According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- EUR 5,000

- OptionTrade

- TWS Trader

- AgenaTrade

- BasketTrader

- FXTrader

Our Evaluation of RIDE

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

RIDE is a moderate-risk broker with the TU Overall Score of 5.11 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by RIDE clients on our website, Traders Union expert Anton Kharitonov recommends users to thoroughly analyze pros and cons before opening an account with this broker as not all clients are satisfied with the company, according to reviews.

Due to its unique products and advanced approach to optimizing trading expenses, RIDE's services will be more appealing to experienced traders and investors with substantial portfolios.

Brief Look at RIDE

The RIDE company was established in 2019 to legally optimize taxes for individuals trading in financial markets. It specializes in the creation and management of GmbH (Gesellschaft mit beschränkter Haftung or limited liability company) for private traders and investment firms. Among its related services is brokerage on securities markets, Forex, and CFDs. Interactive Brokers LLC serves as the executing broker for RIDE, while FXFlat Bank, regulated by the Federal Financial Supervisory Authority of Germany (BaFin), serves its clients. RIDE clients can trade more than 1,200,000 financial instruments on stock exchanges worldwide and over-the-counter platforms provided by partner brokerage companies.

We've identified your country as

US

We have thoroughly analyzed all companies legally providing trading services in your country and created a ranking of the best ones. Our analysis highlights companies that offer optimal working conditions, uphold a strong reputation, and consistently receive the highest number of positive reviews from traders on our website.

Explore the 5 top-rated companies in

US :

- Reliable trading and banking partners with licenses from international regulators;

- A unique concept of operation and fund management tools not available at other brokerage companies;

- Access to derivatives trading in the advanced Trader Workstation (TWS) platform;

- Average trading fees for Forex and CFDs;

- A vast selection of financial instruments (over 150 markets);

- Free account opening and no maintenance fees with minimal trading activity (from 1 trade per month);

- Negative balance protection on retail trader accounts.

- Only superficial training in securities and CFD trading, lack of basic Forex information;

- A minimum deposit of EUR 5,000 to start trading on the Trader Workstation (TWS) platform;

- Non-typical calculation of Forex trading fees uses a special formula rather than spreads.

TU Expert Advice

Financial expert and analyst at Traders Union

RIDE specializes in creating and servicing Vermögensverwaltende GmbH (or vvGmbH) — asset management companies for individuals and legal entities. RIDE employees can both establish a new GmbH according to the client's requests and financial capabilities and offer a ready-registered GmbH, which can be used within 2-3 weeks after the request through the company. Additionally, through RIDE's intermediation, traders can trade securities on major world exchanges, as well as engage in CFD and Forex transactions.

Clients receive order execution at the best price thanks to the IB SmartRouting algorithm integrated into the trading platform. They have access to over 100 types of trading orders, more than 20 preset indicators, graphical models, and 6 types of charts.

RIDE clients have access to over 1 million trading instruments in the EU and global markets. The fee for securities orders starts from EUR 0.9, and for Forex and CFDs, it starts from EUR 1.9. The company offers the opportunity to withdraw profits once a month for free and does not withhold fees for depositing funds. Traders interested in capital management with lower tax rates can join the RIDE's internal community and communicate with professionals in this field.

RIDE Trading Conditions

Your capital is at risk. 79.43% of retail investor accounts lose money when trading CFDs with this provider. RIDE and its affiliates do not target EU/EEA/UK clients. It is the user's responsibility to ensure that any use of the website or services adhere to local laws or regulations. Please be aware that you are able to receive investment services at your own exclusive initiative only, ensuring you fully understand all the risks involved.

| 💻 Trading platform: | Trader Workstation (TWS), AgenaTrader, OptionTrader, BasketTrader, FXTrader |

|---|---|

| 📊 Accounts: | Demo, Trader Workstation Account |

| 💰 Account currency: | EUR |

| 💵 Deposit / Withdrawal: | Bank transfer, SEPA |

| 🚀 Minimum deposit: | 5,000 EUR |

| ⚖️ Leverage: | Up to 1:30 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.01 |

| 💱 EUR/USD spread: | 0,05 pips |

| 🔧 Instruments: |

Forex, CFDs on currency pairs, stocks, and indices, Real stocks, futures, options, bonds, ETFs |

| 💹 Margin Call / Stop Out: | N/A |

| 🏛 Liquidity provider: | Major financial institutions and banks |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | No |

| 📋 Order execution: | Market |

| ⭐ Trading features: | Forex and CFD trading is conducted through Interactive Brokers |

| 🎁 Contests and bonuses: | No |

Trading in exchange instruments and Forex is carried out through partner brokers. RIDE clients have access to advanced electronic and mobile platforms, which allow them to work with orders online. However, in case of technical issues with the platform, a trader can open/close a position over the phone, with the cost of this service being EUR 30 per order. Telephone desk services are available from 11:00 PM on Sunday to 11:00 PM on Friday.

RIDE Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

Trading Account Opening

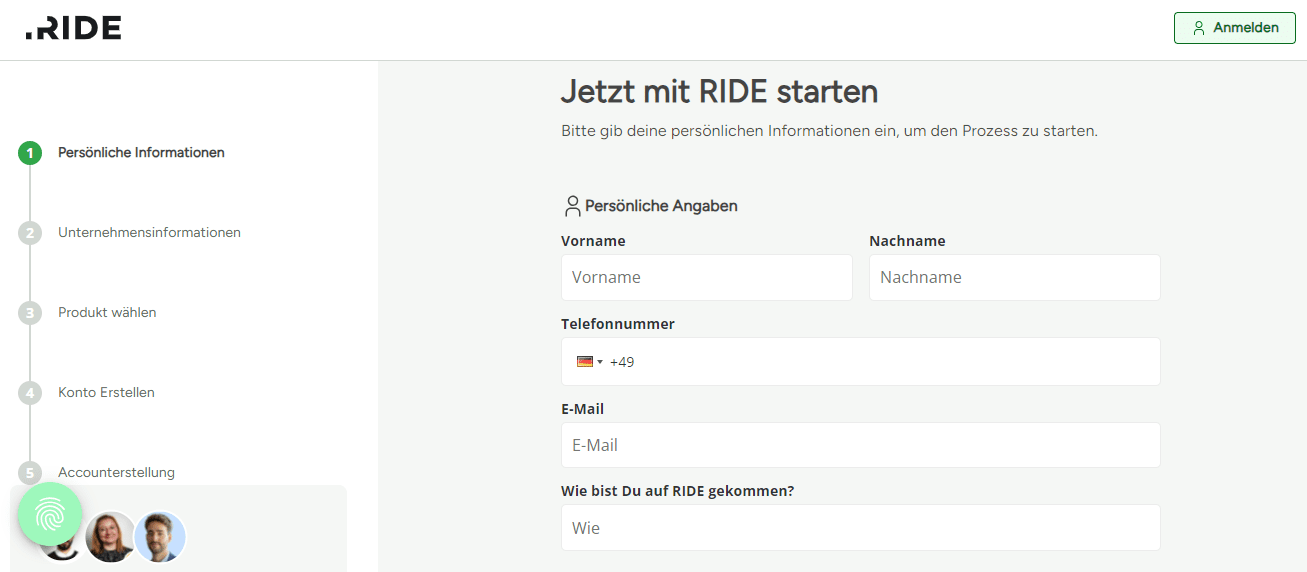

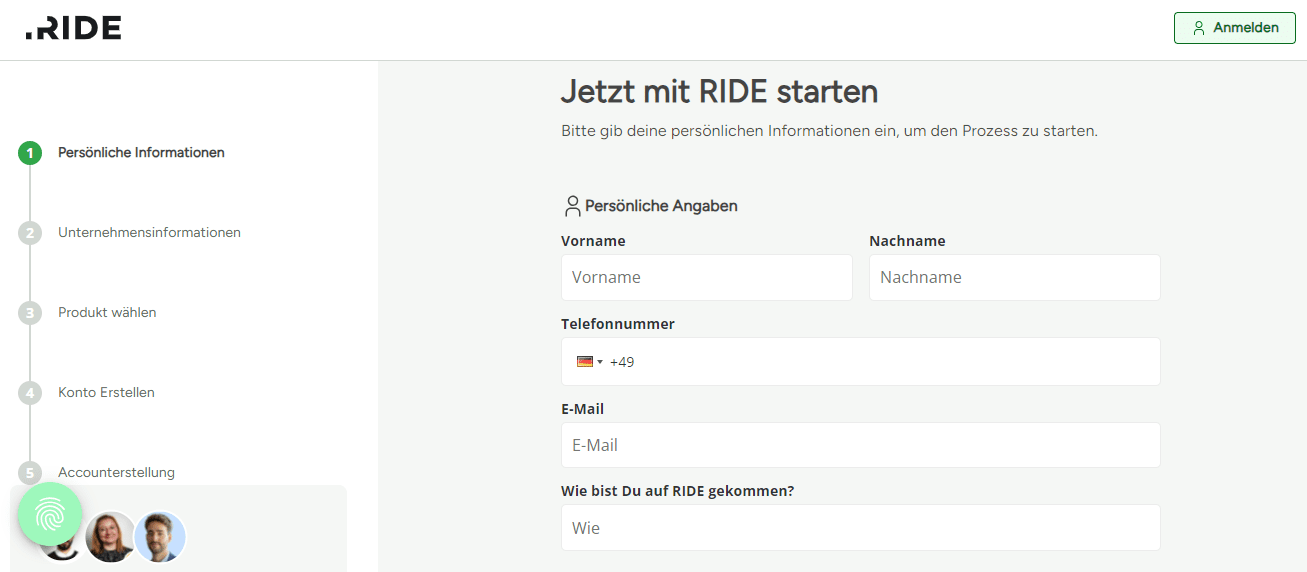

To become a client of the RIDE company, create an account on its website following the below procedure:

Fill out the registration form and provide your name, surname, phone number, and email.

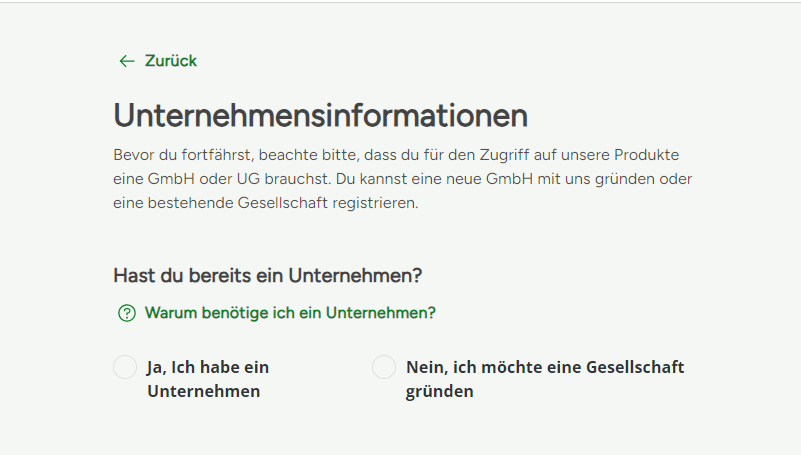

Answer the question about whether you have a registered GmbH or UG company.

Select the desired service.

After uploading identity verification documents, an account will be created. This will allow you to open a trading account. If you are a client of FXFlat Bank, you can open a trading account for financial instruments in the FXFlat Mobil mobile application.

Regulation and safety

RIDE has a safety score of 1.5/10, which corresponds to a Low security level. The safest brokers are those with Tier-1 regulation, a long history (over 10 years in the market), and participation in investor compensation schemes.

- Negative balance protection

- Not tier-1 regulated

RIDE Security Factors

| Foundation date | - |

| Negative balance protection | Yes |

| Verification (KYC) | Yes |

RIDE is Not a Regulated Broker

Commissions and fees

The trading and non-trading commissions of broker RIDE have been analyzed and rated as Medium with a fees score of 7/10. Additionally, these commissions were compared with those of the top two competitors, Pepperstone and OANDA, to provide the most comprehensive information.

- Tight EUR/USD market spread

- No inactivity fee

- No deposit fee

- No withdrawal fee

- Above-average Forex trading fees

Trading Fees and Spread

Below, we evaluated and compared the trading commissions of RIDE with those of two competitors. We focused on the spreads and other transaction fees directly associated with executing trades (e.g commission per lot on an ECN account). This comparison aimed to provide a clear understanding of the cost efficiency of each broker.

Standard Account Spread

For Standard accounts, RIDE’s commissions are part of the floating spread, which varies with market conditions. Typical values are provided, but during high volatility, the spread may exceed these.

RIDE Standard spreads

| RIDE | Pepperstone | OANDA | |

| EUR/USD min, pips | 0,5 | 0,5 | 0,1 |

| EUR/USD max, pips | 1,5 | 1,5 | 0,5 |

| GPB/USD min, pips | 0,5 | 0,4 | 0,1 |

| GPB/USD max, pips | 1,9 | 1,4 | 0,5 |

RAW/ECN Account Commission And Spread

The spread on ECN/RAW accounts is market-based and fluctuates, with average values given during active hours. It may vary during volatility spikes. A commission per lot is also charged.

RIDE RAW/ECN spreads

| RIDE | Pepperstone | OANDA | |

| Commission ($ per lot) | 3,00 | 3 | 3,5 |

| EUR/USD avg spread | 0,05 | 0,1 | 0,15 |

| GBP/USD avg spread | 0,10 | 0,15 | 0,2 |

Non-Trading Fees

We conducted a detailed analysis of the non-trading fees associated with RIDE. This review offers a comprehensive overview of the additional costs that may impact traders beyond regular trading activities.

RIDE Non-Trading Fees

| RIDE | Pepperstone | OANDA | |

| Deposit fee, % | 0 | 0 | 0 |

| Withdrawal fee, % | 0 | 0 | 0 |

| Withdrawal fee, USD | 0 | 0 | 0-15 |

| Inactivity fee ($, per month) | 0 | 0 | 0 |

Account types

RIDE offers different types of accounts from its partner brokers. Trading conditions depend on the exchange and pricing of the executing broker. Over-the-counter trading is carried out on accounts in the Trader Workstation (TWS) platform provided by the Interactive Brokers firm.

Account Types:

On the TWS platform, you can open a demo account for training or learning the basics of trading. It is funded with virtual funds, so the trader cannot lose their money, but the income will also be virtual.

In Forex and CFD trading, RIDE acts as an intermediary between traders and Interactive Brokers.

Deposit and withdrawal

RIDE received a Low score for the efficiency and convenience of its deposit and withdrawal processes.

RIDE offers limited payment options and accessibility, which may impact its competitiveness.

- No withdrawal fee

- No deposit fee

- Low minimum withdrawal requirement

- Bank wire transfers available

- BTC not available as a base account currency

- Limited deposit and withdrawal flexibility, leading to higher costs

- Minimum deposit above industry average

What are RIDE deposit and withdrawal options?

RIDE offers a limited selection of deposit and withdrawal methods, including Bank Wire. This limitation may restrict flexibility for users, making RIDE less competitive for those seeking diverse payment options.

RIDE Deposit and Withdrawal Methods vs Competitors

| RIDE | Plus500 | Pepperstone | |

| Bank Wire | Yes | Yes | Yes |

| Bank card | No | Yes | Yes |

| PayPal | No | Yes | Yes |

| Wise | No | No | No |

| BTC | No | No | No |

What are RIDE base account currencies?

A wide range of base account currencies minimizes the need for currency conversion, potentially reducing transaction costs for clients worldwide. RIDE supports the following base account currencies:

What are RIDE's minimum deposit and withdrawal amounts?

The minimum deposit on RIDE is $5000 EUR, while the minimum withdrawal amount is $1. These minimums may vary depending on the chosen account type and payment method. For specific details, please contact RIDE’s support team.

Markets and tradable assets

RIDE offers a wider selection of trading assets than the market average, with over 1200000 tradable assets available, including 27 currency pairs.

- Commodity futures are available

- Passive income with bonds

- 1200000 assets for trading

- Crypto trading not available

- Small selection of currency pairs

Supported markets vs top competitors

We have compared the range of assets and markets supported by RIDE with its competitors, making it easier for you to find the perfect fit.

| RIDE | Plus500 | Pepperstone | |

| Currency pairs | 27 | 60 | 90 |

| Total tradable assets | 1200000 | 2800 | 1200 |

| Stocks | Yes | Yes | Yes |

| Commodity futures | Yes | Yes | Yes |

| Crypto | No | Yes | Yes |

| Stock indices | Yes | Yes | Yes |

| Options | Yes | Yes | No |

Investment options

We also explored the trading assets and products RIDE offers for beginner traders and investors who prefer not to engage in active trading.

| RIDE | Plus500 | Pepperstone | |

| Bonds | Yes | No | No |

| ETFs | Yes | Yes | Yes |

| Copy trading | Yes | No | Yes |

| PAMM investing | No | No | Yes |

| Managed accounts | No | No | No |

Customer support

RIDE provides support online and over the phone. The calendar on the website allows you to schedule a callback during the working hours of the information department, from 10:00 to 19:30, Monday to Friday (GMT+1). Online chat support is available on weekdays from 9:00 to 18:00.

Advantages

- Service available in German and English

- Online chat on the website with immediate response from operators

Disadvantages

- Breaks in support service operation

- No support through messengers

To receive assistance or information from a RIDE representative, you can:

-

Telephone;

-

Email;

-

Chat online on the website.

To request a callback, choose a convenient date and time on the virtual calendar, specify the product or service of interest, and the duration of the phone session with a representative takes no more than 15 minutes.

Contacts

| Registration address | RIDE GmbH, Haus Watergate Falckensteinstraße 49, 10997 Berlin, Deutschland |

|---|---|

| Official site | https://www.ride.capital/ |

| Contacts |

Education

To find educational materials on the RIDE website, scroll down to its basement and navigate to the Broker section. There, you will find basic information on stocks and CFDs for beginners, although there are no education materials on Forex.

In the Warum RIDE section of the website, there are short videos that will be useful for both beginner traders and experienced market participants interested in the rules of GmbH. For active trading education, a demo account can be used.

Comparison of RIDE with other Brokers

| RIDE | Eightcap | XM Group | RoboForex | LiteFinance | Kama Capital | |

| Trading platform |

AgenaTrade, BasketTrader, FXTrader, OptionTrade, TWS Trader | MT4, MT5, TradingView | MT4, MT5, MobileTrading, XM App | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | MT4, MT5, MultiTerminal, Sirix Webtrader | MetaTrader5 |

| Min deposit | $5000 | $100 | $5 | $10 | $10 | No |

| Leverage |

From 1:1 to 1:30 |

From 1:30 to 1:500 |

From 1:1 to 1:30 |

From 1:1 to 1:2000 |

From 1:1 to 1:1000 |

From 1:1 to 1:400 |

| Trust management | No | No | No | No | Yes | No |

| Accrual of % on the balance | No | No | No | 10.00% | 7.00% | No |

| Spread | From 1.9 point | From 0 points | From 0.8 points | From 0 points | From 0.5 points | From 0 points |

| Level of margin call / stop out |

No | 80% / 50% | 100% / 50% | 60% / 40% | 50% / 20% | 20% / No |

| Order Execution | Market Execution | Market Execution | Market Execution | Market Execution, Instant Execution | Market Execution, Instant Execution | Market Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | No | No | Yes | Yes | Yes |

Detailed review of RIDE

The company RIDE specializes in solutions for optimizing trading expenses by reducing the tax rate on profits. RIDE helps to establish an asset management company in the form of a GmbH (Gesellschaft mit beschränkter Haftung or limited liability company) and assists in financial reporting and tax return preparation. Trading in securities, CFDs, and Forex is carried out on the platforms of partner brokers. The brokerage account is opened with FXFlat Bank AG and serviced by the bank.

RIDE by the numbers:

-

Access to 150 markets and over 1 million trading instruments;

-

Trading pairs with 24 currencies;

-

Over 1,000 asset management companies created;

-

More than 1,500 clients receive support in servicing their GmbH.

RIDE is a company for active trading and passive investments

By creating an asset management company GmbH (vvGmbH), a trader can reduce the tax on profits. For example, the tax on trading stocks without GmbH is 26.38%; through GmbH, the tax is 1.54% of the stock price increase. RIDE offers various tariff plans depending on the client's trading volume, experience, and financial instruments on which they earn profit. The basic package costs is EUR 2,449, but the founder of the GmbH must also contribute a share capital of EUR 25,000.

If a trader does not want to establish a GmbH, they can use RIDE to trade basic assets on more than 130 exchanges worldwide and derivatives in the over-the-counter Forex market. It is possible to trade on different platforms. For example, if a RIDE client chooses Trader Workstation (TWS), their trades will be executed by Interactive Brokers LLC.

Useful functions of RIDE:

-

Market scanners. These are tools that help traders and investors quickly analyze various markets and assets to identify potentially profitable trading opportunities;

-

Tools for tax optimization. These include calculators for calculating tax discounts for stocks and futures contracts;

-

RIDE community on Discord. It has over 800 members. They can communicate with each other on investment topics and quickly contact the RIDE administration for informational support.

Advantages:

Wide range of trading instruments;

Online and phone trading support;

Analytical data and market research;

Demo mode of the trading platform;

Low minimum fees for all asset classes.

RIDE does not prohibit any trading strategies, so its clients can invest long-term and also actively trade financial instruments, including intraday trading. Hedging positions is also allowed.

Articles that may help you

Check out our reviews of other companies as well

User Satisfaction i