Best Market Alerts For Day Trading in 2024

The best day trading alerts service - The Trading Analyst

The best day trading alerts in 2024 are:

-

1

The Trading Analyst - real-time options alerts with proven profitability and educational resources

-

2

Market Chameleon - versatile research platform for stock and options trading opportunities

-

3

eToro - known for copy trading, suitable for both beginners and experts

-

4

Mindful Trader - data driven swing trade alerts

-

5

Learn2Trade - high-success-rate swing trade alerts across various assets

-

6

Forex Signals - real-time analysis and trade recommendations for currencies

As the markets continue to evolve, traders seek real-time insights and actionable signals to seize opportunities and navigate the financial landscape effectively. In this article, the experts at TU will look at the best day trading software services with alerts in 2024.

Best day trading alerts in2024

| Alerts Provider | Alert channel | Markets | Costs |

|---|---|---|---|

SMS |

Stocks |

Monthly Plan: $147, Annual Plan: $787, Quarterly: $357 |

|

Stocks and options |

Free Service: $0, Stock Trader: $39/month, Options Trader: $69/month, Earnings Trader: $79/month, Total Access: $99/month |

||

Web App |

Forex, stocks, CFDs, crypto, commodities |

Nil |

|

Email, SMS |

Stocks, options, futures |

$47/month |

|

Email, SMS, Telegram |

Forex, stocks, CFDs, crypto, commodities |

1-month subscription: £40, 3-month subscription: £30, 6-month subscription: £21.5, Lifetime subscription: £399, trading group: £50 |

|

Email, SMS |

Forex |

The Apprentice: $59/month w/ 50% discount, The Committed: $37/month w/ 50% discount, The Professional: $26/month w/ 50% discount |

The Trading Analyst

The Trading Analyst

The Trading Analyst is a good option for traders looking to make informed decisions without emptying their wallets. This service provides real-time trading alerts via SMS, making it particularly appealing to beginners. Its offering includes reasonable pricing, a track record of profitability, frequent alerts, and access to educational materials.

Upon subscribing to The Trading Analyst, traders receive timely alerts with clear signals and precise pricing. This approach tries to ensure that traders never miss out on trading opportunities. The service places a strong emphasis on achieving long-term, consistent profits, targeting gains ranging from 10% to 25% per trade, all while promoting sound risk management practices. Priced at an annual subscription fee of $787, The Trading Analyst offers an affordable means to access valuable trading insights and potentially gain a competitive edge in the market.

Key features

Profound insights from seasoned traders

Real-time trading alerts featuring exact entry prices and profit targets

Implementation of a distinctive volume confirmation algorithm for secure trading

A comprehensive collection of educational resources

Multiple membership plans catering to various needs and budgets

Transparent disclosure of performance results and strategies

A thriving community for networking and support

Abundant research opportunities and strategies for risk management

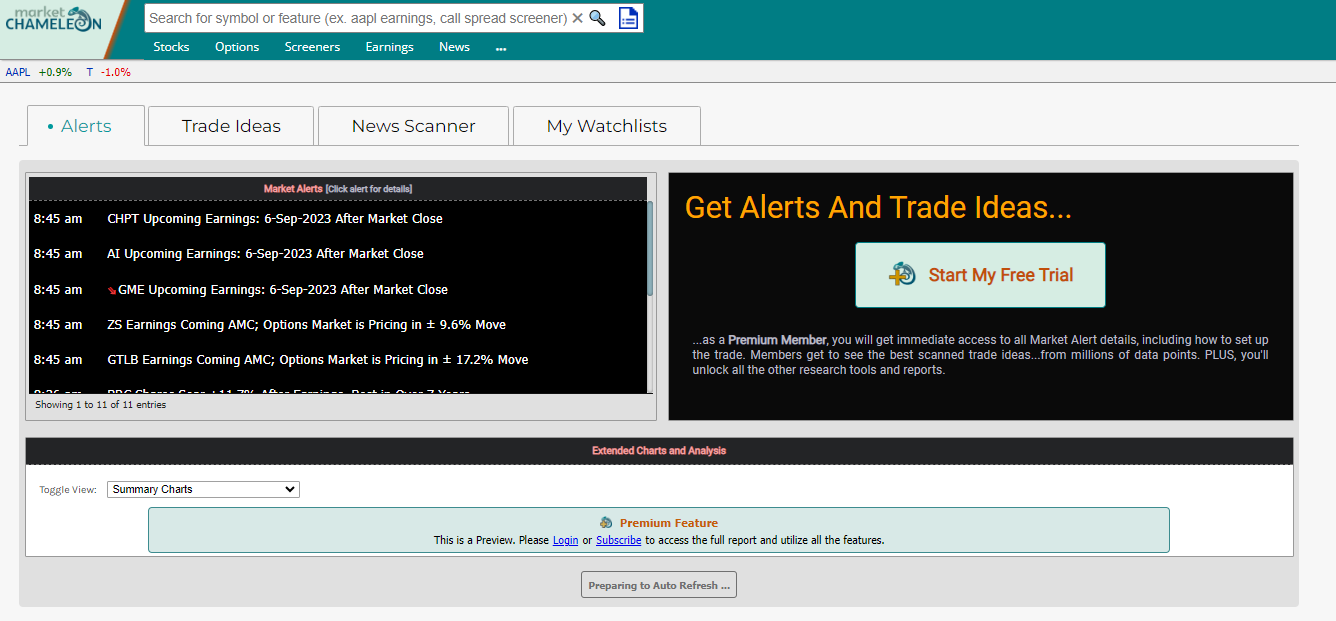

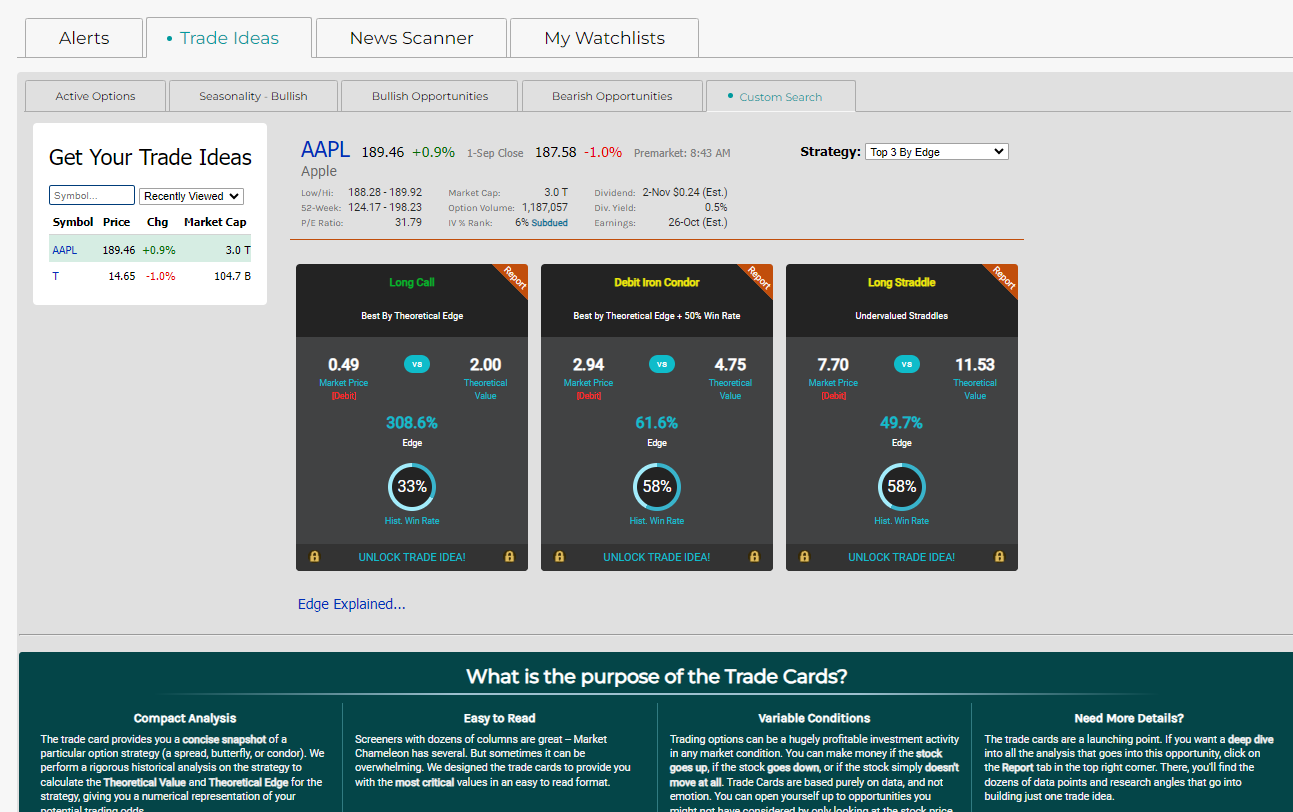

Market Chameleon

Market Chameleon

Market Chameleon is a versatile trading research platform designed to help traders uncover trading opportunities in the U.S. stock and options markets. The platform's toolkit is replete with tools like stock and options screeners, earnings research, and volume reports, making it a powerful resource for investors and traders alike.

Key features

A wide array of features, including stock, options, and earnings research

Availability of newsletters and customizable stock watchlists

Pre-market trading data for early birds

Historical analysis of Gap Up and Gap Down stock prices

In-depth examination of after-hours trading activity

Insights into market order imbalances

Options volume and volatility scanners

A comprehensive earnings calendar for strategic planning

Diverse stock and options screeners with customizable filters

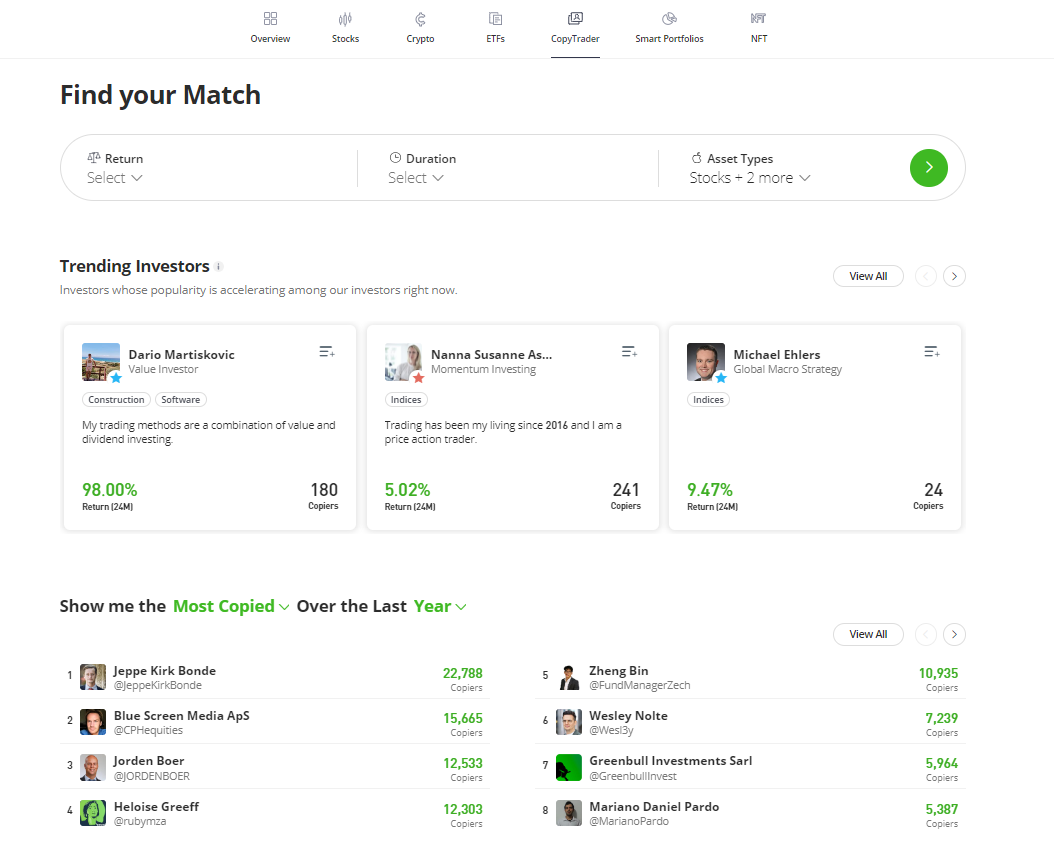

eToro

eToro

eToro takes a different approach by offering a unique copy trading experience that allows beginners to potentially earn on par with top traders on the platform. With a minimum investment requirement of $200 and no additional commissions, it has the largest copy trading network globally and maintains regulatory compliance in the UK, EU, and Australia.

eToro's platform resembles a social network, complete with trader profiles featuring verified data and user interactions. Traders' statistics reveal comprehensive performance metrics, including returns, maximum losses, and risk scores. The platform also provides insights into portfolio composition and profitability dynamics. It's important to note, though, that past performance does not guarantee future results.

Key features

User-friendly, social network-style interface

Trader profiles with verified data for trustworthiness

In-depth performance statistics, risk scores, and drawdown data

Real-time portfolio composition and current Profit/Loss percentages

Dynamic profitability charts for performance assessment

Insights into the distribution of assets by markets and recent trades

Averages for profitable trades to gauge trader competence

Mindful Trader

Mindful Trader

Mindful Trader, founded by Eric Ferguson in 2020, stands out as a day trade alert service with a solid foundation. Armed with a Stanford University degree in Economics, Ferguson delved into the intricate world of stock price action, trading patterns, and strategies. His extensive analysis paved the way for the creation of Mindful Trader, using a data-driven approach.

One of the key highlights of Mindful Trader is its impressive 20-year backtest, revealing a winning scenario with an average annual return of 181%. This remarkable track record sets the stage for the service's success.

Mindful Trader offers its members a stream of day trade alerts that have proven their worth. Subscribers receive between five to fifteen trade alerts each week, all generated using Eric Ferguson's data-driven methodology.

Members gain access to valuable resources, including the creator's watchlist, real-time positions displayed on the member dashboard, and a detailed trading history dating back to the service's inception. This paid day trading alerts service equips traders to capitalize on short-term market movements, providing clear instructions on when to open and close positions.

Mindful Trader offers its service at a cost of $47 per month, with the flexibility to cancel at any time.

Key features

A robust foundation built on comprehensive backtesting and analysis

Clear and defined trade conditions with precise entry and exit details

Access to the creator's watchlist prior to trade execution

A transparent display of the entire trading history and live positions on the member dashboard

A strong emphasis on achieving a balanced risk-reward ratio

In-depth trade analysis

Transparent trading history for scrutiny

Real-time trade alerts

Comprehensive educational resources

Strategy backtesting tools

Learn2Trade

Learn2Trade

Learn2Trade emerges as a platform for receiving trading price alerts with a high success rate and probability. This all-encompassing solution caters to both beginners and seasoned professionals, offering insightful trade ideas, market news, and price alerts.

Learn2Trade's versatility extends beyond geographical boundaries and financial instruments. It covers Forex currencies, stocks, CFDs, cryptocurrencies, and commodities, ensuring a wide range of trading options. Regardless of your broker, you can receive asset-specific alerts by signing up with Learn2Trade.

The platform offers both free and paid versions, with the premium option unlocking additional features and benefits. Signals are conveniently delivered via Telegram, either through the Telegram app or directly to your phone.

Learn2Trade's signals are generated by experienced experts with over 15 years of industry knowledge, enhancing their reliability. Operating from the UK, the platform's analysts are well-positioned to provide timely and accurate insights.

With a diverse community of over 50,000 members, Learn2Trade offers price alerts that go beyond mere figures, providing traders with comprehensive information for informed decision-making. These alerts include take profit and stop-loss levels.

Key features

Daily technical analysis & weekly webinars

Alerts on economic events

Unlock entry price

Mobile notifications & Telegram alerts on all signals

3 VIP Forex signals a week

ForexSignals

Forexsignals.com

Forexsignals.com offers a subscription-based online service designed to provide real-time analysis and trade recommendations for currency pairs. Accessible through a mobile app and online platform, it ensures flexibility and convenience for traders.

A standout feature of Forex Signals is its extensive market analysis, combining technical and fundamental factors to generate daily trade recommendations. Beyond market insights, the platform emphasizes education, offering video tutorials, webinars, and tools to enhance trading skills.

Key Features of Forex Signals

Real-time analysis and trade recommendations for currency pairs

Accessibility through mobile app and online platform

Comprehensive market analysis blending technical and fundamental factors

Educational resources, including video tutorials and webinars

Diverse range of strategies, including day trading, swing trading and scalping

Trading Room for live trading with professionals

Free tools such as lot size and profit calculators

Currency heat map for tracking currency pair performance

What is day trading?

Day trading uses short-term fluctuations or price movements of securities within a single trading day. The premise of day trading involves purchasing a stock at one point during the trading day and subsequently liquidating the position before the market's closing bell. Should the security’s price ascend during the duration of ownership, the day trader can realize a swift capital gain.

However, it's essential to acknowledge that day trading also has its own set challenges, with the most significant one being transaction costs. These costs primarily encompass taxes and trading commissions. Furthermore, day trading isn't universally suitable, particularly for individuals with limited financial resources, minimal investment or trading experience, and a low tolerance for risk.

What are trading alerts?

Trading alerts serve as valuable tools that notify traders of potential trading opportunities, rooted in predefined criteria or significant market occurrences. These alerts are spread through various channels, including email, text messages, or directly within trading platforms. These alert services specialize in different timeframes, encompassing intra-session day trading, multi-day, weekly, or monthly swing trades, and even medium-to-long-term strategies focused on momentum or growth stocks. They offer systematic and rule-based approaches, equipped with actionable watch lists, scanning tools, idea validation, and a comprehensive array of both swing and day trading alerts.

How do trading alerts work?

Trading alerts serve as real-time notifications, delivering valuable insights into potential trading opportunities that align with predefined criteria or noteworthy market shifts. These alerts can draw upon a range of sources, including technical indicators, fundamental analysis, or a fusion of both methodologies.

Trading alerts function by promptly apprising traders of promising trading prospects, grounded in predetermined criteria or notable market developments. These notifications reach traders through diverse channels, encompassing email, text messages, or within their chosen trading platforms. Trading alerts specifically inform traders when a favorable trade setup emerges in the market, requiring traders to subscribe to signal providers for access. These providers often include seasoned traders who sell their trading signals as an additional income stream or financial firms with a specialization in market analysis.

To pinpoint the ideal stocks or financial instruments for trading at a given moment, trade alert providers meticulously evaluate trade setups, strategies, historical data, and the prevailing market conditions. Services offering alerts present a structured, rule-based approach, complemented by actionable watch lists, robust scanning tools, idea validation mechanisms, and a comprehensive array of trading alerts.

Pros and cons of trading alerts

👍 Pros

•

Capitalizing on short-term trends

Trading alerts serve as a valuable tool for traders seeking to harness short-term market trends. These alerts enable traders to hold assets for brief periods, often overnight, in a bid to profit from day-to-day price shifts.

•

Broadening horizons

Trading alerts can expand a trader's perspective, unveiling fresh trading opportunities that might have otherwise gone unnoticed.

•

Streamlined watchlists

By receiving trade alerts, traders can construct more manageable watchlists, ensuring they don't miss out on potentially profitable trades.

•

Enhanced market tracking

Alerts keep traders informed about multiple setups and current company news, helping them stay abreast of market developments.

•

Competitive advantage

Utilizing a reputable trading alert service can provide traders with a significant edge, owing to real-time SMS alerts, competitive pricing, and a proven track record of returns.

•

Time and effort savings

Trading alerts streamline the decision-making process, saving traders valuable time while still equipping them with valuable trading insights.

•

Rapid decision-making

These alerts are invaluable for short-term investors, facilitating swift decision-making and furnishing reliable data.

👎 Cons

•

Variable profitability

Market conditions can vary, leading to periods of slower trading activity where not all alerts may yield profitable outcomes.

•

Fine-tuning challenges

The key to effective alerts lies in their precision, ensuring traders receive only the most relevant information.

•

Alert overload

It's essential to guard against receiving an excessive number of alerts, which can become overwhelming and counterproductive.

•

Profit guarantee absence

Providers of trade alerts can range from experienced traders to financial firms specializing in market research. However, there's no guarantee that every alert will translate into profits, underscoring the importance of due diligence in selecting providers.

How to find the best software for trading alerts?

Selecting the optimal trading alert software in 2023 can be simplified by following these strategic steps:

Define your alert requirements

Start by pinpointing the type of trading alerts you need, whether it's day or swing trading alerts, aligning with your trading style.

Conduct comprehensive research

Explore the diverse array of trading alert software available in the market. Compare their features, functionality, and user reviews to gauge their suitability.

Real-time alert capability

Prioritize software that delivers real-time alerts via email, text messages, or directly within your chosen trading platform. This ensures you stay promptly informed.

Customizable charting and tools

Look for software that offers customizable charting capabilities and essential trade tools upfront, enabling you to tailor your trading experience.

Technical signal detection

Seek software equipped to alert you to crucial technical signals in stocks you're tracking, enhancing your decision-making process.

Alert services

Opt for software that provides a comprehensive package, encompassing an actionable watch list, efficient scanners, idea vetting resources.

Access to portfolio tracking

Ensure the software grants access to a real-time portfolio tracker, allowing you to monitor your investments effectively. Additionally, consider whether it offers an educational database to enrich your trading knowledge.

Trial period and guarantees

Check if the software offers a free trial period or a money-back guarantee. This allows you to test its suitability without committing fully.

User feedback analysis

Peruse reviews and ratings from fellow traders to gauge the reliability and effectiveness of the software in real-world trading scenarios.

Cost

Ultimately, choose software that aligns with your specific trading needs and budget constraints, ensuring a harmonious fit for your trading journey.

FAQs

What is daily trade alert?

A daily trade alert is a brief message or signal that highlights potential trading opportunities in financial markets, helping traders make informed decisions.

How do you keep track of day trades?

Traders keep track of day trades by using trading journals, real-time trading platforms, risk management tools, and alerts to monitor positions and performance.

How do I set up trade alerts?

To set up trade alerts, choose a platform, specify alert conditions (e.g., price levels, technical indicators), select alert types (email, SMS), and activate the alerts to receive notifications when specified criteria are met.

How do stock alerts work?

Stock alerts work by notifying traders about specific stock-related events or conditions, such as price movements, volume changes, news releases, or technical indicator signals, helping them make informed trading decisions.

Glossary for novice traders

-

1

Trading

Trading involves the act of buying and selling financial assets like stocks, currencies, or commodities with the intention of profiting from market price fluctuations. Traders employ various strategies, analysis techniques, and risk management practices to make informed decisions and optimize their chances of success in the financial markets.

-

2

Broker

A broker is a legal entity or individual that performs as an intermediary when making trades in the financial markets. Private investors cannot trade without a broker, since only brokers can execute trades on the exchanges.

-

3

Day trading

Day trading involves buying and selling financial assets within the same trading day, with the goal of profiting from short-term price fluctuations, and positions are typically not held overnight.

-

4

Risk Management

Risk management is a risk management model that involves controlling potential losses while maximizing profits. The main risk management tools are stop loss, take profit, calculation of position volume taking into account leverage and pip value.

-

5

Cryptocurrency

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

Team that worked on the article

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).