapital | Plus500 | Pepperstone | |

| Bonds | No | No | No |

| ETFs | Yes | Yes | Yes |

| Copy trading | Yes | No | Yes |

| PAMM investing | No | No | Yes |

| Managed accounts | No | No | No |

Customer support

Traders may have various questions that require prompt responses from the broker’s specialists. Otherwise, under fierce competition, traders prefer a more responsive competitor. Active clients when receiving unclear responses may leave for another broker. PAŞA Kapital provides high-quality technical support. Managers are available 24/5 by phone, email, and live chat on the website.

Advantages

- Three main communication channels

- Client service is available round the clock on weekdays

- Support is highly competent

Disadvantages

- Technical support doesn’t work on weekends

Whether you are the broker’s client or just intend to become one, you can address technical support in any doubtful situation.

Available communication channels are:

-

Telephone;

-

Email;

-

Live chat on the website and in the user account.

The broker has profiles on Facebook, Instagram, and LinkedIn, which are also available for contacting support.

Contacts

| Registration address | Caspian Plaza, Jafar Jabbarli Street, 44, Baku AZ1065, Azerbaijan |

|---|---|

| Official site | https://www.pashacapital.az/ |

| Contacts |

+994 12 493 46 46, +994 55 226 33 66

|

Education

Not only experienced traders work with brokers. Users with minimum trading experience or without it also come to trade. That is why some companies provide educational materials like articles, guides, or podcasts on their websites. Sometimes, brokers hold webinars. PAŞA Kapital doesn’t offer any education, since it focuses on providing high-quality trading services.

Novice traders have to look for information on third-party resources, which are many. A demo account helps to test acquired knowledge via practice and to improve trading skills.

Comparison of PAŞA Kapital with other Brokers

| PAŞA Kapital | Eightcap | XM Group | RoboForex | Bybit | FBS | |

| Trading platform |

PAŞA Kapital | MT4, MT5, TradingView | MT4, MT5, MobileTrading, XM App | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | MetaTrader5 | MT4, MobileTrading, MT5, FBS app |

| Min deposit | $200 | $100 | $5 | $10 | No | $5 |

| Leverage |

From 1:1 to 1:50 |

From 1:30 to 1:500 |

From 1:1 to 1:30 |

From 1:1 to 1:2000 |

From 1:1 to 1:500 |

From 1:1 to 1:3000 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | 10.00% | No | No |

| Spread | From 0.2 points | From 0 points | From 0.8 points | From 0 points | From 0 points | From 1 point |

| Level of margin call / stop out |

100% / 50% | 80% / 50% | 100% / 50% | 60% / 40% | No / 50% | 40% / 20% |

| Order Execution | Market Execution | Market Execution | Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | No | No | Yes | No | No |

Detailed review of PAŞA Kapital

PAŞA Kapital has been developing for 12 years. It partners with reputable liquidity providers and uses VPS. Order execution of 15 ms shows the high optimization level for all processes. Authentication tokens and SSL encryption protocols ensure reliable anti-scam protection. Client funds are held in segregated accounts with major banks in Azerbaijan. The company’s activities are completely transparent, and there are no hidden nuances.

PAŞA Kapital by the numbers:

-

Minimum deposit is $200;

-

Maximum leverage is 1:50

-

200+ financial instruments;

-

Minimum spread is 0.2 pips;

-

Trading fee is from $4 per lot.

PAŞA Kapital is a broker with comfortable trading conditions for all traders

The broker offers eight asset groups: CFDs on currency pairs, stocks, indices, metals, commodities, cryptocurrencies, energies, and ETFs. In total, there are over 200 instruments available to trade. Due to such variety, traders can build diverse investment portfolios, thus decreasing market risks. They can start trading on the Classic account with only $200. Orders from 0.01 to 50 lots and leverage up to 1:50 allow traders to use different strategies. PAŞA Kapital, on its part, allows its clients to scalp, hedge, trade on news events, and use expert advisors.

Useful services offered by PAŞA Kapital:

-

Intermediary services. They are provided for additional fees within the development of the investment direction. The broker’s professionals buy real stocks and bonds on the Baku Stock Exchange and the over-the-counter market. Also, they buy securities of foreign companies upon request.

-

Consulting and research services. Traders can request support from experts when building or amending their trading portfolios. The broker’s team analyzes the situation, finds main trends in assets interesting to traders, and gives competent recommendations.

-

Partnership program. It is quite profitable. Partners receive up to 35% of the income received by the broker from referrals. PAŞA Kapital allows its partners to distribute its marketing materials on their websites, blogs, forums, etc.

Advantages:

Low initial threshold due to availability of a demo account and a $200 minimum deposit;

Optimal trading conditions: low fees, many various assets, and moderate flexible leverage;

No hidden pitfalls or additional fees;

Highly competent technical support with high response speed at broad working hours;

The broker is reputable and is a part of the largest holding company in Azerbaijan.

Articles that may help you

Check out our reviews of other companies as well

User Satisfaction i