5 Steps to Find the Next 100x Altcoin Early

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

5 Steps to find the next 100x altcoin early:

Use Tools - Access platforms like CoinMarketCap for insights

Do Research - Dive into whitepapers and evaluate the development team

Apply the Fundamental Analysis - Identify real-world use cases and regulatory compliance

Apply the Technical Analysis - Analyze market trends and volume

Build Your Investment Plan - Set clear targets, diversify, and stay informed

Always conduct thorough research and consider consulting a financial advisor.

In the cryptocurrency market, 2024 presents a unique set of challenges and opportunities. Investors are on a constant lookout for the next big thing, with 100x altcoins being the most coveted treasure.

These digital assets promise exponential returns, but finding them requires more than just luck. It demands a deep understanding of the market's intricacies and a keen eye for potential. This article aims to provide a guide and a roadmap to uncovering these rare gems in a market teeming with possibilities.

What you need to do before looking for the next 100x altcoin

Before diving into the hunt for a 100x altcoin, grounding yourself in the cryptocurrency market's fundamentals is essential. Understanding blockchain, consensus mechanisms, tokenomics, and recent technological advances is critical. This knowledge differentiates potential from hype.

The allure of quick riches in the crypto world brings its share of dangers, notably scams. In 2022 and 2023, the cryptocurrency market saw a staggering amount of fraudulent schemes, with gigantic losses. Projects promising guaranteed returns or those shrouded in anonymity often signal red flags. Vigilance and due diligence are your best defenses against these pitfalls.

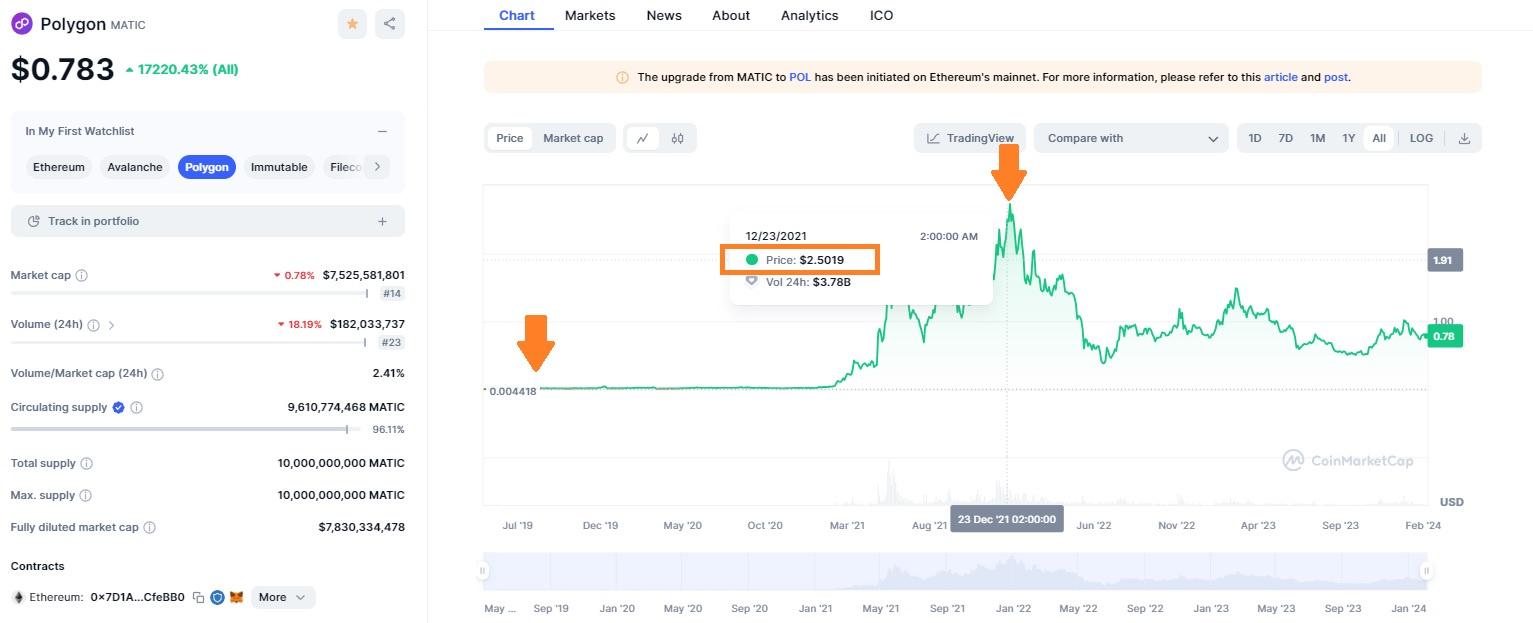

Securing your investments is paramount. With increasing digital asset theft, using secure wallets and practicing safe storage are non-negotiable. Consider the price chart of Polygon, an altcoin that went from significantly less than 1 cent to more than $2.5 as a guide and inspiration, reminding you of the research and strategy needed to spot such opportunities.

Best crypto exchanges

Polygon chart

Polygon chartThe image depicts a price chart of Polygon against the US dollar, highlighting the all-time low and the all-time high in prices.

5 Steps to find the next 100x altcoin

Discovering an altcoin with the potential to deliver a 100x return is akin to finding a needle in a digital haystack. The journey requires a blend of technological insight, market acumen, and strategic foresight. Here, we outline a five-step roadmap to navigate this complex landscape, aiming to bring clarity and direction to your investment approach.

Use Tools and Resources:Leverage the wealth of information available on crypto analytic platforms like CoinMarketCap, CoinGecko, and others. These platforms offer critical data and insights that can help you identify emerging opportunities. Community feedback on social media and forums also provides valuable sentiment analysis.

Research and Due Diligence:Deep dive into potential investments by examining whitepapers, roadmaps, and the development team's credentials. A project's value proposition, use cases, and future plans are essential factors to consider.

Do Fundamental Analysis:Assess the real-world application, partnerships, and regulatory compliance of the project. Coins with practical use cases and strong partnerships often have a solid foundation for growth.

Do Technical Analysis:Analyze market trends, trading volume, and market capitalization to understand investor interest and the potential for price movements. Recognizing patterns and breakout points can be crucial for timing investments.

Develop an Investment Plan:Establish clear goals, diversification strategies, and risk management measures. Setting targets and stop-loss levels before investing can help protect your capital and maximize returns.

Step 1. Use tools and resources

Navigating the vast ocean of cryptocurrencies requires reliable tools and resources. Platforms such as CoinMarketCap, CoinGecko, 3Commas, and CryptoSlate are invaluable for their comprehensive data and insights. They provide real-time information on price movements, market capitalization, and volume that are crucial for making informed decisions.

Equally important is tapping into community feedback. Social platforms like Reddit, Twitter, Discord, and Telegram are rich sources of sentiment and feedback from a diverse set of participants. These communities can offer unfiltered perspectives on projects, sharing experiences, expectations, and concerns that may not be evident from data alone.

Step 2. Research and due diligence

Whitepapers and Roadmaps:A project’s whitepaper and roadmap are its blueprint. Reading these documents thoroughly can give you insight into its unique value propositions, practical use cases, and future plans. They reflect the project’s ambition, feasibility, and attention to detail.

Development Team:The people behind a project are as critical as the project itself. Investigate the track record and reputation of the developers and advisors. Experienced and reputable team members can significantly enhance a project's credibility and its chances of success.

Community and Ecosystem:A vibrant, engaged community is often a sign of a project's vitality. Explore forums, social media, and other platforms for community interactions. A strong community not only supports the project but can also drive adoption and foster a robust ecosystem around the coin.

Step 3. Do fundamental analysis

Fundamental analysis delves into the core attributes of a cryptocurrency to evaluate its long-term viability.

Real-World Use Case:Seek out coins that address genuine problems with practical applications. Cryptocurrencies that offer solutions to existing challenges in industries such as finance, supply chain, or healthcare have a foundation for adoption and growth.

Partnerships and Collaborations:Partnerships with well-established companies are promising indicators of a project's credibility and market acceptance. They can provide the necessary infrastructure, exposure, and validation that accelerate adoption.

Regulatory Compliance:In a landscape where regulations are evolving, ensuring that a project adheres to legal standards is crucial. Compliance reduces the risk of shutdowns, fines, or other legal issues, providing a more stable investment.

Step 4. Do technical analysis

Technical analysis focuses on market behavior, primarily through the study of price charts and trading volumes, to forecast future price movements.

Market Trends:Understanding the general direction of the market is vital. Analyzing trends helps in identifying whether the overall market sentiment is bullish or bearish, affecting altcoin prices. Look for patterns and potential breakout points that signal buying opportunities.

Avoid investing in very risky altcoins during a bear market:Altcoins tend to suffer significantly in bear markets, making them riskier investments. It's often wise to wait for signs of a market turnaround before investing.

Volume and Market Cap:Trading volume and market capitalization are key indicators of investor interest and the potential for growth. High volume in relation to market cap can indicate a strong interest in the coin and, potentially, price movement to the upside.

Step 5. Develop an investment plan

Creating a well-thought-out investment plan is crucial for navigating the volatile landscape of cryptocurrency investments, especially when considering altcoins with the potential for 100x returns.

Set Targets and Stop Loss Levels in Advance:Before making any investment, define clear entry and exit strategies. Setting target prices for taking profits and stop-loss levels to minimize losses allows you to manage risk effectively, ensuring emotions don't dictate your trading decisions.

Diversify Your Portfolio:Avoid the temptation to put all your funds into a single project, no matter how promising it may seem. Diversification spreads your risk across different assets, protecting you from significant losses if one investment underperforms.

Invest Only What You Can Afford to Lose:The high-reward potential of cryptocurrencies comes with high risk. It’s essential to only invest money that you can afford to lose, ensuring that potential losses do not impact your financial stability.

Stay Informed:The crypto market is dynamic, with new information and developments constantly emerging. Keeping abreast of the latest news, technological advancements, and regulatory changes can help you make informed decisions and adjust your investment plan as needed.

Pros and cons of investing in altcoins

Investing in altcoins can be an attractive proposition for many investors looking to diversify their portfolios beyond the more established cryptocurrencies like Bitcoin and Ethereum. However, as with any investment, there are both potential rewards and risks involved. Understanding these can help investors make more informed decisions.

- Pros

- Cons

- High Growth/Profit Potential:Altcoins often have a lower market capitalization compared to their mainstream counterparts, which means they have the potential for significant growth. A well-chosen altcoin can provide returns that far exceed those of more established cryptocurrencies, offering the allure of 100x gains that attract investors to the space.

- Innovation and Utility:Many altcoins are developed to address specific problems or introduce new functionalities not available in Bitcoin or Ethereum. Investing in these projects can not only yield financial returns but also support the development of innovative technologies and applications in the blockchain ecosystem.

- Diversification:Including altcoins in a cryptocurrency portfolio can reduce risk through diversification. Different altcoins may respond differently to market dynamics, spreading the investor's risk across various projects and sectors within the crypto space.

- Volatility and Risk:Altcoins are subject to high volatility and can be more risky than more established cryptocurrencies. Their prices can experience sharp fluctuations based on market sentiment, news, or project developments, which can lead to significant losses.

- Liquidity Concerns:Some altcoins may have lower trading volumes, making them harder to buy or sell without affecting the market price. This liquidity risk can be a concern for investors looking to enter or exit positions in these assets.

- Regulatory Uncertainty:The regulatory environment for cryptocurrencies is still evolving, and altcoins could be significantly affected by future regulations. Changes in laws and regulations can impact the viability of a project or its ability to operate, introducing additional risks for investors.

For further insights into crypto investing, read our article on How To Become A Successful Cryptocurrency Investor?

Conclusion

The allure of altcoins lies in their potential to deliver substantial returns, a prospect that continues to draw investors to the crypto market. However, the path to finding a 100x altcoin is fraught with volatility and uncertainty. It's a venture that demands thorough research, a keen understanding of the market, and a well-considered strategy.

Always prioritize doing your own research (DYOR) to navigate the complexities of the cryptocurrency landscape. Additionally, seeking advice from a financial advisor can provide valuable insights and help mitigate risks. Remember, while the opportunities for growth are vast, the journey is speculative and requires a cautious and informed approach.

FAQs

What does 100x mean in crypto?

In crypto, 100x refers to an investment increasing to 100 times its original value. It signifies a substantial return on investment, where, for example, $1 would turn into $100.

Is it worth buying altcoins?

Buying altcoins can be worth it for investors looking for high growth potential and willing to accept the associated risks. They offer diversification and the chance to invest in innovative projects.

Where can I find altcoins?

Altcoins can be found on various cryptocurrency exchanges and trading platforms. Popular ones include Binance, ByBit, and Kraken, among others that list a wide range of altcoins for trading.

Is it a good time to buy altcoins?

The best time to buy altcoins depends on market conditions, the specific altcoin's fundamentals, and technical analysis. It's crucial to research and understand the current market cycle before investing.

Related Articles

Team that worked on the article

Vuk stands at the forefront of financial journalism, blending over six years of crypto investing experience with profound insights gained from navigating two bull/bear cycles. A dedicated content writer, Vuk has contributed to a myriad of publications and projects. His journey from an English language graduate to a sought-after voice in finance reflects his passion for demystifying complex financial concepts, making him a helpful guide for both newcomers and seasoned investors.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Bitcoin is a decentralized digital cryptocurrency that was created in 2009 by an anonymous individual or group using the pseudonym Satoshi Nakamoto. It operates on a technology called blockchain, which is a distributed ledger that records all transactions across a network of computers.

Forex leverage is a tool enabling traders to control larger positions with a relatively small amount of capital, amplifying potential profits and losses based on the chosen leverage ratio.

Diversification is an investment strategy that involves spreading investments across different asset classes, industries, and geographic regions to reduce overall risk.

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

Yield refers to the earnings or income derived from an investment. It mirrors the returns generated by owning assets such as stocks, bonds, or other financial instruments.