According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $100

- MetaTrader4

- 2021

Our Evaluation of WCG Markets

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

WCG Markets is a broker with higher-than-average risk and the TU Overall Score of 4.87 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by WCG Markets clients on our website, Traders Union expert Anton Kharitonov recommends users to consider a more reliable broker with better conditions, as, according to reviews, many clients of this broker are not satisfied with the company’s work.

WCG Markets is a broker for traders from China with a limited choice of assets. Its clients are offered leverage up to 1:200, 24/7 support, and access to trading using MT4.

Brief Look at WCG Markets

WCG Markets offers trading currency pairs, precious metals, indices, and energies in the over-the-counter (OTC) market through MetaTrader 4 (MT4). The WCG brand was registered in 2018. Over 5 years, the company shifted from the Asian market to international business and opened representative offices in Canada, the UK, and St. Vincent and the Grenadines. WCG Markets provides qualitative brokerage services and has been awarded with many rewards, including Best Financial Technology and Solution on Foreign Exchange WikiFX-2024.

We've identified your country as

US

We have thoroughly analyzed all companies legally providing trading services in your country and created a ranking of the best ones. Our analysis highlights companies that offer optimal working conditions, uphold a strong reputation, and consistently receive the highest number of positive reviews from traders on our website.

Explore the 5 top-rated companies in

US :

- The broker is regulated in several jurisdictions where it has its representative offices;

- It offers trading through classic MetaTrader 4 with important trading and analytical features;

- Partnership programs with various fee plans and working patterns are available;

- WCG Markets’ service charge is included in the spread;

- The broker offers bonus programs with the opportunity to withdraw bonus funds;

- A demo account is available;

- The company provides passive income services, such as copy trading, MAM, and expert advisors.

- Minimum deposit is $100 but without the opportunity to open a cent account;

- Limited choice of trading instruments, as compared to the broker's competitors;

- Accounts are restricted to citizens of China aged 18-65.

TU Expert Advice

Author, Financial Expert at Traders Union

WCG Markets offers trading services using MetaTrader 4, focusing on currency pairs, precious metals, indices, and energies. The platform provides leverage up to 1:200 for Forex trading, with floating spreads for minimal trading rates. While offering various promotional bonuses and programs, WCG Markets also supports copy trading for passive income. The presence of a demo account allows novice traders to practice before engaging in live trading, enhancing the accessibility of trading conditions for users.

Drawbacks of WCG Markets include a limited range of assets and regional restrictions, notably servicing only Chinese citizens aged 18-65. The platform's lack of Tier-1 regulation and a less diverse asset selection may not suit experienced traders seeking a wide array of trading instruments. Therefore, WCG Markets may be more appropriate for beginners practicing on demo accounts or Forex traders focusing on specific currency pairs rather than a broad investment portfolio.

WCG Markets Trading Conditions

| 💻 Trading platform: | MetaTrader 4 |

|---|---|

| 📊 Accounts: | Demo and Real |

| 💰 Account currency: | CNY |

| 💵 Deposit / Withdrawal: | Bank transfers and electronic payment systems |

| 🚀 Minimum deposit: | $100 |

| ⚖️ Leverage: | 1:1 up to 1:200 |

| 💼 PAMM-accounts: | Yes |

| 📈️ Min Order: | 0.01 |

| 💱 EUR/USD spread: | 0,2-0,4 pips |

| 🔧 Instruments: | Forex, precious metals, oil (WTI and Brent), and indices |

| 💹 Margin Call / Stop Out: | Margin closeout: ≤ 30% |

| 🏛 Liquidity provider: | Selected major world banks |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Order execution: | Market execution |

| ⭐ Trading features: | Only citizens of China can trade with the broker |

| 🎁 Contests and bonuses: | Trading Bonus and Invite a Friend |

WCG Markets offers only 37 trading instruments, most of which are currency pairs. Floating spreads provide for trading at minimum rates. Trading leverage for currency pairs is up to 1:200 and it is up to 1:100 for indices. The base margin for metals is $800, and for USOIL and UKOIL it is $1,000. The minimum contract for gold is 100 oz; for silver, it is 2,500 oz; for oil, it is 1,000 barrels; and for currency pairs, it is 100,000 units of the base currency.

WCG Markets Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

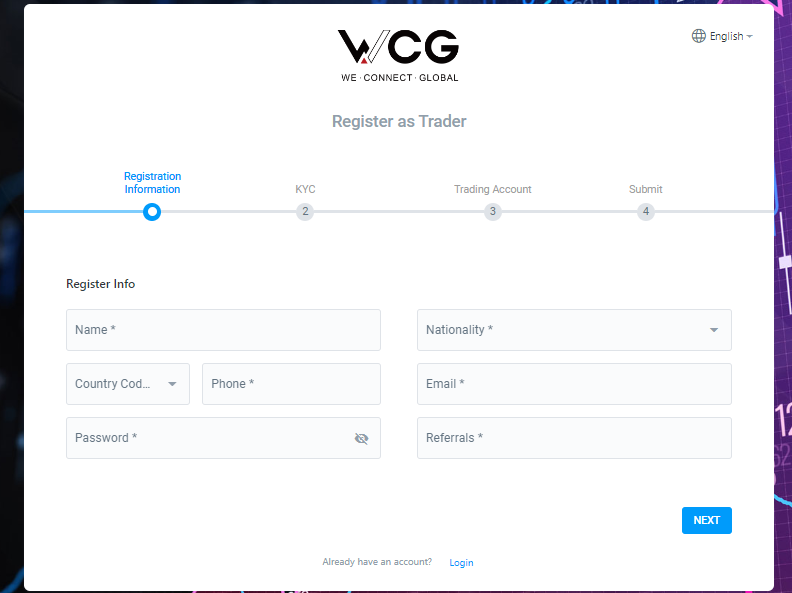

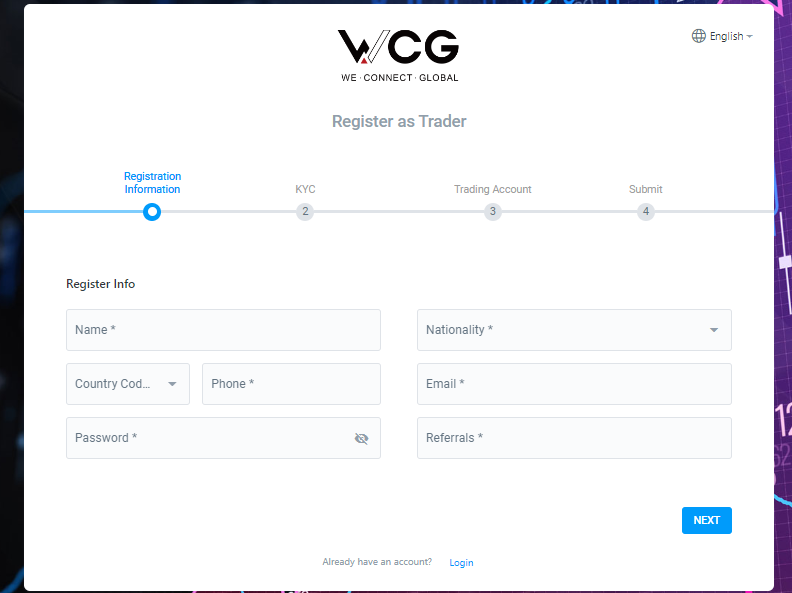

Trading Account Opening

Only traders registered on the WCG Markets website have access to user accounts. The broker provides its services only to citizens of China. To create a user account, follow the instructions below:

Click the “Open Real Account” button on the company's official website.

In the form, enter your name, country, phone number, and email. Also, create or generate a password to protect your user account.

Traders who reside in Mainland China only need to upload identification documents. Residents of other regions only need a passport and confirmation of address, such as a driver's license, permanent resident card, or utility bill for the last three months. Thereafter, you can open an account in your user account, make a deposit, and start trading on a pre-installed platform or in WebTrader.

Regulation and safety

WCG Markets has a safety score of 3.7/10, which corresponds to a Low security level. The safest brokers are those with Tier-1 regulation, a long history (over 10 years in the market), and participation in investor compensation schemes.

- Is regulated

- Negative balance protection

- Not tier-1 regulated

- Track record of less than 8 years

WCG Markets Regulators and Investor Protection

| Abbreviation | Full Name | Country of regulation | Investor Protection Fund | Regulation Level |

|---|---|---|---|---|

SVG FSA SVG FSA |

Financial Services Authority of St. Vincent and the Grenadines | St. Vincent and the Grenadines | No specific fund | Tier-3 |

WCG Markets Security Factors

| Foundation date | 2021 |

| Negative balance protection | Yes |

| Verification (KYC) | Yes |

Commissions and fees

The trading and non-trading commissions of broker WCG Markets have been analyzed and rated as Medium with a fees score of 6/10. Additionally, these commissions were compared with those of the top two competitors, Pepperstone and OANDA, to provide the most comprehensive information.

- No inactivity fee

- No deposit fee

- No withdrawal fee

- Above-average Forex trading fees

- No ECN/Raw Spread account

Trading Fees and Spread

Below, we evaluated and compared the trading commissions of WCG Markets with those of two competitors. We focused on the spreads and other transaction fees directly associated with executing trades (e.g commission per lot on an ECN account). This comparison aimed to provide a clear understanding of the cost efficiency of each broker.

Standard Account Spread

For Standard accounts, WCG Markets’s commissions are part of the floating spread, which varies with market conditions. Typical values are provided, but during high volatility, the spread may exceed these.

WCG Markets Standard spreads

| WCG Markets | Pepperstone | OANDA | |

| EUR/USD min, pips | 0,2 | 0,5 | 0,1 |

| EUR/USD max, pips | 0,4 | 1,5 | 0,5 |

| GPB/USD min, pips | 0,4 | 0,4 | 0,1 |

| GPB/USD max, pips | 1,1 | 1,4 | 0,5 |

Does WCG Markets support RAW/ECN accounts?

As we discovered, WCG Markets does not offer RAW/ECN accounts, which might be a drawback for transparency and liquidity. However, this doesn't make the broker uncompetitive. Consider factors like spread levels, execution speed, regulation, support quality, and trading tools when choosing a reliable broker.

Non-Trading Fees

We conducted a detailed analysis of the non-trading fees associated with WCG Markets. This review offers a comprehensive overview of the additional costs that may impact traders beyond regular trading activities.

WCG Markets Non-Trading Fees

| WCG Markets | Pepperstone | OANDA | |

| Deposit fee, % | 0 | 0 | 0 |

| Withdrawal fee, % | 0 | 0 | 0 |

| Withdrawal fee, USD | 0 | 0 | 0-15 |

| Inactivity fee ($, per month) | 0 | 0 | 0 |

Account types

Upon registration of the user account on the WCG Markets website, traders can choose one of two available account types.

Account types:

Currently, cent accounts are not available.

WCG Markets provides an opportunity to test trading conditions in demo mode before switching to the live account. The broker doesn’t provide micro accounts, which is a disadvantage for Forex novice traders.

Deposit and withdrawal

WCG Markets received a Low score for the efficiency and convenience of its deposit and withdrawal processes.

WCG Markets offers limited payment options and accessibility, which may impact its competitiveness.

- Minimum deposit below industry average

- No withdrawal fee

- Bank wire transfers available

- Low minimum withdrawal requirement

- Wise not supported

- BTC payments not accepted

- Limited deposit and withdrawal flexibility, leading to higher costs

What are WCG Markets deposit and withdrawal options?

WCG Markets offers a limited selection of deposit and withdrawal methods, including Bank Wire, Skrill, Neteller. This limitation may restrict flexibility for users, making WCG Markets less competitive for those seeking diverse payment options.

WCG Markets Deposit and Withdrawal Methods vs Competitors

| WCG Markets | Plus500 | Pepperstone | |

| Bank Wire | Yes | Yes | Yes |

| Bank card | No | Yes | Yes |

| PayPal | No | Yes | Yes |

| Wise | No | No | No |

| BTC | No | No | No |

What are WCG Markets base account currencies?

A wide range of base account currencies minimizes the need for currency conversion, potentially reducing transaction costs for clients worldwide. WCG Markets supports the following base account currencies:

What are WCG Markets's minimum deposit and withdrawal amounts?

The minimum deposit on WCG Markets is $100, while the minimum withdrawal amount is $100 USDT. These minimums may vary depending on the chosen account type and payment method. For specific details, please contact WCG Markets’s support team.

Markets and tradable assets

WCG Markets offers a limited selection of trading assets compared to the market average. The platform supports 100 assets in total, including 36 Forex pairs.

- Crypto trading

- Copy trading platform

- Indices trading

- Small selection of currency pairs

- Limited asset selection

Supported markets vs top competitors

We have compared the range of assets and markets supported by WCG Markets with its competitors, making it easier for you to find the perfect fit.

| WCG Markets | Plus500 | Pepperstone | |

| Currency pairs | 36 | 60 | 90 |

| Total tradable assets | 100 | 2800 | 1200 |

| Stocks | Yes | Yes | Yes |

| Commodity futures | Yes | Yes | Yes |

| Crypto | Yes | Yes | Yes |

| Stock indices | Yes | Yes | Yes |

| Options | No | Yes | No |

Investment options

We also explored the trading assets and products WCG Markets offers for beginner traders and investors who prefer not to engage in active trading.

| WCG Markets | Plus500 | Pepperstone | |

| Bonds | No | No | No |

| ETFs | Yes | Yes | Yes |

| Copy trading | Yes | No | Yes |

| PAMM investing | No | No | Yes |

| Managed accounts | Yes | No | No |

Customer support

WCG Markets provides multiple communication channels, which are available 24/5. The main languages are Chinese and English, but support operators use an online translator at the trader’s request.

Advantages

- Wide choice of communication channels

- Round-the-clock support on trading days on Forex

Disadvantages

- Chat operators’ responses are not always comprehensive

- Requests sent by email can be ignored

To contact the broker, use the following channels:

email;

live chat on the website (2 communication channels are available);

WhatsApp;

LINE;

Telegram;

WeChat;

Tencent QQ.

There is a feedback form in the Contact Us section. Specify your email and phone number, and the broker’s representative will contact you by one of the above channels. Communication with the broker is also carried out through the Users’ Center.

Contacts

| Foundation date | 2021 |

|---|---|

| Registration address |

WCG Markets Ltd, 150-10451 Shellbridge Way, Richmond BC V6X 2W8, Canada FINTRAC, SVGFSA, Hong Kong Customs Department |

| Official site | https://www.wcgmarkets.com/ |

| Contacts |

4001 203 612, 4008 428 912

|

Education

Novice traders can use the “Learn Trade” section of the website. The basics of trading in financial markets is provided in the Basic Trading course. More experienced traders can find useful information in the Intermediate Trading and Advanced Trading courses.

A demo account is another training instrument. The broker provides virtual $100,000 that can be used for training and gaining practical trading skills.

Comparison of WCG Markets with other Brokers

| WCG Markets | Eightcap | XM Group | RoboForex | TeleTrade | Kama Capital | |

| Trading platform |

MetaTrader4 | MT4, MT5, TradingView | MT4, MT5, MobileTrading, XM App | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | MT4, MT5 | MetaTrader5 |

| Min deposit | $100 | $100 | $5 | $10 | $10 | No |

| Leverage |

From 1:1 to 1:200 |

From 1:30 to 1:500 |

From 1:1 to 1:30 |

From 1:1 to 1:2000 |

From 1:1 to 1:1000 |

From 1:1 to 1:400 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | 10.00% | 1.00% | No |

| Spread | From 0.1 points | From 0 points | From 0.8 points | From 0 points | From 0.2 points | From 0 points |

| Level of margin call / stop out |

No / 30% | 80% / 50% | 100% / 50% | 60% / 40% | 70% / 20% | 20% / No |

| Order Execution | Market Execution | Market Execution | Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | No | No | Yes | Yes | Yes |

Detailed review of WCG Markets

On May 8, 2024, the broker introduced the updated user account with more comfortable management features and extended functionality. Now it’s called the Users’ Center 2.0. Partnering with the world-recognized liquidity providers that have significant market depth and the best prices, ensures high execution speeds and low latency. The company strives to apply the best technologies to reduce slippage and to provide 24/7 personal technical support.

WCG Markets by the numbers:

Over 5 years of experience in financial markets;

6 representative offices;

Leverage is up to 1:100-1:200.

WCG Markets is a broker for trading Forex on MT4

WCG Markets offers for trade 7 major and 21 minor currency pairs, 5 stock indices, gold, silver, and Brent and WTI oil. The minimum order for Forex, metals, and oil is 0.01 lots and the maximum is 20 lots. The minimum order for indices is 0.02 lots, and the maximum is 10 lots. Swaps are charged for transferring positions overnight. Swaps for indices can vary subject to ex-dividends on stocks included in them on a certain date. Special swap adjustments are provided on the official WCG Markets website.

The broker offers MetaTrader 4, which is the most popular platform for trading in OTC markets. MT4 is available for mobile apps and a desktop version for Windows. Mobile apps can be downloaded from stores for Android, iOS, and Huawei. The platform supports algorithmic trading using EAs, 9 time frames, 3 chart options, and over 50 technical indicators. MT4 is available in 39 languages.

Useful services offered by WCG Markets:

Announcements. This section provides important trading information, including special swap quotes for CFDs on indices and trading schedules on holidays;

Financial calendar. It provides important events by financial markets and can be sorted by importance, country, and date. The available language is Chinese;

Financial news. This section of the official broker’s website provides financial news in Chinese;

Online support. The broker offers many communication channels through popular instant messengers and social media. Communication is available in English. Other languages are available using an online translator.

Advantages:

Real-time quotes for trading instruments;

24/7 services for global trading of financial products;

Automatic order execution and transfer of orders directly to major liquidity providers;

Proprietary system of investing in MAM accounts with various capital distribution options;

24/7 access to market data that provides for conducting qualitative analysis.

Accounts are usually opened within 1 business day, however, the broker can confirm user accounts within several hours subject to provision of truthful information and qualitative scans of documents.

Articles that may help you

Check out our reviews of other companies as well

User Satisfaction i