Best Healthcare Stocks To Buy In 2025

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Best healthcare stocks to buy in 2025:

UnitedHealth Group. Inc (UNH) - offers a range of health insurance products and services

Elevance Health, Inc. (ELV) - known for its comprehensive health plans and innovative healthcare solutions

The Cigna Group (CI) - provides a range of healthcare products and services, including insurance and wellness programs

HCA Healthcare, Inc. (HCA) - known for its network of hospitals, providing comprehensive medical services

Humana Inc. (HUM) - leading health and well-being company focused on providing health insurance and healthcare services

IQVIA Holdings, Inc. (IQV) - provides technology solutions, and contract research services to the healthcare industry

The healthcare sector is a resilient and vital part of the global economy, continuously growing and evolving to meet the needs of an aging population and the advancements in medical technology. Investing in the healthcare sector provides unique opportunities and challenges. The sector’s growth is driven by demographic changes, technological advancements, and increasing healthcare needs. This article explores key companies and strategic considerations for long-term investment in healthcare stocks.

Best healthcare stocks to buy for long-term

Long-term stocks represent a strategic investment approach where investors commit to holding assets for more than a year, emphasizing discipline and patience to endure market fluctuations and achieve higher returns over time.

| Name | Stock Ticker | Founded | Market Cap (B USD) | EPS (USD) | Dividend Yield (%) |

|---|---|---|---|---|---|

| UnitedHealth Group Inc. | UNH | 1977 | 445.503 | 16.37 | 1.55 |

| Elevance Health, Inc. | ELV | 1944 | 124.186 | 26.46 | 1.14 |

| The Cigna Group | CI | 1982 | 95.898 | 12.18 | 1.51 |

| HCA Healthcare, Inc. | HCA | 1968 | 89.177 | 20.07 | 0.72 |

| Humana Inc. | HUM | 1961 | 43.512 | 16.07 | 0.98 |

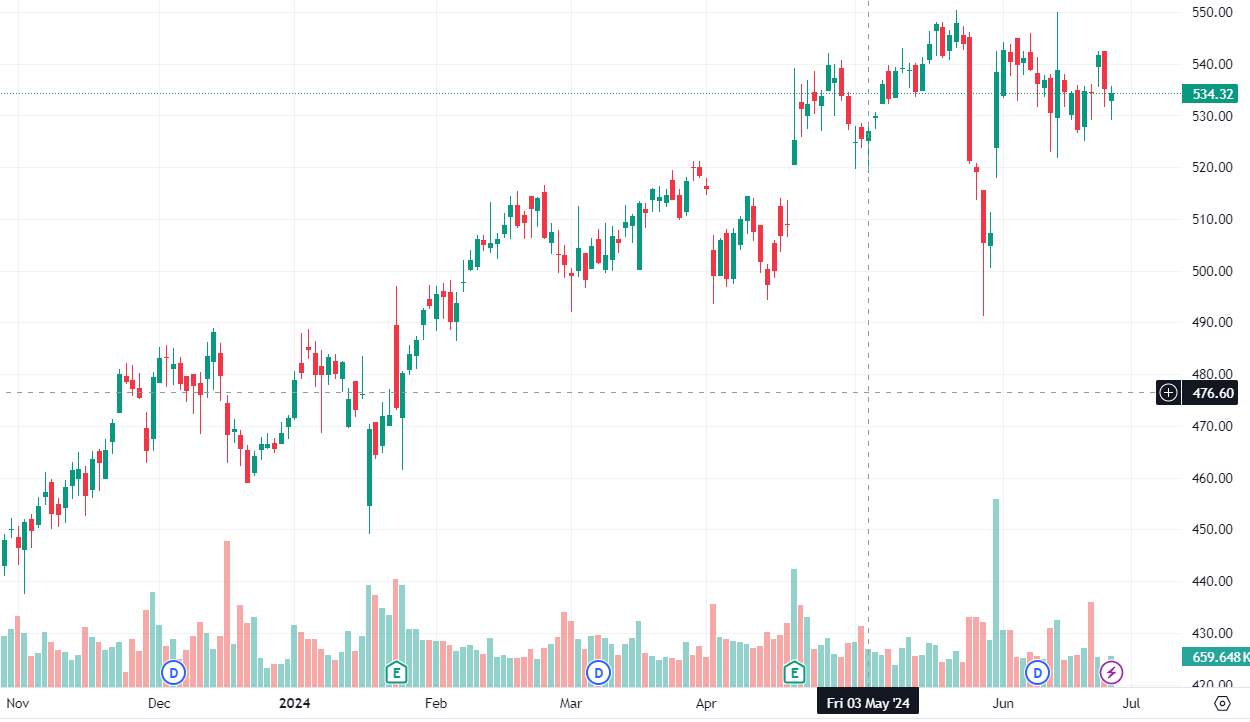

UnitedHealth Group Inc. (UNH)

Sector: Health Services

Strengths: UnitedHealth Group Inc. is a leading diversified health and well-being company, known for its strong financials and extensive network of healthcare services. The company offers a range of health insurance products and services, including medical, dental, vision, and pharmaceutical benefits. UnitedHealth Group is recognized for its innovative approaches to healthcare delivery, integration of technology, and commitment to improving patient outcomes. The company consistently delivers strong financial performance and provides reliable dividend payouts to its shareholders.

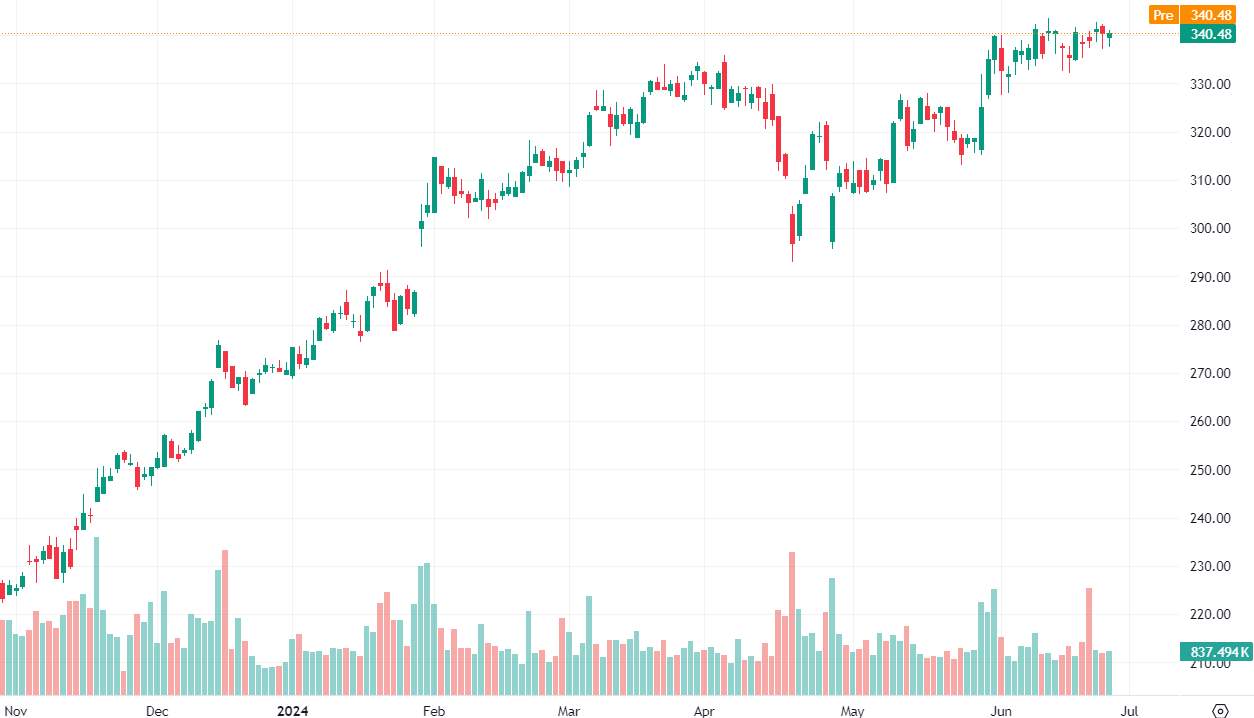

Elevance Health, Inc. (ELV)

Sector: Health Services

Strengths: Leading healthcare provider with strong financials and consistent dividend payouts. Known for its comprehensive health plans and innovative healthcare solutions.

The Cigna Group (CI)

Sector: Health Services

Strengths: A global health services company with a diversified portfolio. Provides a range of healthcare products and services, including insurance and wellness programs.

HCA Healthcare, Inc. (HCA)

Sector: Health Services

Strengths: One of the largest for-profit healthcare providers in the US. Known for its extensive network of hospitals and healthcare facilities, providing comprehensive medical services.

Humana Inc. (HUM)

Sector: Health Services

Strengths: A leading health and well-being company focused on providing health insurance and healthcare services. Strong emphasis on preventative care and patient-centered healthcare solutions.

IQVIA Holdings, Inc. (IQV)

Sector: Health Services

Strengths: Provides advanced analytics, technology solutions, and contract research services to the healthcare industry. Known for its innovative approaches to improving healthcare outcomes.

Pros and cons of buying long-term healthcare stocks

- Pros of Buying Long-Term Healthcare Stocks:

- Cons of Buying Long-Term Healthcare Stocks:

- Wealth accumulation: Long-term investments benefit from compounding effects, significantly growing your wealth over time.

- Reduced volatility impact: Holding stocks for an extended period helps mitigate the impact of short-term market fluctuations.

- Dividend income: Many long-term stocks offer regular dividends, providing a steady income stream in addition to capital appreciation.

- Lower transaction costs: Fewer transactions mean lower brokerage fees and other trading costs.

- Tax benefits: Long-term capital gains often enjoy favorable tax treatment compared to short-term gains.

- Informed decisions: With a long-term horizon, investors can make more informed decisions based on fundamental analysis rather than market speculation.

- Economic growth participation: Long-term investments allow you to participate in the growth of the healthcare sector and benefit from the success of major companies.

- Market risk: Even with a long-term approach, market downturns can lead to significant losses.

- Liquidity issues: Long-term investments can tie up funds, making them less accessible for short-term financial needs.

- Company performance: Changes in management, industry disruptions, or poor business decisions can negatively impact a company’s stock.

- Opportunity cost: Long-term investing means potentially missing out on short-term gains from other investments.

- Economic and political factors: Changes in economic policies, political instability, or global economic conditions can affect stock performance.

- Patience required: Long-term investing requires patience and discipline, as it may take years to see substantial returns.

- Inflation risk: If the stock’s returns do not outpace inflation, the real value of your investment may decline over time.

How to buy long-term healthcare stocks?

Investing in healthcare stocks requires a strategic approach beyond speculation. Experts recommend considering the following factors before buying long-term stocks:

Research and analysis: Thoroughly research potential long-term stocks by examining the company's financial health, growth prospects, industry trends, and competitive positioning. Analyze historical performance and financial statements to assess stability and potential.

Selecting stocks: Choose companies with a strong track record, sustainable business models, and long-term growth potential.

Investment horizon: Hold stocks for extended periods, typically over three years, to align with long-term financial goals and benefit from the compounding effect. Avoid impulsive reactions to short-term market fluctuations.

Diversification: Construct a diversified portfolio by spreading investments across different sectors to mitigate risk and enhance resilience against sector-specific downturns.

Brokerage account: Open a brokerage account with a reputable firm that offers access to the healthcare sector, user-friendly interfaces, research tools, and a secure trading environment. It is important to make sure that the broker is regulated and operates legally.

Below is a comparison table of the best brokers for purchasing healthcare stocks:

| Broker | Demo | Minimum deposit, $ | ECN Commission, $ per lot | Leverage, 1: | Stocks | Open an Account |

|---|---|---|---|---|---|---|

| Admiral Markets | Yes | 250 | 3 | 500 | Yes | Open an account Your capital is at risk. |

| InstaForex | Yes | 1 | 3 | 1000 | Yes | Open an account Your capital is at risk. |

| Forex4you | Yes | 0 | 3 | 1000 | Yes | Open an account Your capital is at risk. |

| AvaTrade | Yes | 100 | 0 | 400 | Yes | Open an account Your capital is at risk. |

| eToro | Yes | 50 | 3 | 400 | Yes | Open an account Your capital is at risk.

|

What affects the healthcare sector?

The aging population significantly impacts the healthcare sector, driving both opportunities and challenges for healthcare companies and investors. Here’s how the demographic shift influences the sector:

Increased Demand for Healthcare Services

As the population ages, there is a natural increase in the demand for healthcare services. Older adults typically require more medical attention, including regular check-ups, chronic disease management, and specialized care. This rising demand supports growth for healthcare providers, pharmaceutical companies, and medical device manufacturers. Companies like UnitedHealth Group Inc. (UNH) and Elevance Health, Inc. (ELV) are well-positioned to benefit from this trend due to their extensive range of healthcare services and innovative solutions.

Growth in Chronic Disease Management

Chronic diseases such as diabetes, heart disease, and arthritis are more prevalent among older adults. The need for ongoing treatment and management of these conditions drives revenue for healthcare companies specializing in chronic disease care. UnitedHealth Group, with its comprehensive health plans and integrated care models, stands to gain from this growing need.

Expansion of Medicare and Elderly Care Services

Government programs like Medicare, which cater to older populations, expand as the number of eligible beneficiaries grows. Companies providing Medicare Advantage plans, such as Humana Inc. (HUM) and The Cigna Group (CI), see increased enrollment and revenue. Additionally, there is a rising demand for elderly care services, including home healthcare, assisted living, and nursing homes.

Innovation and Technological Advancements

The aging population spurs innovation in medical technology and pharmaceuticals aimed at improving the quality of life for older adults. This includes advancements in telehealth, wearable health monitoring devices, and precision medicine. Companies investing in healthcare technology and innovation are likely to experience significant growth.

Financial Implications and Investment Opportunities

From an investment perspective, the aging population creates lucrative opportunities in healthcare stocks. Investors look for companies with strong fundamentals, consistent dividend payouts, and the ability to adapt to the increasing healthcare needs of older adults. Stocks like UnitedHealth Group and Elevance Health are considered attractive due to their strong market positions and growth potential in this expanding market.

Challenges and Considerations

While the aging population presents opportunities, it also poses challenges, such as higher healthcare costs and the need for a larger healthcare workforce. Companies must navigate these challenges by optimizing operational efficiencies and leveraging technology to manage costs effectively.

The healthcare sector has a great potential

I see great potential in the healthcare sector due to the increasing demand for medical services and technological advancements. A company like Elevance Health, Inc. plays a crucial role in providing comprehensive health plans, offering financial stability and consistent dividends. In the health services sector, a company like IQVIA Holdings, Inc. is known for its innovative approaches to improving healthcare outcomes, making it a reliable long-term option.

Investing in these sectors, backed by thorough research and understanding of the fundamentals, can help investors make informed decisions that align with their long-term financial goals.

Summary

The healthcare sector presents substantial long-term investment opportunities due to increasing demand for medical services, technological advancements, and supportive policies. Key companies to consider include Elevance Health, The Cigna Group, HCA Healthcare, Humana Inc., and IQVIA Holdings. Thorough research and understanding of these companies can help investors make informed decisions that align with their long-term financial goals.

FAQs

Which healthcare stock is good for the long term?

Determining the best healthcare stock for the long term involves considering various factors such as the company's financial health, growth prospects, and industry positioning.

Which sectors in healthcare are the most promising for stock investments?

The most promising sectors for stock investments in healthcare are Health Services, Pharmaceuticals, Medical Devices, and Biotechnology.

How can investors benefit from the healthcare sector?

Investors can benefit from the healthcare sector by investing in companies that are leading in medical innovations, capitalizing on the growing demand for healthcare services, and supporting companies involved in the production and distribution of medical products and services.

Related Articles

Team that worked on the article

Parshwa is a content expert and finance professional possessing deep knowledge of stock and options trading, technical and fundamental analysis, and equity research. As a Chartered Accountant Finalist, Parshwa also has expertise in Forex, crypto trading, and personal taxation. His experience is showcased by a prolific body of over 100 articles on Forex, crypto, equity, and personal finance, alongside personalized advisory roles in tax consultation.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.

Volatility refers to the degree of variation or fluctuation in the price or value of a financial asset, such as stocks, bonds, or cryptocurrencies, over a period of time. Higher volatility indicates that an asset's price is experiencing more significant and rapid price swings, while lower volatility suggests relatively stable and gradual price movements.

Diversification is an investment strategy that involves spreading investments across different asset classes, industries, and geographic regions to reduce overall risk.

Yield refers to the earnings or income derived from an investment. It mirrors the returns generated by owning assets such as stocks, bonds, or other financial instruments.

An ECN, or Electronic Communication Network, is a technology that connects traders directly to market participants, facilitating transparent and direct access to financial markets.