Ethereum Cloud Mining Sites: Scam Or Safe - Can You Mine ETH?

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

As of 2025, most references to Ethereum cloud mining should raise red flags. This is largely because Ethereum moved to a Proof-of-Stake consensus mechanism, completely removing the need for traditional mining. Despite this, certain platforms continue to promote mining-based returns tied to ETH, which often turn out to be misleading or outright fraudulent. For those seeking safer passive income options, staking, yield farming, and crypto savings tools provide transparent alternatives backed by real blockchain protocols.

The internet is still crowded with platforms claiming to offer ETH cloud mining in 2025 — some with glossy dashboards, daily payout counters, and testimonials that seem too perfect. These websites often blur the lines between simulation and deception, using mining lingo to disguise what's essentially a façade. No real hardware. No block validation. Just flashy promises built on outdated narratives. While some newcomers may get drawn in by the allure of “cloud mining in Ethereum,” what’s really happening behind the scenes is far more opaque — and in many cases, dangerously misleading. We will talk about this in more detail in our article.

Risk warning: Cryptocurrency markets are highly volatile, with sharp price swings and regulatory uncertainties. Research indicates that 75-90% of traders face losses. Only invest discretionary funds and consult an experienced financial advisor.

Can you cloud mine Ethereum (ETH)? No, and here’s why

Since Ethereum’s transition to the Proof-of-Stake mechanism in September 2022, traditional mining using computational power has become irrelevant. As a result, services that once offered Ethereum cloud mining app access no longer operate in the same way. Mining ETH through cloud services is no longer possible, and most platforms advertising cloud mining of ETH are no longer tied to actual mining activities.

Even so, many sites still promote Ethereum-related cloud mining options. These platforms often lack transparency about what is being mined or how user earnings are calculated. By using generic terms and vague promises, some create the illusion that Ethereum mining is still active. In reality, these offerings may simulate returns or mine entirely different coins. It’s important to note that services advertising Ethereum classic cloud mining might sound similar but refer to a different network altogether, which still supports Proof-of-Work mining.

Returning to the main subject of Ethereum Cloud Mining 2025: Real or Scam?, it's important to clarify that we are no longer referring to Ethereum Classic. Since the Ethereum merge, staking has fully replaced mining as Ethereum’s method for validating transactions and distributing rewards. Those who contribute to the network by locking ETH in validator roles receive yield as compensation, making staking the only legitimate method to participate. Any platform in 2025 claiming to offer active mining of Ethereum should be approached cautiously. Claims made by an Ethereum's cloud mining website should always be verified through independent research and proof of actual blockchain interaction.

Ethereum cloud mining sites: scam or safe investment?

Is Ethereum cloud mining free, or is it a trap for unsuspecting users? Scam websites promote ETH cloud mining for free through social media ads and search listings. These services often advertise passive income, quick returns, and zero upfront costs, appealing to newcomers who may not be aware of Ethereum’s shift to staking.

But these platforms frequently ask users to deposit crypto or pay “activation” fees to access services. Yet there’s often no link between these payments and real blockchain operations. Even if the website displays user earnings on a dashboard, these amounts may be fabricated. Sadly, this kind of setup mimics high-risk investment traps designed to gain user trust and quietly disappear — leaving no recourse or refunds.

Considering that Ethereum cannot be mined anymore, any ETH cloud mining app or cloud service claiming to offer “free mining” in exchange for deposits or sign-ups should raise red flags. Before committing to any such platform, users should check the company’s legal standing, check community reviews, and demand operational transparency.

Ethereum cloud mining app: can mobile platforms be trusted?

Mobile apps advertising cloud mining of ETH are popping up across app stores and ad networks — often with flashy promises of passive income and "easy mining." But since Ethereum no longer supports mining, these apps don't actually mine ETH. Instead, they simulate activity or gamify user engagement through ads, referrals, or tasks.

The real issue? Most of these mobile-based Ethereum mining and cloud services use technical-sounding language to mislead users while offering little to no transparency. Some even pose serious risks such as phishing or wallet baiting. Here’s how to assess them:

| Feature or Behavior | What It Means | Safety Level |

|---|---|---|

| Ask for wallet access or smart contract signature | Risk of phishing or token draining | Dangerous |

| No clear income model or backend explanation | Likely a simulation; no actual mining | Misleading |

| Heavy use of referral programs | Growth-based engagement loop | Requires caution |

| Mentions “staking rewards” or validator yield | May imitate real models | Only if verifiable |

While a few apps may offer legitimate micro-staking services or connect to validator nodes, these are rare. If an app doesn't offer proof of validator operation, on-chain logic, or external audits — especially those advertising ETH cloud mining & mobile earn — it’s best to treat it as entertainment, not investment.

Ethereum Classic cloud mining: a legitimate alternative?

As mentioned earlier, Ethereum Classic (ETC) should not be confused with Ethereum (ETH). Although they share a common origin, the two networks diverged after the 2016 DAO hack. Since ETC still runs on Proof-of-Work, Ethereum classic cloud mining is still alive and kicking, unlike Ethereum, which moved to staking. That makes ETC one of the few big coins still available to mine through the cloud, drawing in a small but loyal group of miners.

Here’s where things get more interesting. With cloud mining for Ethereum Classic, you’re renting power from someone else’s machines instead of buying your own. But what many people miss is that the best ETC mining deals often come from small, lesser-known providers. These aren’t the big-name sites that are all style and no substance. Instead, they work mostly on trust and reputation in forums or developer channels. They usually have better uptime and flexible pricing if you’re willing to dig a little deeper.

But here’s the tough truth. Is free cloud Ethereum mining even real? Most of the time, not really. A few platforms do give small amounts of hash power for free to get new users in the door. The catch? You’ll hit payout limits or face locked withdrawals. Still, if you're just testing the waters or want to check performance, it’s a decent way to try things out, as long as you're not chasing numbers that sound too good to be true.

The cool part about mining ETC this way is the lower competition and power-friendly algorithm. It uses Etchash, which isn’t as demanding as Ethereum’s old system. That makes it more doable for longer-term cloud contracts. And since the rewards and hashrate are smaller, small-scale miners can actually see returns faster if the setup is managed properly. Like any mining plan, though, success depends on smart choices behind the scenes, not just the coin you're mining.

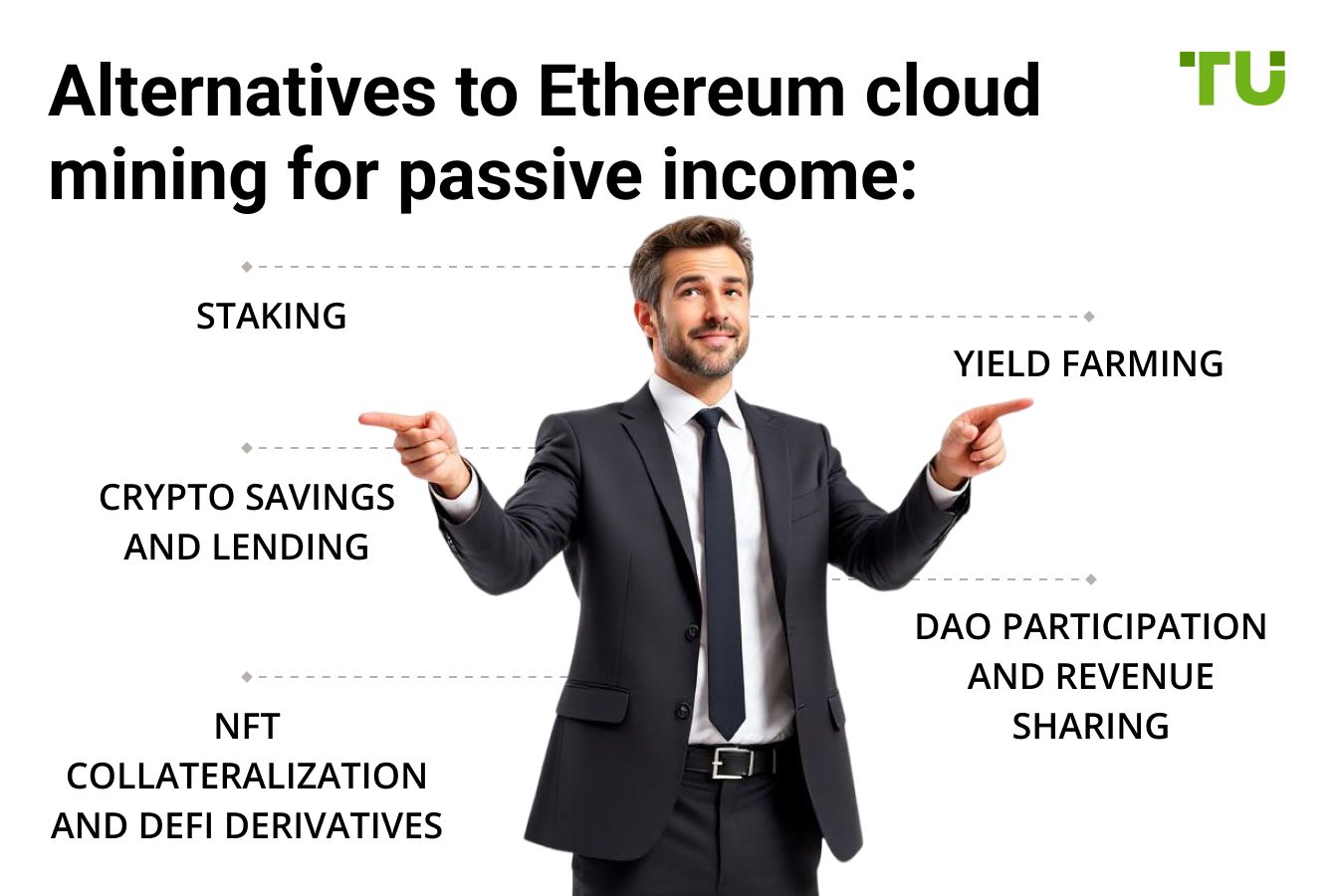

Now you know that the websites claiming the possibility of cloud mining Ethereum for free are misleading. So, instead of relying on outdated or deceptive services, users should explore legitimate, infrastructure-based methods to earn passive income through Ethereum and related assets.

Staking

With the Proof-of-Stake model now fully implemented, Ethereum holders can earn rewards by locking 32 ETH into a validator node. For those without the full amount or technical setup, liquid staking platforms like Lido, Rocket Pool, and Binance Staking offer more accessible paths. These services allow users to stake ETH without managing hardware, and in return, they receive tokens like stETH or rETH that retain liquidity. Annual yields typically fall between 3.5% and 4.5%, paid in ETH and reinvested automatically or manually.

Yield farming

Yield farming is a strategy where you lend your crypto assets, like ETH or stablecoins, to DeFi platforms such as Aave, Uniswap, or Curve. In return, you earn interest and often receive bonus tokens tied to the platform’s governance. These earnings typically come from a mix of trading fees and incentives for providing liquidity to the ecosystem. Pairs like ETH/USDC generally yield 5–10% annually, while high-risk incentive pools may offer over 20%. Unlike schemes built around free ETH cloud mining, yield farming is grounded in real protocols and smart contract interactions.

Crypto savings and lending

Centralized services like Binance Earn, CoinLoan, Nexo, and YouHodler offer crypto savings accounts that pay fixed interest on digital assets. Users can deposit ETH, USDT, USDC, or BTC and earn 7–10% yearly by locking funds for short terms. Interest is paid in the same asset and can be reinvested or withdrawn. While these platforms carry custodial risks, they remain attractive for users seeking short- to mid-term passive income. This is a more secure alternative to questionable cloud mining of Ethereum advertised online.

DAO participation and revenue sharing

Users holding governance tokens like UNI, LDO, or RPL may earn protocol-based income by participating in decentralized autonomous organizations (DAOs). Revenue streams include a share of trading fees, protocol rewards, or dividends distributed to active participants. Projects such as GMX and dYdX implement real-fee sharing mechanisms that reward token holders who stake and engage in governance processes.

NFT collateralization and DeFi derivatives

Innovative models now allow users to use NFTs or staked tokens as collateral. Platforms like JPEG’d and NFTfi let users borrow against NFTs while continuing to earn protocol incentives. In parallel, staked ETH derivatives such as rETH or stETH can be deployed into liquidity pools or lending protocols, generating additional yield.

Instead of chasing misleading ideas like cloud mining Ethereum for free, users should focus on transparent, on-chain mechanisms that offer measurable rewards and lower operational risk. On-chain strategies not only provide better security and clarity, but they also align with Ethereum’s evolution toward sustainability and decentralization. Here are some platforms supporting these alternatives:

| Foundation year | Ethereum | Staking | Yield farming | NFT | Crypto bonuses | Regulation | TU overall score | Open an account | |

|---|---|---|---|---|---|---|---|---|---|

| 2017 | Yes | Yes | Yes | Yes | Yes | No | 8.9 | Open an account Your capital is at risk. |

|

| 2011 | Yes | Yes | Yes | Yes | Yes | No | 8.48 | Open an account Your capital is at risk. |

|

| 2016 | Yes | Yes | Yes | Yes | Yes | Malta Financial Services Authority | 8.36 | Open an account Your capital is at risk. |

|

| 2018 | Yes | Yes | No | No | Yes | No | 7.41 | Open an account Your capital is at risk. |

|

| 2012 | Yes | Yes | Yes | Yes | No | No | 6.89 | Open an account Your capital is at risk. |

Spot fake Ethereum cloud mining and choose better yield options through staking hybrids

In 2022, Vitalik Buterin spearheaded a major update to Ethereum’s consensus mechanism, replacing energy-intensive Proof-of-Work with Proof-of-Stake. While this move was praised for making the network more environmentally friendly, it also introduced confusion for many crypto users and newcomers. Most beginners don’t realize that Ethereum mining is no longer technically viable. What’s deceptive is that many “cloud mining” websites still use Ethereum branding to lure users into paying for hashrate that doesn’t even contribute to block validation anymore. If a platform doesn’t clearly show validator-level operations or POS rewards structures, that’s a big red flag. Instead of renting imaginary hashpower, you should be checking for proof of validator uptime and whether rewards are tied to network consensus, not outdated GPU metrics.

Here’s a better angle: look for platforms that combine staking with distributed yield models. Some emerging platforms take pooled ETH, stake it across multiple validators, and offer extra rewards by allocating a portion to decentralized lending markets or real-world asset protocols. You’re not just getting validator rewards, you’re earning on yield-layered ETH. This approach offers transparency, liquidity, and better returns than shady cloud mining promises. It’s like combining staking with smart portfolio automation, but with clearer proof of work and reward.

Conclusion

When comparing cloud mining vs hardware mining of Ethereum, remember that Ethereum cloud mining platforms are no longer technically valid. Since Ethereum moved to Proof-of-Stake, ETH can't be mined — platforms offering such services usually operate off-chain, without real blockchain interaction or validator access. Always verify on-chain activity, registration data, and withdrawal conditions before investing.

If you’ve already fallen for a fake ETH cloud mining site, act quickly:

Stop all payments and disconnect your wallet.

Use Etherscan Token Approvals to revoke permissions.

Move funds to a secure wallet.

Report the site to cybersecurity platforms or crypto communities.

Instead, focus on transparent income tools like staking or DeFi protocols, where yields are backed by real blockchain activity.

FAQs

What are signs that ETH cloud mining is just a simulation?

Fixed payouts regardless of network conditions, no verifiable on-chain activity, no wallet-level tracking, and upfront fees before “mining” begins are common indicators.

Can you earn passive income with PoS assets besides Ethereum?

Yes, many Proof-of-Stake networks allow delegation with variable yields. Returns depend on staking terms, inflation schedules, and validator performance.

How can I verify that my assets are actually being staked?

On-chain explorers and DeFi dashboards display validator addresses, staking volumes, and lock status. Legitimate staking ties assets to publicly visible validator nodes.

Is it safe to use automated passive income strategies?

Automation is viable when smart contracts are open and funds remain in the user's control. Main risks involve smart contract bugs and reliance on external price oracles.

Related Articles

Team that worked on the article

Maxim Nechiporenko has been a contributor to Traders Union since 2023. He started his professional career in the media in 2006. He has expertise in finance and investment, and his field of interest covers all aspects of geoeconomics. Maxim provides up-to-date information on trading, cryptocurrencies and other financial instruments. He regularly updates his knowledge to keep abreast of the latest innovations and trends in the market.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

Yield refers to the earnings or income derived from an investment. It mirrors the returns generated by owning assets such as stocks, bonds, or other financial instruments.

Xetra is a German Stock Exchange trading system that the Frankfurt Stock Exchange operates. Deutsche Börse is the parent company of the Frankfurt Stock Exchange.

Forex leverage is a tool enabling traders to control larger positions with a relatively small amount of capital, amplifying potential profits and losses based on the chosen leverage ratio.

Ethereum is a decentralized blockchain platform and cryptocurrency that was proposed by Vitalik Buterin in late 2013 and development began in early 2014. It was designed as a versatile platform for creating decentralized applications (DApps) and smart contracts.