Oil Trading: Step-by-Step Guide

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Oil trading involves the buying and selling of crude oil and its derivatives with the aim of making a profit. Traders can speculate on the price movements of oil through various financial instruments, including futures contracts, options, and CFDs (Contracts for Difference).

Oil trading is exciting and can be profitable, with oil traders playing a big part in the global economy. With oil being so heavily traded, knowing how this market works can open up many opportunities. This guide covers everything you need to know, from basics to advanced strategies, to help both new and experienced traders understand this market better.

What is oil trading?

Oil trading involves the buying and selling of crude oil and its derivatives. Traders can speculate on the price movements of oil through various financial instruments, including:

Futures contracts - agreements to buy or sell a specific quantity of oil at a predetermined price at a future date.

Exchange-Traded Funds (ETFs) - funds that track the price of oil or oil indices (examples: United States Oil Fund (USO), SPDR S&P Oil & Gas Exploration & Production ETF (XOP)).

Contracts for Difference (CFDs) - financial derivatives that allow traders to speculate on oil price movements without owning the actual asset.

Stocks and Shares - investing in companies involved in oil exploration, production, and distribution (examples: ExxonMobil, Chevron, BP).

Oil trading typically involves speculating on the future price movements of crude oil. Traders analyze market trends, geopolitical events, and supply-demand dynamics to take positions in this commodity.

Crude oil: Unrefined petroleum extracted from the ground.

Brent crude: Oil extracted from the North Sea, used as a global benchmark.

WTI (West Texas Intermediate): Oil from the U.S., used as a benchmark in North America.

Dubai Crude: Produced in Dubai, UAE.

Oman Crude: Produced in Oman, similar to Dubai Crude in characteristics and used in some contracts for oil sales to Asia.

Urals: Produced in Western Russia and Siberia, used to assess the price of Russian oil sold in Europe.

Siberian Light: Produced in Western Siberia, a blend of light and heavy crude oils.

Bonny Light: Produced in Nigeria, used as a benchmark for light, low-sulfur oil sold in Africa and Europe.

Basrah Light: Produced in Iraq, benchmark for oil sold in Middle Eastern markets.

Murban Crude: Produced in Abu Dhabi, UAE, light oil with low sulfur content, used for sales in Asian markets.

Oil trading step-by-step guide

Choosing the right broker

Choosing the right broker leads to hassle-free trading. When faced with a lot of options, you should prioritize user-friendly platforms, reasonable fees, strong security and regulation, responsive customer support, and a wide range of financial instruments, which in this case should include oil.

We have compared brokers for you according to all these parameters and offer you to familiarize yourself with their conditions in the table below:

| Oil | Min. deposit, $ | ECN Commission, $ per lot | Leverage, 1: | Investor protection | Open account | |

|---|---|---|---|---|---|---|

| Yes | 100 | No | Up to 1:30 or up to 1:300 | €20,000 £85,000 SGD 75,000 | Open an account Your capital is at risk. |

|

| Yes | No | 3 | Up to $400:1 retail, 500:1 Pro | £85,000 €20,000 €100,000 (DE) | Open an account Your capital is at risk.

|

|

| Yes | No | 3,5 | Up to 1:200 | £85,000 SGD 75,000 $500,000 | Open an account Your capital is at risk. |

|

| Yes | 100 | 5 | Up to 1:400 | £85,000 | Study review | |

| Yes | No | 2 | Depending on the asset | $500,000 £85,000 | Open an account Your capital is at risk. |

Opening your crude oil trading account

To start trading oil, you'll need to open an account with a brokerage that offers oil trading instruments. The registration process typically involves providing personal information and verifying your identity.

Starting oil trading

Successful oil trading requires a well-thought-out strategy. This involves setting clear trading goals, determining your risk tolerance, and choosing a trading style that suits your preferences, such as day trading, swing trading, or long-term investing.

Choose the instrument of your interest: Select the oil-related financial instrument you wish to trade, such as WTI Crude Oil CFDs.

Use your preferred trading strategy: Identify buy and sell signals based on your strategy.

Open your first trade and set a stop loss: Enter your trade and set a stop loss to manage risk.

Monitor your trade: Use technical and fundamental analysis to keep track of your trade.

Close your position: Exit your trade when your strategy indicates it’s time to close.

Oil trading strategies

Oil trading is a dynamic and potentially profitable market for traders who understand its unique characteristics and drivers. Here are a few common oil trading strategies, along with descriptions and examples of how they work.

1. Trend Following Strategy

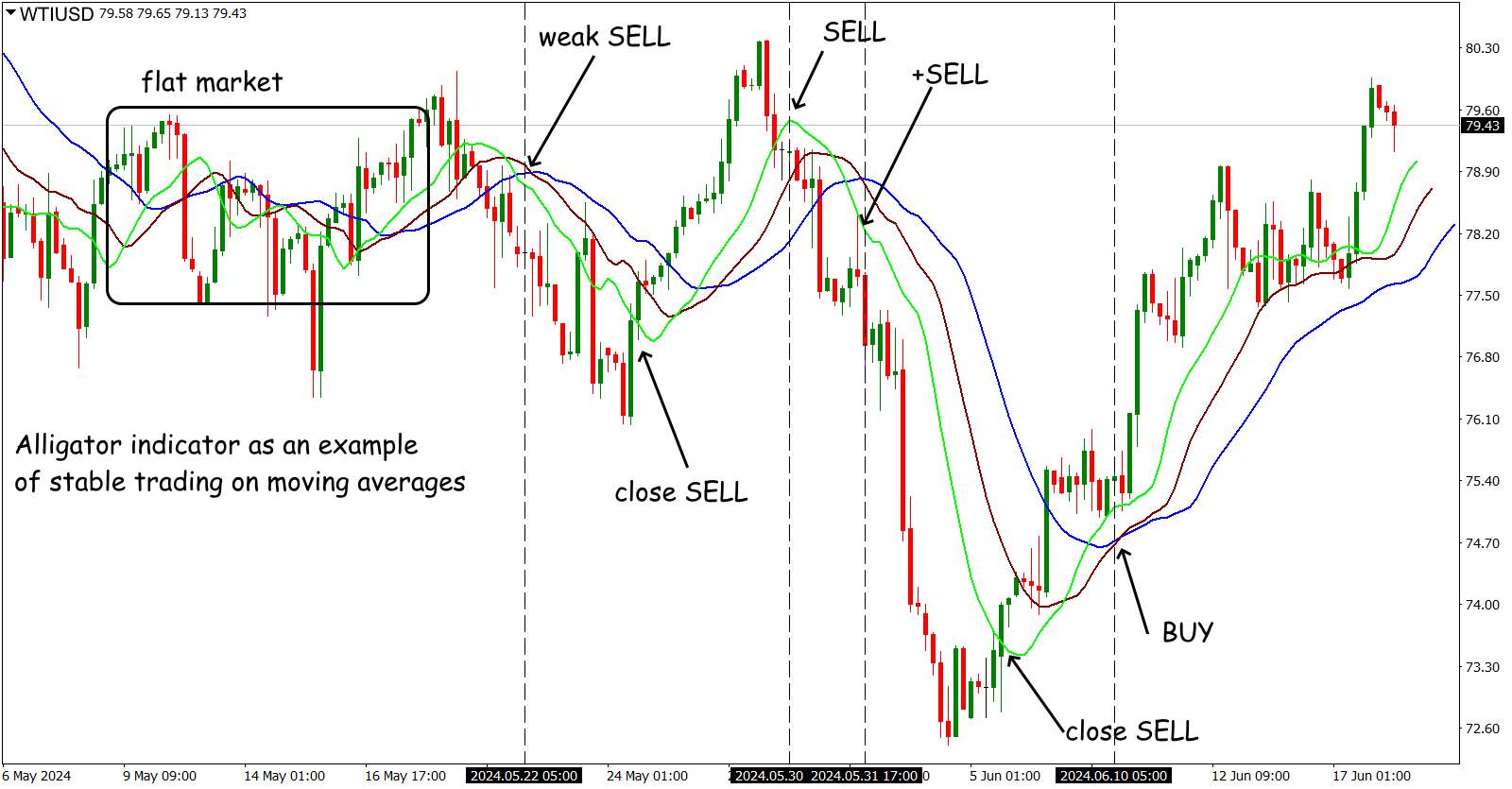

Trend following is one of the most popular trading strategies in the oil market. It involves identifying and trading in the direction of the prevailing trend. Traders use technical indicators like moving averages, trend lines, and momentum indicators to spot trends and make trading decisions.

Moving Average Crossover: A common trend-following strategy where traders buy when a short-term moving average crosses above a long-term moving average (bullish signal) and sell when the short-term moving average crosses below the long-term moving average (bearish signal).

2. Range Trading Strategy

Range trading involves identifying key support and resistance levels where the price of oil tends to trade within a range. Traders buy at the support level and sell at the resistance level. This strategy works best in a sideways or non-trending market.

Support and Resistance: Traders identify the horizontal levels where the price consistently bounces back and forth. They place buy orders at the support and sell orders at the resistance.

3. Breakout Strategy

The breakout strategy involves trading on significant price movements that occur when the price of oil breaks through a key support or resistance level. This strategy aims to capture the volatility and momentum following a breakout.

Example:

Resistance Breakout: Traders place buy orders just above the resistance level, expecting the price to surge upwards after breaking the resistance;

Support Breakout: Conversely, traders place sell orders just below the support level, expecting the price to drop further after breaking the support.

4. News Trading Strategy

News trading involves making trading decisions based on economic news and geopolitical events that impact the oil market. This strategy requires staying updated with news that can affect oil supply and demand, such as OPEC meetings, inventory reports, and geopolitical tensions.

Example:

Crude Oil Inventories Report: Traders watch the weekly crude oil inventories report from the U.S. Energy Information Administration (EIA). A larger-than-expected increase in inventories can drive prices down, while a decrease can push prices up.

5. Arbitrage Strategy

Arbitrage involves taking advantage of price discrepancies between different markets or instruments. In oil trading, this can involve trading between spot prices and futures prices or between different geographical markets.

Example:

Spot-Futures Arbitrage: Traders buy oil in the spot market and simultaneously sell oil futures contracts if the futures price is significantly higher than the spot price, locking in a risk-free profit.

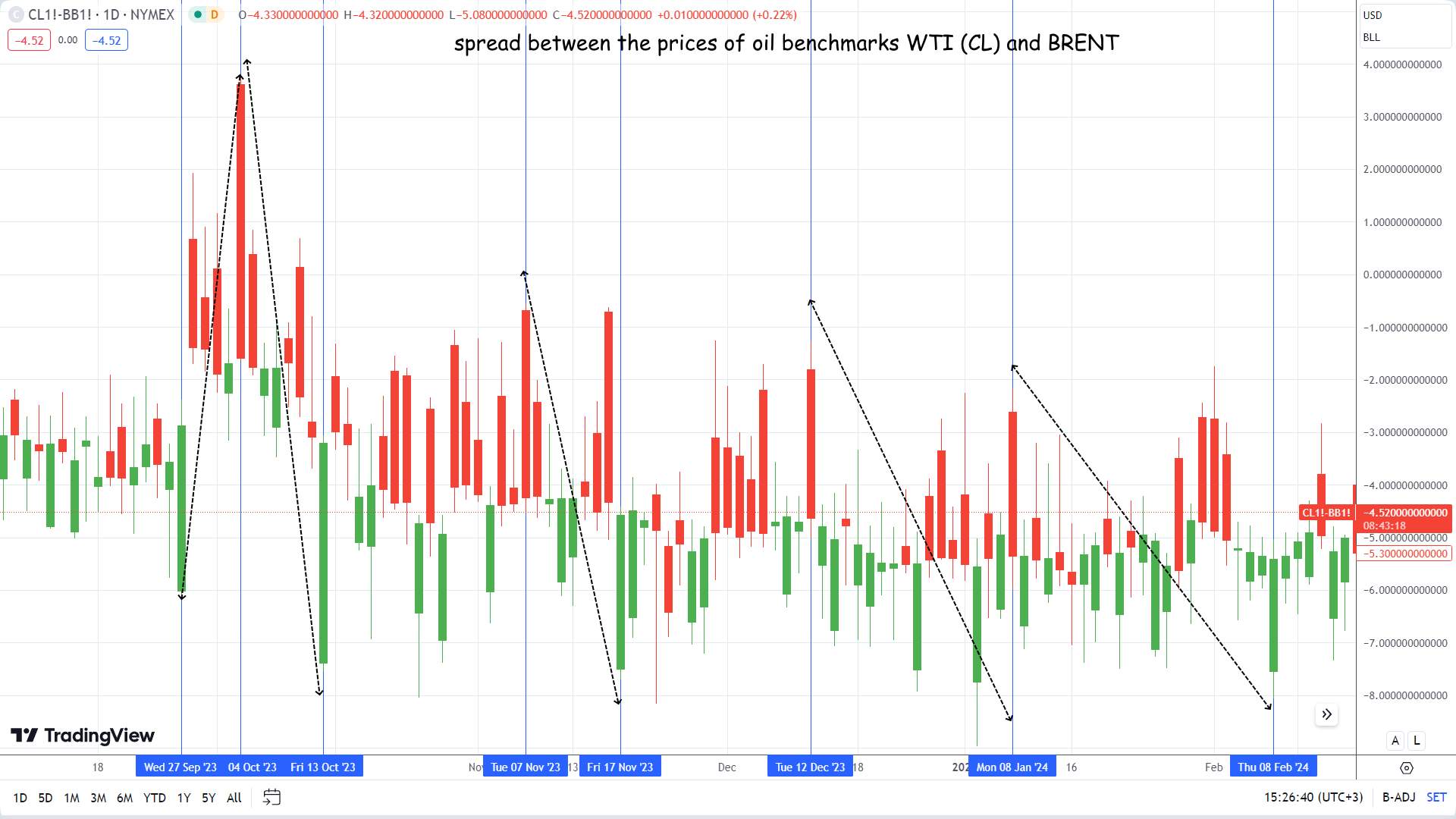

For example: You can use the price difference between Brent oil and WTI oil to make a profit. This difference (spread) can vary depending on different market conditions, and an arbitrage strategy involves buying one contract and selling the other in the hope that the spread will change in your favor.

Steps to implement the strategy:

Spread Monitoring

Constantly monitor the current spread between Brent and WTI. The spread can be calculated as the difference between the price of the Brent futures contract and the price of the WTI futures contract.

Identify anomalies

Look for anomalies or extremes in the spread that may indicate a possible change in its direction. This can be done using historical analysis and statistical methods.

Opening positions

If the spread is too wide (Brent is significantly more expensive than WTI), you can:

Sell a futures contract on Brent (take a short position)

Buy a futures contract on WTI (take a long position).

If the spread is too narrow (Brent is worth almost the same as WTI), you can:

Buy a Brent futures contract (take a long position)

Sell a WTI futures contract (take a short position)

Closing positions

Close positions when the spread returns to normal levels or reaches a certain target value. For example, if you expected the spread to narrow from $5 to $3, close positions when the spread reaches $3.

Tips for beginners

Here are some tips for beginners:

Understanding market basics: Beginners should start by understanding the fundamental aspects of the oil market, including how supply and demand affect prices and the impact of geopolitical events.

Practice with demo accounts: Using demo accounts allows beginners to practice trading without risking real money. This helps in gaining confidence and understanding the mechanics of trading platforms.

Continuous learning: Keep learning by using online resources, joining webinars, and keeping up with market analyses to stay on top of your game.

Managing initial investments and minimizing risks: Start with small investments and gradually increase your exposure as you gain experience. Always prioritize risk management to protect your capital.

How I began oil trading

When I began oil trading, I quickly learned it's a complex yet rewarding field. It's deeply influenced by geopolitical events, supply and demand dynamics, and macroeconomic indicators. Staying updated on global news is crucial, as political instability or OPEC meetings can drastically impact prices.

Understanding supply and demand is essential. For example, technological advances and the shift towards renewable energy affect long-term demand. Macroeconomic indicators like GDP growth and currency fluctuations also play significant roles in oil prices.

Risk management is vital due to oil's price volatility. Tools like stop-loss orders and futures contracts help mitigate risks. Technical analysis, using techniques like moving averages and RSI, provides additional trading insights.

Successful oil trading requires a blend of geopolitical awareness, economic understanding, risk management, and technical analysis. It's a dynamic field that demands continuous learning and strategic adaptation.

Summary

Success in Oil trading depends on several factors. Geopolitical events, such as political instability and OPEC decisions, significantly impact prices, making it essential to stay informed about global events.

Supply and demand dynamics are crucial, with technological advancements and the shift towards renewable energy altering the landscape and long-term demand for oil. Macroeconomic indicators, like GDP growth and currency strength, also play a significant role in influencing prices.

Overall, oil trading requires a comprehensive approach that combines geopolitical awareness, economic understanding, and effective risk management. It’s a challenging yet fascinating field that demands continuous learning and adaptation.

FAQs

What does an oil trader do?

Oil traders buy and sell oil contracts on financial markets to take advantage of price changes. They look at supply and demand, geopolitical events, and economic data to trade crude oil derivatives.

How can I manage risks in oil trading?

Given the volatility of oil prices, managing risks is crucial. You can use strategies like stop-loss orders to limit potential losses and futures contracts to hedge against price fluctuations. Additionally, having a well-thought-out risk management plan and sticking to it is essential.

Is oil trading profitable?

Oil trading can very well be profitable because of its price swings. But it's also risky due to geopolitical events and market volatility.

Related Articles

Team that worked on the article

Parshwa is a content expert and finance professional possessing deep knowledge of stock and options trading, technical and fundamental analysis, and equity research. As a Chartered Accountant Finalist, Parshwa also has expertise in Forex, crypto trading, and personal taxation. His experience is showcased by a prolific body of over 100 articles on Forex, crypto, equity, and personal finance, alongside personalized advisory roles in tax consultation.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Ranging markets are a type of market characterized by short-term movement between apparent asset price highs and lows.

Scalping in trading is a strategy where traders aim to make quick, small profits by executing numerous short-term trades within seconds or minutes, capitalizing on minor price fluctuations.

Forex leverage is a tool enabling traders to control larger positions with a relatively small amount of capital, amplifying potential profits and losses based on the chosen leverage ratio.

CFD is a contract between an investor/trader and seller that demonstrates that the trader will need to pay the price difference between the current value of the asset and its value at the time of contract to the seller.

Fundamental analysis is a method or tool that investors use that seeks to determine the intrinsic value of a security by examining economic and financial factors. It considers macroeconomic factors such as the state of the economy and industry conditions.