Crypto Trading in the UK - Is it legit? Is it Taxable?

Bybit - Best crypto exchange for 2025 (UK)

The growing popularity of cryptocurrency is no longer just in the United States and Canada. It has made its way to Europe, too, specifically the United Kingdom.

Being relatively new, though, its relation with regards to paying taxes is still unclear. Many countries, even, are still regularly updating their policies in hopes of finding a win-win situation between themselves, and crypto investors.

Today, we would like to provide greater clarity by sharing the most recent updates on this matter. In this article, we’ll answer all your pressing questions about its legality, taxability, how crypto investing works, the process of paying taxes, and plenty more.

Start trading cryptocurrencies right now with Binance!What is Crypto Trading?

This probably isn’t the first time you came across this term. Crypto Trading has been around since 2009, and is defined as the act of buying or selling of digital currency across an online platform. Traders purchase them when their value is low, hold onto it for a certain period, and then sell at a profit.

Many traders have preferred crypto over other kinds of assets because of their earning potential. More and more types are getting introduced into the market, which gives you new opportunities to invest in case the last one has already reached its peak.

To give you a better and more detailed understanding, here’s a quick pros and cons list when trading with cryptocurrency.

👍 Pros

• High potential for earning

•Several types of crypto available

• Low transaction or processing fees when trading on platforms

• Incredibly accessible to beginners

👎 Cons

• Not regulated in a lot of countries

• Prone to hacking since everything is on a digital landscape

•Very volatile peaks and valleys

Cryptocurrency Regulation in the UK

As of this writing, cryptocurrency is not currently regulated in the United Kingdom. This doesn’t make it illegal to trade, though; just that it isn’t covered by any existing laws. So should something unfortunate happen to your crypto savings, like a cyber-attack, you cannot file any corresponding charges.

Unfortunately, according to the Financial Conduct Authority (FCA), more than 69% of young traders aren’t aware of this risk. They enter into these transactions out of naivete, misinformation, or worse, fueled by competition with friends.

This has led the FCA to release a strongly-worded statement in January of 2023, warning everyone that those who choose to invest in crypto “must be prepared to lose the full amount of their investment”. Unsurprisingly, the Bank of England shares a similar sentiment, reminding investors that while 0.1% of all UK household’s wealth was in cryptocurrency, theoretically, it could lose all its value at a moment’s notice.

Both these financial institutions, however, are slowly accepting that digital currency is here to stay. On their end, they have begun making a conscious effort to monitor transactions, jumpstarted dialogues with different crypto exchange platforms, and commenced crafting different guidelines. All this is designed to minimize the risk that investors take when entering into these types of transactions.

Furthermore, in hopes of creating more transparency, Binance UK is requiring all users to provide additional information when accessing its services. Particularly when trading Futures, Margins, Leverage Tokens, and Options. Failure to comply would mean their access will be temporarily restricted.

This - among others - is just an example of some restrictions currently being implemented in the UK. Hopefully, investors gain more clarity, and inch closer towards a mutually-beneficial situation between themselves and the government.

What is Crypto Tax in the UK?

Like most countries, there is no specific crypto tax. Instead, traders are responsible for declaring their earnings either in the form of income or future gains. This will greatly depend on how it was obtained, so let’s differentiate the two terms, shall we?

Income Tax vs. Capital Gains Tax

According to UK tax laws, income is defined as receiving payment in exchange for a product or service. This includes profit earned from mining tokens, staking rewards, and engaging in play-to-earn platforms like Odysee or Axie Infinity.

Decentralized Finance (DeFi), an emerging financial technology entity, has also recently released other money-earning situations that must be classified under income. This consists of interest earned through yield farming, crypto dividends, and liquidity pools.

On the other hand, capital gains happen when selling, spending, trading, or gifting digital currency at a higher value. Of course, only your earnings are taxable. For example, you bought Bitcoin at £10,000, held it for ten years, and sold it at £50,000. You only have to pay a percentage of the £40,000 to the government.

Tax Rates in the UK

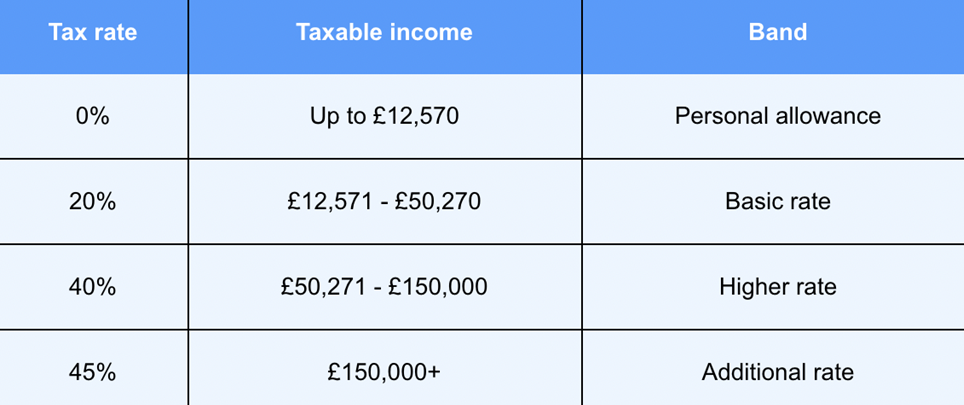

Now that we’ve carefully defined those two terms, let’s now discuss the tax rates. Typically, taxpayers fall under different categories, depending on the size of their annual earnings. Each one has a corresponding percentage that is collected from them for various government and economic initiatives.

Here’s a quick breakdown.

Income tax is computed as such. Earning between £12,571 and £50,270, will require you to pay 20% income tax; 40% for those earning between £50,271 and £150,000 on a yearly basis; and 45% for anyone with an annual income of more than £150,000.

The UK government also grants a tax exemption (or as they call it, personal allowance benefit) for anyone earning £12,570 or less. They probably considered a person’s average monthly expenses and cost of living when implementing this ruling.

Photo: Tax rates in the UK

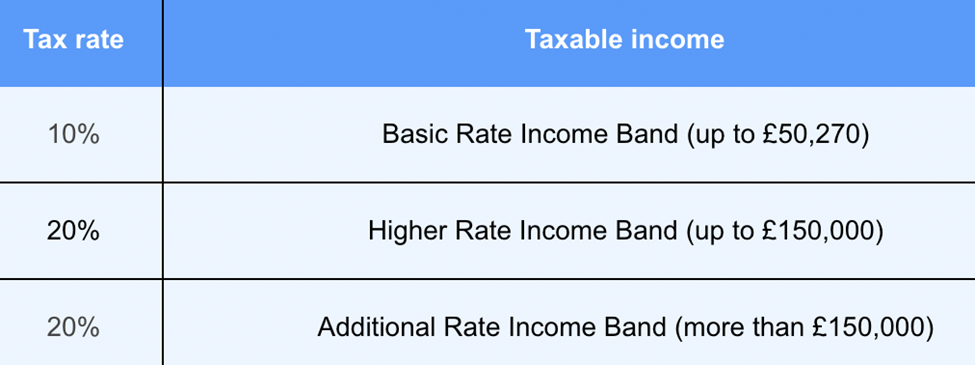

In contrast, capital gains tax is computed quite differently. For starters, it collects a small percentage, as well as has less categories. There is also no threshold extended because it assumes you have other streams of income for your day-to-day expenditures.

Photo: Tax rates in the UK

Basically, anyone with a capital gain of up to £50,270 is required to pay 10% tax, while those earning beyond that will be charged 20%.

Now, knowing the difference between the two will be crucial to maximizing your profit. If you know that income tax charges a much higher yield, you may choose to focus on selling and trading crypto instead, especially if you have other existing sources of income.

Sharing Trader Information

Of course, we would always recommend that you declare that correct amount of income and capital gains when filing your taxes. Otherwise, you might end up facing several counts of tax evasion or money laundering.

One thing you ought to know, though, is that since UK regulations on crypto are still very unclear, they have started to coordinate with trading platforms and various brokers. In the process, each side is sharing transaction details and trader information, in hopes of better understanding trends and patterns.

Although this is definitely a step in the right direction, investors not properly reporting their taxable income might be placed in a tough situation, and will have to adjust all strategies moving forward to avoid any run-ins with the law.

Best Place to Buy Bitcoin in the UKCan I Day Trade Cryptocurrency?

Among the many different types of trading, day trading perhaps offers the least amount of risk. And in an industry that already has its fair share of volatility, this is a perfect starting point for beginners with limited experience and minimal capital.

Day trading is defined as the buying and selling of assets within a single day. This means that these are considered short-term investments, where you can buy crypto when its value is low, and then sell as it increases. In order to do this, though, careful monitoring of trends and projections, flexibility, and attention-to-detail is needed.

Currently, several cryptocurrency exchanges offer access to this. Just make sure to devote enough time in your daily routine for this endeavor.

Later on in this article, we’ll help you decide among the different trading platforms available for beginners, depending, of course, on your current needs and requirements.

How Can I Trade in the UK?

If you are a beginner unsure of where to start your journey in crypto trading, we recommend checking out the following avenues. Although these aren’t yet fully regulated in the UK, each one does come with its own set of rules that protect your vested interests.

Moreover, most, if not all, have several years of experience under their belt. So when conducting a background check, you’ll immediately have resources like customer reviews, case studies, and even legal documents, which should help you when deciding what to use.

In this section, allow us to go through the top three methods to trade cryptocurrency in the United Kingdom.

Crypto Exchanges

We’ve already touched on this a bit earlier, but crypto exchanges are businesses that provide traders with a platform to buy and sell virtual currency. On it, you can keep track of how much money you invested or converted, your earnings, the daily trends in the market, and a lot more useful information. Some even have training modules available, which can give you a deeper insight into this industry.

All it takes to begin is to create an account. Typically, there’s no added cost for this. You’ll just need to link an existing bank account, credit card, or payment gateway. This is used when depositing or withdrawing money.

These are arguably the most popular way to trade crypto in the UK. One reason is that crypto exchanges are really user-friendly. Their dashboard is accessible through a web or mobile application, which means you can monitor everything from virtually anywhere.

Contract for Difference (CFD) Brokers

For interested traders without much time to spare, securing the services of a CFD broker could be a viable alternative. Since they serve as intermediaries between lay investors and the financial market, you can invest money in their day-to-day goings. All you have to pay is a commission.

Collaborating with a CFD broker won’t be as simple as transacting through a phone. Everything passes through online platforms where their terms, conditions, and charges are all carefully discussed. If you agree with all that, then signing up is the next step.

Although this may seem so simple, your success (and ultimately, profitability) will depend greatly on who you decide to invest in. As such, thorough research and careful analysis of a broker's track-record, risk appetite, and success rate is required.

Regulated Stock Brokers Offering Crypto

The third option we’d like to discuss is a regulated stock offering offering crypto trading services. While they don’t just focus on transacting with digital currency, generally speaking, these entities have been around for longer, and boast of a more extensive portfolio.

I would say the only difference between this and crypto exchanges is their product listings. If you’re really serious about investing and see it as a viable career path, then we propose signing up for this. You’ll have more on your plate to learn, but also far greater opportunities.

However, if you want to focus solely on cryptocurrency, then a crypto exchange is best, at least at the beginning.

How to Start Trading Crypto in the UK - A Step by Step Guide

If you have already decided to try crypto trading, congratulations. In order to get you started, here’s a quick step-by-step guide that should help make this process a whole lot easier.

Step 1 - Choose a UK Regulated Trading Platform

We’ve already set forth three options for you to choose from. What’s important when selecting a specific medium is making sure it’s regulated by the UK government. This will, at least, give you greater peace of mind about its credibility.

As you do this, make sure to also evaluate its different features, and match it with your current needs. This can be done through visiting their website, reading customer feedback on social media, and researching their previous transactions.

Learn about Top 8 Best Trading Apps in the UK (2024)Step 2 - Start with Minimal Investment

Once you’ve already signed up on a trading platform, the next step is determining how much your initial investment will be. Some people may tell you to be aggressive and decide depending on the current market value. But for us, we recommend starting based on what you are comfortable with.

Since crypto trading is still very volatile, losing money is a very real possibility. Invest a minimal amount first and see how that goes. Then, when you’ve gotten the hang of things and feel more comfortable, you can always add more.

Step 3 - Test Your Strategy

Unfortunately, there isn’t a single proven strategy to achieve success in crypto trading. For many, experience has been their most effective mentor. Learning things on a first-hand basis has allowed many traders to find a strategy that works for them.

For beginners, testing out different plans of action is recommended. Don’t be scared to employ new ways of doing things. What’s important is to always evaluate your moves and keep improving, until you find a routine that’s effective.

Step 4 - Learn, Learn, and Learn

To build on what we shared last, crypto trading is a learning experience. If at first you don’t succeed, just keep trying. Remember, you shouldn’t compare your performance to other people, just to yourself a day before.

Best Crypto Trading Platforms in the UK

We’ve also compiled a list of the best crypto trading platforms, currently available in the UK. Here are some of their best qualities.

Unlike other trading platforms, Coinbase has been in operations for nearly a decade. In that time, they have amassed a wide portfolio. Besides that, here are other important features:

Local Regulation - Ongoing agreement with the UK FCA

Platform - Can be accessed easily either through a web or mobile app

Accounts for Beginners - Offer both a trial and paid version

Trading Fees - Quite high when compared to other platforms

Opportunities for Passive Earnings - Allow copy trading

Crypto Education - Don’t offer reliable support for beginners

Photo: Coinbase

eToro (Best for Crypto Copy Trading)

eToro is arguably the most popular investment website around. One of the reasons is how well they reach out to clients, offering innovative tools that help make trading more fun and profitable. It’s an ideal option for newbies with no prior experience.

Local Regulation - Yes, regulated in the UK

Platform - Very easy to understand, learn, and navigate around

Accounts for Beginners - all eToro accounts are free from any charge

Trading Fees - Affordable given the level of service it offers

Opportunities for Passive Earning - One of the best copy trading features around

Crypto Education - Has several tools, but overall quality can still be improved

Photo: eToro

FXTM (Best CFD Broker)

When selecting a CFD brokerage to partner with, FXTM instantly comes to mind. It is one of the safest trading platforms around, having been regulated in several countries worldwide.

Local Regulation - Yes, regulated by top authorities in the UK

Platform - Generally usable, but the design and layout could use some work

Accounts for Beginners - None for beginners, but have three accounts to choose from

Trading Fees - Quite high for CFD

Opportunities for Passive Income - Not so reliable

Crypto Education - Amazing tools for learning are available

Photo: FXTM

Interactive Brokers (Best Crypto Broker)

If you’re looking for a global entity to partner with, Interactive Brokers is simply one of the best. They are present in 33 different countries, have introduced state-of-the-art tools, and can cater to virtually anyone in the world.

Local Regulation - Regulated in the UK (among others)

Platform - Professionally designed, but seems better suited for seasoned traders

Accounts for Beginners - Offer a free trial with minimal fees

Trading Fees - Quite low and very affordable

Opportunities for Passive Income - None

Crypto Education - Training tools are informative and relevant

Photo: Interactive Brokers

How Much Can I Earn?

This will greatly depend on your strategy and how much effort you put into learning the craft. But for many, crypto trading has become a viable source of income for them. As mentioned earlier, we advise starting small, working your way up, before investing big amounts of money. This way, the risk is controlled.

Summary

Unlike other countries where crypto trading is already a widely-accepted practice, the UK still needs to implement more regulations to protect all sides involved. Still, this hasn’t stopped traders from investing millions of their hard-earned money into digital currency.

This just goes to show us that while there is risk involved, there’s also much to be gained. Beginners will just need to traverse through this carefully, do all the necessary research, plan out a strategy, and learn as things go by.

If these steps are taken, there’s no reason to fear crypto trading in the UK.

FAQs

Is crypto trading legal?

Yes, but it’s not fully regulated yet in the UK. To protect yourself, we recommend trading on platforms that are accredited by the government.

Do I need to pay taxes for earnings from crypto?

Yes, of course. This will depend whether it is classified as income or capital gains.

If I am not comfortable with crypto exchanges, are there other platforms I can use?

Besides that, you can also utilize CFD Brokers or Stock Brokers who can trade crypto.

What are examples of platforms that trade crypto for beginners?

eToro, FXTM, Interactive Brokers, and Coinbase are just some of the platforms we would recommend because of their reliable track record, experience, and user-friendliness.

Team that worked on the article

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Olga Shendetskaya has been a part of the Traders Union team as an author, editor and proofreader since 2017. Since 2020, Shendetskaya has been the assistant chief editor of the website of Traders Union, an international association of traders. She has over 10 years of experience of working with economic and financial texts. In the period of 2017-2020, Olga has worked as a journalist and editor of laftNews news agency, economic and financial news sections. At the moment, Olga is a part of the team of top industry experts involved in creation of educational articles in finance and investment, overseeing their writing and publication on the Traders Union website.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).