Comprehensive Guide To TikTok Stock

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

To invest in TikTok, you can buy shares in ByteDance, its parent company, indirectly. ByteDance is privately held, but you can invest in it by purchasing shares in private equity funds like KKR and Sequoia Capital, or companies holding ByteDance stakes such as SoftBank Group. Eligible investors can also buy pre-IPO shares on platforms like EquityZen. Additionally, you can also trade ByteDance shares on gray markets to speculate on its IPO valuation, though this carries a lot of risk.

TikTok is a social media app that allows users to create and share short videos, often set to music. Its ease of use and engaging content have made it a favorite among younger demographics. ByteDance, the parent company of TikTok, is a Chinese technology firm that also owns other products like Douyin (the Chinese version of TikTok), Lark, Xigua Video, and more. With the rising frenzy around short-form content, the idea to invest in TikTok is also gaining popularity. This article explores the ways you can invest in TikTok along with important guidelines to follow during the process.

Comprehensive guide to TikTok stock

Does TikTok have a stock?

Currently, TikTok itself does not have publicly traded stock. Instead, ByteDance, a privately held company, owns TikTok. This means that you cannot buy TikTok stock directly on any stock exchange.

Who owns ByteDance?

ByteDance's ownership is divided among its global investors, founders, and employees. Key investors include SoftBank, Sequoia Capital, and General Atlantic. Co-founders Zhang Yiming and Liang Rubo, along with the employees, also hold significant stakes.

ByteDance's market position and revenue streams

ByteDance’s portfolio includes Douyin, Lark, Xigua Video, and other popular apps, each contributing significantly to its revenue.

Revenue from these products, particularly from advertising and in-app purchases, significantly impact ByteDance's valuation.

TikTok’s competitive landscape

TikTok faces competition from Instagram Reels, Snapchat, and YouTube Shorts, each offering similar short-form video content. Despite the competition, TikTok continues to grow its user base and engagement metrics.

Global and regulatory challenges

Regulations in various countries, such as the US and India, pose significant challenges for TikTok's operations. Investors need to consider the potential risks posed by ongoing regulatory scrutiny and geopolitical tensions.

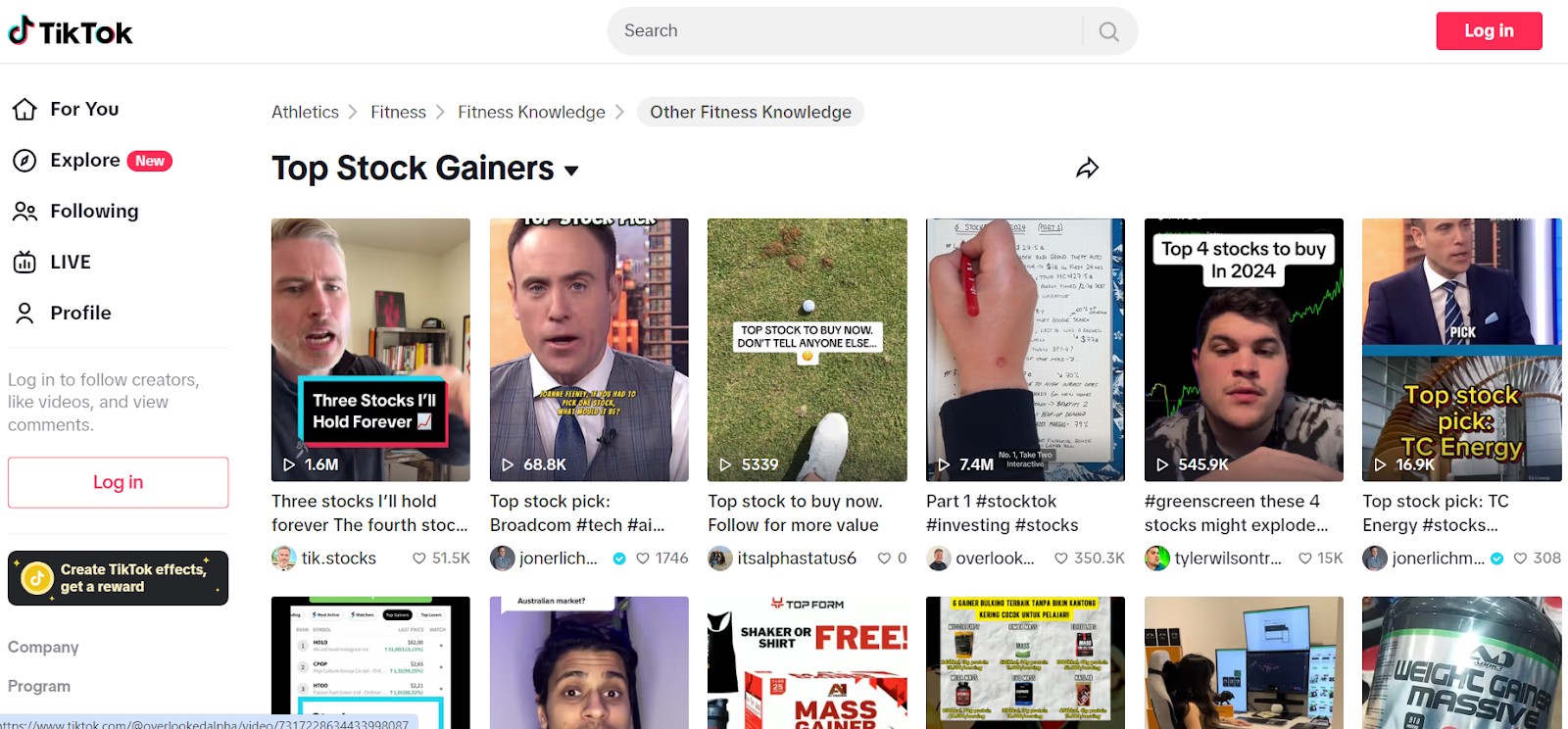

Public perception and media coverage

Public opinion on TikTok is mixed, with concerns over data privacy balanced by its popularity. Major media outlets frequently report on TikTok’s data privacy practices and geopolitical implications.

Will TikTok have an IPO?

ByteDance has completed several fundraising rounds, the most notable being in 2018 and 2020, with valuations soaring from $72 billion to $180 billion. These rounds involved major investors like KKR and SoftBank. The current investors are likely to look for an exit in the medium term (nearly three to five years).

Current status of ByteDance plans for an IPO

ByteDance has long been rumored to consider an IPO, but as of now, there are no concrete plans or timelines for such an event. The company has raised significant funds in private rounds, which suggests it may not be in immediate need of public capital.

Predictions and expert opinions on a potential IPO

Experts suggest that ByteDance could opt for an IPO in Hong Kong or the US, depending on regulatory environments and market conditions. An IPO could potentially value ByteDance at over $400 billion.

How to invest in TikTok (indirect methods)

Investing in ByteDance through private equity funds. Investors can gain exposure to ByteDance by investing in private equity funds that hold ByteDance shares. Examples include KKR and Sequoia Capital.

Buying shares in companies that hold stakes in ByteDance. Another way to indirectly invest in TikTok is by purchasing shares of companies that own significant stakes in ByteDance, such as SoftBank Group.

Participating in Pre-IPO investments. Platforms like EquityZen allow accredited investors to buy pre-IPO shares from existing shareholders looking to liquidate their holdings.

Trading ByteDance (TikTok) on grey markets. Some platforms, like IG International, offer the ability to trade ByteDance shares on grey markets, allowing speculation on ByteDance’s potential IPO valuation.

Step-by-step guide to investing in TikTok stock

Create or log in to a trading account. To start investing, you need to create an account with a trading platform that offers access to private equity or gray markets. Choose the best one from table below:

| Demo | Account min. | Signals (Alerts) | Research and data | Basic stock/ETF fee | Min. stock/ETF fee | Open an account | |

|---|---|---|---|---|---|---|---|

| Yes | No | Yes | Yes | $3 per trade | $3 per trade | Open an account Via eOption's secure website. |

|

| No | No | Yes | Yes | Zero Fees | Zero Fees | Open an account Via Wealthsimple's secure website. |

|

| No | No | No | Yes | Standard, Plus, Premium, and Metal Plans: 0.25% of the order amount. Ultra Plan: 0.12% of the order amount. | £1.00 in the UK, €1.00 in the Eurozone | Study review | |

| Yes | No | Yes | Yes | 0-0,0035% | $1,00 | Open an account Your capital is at risk. |

|

| No | No | No | Yes | Zero Fees | Zero Fees | Study review |

Search for ByteDance-related investment opportunities. Use the platform's search function to find ByteDance or related investment opportunities.

Place an order (market order vs. limit order). Choose between a market order (buying at the current price) or a limit order (setting a maximum price you’re willing to pay).

Monitor your investment. Keep track of your investments through your trading platform’s dashboard.

Pros and cons of investing in TikTok

- Pros

- Cons

Rapid growth and popularity. TikTok’s user base is expanding rapidly.

Strong user engagement metrics. High engagement levels indicate robust user retention.

High potential for future revenue growth. Diverse revenue streams from ads and in-app purchases.

Data privacy concerns. Ongoing scrutiny over data practices.

Regulatory challenges. Potential bans and restrictions in various markets.

Uncertain IPO timeline. No confirmed date for ByteDance’s IPO.

Risks and warnings

When investing in new-age tech apps, there are some specific risks that you get exposed to:

Volatility of tech stocks

Investing in tech stocks is inherently volatile, and ByteDance is no exception. Tech companies often experience significant price swings due to various factors, including market sentiment, technological advancements, and competitive dynamics. For instance, companies like Facebook and Snap Inc. have shown substantial price fluctuations post-IPO. ByteDance, with its heavy reliance on user engagement and advertising revenue, could face similar volatility.

Regulatory and geopolitical risks

Regulatory scrutiny and geopolitical tensions add layers of risk to investing in ByteDance. In recent years, TikTok has faced significant regulatory challenges, particularly in the United States and India. The app was banned in India due to data privacy concerns, and it has been under investigation in the US for its ties to China and the handling of user data. These regulatory issues can impact ByteDance's operations, limit its market access, and reduce its overall valuation.

Privacy and data security concerns

Concerns over data privacy can impact TikTok’s user trust and growth. TikTok has been under scrutiny for its data collection practices and how it stores and uses user data. Allegations of data being shared with the Chinese government have raised significant concerns among users and regulators.

Lack of transparency in private company valuations

Private company valuations can be opaque, leading to uncertainty. Unlike publicly traded companies, private firms like ByteDance are not required to disclose detailed financial information, making it difficult for investors to accurately assess their value. Valuations are often based on funding rounds and investor sentiment, which can be subjective and prone to fluctuation.

Don’t put all your eggs in one basket

One of the significant risks of investing in new-age apps like TikTok (or its parent ByteDance) includes the lack of liquidity associated with private investments. Unlike publicly traded stocks, pre-IPO shares can be challenging to sell before an IPO occurs. Furthermore, private company valuations can be opaque, adding another layer of uncertainty. In such cases, diversifying your investment portfolio can help mitigate some of these risks. As they say, Don’t put all your eggs in one basket; consider spreading your investments across various sectors and asset classes to balance potential rewards and risks.

From my experience, it’s also important to adopt a long-term perspective. While the attraction towards quick gains is strong, the tech sector, especially companies like ByteDance, thrives on innovation and long-term growth. Patience and a well-thought-out strategy often yield better results than attempting to capitalize on short-term market movements.

Conclusion

TikTok, owned by ByteDance, has quickly become a dominant force in the social media landscape, captivating millions of users worldwide. However, as a privately held company, investing directly in TikTok stock is not an option. Instead, potential investors can explore indirect methods such as buying shares in companies like SoftBank and KKR that hold stakes in ByteDance or participating in pre-IPO investments through platforms that offer this feature.

Investing in ByteDance offers significant growth potential, given TikTok's massive user base and engagement levels. Yet, it's crucial to acknowledge the risks, including regulatory challenges, data privacy concerns, and the volatile nature of tech stocks. Understanding these factors and staying informed about market trends and expert opinions can help manage risks and make informed investment decisions.

FAQs

How can I buy shares of ByteDance before an IPO?

You can buy shares of ByteDance before an IPO, which allows accredited investors to purchase pre-IPO shares from existing shareholders.

Is it possible to invest in TikTok through mutual funds or ETFs?

Indirectly, yes. Some mutual funds and ETFs might hold shares in companies that have invested in ByteDance.

What is the minimum investment for pre-IPO shares of ByteDance?

The minimum investment for pre-IPO shares can vary by platform. And so, the specific amount can be known by researching the terms of offer of the platform you choose.

Are there any risks associated with investing in pre-IPO shares of ByteDance?

Yes, investing in pre-IPO shares carries risks such as lack of liquidity, potential loss of capital, and uncertainty regarding the company's future performance and eventual IPO.

Related Articles

Team that worked on the article

Igor is an experienced finance professional with expertise across various domains, including banking, financial analysis, trading, marketing, and business development. Over the course of his career spanning more than 18 years, he has acquired a diverse skill set that encompasses a wide range of responsibilities. As an author at Traders Union, he leverages his extensive knowledge and experience to create valuable content for the trading community.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Forex leverage is a tool enabling traders to control larger positions with a relatively small amount of capital, amplifying potential profits and losses based on the chosen leverage ratio.

Volatility refers to the degree of variation or fluctuation in the price or value of a financial asset, such as stocks, bonds, or cryptocurrencies, over a period of time. Higher volatility indicates that an asset's price is experiencing more significant and rapid price swings, while lower volatility suggests relatively stable and gradual price movements.

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

Yield refers to the earnings or income derived from an investment. It mirrors the returns generated by owning assets such as stocks, bonds, or other financial instruments.

A day trader is an individual who engages in buying and selling financial assets within the same trading day, seeking to profit from short-term price movements.