Best Stocks To Buy For Long-Term

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

The best stocks for long-term investment are:

(AAPL) Apple Inc. - Innovation, brand strength, financial resilience.

(MSFT) Microsoft Corporation - Dominant tech, diversified businesses.

(AMZN) Amazon.com Inc. - E-commerce and cloud computing growth.

(GOOGL) Alphabet Inc. - Market leader, advertising cash generation.

(JNJ) Johnson & Johnson - Healthcare stability, dividend history.

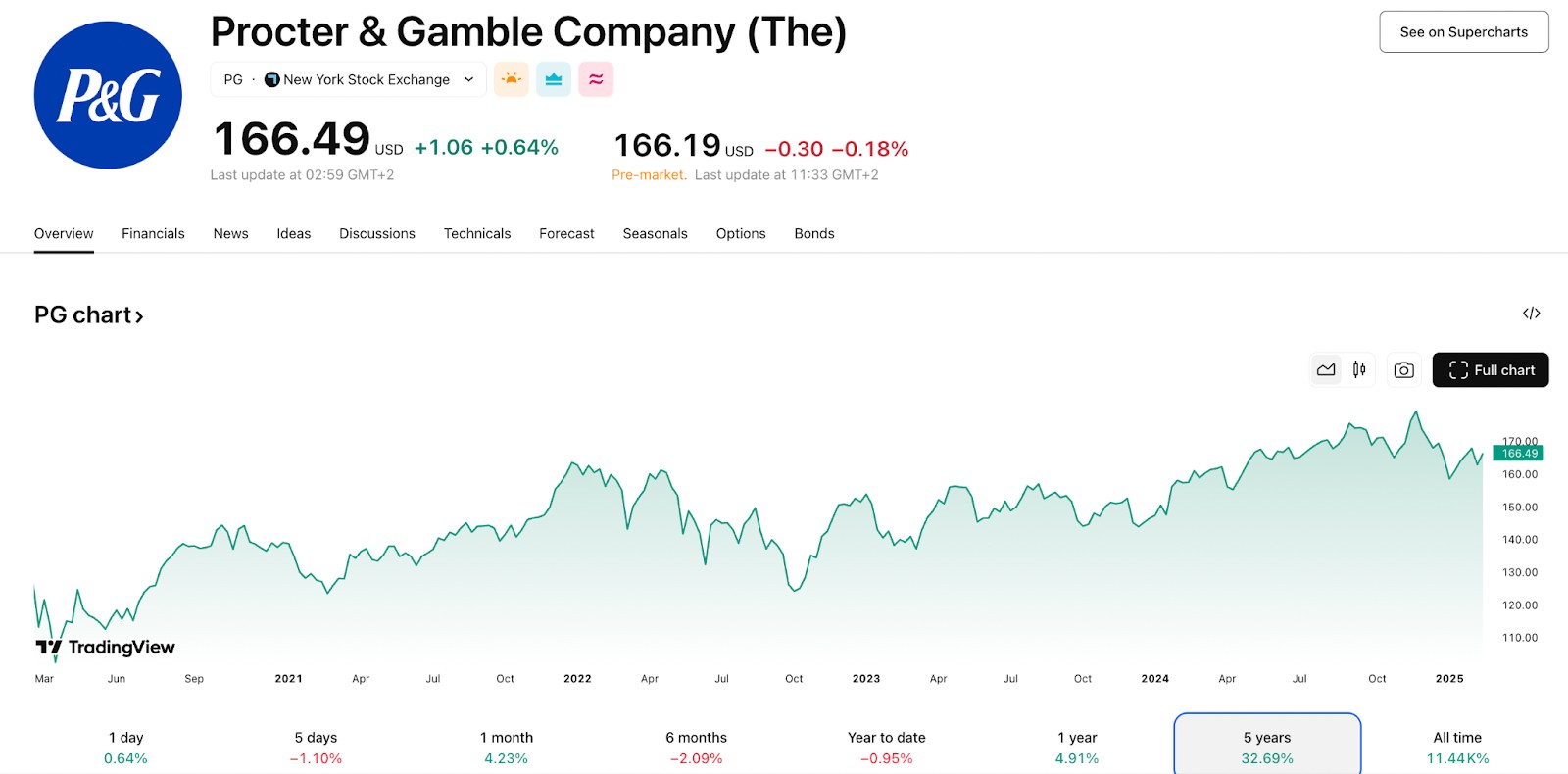

(PG) Procter & Gamble Co. - Essential brands, pricing power.

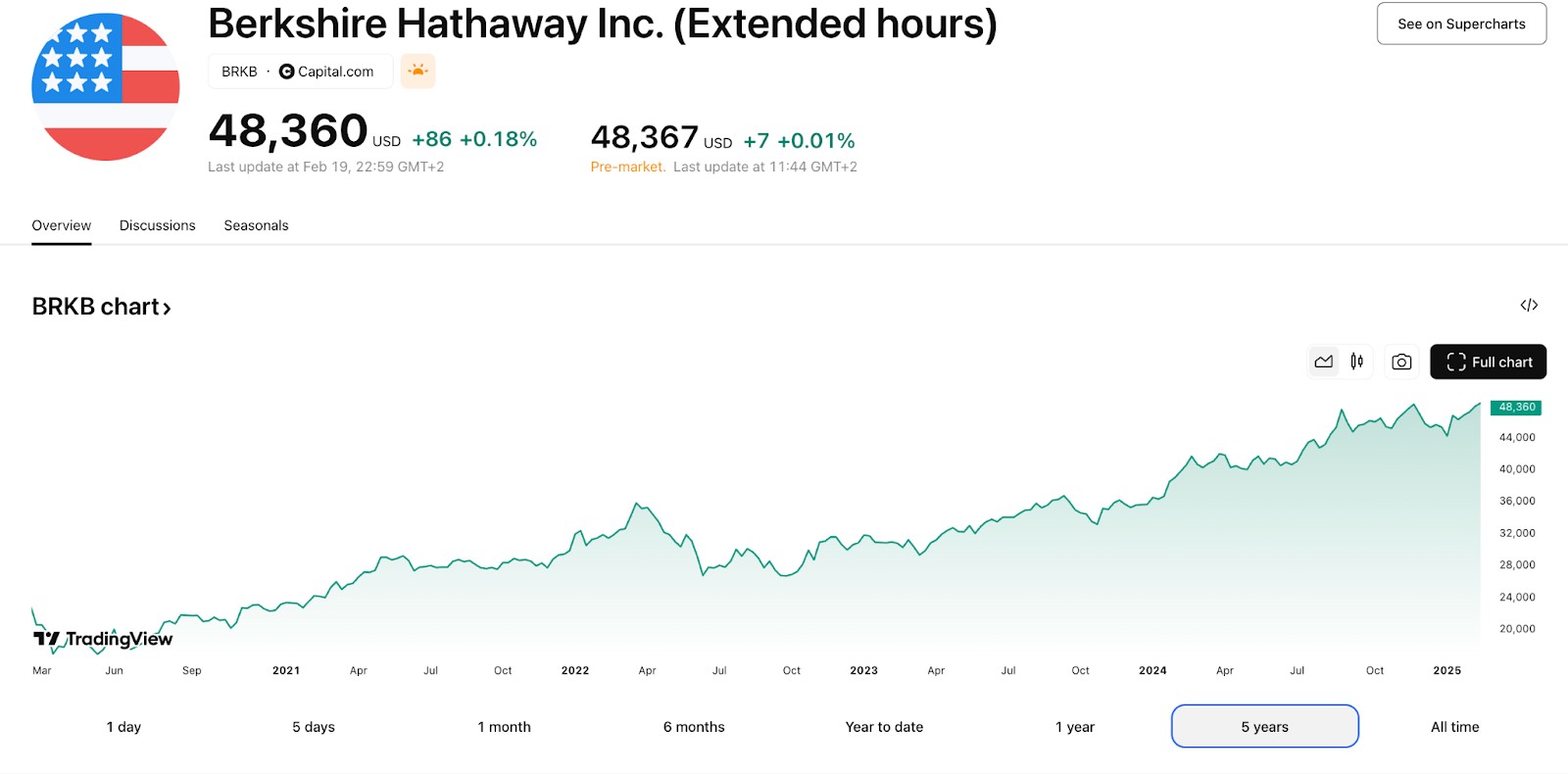

(BRK.B) Berkshire Hathaway Inc. - Diverse and defensive holdings.

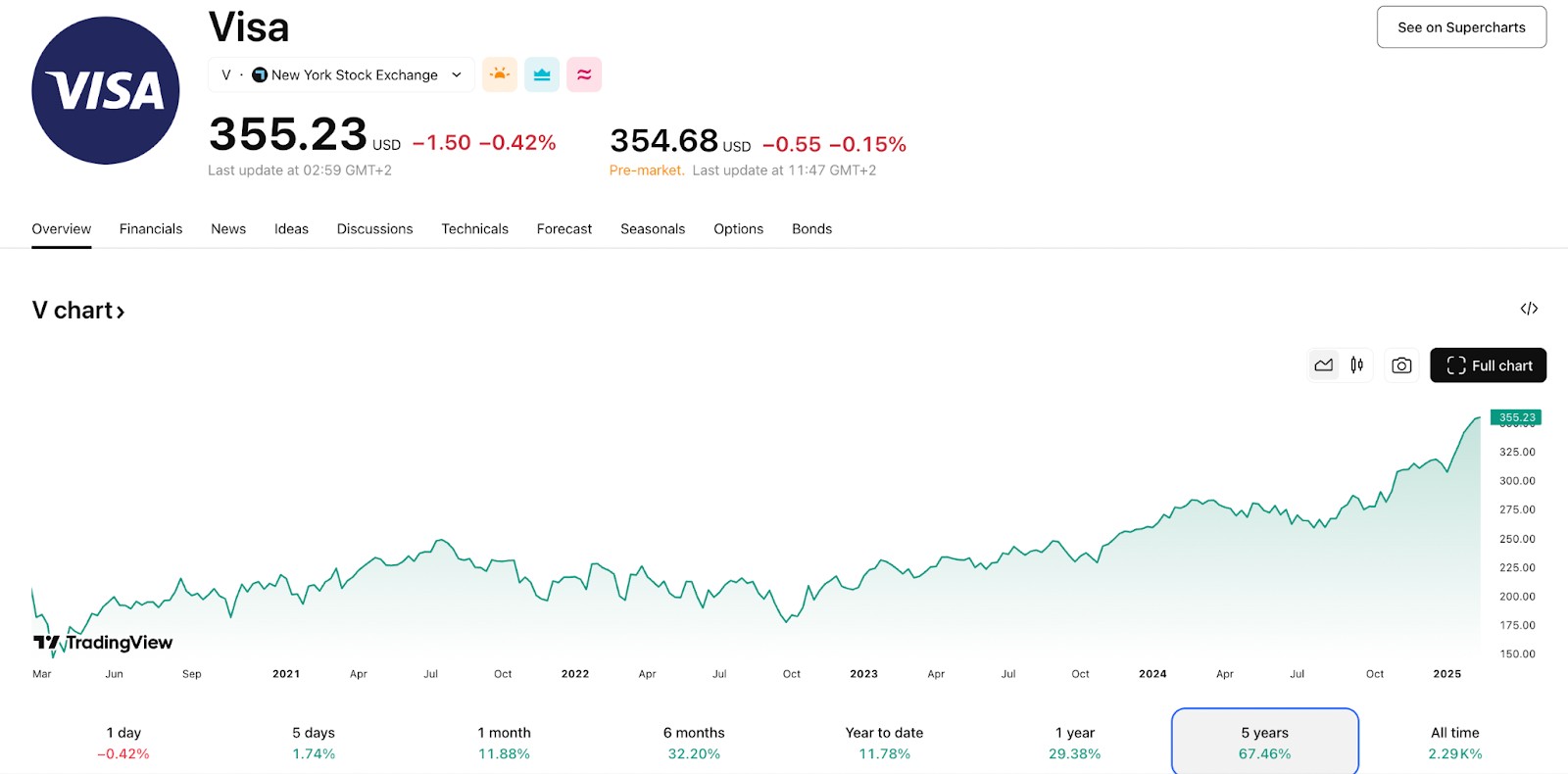

(V) Visa Inc. - Global digital payments leader, scale advantage.

Investors vary significantly in their financial situations and needs, making stock selection a complex decision. What suits one investor may not suit another, but if you concentrate on the appropriate long-term stocks, stock market investing can create enduring wealth.

This article will present you with a carefully curated selection by experts, listing what we have determined to be the top 8 long-term stocks for 2025 from a fundamental perspective that could outperform the broader market in the coming years.

Risk warning: All investments carry risk, including potential capital loss. Economic fluctuations and market changes affect returns, and 40-50% of investors underperform benchmarks. Diversification helps but does not eliminate risks. Invest wisely and consult professional financial advisors.

Top 8 stocks to buy and hold for long-term

The Traders Union team of financial experts has identified companies with strong potential for long-term market outperformance under current fundamentals and economic conditions:

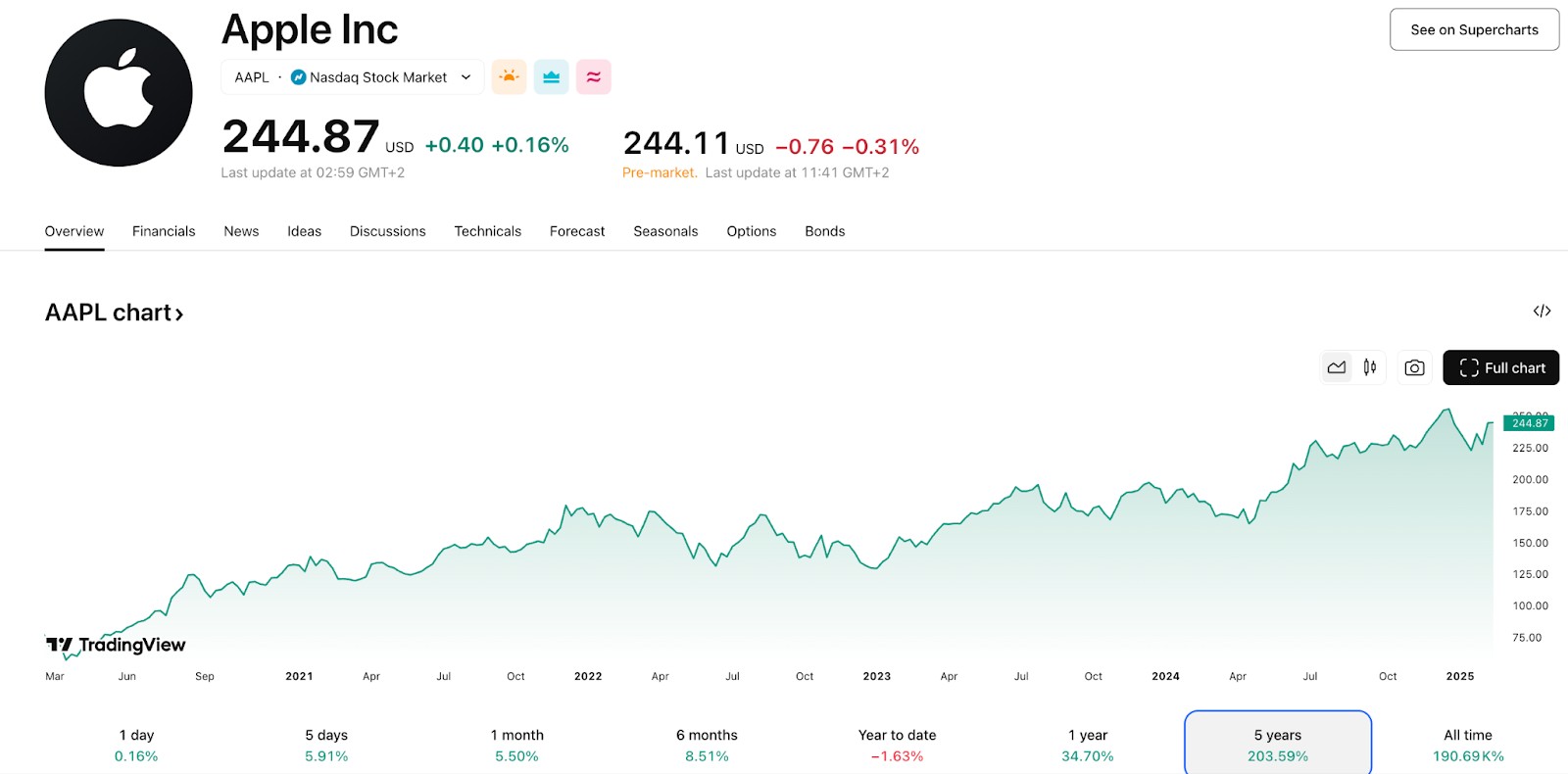

Apple Inc. (AAPL)

Apple's consistent innovation and strong brand loyalty have driven robust financial performance. The company's diverse product lineup, including the iPhone, iPad, and Mac, contributes to substantial revenue streams. Apple's services segment, encompassing Apple Music, iCloud, and the App Store, has shown significant growth, enhancing profitability. The company's strong cash flow supports regular dividend payments and share buybacks, rewarding investors. Apple's commitment to research and development positions it well for future technological advancements.

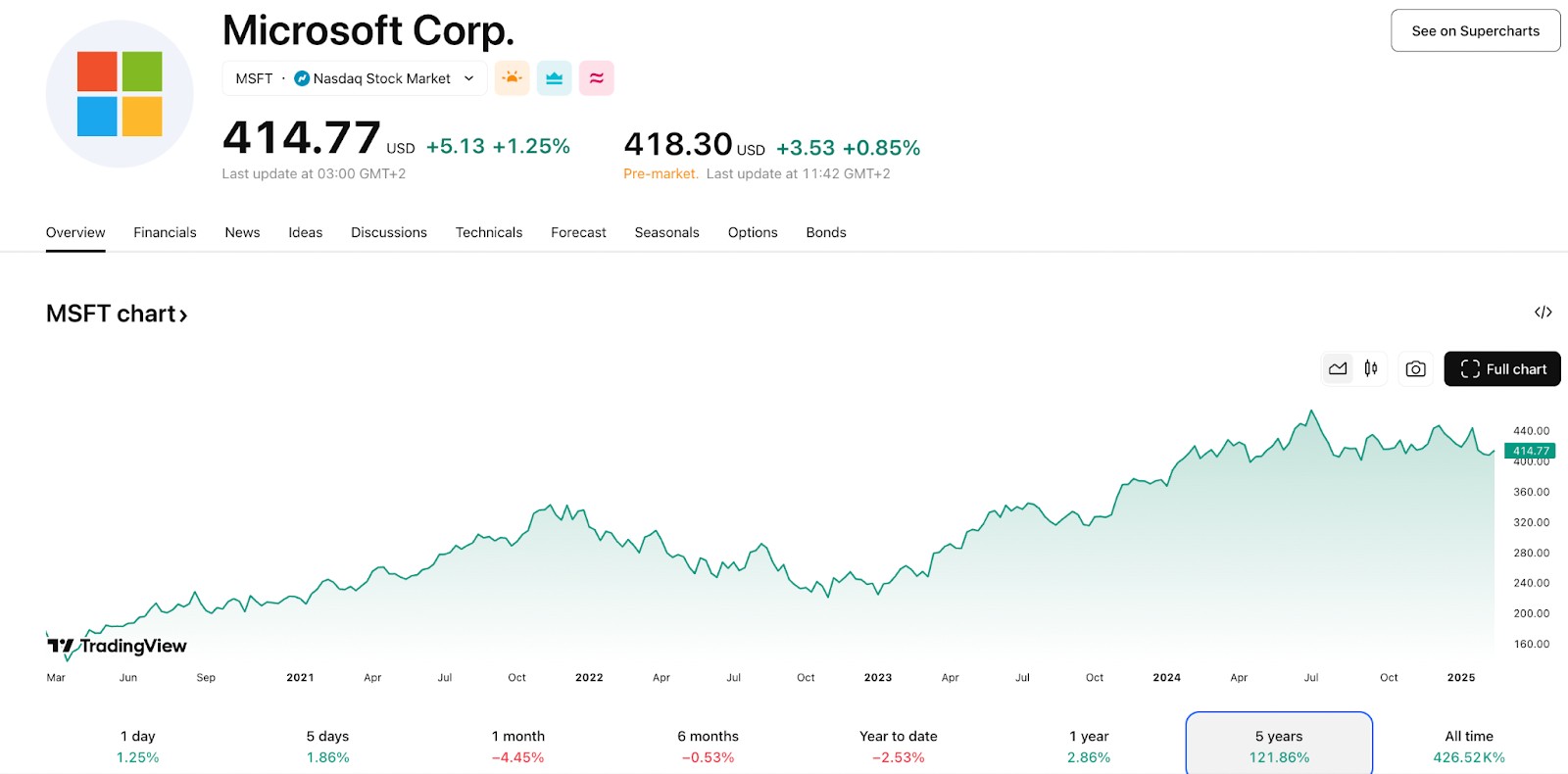

Microsoft Corporation (MSFT)

Microsoft's dominance in software, particularly with its Windows operating system and Office suite, ensures a steady revenue base. The company's Azure cloud platform has experienced significant growth, contributing to overall revenue expansion. Microsoft's diversified business model includes gaming (Xbox), LinkedIn, and enterprise solutions, reducing dependence on any single segment. Strong financials, including consistent revenue and earnings growth, make Microsoft a reliable investment. The company's focus on artificial intelligence and cloud services positions it for sustained future growth.

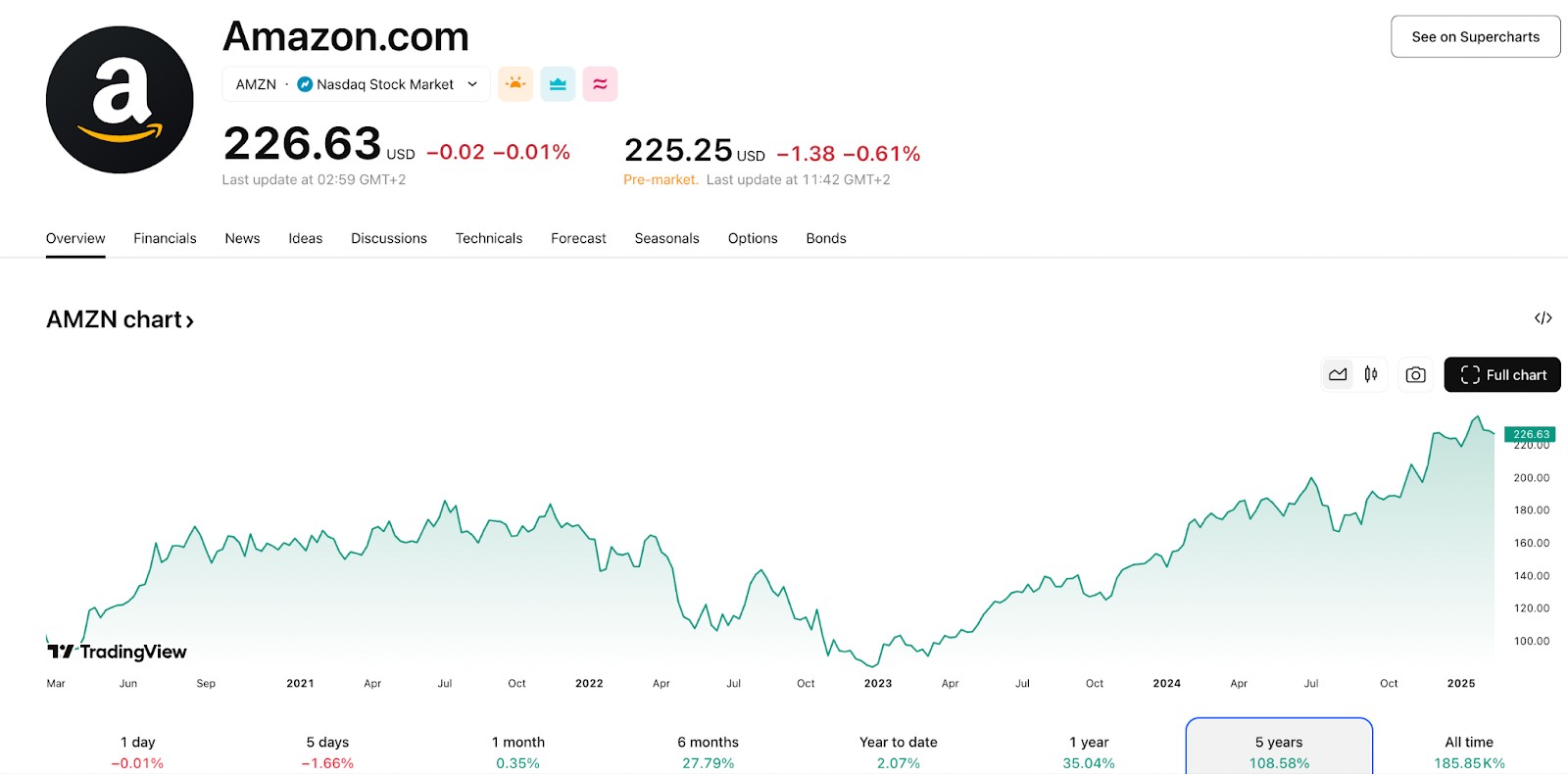

Amazon.com Inc. (AMZN)

Amazon's leadership in e-commerce provides a vast and growing revenue base. Amazon Web Services (AWS) is a significant profit driver, with substantial growth in the cloud computing sector. The company's expansion into advertising services has opened new revenue streams. Amazon's continuous investment in logistics and technology enhances operational efficiency and customer experience. The company's focus on innovation and market expansion supports long-term growth prospects.

Alphabet Inc. (GOOGL)

Alphabet's dominance in online search and advertising generates substantial revenue and cash flow. The company's investments in cloud computing through Google Cloud have led to significant growth in this segment. Alphabet's diverse portfolio includes ventures in autonomous vehicles (Waymo), healthcare (Verily), and other innovative technologies. Strong financial health, with consistent revenue and profit growth, underscores its market leadership. Alphabet's commitment to artificial intelligence and machine learning positions it at the forefront of technological innovation.

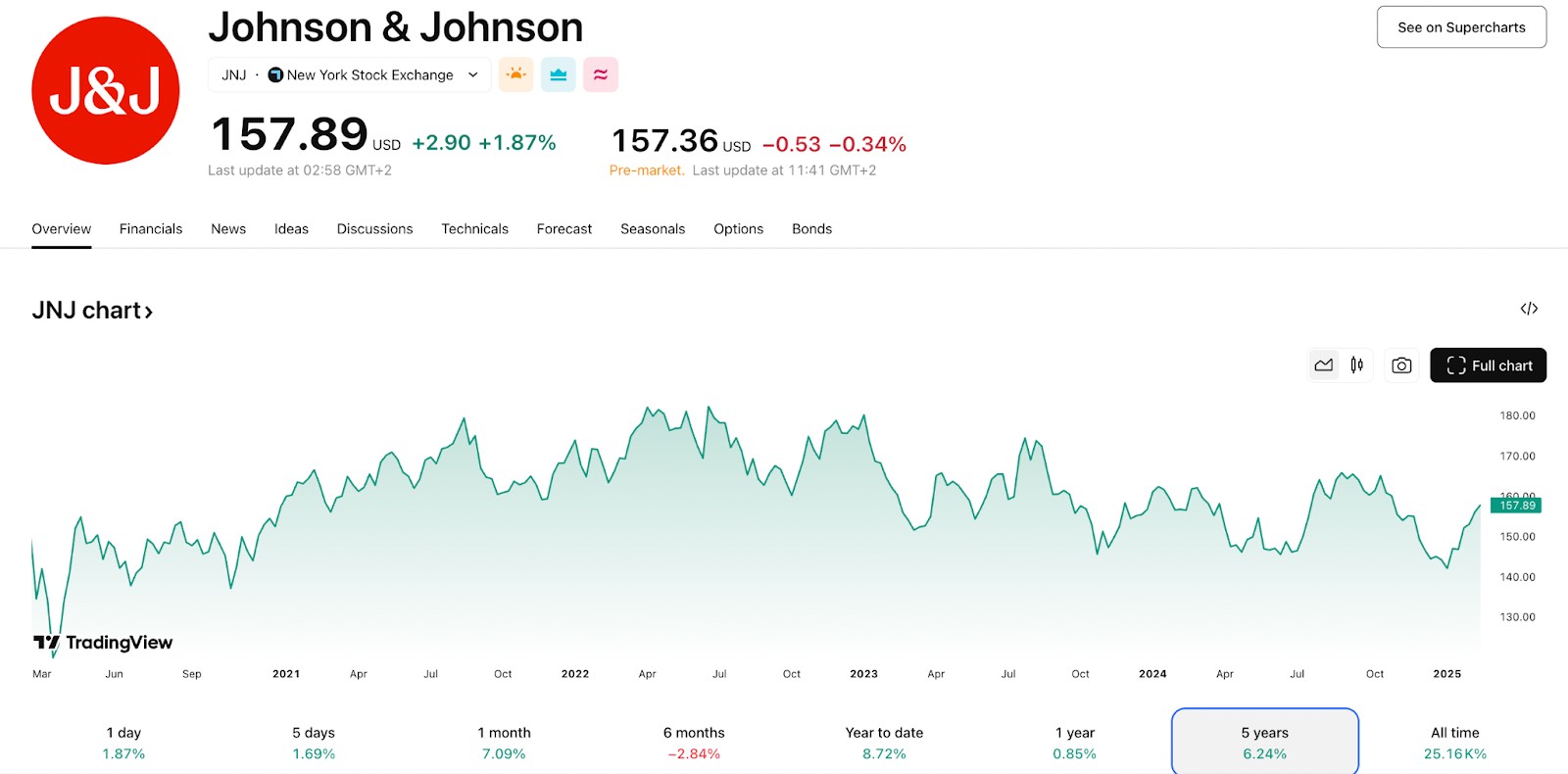

Johnson & Johnson (JNJ)

Johnson & Johnson's diversified healthcare portfolio spans pharmaceuticals, medical devices, and consumer health products, providing stability. The company's consistent dividend payments and history of dividend increases appeal to income-focused investors. Strong financials, including steady revenue and earnings growth, reflect its resilience in the healthcare sector. Johnson & Johnson's investment in research and development supports a robust pipeline of new products. The company's global presence and brand recognition contribute to sustained market leadership.

Procter & Gamble Co. (PG)

Procter & Gamble's portfolio of essential consumer brands ensures consistent demand and revenue. The company's pricing power allows it to maintain margins even in competitive markets. Strong cash flow supports regular dividend payments and share repurchases, benefiting shareholders. Procter & Gamble's focus on innovation and product development drives market share growth. The company's global reach and diversified product lines provide stability against market volatility.

Berkshire Hathaway Inc. (BRK.B)

Berkshire Hathaway's diverse holdings across various industries offer investors exposure to a broad range of sectors. The company's defensive investments, including insurance and utilities, provide stability during economic downturns. Strong financial management under CEO Warren Buffett has resulted in consistent growth in book value per share. Berkshire's substantial cash reserves enable opportunistic investments and acquisitions. The company's long-term investment approach aligns with investors seeking steady capital appreciation.

Visa Inc. (V)

Visa's leadership in global digital payments positions it to benefit from the ongoing shift towards cashless transactions. The company's extensive network and scale provide a competitive advantage in transaction processing. Strong financial performance, with consistent revenue and earnings growth, reflects its market dominance. Visa's expansion into new payment technologies and markets supports future growth prospects. The company's high-profit margins and efficient business model contribute to robust shareholder returns.

What are the best stocks to buy for the long term?

When selecting a portfolio of stocks for long-term investment, successful investors typically create specific criteria that prioritize stability, consistent growth, competitive advantage, effective management, and valuation.

This criteria includes, but is not limited to, the following:

Stable financial performance. Achieved over several years, indicating resilience during fluctuations in regional or global economic fluctuations

Revenue and profit growth. A history of sustained revenue and profit growth suggests the business is expanding and generating consistent returns for shareholders

Strong competitive position. A competitive advantage, such as a unique product, strong brand, or market dominance, helps the company maintain sustainable profitability

Dividend history. For income-focused investors, a history of increasing and paying dividends provides a steady stream of income

Low debt levels. Companies with manageable debt levels are preferred, as high debt is an additional risk during uncertain economic times and conditions

Cash flow. Positive and increasing cash flow is a barometer of a healthy business. It ensures the company can reinvest in growth and cover expenses

Market position. The company's market share and position in its industry should be strong or improving

Global economic trends. Global economic trends and potential tailwinds or headwinds can affect the industry space

Valuation. The stock price versus its intrinsic value is crucial in determining if it is reasonably priced or undervalued

Long-term vision. A well-defined and executable long-term vision indicates forward-thinking management

Regulatory and environmental factors. How regulatory changes or environmental considerations could potentially impact the company's future

Risk management. Recognizing and managing risks through diversification, hedging, or other strategies

Best brokers to buy stocks 2025

Bank stock investments can be lucrative because they provide consistent dividends and long-term growth. However, choosing the right broker is crucial to maximizing your returns. Let's compare the top brokers for buying stocks.

| Demo | Account min. | Interest rate | Basic stock/ETF fee | Min. stock/ETF fee | Android | iOS | Open an account | |

|---|---|---|---|---|---|---|---|---|

| Yes | No | No | $3 per trade | $3 per trade | Yes | Yes | Open an account Via eOption's secure website. |

|

| No | No | 1 | Zero Fees | Zero Fees | Yes | Yes | Open an account Via Wealthsimple's secure website. |

|

| No | No | No | Zero Fees | Zero Fees | Yes | Yes | Study review | |

| No | No | 0,15-1 | Standard, Plus, Premium, and Metal Plans: 0.25% of the order amount. Ultra Plan: 0.12% of the order amount. | £1.00 in the UK, €1.00 in the Eurozone | Yes | Yes | Study review | |

| Yes | No | 4,83 | 0-0,0035% | $1,00 | Yes | Yes | Open an account Your capital is at risk. |

Is long-term investing a good idea in 2025?

Long-term investing remains a prudent strategy in 2025, offering several key advantages:

Market cycles and compounding returns

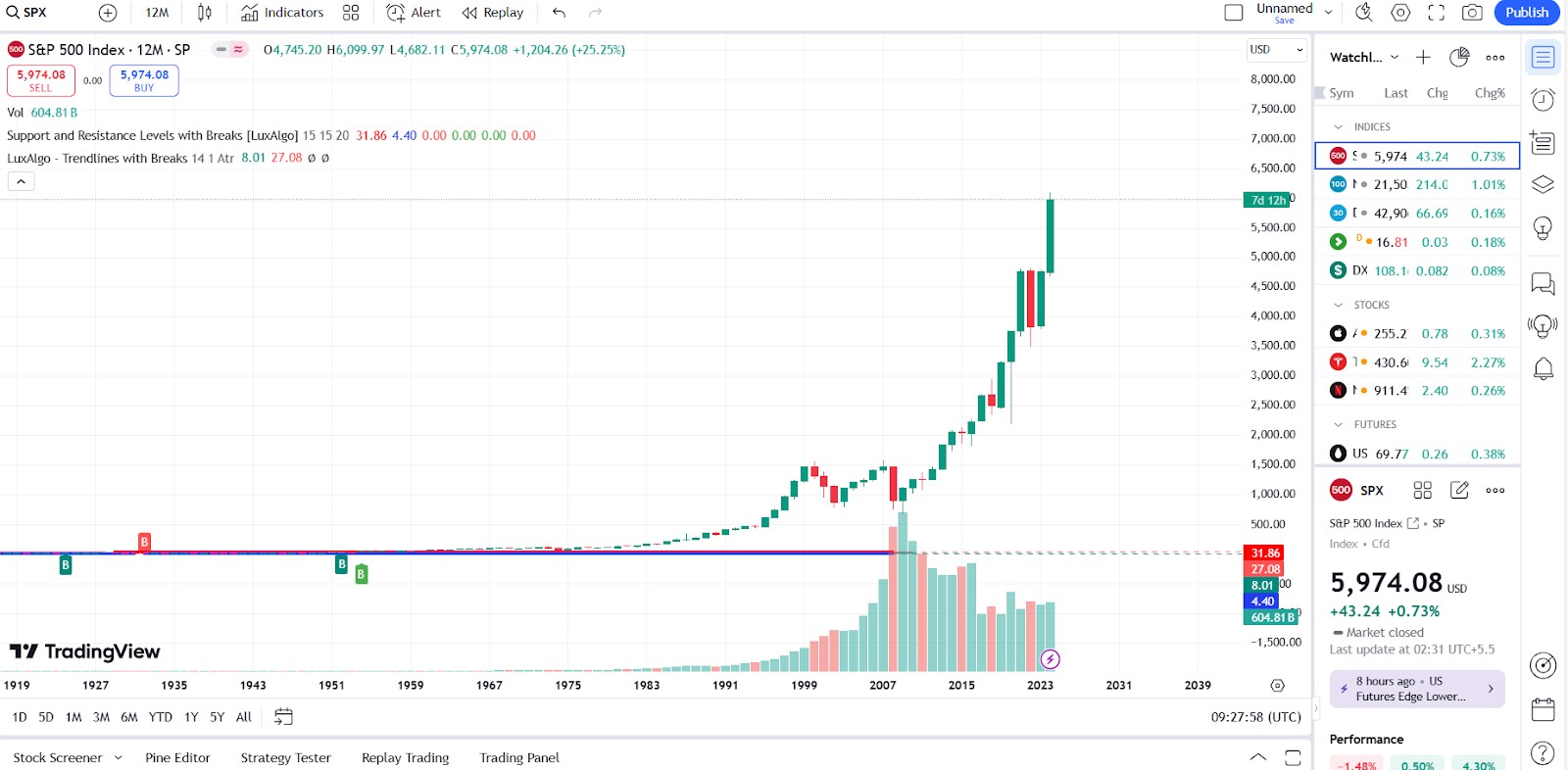

Financial markets inherently experience cycles of growth and decline. Attempting to time these fluctuations is challenging and often counterproductive. By maintaining a long-term investment horizon, investors can ride out short-term volatility and benefit from the power of compounding returns. Historically, the S&P 500 has delivered an average annual return of approximately 10%, underscoring the potential gains from sustained investment.

Historical performance of the S&P 500

The S&P 500 index, representing a broad spectrum of the U.S. stock market, has shown consistent growth over extended periods. For instance, over the past three decades, the index achieved a total return of 1,710%, equating to an annualized return of about 10.1%. This performance highlights the benefits of a long-term investment approach.

Emerging growth sectors

Investing with a long-term perspective allows participation in the growth of sectors such as renewable energy, technology, and healthcare. These industries are poised to drive future economic expansion, offering substantial opportunities for investors. For example, in 2024, the S&P 500's significant gains were largely propelled by companies specializing in technological advancements.

Risk mitigation through diversification

A long-term strategy facilitates diversification across various asset classes and sectors, which can reduce overall portfolio risk. By spreading investments, investors are better positioned to withstand sector-specific downturns and capitalize on broader market upswings.

Tax efficiency

Holding investments over the long term often results in favorable tax treatment, such as lower capital gains tax rates, enhancing net returns.

In summary, long-term investing in 2025 continues to be a sound approach, leveraging market cycles, historical performance, emerging growth sectors, diversification benefits, and tax efficiencies to build wealth over time.

Risks of long-term investing in stocks

Investing in stocks over the long term can build substantial wealth but comes with various risks that investors should consider carefully:

Market volatility. Financial markets are inherently volatile due to economic cycles, geopolitical events, and shifts in investor sentiment. While long-term investing aims to smooth out short-term fluctuations, major market downturns can still impact portfolio values. For instance, stock markets have experienced historical corrections like the dot-com crash in 2000 and the tech-driven market slump in 2022.

Economic and geopolitical risks. Global events such as recessions, trade disputes, wars, and political instability can adversely affect stock markets. Decreased corporate earnings and falling stock prices are common outcomes. U.S. markets face concentration risks, especially if geopolitical tensions disrupt the global economy.

Inflation. Inflation erodes purchasing power over time, reducing real investment returns. If a portfolio's growth fails to outpace inflation, an investor's wealth declines. This risk is particularly relevant for retirees who rely on their investment income to maintain their lifestyle.

Interest rate changes. Rising interest rates often lead to lower stock valuations as borrowing costs increase, reducing corporate profitability. Investors holding stocks during such periods may experience slower portfolio growth. The Federal Reserve's tightening policies in recent years have demonstrated this effect.

How to invest in stocks | Tips for beginners

Investing in stocks can be rewarding but comes with risks. Here’s how to get started:

Educate yourself. Before investing, learn the basics. Understand key terms and strategies.

Set clear financial goals. Define what you want from your investments. Are you aiming for long-term wealth or short-term income?

Diversify your portfolio. Avoid putting all your money into one stock. Consider ETFs or index funds for broad market exposure.

Choose an investment method. Decide between active or passive investing:

Active investing. Buy and sell stocks regularly to beat the market.

Passive investing. Use low-cost index funds to match market performance.

Practice patience and discipline. Avoid reacting to short-term market changes. Stick to your plan, as markets tend to grow over time despite occasional downturns.

Panic selling often costs more than it saves

Always do your homework; invest in companies with strong fundamentals. In 2010, after analyzing Apple’s (AAPL) financials and upcoming product pipeline, I made a bold move. Back then, market sentiment was mixed. Pessimistic headlines warned of competition and slowing innovation. I held my ground, convinced by Apple’s strong fundamentals and visionary leadership. In 2012, when the market dipped due to global economic fears, I resisted selling despite the noise.

My belief in long-term growth paid off. By staying patient through volatility, I watched my Apple investment multiply tenfold, proving that panic-selling often costs more than it saves.

However, while high-growth stocks can offer big returns, they also carry significant risks. In 2020, I invested in a hyped biotech company without fully understanding its long-term potential. The excitement faded, and I lost 40% of my investment. You can avoid such by prioritizing companies with proven resilience, strong financials, and market leadership.

Summary

Long-term investing in stocks focuses on companies with strong financials, sustainable growth, and competitive advantages. It involves selecting businesses with a history of consistent earnings, robust cash flow, and the ability to adapt to changing market conditions. By diversifying portfolios across sectors and managing risks effectively, investors can build lasting wealth even amid market volatility. Staying committed to long-term strategies, reinvesting dividends, and continuously reviewing portfolio performance can help navigate market complexities while maximizing potential returns over time.

FAQs

What are some benefits of long-term investing?

Benefits include compound returns over many years, reduced trading costs, lowered taxes on investments held over 1 year, and avoiding short-term market volatility.

How many stocks should I hold long-term?

Most financial advisors recommend holding 12–20 individual stocks in your long-term portfolio to achieve adequate diversification while still having concentrated positions.

Should I invest in index funds or individual stocks?

Both have advantages: index funds are more hands-off, while individual stocks allow for more company research and potential outperformance. A mixed portfolio is a good approach.

How much of my portfolio should be in long-term stocks?

Most financial experts recommend allocating 60–75% of a portfolio to long-term stocks, which provide growth potential to offset inflation. The rest can be in more stable fixed income.

Related Articles

Team that worked on the article

Peter Emmanuel Chijioke is a professional personal finance, Forex, crypto, blockchain, NFT, and Web3 writer and a contributor to the Traders Union website. As a computer science graduate with a robust background in programming, machine learning, and blockchain technology, he possesses a comprehensive understanding of software, technologies, cryptocurrency, and Forex trading.

Having skills in blockchain technology and over 7 years of experience in crafting technical articles on trading, software, and personal finance, he brings a unique blend of theoretical knowledge and practical expertise to the table. His skill set encompasses a diverse range of personal finance technologies and industries, making him a valuable asset to any team or project focused on innovative solutions, personal finance, and investing technologies.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Index in trading is the measure of the performance of a group of stocks, which can include the assets and securities in it.

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

Forex leverage is a tool enabling traders to control larger positions with a relatively small amount of capital, amplifying potential profits and losses based on the chosen leverage ratio.

Risk management is a risk management model that involves controlling potential losses while maximizing profits. The main risk management tools are stop loss, take profit, calculation of position volume taking into account leverage and pip value.

Diversification is an investment strategy that involves spreading investments across different asset classes, industries, and geographic regions to reduce overall risk.