XM Copy Trade Service To Earn In 2025

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

XM Copy trade service allows users to automatically replicate trades from experienced investors, making it ideal for beginners or those with limited time for market analysis. By selecting a professional trader, allocating funds, and automating the process, users can potentially profit from expert strategies. One of the standout features for generating passive income on its platform is the copy trading service available through MT4 and MT5.

Copy trading has become an increasingly popular method for investors to earn returns without actively managing trades. By mirroring the strategies of experienced traders, individuals can automatically replicate trades within their own accounts. XM, founded in 2009, is a well-established broker regulated across multiple jurisdictions, serving over a million traders worldwide.

This guide will walk you through the process of setting up and using XM’s copy trading service to potentially grow your investment portfolio. We’ll cover the steps to register for copy trading, how to identify and choose successful traders to follow, and the key considerations, such as fees and risks, to be aware of when diving into this form of social trading.

XM copy trading network in 2025

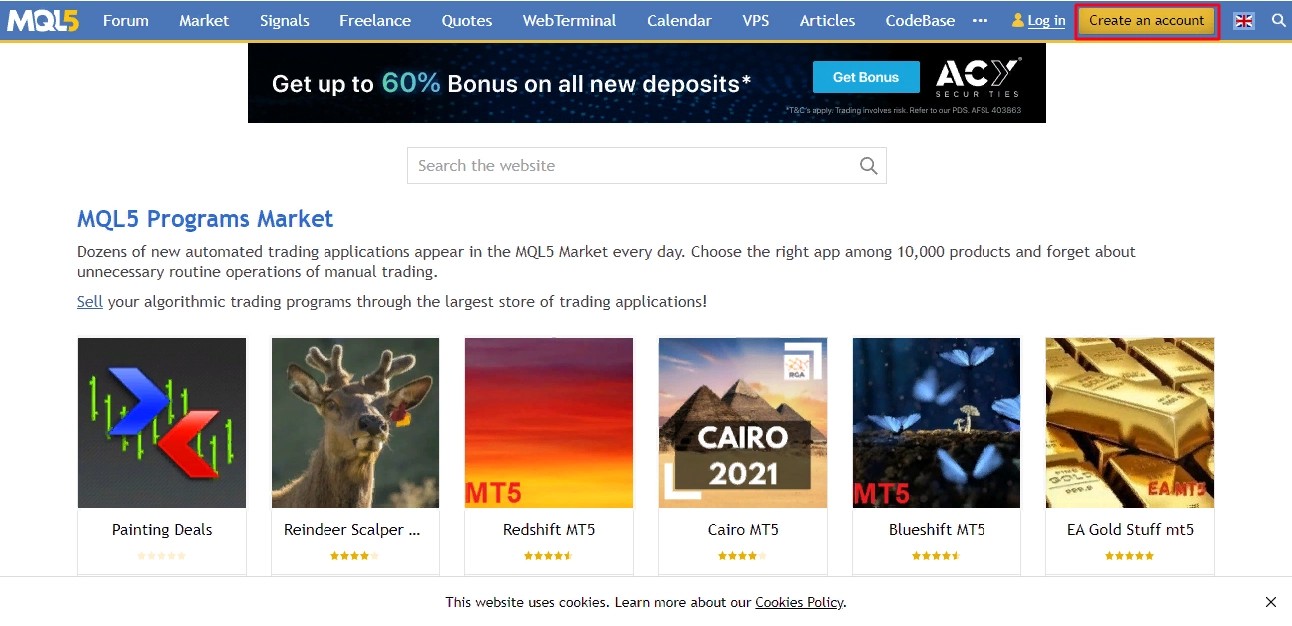

MQL5 remains one of the largest social and copy trading platforms globally, offering access to over 1,000 signal providers. By using XM in partnership with MQL5, traders can tap into diverse market opportunities across Forex, CFDs, cryptocurrencies, stocks, and commodities.

XM copy trading platform overview

Copy trading platform: MQL5

Regulation: MQL5 operates as a community platform and is not regulated; however, XM is regulated by multiple authorities, including CySEC, ASIC, DFSA, and FSC Belize.

Supported platforms: MT4, MT5.

Minimum investment: varies depending on the selected signal provider.

Service fees: no platform fee; subscription fees are set by individual traders, ranging from $1 to $1,000 per month, with an average around $50.

Network size: over 1,000 strategy providers.

Markets available: Forex, CFDs, cryptocurrencies, stocks, commodities.

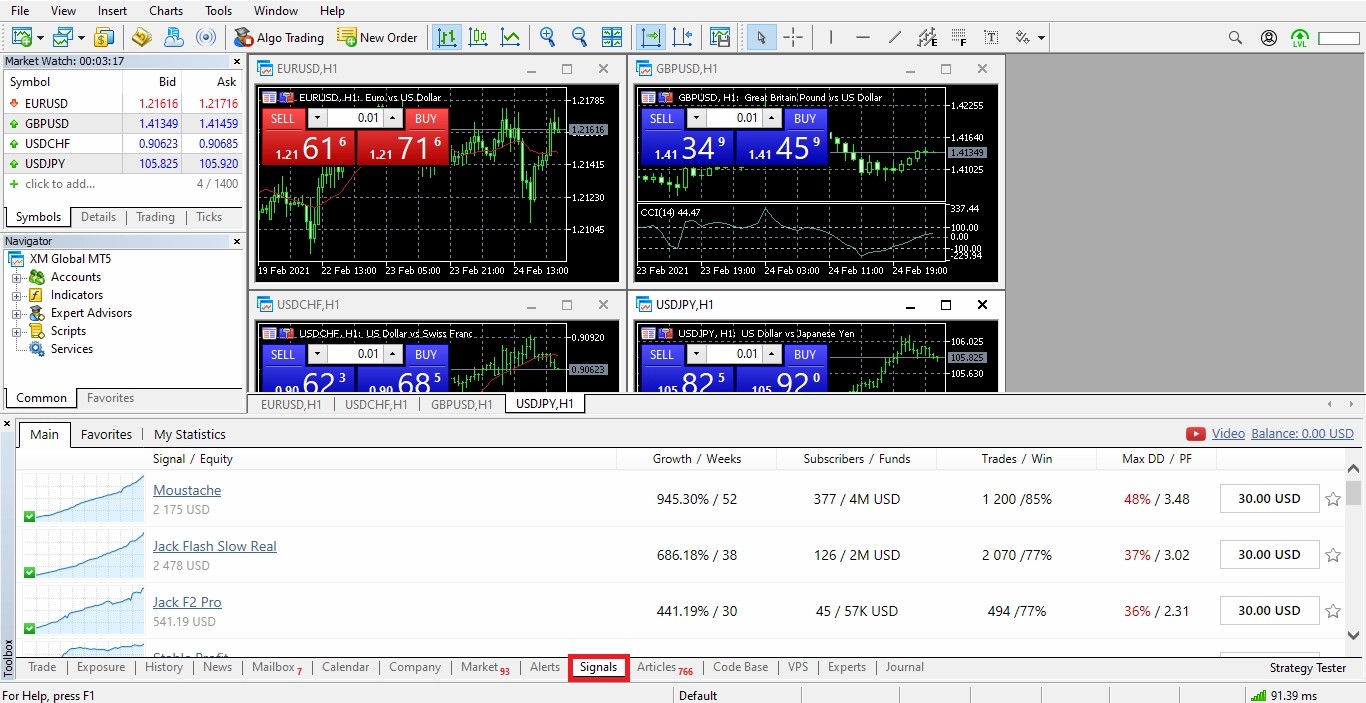

How to find the right trader to copy

Selecting the right trader to copy on MQL5 is essential for optimizing trading outcomes. MQL5 offers tools that help evaluate and choose signal providers based on performance and risk metrics.

Accessing the list

Within the MetaTrader 4 (MT4) or MetaTrader 5 (MT5) platform, go to the “signals” tab to view available providers.

Alternatively, visit the MQL5 website's “signals” section for more options.

Understanding the columns

Trader’s username and account equity. Identifies the provider and shows their current balance.

Growth percentage and active trading weeks. Displays account growth over time and provider activity duration.

Subscriber count and assets under management. Indicates the number of followers and total funds copying the provider.

Total trades and win rate percentage. Shows trading frequency and success rate.

Maximum drawdown and profit factor. Measures the largest decline and the ratio of gross profit to gross loss.

Subscription fee. Specifies the monthly cost to subscribe.

Sorting and filtering

Click on any column header to sort traders based on that criterion. Clicking again reverses the order.

Use filter options to refine results based on drawdown limits, profit factors, or fees.

Getting started with copy trading on XM

Once registered and logged in, follow these steps to begin copying trades:

Access the signals tab: Navigate to the Signals section on MT4 or MT5 and choose a trader whose performance aligns with your goals.

Review trader’s profile: Click on the trader’s username to view detailed statistics. For insights from other users, click the Reviews button to read feedback on the trader’s performance.

Subscribe to a trader: Click the Subscribe button to start copying trades. You’ll be prompted to agree to the service’s terms and enable signal subscriptions.

Customizing copy trading settings:

Copy Take Profit and Stop Loss Levels. Replicate the trader’s risk management settings.

Auto-Sync Positions. Enable or disable automatic synchronization without manual confirmation.

Deposit Load Limit. Set the maximum percentage of your account balance allocated to copy trading.

Auto-Close Settings. Specify a threshold balance where trades will automatically close if your deposit drops below a certain level.

Spread Limit for Trade Execution. Control the maximum spread allowed when executing copied trades.

Once your settings are configured, click OK to finalize the setup. The system will automatically copy trades from your selected trader to your account based on your preferences.

With XM’s robust copy trading network in 2025, you can effortlessly diversify your portfolio, leverage the expertise of professional traders, and optimize your trading strategy — all within a secure and user-friendly platform.

Why XM copy trading is popular

Earning potential. New investors can achieve returns similar to experienced traders without investing significant time in learning complex strategies.

Low entry barrier. It requires minimal capital to get started, making it accessible to a wide range of investors.

Learning and growth. Investors can observe professional strategies in real-time, fostering continuous learning and self-improvement.

However, copy trading also comes with certain risks. One of the main drawbacks is that a trader's past performance doesn’t guarantee future success. Additionally, platforms like MQL5 charge subscription fees to follow professional traders, which can range from a few dollars to as much as $1,000, depending on the trader's reputation and performance.

Here’s a comparison table of XM Copy Trading Platforms to help you understand the key differences:

| Feature | XM Copy Trading via MQL5 (MT4) | XM Copy Trading via MQL5 (MT5) |

|---|---|---|

| Platform Type | MetaTrader 4 (MT4) | MetaTrader 5 (MT5) |

| Copy Trading Provider | MQL5 | MQL5 |

| Regulation | Not regulated (MQL5 platform) | Not regulated (MQL5 platform) |

| Minimum Deposit | $5 (varies by broker account type) | $5 (varies by broker account type) |

| Minimum Investment for Copying | Depends on the selected signal provider | Depends on the selected signal provider |

| Subscription Fee | Set by traders (ranges from $1 to $1,000/month, avg. $50) | Set by traders (ranges from $1 to $1,000/month, avg. $50) |

| Supported Markets | Forex, CFDs, Commodities | Forex, CFDs, Cryptocurrencies, Stocks, Commodities |

| Trade Execution Speed | Fast but may have slight delays compared to MT5 | Real-time execution with advanced processing |

| Technical Analysis Tools | Basic charting tools, limited timeframes | Advanced charting, more timeframes, built-in economic calendar |

| Order Types Supported | Market orders, limit orders, stop orders | Market orders, limit orders, stop orders, trailing stop, advanced pending orders |

| Risk Management Settings | Copy TP/SL, deposit load limit | Copy TP/SL, deposit load limit, max drawdown settings |

| Synchronization Options | Manual confirmation or automatic syncing | Enhanced automatic syncing with more flexibility |

| Mobile App Support | Yes (MT4 mobile app) | Yes (MT5 mobile app) |

| Ease of Use | Simple interface, beginner-friendly | Slightly more complex, designed for advanced traders |

| Backtesting Capabilities | Limited | Advanced backtesting with real tick data |

| Network Size (Signal Providers) | 1,000+ traders | 1,000+ traders |

XM copy trading: Pros and cons

- Pros

- Cons

Integration with a leading signal provider. XM collaborates with MQL5, offering access to top trading signals.

Low minimum deposit. You can start copy trading with as little as $5.

Diverse trading instruments. XM provides a wide range of assets, including Forex, CFDs, and commodities.

Strong regulatory framework. XM is regulated in key regions such as the UK, EU, and Australia, ensuring a secure trading environment.

Educational opportunity. By observing the trades of experienced investors, users can gain insights into effective trading strategies and risk management techniques.

Performance variability. The success of copy trading depends on the chosen signal providers. Poor performance by these traders can lead to significant losses for followers.

Limited control. When copying another trader, users have limited influence over individual trade decisions, which may not align with their personal risk tolerance.

Fees. Some signal providers charge performance fees, which can reduce overall profitability.

How to get started with XM copy trading

To begin copy trading with XM, you’ll first need to register an account with the broker and download their trading platform. This guide will walk you through the process using MetaTrader 5 (MT5) as an example, which is currently available only on the desktop version. The setup involves two key steps:

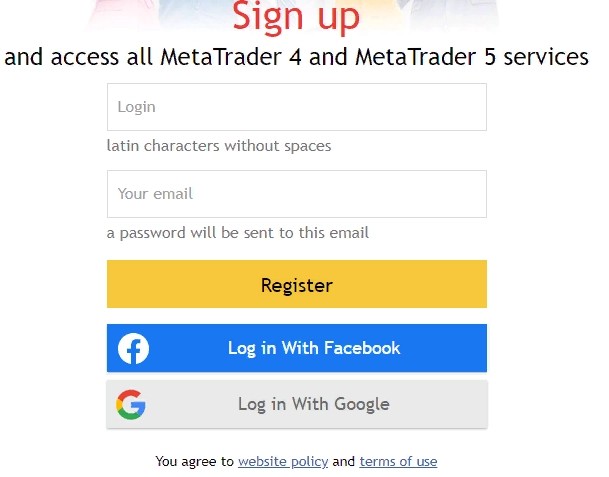

Step 1: Registering with MQL5

Once you’ve opened a trading account with XM, the next step is to sign up for an MQL5 account, as XM’s copy trading service operates through this platform. Registration is straightforward:

Go to the MQL5 website and click the “Create an account” button on the homepage.

Enter your preferred username and email address. You won’t need to create a password manually — MQL5 will send one directly to your email.

Alternatively, you can register using your Facebook or Google account for quicker access.

Step 2: Setting up copy trading on MetaTrader 5

After successfully registering with MQL5, it’s time to configure your MT5 platform:

Log In to MT5: Launch the MetaTrader 5 platform and log in using your XM trading account credentials. Allow a few moments for the platform to synchronize with your account.

Access copy trading signals: In the bottom panel of MT5, click on the “Toolbox” section and select the “Signals” tab. Here, you’ll find a comprehensive list of traders offering copy trading services through MQL5. This same list is also accessible directly on the MQL5 website.

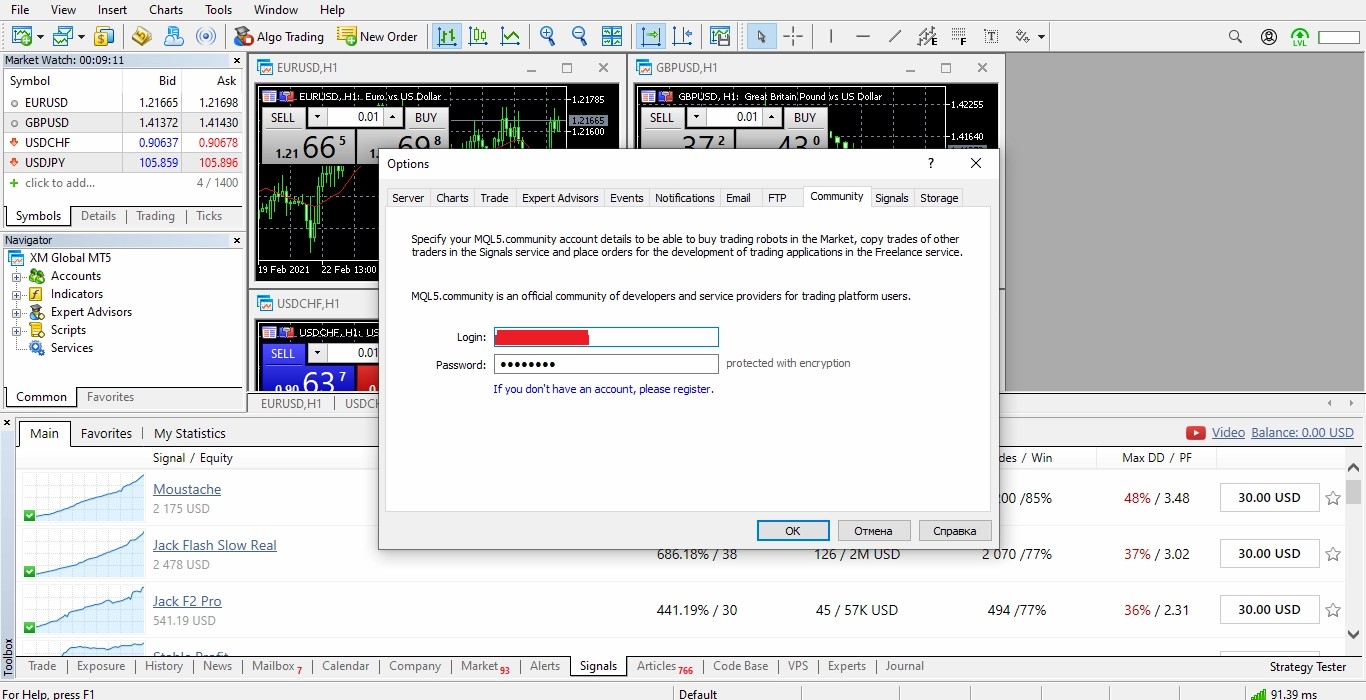

Connect to the MQL5 community: At the top of the MT5 interface, click on “Tools” in the main menu, then select “Options” from the dropdown.

In the Options window, navigate to the “Community” tab.

If you haven’t already registered with MQL5, the platform will prompt you to do so.

If you already have an account, click “If you have an account, please log in.”

Enter your MQL5 login credentials (username and password), then click “OK” or press Enter to confirm.

Once connected, you’ll be able to subscribe to traders, adjust your copy trading preferences, and start replicating trades directly from XM’s MT5 platform.

Can I make money by copying traders on XM?

Copy trading with XM can be profitable. Using the copy trading service, you can earn additional income, but also gain trading experience by watching the trades of qualified traders. The profit amount can vary depending on the risk level of the strategy, your deposit amount, trading style of the trader you are copying.

However, copy trading with XM is not a guarantee of profit. The risks of financial losses also exist. In case of a failed trade of the strategy provider, all his/her subscribers will suffer a loss. In order to avoid critical loss of the deposit, we recommend to be thorough when choosing a trader to copy and observe risk management rules.

How much does XM copy trading cost?

Copy trading on XM is provided for free. There is no additional commission for copying trades. Copy trading is charged with the same commission as traditional trades. For example, if you are copying trades on EUR/USD, the average spread will be 1.7 pips. This is quite a lot.

Strategy providers may charge a commission for copying trades. It is charged as a monthly subscription. The subscription fee ranges from USD 1 to USD 1,000. The average subscription fee is $50 per month. You can also choose traders who provide trades for copy trading for free. To maximize earnings, traders can earn more with the best Forex cashback rebate, which provides cashback on executed trades, effectively lowering overall trading expenses.

Is XM copy trading safe?

XM is regulated by highly respected regulators. The company obtained licenses from the regulators of the UK (FCA), Cyprus (CySec) and Australia (ASIC). The broker also has an offshore license of Belize (IFSC). The numbers of financial licenses are as follows:

Cyprus Securities and Exchange Commission (CySEC): trading point of Financial Instruments Ltd, operating as XM, holds license number 120/10.

Australian Securities and Investments Commission (ASIC): XM is licensed under number 443670.

Financial Services Commission (FSC) of Belize: XM operates under license number 000261/106.

It’s not just about copying, it’s about growing into a skilled trader by absorbing insights

Starting with a small investment is a game-changer in XM copy trading. Many beginners assume they need to put in large amounts to see meaningful returns, but that’s a mistake. By beginning with small, calculated amounts, you can experiment with different strategies, understand how signal providers operate, and learn from mistakes without major financial setbacks. This not only builds confidence but also allows for gradual scaling. A steady approach helps in identifying patterns and trends that many traders overlook when they dive in headfirst with a large capital.

While automation is convenient, traders who interact in forums, ask questions, and analyze why top signal providers make certain decisions gain an edge. This habit transforms passive trading into an educational process. Understanding the rationale behind each trade builds knowledge that can help you transition from a follower to an independent trader. It’s not just about copying, it’s about growing into a skilled trader by absorbing insights from those ahead of you.

Conclusion

In 2025, XM’s Copy Trade service through MQL5 presents a powerful opportunity for both novice and experienced traders to earn money by leveraging the expertise of professional traders. Its seamless integration with the MT4 and MT5 platforms allows for convenient account setup and easy management of copied trades directly from the XM platform. Traders can customize their risk management settings, such as stop loss and take profit levels, to align with their individual strategies.

FAQs

Can I adjust copied trades?

Yes, you can customize copied trades by modifying settings such as take profit and stop loss levels to match your risk preferences.

How can I verify if a trader is authentic?

Review the trader’s performance history, success rate, follower count, and feedback from other users to assess their credibility.

Is there a cost to link MT4/MT5 with MQL5?

No, connecting your MT4 or MT5 account to MQL5 for copy trading with XM is completely free. However, subscription fees for specific traders may apply.

How often are copied trades updated?

Copied trades are executed in real-time, mirroring the trades of the strategy provider without any delays in order placement.

Related Articles

Team that worked on the article

Mikhail Vnuchkov joined Traders Union as an author in 2020. He began his professional career as a journalist-observer at a small online financial publication, where he covered global economic events and discussed their impact on the segment of financial investment, including investor income. With five years of experience in finance, Mikhail joined Traders Union team, where he is in charge of forming the pool of latest news for traders, who trade stocks, cryptocurrencies, Forex instruments and fixed income.

Olga Shendetskaya has been a part of the Traders Union team as an author, editor and proofreader since 2017. Since 2020, Shendetskaya has been the assistant chief editor of the website of Traders Union, an international association of traders. She has over 10 years of experience of working with economic and financial texts. In the period of 2017-2020, Olga has worked as a journalist and editor of laftNews news agency, economic and financial news sections. At the moment, Olga is a part of the team of top industry experts involved in creation of educational articles in finance and investment, overseeing their writing and publication on the Traders Union website.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).