Will EUR go up or down in coming days?

The reasons for the fluctuation of the euro’s value up and down lie in the imbalances of supply and demand, which arise from various drivers. These drivers may have different natures, and to form your forecast regarding the rise or fall of the EUR, you need to try and consider as many of them as possible. The most important ones are described below.

Fundamental drivers of the EUR price change

Fundamental drivers of the EUR price change may be:

-

Scheduled events;

-

Unscheduled events.

Scheduled events

Typically, these are releases of economic news, press conferences of governors of central bank, etc. Such events, including the timing of their release, as well as the degree of their influence on the EUR exchange rate, can be found in special economic calendars. Being aware of upcoming events and expectations associated with them is extremely important for forecasting the EUR exchange rate for the coming days.

You can familiarize yourself with upcoming events here: Forex Economic Calendar.

The most important events that affect the direction of the EUR price movement – up or down – are:

-

News from the ECB. Decisions on changes in interest rates, press conferences by the ECB President and other top officials regarding monetary policy – such events occur practically every month.

-

Inflation news. The most significant for market participants in the Eurozone are the publications of German Prelim CPI values.

-

Publication of PMI values. Purchasing Managers' Index for France and Germany (+ ZEW Economic Sentiment Index) is published at the end of each month and has a noticeable impact on the rise or fall of the EUR.

-

Basic dollar statistics - CPI, PPI, GDP, NFP, Industrial production, retail sales.

-

Other scheduled events. Publication of GDP values, election results, labor market news, financial forums.

-

Force majeure - emergencies, natural disasters, man-made disasters, terrorist attacks, epidemics.internal political instability (as an example - Brexit).

Usually, if the news forecasts are far from the facts, this leads to stronger volatility spikes; the EUR may depreciate or appreciate very strongly – both in the first minutes after the event and during the trading session, or even several.

Unscheduled events

These include natural disasters, terrorist attacks, military actions, unexpected statements by politicians and other influential figures, various crises. The economic calendar does not include all events that can cause the EUR to rise or fall.

A vivid example is the events of spring 2020.

Weekly EUR/USD chart

Coronavirus-related panic had a strong impact on the EUR exchange rate: following a volatility spike, the trend reversed from bearish to bullish.

This example highlights the importance of traders staying informed about various events that can impact the currency market. If there are no important fundamental drivers on the agenda, it increases the chances that the value of the EUR will not change significantly.

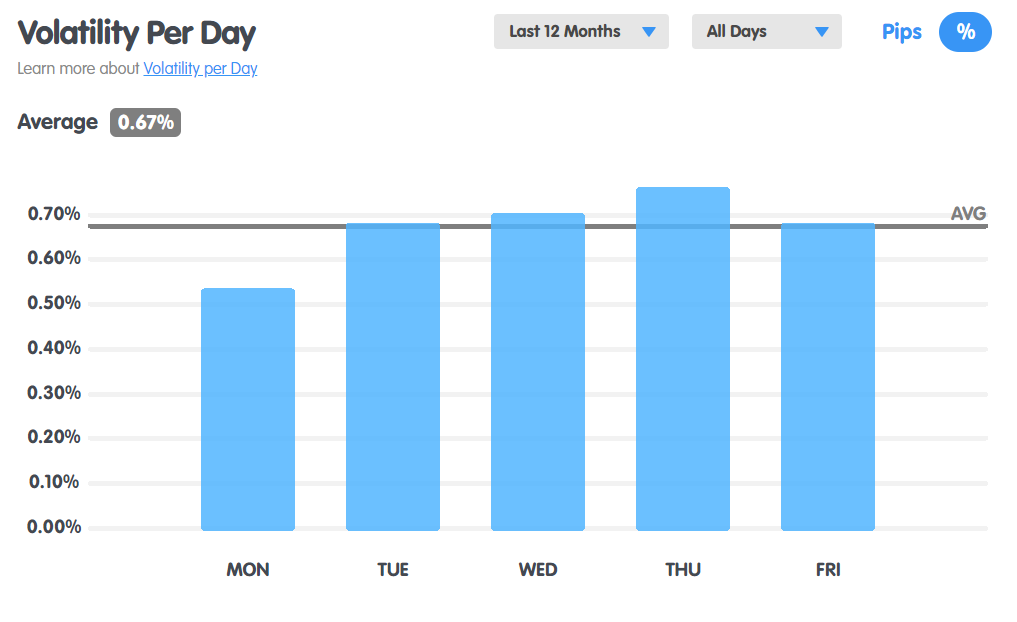

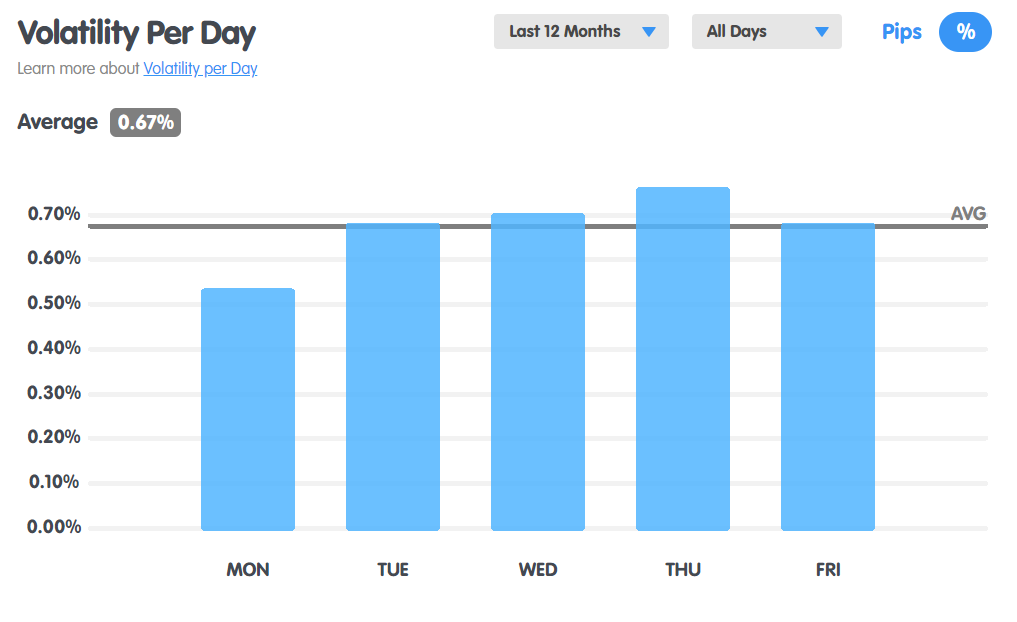

Volatility of EUR/USD by days of the week

The average change of the EUR price against the USD is 0.67% per day. According to statistics, the probability of the EUR price increasing or decreasing is:

-

Highest on Thursday. On this day, important news is most often published;

-

Lowest on Monday. This is partly due to the fact that Mondays often coincide with additional days off.

Technical drivers of the EUR price change

Technical analysis drivers include:

-

Support and resistance levels. The EUR price may bounce (reversal). Or break out, potentially starting a significant trend;

-

Trend lines and channels. They are applicable to any timeframe. When building trend channels, pay attention to its median line, which helps to construct the channel more accurately;

-

Chart patterns. An important formation is the triangle, which can have various configurations, as a triangle usually indicates consolidation, and a triangle breakout is a potential signal of a new trend;

-

Indicator patterns. Usually, using only well-known indicators, such as RSI, MACD, Moving Averages, and others, cannot provide a competitive advantage. But they can be used as a component of a trading system, for example, for entering a trade or managing a stop-loss;

-

Candlestick patterns. Examples can be found here: 20 Best Candlestick Patterns To Learn

-

Other patterns. For example, from volume analysis. Or from the Elliott Wave Theory.

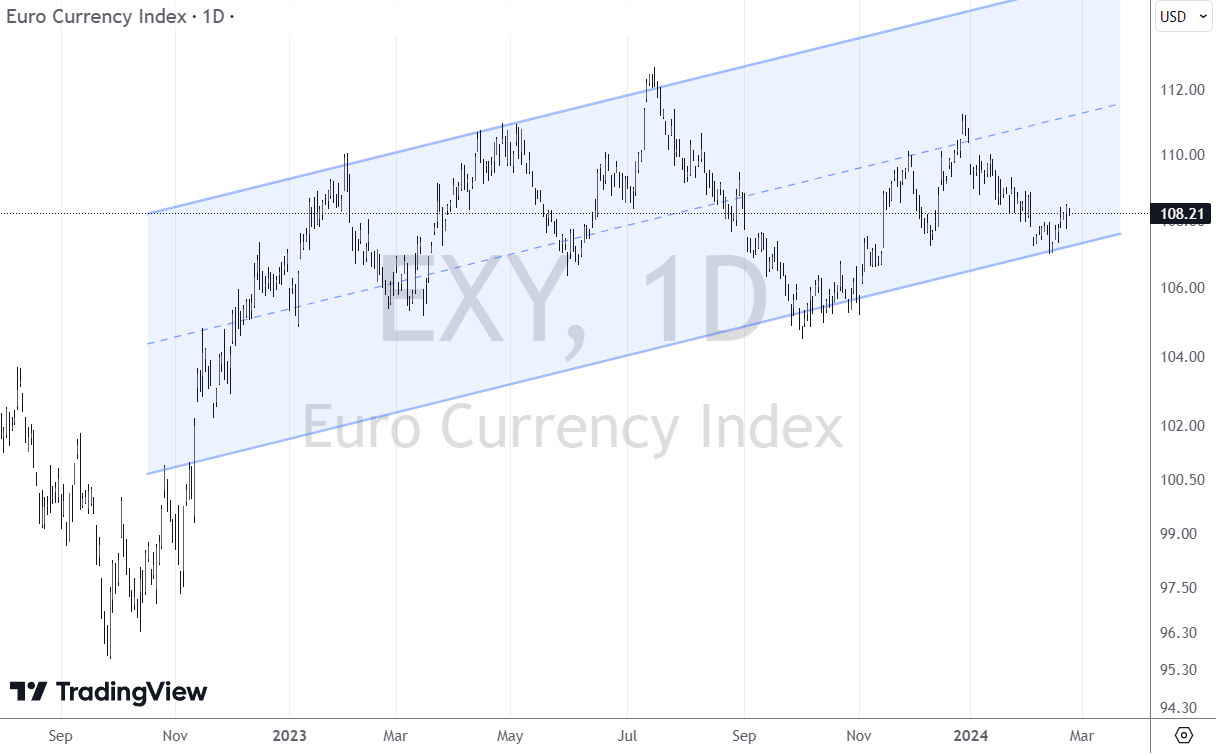

The chart below shows how effectively technical analysis tools can be used in forecasting the EUR exchange rate.

EUR/USD Chart

Suppose we are at the end of the day indicated by the arrow. How can we understand what will happen next? Will the EUR rise or fall? To do this, pay attention to the price action, namely:

-

The price reacted in the past to the level of 1.07250;

-

The price attempted a bearish breakout;

-

However, after the attempt at a bearish breakout, 2 bullish candles formed, with the second one much larger. This means that bulls are strengthening their dominance.

Therefore, the main assumption about the price action in the coming days should be a forecast with the strengthening of the EUR above the level of 1.07250.

To increase the probability of success of your forecasts on the price of the euro in the short and long term, combine fundamental and technical analysis.