The Trading Analyst alerts - Should you try?

The service is definitely worth a try. Considering proven profits, low fees, and educational materials, The Trading Analyst alerts could be a smart option to help optimize your options portfolio. With over 10+ years of profitable trades thanks to careful risk management, it has a strong track record. A free trial lets you decide if the swing trading approach and ease of use fit your needs.

When it comes to options trading, making profitable decisions in fast-moving markets can be challenging. This is where options trading alert services provide value, helping traders stay up-to-date on emerging opportunities and trends. In this review, we examine The Trading Analyst alerts service to see if it can deliver on its promises. We will take an in-depth look at the service's key features and performance stats, evaluating whether a subscription could help boost returns. Important considerations include the types of alerts offered, educational resources available, costs versus competitors, and of course, the ability to ultimately generate profits over time.

Key points from the article

-

The Trading Analyst is an options alert service that provides real-time options trade alerts via SMS messages with clear buy/sell signals and price levels.

-

It uses a swing trading strategy targeting gains of 10-25% per trade with a focus on risk management and limiting losses.

-

The platform has a proven track record since 2018 with 331 winning trades and 289 losing trades, for a win rate of 53.3% and profit factor of 1.67.

-

Subscription plans range from $147/month to $787 annually, with 2-5 alerts per week on average.

-

Subscribers can track their portfolio and performance in real-time through the service's tracker and have access to educational databases with videos, webinars, articles.

-

The service provides an exclusive weekly trading report for members with market outlook and portfolio updates.

What is The Trading Analyst?

The Trading Analyst presents an options alert service, giving traders real-time trading alerts through SMS. This service is perfect for beginners who seek well-informed trading choices without incurring excessive fees. The Trading Analyst delivers reasonable pricing, a demonstrated history of profitability, an adequate frequency of alerts, and access to educational resources.

Upon joining The Trading Analyst, traders obtain real-time text message alerts containing clear signals and precise pricing. When the service takes on a new options position, traders are sent a buy alert, and upon exiting a position, they receive a sell alert – all happening in real-time. This guarantees traders won't miss any trading prospects.

The Trading Analyst adheres to a strategy centered on long-term, steady profits, targeting gains of 10% - 25% per trade. The service emphasizes proper risk management to reduce losses and optimize gains. With an annual subscription fee of $787, The Trading Analyst provides a cost-efficient means of acquiring valuable trading insights and potentially gaining a competitive edge in the market.

To sum up, experts find The Trading Analyst to be a trustworthy and reasonably priced option alert service that supplies transparent, actionable trading signals in real-time. Focusing on consistent earnings and appropriate risk management, it serves as an exceptional choice for novice traders aiming to enhance their trading outcomes.

Binary Options Signals – Top 7 Free Providers for TradingWhat are options trading alerts?

An options trading alert service is a powerful tool utilized by options traders to enhance their trading decisions and boost profitability. Essentially, it is a subscription-based service that provides alerts to traders via phone or email when key trading opportunities arise. These alerts are generated by a combination of expert analysis, algorithms, and analyzed information, which are all used to make informed trading decisions.

The alerts not only provide notification of potential trades but can also contain valuable information such as new trading strategies, ideas, time-saving tips, and risk reduction techniques. These services are used by both novice and expert traders, as they can help traders of all levels improve their trading performance and stay up to date with market trends.

In summary, an options trading alert service is an essential tool for traders looking to stay ahead of the game and maximize their profitability. By receiving timely and accurate information, traders can make informed trading decisions and potentially gain an edge in the market.

Best Options Trading Alert ServicesHow do options trading alerts work?

Option alerts are generated in several different ways, with the aim of providing traders with timely and relevant information to make informed trading decisions. One of the most common methods is through the use of sophisticated algorithms that can analyze vast amounts of market data and predict changes in market trends.

Another source of option alerts is expert traders who have in-depth knowledge of different assets and market trends. These traders use their expertise to identify key information and then extend advice to other traders based on their discoveries. This method is particularly useful for traders who want to gain insights into the market from experienced professionals.

For a fully automated trading experience, some traders opt to implement option alerts directly into their trading platforms. However, many day traders prefer to examine each signal before implementing it into their trading strategy. This allows traders to maintain full control over their trades and make informed decisions based on the information provided.

In summary, option alerts can be generated through algorithms, expert traders, or integrated into trading platforms. Regardless of the method used, option alerts provide traders with valuable information to make informed trading decisions and potentially gain an edge in the market.

How to Set Alerts in OptionsThe Trading Analyst features review

Out of all the services The Trading Analyst has to offer, the experts have reviewed some of the most unique and useful ones:

Real-time trading alerts via SMS

The Trading Analyst's real-time trading alerts via SMS messaging are one of the most convenient features of the service. These alerts allow traders to receive timely notifications of potential trading opportunities, making it easier for them to make informed decisions in real-time. The real-time nature of these alerts is especially useful in fast-moving markets where timing can be critical.

Gain access to a real-time Portfolio Tracker

The real-time portfolio tracker offered by The Trading Analyst provides a detailed view of a trader's portfolio performance in real-time. This feature is especially useful for traders who want to track their progress over time and make adjustments to their trading strategy as needed. With the ability to monitor gains and losses, traders can easily adjust their strategy to maximize profits and minimize losses.

Educational database

The educational database offered by The Trading Analyst is an extensive resource that provides traders with valuable insights into the options trading market. The database includes detailed explanations of various trading strategies, analysis of market trends, and helpful tips for managing risk. This feature is especially useful for novice traders who want to learn more about the market and improve their trading performance.

2-5 real-time trade alerts per week

On average, The Trading Analyst generates 2-5 real-time trade alerts per week, which is a manageable number for traders to consider. This feature helps to avoid overwhelming traders with too many alerts, allowing them to focus on the most promising trades. The alerts are generated based on a range of market data and expert analysis, making them reliable and potentially profitable.

Profitable trading record

The Trading Analyst has a strong trading record, with 331 winning trades and 289 losing trades. This translates to a win rate of 53.3%, with a profit factor of 1.67. These statistics indicate that the service has generated 1.8 times more profit than what was lost, making it a potentially profitable option for traders. This feature is especially attractive for traders who want to maximize their profits while minimizing their risk.

Weekly trading report

The Trading Analyst's weekly trading report is an exclusive member-only feature that provides subscribers with valuable insights into the options trading market. This report is released every week and helps keep subscribers up-to-date on current market events and prepares them for the following week.

Best Day Trading Software and Tools to UseThe Trading Analyst additional features

Apart from the features discussed above, The Trading Analyst also offers the following:

Alerts feature exact prices and signals

The Trading Analyst's alerts feature exact prices and signals, making it easy for traders to execute trades. The service provides clear and concise information about each trade, including the entry and exit prices. The exact prices and signals provided by the alerts help traders make informed decisions, as they can be confident that they are receiving accurate information.

Swing trading strategy - Going for larger wins

The Trading Analyst's swing trading strategy is designed to target larger wins. Swing trading is a strategy that involves holding a position for a short period of time, typically a few days to a few weeks, to capture short-term gains in the market. This strategy differs from day trading, which involves opening and closing positions within a single trading day. By focusing on larger wins, The Trading Analyst aims to help traders maximize their profits over time.

Best Swing Trading Alerts ServicesThe Trading Analyst costs

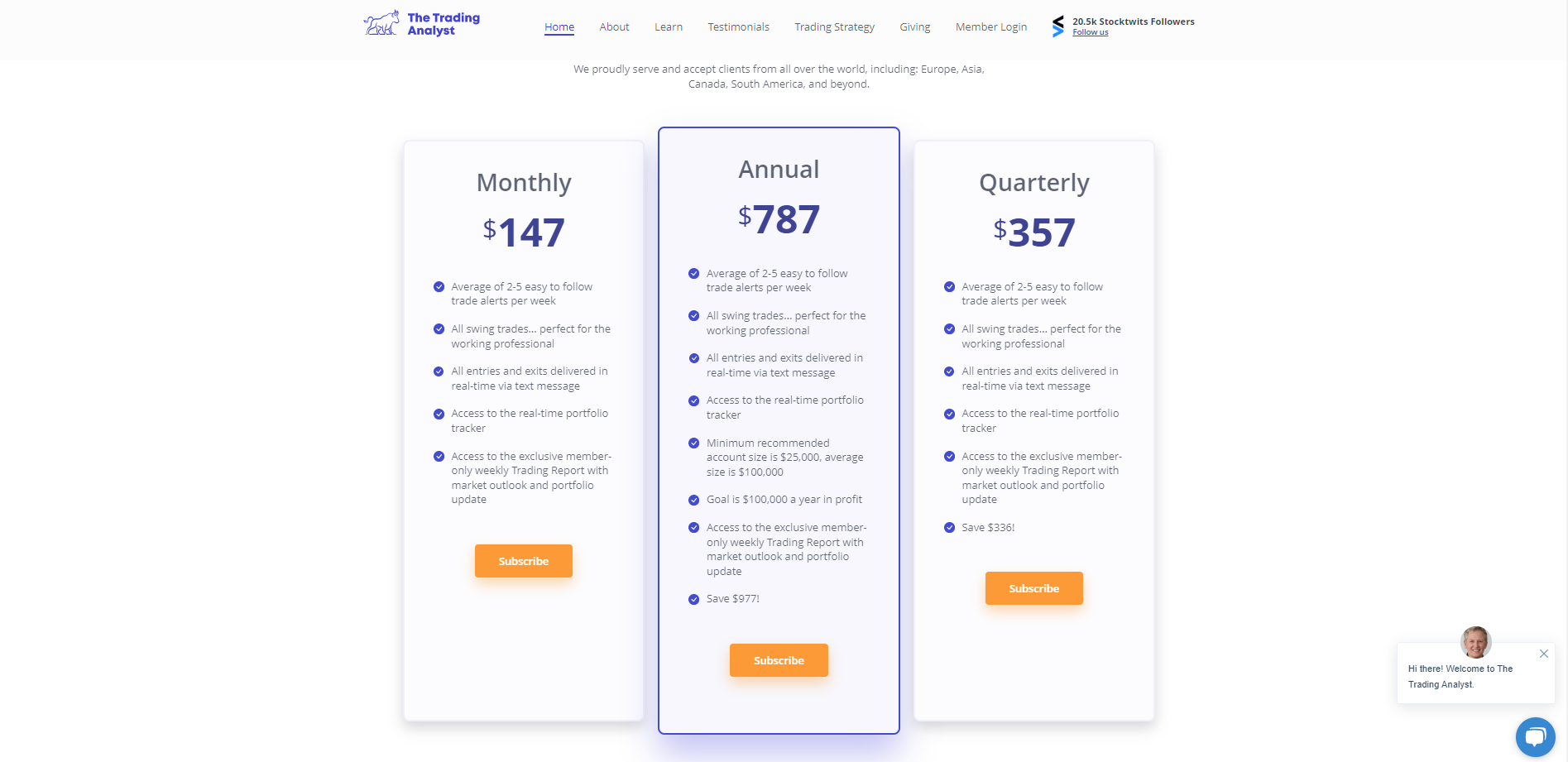

The Trading Analyst offers three subscription options to fit different trading styles and budgets. Here's a closer look at each subscription option:

Monthly Subscription - $147 per month

The monthly subscription to The Trading Analyst costs $147 per month and includes an average of 2-5 easy to follow trade alerts per week. These trade alerts are all swing trades, making them perfect for working professionals who don't have time to monitor the markets all day. All entries and exits are delivered in real-time via text message, and subscribers gain access to a live portfolio tracker.

Annual Subscription - $787 per year

The annual subscription to The Trading Analyst costs $787 per year and includes all the same features as the monthly subscription. In addition, the minimum recommended account size is $25,000, and the average size is $100,000. The goal of this subscription is to generate $100,000 per year in profit. Subscribers of the annual subscription save $977 compared to the monthly subscription, making it a cost-effective option for traders who want to commit to the service long-term.

Quarterly Subscription - $357 per quarter

The quarterly subscription to The Trading Analyst costs $357 per quarter and includes all the same features as the monthly and annual subscriptions. Subscribers of the quarterly subscription save $336 compared to the monthly subscription, making it a great option for traders who want to try the service out for a few months before committing to a longer-term subscription.

In summary, The Trading Analyst offers three subscription options to fit different trading styles and budgets. The monthly subscription costs $147 per month, the annual subscription costs $787 per year, and the quarterly subscription costs $357 per quarter. All three subscriptions include 2-5 easy to follow trade alerts per week, all swing trades, all entries and exits delivered in real-time via text message, access to the live portfolio tracker, and access to the exclusive member-only weekly Trading Report with market outlook and portfolio updates.

Best Time Frames For Swing Trading You Should KnowIs The Trading Analyst worth it? Is it effective?

The Trading Analyst claims to offer a key to winning long-term trades through proper risk management. Since July of 2018, they have had 331 winning trades and 289 losing trades, resulting in an average win of $4,383.25 and an average loss of -$2,619.59. This gives them a profit factor of 1.67, which is a positive sign for traders who are considering subscribing to their service.

In addition, one of the key features of The Trading Analyst is their protected Target Profit Calculation formula. This formula is used to determine not just when it's time to take a profit, but also when it's time to cut losses. By keeping losses to a minimum and ensuring maximum gains, The Trading Analyst aims to help traders generate consistent profits over time.

👍 Pros

•Easy-to-follow real-time alerts: The Trading Analyst's alerts are designed to be easy to understand and execute. They are delivered in real-time via text message, making it simple for traders to act quickly on potential trading opportunities.

•Uses a proven trading strategy: The Trading Analyst focuses on swing trading, which is a trading strategy that aims to target larger wins. This strategy has been proven to be effective in the options trading market, and The Trading Analyst has a solid track record of successful trades.

•Subscribers can save up to $1,467 by choosing the annual plan: The annual subscription plan for The Trading Analyst is significantly cheaper than the monthly or quarterly plans, and subscribers can save up to $1,467 per year by choosing this option.

•All subscriptions can be canceled anytime: The Trading Analyst offers flexibility for traders who want to try the service out before committing to a longer-term subscription. All subscriptions can be canceled at any time, providing peace of mind for subscribers who want to avoid long-term commitments.

•Protected Target Profit Calculation formula ensures maximum gains and minimum losses: The Trading Analyst's protected Target Profit Calculation formula is designed to maximize gains and minimize losses. This formula is used to determine when it's time to take a profit and when it's time to cut losses, helping subscribers to generate consistent profits over time.

•Weekly trading report provides valuable insights into the options trading market: The Trading Analyst's weekly trading report provides subscribers with a market outlook, portfolio updates, and a summary of the previous week's trades. This report is exclusive to members and provides valuable insights into the options trading market.

👎 Cons

•Relatively pricey compared to competitors: The Trading Analyst's subscription fees are relatively high compared to some of their competitors. This may be a barrier for some traders who are looking for a more affordable options trading alert service.

•Does not provide in-depth research reports: While The Trading Analyst offers an extensive educational database and a weekly trading report, they do not provide in-depth research reports. This may be a disadvantage for traders who require detailed research and analysis to inform their trading decisions.

Is The Trading Analyst safe?

Experts have found The Trading Analyst to be an options trading alert service tailored to assist traders in achieving steady gains while mitigating risk. Their methodology encompasses a group of analysts who scrutinize a vast array of data sets to predict forthcoming market movements. They strictly adhere to their criteria before entering any position, which diminishes long-term risk and boosts overall profitability.

A significant aspect of The Trading Analyst's success lies in their profit target determination and risk management. They establish an initial profit target to sell half of each position and a secondary target to liquidate the remaining portion. Furthermore, they employ a stop-loss mechanism to curb losses and meticulously monitor option position sizing.

Since July 2018, The Trading Analyst has sustained a win rate exceeding 53%, comprising 331 victorious trades and 289 unsuccessful trades. Their average loss stands at -$2,619.59, while their average win amounts to $4,383.25, yielding a profit factor of 1.67.

By eliminating the necessity to comprehend market dynamics and scout for opportunities, The Trading Analyst streamlines the trading experience for subscribers. They benefit from successful trades, assurance, and the ability to maintain their daily routines.

In conclusion, The Trading Analyst's options trading alert service is designed to ensure safety and efficiency for traders seeking a tried-and-tested process, profit target computation, risk management, and a track record of profitability. The Trading Analyst distinguishes itself through its dedication to long-term risk management and its focus on reducing risk while maximizing gains.

FX Options for Beginners. Should I Trade?How to start working with The Trading Analyst

Here's a step-by-step process to start working with The Trading Analyst:

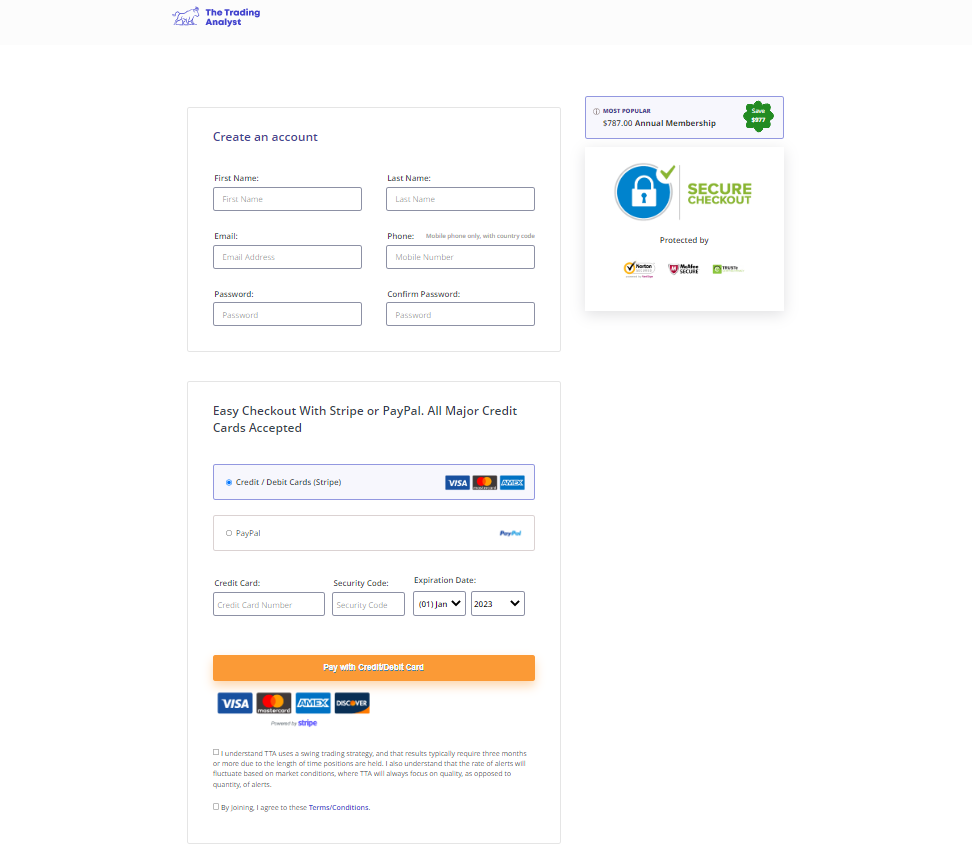

Go to The Trading Analyst website and choose your preferred subscription plan. The Trading Analyst offers a monthly plan for $147, a quarterly plan for $357, and an annual plan for $787.

How to start working with The Trading Analyst

Provide your contact information and billing details to sign up for the service. You can cancel your subscription anytime.

How to start working with The Trading Analyst

Once you have subscribed, you will start receiving the alerts.

Follow the trade alerts closely, and implement them in your trading strategy. The Trading Analyst recommends keeping your trading platform and alert service open at the same time for maximum efficiency, especially if you work as a day trader.

Utilize The Trading Analyst's educational database to enhance your trading knowledge and skills. They provide access to great educational content, including video tutorials, webinars, and blog posts.

Gain access to The Trading Analyst's real-time portfolio tracker, which shows your current and past trades, as well as your performance metrics.

Take advantage of the exclusive member-only weekly Trading Report with market outlook and portfolio update. This report helps keep you up to date on current market events and prepares you for the following week.

Monitor your trades and track your profits and losses. Use The Trading Analyst's recommended risk management strategies to minimize losses and maximize gains.

Is The Trading Analyst the best options signal provider for you?

As an aspiring trader or investor, choosing the right option signal provider can be a daunting task. With so many options out there, how do you know which provider is the best for you? It's important to evaluate a signal provider based on several key factors, including performance record, signaling methods, trading strategy, and educational resources. Here's why The Trading Analyst might just be the best option signal provider for you.

Maintaining a good (and transparent) performance record

The Trading Analyst has a strong and transparent performance record, which is essential when evaluating a signal provider. The performance record is a good indicator of the strength of their portfolio, and their ability to beat the market. TTA has consistently beaten the average market returns by over 20%, which is a rare feat. They employ a strong and adaptive strategy that focuses on risk management, with a proven track record of over 331 winning trades and 289 losing trades since July 2018. This demonstrates that they have both experience and strong returns over time, giving you more confidence in choosing them as your signal provider.

Consistent alerts and signals

The Trading Analyst sends real-time text alerts, which ensures that you don't miss out on any trading opportunities. The alerts feature clear BUY and SELL signals, based on the activity in their portfolio, which is essential for transparency. This is a much more effective signaling method compared to email alerts, which can be easily overlooked. You can also rely on frequent and consistent alerts, with an average of 2-5 per week, making it easy for you to follow in their footsteps to realize the same gains.

Proven trading strategy

The Trading Analyst has a clear, defined, and flexible strategy that guides the direction of their portfolio. Their risk management strategy is their top priority, which has resulted in more wins than losses, and losses being less than wins. They put potentially viable securities through a number of filters and key indicators, including technical analysis, avoiding small cap stocks due to inherent risk, and using screeners for certain activity. Their entry and exit strategy is also clearly defined, making it easy for you to follow. Experts find them to be concrete and succinct, which instills trust and confidence in their trading strategy.

Educational material

Lastly, The Trading Analyst doesn't just provide effective alerts; they also provide you with a wealth of educational material to help you become more knowledgeable on the market and trading. Their articles, videos, and guides are helpful resources that supplement your decision-making process, allowing you to make informed decisions.

Best Forex signals providersHow to use option alerts?

If you're interested in using option alerts to enhance your trading performance, here's a quick step-by-step guide to get started:

Research and choose an options trading alert service that suits your needs. You may want to consider factors such as the reliability and accuracy of the service, the level of customer support, and the cost of the subscription.

Sign up for the subscription service and complete any necessary registration or verification steps. Some services may offer a free trial period, while others may require a monthly or annual fee to access their alerts.

Determine how you would like to receive your alerts. Some services may offer a direct implementation of alerts into actionable trades via your broker, while others may be delivered via email, text message, or push notifications.

Once you have set up your alerts, start receiving them! We recommend keeping your trading platform and alert service open simultaneously for maximum efficiency, particularly if you work as a day trader.

By following these simple steps, you can start using options trading alerts to improve your trading decisions and potentially gain an edge in the market. Remember to stay vigilant and make informed decisions based on the information provided by the alerts. With the right approach, option alerts can be a valuable tool for traders of all levels.

Do professional traders use alerts?Summary

The Trading Analyst presents an encouraging options trading alert service based on its steady long-term performance and dedicated focus on risk management. By systematically limiting downside exposure through its protected profit calculation formula while still targeting reliable upside gains, the service seems built for sustainable success over many market cycles.

Traders drawn to the simplicity of its easy-to-action text alerts and educational resources should feel at ease experimenting with The Trading Analyst's proven swing trading approach. Those willing to commit long-term can benefit further from its cheaper annual subscription. Overall, the service seems well-designed for mobilizing options opportunities in a thoughtful, transparent manner which aligns well with building long-run trading profits. While not risk-free, The Trading Analyst's consistent outcomes indicate it delivers on backing subscribers with factual guidance for informed decision-making.

Glossary for novice traders

-

1

Trading

Trading involves the act of buying and selling financial assets like stocks, currencies, or commodities with the intention of profiting from market price fluctuations. Traders employ various strategies, analysis techniques, and risk management practices to make informed decisions and optimize their chances of success in the financial markets.

-

2

Options trading

Options trading is a financial derivative strategy that involves the buying and selling of options contracts, which give traders the right (but not the obligation) to buy or sell an underlying asset at a specified price, known as the strike price, before or on a predetermined expiration date. There are two main types of options: call options, which allow the holder to buy the underlying asset, and put options, which allow the holder to sell the underlying asset.

-

3

Risk Management

Risk management is a risk management model that involves controlling potential losses while maximizing profits. The main risk management tools are stop loss, take profit, calculation of position volume taking into account leverage and pip value.

-

4

Swing trading

Swing trading is a trading strategy that involves holding positions in financial assets, such as stocks or forex, for several days to weeks, aiming to profit from short- to medium-term price swings or "swings" in the market. Swing traders typically use technical and fundamental analysis to identify potential entry and exit points.

-

5

Broker

A broker is a legal entity or individual that performs as an intermediary when making trades in the financial markets. Private investors cannot trade without a broker, since only brokers can execute trades on the exchanges.

Team that worked on the article

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).