Are Binary Options Legal?

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Binary options are legal, but there are legal nuances in individual countries. In the US, binary trading is directly controlled by the SEC and the CFTC. In the UK, strict requirements are set for binary brokers by the FCA. The most loyal conditions for brokers and clients in Cyprus, the license of the CySEC regulator is accepted in most countries.

With the financial markets becoming increasingly accessible due to technological advancements, many traders and investors are turning their attention to the binary options trading market. It is important to know, however, that this form of high-risk investment may not always be considered legal in certain countries.

In this article, we will explore whether binary options are considered legal in certain countries such as the United States of America, the United Kingdom, and beyond. We will also discuss some warning signs associated with dishonest brokers or providers, as well as some legitimate companies that offer a secure platform for traders.

Overview of binary options legality

Binary options trading is a financial instrument with varying levels of legality across the globe. In some jurisdictions, such as the United States and the United Kingdom, trading binary options is permitted and strictly regulated to protect traders.

However, in many other regions, the activity is banned due to concerns over high-risk practices and fraud. Before engaging in binary options trading, it is crucial for traders to understand the specific regulations and restrictions that apply in their country.

Is binary trading legit in my country?

The legality of binary options trading varies from country to country. In some countries, it is considered legal and regulated by financial authorities, while in others it is seen as a form of gambling and not allowed. In most countries, the market is unregulated or poorly regulated. It is important to research the laws and regulations in your own country before considering investing in binary options.

Binary trading in the US

In the United States, binary options are legal to trade. There is a very strict set of regulations in the US when it comes to binary options, which makes it quite complicated for both traders and brokers. The Commodity Futures Trading Commission (CFTC) and Securities and Exchange Commission (SEC) regulate its financial trading market. The former regulates financial securities and exchanges for stocks and options, while the latter regulates futures and options.

They grant valid licenses to financial service providers and allow them to operate in the country. As well as suspending licenses, they enforce the rules and regulations imposed upon brokers.

Binary trading in the UK

In the UK, trading binary options and brokering them are both legal. Several binary brokers were initially established there. Some different regulations govern the operation of binary brokers in the UK in comparison to other EU countries. At its core, investing in binary options is a legal and regulated activity in Britain, with no laws or restrictions prohibiting the practice.

Thus, companies are able to operate and provide services. It is worth noting, however, that British law doesn't allow these firms to be directly regulated. However, regulation and recognition by a financial authority such as the British FCA (Financial Conduct Authority) are important for a broker to gain legitimacy and trust among traders.

As part of its efforts to ensure the safety of its citizens, the UK government is carefully evaluating and consulting on the classification of this trading. A clear dispute resolution process, segregating traders' funds from broker accounts, and checking the suitability of products are some of the requirements to ensure enhanced customer protection. As a matter of fact, the UK's financial watchdog continuously checks firms, especially those that claim to be based in the UK.

Other countries

Canada. Binary options are outright banned to protect investors from fraud. However, derivative trading on regulated exchanges like the Montreal Exchange (MX) is permitted.

Australia. Fully legal and regulated by the Australian Securities and Investments Commission (ASIC). Both local and international brokers can offer services to Australian residents.

South Africa. Binary options trading is legal but remains unregulated. Traders rely on international brokers to participate in the market.

Japan. Strictly regulated by the Financial Services Agency (FSA) and the Securities and Exchange Surveillance Commission (SESC), making trading safe for residents.

Cyprus. One of the pioneers in regulating binary options, governed by CySEC. Brokers licensed in Cyprus often operate across the European Union.

Malta. Legal and regulated, with a robust framework designed to protect traders.

New Zealand. Legal and increasingly regulated to ensure fair trading practices.

Singapore. Binary options are regulated under stringent financial laws, ensuring trader security.

Other countries where binary options are restricted

While some countries regulate or allow binary options trading, others have imposed strict restrictions or outright bans to protect their citizens from financial losses and fraud. Here are key examples:

India. Binary options trading is largely restricted and considered illegal. The Reserve Bank of India (RBI) and Securities and Exchange Board of India (SEBI) do not recognize or regulate this form of trading.

European Union. The European Securities and Markets Authority (ESMA) has banned the marketing, distribution, and sale of binary options to retail clients due to their high-risk nature.

Israel. Binary options trading is completely banned. The Israel Securities Authority (ISA) has taken strong measures to eliminate this activity domestically and internationally.

Turkey. Binary options are restricted, and domestic brokers are prohibited from offering such instruments to residents.

Russia. Binary options are viewed skeptically, with partial restrictions in place to protect retail investors.

Belgium. The Financial Services and Markets Authority (FSMA) prohibits binary options trading for retail clients due to concerns about fraud and high risks.

How binary options work

Binary options operate on a simple "yes or no" proposition. Traders predict whether the price of an asset will rise or fall within a specified time frame. If the prediction is correct, a predetermined payout is earned.

If the prediction is wrong, the trader loses the invested amount. This straightforward mechanism is what makes binary options appealing to newcomers; however, it also increases the risk of significant losses due to the all-or-nothing nature of the contracts.

Are binary options a scam itself?

Binary options themselves are not inherently a scam, but the market is plagued by fraudulent brokers. Scammers often promise unrealistic returns and bonuses but fail to deliver.

To avoid such risks, traders should only work with licensed brokers regulated by authorities like the CFTC or FCA. Conducting thorough research and verifying a broker’s credentials can protect investors from falling victim to scams.

How to spot illegal binary companies

Spotting illegal binary options trading providers can be difficult, as many of these brokers are unregulated and do not follow standard industry protocols. However, there are certain warning signs to look out for that may indicate a potentially fraudulent provider.

Traders should always check whether the company is regulated by any financial authority in any country. If it has no regulation from an official body then this should be seen as a major red flag.

Investors should also ensure that all legal information regarding the broker’s operations is clearly visible on their website or platform. If such information cannot be found then this could suggest that they are hiding something which should put potential customers on alert.

Another thing to watch out for when selecting a binary options trading provider is promises of fast and easy money. While some brokers may offer attractive returns, it is important to remember that there is no guarantee of success with investing and no one can ever promise consistent profits without taking into account market conditions and other factors associated with risk management strategies.

Another sign of an illegal binary options scammer might be if they try to hide all risks associated with investing rather than providing adequate education material so customers can make informed decisions before entering into agreements with them. Therefore, investors must always take care to perform due diligence prior to engaging any third-party service provider related to binary options trading activity within their jurisdiction.

How to check regulation of binary brokers?

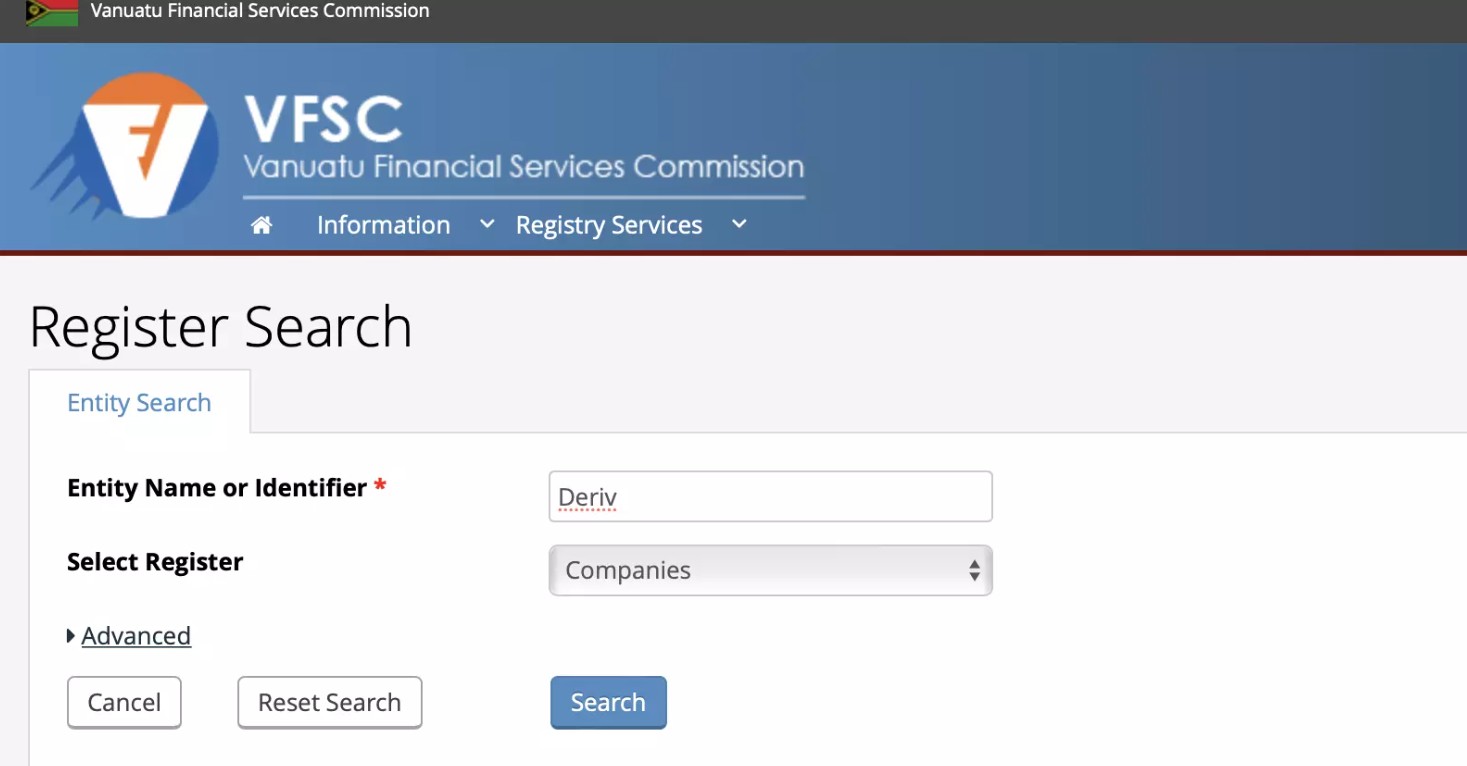

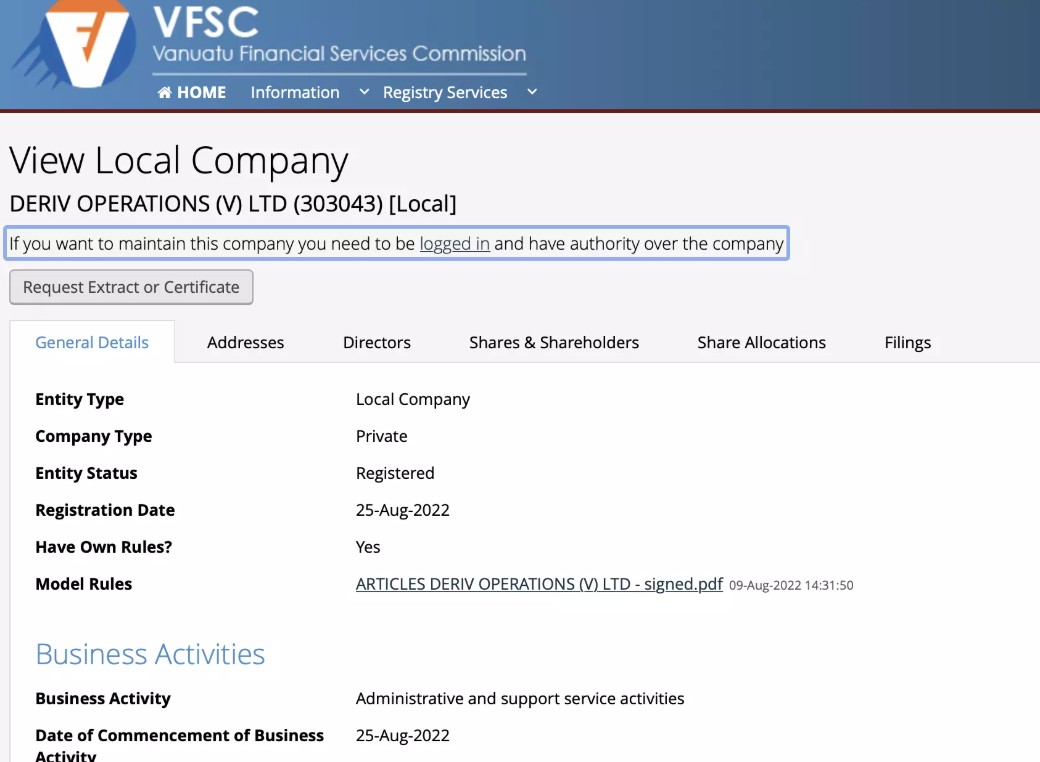

You can check whether a broker has a license on the regulator’s official website. We will tell you how to do this using the example of Deriv, which is one of the top binary brokers.

1. Visit the regulatory authority's website and verify authorization

Visit the official website of the regulatory authority, specified by the broker, and look for a section that allows you to verify the authorization status of financial entities. This is often called a "Register" or "License Search.

2. Search for the broker

Enter the name or registration number of the binary options broker into the regulatory authority's search tool. This should provide information on the broker's regulatory status, license details, and any disciplinary actions, if applicable.

Thanks to this check, you will find out whether the broker is telling the truth about the availability of licenses.

Choosing a reliable broker is crucial for safe and profitable binary options trading. Below, we highlight three top-rated brokers that are known for their regulation, transparency, and user-friendly platforms.

| Regulation | Demo | Min. deposit | Min. trade size | Min. Payout (%) | Open an account | |

|---|---|---|---|---|---|---|

| No | Yes | 5 | 1 | 17 | Open an account Your capital is at risk. |

|

| No | Yes | 100 | 0.01 | 70 | Open an account Your capital is at risk. |

|

| No | Yes | 250 | 0.01 | 70 | Open an account Your capital is at risk. |

|

| No | Yes | 250 | 1 | No | Study review | |

| MISA | Yes | 5 | 1 | 50 | Open an account Your capital is at risk. |

Access niche binary options brokers and ensure fund protection

Binary options legality is not one-size-fits-all, but understanding the guidelines can open up new opportunities. In Europe, ESMA’s ban excludes professional traders. If you meet criteria like high trading volumes or financial expertise, you can access brokers designed for this niche. In the U.S., platforms like Nadex ensure strict compliance with capped risks and clear pricing. For unregulated regions, skip brokers with only offshore registrations and look for ones audited by global bodies like IFSC for added credibility.

Transparency is crucial when choosing a broker. Ask regulated brokers for audit trails that track every trade from start to finish. Check if your broker offers account protection through insurance schemes required by some regulators, like the FCA in the UK. Another overlooked safeguard is segregated accounts overseen by independent trustees, keeping your funds secure during disputes or broker insolvencies. By focusing on these specialized strategies, you can navigate binary options trading safely and effectively.

Conclusion

Binary options trading exists within a complex legal and regulatory framework that varies across countries. While it provides a straightforward and accessible trading mechanism, it also carries inherent risks. Whether binary options are legal in your jurisdiction depends on the local regulations and authorities governing financial activities. Traders are encouraged to conduct thorough research, choose licensed brokers, and understand the risks involved before participating in this form of trading.

FAQs

Are binary options legit?

Yes. In binary options, there's a lot of money - for users, brokers, and advertisers. It is legal to trade binary options, but it is extremely risky. Unless you understand the risks involved, you may be better off staying away altogether.

In which countries is binary options trading legal?

There are many countries that regulate binary options trading, including the United States, the United Kingdom, Australia, New Zealand, Japan, Cyprus, and Malta.

Are binary options illegal in the US?

No. The US allows the trading of binary options, but they must be traded on a regulated exchange. The exchanges are known as Designated Contract Markets (DCMs). CFTC or SEC oversight is required when binary options are listed on registered exchanges or traded on DCMs.

How risky are binary options?

It is extremely risky to trade binary options. It is important to note that binary options are all-or-nothing contracts. When a binary option expires, the investor loses all their money. There is either a predetermined amount of money made or none at all.

Related Articles

Team that worked on the article

Mikhail Vnuchkov joined Traders Union as an author in 2020. He began his professional career as a journalist-observer at a small online financial publication, where he covered global economic events and discussed their impact on the segment of financial investment, including investor income. With five years of experience in finance, Mikhail joined Traders Union team, where he is in charge of forming the pool of latest news for traders, who trade stocks, cryptocurrencies, Forex instruments and fixed income.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Copy trading is an investing tactic where traders replicate the trading strategies of more experienced traders, automatically mirroring their trades in their own accounts to potentially achieve similar results.

Index in trading is the measure of the performance of a group of stocks, which can include the assets and securities in it.

Options trading is a financial derivative strategy that involves the buying and selling of options contracts, which give traders the right (but not the obligation) to buy or sell an underlying asset at a specified price, known as the strike price, before or on a predetermined expiration date. There are two main types of options: call options, which allow the holder to buy the underlying asset, and put options, which allow the holder to sell the underlying asset.

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

The CFTC protects the public from fraud, manipulation, and abusive practices related to the sale of commodity and financial futures and options, and to fosters open, competitive, and financially sound futures and option markets.