According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $1

- Proprietary portal

- CySEC

- 2016

Our Evaluation of TFI Markets Ltd

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

TFI Markets Ltd is a broker with higher-than-average risk and the TU Overall Score of 4.87 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by TFI Markets Ltd clients on our website, Traders Union expert Anton Kharitonov recommends users to consider a more reliable broker with better conditions, as, according to reviews, many clients of this broker are not satisfied with the company’s work.

The TFI Markets broker is keen on corporate clients who want to expand their business with TFI Markets brokerage services.

Brief Look at TFI Markets Ltd

The TFI Markets Ltd (dba TFI Markets) has been in business for more than 20 years. The specialty of the company is forward contracts. The broker cooperates with legal entities from different countries, offers 20 working instruments and multicurrency accounts. It is licensed by CySEC (117/10) and the Central Bank of Cyprus. The TFI Markets is a sponsor of the Invest Cyprus CIPA Awards, IN Business Awards, and other events.

We've identified your country as

US

We have thoroughly analyzed all companies legally providing trading services in your country and created a ranking of the best ones. Our analysis highlights companies that offer optimal working conditions, uphold a strong reputation, and consistently receive the highest number of positive reviews from traders on our website.

Explore the 5 top-rated companies in

US :

- Clients have access to the broker's real offices in Cyprus and trading branches in Greece.

- The company offers several ways to contact its support team.

- There is no non-trading commission at TFI Markets.

- A free multi-currency account is available to all clients by default.

- Traders who access TFI Markets can receive additional income for participation in the referral program.

- The broker provides clients with currency risk-management tools.

- The company cooperates only with legal entities (corporates, companies, partnerships, entrepreneurs, or agencies).

- There are no training materials on the broker's website.

- There are only a few ways to deposit and withdraw capital.

TU Expert Advice

Financial expert and analyst at Traders Union

The TFI Markets brokerage has been an intermediary for more than 20 years and offers favorable conditions for making money on currency conversion and forward contracts. The broker cooperates only with legal entities such as companies, corporations, partnerships, and individual entrepreneurs. To open an account, you need to download a document from the broker's website, fill it out and send it, after which the user will be contacted by employees of TFI Markets.

The broker's clients can choose from 20 currencies and make payments to 150 countries. At the same time, TFI Markets provides a multi-currency account free of charge and ensures that all payments are secured regardless of their destination. The company is registered with the Cyprus Central Bank and is CySEC licensed, as well as EU compliant, and keeps traders' money in segregated accounts.

TFI Markets is focused on active traders, so there are no ways to access passive income in the company. There are also no training materials, which indicates that the broker is aimed at more experienced clients.

TFI Markets Ltd Trading Conditions

| 💻 Trading platform: | Proprietary online portal |

|---|---|

| 📊 Accounts: | Corporate account, Personal account |

| 💰 Account currency: | Multicurrency accounts are available |

| 💵 Deposit / Withdrawal: | Bank wire transfer via IBAN, SWIFT, and SEPA |

| 🚀 Minimum deposit: | 1$ |

| ⚖️ Leverage: | From 1:1 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | Not indicated |

| 💱 EUR/USD spread: | 0,1 pips |

| 🔧 Instruments: | Currency pairs |

| 💹 Margin Call / Stop Out: | The company offers instruments to manage currency risks |

| 🏛 Liquidity provider: | No data |

| 📱 Mobile trading: | No |

| ➕ Affiliate program: | Yes |

| 📋 Order execution: | Trading is done by direct transfer of funds from buyer to the seller through TFI Markets online portal |

| ⭐ Trading features: | Forward contracts trading |

| 🎁 Contests and bonuses: | Traders Union bonuses; Introducing Broker (IB). |

The TFI Markets intermediary is a non-standard Forex broker. The company's clients trade forward contracts which have the opportunity to freeze currency rates and make payments for the next day. Trading is done on the online platform and traders do not need to install additional software. There are 20 currency pairs available, and payments can be made to 150 countries. There are no commissions for opening and maintaining an account, using the broker's platform, account statements, and other non-trading operations. Only registered legal entities can open an account with TFI Markets.

TFI Markets Ltd Key Parameters Evaluation

Video Review of TFI Markets Ltd

Share your experience

- Best

- Last

- Oldest

Trading Account Opening

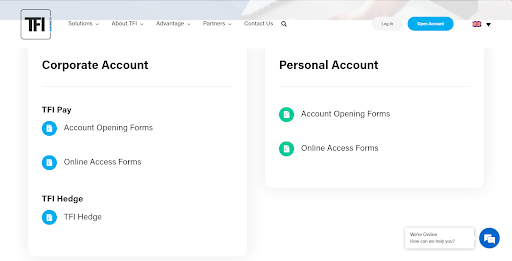

Trading at TFI Markets starts with opening a real trading account with the company. You can do this by following the below brief step-by-step guide:

Open the official website of TFI Markets, which is here: https://tfimarkets.com. You will find the "Open Account" button on the main page in the upper right corner. Click on it to create a new trading account.

Choose the type of account that’s best for you. The TFI Markets broker offers corporate accounts and personal accounts. Click on the button "Account Opening Form" to proceed with your registration.

A form will automatically download to your PC or mobile device and you will need to complete it to become a TFI Markets customer.

The form tells you what documents are required to open an account. There is also a form that you need to fill out with personal information including personal, banking, financial, and customer identification information.

To complete your registration, send the completed form to the TFI Markets broker. A staff member will contact you and provide you with information to proceed.

Regulation and safety

TFI Markets Ltd has a safety score of 8.5/10, which corresponds to a High security level. The safest brokers are those with Tier-1 regulation, a long history (over 10 years in the market), and participation in investor compensation schemes.

- Tier-1 regulated

- Negative balance protection

- Track record over 9 years

- Strict requirements and extensive documentation to open an account

TFI Markets Ltd Regulators and Investor Protection

| Abbreviation | Full Name | Country of regulation | Investor Protection Fund | Regulation Level |

|---|---|---|---|---|

CySec CySec |

Cyprus Securities and Exchange Commission | Cyprus | Up to €20,000 | Tier-1 |

TFI Markets Ltd Security Factors

| Foundation date | 2016 |

| Negative balance protection | Yes |

| Verification (KYC) | Yes |

Commissions and fees

The trading and non-trading commissions of broker TFI Markets Ltd have been analyzed and rated as Medium with a fees score of 7/10. Additionally, these commissions were compared with those of the top two competitors, Pepperstone and OANDA, to provide the most comprehensive information.

- Tight EUR/USD market spread

- No deposit fee

- No withdrawal fee

- Above-average Forex trading fees

- Inactivity fee applies

Trading Fees and Spread

Below, we evaluated and compared the trading commissions of TFI Markets Ltd with those of two competitors. We focused on the spreads and other transaction fees directly associated with executing trades (e.g commission per lot on an ECN account). This comparison aimed to provide a clear understanding of the cost efficiency of each broker.

Standard Account Spread

For Standard accounts, TFI Markets Ltd’s commissions are part of the floating spread, which varies with market conditions. Typical values are provided, but during high volatility, the spread may exceed these.

TFI Markets Ltd Standard spreads

| TFI Markets Ltd | Pepperstone | OANDA | |

| EUR/USD min, pips | 0,1 | 0,5 | 0,1 |

| EUR/USD max, pips | 0,2 | 1,5 | 0,5 |

| GPB/USD min, pips | 0,15 | 0,4 | 0,1 |

| GPB/USD max, pips | 0,2 | 1,4 | 0,5 |

RAW/ECN Account Commission And Spread

The spread on ECN/RAW accounts is market-based and fluctuates, with average values given during active hours. It may vary during volatility spikes. A commission per lot is also charged.

TFI Markets Ltd RAW/ECN spreads

| TFI Markets Ltd | Pepperstone | OANDA | |

| Commission ($ per lot) | 5 | 3 | 3,5 |

| EUR/USD avg spread | 0,1 | 0,1 | 0,15 |

| GBP/USD avg spread | 0,1 | 0,15 | 0,2 |

Non-Trading Fees

We conducted a detailed analysis of the non-trading fees associated with TFI Markets Ltd. This review offers a comprehensive overview of the additional costs that may impact traders beyond regular trading activities.

TFI Markets Ltd Non-Trading Fees

| TFI Markets Ltd | Pepperstone | OANDA | |

| Deposit fee, % | 0 | 0 | 0 |

| Withdrawal fee, % | 0 | 0 | 0 |

| Withdrawal fee, USD | 0 | 0 | 0-15 |

| Inactivity fee ($, per month) | 80 | 0 | 0 |

Account types

The TFI Markets intermediary cooperates with legal entities from different countries and offers only two types of accounts.

Account types:

Demo accounts in TFI Markets are not available due to broker specifics.

TFI Markets is a company for trading forward contracts.

Deposit and withdrawal

TFI Markets Ltd received a Medium score for the efficiency and convenience of its deposit and withdrawal processes.

TFI Markets Ltd provides a reasonable range of deposit and withdrawal options with moderate fees, in line with industry standards.

- No withdrawal fee

- Low minimum withdrawal requirement

- Bank wire transfers available

- Bank card deposits and withdrawals

- BTC payments not accepted

- USDT payments not accepted

- Limited deposit and withdrawal flexibility, leading to higher costs

What are TFI Markets Ltd deposit and withdrawal options?

TFI Markets Ltd provides a basic range of deposit and withdrawal options, covering essential methods in line with industry standards. This set of options is sufficient for most traders, with available methods Bank Card, Bank Wire.

TFI Markets Ltd Deposit and Withdrawal Methods vs Competitors

| TFI Markets Ltd | Plus500 | Pepperstone | |

| Bank Wire | Yes | Yes | Yes |

| Bank card | Yes | Yes | Yes |

| PayPal | No | Yes | Yes |

| Wise | No | No | No |

| BTC | No | No | No |

What are TFI Markets Ltd base account currencies?

A wide range of base account currencies minimizes the need for currency conversion, potentially reducing transaction costs for clients worldwide. TFI Markets Ltd supports the following base account currencies:

What are TFI Markets Ltd's minimum deposit and withdrawal amounts?

The minimum deposit on TFI Markets Ltd is $1, while the minimum withdrawal amount is $30. These minimums may vary depending on the chosen account type and payment method. For specific details, please contact TFI Markets Ltd’s support team.

Markets and tradable assets

TFI Markets Ltd offers a limited selection of trading assets compared to the market average. The platform supports 47 assets in total, including 45 Forex pairs.

- 45 supported currency pairs

- Multiple markets

- Bonds not available

- Futures not available

Supported markets vs top competitors

We have compared the range of assets and markets supported by TFI Markets Ltd with its competitors, making it easier for you to find the perfect fit.

| TFI Markets Ltd | Plus500 | Pepperstone | |

| Currency pairs | 45 | 60 | 90 |

| Total tradable assets | 47 | 2800 | 1200 |

| Stocks | No | Yes | Yes |

| Commodity futures | No | Yes | Yes |

| Crypto | No | Yes | Yes |

| Stock indices | No | Yes | Yes |

| Options | No | Yes | No |

Investment options

We also explored the trading assets and products TFI Markets Ltd offers for beginner traders and investors who prefer not to engage in active trading.

| TFI Markets Ltd | Plus500 | Pepperstone | |

| Bonds | No | No | No |

| ETFs | No | Yes | Yes |

| Copy trading | No | No | Yes |

| PAMM investing | No | No | Yes |

| Managed accounts | Yes | No | No |

Customer support

Clients of TFI Markets may require additional information when opening their accounts or later while trading. They can obtain this information by contacting the company's support team. The broker's staff will not only help resolve account opening issues but will also answer questions related to the trading process and the technical part of the work. The customer support service is available 24 hours a day, Monday to Friday.

Advantages

- Several methods of contacting the support team are available to the company's clients

- It is possible to visit the actual office of TFI Markets or one of its branches.

- Employees are available 24 hours a day during the working week.

Disadvantages

- No communication with customer support on weekends

There are a number of methods available for clients to contact the TFI Markets support team. They can:

-

call via the listed phone number;

-

send a fax;

-

fill out a feedback form;

-

visit an offline office of the company or its branches;

-

chat online via the broker's website;

-

send an email.

TFI Markets is also present on social networks such as YouTube, Facebook, Twitter, and LinkedIn.

Contacts

| Foundation date | 2016 |

|---|---|

| Registration address | 178 Athalassas Ave, 1st Floor, Irene Tower, 2025, Nicosia, Cyprus |

| Regulation | CySEC |

| Official site | https://tfimarkets.com/ |

| Contacts |

+357 22 749 800

|

Education

The TFI Markets broker cooperates with clients who have experience in the sphere of banking and other financial institutions. That is why basic information about trading currency pairs, peculiarities of trading in the Forex market, and other training materials are absent from this website. The company only provides the data that you need to know before you start working with TFI Markets.

It is impossible to check the broker's trading conditions or your trading skills on a risk-free demo account. The company also does not offer cent accounts.

Comparison of TFI Markets Ltd with other Brokers

| TFI Markets Ltd | Eightcap | XM Group | RoboForex | TeleTrade | Kama Capital | |

| Trading platform |

Proprietary portal | MT4, MT5, TradingView | MT4, MT5, MobileTrading, XM App | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | MT4, MT5 | MetaTrader5 |

| Min deposit | $1 | $100 | $5 | $10 | $10 | No |

| Leverage |

From 1:1 to 1:1 |

From 1:30 to 1:500 |

From 1:1 to 1:30 |

From 1:1 to 1:2000 |

From 1:1 to 1:1000 |

From 1:1 to 1:400 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | 10.00% | 1.00% | No |

| Spread | No | From 0 points | From 0.8 points | From 0 points | From 0.2 points | From 0 points |

| Level of margin call / stop out |

No | 80% / 50% | 100% / 50% | 60% / 40% | 70% / 20% | 20% / No |

| Order Execution | Market Execution | Market Execution | Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution |

| No deposit bonus | $1 | No | No | No | No | No |

| Cent accounts | Yes | No | No | Yes | Yes | Yes |

Detailed Review of TFI Markets

The TFI Markets brokerage has been providing financial services for over 20 years. Corporate and private individuals can become clients of this broker. It provides conditions for comfortable currency conversion and earning by means of currency exchange. The broker's website provides up-to-date data on currency values and an online calculator that converts currencies at the prevailing exchange rate.

TFI Markets' success by the numbers :

-

TFI Markets clients can make fast payments to 150 countries.

-

Two types of accounts — for corporate clients and private legal entities — are available at TFI Markets.

-

The broker offers 20 currency pairs as trading instruments.

-

Support service and personal managers are available 24/5.

-

Among clients of TFI Markets, there are more than 800 registered companies and private entrepreneurs.

-

The broker has been providing financial services for over 20 years.

The TFI Markets broker is primarily for making money on currency conversions.

The TFI Markets broker is the choice of those who are ready to manage their funds independently and who know how to make money on currency conversion and multiply their capital. The company provides comfortable conditions for traders, offers the assistance of personal managers, has convenient ways to transfer funds, and guarantees safe transactions. As the broker is focused on active traders, there are no investment proposals, copy services, and other gateways to passive income at TFI Markets. Clients of the company can receive additional income by participating in the referral program.

Trading at TFI Markets is done through the broker's online platform. No additional software must be installed. There is no mobile trading application.

Useful services offered by TFI Markets:

-

Newsletter. Clients can subscribe to the broker's free newsletter and be among the first to know all the news. Users can choose to subscribe to Forex news, daily Forex price alerts, and the TFI Markets newsletter.

-

Cut-off Times. This section contains information that traders can use to intelligently select times for converting various currencies. The table shows all 20 currencies that clients of TFI Markets can use.

-

Online Currency Converter. Under the Solutions>Currency Payments tab, traders can use the calculator to easily calculate how much they will receive after exchanging one currency for another. Data about the value of currencies on the site is updated automatically and corresponds to the prevailing market figures.

Advantages:

Traders get a free multi-currency account.

The broker does not charge for account maintenance, account statements, and other non-trading operations.

TFI Markets cooperates with companies as well as with private persons having the status of legal entities.

A referral program is available to clients as a source of additional income.

The broker is licensed to provide financial services.

TFI Markets complies with European requirements and segregates its clients' money from its own capital accounts.

Articles that may help you

Check out our reviews of other companies as well

User Satisfaction i