Best Defensive Stocks For 2024 Investment

The top 10 defensive stocks to invest in 2024 are:

-

GlaxoSmithKline (GSK): Diversified portfolio, strong pipeline, undervalued

-

Procter & Gamble (PG): Historic stability, innovation, growth potential

-

NextEra Energy (NEE): Clean energy leader, dividend growth

-

BioNTech SE (BNTX): mRNA pioneer, strong Q3 earnings

-

Johnson & Johnson (JNJ): Robust financials, innovative medicines

-

Taiwan Semiconductor (TSM): Chip technology leader, market recovery

-

Companhia Energetica de Minas Gerais (CIG): Defensive utility, high dividend yield

-

General Dynamics Corporation (GD): Strong growth, geopolitical exposure

-

Osisko Gold Royalties (OR): Strong gold outlook, diversified revenue

-

Entergy Corporation (ETR): Utility stability, clean energy commitment

In the ever-changing world of money matters, everyone wants investments that can stand strong against the uncertainties. In this article TU experts dives into the top 10 defensive stocks set for success in 2024. From pharmaceuticals to energy, it explores companies with sturdy financials, strategic moves, and promising outlooks. Analysts unravel the numbers, market trends, and recent events to uncover opportunities in various sectors. Whether it's groundbreaking science, resilient energy solutions, or solid dividends, these stocks promise a mix of stability and growth.

-

What are defensive stocks?

Defensive stocks are shares of companies known for stable performance, often in sectors like utilities, healthcare, or consumer goods, making them less vulnerable to economic downturns.

-

Why invest in defensive stocks?

Defensive stocks are considered safer investments as they tend to provide consistent returns and dividends, offering stability even during economic uncertainties or market volatility.

-

Which sectors are typically defensive?

Defensive sectors include utilities, pharmaceuticals, consumer staples, and healthcare. These industries offer essential goods and services, maintaining demand regardless of economic conditions.

-

How do defensive stocks differ from growth stocks?

Defensive stocks focus on stability and consistent dividends, while growth stocks aim for capital appreciation through rapid earnings growth. Defensive stocks are more resilient during economic downturns.

Top 10 defensive stocks to invest

| STOCK NAME | STOCK TICKER | MARKET CAP | EPS NEXT 5Y | DIVIDEND YIELD |

|---|---|---|---|---|

GlaxoSmithKline |

GSK |

$79.63B |

4.80% |

3.60% |

Procter & Gamble |

PG |

$350.35B |

7.80% |

2.57% |

NextEra Energy |

NEE |

$126.80B |

8.15% |

3.00% |

BioNTech SE |

BNTX |

$25.55B |

N/A |

N/A |

Johnson & Johnson |

JNJ |

$386.68B |

4.68% |

2.87% |

Taiwan Semiconductor Manufacturing Company |

TSM |

$514.13B |

2.70% |

1.86% |

Companhia Energetica de Minas Gerais |

CIG |

$3.35B |

0.00% |

7.89% |

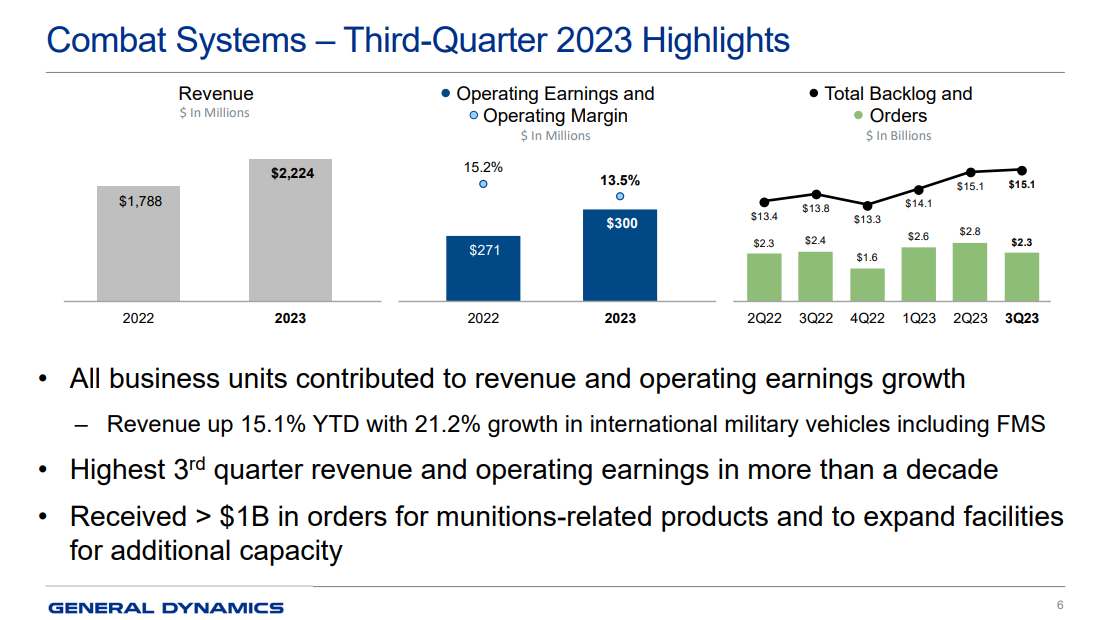

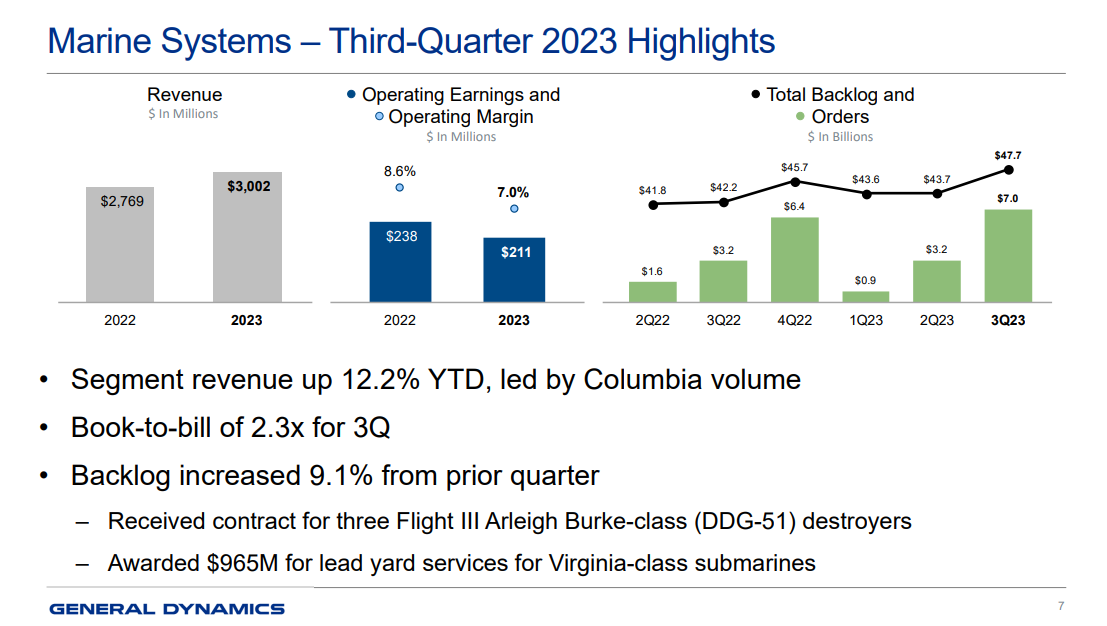

General Dynamics Corporation |

GD |

$69.91B |

9.80% |

2.05% |

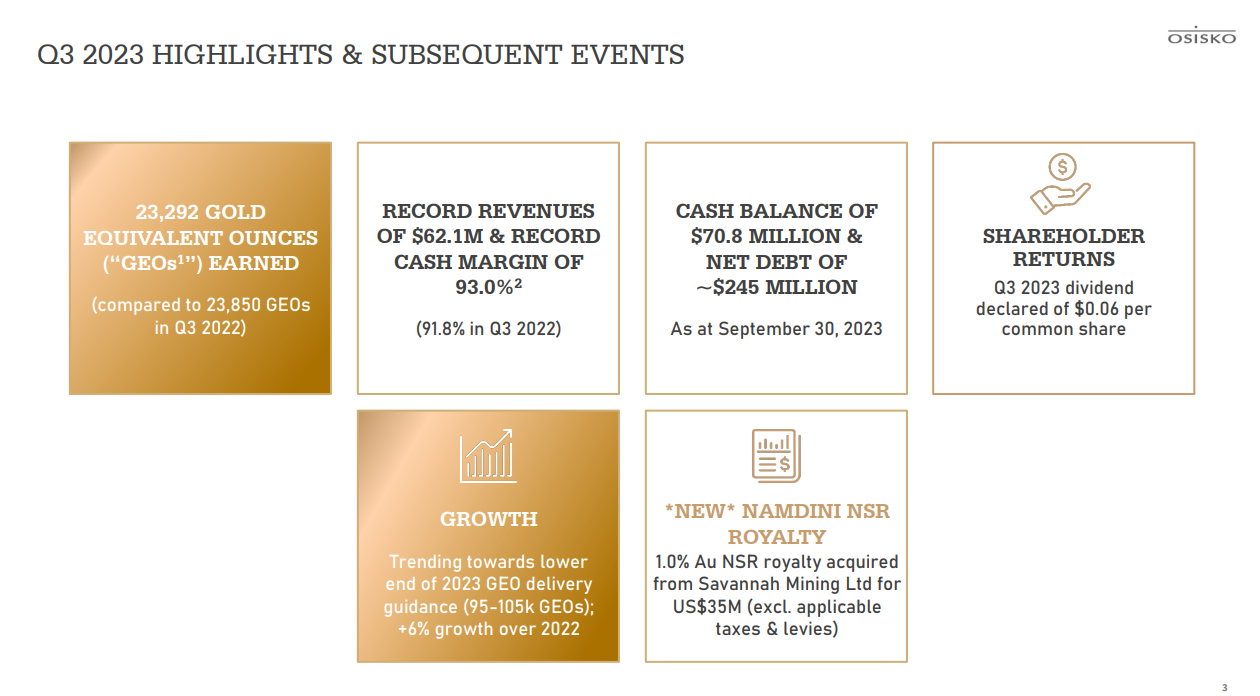

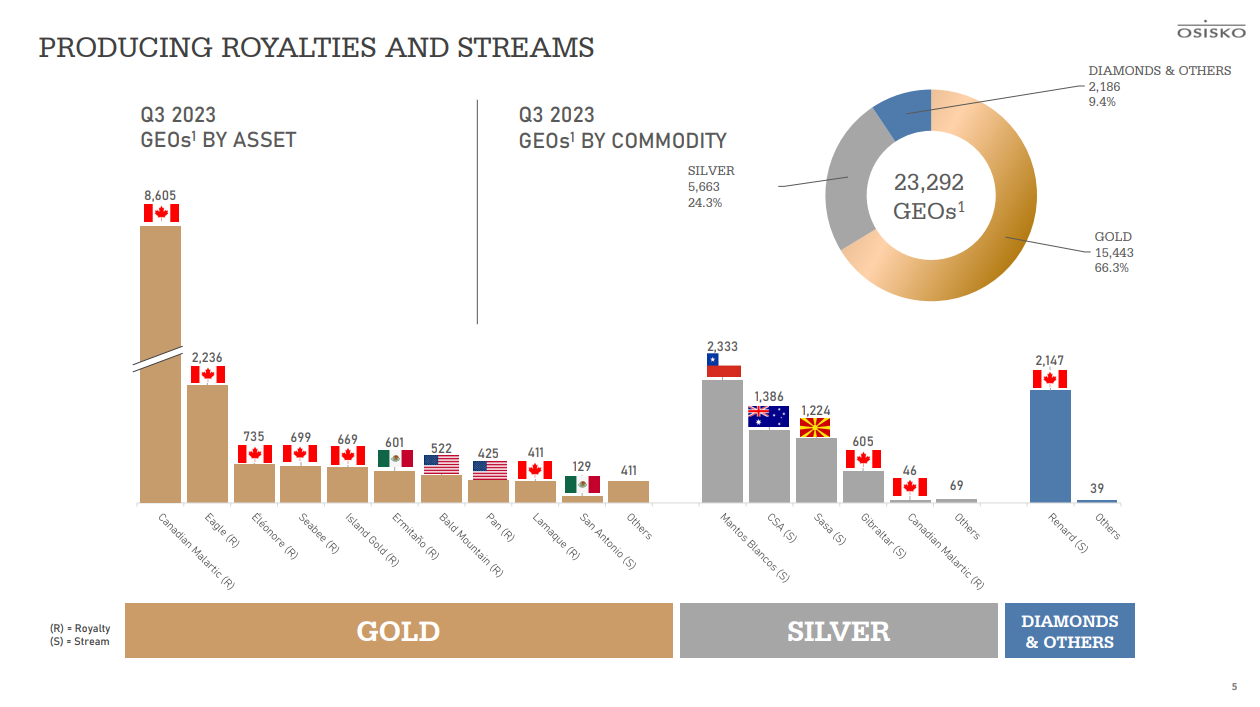

Osisko Gold Royalties |

OR |

$2.58B |

N/A |

1.15% |

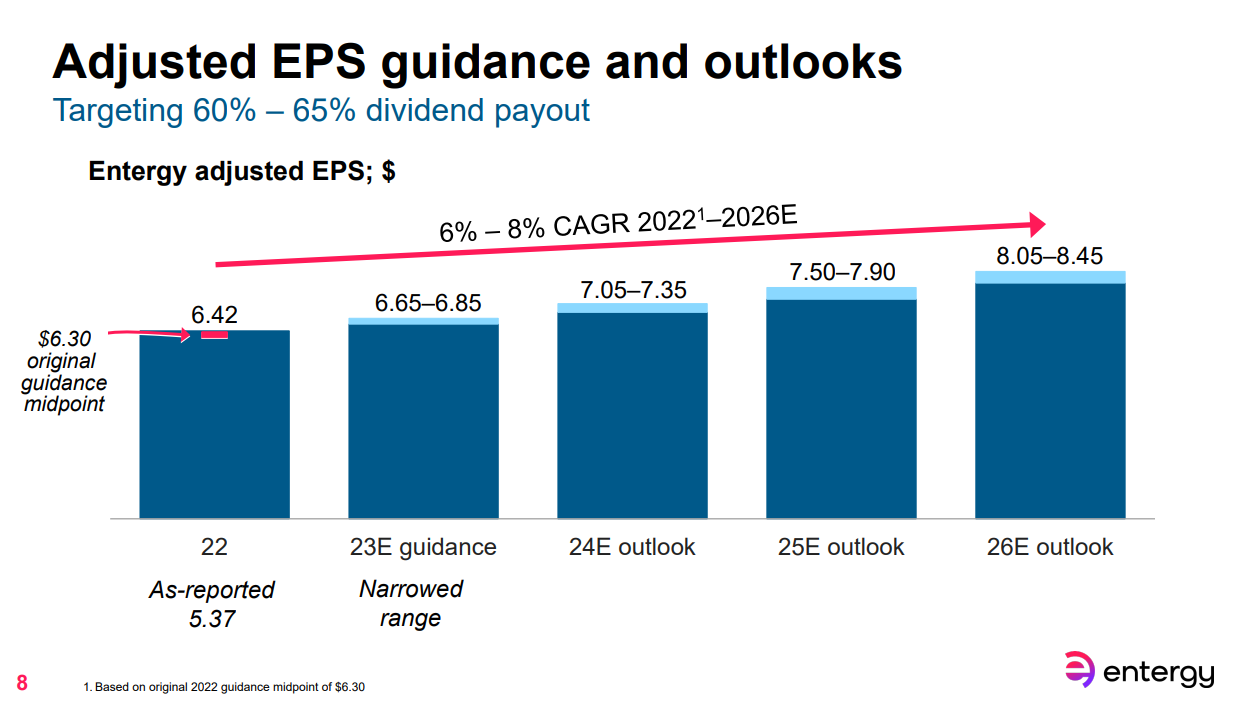

Entergy Corporation |

ETR |

$21.79B |

11.00% |

4.20% |

GlaxoSmithKline (GSK)

As we set our sights on the investment landscape of 2024, GSK emerges as a compelling opportunity as a defensive stock in the pharmaceutical sector. With a rich legacy and a forward-looking approach, GSK presents several key factors that make it an attractive choice for investors seeking stability, growth, and resilience.

| Investment Factors for GSK in 2024 | Description |

|---|---|

Extensive product range covering respiratory, HIV/AIDS, oncology, vaccines, and consumer healthcare. |

|

Strong Pipeline |

Robust pipeline with potential blockbusters in HIV treatments, respiratory drugs, and oncology therapies. |

Innovation Focus |

Commitment to research and development, fostering innovation for breakthrough drugs and future growth. |

Shareholder-Friendly Policies |

History of returning value to shareholders through dividends and share buybacks, reinforced by recent dividend ratio increase. |

Licensing Agreements and Approvals |

Recent license agreement with Hansoh Pharma and EU approval of Jemperli showcase expansion and market entry strategies. |

Mention in Ariel Investments' Letter |

Recognition in Ariel Investments' Q3 2023 letter highlights positive performance, indicating potential sustained growth. |

Undervalued Defensive Stock |

Identification among undervalued defensive stocks for 2024, emphasizing GSK's appeal as a solid defensive investment. |

Q3 2023 Performance

| Performance Metrics | Values |

|---|---|

Total Sales Growth |

10% (16% excluding COVID-19 impact) |

Vaccines Sales Growth |

33% (34% excluding COVID-19 impact) |

Specialty Medicines Growth |

17% (excluding COVID-19 impact) |

General Medicines Decline |

2% (impacted by generic competition) |

Adjusted Operating Profit and EPS Growth |

Significant |

Q3 Dividend |

14p (full-year expectation – 56.5p) |

Technical analysis for GSK

The technical analysis for GSK (NYSE –GSK) reveals a noteworthy development as the 50-day Exponential Moving Average (EMA) has recently crossed above the 200-day EMA. This bullish crossover is often considered a positive signal by technical analysts, indicating potential upward momentum in the stock.

Procter & Gamble (PG)

Procter & Gamble (PG) stands as a promising investment for 2024. With a history spanning over 180 years in consumer goods, PG is expected to showcase robust financial performance. Anticipated earnings per share (EPS) of $1.71 in the upcoming report reflect a strong 7.55% growth from the previous year. Revenue estimates of $21.73 billion further underscore the company's consistent growth, projecting a 4.63% increase compared to the same quarter last year.

Bryan Spillane from Bank of America Securities reaffirms PG's Buy rating, setting a target price of $175.00. His endorsement is grounded in PG's operational strength within the consumer goods sector. Despite a modest adjustment in organic sales estimates, PG demonstrates stable market share and ongoing growth prospects. Efficient cost management and an upward revision of gross margin projections contribute positively.

PG's premium valuation, justified by its innovation and strategic pricing history, is highlighted. Trading at 22.3x and 20.7x the forward PE for FY24 and FY25, respectively, and projecting revenue growth of 3.7% annually for the next two years, PG emerges as an attractive investment option. With a strategic approach to market challenges, PG offers stability and growth potential for investors in 2024.

| Financial Metric | Value |

|---|---|

Forward PE (FY24 consensus) |

22.3x ($6.43) |

Forward PE (FY25 consensus) |

20.7x ($6.91) |

EBITDA (FY24 consensus) |

$22.95 billion |

EBITDA (FY25 consensus) |

$24.31 billion |

Projected Revenue Growth (Next 2 Years) |

3.7% each year |

Technical analysis for PG

Looking at the chart, it seems like the stock has some key points to watch. There's a potential support level at $143, which means the stock has tended to bounce back when it hits that price. On the flip side, there's a resistance level at $153, suggesting that the stock has struggled to go above that price in recent times.

Now, considering the trend since June 2023, things are looking positive. The overall direction seems to be upward, indicating that the stock's price has been on the rise.

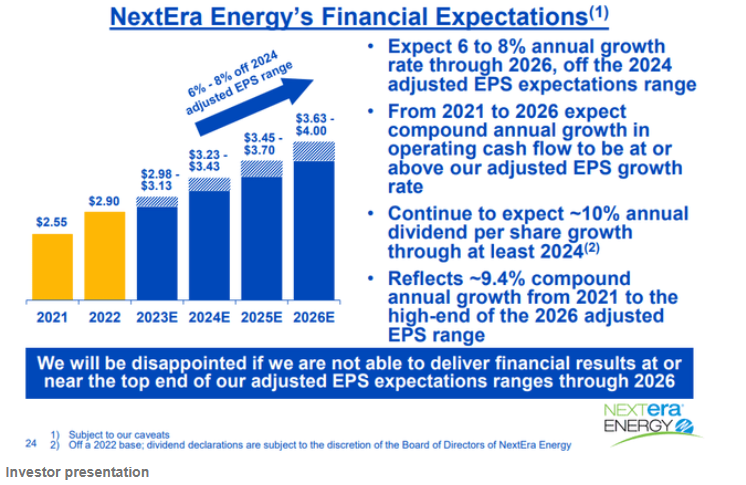

NextEra Energy (NEE)

Investing in NextEra Energy (NEE) in 2024 offers a compelling opportunity within the utilities sector. As a clean energy leader, NEE boasts a diversified portfolio with America's largest electric utility, Florida Power & Light Company, and is the world's foremost generator of renewable energy through NextEra Energy Resources. The company's commitment to sustainability is underscored by consistent recognition, including Fortune's 2023 "World's Most Admired Companies" ranking.

Despite recent weakness in utility stocks attributed to a strong bull market and interest rate sensitivity, NEE stands resilient with projected adjusted EPS of $3.63 to $4.00 for 2026, aligning with analysts' optimistic expectations at $3.92. Notably, NEE offers a compelling proposition for dividend investors with an anticipated annual dividend growth rate of 10%.

| Financial Metric | Value |

|---|---|

Projected EPS (2026) |

$3.63 - $4.00 |

Analyst Expectations (2026) |

$3.92 |

Dividend Growth Rate |

10% annually |

Current P/E Ratio |

15.7 |

Forward Dividend Yield |

3.10% |

The utilities sector is undergoing transformation, propelled by the accelerating adoption of electric vehicles (EVs). NEE is strategically positioned to capitalize on this trend, expecting a 19-fold increase in EV-related load on the grid by 2040. This aligns with broader industry shifts, as new car sales are projected to reach 1,000,000 vehicles in 2024.

With its strong presence, growth potential, and alignment with evolving market dynamics, NextEra Energy emerges as an attractive defensive stock for investors seeking stability and sustainability in 2024.

Technical analysis for NEE

NextEra Energy's stock is in a positive trend as its current price is above the 50-day Moving Average. It's like the stock has taken a breather after finding support, getting ready for the next upward move. This suggests potential for more gains in the near future.

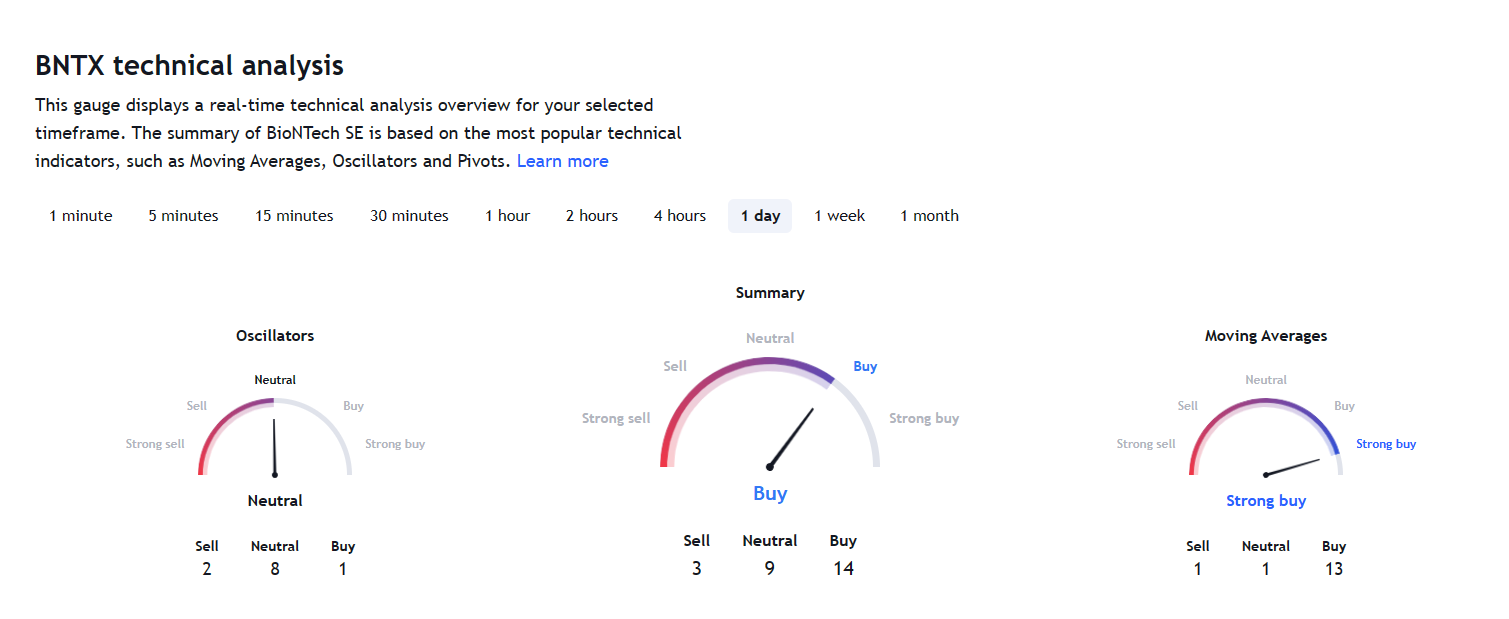

BioNTech (BNTX)

BioNTech, a trailblazer in mRNA science, revolutionizes medicine by decoding human immunity. From cancer cures to COVID vaccines, the company leads in personalized immunotherapies, tapping into the potential of our immune system for groundbreaking therapies.

| Aspect | Summary |

|---|---|

Financial Performance |

BioNTech's Q3 earnings exceeded expectations, and despite a lower FY23 revenue forecast, vaccine sales were strong at €894 million. Cautious guidance and reduced R&D spending position the company for future growth. |

Oncology Portfolio |

BioNTech is focusing on oncology with two late-stage candidates and 37 programs in phase 1 and 2 testing. The founders aim for a successful cancer vaccine by 2030, emphasizing long-term innovation. |

Global Expansion and COVID-19 Outlook |

BioNTech is expanding globally with the inauguration of an African site. Amidst the rise of new COVID-19 variants, continued vaccine demand could boost BioNTech's stock in 2024. |

Technical analysis for BNTX

The stock has broken through the resistance trend line from the top, indicating a shift in momentum towards upward movement.

Johnson & Johnson (JNJ)

Investing in Johnson & Johnson (JNJ) in 2024 is a wise decision due to its robust financial performance and strategic initiatives. In Q3 2023, the company exceeded expectations with total reported sales of $21.4 billion, marking a 6.8% YoY increase, and an impressive 19.3% surge in adjusted EPS to $2.66. The Innovative Medicine division, contributing $41 billion in sales for the first nine months of 2023, demonstrated a 5.1% growth in Q3, with key drugs like Stelara achieving a remarkable 16.9% increase to $2.8 billion.

Oncology drugs, including Darzalex and Erleada, added $3.1 billion to total revenue in Q3, highlighting JNJ's strength in critical therapeutic areas. The company's commitment to research and development is evident, with expenses accounting for 16.2% of total sales in Q3, amounting to $3.44 billion. JNJ's MedTech segment recorded a 10% YoY sales growth to $7.5 billion in Q3, aligning with the thriving artificial intelligence market. The entry into the robotic surgery market with the Ottava system positions JNJ in a market projected to be worth $18.4 billion by 2027.

JNJ's consistent dividend payouts, coupled with its "Dividend King" status, offer stability and a 3.02% yield, exceeding sector averages. With a history of innovation, strong financials, and a focus on shareholder value, JNJ emerges as a stable and reliable investment choice for 2024.

| Financial Performance | Q3 2023 Results |

|---|---|

Total Reported Sales |

$21.4 billion (6.8% YoY increase) |

Adjusted EPS |

$2.66 (19.3% increase, surpassing analysts' expectations) |

| Innovative Medicine Division | Q3 2023 Performance |

|---|---|

Sales |

$13.9 billion (5.1% increase, contributing 65% to total revenue) |

Key Drugs |

Stelara – $2.8 billion (16.9% YoY increase) |

Tremfya – $891 million (22.2% YoY increase) |

Technical analysis for JNJ

The chart displays a bullish cup and handle pattern, with a rounded bottom between September and November 2023 forming the cup and a recent pullback in December 2023 forming the handle. The stock has successfully broken the handle resistance, indicating a bullish trend and signaling potential upside momentum after a successful retest.

Taiwan Semiconductor Manufacturing Company (TSM)

Investing in Taiwan Semiconductor Manufacturing Company (TSM) in 2024 presents a compelling opportunity driven by various factors. TSM, a global leader in advanced semiconductors, holds a technical edge with cutting-edge chip production technology, positioning itself favorably in AI, high-performance computing, and cloud computing markets.

Positive Factors

Technical Leadership – TSM's forefront position in chip technology caters to the increasing demand for advanced chips in key sectors.

Market Recovery – With the semiconductor industry rebounding, TSM is ready to benefit from heightened demand for its products.

AI Boom – The surge in AI adoption fuels the need for advanced chips, and TSM's pivotal role as a key supplier positions it for substantial gains.

Valuation – TSM's current stock price, trading below historical averages, presents an attractive investment opportunity. The stock's 1.9% dividend yield adds to its appeal.

TSM Future Outlook

| Aspect | Summary |

|---|---|

Bottom of Chip Cycle |

TSM expects a turnaround in the current chip cycle downturn, especially with increased demand in PC and smartphone chips. |

Innovation |

TSM maintains a competitive edge through continuous innovation, evident in its leadership in chip technology. This commitment ensures sustained revenue growth for the company. |

Valuation Upside |

Trading below historical averages, TSM's stock is ready for potential growth. The forecasted 15% upside in 2024, combined with a 1.9% dividend yield, presents an attractive opportunity for investors. |

Technical analysis for TSM

The stock has maintained position above its 50-day Exponential Moving Average (EMA). Additionally, it successfully broke through the downward trend resistance in November 2023, indicating a positive shift in market sentiment. The stock's recent performance reflects bullish momentum, and it has demonstrated resilience by taking support at crucial levels, further reinforcing the positive outlook.

Companhia Energetica de Minas Gerais CEMIG (CIG)

Investing in CEMIG in 2024 holds several compelling reasons, combining financial strength, strategic positioning, and sustainability efforts. Here's a breakdown of key factors

| Investment Factors | Description |

|---|---|

Defensive Stock |

Operates in a stable utility sector, providing resilience during economic downturns. |

High Dividend Yield |

Offers an attractive 9.82% dividend yield, appealing to income-seeking investors. |

Potential for Growth |

Strategic plans for expansion in renewable energy and transmission lines indicate future growth potential. |

Undervaluation |

Low P/E ratio compared to peers suggests potential undervaluation. |

Economic Outlook |

Positive projections for Brazil's economy in 2024, which may benefit CEMIG. |

| Financial Highlights | Q3 2023 Results |

|---|---|

Adjusted Ebitda |

R$2.0 billion (up 28.0% YoY) |

Net Profit |

R$1.2 billion (up 20.0% YoY) |

Asset Sales |

Successful auction of Small Hydro Plants, earning R$100.5 million with a premium of 108.6%. |

ESG Leadership |

CEMIG recognized for 23 consecutive years in ESG index, showcasing commitment to sustainability. |

Technical analysis for CEMIG

The stock of CEMIG has been exhibiting a positive trend, taking support from a long-term trend line that has been in place since July 2020. This sustained support suggests a consistent upward trajectory, providing investors with confidence in the stock's performance.

Furthermore, the observation that the stock is undervalued reinforces its attractiveness as an investment. The undervaluation could be indicative of market conditions not fully reflecting the company's intrinsic value or future growth potential.

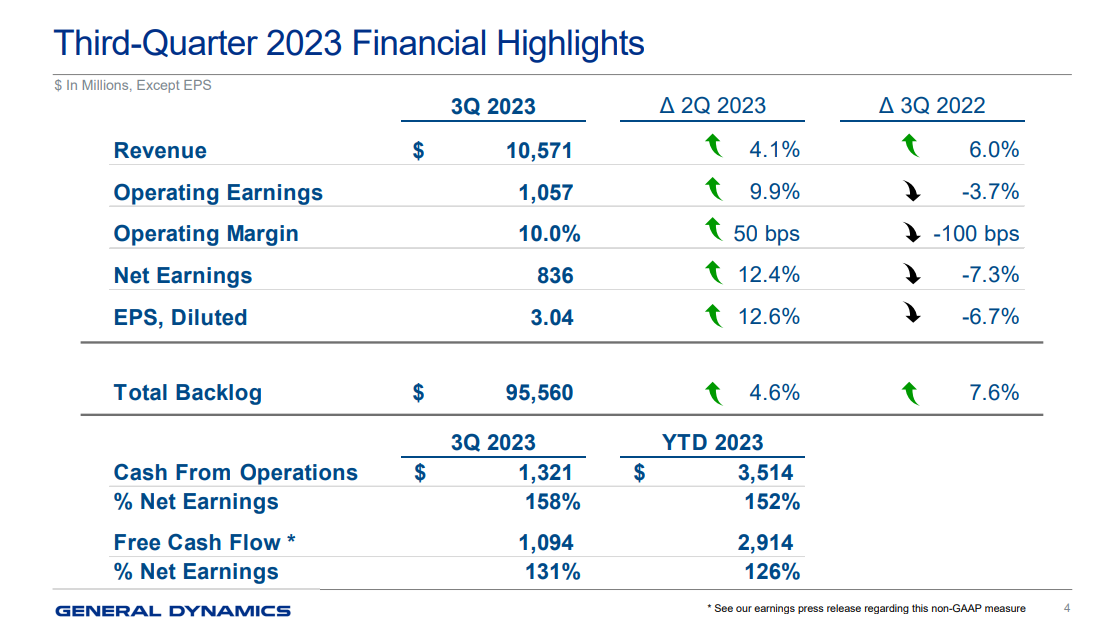

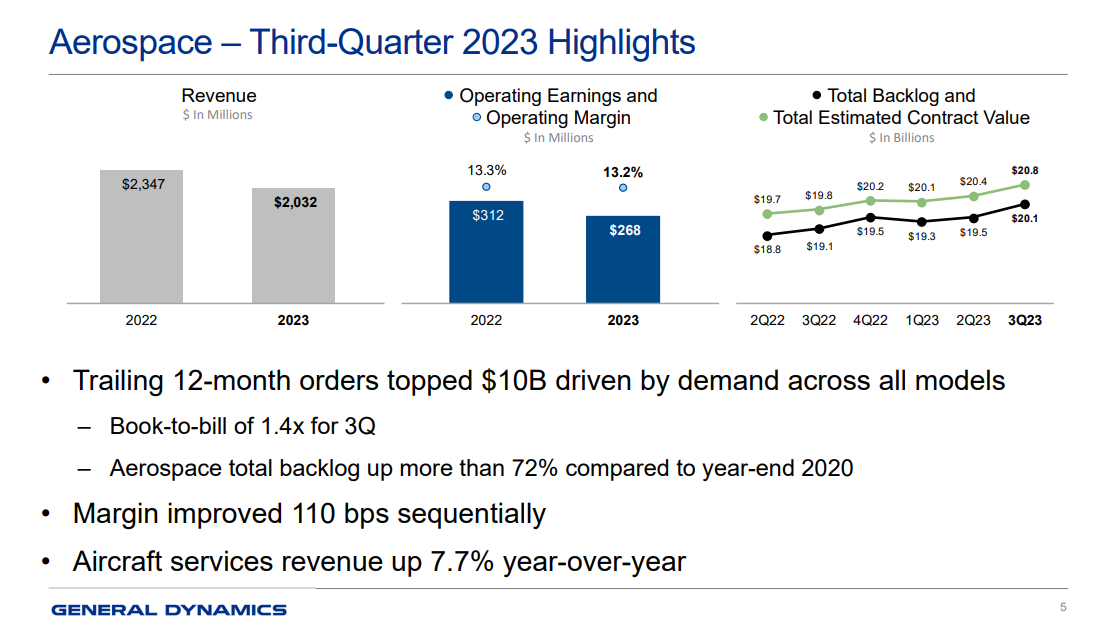

General Dynamics (GD)

Investing in General Dynamics (GD) in 2024 could be a sound decision for several reasons. Firstly, the company shows strong growth prospects, with analysts forecasting a 6.24% increase in revenue and an 8.96% growth in long-term earnings. GD's substantial backlog of $95.56 billion provides a clear picture of future revenue.

Financial stability is another key factor favoring GD. With a 2.03% dividend yield and a history of dividend increases, it offers income potential. The company boasts a robust return on equity (ROE) at 17.13%, outperforming the industry average of 10.51%.

Additional factors supporting GD's investment appeal include its exposure to geopolitical tensions, potentially benefiting from increased global defense spending. The company's diversification across aerospace, defense, and marine sectors reduces risk. With 81% institutional ownership, analysts express confidence in GD's prospects.

Moreover, recent positive outlooks from multiple analysts, recommending a “Buy” rating, further underline GD's strong fundamentals and growth potential, making it an attractive investment option for 2024.

Technical analysis for GD

The stock has recently surpassed its all-time high, and after a brief retest, the previous resistance has now transformed into a support level. Additionally, the stock is currently following an upward trajectory, indicating a positive trend.

Osisko Gold Royalties (OR)

Osisko Gold Royalties (OR) emerges as a promising investment for 2024, driven by a robust outlook in the gold market, diversified revenue streams, and sound financial performance. Recent strategic moves, including the sale of equity in Osisko Mining and approval for a share repurchase program, further highlights its commitment to a focused and rewarding investment approach. Some potential reasons to invest are:

| Reasons to Invest | Details |

|---|---|

1. Strong Gold Price Outlook |

Gold prices are expected to stay high in 2024 due to geopolitical tensions, inflation concerns, and potential US Fed rate cuts, benefiting OR's revenue tied to gold production. |

2. Diversification and Stable Income |

OR offers an alternative to direct gold investment, providing exposure without operational risks. Diversified royalties across jurisdictions ensure a steady income stream, complemented by a consistent dividend history. |

3. Robust Financial Performance |

Impressive profit margins and low operating costs. Recent fiscal Q3 2023 report exceeded revenue expectations, coupled with a dividend increase. |

4. Growth Potential |

Actively engages in acquisitions, expanding its portfolio and securing future revenue streams. New CEO, Jason Attew, brings industry expertise and focuses on strategic growth. |

Recent Developments

-

Sale of equity position in Osisko Mining for approximately C$132,000,000, reaffirming commitment to a precious metals royalty and streaming focus.

-

Approval for a normal course issuer bid (NCIB Program) to repurchase up to 9,258,298 Common Shares.

| Q3 Highlights | Details |

|---|---|

Gold Equivalent Ounces (GEOs) Earned |

23292 |

Revenues |

$62.1 million |

Cash Flows from Operating Activities |

$43.5 million |

Net Loss |

$20.0 million (mainly due to non-cash impairment charges) |

Dividend |

$0.06 per share declared in October 2023, payable January 15, 2024 (increased from the previous quarter) |

Technical analysis for OR

These stocks have broken past downtrends by breaking resistance. They find support on moving averages, showcasing resilience. The bullish momentum intensifies as the 50 EMA crosses the 100, with the 100 crossing the 200. Now, these stocks signal a promising shift, presenting an opportune moment for investors

Entergy Corporation (ETR)

Entergy Corporation (ETR) stands out as a compelling investment choice for 2024, primarily due to its resilience as a major utility provider in the U.S. The company, serving millions across four states with electricity, natural gas, and water services, presents several key reasons for consideration:

-

Stability in Uncertain Times – ETR's status as a utility company positions it as a stable and defensive investment, known for weathering economic downturns by offering essential services with consistent demand. This makes ETR a reliable choice during periods of economic uncertainty.

-

Attractive Dividend Yield – With a solid track record of dividend payments, Entergy offers investors an enticing 4.39% yield. This not only provides a steady stream of recurring income but also complements the potential for share appreciation.

-

Commitment to Clean Energy – Entergy demonstrates a forward-looking approach by actively investing in renewable energy sources such as wind and solar power. This strategic move aligns with the global shift toward cleaner energy solutions, positioning the company for long-term growth.

-

Regulatory Support for Expansion – The regulatory environment is favorable for Entergy, particularly with tailwinds supporting investments in clean energy and grid modernization. This bodes well for the company's expansion plans and future initiatives.

-

Undervalued Status – Analysts suggest that ETR may be currently undervalued compared to its peers in the utility sector. This undervaluation presents an opportunity for investors, indicating the potential for ETR's stock price to appreciate in the near future.

Technical analysis for ETR

The stock has recently broken its downward trendline, signaling a shift in momentum towards the upside. Following a successful retest, it has established a robust support level around $100. Technical indicators, including moving averages and the Relative Strength Index (RSI), suggest considerable strength and bullish momentum in the short term.

Best Stock brokers

Glossary for novice traders

-

1

Broker

A broker is a legal entity or individual that performs as an intermediary when making trades in the financial markets. Private investors cannot trade without a broker, since only brokers can execute trades on the exchanges.

-

2

Investor

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.

-

3

Trading

Trading involves the act of buying and selling financial assets like stocks, currencies, or commodities with the intention of profiting from market price fluctuations. Traders employ various strategies, analysis techniques, and risk management practices to make informed decisions and optimize their chances of success in the financial markets.

-

4

Yield

Yield refers to the earnings or income derived from an investment. It mirrors the returns generated by owning assets such as stocks, bonds, or other financial instruments.

-

5

Diversification

Diversification is an investment strategy that involves spreading investments across different asset classes, industries, and geographic regions to reduce overall risk.

Team that worked on the article

Parshwa is a content expert and finance professional possessing deep knowledge of stock and options trading, technical and fundamental analysis, and equity research. As a Chartered Accountant Finalist, Parshwa also has expertise in Forex, crypto trading, and personal taxation. His experience is showcased by a prolific body of over 100 articles on Forex, crypto, equity, and personal finance, alongside personalized advisory roles in tax consultation.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Tobi Opeyemi Amure is an editor and expert writer with over 7 years of experience. In 2023, Tobi joined the Traders Union team as an editor and fact checker, making sure to deliver trustworthy and reliable content. The topics he covers include trading signals, cryptocurrencies, Forex brokers, stock brokers, expert advisors, binary options.

Tobi Opeyemi Amure motto: The journey of a thousand miles begins with a single step.