Best Publicly Traded Robotics Companies: A Full Guide

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Best publicly traded robotics companies in 2025:

UiPath Inc. (NYSE: PATH): specializes in robotic process automation (RPA)

NVIDIA Corporation (NASDAQ: NVDA): provides AI hardware for robotics

ABB Ltd. (NYSE: ABB): focuses on industrial and collaborative robots

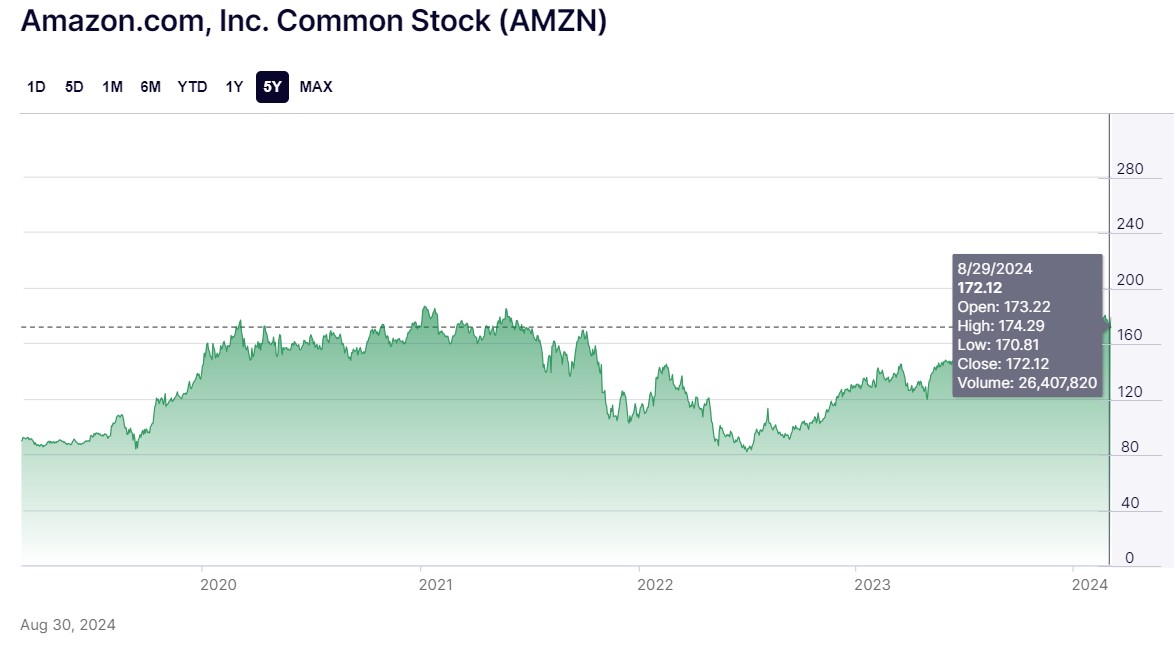

Amazon (NASDAQ: AMZN): advances in logistics and warehouse robotics

Zebra Technologies Corporation (NASDAQ: ZBRA): offers automation and tracking solutions

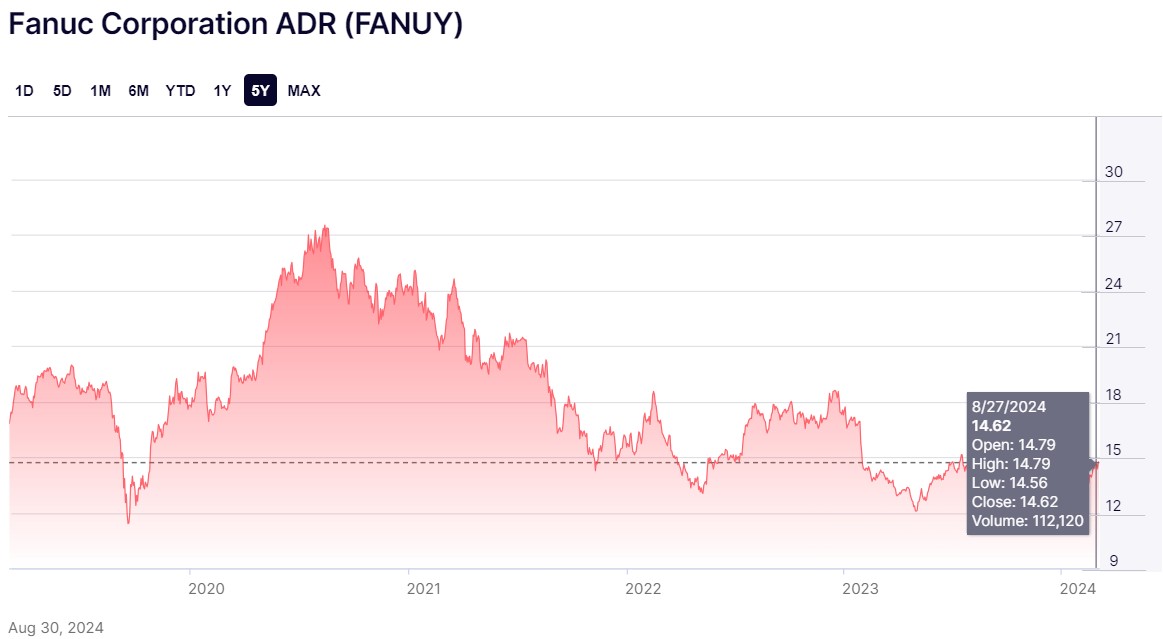

Fanuc Corporation (OTCMKTS: FANUY): leader in industrial robotics

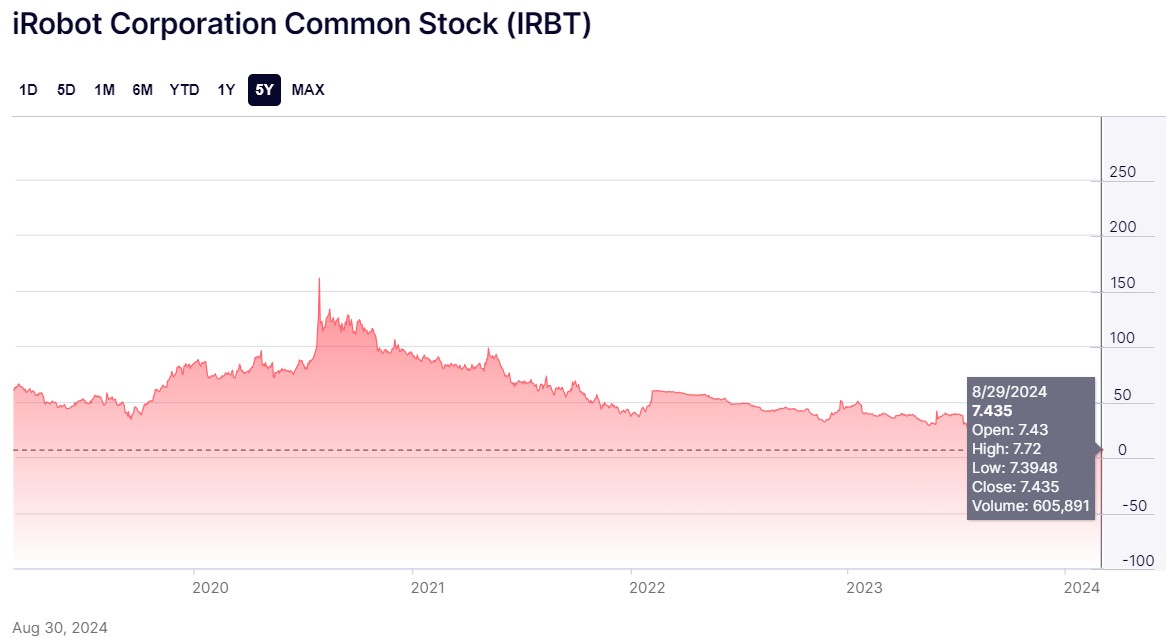

iRobot Corporation (NASDAQ: IRBT): famous for consumer robots like Roomba

The robotics industry is rapidly transforming the way businesses operate, driving efficiency and innovation across a multitude of sectors. From manufacturing and logistics to healthcare and defense, robotics companies are at the forefront of technological advancement. For investors, publicly traded robotics companies represent a unique opportunity to tap into this growing market. Robotics stocks are gaining attention as they offer exposure to a sector that is increasingly integral to modern industry.

Top publicly traded robotics companies

UiPath Inc. (NYSE: PATH)

UiPath is a pioneer in robotic process automation (RPA), offering software that automates repetitive tasks, allowing businesses to operate more efficiently. Founded in 2005, UiPath has quickly risen to prominence due to its innovative approach to automation. The company’s software is used across various industries, including finance, healthcare, and manufacturing, to streamline processes and improve productivity.

Growth opportunities:

AI-driven tools like task and process mining are expanding.

150% year-over-year growth in task mining clients.

Growing adoption across industries like healthcare, manufacturing, and finance.

Risks and challenges:

Facing intense competition in the automation software market.

Navigating complex AI regulations and data privacy concerns.

Reliance on emerging technologies like AI and IoT, which could have slower adoption.

NVIDIA Corporation (NASDAQ: NVDA)

NVIDIA, initially known for its powerful GPUs, has become a leader in AI and robotics. The company’s technology is integral to the development of advanced robotics systems, providing the computational power necessary for AI-driven applications. NVIDIA’s GPUs are not only used in gaming and graphics but also in data centers, autonomous vehicles, and robotics.

Growth opportunities:

NVIDIA's push into AI-driven industries like healthcare and self-driving cars presents a big opportunity for future growth.

More businesses are relying on cloud computing, which could drive up demand for NVIDIA's data center products.

Robotics powered by NVIDIA’s GPUs could revolutionize industries like manufacturing and autonomous tech.

Risks and challenges:

With such a large market share, NVIDIA might face regulatory challenges related to competition.

Ongoing semiconductor shortages could slow down NVIDIA's production capabilities.

Rivals like AMD and Intel are stepping up their game, which could lead to tougher competition in the AI and GPU space.

ABB Ltd. (NYSE: ABB)

ABB is a global leader in industrial automation and robotics, with operations in over 100 countries. The company is known for its wide range of products, including robots used in manufacturing, automotive, and logistics industries. ABB’s robotics division focuses on creating solutions that enhance productivity and efficiency, making it a key player in the industrial automation space.

Growth opportunities:

ABB’s integration of AI into industrial automation could significantly boost productivity and efficiency, driving demand in manufacturing and logistics.

The global shift towards renewable energy presents ABB with the chance to offer automation solutions that incorporate clean energy technologies.

Expanding into emerging markets like Asia and South America offers ABB the potential to increase its market presence and revenues.

Risks and challenges:

Increasing competition from companies like Siemens and Fanuc could put pressure on ABB to maintain its market position and pricing strategies.

Ongoing global supply chain disruptions may impact ABB's ability to deliver products on time, raising costs and delaying projects.

Stricter regulations in key markets like the EU and US could increase operational costs and limit product innovations for ABB.

Amazon (NASDAQ: AMZN)

Amazon’s investment in robotics is a critical part of its strategy to optimize its vast logistics network. Through Amazon Robotics, the company has developed autonomous robots that manage inventory and streamline operations in its fulfillment centers. These robots are crucial to Amazon’s ability to deliver products quickly and efficiently.

Growth opportunities:

Amazon’s use of AI for smarter logistics and better customer service could boost efficiency and cut costs.

The surge in online shopping, especially in developing countries, gives Amazon a chance to expand its reach and sell more products.

Investing in robots for its warehouses could make Amazon's operations quicker and cheaper, giving it a strong edge.

Risks and challenges:

Governments worldwide are questioning Amazon’s dominance, and stricter regulations or fines could slow it down.

Problems with getting tech supplies on time might hold back Amazon’s plans for upgrading its warehouses.

Rivals li ke Walmart and Alibaba are getting better at online shopping, which could make it harder for Amazon to stay ahead.

Zebra Technologies Corporation (NASDAQ: ZBRA)

Zebra Technologies is at the forefront of providing end-to-end robotic solutions for industries such as healthcare, retail, and logistics. The company’s partnership with Fetch Robotics allows it to offer automated solutions for product distribution and warehouse management. Zebra’s robotics solutions help businesses automate and optimize their operations, making it a critical player in the automation industry.

Growth opportunities:

With more industries like healthcare and retail moving toward automation, Zebra is in a good position to grow as businesses need smarter solutions.

Zebra's work with Fetch Robotics looks promising and could lead to more breakthroughs in managing warehouses more efficiently.

The e-commerce boom is driving more companies to automate their supply chains, which could mean more business for Zebra in the logistics space.

Risks and challenges:

Zebra is facing stiff competition from big names in automation, which could make it harder for them to stay ahead.

Supply chain issues are causing shortages of key components, and this could slow down Zebra's ability to produce its robotic systems.

New regulations, especially in healthcare and retail, could complicate Zebra’s plans to grow in these industries.

Fanuc Corporation (OTCMKTS: FANUY)

Fanuc is a global leader in industrial robotics, offering a wide range of robots used in manufacturing processes. The company’s products are known for their reliability and performance, making them essential in industries like automotive and electronics. Fanuc’s commitment to innovation and its extensive product line make it a key player in the global robotics market.

Growth opportunities

Fanuc’s robotics systems are well-positioned to meet the increasing need for automation in industries like automotive and electronics, where efficiency is key.

The company’s focus on combining AI and connected technologies could lead to smarter, more versatile robots that can enhance manufacturing processes.

As manufacturing expands in regions like Southeast Asia, Fanuc has the potential to grow its sales by entering these new markets.

Risks and challenges

Fanuc is up against tough competitors like ABB and KUKA, which could make it harder to grow its market share.

If the supply of key components slows down, it could disrupt Fanuc’s production timelines and affect customer deliveries.

Changes in trade laws or government regulations, particularly in large markets, might complicate Fanuc’s operations globally.

iRobot Corporation (NASDAQ: IRBT)

iRobot is a consumer robotics company best known for its Roomba robotic vacuum cleaners. The company is expanding its product line to include AI-driven home automation solutions. iRobot’s focus on consumer robotics and its ongoing investment in AI technology make it a compelling option for investors looking to tap into the growing home automation market.

Growth opportunities:

iRobot can leverage its advancements in AI to launch new smart home products, giving them a bigger slice of the growing automation market.

There’s rising demand for practical household robotics, offering iRobot a path to introduce more innovative devices like AI-powered vacuums and floor cleaners.

By focusing on AI and machine learning, iRobot can make its products smarter, offering more personalized features that set them apart from competitors.

Risks and challenges:

iRobot faces stiff competition as more tech companies enter the robotics and smart home spaces, making it harder to stand out.

Supply chain issues, particularly with securing semiconductor chips, might cause delays in getting new products to market.

Data privacy laws and AI regulations could create obstacles for iRobot as it rolls out more AI-focused home automation tools.

Key factors to consider when investing in robotics stocks

Innovation and competitive edge. Innovation is the lifeblood of the robotics industry. Companies that lead in research and development are often the ones pushing the boundaries of what is possible in automation and AI.

Market demand and growth potential. The global demand for robotics and automation solutions is rising as industries seek ways to increase efficiency, reduce costs, and enhance productivity. This demand creates significant growth potential for robotics companies, making them attractive investments for those looking for long-term gains.

Regulatory environment and technological risks. While the robotics industry is booming, it is not without risks. The rapid pace of technological change means that companies must continually innovate or risk becoming obsolete.

Choosing the right broker for stock investments involves evaluating various aspects such as available assets, account requirements, and additional features like demo accounts and fractional shares. The following table compares the top brokers that offer stock trading, detailing key factors including account minimums, interest rates, access to penny stocks, and bonds.

| Demo | Account min. | Interest rate | Basic stock/ETF fee | Min. stock/ETF fee | Signals (Alerts) | Research and data | Regulation level | Open an account | |

|---|---|---|---|---|---|---|---|---|---|

| Yes | No | No | $3 per trade | $3 per trade | Yes | Yes | Tier-1 | Open an account Via eOption's secure website. |

|

| No | No | 1 | Zero Fees | Zero Fees | Yes | Yes | Tier-1 | Open an account Via Wealthsimple's secure website. |

|

| No | No | 0,15-1 | Standard, Plus, Premium, and Metal Plans: 0.25% of the order amount. Ultra Plan: 0.12% of the order amount. | £1.00 in the UK, €1.00 in the Eurozone | No | Yes | Tier-1 | Study review | |

| Yes | No | 4,83 | 0-0,0035% | $1,00 | Yes | Yes | Tier-1 | Open an account Your capital is at risk. |

|

| No | No | 0,01 | Zero Fees | Zero Fees | No | Yes | Tier-1 | Study review |

Considerations for different types of investors

Long-term investors

Watch patent filings, not just profits. Don’t get stuck focusing on revenue alone. When you look closer at a company's patent activity, you’ll start seeing the future market leaders — especially those working on cutting-edge AI robotics or edge computing.

Supply chain resilience is a make-or-break factor. Think about it this way — robotics manufacturing heavily relies on rare materials like semiconductors. If the company can’t adapt to supply chain issues, their growth is at serious risk.

The speed of turning R&D into products. You might hear a lot about R&D spending, but here’s the kicker — it’s not just about how much they spend, but how fast they can turn research into real-world products. If they’re too slow, they risk getting left behind as the tech advances.

Short-term traders

Keep an eye on regulations, not just earnings. Don’t just zero in on quarterly reports — government regulations can shake up the robotics industry more than earnings announcements. Changes in policies, especially in areas like healthcare or defense automation, can move stocks fast.

Follow robotics adoption in niche markets. While everyone’s watching major industries, there’s gold in niches like agriculture or underwater exploration, where robotics is gaining momentum at breakneck speed.

Use real-time sentiment tools. Here’s a shortcut for you — real-time AI sentiment trackers can help you catch stock shifts before they even show up in the charts. By analyzing investor and media buzz around key robotics firms, you can predict sudden moves.

RaaS can be the future

Here’s what it comes down to. Focus on the diversity of a company's robotics applications. It’s not enough to know they’re making robots — you need to know where those robots are being used. A company that only caters to one sector, like automotive, could tank if that industry slows down. But if they’re supplying robots to healthcare, logistics, and agriculture, they’ve spread their risk across multiple markets.

Now, look beyond sales numbers and check out their service models. More and more robotics companies are shifting to offering robots-as-a-service (RaaS). Instead of just selling machines, they’re leasing them out, handling upgrades, and charging subscriptions. This gives them steady, recurring income, which can help keep the business stable, especially when markets are unpredictable.

Conclusion

Investing in robotics stocks offers a unique opportunity to participate in the growth of an industry that is shaping the future of technology. Whether you are a long-term investor looking for sustained growth or a short-term trader seeking to capitalize on market volatility, publicly traded robotics companies provide a wide range of investment opportunities. However, as with any investment, it is crucial to conduct thorough research and consider diversifying your portfolio to mitigate risks.

FAQs

What are the tax implications of investing in robotics stocks?

The tax implications are similar to other stock investments. If you sell your robotics stocks at a profit, you may owe capital gains tax. The rate depends on how long you've held the stock and your overall income level.

How do I determine if a robotics stock is overvalued?

To determine if a robotics stock is overvalued, you can look at financial metrics like the Price-to-Earnings (P/E) ratio, Price-to-Sales (P/S) ratio, and compare them to industry averages.

Are there ETFs that focus specifically on robotics stocks?

Yes, there are several ETFs that focus on robotics and automation, such as the Global X Robotics & Artificial Intelligence ETF (BOTZ) and the iShares Robotics and Artificial Intelligence ETF (IRBO).

Is it risky to invest in small-cap robotics companies?

Yes, small-cap robotics companies can be riskier because they are often less established and more volatile. However, they also offer higher growth potential compared to large-cap companies.

Related Articles

Team that worked on the article

Oleg Tkachenko is an economic analyst and risk manager having more than 14 years of experience in working with systemically important banks, investment companies, and analytical platforms. He has been a Traders Union analyst since 2018. His primary specialties are analysis and prediction of price tendencies in the Forex, stock, commodity, and cryptocurrency markets, as well as the development of trading strategies and individual risk management systems. He also analyzes nonstandard investing markets and studies trading psychology.

Also, Oleg became a member of the National Union of Journalists of Ukraine (membership card No. 4575, international certificate UKR4494).

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Diversification is an investment strategy that involves spreading investments across different asset classes, industries, and geographic regions to reduce overall risk.

Risk management is a risk management model that involves controlling potential losses while maximizing profits. The main risk management tools are stop loss, take profit, calculation of position volume taking into account leverage and pip value.

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

Forex leverage is a tool enabling traders to control larger positions with a relatively small amount of capital, amplifying potential profits and losses based on the chosen leverage ratio.