According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $10

- MT4

- MT5

- WebTrader

- 2016

Our Evaluation of YaMarkets

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

YaMarkets is a broker with higher-than-average risk and the TU Overall Score of 4.02 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by YaMarkets clients on our website, Traders Union expert Anton Kharitonov recommends users to consider a more reliable broker with better conditions, as, according to reviews, many clients of this broker are not satisfied with the company’s work.

YaMarkets offers generally favorable trading conditions. It allows traders to work with a wide range of financial instruments and use leverage. Trading is carried out through MT4 and MT5, which are the most popular platforms. There are no artificial restrictions. There is a demo account and four live accounts. You can start with $10, though other currencies are not available. A special advantage is a large number of bonuses and promotions, including rebates from Traders Union (TU). YaMarkets has an excellent copy trading service and an extensive training program for traders of all levels.

Brief Look at YaMarkets

The broker entered the market in 2016. It is headquartered in Saint Vincent and the Grenadines and is regulated by several authorized organizations, including the Financial Services Commission of Mauritius (FSC) and the Vanuatu Financial Services Commission (VFSC). YaMarkets offers four account types and a minimum deposit of $10. CFDs on currency pairs, cryptocurrencies, indices, commodities, and metals are available for trading with the maximum leverage of 1:1000. Trading is carried out through the MetaTrader 4 (MT4), MetaTrader 5 (MT5), and WebTrader platforms. There are several options for depositing and withdrawing funds, such as bank cards, e-wallets, and crypto wallets. The broker has an extensive training program, which even includes its own TV show. YaMarkets constantly holds promotions for traders and partners. Technical support is represented by a call center, live chat, and email. It works 24/5 and is available in several languages.

We've identified your country as

US

We have thoroughly analyzed all companies legally providing trading services in your country and created a ranking of the best ones. Our analysis highlights companies that offer optimal working conditions, uphold a strong reputation, and consistently receive the highest number of positive reviews from traders on our website.

Explore the 5 top-rated companies in

US :

- Four account types, plus a demo account, and instant order execution;

- The minimum deposit is $10, a fee is charged only on ECN accounts, and spreads start from 0 pips;

- The broker offers more than 80 financial instruments and the list is constantly expanding;

- Deposits are made instantly and withdrawal requests are processed on the day of submission;

- Traders can work with leverage, which depends on the asset and account type. The maximum is 1:1000;

- Multilingual technical support works 24/5 and its managers respond promptly;

- The broker has its own copy trading service, which is highly appreciated by experts.

- Ultimate and Standard accounts have rather high spreads;

- If traders are not registered with the broker, they cannot access full training;

- Technical support is available only on weekdays.

TU Expert Advice

Author, Financial Expert at Traders Union

YaMarkets offers a variety of trading instruments, MT4 and MT5 platforms, and four distinct account types, including a demo option. Traders can open accounts with a minimum deposit of $10, and access CFDs on currency pairs, cryptocurrencies, indices, commodities, and metals with leverage up to 1:1000. The platform is complemented by an extensive training program and a copy trading service. Additional perks include bonuses, promotions, and multilingual client support available 24/5.

However, YaMarkets faces some drawbacks. Spreads on Ultimate and Standard accounts can be relatively high, and client support is unavailable during weekends. Additionally, its regulatory oversight does not include Tier-1 authorities, which may concern safety-conscious traders. Overall, YaMarkets may be more suitable for experienced traders who can navigate higher spreads and are not reliant on 24/7 support.

YaMarkets Trading Conditions

| 💻 Trading platform: | MT4, MT5, and WebTrader |

|---|---|

| 📊 Accounts: | Demo, Ultimate, Standard, Royale, and ECN |

| 💰 Account currency: | USD |

| 💵 Deposit / Withdrawal: | Bank cards, e-wallets, and crypto wallets |

| 🚀 Minimum deposit: | $10 |

| ⚖️ Leverage: | Up to 1:1000 for certain assets |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.01 |

| 💱 EUR/USD spread: | 0,1 pips |

| 🔧 Instruments: | CFDs on currency pairs, cryptocurrencies, indices, commodities, and precious metals |

| 💹 Margin Call / Stop Out: | 70%/50% |

| 🏛 Liquidity provider: | No |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Order execution: | Instant execution |

| ⭐ Trading features: |

Four account types; Over 80 financial instruments; High leverage; Services for market technical analysis; Copy trading platform; Extensive educational program |

| 🎁 Contests and bonuses: | Yes |

The minimum deposit is the lowest amount traders can put into their accounts. Of course, they have the opportunity to replenish the balance by a larger amount when desired. The minimum deposit depends on the account type. For example, Ultimate accounts require a minimum deposit of $10, while to trade on ECN accounts not less than $5,000 must be deposited. The maximum leverage of 1:1000 is only available for selected assets. Leverage is determined not only by the asset, but also by the account type. For example, for Standard accounts it is up to 1:500, and the maximum leverage for Royale accounts is 1:300. YaMarkets’ technical support is capable and efficient. It is available 24/5 through three main communication channels.

YaMarkets Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

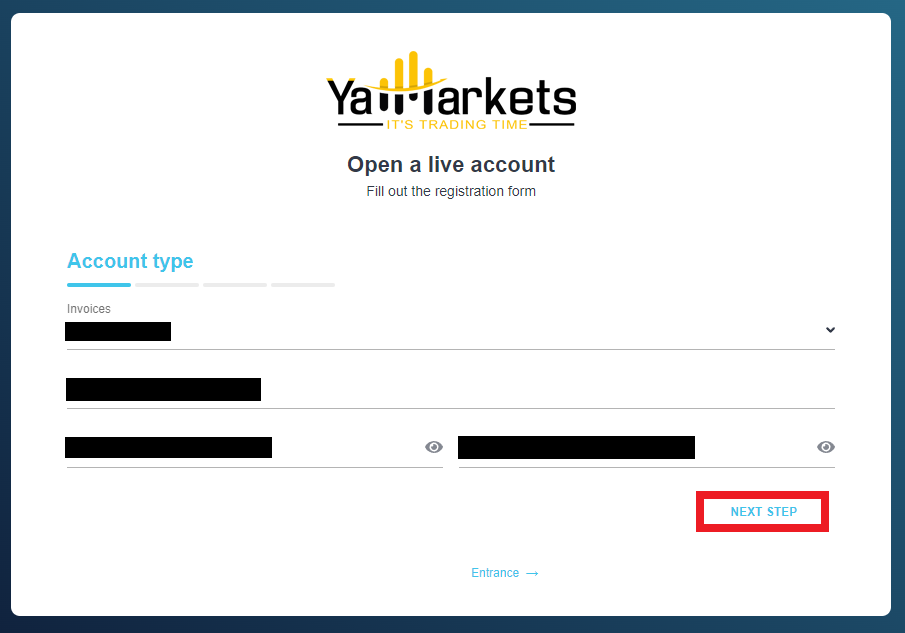

Trading Account Opening

To start trading with YaMarkets, register on its official website, go through verification, and make a deposit, which minimum level is determined by the account you select (no deposit is needed for a demo account). Below is a step-by-step guide to eliminate any questions in the process of registration.

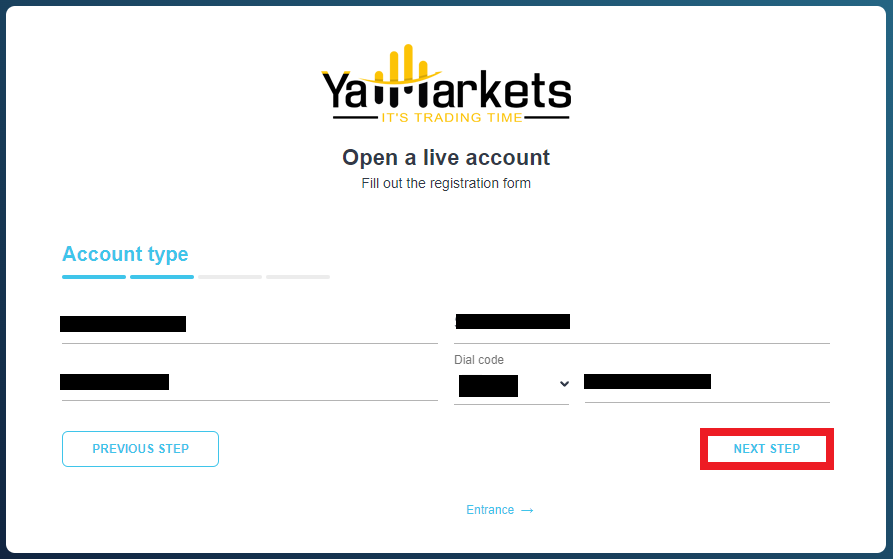

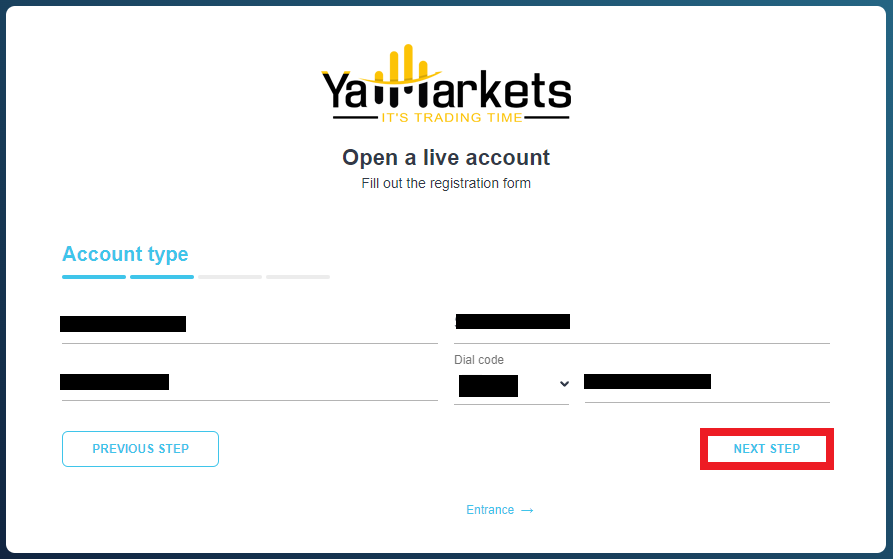

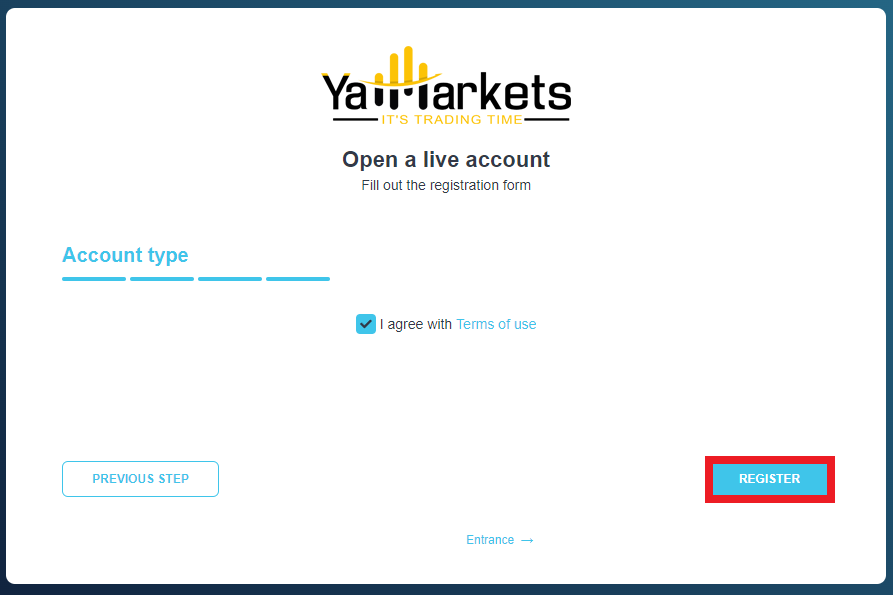

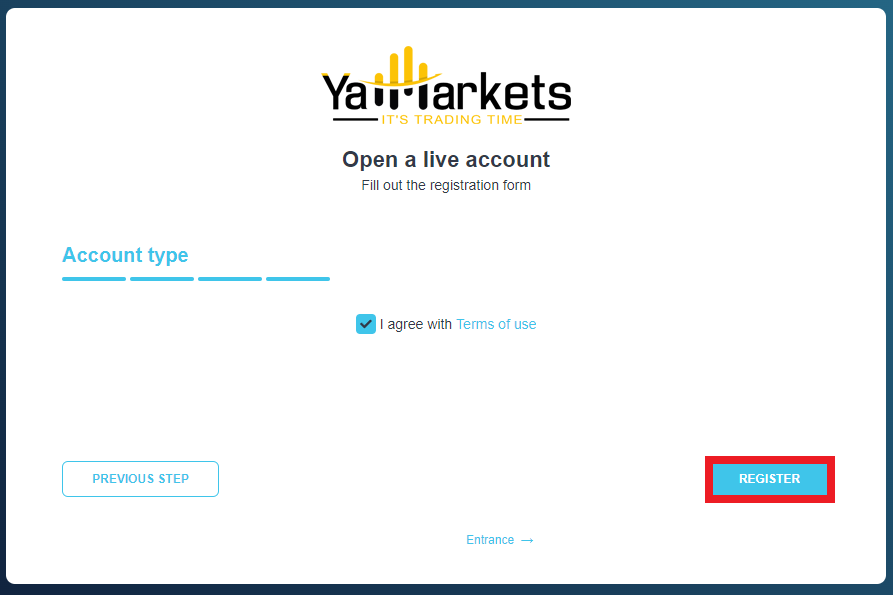

Go to the broker's website, select the interface language in the upper right corner, and click the "Login" button. In the drop-down menu, select the "MT4 Register" or "MT5 Register" button depending on the platform through which you intend to work.

Choose the account type that suits you. Enter your first and last names, email address, and password, which needs to be confirmed. Click the “Next Step" button.

Enter your first and last names again, your date of birth, and your mobile phone number. Click the “Next Step" button.

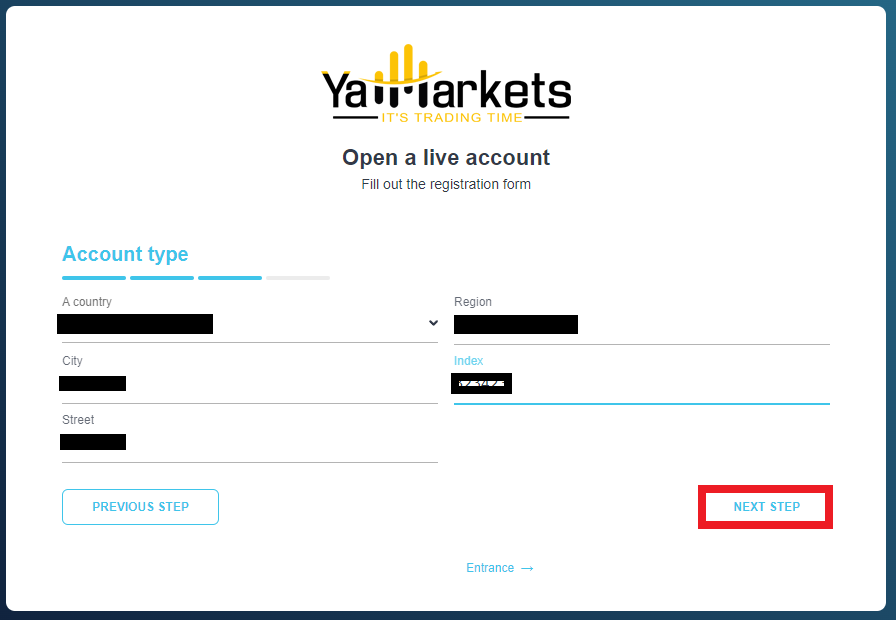

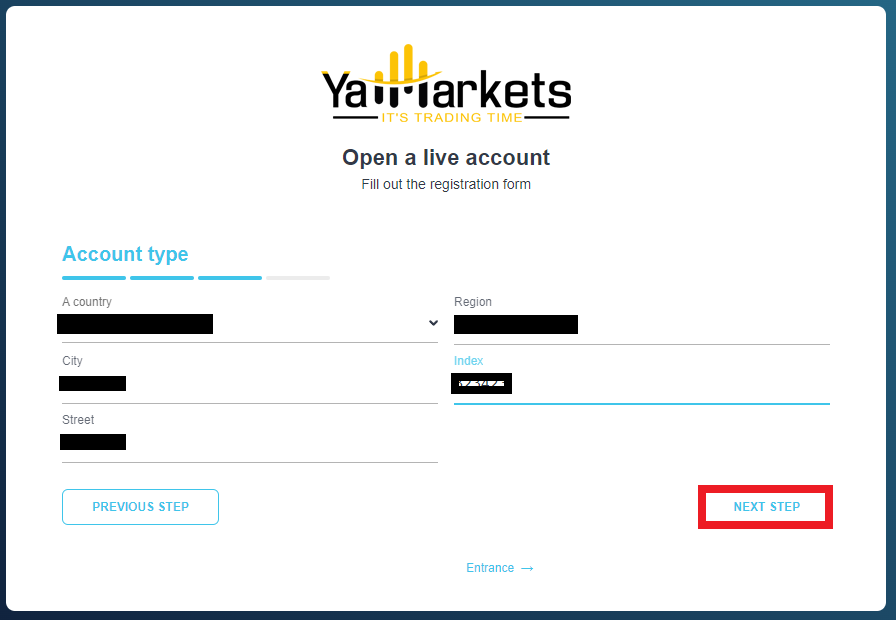

Enter your registration address with the postal code. Click the “Next Step" button.

Agree to the terms of service by ticking the box, then go through the anti-bot check, and click the "Register" button.

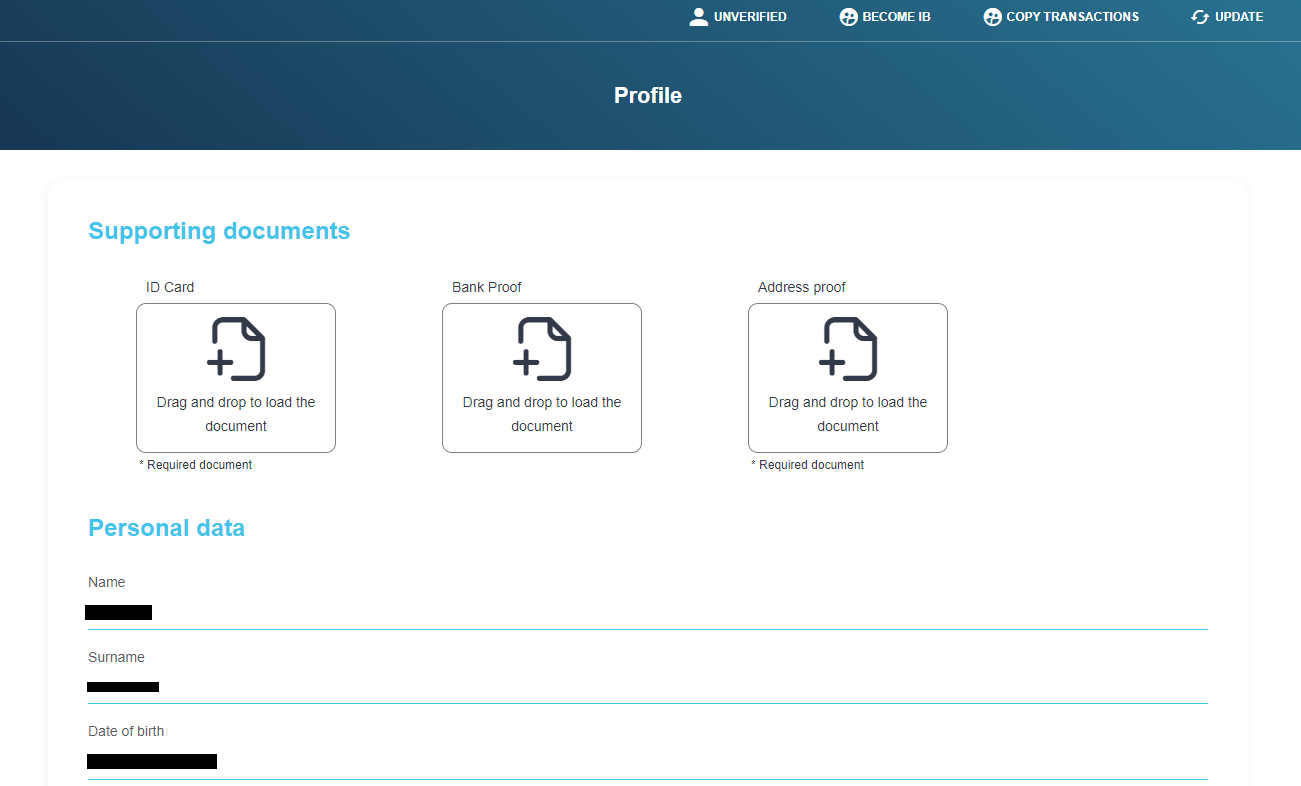

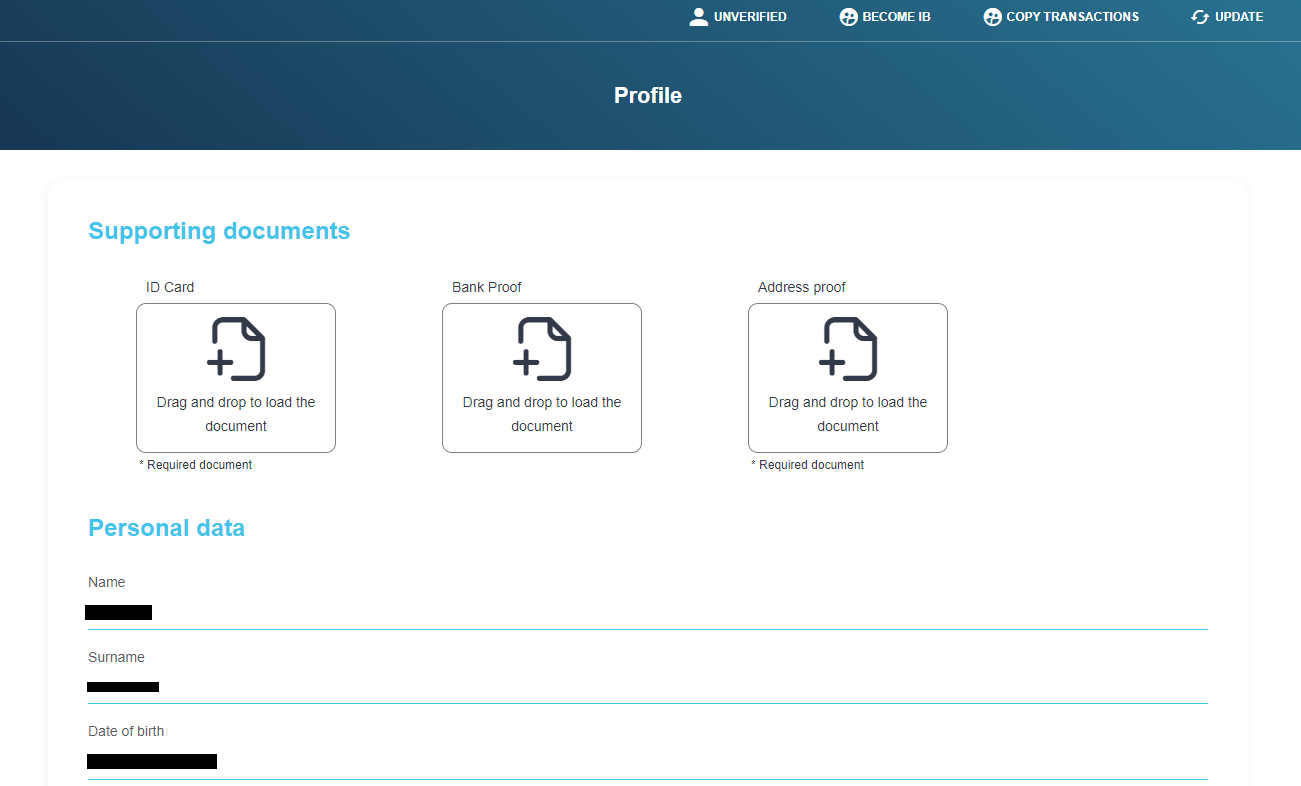

You have registered your user account, but you cannot open a live account until you get verified. Read the pop-up message and proceed to verification, and upload scans or photos of the documents confirming your identity. Check your personal details and address. Enter your bank details and click the "Save" button.

After that, wait for the verification to complete and you will get full access to your user account with the ability to open a trading account.

Features of the user account:

Track the comprehensive statistics on open accounts with detailed parameters;

Access to up-to-date data on deposits, withdrawals, and internal transactions;

Tracking your income from invited referrals and status in the partnership program;

Become a signal provider or join the copy trading service as a regular trader;

Traders can download trading platforms and use technical analysis instruments;

Possibilities to study the materials of the YAM Academy and to apply to technical support;

Correction of registration information and configuring the security settings.

Regulation and safety

YaMarkets has a safety score of 6.9/10, which corresponds to a Medium security level. The safest brokers are those with Tier-1 regulation, a long history (over 10 years in the market), and participation in investor compensation schemes.

- Is regulated

- Negative balance protection

- Track record over 9 years

- Not tier-1 regulated

YaMarkets Regulators and Investor Protection

| Abbreviation | Full Name | Country of regulation | Investor Protection Fund | Regulation Level |

|---|---|---|---|---|

VFSC VFSC |

Vanuatu Financial Services Commission | Vanuatu | No specific fund | Tier-3 |

FSCA SA FSCA SA |

Financial Sector Conduct Authority of South Africa | South Africa | No specific fund | Tier-2 |

FSC (Mauritius) FSC (Mauritius) |

Financial Services Commission of Mauritius | Mauritius | No specific fund | Tier-3 |

SVG FSA SVG FSA |

Financial Services Authority of St. Vincent and the Grenadines | St. Vincent and the Grenadines | No specific fund | Tier-3 |

YaMarkets Security Factors

| Foundation date | 2016 |

| Negative balance protection | Yes |

| Verification (KYC) | Yes |

Commissions and fees

The trading and non-trading commissions of broker YaMarkets have been analyzed and rated as Medium with a fees score of 7/10. Additionally, these commissions were compared with those of the top two competitors, Pepperstone and OANDA, to provide the most comprehensive information.

- Tight EUR/USD market spread

- No inactivity fee

- No deposit fee

- No withdrawal fee

- Above-average Forex trading fees

Trading Fees and Spread

Below, we evaluated and compared the trading commissions of YaMarkets with those of two competitors. We focused on the spreads and other transaction fees directly associated with executing trades (e.g commission per lot on an ECN account). This comparison aimed to provide a clear understanding of the cost efficiency of each broker.

Standard Account Spread

For Standard accounts, YaMarkets’s commissions are part of the floating spread, which varies with market conditions. Typical values are provided, but during high volatility, the spread may exceed these.

YaMarkets Standard spreads

| YaMarkets | Pepperstone | OANDA | |

| EUR/USD min, pips | 0,5 | 0,5 | 0,1 |

| EUR/USD max, pips | 1,5 | 1,5 | 0,5 |

| GPB/USD min, pips | 0,7 | 0,4 | 0,1 |

| GPB/USD max, pips | 1,8 | 1,4 | 0,5 |

RAW/ECN Account Commission And Spread

The spread on ECN/RAW accounts is market-based and fluctuates, with average values given during active hours. It may vary during volatility spikes. A commission per lot is also charged.

YaMarkets RAW/ECN spreads

| YaMarkets | Pepperstone | OANDA | |

| Commission ($ per lot) | 3,5 | 3 | 3,5 |

| EUR/USD avg spread | 0,1 | 0,1 | 0,15 |

| GBP/USD avg spread | 0,15 | 0,15 | 0,2 |

Non-Trading Fees

We conducted a detailed analysis of the non-trading fees associated with YaMarkets. This review offers a comprehensive overview of the additional costs that may impact traders beyond regular trading activities.

YaMarkets Non-Trading Fees

| YaMarkets | Pepperstone | OANDA | |

| Deposit fee, % | 0 | 0 | 0 |

| Withdrawal fee, % | 0 | 0 | 0 |

| Withdrawal fee, USD | 0 | 0 | 0-15 |

| Inactivity fee ($, per month) | 0 | 0 | 0 |

Account types

As a rule, the account type is of primary importance, because it determines the basic trading conditions. In addition to a demo account, YaMarkets offers Ultimate, Standard, Royale, and ECN live accounts. The last of these has characteristics that are common to all accounts using the Electronic Communications Network (ECN). Ultimate accounts have a low entry threshold and are more suitable for novice traders. Standard accounts are the most universal in terms of trading conditions and have moderate leverage. Royale, in accordance with its name, is designed for professionals. It has a fairly high initial deposit, but it also offers the most extensive opportunities.

Account types:

Traders work on the MT4, MT5, or WebTrader platforms, which can be downloaded from the broker's website. A demo account is also available for MT platforms.

Deposit and withdrawal

YaMarkets received a Low score for the efficiency and convenience of its deposit and withdrawal processes.

YaMarkets offers limited payment options and accessibility, which may impact its competitiveness.

- Low minimum withdrawal requirement

- No withdrawal fee

- Minimum deposit below industry average

- No deposit fee

- Wise not supported

- USDT payments not accepted

- No bank wire option

What are YaMarkets deposit and withdrawal options?

YaMarkets offers a limited selection of deposit and withdrawal methods, including Bank Card, Skrill, Neteller, BTC. This limitation may restrict flexibility for users, making YaMarkets less competitive for those seeking diverse payment options.

YaMarkets Deposit and Withdrawal Methods vs Competitors

| YaMarkets | Plus500 | Pepperstone | |

| Bank Wire | No | Yes | Yes |

| Bank card | Yes | Yes | Yes |

| PayPal | No | Yes | Yes |

| Wise | No | No | No |

| BTC | Yes | No | No |

What are YaMarkets base account currencies?

A wide range of base account currencies minimizes the need for currency conversion, potentially reducing transaction costs for clients worldwide. YaMarkets supports the following base account currencies:

What are YaMarkets's minimum deposit and withdrawal amounts?

The minimum deposit on YaMarkets is $10, while the minimum withdrawal amount is $1. These minimums may vary depending on the chosen account type and payment method. For specific details, please contact YaMarkets’s support team.

Markets and tradable assets

YaMarkets offers a limited selection of trading assets compared to the market average. The platform supports 150 assets in total, including 50 Forex pairs.

- 50 supported currency pairs

- Indices trading

- Crypto trading

- Futures not available

- Bonds not available

Supported markets vs top competitors

We have compared the range of assets and markets supported by YaMarkets with its competitors, making it easier for you to find the perfect fit.

| YaMarkets | Plus500 | Pepperstone | |

| Currency pairs | 50 | 60 | 90 |

| Total tradable assets | 150 | 2800 | 1200 |

| Stocks | No | Yes | Yes |

| Commodity futures | Yes | Yes | Yes |

| Crypto | Yes | Yes | Yes |

| Stock indices | Yes | Yes | Yes |

| Options | No | Yes | No |

Investment options

We also explored the trading assets and products YaMarkets offers for beginner traders and investors who prefer not to engage in active trading.

| YaMarkets | Plus500 | Pepperstone | |

| Bonds | No | No | No |

| ETFs | No | Yes | Yes |

| Copy trading | No | No | Yes |

| PAMM investing | No | No | Yes |

| Managed accounts | No | No | No |

Customer support

Technical (client) support is necessary in case of situations that traders cannot handle on their own. Such situations will arise in any case, regardless of the experience of a trader, the quality of the FAQs, and the intuitiveness of the website interface. At YaMarkets, technical support can be reached by phone, email, live chat, WhatsApp, or social networks. All communication channels are available 24/5, that is, they work around-the-clock on weekdays but do not work on weekends.

Advantages

- Non-clients of the broker can contact technical support

- Support is available in several languages

- On weekdays support works 24/7

Disadvantages

- Technical support is not available on weekends

To contact technical support, use the following communication channels:

-

call center;

-

WhatsApp;

-

email;

-

live chat on the website and in the user account;

-

tickets on the page.

The broker has its official profiles on many social networks, such as Facebook, Instagram, YouTube, etc. It is recommended to subscribe to them to keep up-to-date with the latest news.

Contacts

| Foundation date | 2016 |

|---|---|

| Registration address | Suite 305, Griffith Corporate Centre, Kingstown, P.O. Box 1510, Beachmont, Kingstown, St. Vincent and the Grenadines |

| Official site | http://yamarkets.com/ |

| Contacts |

+357 22030234

|

Education

It is important for traders not only to stay in trading shape, but also to follow the market, and improve their own skills. Some brokers help their clients by offering educational programs. Often these are just sets of specialized materials, but sometimes, as in the case of YaMarkets, it is a complete system. The broker provides blog articles, selections in the educational center, video tutorials, and full-fledged TV shows conducted by the broker’s experts. Most of the information is available only after registration and verification on the website.

As you can see, the broker tries to cover most of the issues for its traders by offering an impressive amount of expert training materials. The YAM Academy is constantly evolving and expanding.

Comparison of YaMarkets with other Brokers

| YaMarkets | Bybit | Eightcap | XM Group | RoboForex | VT Markets | |

| Trading platform |

MT4, MT5, WebTrader | MetaTrader5 | MT4, MT5, TradingView | MT4, MT5, MobileTrading, XM App | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | MetaTrader4, MetaTrader5, VT Markets App, Web Trader+ |

| Min deposit | $10 | No | $100 | $5 | $10 | $50 |

| Leverage |

From 1:1 to 1:1000 |

From 1:1 to 1:500 |

From 1:30 to 1:500 |

From 1:1 to 1:30 |

From 1:1 to 1:2000 |

From 1:1 to 1:500 |

| Trust management | No | No | No | No | No | Yes |

| Accrual of % on the balance | No | No | No | No | 10.00% | No |

| Spread | From 0 points | From 0 points | From 0 points | From 0.8 points | From 0 points | From 0 points |

| Level of margin call / stop out |

70% / 50% | No / 50% | 80% / 50% | 100% / 50% | 60% / 40% | No / 50% |

| Order Execution | Instant Execution | Market Execution | Market Execution | Market Execution | Market Execution, Instant Execution | Market Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | No | No | No | Yes | No |

Detailed review of YaMarkets

YaMarkets works with traders worldwide, with subsidiaries in various regions. For example, in Dubai the company is registered under the name YAM Technology. However, the accounts support only one currency and it is the USD. This means that deposits in other currencies will be automatically converted at the market rate. YaMarkets has gained wide popularity due to favorable trading conditions. Its training program was compiled by experts and professional traders. It is well structured, includes only useful materials, and is interesting for traders with any experience. Another advantage is its own copy trading service, as not every broker has one. YaMarkets allows you to use bots and advisors, hedge, and trade news. Traders are not limited in choosing a strategy.

YaMarkets by the numbers:

-

80 trading instruments;

-

The minimum deposit is $10;

-

It takes 5 minutes to open an account;

-

Spreads start from 0.1 pips.

YaMarkets is a broker for independent trading and copy trading

An important advantage of the broker is a wide range of financial instruments. Not all brokers allow you to trade currencies, cryptocurrencies, indices, precious metals, and commodities. The more assets traders can use, the less they limit themselves, and the wider are their opportunities to diversify risks. In this aspect, YaMarkets demonstrates strong competition. The referral program is not considered as the option for passive income, because in order to receive significant referral bonuses, it is necessary to be highly active on the network. The copy trading service can be defined as an investment option, despite the increased risks, because traders do not trade on their own. In fact, signal providers trade for them.

Useful services offered by YaMarkets:

-

Copy trading. The broker offers an integrated platform where traders can register as signal providers or investors. The program is 100% transparent, and fees are low;

-

Education. It is one more built-in service that includes text and video materials on trading theory. Full training is available only to registered users;

-

Instruments for technical analysis. There is a wide range of practically useful services, such as an economic calendar and expense calculator. They help traders simplify routine operations.

Advantages:

Traders can open a live account of one of four types and each of them is optimal in a particular situation;

Assets from all major groups are presented, which allows traders to use different strategies and diversify their portfolios;

Traders can receive additional income by participating in the referral program and inviting new users;

The copy trading service makes it possible to earn almost passively by investing in signal providers;

Traders pay spreads. Trading fees are charged only on ECN accounts, there are no other trading fees;

A withdrawal application can be submitted at any time, it is processed on the same day, unless it is submitted during non-working hours;

To deposit and withdraw funds almost any channel is available, including bank cards and e-wallets.

Another advantage is technical support. It is multilingual, represented by several communication channels, and works 24/5.

Latest YaMarkets News

Articles that may help you

Check out our reviews of other companies as well

User Satisfaction i