How to mine Ethereum after hard fork

Ethereum is the second most popular currency after Bitcoin, also in terms of capitalization. It is extremely popular among miners, as its mining provides good income. However, the situation changed after activation of the London update. The rules of mining changed substantially. In this article, Traders Union analysts will discuss the major changes after the hard fork, how to mine Ethereum by the new rules and whether mining will be profitable.

Start investing in Ethereum now with Binance!How to mine Ethereum after the update?

With the activation of the London update, the rules for miners changed significantly. The Ethereum team continues to change the configuration of the system before fully switching to the Proof-of-Stake algorithm; therefore mining has changed. Let’s discuss these changes in more detail.

What changed in Ethereum mining?

Earlier, mining of Ethereum was based on the classic Proof-of-Work algorithm, with the rules of mining being close to standard.

The reward for the mined block consisted of two criteria:

-

Base reward for the mined block;

-

Fees charged on the users, whose transactions are recorded in the block.

This policy provided for maintenance of mining profitability at a rather high level and also allowed for an opportunity to mine priority blocks. The more fees were paid in the block, the faster it was sent for processing. This, however, will no longer be the case after the introduction of the new rules.

After the changes, the possibility of mining with hardware still remains. This means that the miners will be able to continue to mine ETH with video cards, GPUs and ASIC miners. However, the calculation of the commissions changed. Ethereum excluded transaction fees from the calculation of the reward for mining. After activation of London hard fork, the commissions only include base reward, with the miners no longer getting paid through the fees.

In order to reduce the losses of the miners, a decision was made to introduce voluntary reward, where each participant of a transaction was able to voluntarily send ‘tips’ to the miners. These methods, however, did not increase income by much and the people who made their money from mining Ethereum still faced considerable losses.

There is another important change that is imminent. Ethereum is planning to push the so-called Difficulty Bomb – to considerably increase the difficulty level of puzzles. Initially, this change was planned for the summer of 2023, but before the London update, the date of the bomb was pushed to December 1, 2023. Therefore, miners will either have to update their equipment or fully abandon mining of Ethereum with hardware.

Current reward for Ethereum mining

The reward for the mined block consisted of two criteria:

-

Current difficulty – 9.735.226 T;

-

Hashrate – 771.828 Th/s;

-

Block generation – every 15 seconds;

-

Reward for mined block – 2 ETH.

Therefore, per each 100 Mh/s of calculating capacities, with energy consumption at 400 Watt and electricity price at US$0.1 per kilowatt, miners will be able to earn $6.96 per day or $2,540 per year. However, these data will remain relevant only until January 2023, because as soon as the Difficulty Bomb is introduced, mining difficulty will increase substantially and these figures will take a turn for the worse for the miners.

What will happen to transaction fees?

After the update, the principle of priority of blocks based on fees no longer plays such an important role. From now one, there will be equal fees in each block and the part of the fees that exceeds the pre-set value will simply burn.

Miners will no longer earn additional income from transaction fees. It is still possible for the moment, as there are both transactions of the new and old types in the network. As soon as the old-type transactions disappear, the miners will no longer receive the reward.

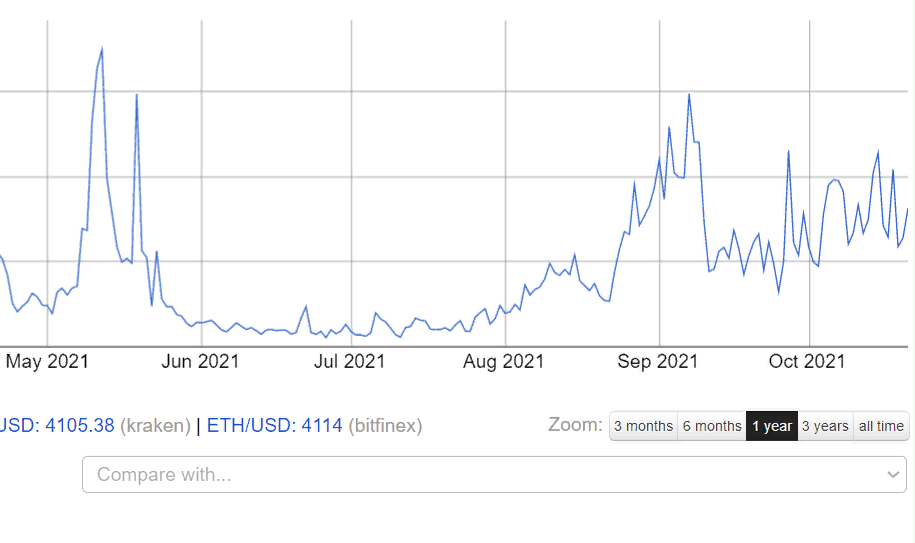

As for the current level of fees, as of 22.10.2023, it was 0.079 ETH per financial transaction. After the hard fork, a substantial hike in the fees was observed, reaching its peak level in the middle of September. However, after that, they dropped and are currently at an average level.

Ethereum transaction fees in the past six months

Is Ethereum mining profitable?

Ethereum is actively working on the introduction of the Ethereum 2.0 algorithm. This step will completely remove the Proof-of-Work algorithm and introduce the Proof-of-Stake one. Vitalik Buterin, the inventor of Ethereum, stated that this step will make the cryptocurrency 99% more environmentally friendly than it is now. In addition, unlike Bitcoin, Ethereum has no limit of emission, which means that this cryptocurrency is inflationary and the more coins are available, the less they will cost. Introduction of Ethereum 2.0 is one of the steps to hold back inflation.

What does this mean for a miner? That mining Ethereum will be more difficult and less profitable with each update, until it is stopped altogether. Let’s review the pros and cons of ETH mining after the London update.

👍 Pros

• Mining with hardware remains profitable at the moment.

• The old blocks allow for earning not only the base rate, but also a percentage of the fees.

👎 Cons

• Ethereum will exclude old blocks and will soon switch to new ones.

• The Difficulty Bomb will be introduced December 1, 2023, which will sharply increase the difficulty of mining.

• The policy of voluntary ‘tips’ for confirmation of transactions will provide lower return on mining than the fees policy.

Should I start mining?

Profitability of mining is expected to drop 20-35% after the old blocks are fully replaced with the new ones. Also, the Difficulty Bomb will put the majority of private miners out of the game, with only the largest organizations mining Ethereum able to continue to work. It is possible that the fees will increase also in the mining pools, because the pools of miners will have to merge in order to survive.

If you are only thinking of starting to mine, you will have to incur high expenses for the equipment and payment of electricity bills. So, think hard whether it is worth starting to mine Ethereum in the conditions, when the team of Vitalik Buterin is doing everything to remove mining altogether.

How to mine Ethereum: a step-by-step guide

If you are still set on mining Ethereum, you will require special hardware and software. Here’s a step-by-step guide on how to start mining cryptocurrency.

Step 1. Choosing the place for mining and electricity price rate

Electricity bills are one of the key expenses. The more hardware you have the higher the bills will be. Therefore, you need to switch to a better tariff or move to an area where the electricity costs less.

In the example above, per each 100 Mh/s of calculating capacities, with energy consumption at 400 Watt and electricity price at US$0.1 per kilowatt, the profit will be $6.96 per day or $2,540 per year. If the price of electricity is $0.2 per kWatt, the profitability of mining will drop to $6 per day or $2,190 per year at the same other criteria.

Step 2. Buy hardware

Mining by the Proof-of-Work algorithm is done with hardware.

You can select the following options:

-

Mining with GPU. Mining Ethereum using graphic processors remains rather popular. A mining farm is essentially an ordinary computer but with a large number of video cards. You choose the number of video cards yourself. With the current network specifications, profitability of mining with one GeForce RTX 3080 is $7 per day, and on one GeForce RTX 3060 Ti – $4.5 per day.

-

Mining with ASIC miners. ASIC miners are devices with microprocessors for mining and preinstalled software. For example, Bitmain Antminer is the most popular ASIC for mining Ethereum. For example, you can choose S19 or S19 Pro models.

Step 3. Choose software

Software is essential for mining. You won’t be able to mine Ethereum without special software. Therefore, you need to install suitable software.

The following can be used for mining Ethereum:

-

ETHminer;

-

Claymore;

-

CGMiner;

-

WinETH;

-

Minergate.

ASIC miners have pre-installed software, and therefore software is required only for the mining farms, which you make yourself.

Step 4. Choose a wallet

You will also need to choose a cryptocurrency wallet, where the coins you mined will be credited to. There are several types of cryptocurrency wallets.

You can choose one of the following:

-

MyEtherWallet

-

Metamask

-

Jaxx

For mining, it is better to choose MyEtherWallet, because it is the official Ethereum cryptocurrency wallet and has good security.

Step 5. Choose a pool and start mining

After that you need to choose a pool for mining. Independent mining is practically impossible in the current conditions. Therefore, you need to join one of the large mining pools.

The Top 8 largest pools are:

-

Ethpool.org;

-

Nanopool;

-

Whalesburg;

-

2Miners;

-

Ethereumpool;

-

WeiPool;

-

AlphaPool;

-

Supernova.

After you purchased the hardware, installed the software, opened the wallet and set up your equipment, you can start mining. The only thing left to do is to launch your farm or ASIC and start mining cryptocurrencies.

How to Get Ethereum with staking

Ethereum team plans to completely abandon the Proof-of-Work algorithm and switch to Proof-of-Stake. This means that after the update, mining with hardware won’t be possible; the coins will have to be earned with staking.

Staking is a proof of a share of ownership. It is a certain form of deposit in cryptocurrencies. Essentially, it involves a miner having to ‘freeze’ a certain number of coins. These coins will be used to support the network’s stability, while the person who ‘froze’ the coins will become a validator of the network and confirm transactions. After the period of ‘freezing’ expires, the miner will get his amount back plus profit. Profit in this case is a fee for transaction validation.

Several popular cryptocurrencies started using staking even before Ethereum began working on its 2.0 version.

For example:

-

-

-

-

Uniswap (UNI) and others.

Full transition to the new system will happen after Ethereum 2.0 is introduced. However, miners can mine Ethereum with staking already now. Some exchanges provide for such an opportunity.

How much can I earn?

Earning from staking happens through multiplication of the frozen coins by a certain percentage. Staking rates are not stable; they change constantly.

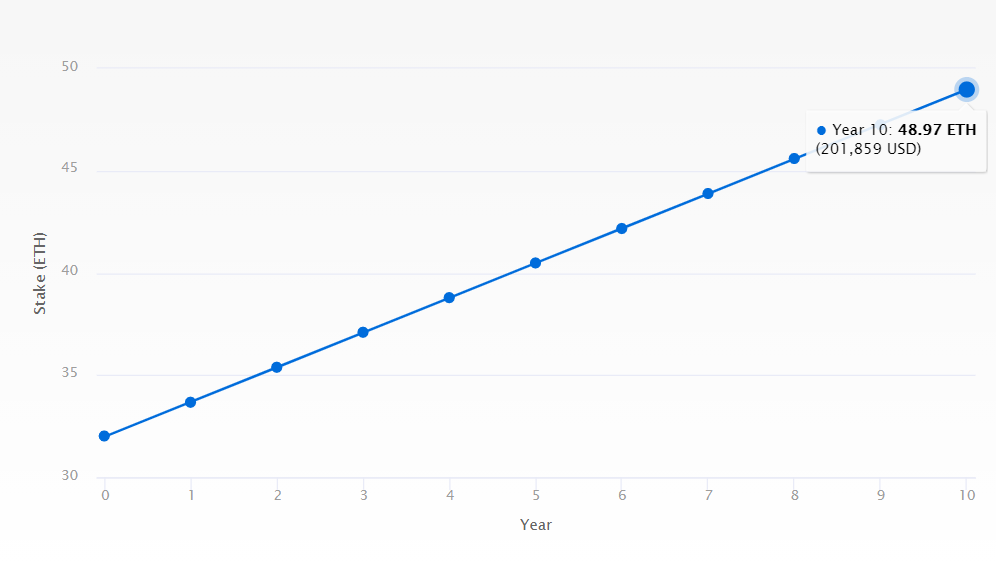

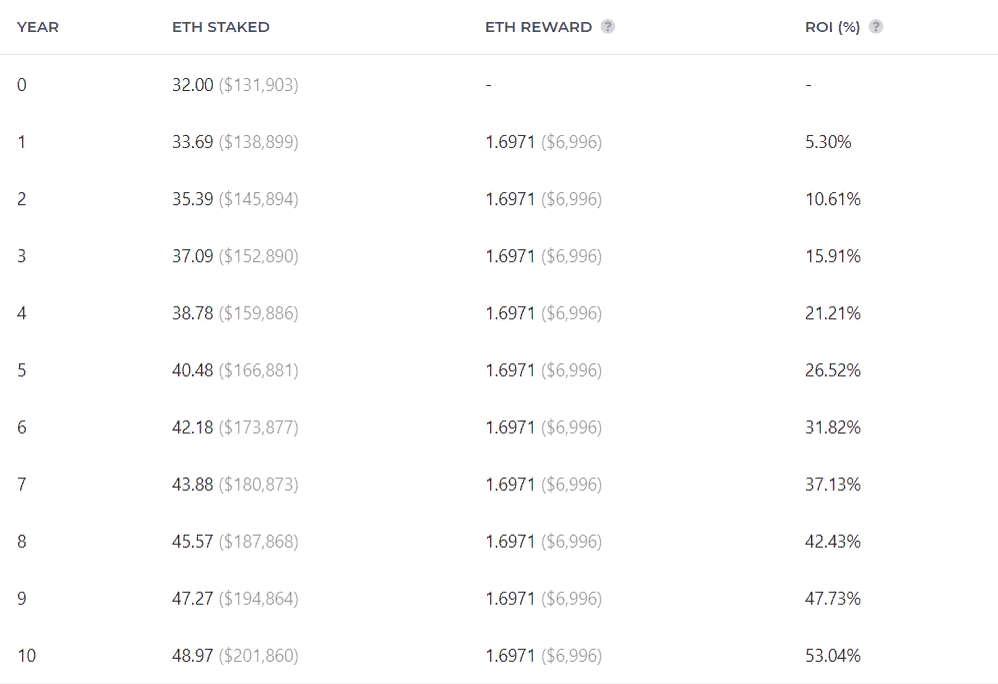

As for Ethereum 2.0, there are special requirements. Specifically, you can freeze no less than 32 ETH. The interest rate on staking ranges from 4.90% to 21.60%. As of January 2023, the annual profitability of staking is 5.30%.

Below is a chart of forecast profitability from staking Ethereum. As an example, we used freezing of the minimum allowed number of coins – 32 ETH.

ETH staking profitability chart

As you can see from the chart, if you freeze 32 ETH right now, in about a year your deposit will increase to 33.69 ETH. In 10 years, your deposit will increase to 48.97 ETH. You can see more detailed results in the table below.

ETH staking profitability table

How to earn from staking ETH

At the moment, a limited number of cryptocurrency exchanges and platforms offer the option of staking Ethereum 2.0 and earning a profit. We chose Binance because it is the largest crypto exchange in the world. It is also one of the most reliable cryptocurrency trading platforms. It offers an option of staking Ethereum. Below is a step-by-step guide on how to earn a profit from staking.

Step 1. Open an account

In order to open an account on Binance, click on Register Now on the home page. Next, fill out the registration form and confirm your email.

How to open an account on Binance

Stop 2. Buy Ethereum

After you open an account, you need to buy cryptocurrency.

For example:

-

Through the exchange;

-

Via debit/credit card.

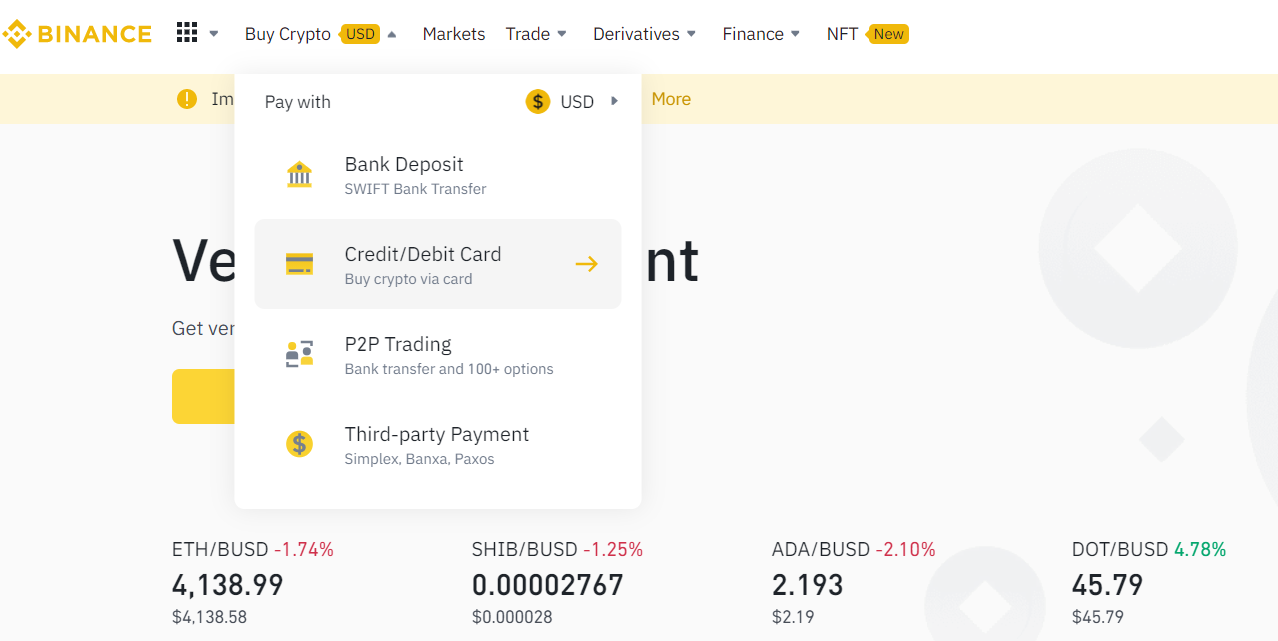

Let’s briefly review the second option. In the top menu of the website, choose Buy Crypto and then click on the Debit/Credit Card option.

Choosing to buy Ethereum via a debit/credit card

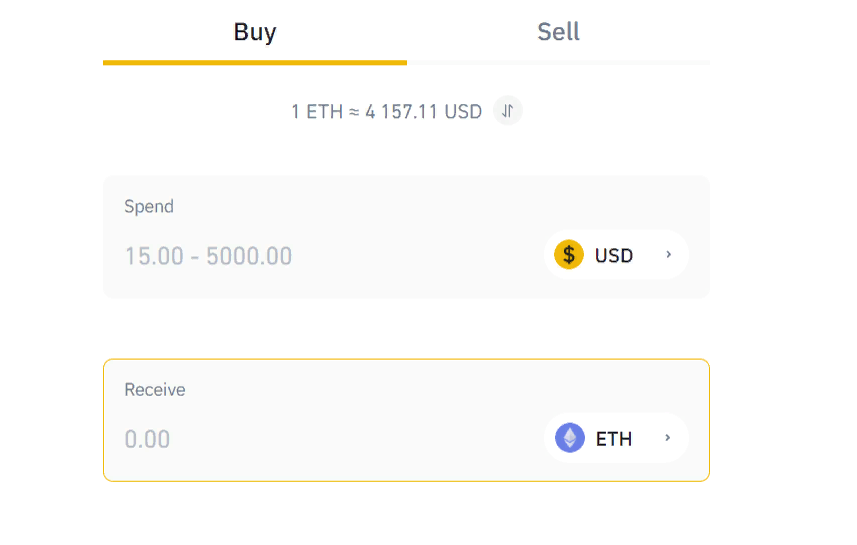

Next, you will see the purchase field. Binance clients working without verification can buy cryptocurrency for an amount of no more than $5,000 per day. Therefore, if you want to buy more, you will need to pass verification. As a reminder, the minimum amount for staking Ethereum is 32 ETH.

Buying Ethereum

Step 3. Start staking Ethereum

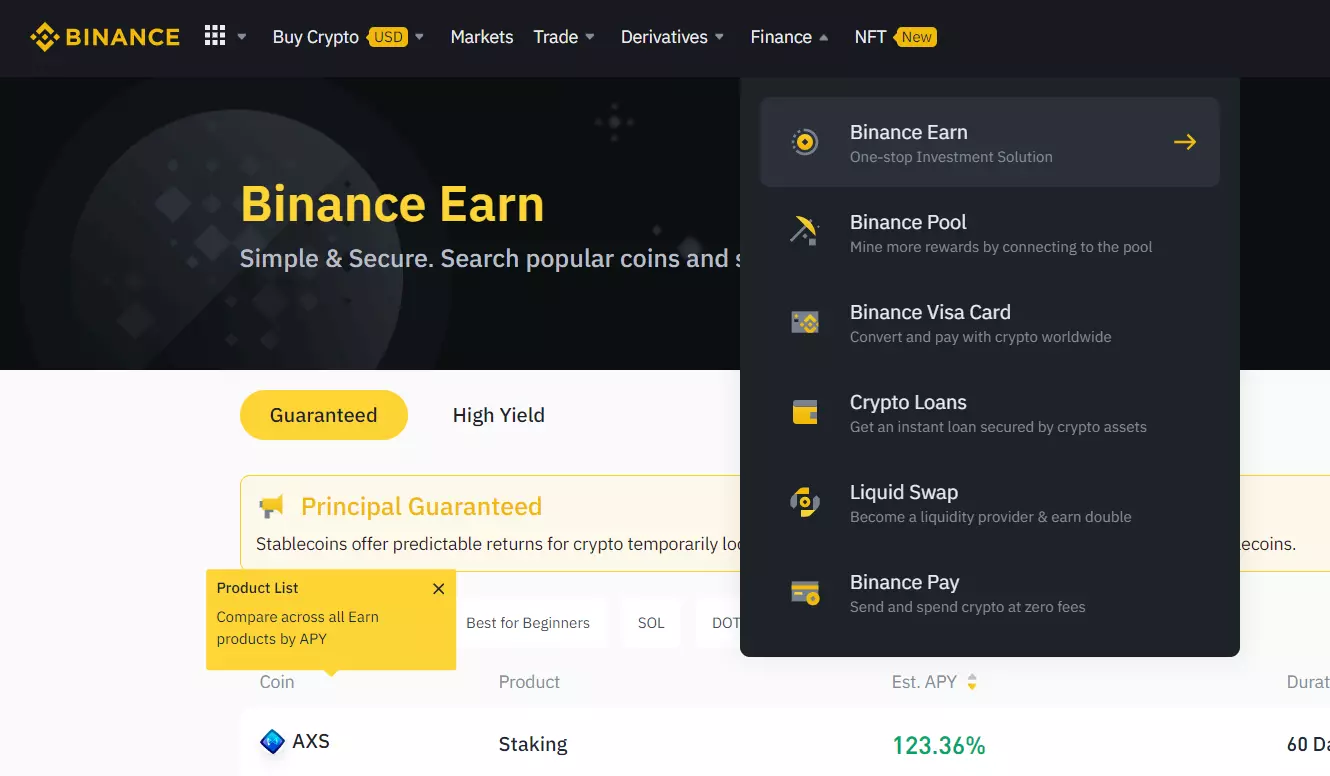

In order to start staking Ethereum, after you buy the cryptocurrency, you need to select Finance in the top menu and then Binance Earn from the pop-down list.

How to choose Binance Earn

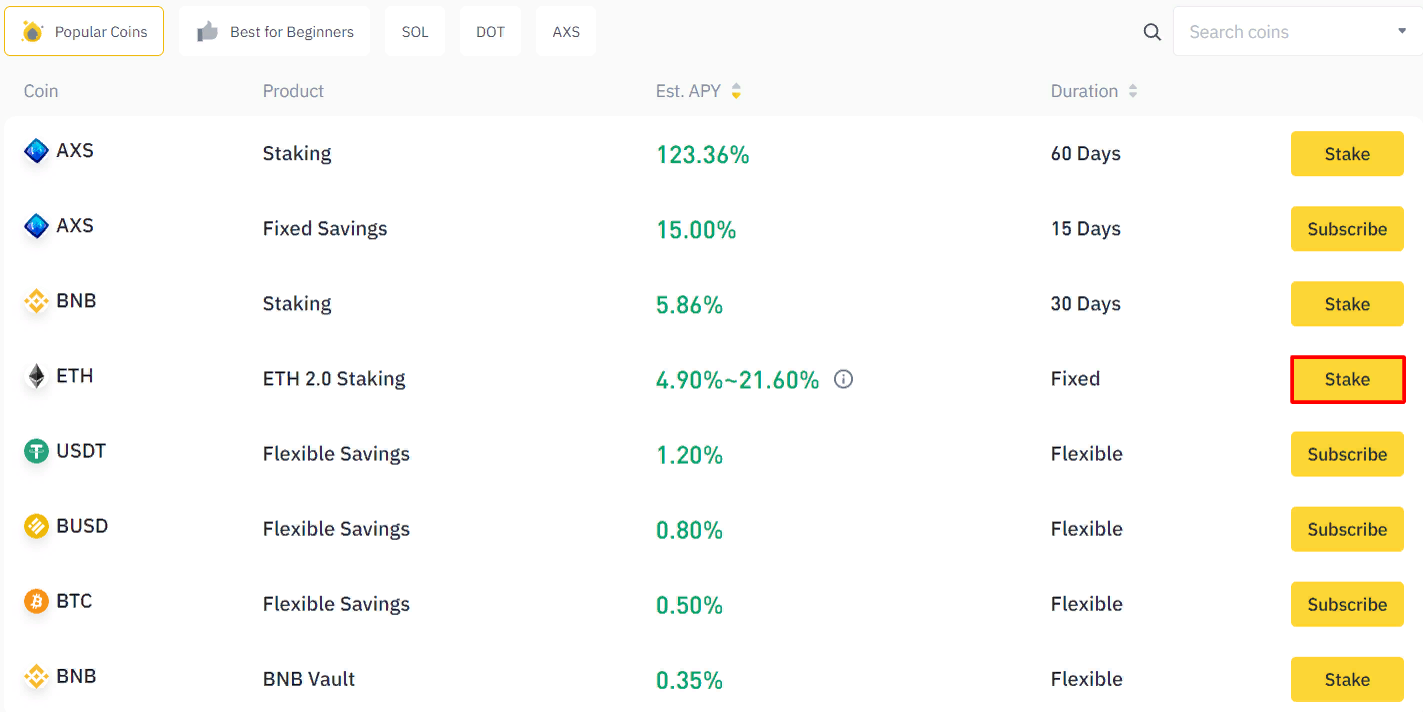

In the Binance Earn section, you will see a table containing all investment offers of Binance. Here, you need to select Ethereum 2.0. Also here, you can see the current interest rates.

How to start staking ETH on Binance

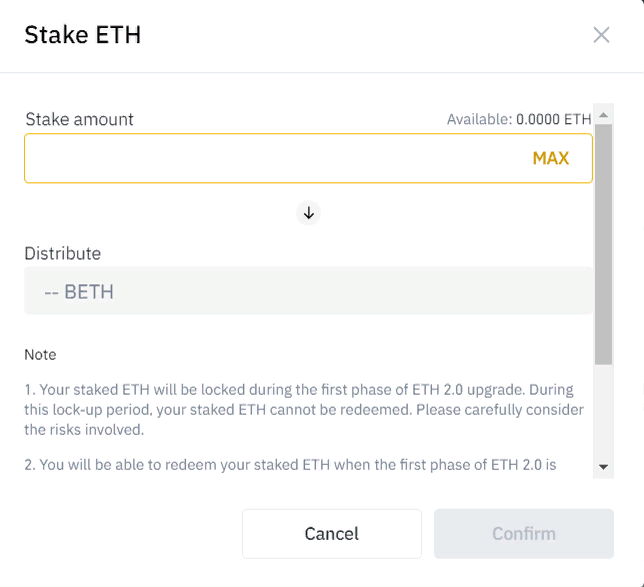

Next, the system will ask you to specify the number of crypto coins for staking and select their distribution by BETH. BETH is a token, which is credited to your account based on the 1:1 ratio. Factually, it confirms that you started staking. After the period of staking expires, BETH will be deleted and the amount of the deposit and the interest will be transferred to your account.

How to start staking ETH on Binance

That’s it. After you specify the amount and distribute it by BETH, all you have to do is to click on Confirm and your crypto coins will be frozen; the process of staking will start.

Where to buy Ethereum in 2024?

Many cryptocurrency exchanges offer to buy Ethereum, and it is important that you find the one that offers the very best conditions. Traders Union analysts recommend buying ETH via Binance, ByBit or Kraken exchanges. These cryptocurrency exchanges occupy high positions in the TU rating. They have proven that they are reliable, offer a good choice of markets and low commission for trading Ethereum.

| Broker | Pros | Fees | Number of cryptocurrency markets | |

|---|---|---|---|---|

High liquidity |

0.1% |

1,485 |

||

A possibility of discounts on commissions and fees |

0.075% - 0.10% |

57 |

||

Reliable protection |

0.25% – 0% |

371 |

Summary

Mining of Ethereum with hardware is gradually becoming a thing of the past. It is still possible, but the London update already spoiled the life of the miners. Therefore, if you want to mine cryptocurrencies, it is best to consider the option of buying them at exchanges. Staking is an effective way of multiplying cryptocurrency assets. With staking, you can earn up to 20% annual on ETH. Therefore, there is no sense in spending money on equipment for mining and payment of electricity bills. Passive income on Ethereum can become a good choice for you.

FAQs

What is difficulty of mining?

The difficulty of mining shows how much capacity of a computer is required for mining cryptocurrency. The more difficult the mining, the more capacity it requires.

When will Ethereum 2.0 be fully rolled out?

Full transition to Ethereum 2.0 is expected in November-January 2024.

Why does staking bring profit?

A crypto investor who freezes cryptocurrency in the wallet becomes a validator of transactions in the system. Profit from staking is the reward for validation of transactions.

Will it be profitable to mine Ethereum after the launch of the Difficulty Bomb?

Most likely, no. Difficulty will increase exponentially, and therefore mining cryptocurrency will require bigger capacities.

Team that worked on the article

Andrey Mastykin is an experienced author, editor, and content strategist who has been with Traders Union since 2020. As an editor, he is meticulous about fact-checking and ensuring the accuracy of all information published on the Traders Union platform. Andrey focuses on educating readers about the potential rewards and risks involved in trading financial markets.

He firmly believes that passive investing is a more suitable strategy for most individuals. Andrey's conservative approach and focus on risk management resonate with many readers, making him a trusted source of financial information.

Bruce Powers is an expert trader and technical analyst with over 20 years of experience in Forex, commodities, ETFs, cryptocurrencies and other assets. He is an active trader, technical and fundamental analyst, media commentator, educator and a writer. As an author for Traders Union, he contributes his deep analytical skills, expertise and understanding of the global economy and financial markets to provide market analysis and insights. Powers is also a frequent guest on business TV news shows.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO). Mirjan is a cryptocurrency and stock trader. This deep understanding of the finance sector allows her to create informative and engaging content that helps readers easily navigate the complexities of the crypto world.