How to Buy Coinbase (COIN) Stock?

Step 1

Open your stock trading platform of choice. For this step-by-step guide, we’ll be using Webull. Webull has very affordable fees and does charge any commission for trading stocks. If you do not have a Webull account, go ahead and start the signup process. As with any trading platform, U.S. users will need to go through an extensive identity verification process before buying any stocks, crypto, ETFs, options, etc. This verification process can take a day or two to complete. From there, transfer funds into your Webull account via direct deposit or wire transfer.

Step 2

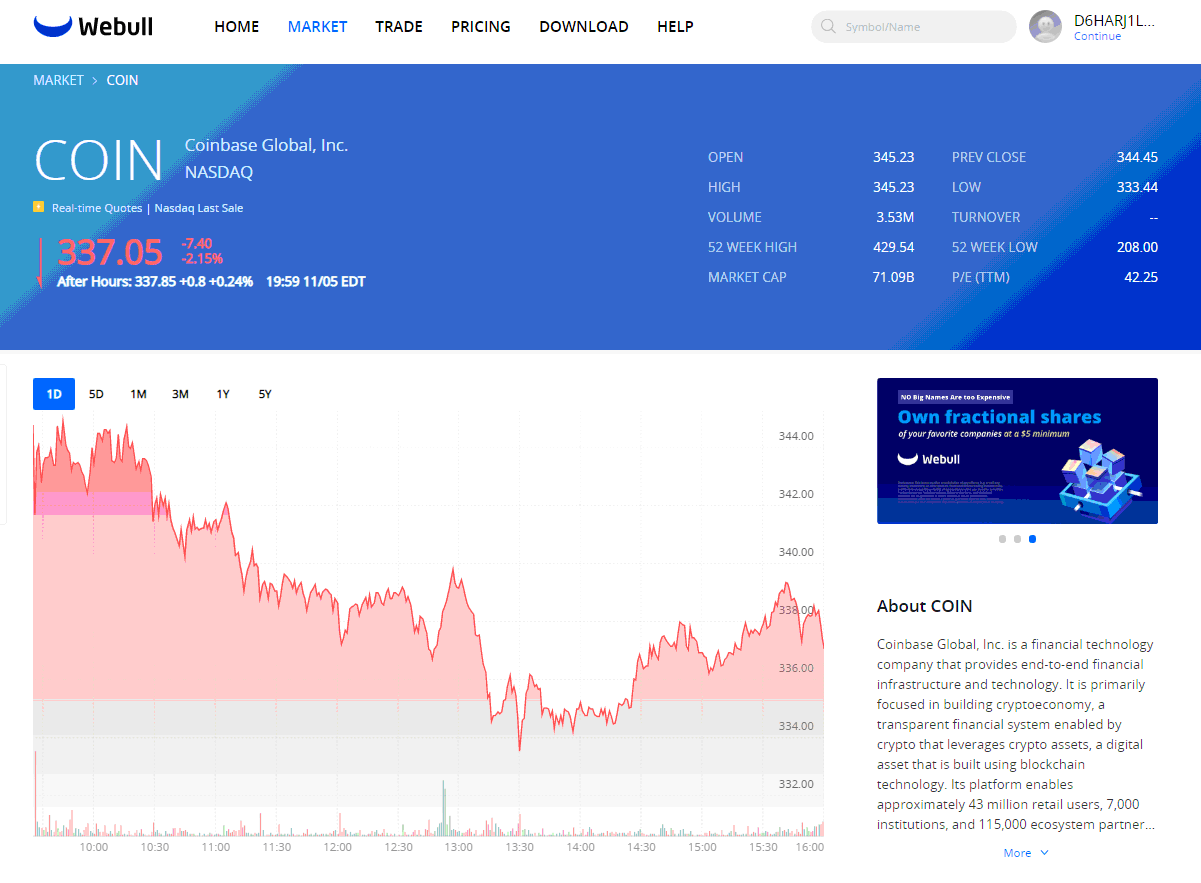

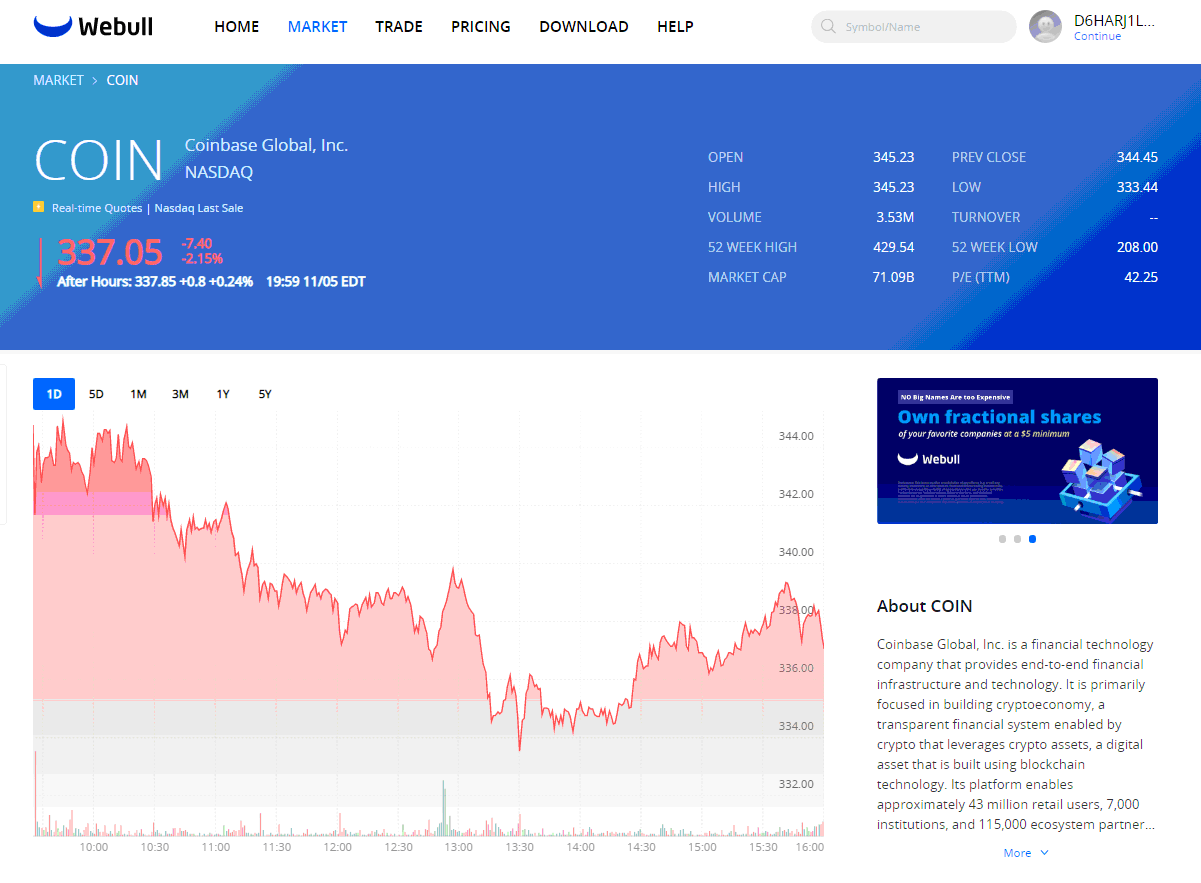

Once your account is set up and your Webull wallet has money in it, it’s time to buy COIN. Navigate to the search bar at the top of your Webull dashboard. In the mobile app as well as the website, the search bar will say “Symbol/Name.” Type in “Coinbase” and select the first option that pops up and says “Coinbase Global, Inc.” or “COIN.” You will then be transferred to COIN’s main stock page.

Step 3

How to Buy Coinbase Stock on Webull

On this stock page, users can view lots of information about Coinbase Global. A few different things on this page include real-time quotes and Nasdaq’s last sale. You can also explore the stock’s opening rate, the highest rate, volume, the 52-week high, and market cap. We recommend giving this page a thorough look-through before buying your shares or COIN.

Step 4

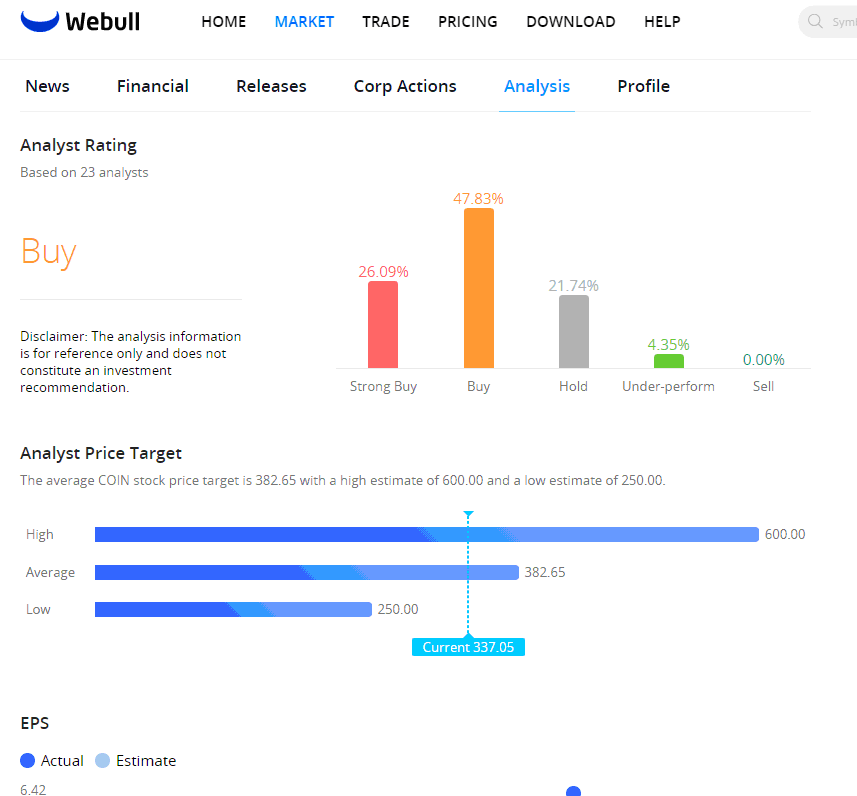

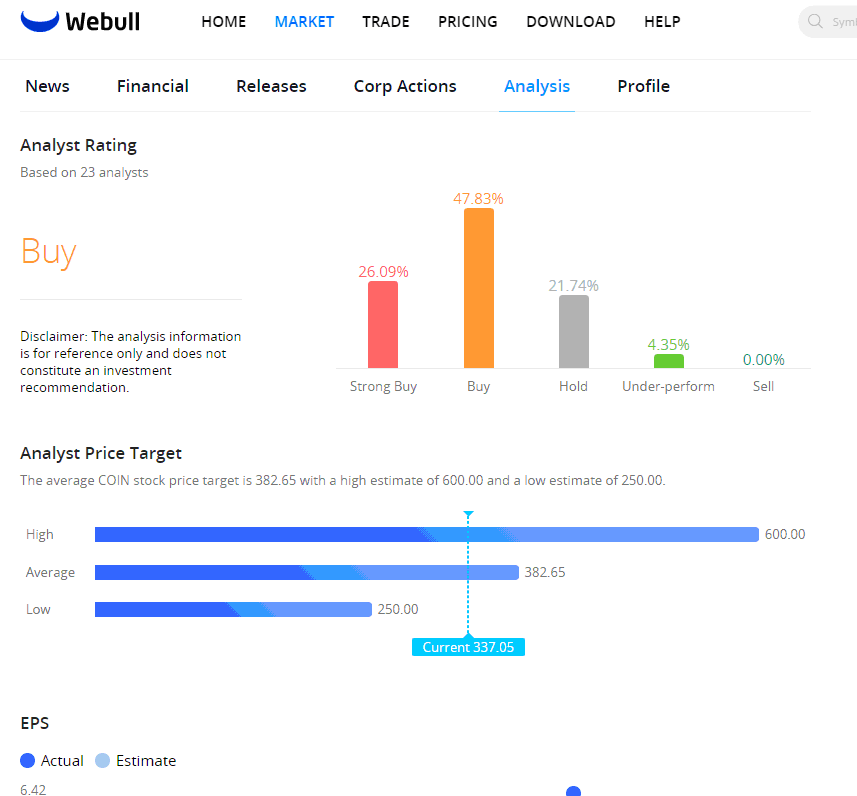

Market Analysis

Below the basic COIN information, you’ll be able to look at things like news, releases, company profile, etc. Navigate to Analysis. This will show you an analyst rating and a recommendation to either buy or sell. If COIN is in a state of “sell”, we would recommend waiting to buy shares of this stock.

Step 5

Buy your shares of COIN. Navigate to the stocks quote page, select your trade, and place an order. You can choose your funding source easily and purchase COIN by the share or via a set price. And that’s it! Congratulations, you now own stock in Coinbase Global.