According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $50

- MT4

- 2017

Our Evaluation of UpFX

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

UpFX is a broker with higher-than-average risk and the TU Overall Score of 4.5 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by UpFX clients on our website, Traders Union expert Anton Kharitonov recommends users to consider a more reliable broker with better conditions, as, according to reviews, many clients of this broker are not satisfied with the company’s work.

UpFX has been operating for 6 years and within this time it has attracted the attention of more than 50,000 traders from 180 countries. The company does not set artificial limits, it has tight spreads and a high speed of order execution. There are over 150 CFDs on assets and high leverage of up to 1:400. These, when combined with favorable fees, allow you to successfully trade using any style and strategy. The broker has its disadvantages, but they are not critical. According to the sum of factors, UpFX can be recommended for work.

Brief Look at UpFX

UpFX allows you to trade CFDs on currencies, cryptocurrencies, indices, stocks, commodities, and metals. In total, more than 150 financial instruments are available. Trading is possible 24/7, there is market execution of orders and leverage depending on the type of account. Its maximum is 1:400. The minimum deposit on the Basic account is $50. Account currency is USD or EUR at the request of a trader. Trading is carried out through the MetaTrader 4 (MT4) platform, including its mobile version. UpFX provides educational materials and specialized solutions like AutoChartist, to make trading easier. The company is regulated by the Vanuatu Financial Services Commission (VFSC).

We've identified your country as

US

We have thoroughly analyzed all companies legally providing trading services in your country and created a ranking of the best ones. Our analysis highlights companies that offer optimal working conditions, uphold a strong reputation, and consistently receive the highest number of positive reviews from traders on our website.

Explore the 5 top-rated companies in

US :

- Traders get access to hundreds of financial instruments from the most popular groups, including Forex and cryptocurrencies;

- Three account types are available. Each of the accounts is optimal for traders with different levels of training and ambitions;

- Leverage is available on all accounts, its size depends on the type of account and asset. The minimum leverage is 1:10 and the maximum is 1:400;

- Deposit on the Basic account, is from $50; on the Optimal account, it is from $5,000; and on the Professional account, it starts from $10,000;

- The broker offers specialized solutions and calculators, which are available on the website and in the user account;

- Registration with verification of the KYC (Know Your Client) type is intuitively simple and takes no more than 3-5 minutes;

- Technical support is represented by a call center and email and is available 24/7.

- Traders can only trade through MetaTrader 4, alternative solutions are not available;

- Technical support does not have a live chat, which is one of the most efficient communication channels;

- There are many brokers that do not require a minimum deposit. With UpFX it is $50.

TU Expert Advice

Author, Financial Expert at Traders Union

UpFX offers CFDs on a variety of financial instruments, including Forex, cryptocurrencies, indices, stocks, and commodities, available through the MetaTrader 4 platform. The broker provides three account types: Basic, Optimal, and Professional, each catering to different trading styles and experience levels. High leverage up to 1:400, minimal deposit requirements, and competitive spreads are notable advantages, along with 24/7 technical support.

However, trading with UpFX is confined to the MT4 platform, lacking alternatives. Technical support channels are limited to email and callback, without an option for live chat. The broker's regulatory oversight comes from the VFSC, and while fees are competitive, the overall service setup may not suit those seeking comprehensive platform options. UpFX is suitable for traders comfortable with MT4 and seeking competitive fees.

UpFX Trading Conditions

| 💻 Trading platform: | MT4 |

|---|---|

| 📊 Accounts: | Basic, Optimal, and Professional |

| 💰 Account currency: | USD and EUR |

| 💵 Deposit / Withdrawal: | Bank cards and e-wallets |

| 🚀 Minimum deposit: | $50 |

| ⚖️ Leverage: | Up to 1:400 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | No |

| 💱 EUR/USD spread: | 0,1 pips |

| 🔧 Instruments: | CFDs on currency pairs, cryptocurrencies, stocks, indices, commodities, and metals |

| 💹 Margin Call / Stop Out: | No |

| 🏛 Liquidity provider: | No |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | No |

| 📋 Order execution: | Market execution |

| ⭐ Trading features: |

Three account types; Over 150 financial instruments; Opportunities for technical analysis; High leverage; Fast registration; Prompt technical support; Trading through MT4 only |

| 🎁 Contests and bonuses: | No |

For brokers, the minimum deposit depends on the type of account. At the same time, there are quite a few companies that do not have any minimum deposit requirements for some accounts. In the case of UpFX, to open the Basic account, a trader needs to deposit an amount of $50, to open the Optimal account a deposit from $5,000 is required, and for the Professional account the deposit is from $10,000. Leverage depends on the asset and the type of account. It ranges from 1:10 to 1:400. Even if the maximum leverage is currently available to traders, they do not have to use it, and can trade without leverage at all. As for technical support, it works 24/7, but is available only via two channels, email and a call center (call back).

UpFX Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

Trading Account Opening

To start trading with UpFX, register on its official website, then select the type of account, and make a deposit. After that, you can download and install the MT4 trading platform to enter registration data into it and gain access to the financial markets. Usually, this process does not cause any problems, however, but TU has compiled the below step-by-step guide so that you know exactly what needs to be done.

Go to the official UpFX website. Click the “Registration” button in the upper right corner.

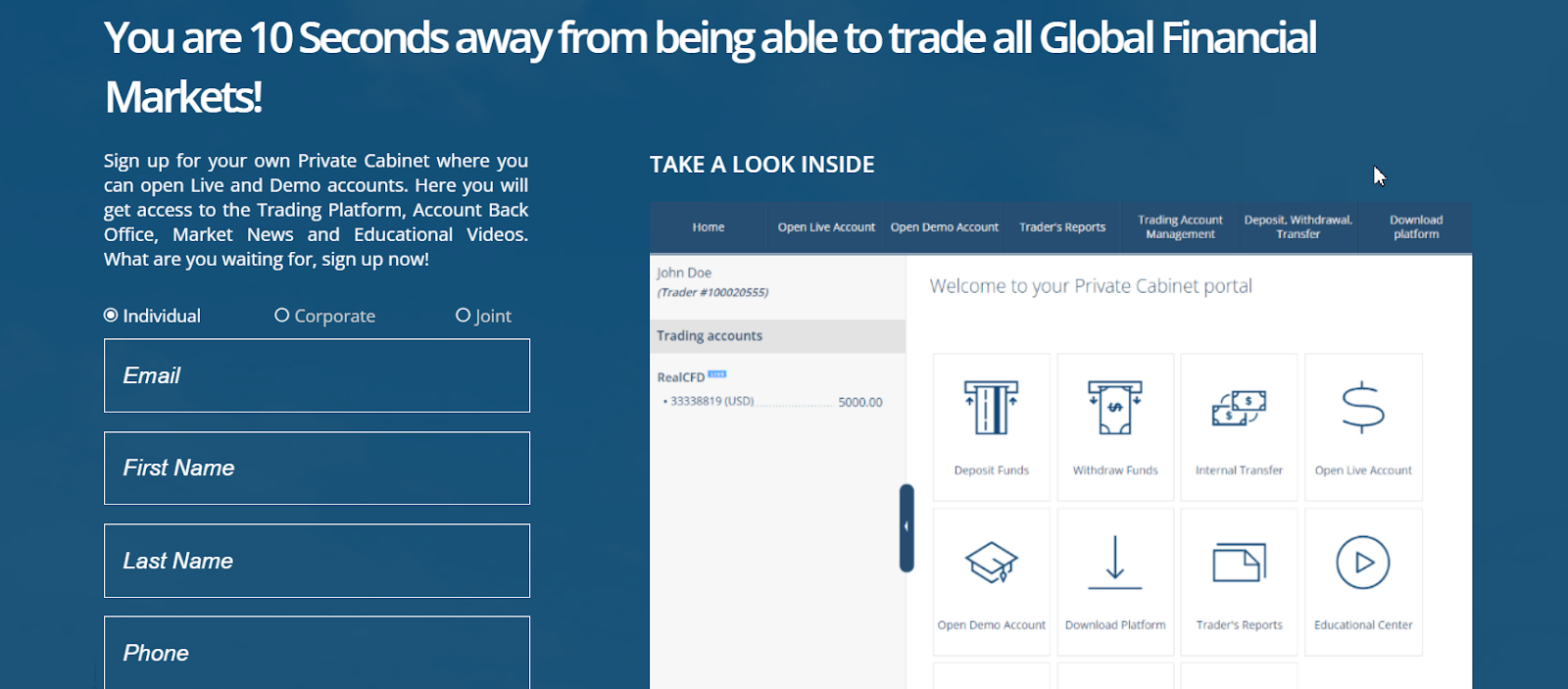

Select your language in the top right corner. Then select the type of account from among Individual, Corporate, and Joint. After that, enter your email, first and last names, phone number, date of birth, and your country of residence. Also, enter a verification code to protect against bots. It will be indicated in the special block. After entering the required information, click the "Sign Up Now" button.

Choose a demo or live trading account. Specify the registration address and upload a scan or photo of your identity document. It can be a passport, driver's license, or insurance policy. Read the terms of service, it is a document at the bottom of the page, and sign it electronically. Click the "Submit" button, and then the "Continue Registration" button.

Select a platform and click the "Registration" button. Here you can also download the trading platform by clicking the link in the pop-up window. Registration data will be sent to your email, you will automatically get access to your user account on the website.

Functions of UpFX’s user account:

Traders can change the profile information, upload documents for verification, select the interface language, and change the password in the main settings;

Deposits and withdrawals of funds, registration of a new account, support center, educational center, and other options are available in the dashboard;

Separate buttons with corresponding names allow you to open a live or demo account with the broker;

You can generate any type of report in the eponymous tab. For example, it can be open and closed positions report or report on withdrawal requests, indicating their status;

The Trading Account Management tab allows you to change your password, make a deposit, withdraw funds, perform an internal transfer, or download the platform;

A separate block contains links to distributions of MetaTrader 4 for desktop and mobile gadgets.

Regulation and safety

UpFX has a safety score of 4.2/10, which corresponds to a Low security level. The safest brokers are those with Tier-1 regulation, a long history (over 10 years in the market), and participation in investor compensation schemes.

- Is regulated

- Negative balance protection

- Track record over 8 years

- Not tier-1 regulated

UpFX Regulators and Investor Protection

| Abbreviation | Full Name | Country of regulation | Investor Protection Fund | Regulation Level |

|---|---|---|---|---|

VFSC VFSC |

Vanuatu Financial Services Commission | Vanuatu | No specific fund | Tier-3 |

UpFX Security Factors

| Foundation date | 2017 |

| Negative balance protection | Yes |

| Verification (KYC) | Yes |

Commissions and fees

The trading and non-trading commissions of broker UpFX have been analyzed and rated as Low with a fees score of 8/10. Additionally, these commissions were compared with those of the top two competitors, Pepperstone and OANDA, to provide the most comprehensive information.

- Low Forex trading fees

- Tight EUR/USD market spread

- No inactivity fee

- No deposit fee

- No withdrawal fee

- Complex fee structure

Trading Fees and Spread

Below, we evaluated and compared the trading commissions of UpFX with those of two competitors. We focused on the spreads and other transaction fees directly associated with executing trades (e.g commission per lot on an ECN account). This comparison aimed to provide a clear understanding of the cost efficiency of each broker.

Standard Account Spread

For Standard accounts, UpFX’s commissions are part of the floating spread, which varies with market conditions. Typical values are provided, but during high volatility, the spread may exceed these.

UpFX Standard spreads

| UpFX | Pepperstone | OANDA | |

| EUR/USD min, pips | 0,1 | 0,5 | 0,1 |

| EUR/USD max, pips | 0,5 | 1,5 | 0,5 |

| GPB/USD min, pips | 0,2 | 0,4 | 0,1 |

| GPB/USD max, pips | 0,5 | 1,4 | 0,5 |

RAW/ECN Account Commission And Spread

The spread on ECN/RAW accounts is market-based and fluctuates, with average values given during active hours. It may vary during volatility spikes. A commission per lot is also charged.

UpFX RAW/ECN spreads

| UpFX | Pepperstone | OANDA | |

| Commission ($ per lot) | 3 | 3 | 3,5 |

| EUR/USD avg spread | 0,1 | 0,1 | 0,15 |

| GBP/USD avg spread | 0,1 | 0,15 | 0,2 |

Non-Trading Fees

We conducted a detailed analysis of the non-trading fees associated with UpFX. This review offers a comprehensive overview of the additional costs that may impact traders beyond regular trading activities.

UpFX Non-Trading Fees

| UpFX | Pepperstone | OANDA | |

| Deposit fee, % | 0 | 0 | 0 |

| Withdrawal fee, % | 0 | 0 | 0 |

| Withdrawal fee, USD | 0 | 0 | 0-15 |

| Inactivity fee ($, per month) | 0 | 0 | 0 |

Account types

The most important factor is the type of account. Many brokers offer demo accounts, they are needed to study the platform and work out trading strategies. UpFX also offers a demo account and three live accounts. The main differences between these accounts are the minimum deposit, maximum leverage, and available assets. CFDs on stocks, indices, and commodities are available on all accounts, and the type of execution is always market. The most popular is the Optimal account. It has a significant minimum deposit, but it provides almost all assets and moderate leverage. The Basic option is usually chosen by novice traders, and the Professional plan will suit the most experienced market participants. Thus, traders should focus on their capabilities and ambitions, but not overestimate them.

Account types:

Technical support works the same for all types of accounts. Also, all traders have equal access to the analytical opportunities of the platform and educational materials.

Deposit and withdrawal

UpFX received a Medium score for the efficiency and convenience of its deposit and withdrawal processes.

UpFX provides a reasonable range of deposit and withdrawal options with moderate fees, in line with industry standards.

- No deposit fee

- Low minimum withdrawal requirement

- No withdrawal fee

- Minimum deposit below industry average

- BTC not available as a base account currency

- BTC payments not accepted

- Wise not supported

What are UpFX deposit and withdrawal options?

UpFX provides a basic range of deposit and withdrawal options, covering essential methods in line with industry standards. This set of options is sufficient for most traders, with available methods Bank Card, Skrill, Neteller.

UpFX Deposit and Withdrawal Methods vs Competitors

| UpFX | Plus500 | Pepperstone | |

| Bank Wire | No | Yes | Yes |

| Bank card | Yes | Yes | Yes |

| PayPal | No | Yes | Yes |

| Wise | No | No | No |

| BTC | No | No | No |

What are UpFX base account currencies?

A wide range of base account currencies minimizes the need for currency conversion, potentially reducing transaction costs for clients worldwide. UpFX supports the following base account currencies:

What are UpFX's minimum deposit and withdrawal amounts?

The minimum deposit on UpFX is $100, while the minimum withdrawal amount is $1. These minimums may vary depending on the chosen account type and payment method. For specific details, please contact UpFX’s support team.

Markets and tradable assets

UpFX offers a limited selection of trading assets compared to the market average. The platform supports 150 assets in total, including 50 Forex pairs.

- Indices trading

- Crypto trading

- 50 supported currency pairs

- Limited asset selection

- Futures not available

Supported markets vs top competitors

We have compared the range of assets and markets supported by UpFX with its competitors, making it easier for you to find the perfect fit.

| UpFX | Plus500 | Pepperstone | |

| Currency pairs | 50 | 60 | 90 |

| Total tradable assets | 150 | 2800 | 1200 |

| Stocks | Yes | Yes | Yes |

| Commodity futures | Yes | Yes | Yes |

| Crypto | Yes | Yes | Yes |

| Stock indices | Yes | Yes | Yes |

| Options | No | Yes | No |

Investment options

We also explored the trading assets and products UpFX offers for beginner traders and investors who prefer not to engage in active trading.

| UpFX | Plus500 | Pepperstone | |

| Bonds | No | No | No |

| ETFs | No | Yes | Yes |

| Copy trading | No | No | Yes |

| PAMM investing | No | No | Yes |

| Managed accounts | No | No | No |

Customer support

The technical (client) support service is one of the most important infrastructures on any platform. No matter how convenient and transparent the interface of the website is, and regardless of the details of the instructions (FAQs) provided, traders will in any case face situations they cannot solve on their own without advice or help from an expert. UpFX has 24/7 technical support. However, it is only available via email and callback.

Advantages

- Non-clients can contact technical support

- Technical support is multilingual

Disadvantages

- No live chat

If you have a question that requires the help of a specialist, you can use the following channels:

-

write via email;

-

order a callback on the page.

Note that to order a callback, you need to fill out a special form, indicating your first and last names, phone number, email, and country of residence.

Contacts

| Foundation date | 2017 |

|---|---|

| Registration address | Law Partners House, Kumul Highway, Port Vila, Vanuatu (CAP 222) |

| Official site | https://upfx.com/ |

| Contacts |

Education

Many brokers offer eBooks, articles, and other educational materials, and conduct free webinars with professional traders. All this allows traders to regularly improve their skills. UpFX takes a similar approach.

If UpFX is compared with its competitors, it will be in the middle of the list in terms of the quantity and quality of training materials. Its Educational Center is more useful for novice traders and users at the intermediate level. It doesn’t contain materials that will help professionals improve their skills.

Comparison of UpFX with other Brokers

| UpFX | Eightcap | XM Group | RoboForex | Exness | LiteFinance | |

| Trading platform |

MT4 | MT4, MT5, TradingView | MT4, MT5, MobileTrading, XM App | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | Exness Trade App (mobile), Exness Terminal (web), MetaTrader5, MetaTrader4 | MT4, MT5, MultiTerminal, Sirix Webtrader |

| Min deposit | $50 | $100 | $5 | $10 | $10 | $10 |

| Leverage |

From 1:1 to 1:400 |

From 1:30 to 1:500 |

From 1:1 to 1:30 |

From 1:1 to 1:2000 |

From 1:1 to 1:2000 |

From 1:1 to 1:1000 |

| Trust management | No | No | No | No | No | Yes |

| Accrual of % on the balance | No | No | No | 10.00% | No | 7.00% |

| Spread | From 0.1 points | From 0 points | From 0.8 points | From 0 points | From 0 points | From 0.5 points |

| Level of margin call / stop out |

100% / 50% | 80% / 50% | 100% / 50% | 60% / 40% | 60% / No | 50% / 20% |

| Order Execution | Market Execution | Market Execution | Market Execution | Market Execution, Instant Execution | Market Execution, Instant Execution | Market Execution, Instant Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | No | No | Yes | Yes | Yes |

Detailed review of UpFX

Since its incorporation in 2017, UpFX has been applying the latest marketing technologies. This is expressed literally in everything, from the list of trading instruments to the speed of order execution. For an average trader, UpFX has many practical advantages. For example, registration within 5 minutes, fast verification, low spreads, and high trading leverage. Today, a broker that does not meet these requirements simply cannot compete. Also, there are integrated instruments for technical analysis that make life easier for traders. This speaks of the client-oriented approach and quality of service.

UpFX by the numbers:

-

Over 50,000 active accounts;

-

150 trading instruments;

-

Minimum deposit is $50;

-

Maximum leverage is 1:400;

-

Registration within 5 minutes.

UpFX is a broker for successfully trading CFDs

There are many brokers that focus on a specific group of assets, most often it is Forex. Some add the most popular instruments from other groups, such as stocks, indices, or cryptocurrencies. UpFX stands out from its competitors by the variety of assets available to traders, regardless of the chosen account. The company's client can work with CFDs on currencies, cryptocurrencies, stocks, indices, commodities, and precious metals. In total, there are 150 positions, and this list is constantly expanding. The advantage of having a large choice of instruments from which to choose is that traders do not need to limit themselves. They work with familiar instruments and implement unique trading strategies.

Useful features offered by UpFX:

-

A trader does not need to spend a lot of time opening a live account. Registration on the platform takes no more than 3-5 minutes. The KYC type of verification is required to ensure the security of the platform and is completed within a couple of days;

-

The broker allows trading through MetaTrader 4, many users and experts consider it to be ideal. It is also because there are hundreds of plug-ins for this platform that simplify and speed up technical analysis;

-

The broker's client can choose a demo account or one of three types of live accounts. Live accounts differ from each other in the minimum deposit, maximum leverage, and some trading metrics.

Advantages:

Traders have the opportunity to work with almost any financial instrument. The most demanded CFDs are presented, and their list is constantly growing;

Leverage depends on the type of account and asset, but even on the Basic account, traders can trade with leverage of up to 1:400, which increases the profit potential;

There are no additional fees, traders only pay a spread or trading fee, and a withdrawal fee;

Technical support is available in major European languages and is active 24/7;

Traders are not limited in their trading strategy;

The broker is interested in the success of traders, so it provides them with special instruments, like AutoChartist for free;

The broker's website has a convenient dashboard with important functions, like an economic calendar and full control of accounts.

UpFX does not apply any unique solutions. The company takes the best practices of the world market and brings them to a qualitatively high level.

Articles that may help you

Check out our reviews of other companies as well

User Satisfaction i