Socially Responsible Investing (SRI): Full Guide

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Plus500 - Best Forex broker for 2025 (United States)

Socially Responsible Investing (SRI) is an investment strategy that focuses on selecting investment securities based on ethical, social, and environmental criteria, alongside financial considerations.

Socially responsible investing (SRI) is becoming one of the prominent ways of investing, especially in today’s world, where people are more conscious of the impact of a company’s activities on society and the environment. In this article, we discuss the principles and practices of SRI and how investors can align their portfolios with values they hold dear. Additionally, we stress the importance of monitoring investment portfolios to ensure ethical alignment in symbiosis with optimal performance.

What is Socially Responsible Investing (SRI)?

Socially Responsible Investing (SRI) is one of the investment strategies gaining popularity in the modern-day financial industry. It is an interesting concept where investors seek financial returns by investing in securities of companies that favor societal and environmentally friendly practices. This investment technique subtly promotes positive societal changes as investment decisions are strictly influenced by financial returns and the alignment of the company to ethical and sustainable practices.

Therefore, investors seek to make financial returns by investing in companies with positive environmental and social policies, while avoiding securities of companies that do not adhere to such policies. For example, investing in the renewable energy industry like solar, wind, and hydroelectric power offers both financial returns and encourages environmentally friendly practices.

Furthermore, it is worth noting that several indexes are designed to track the investment performance of a company’s securities based on environmental, social, and governance (ESG) criteria. Examples of SRI indexes include the MSCI Global sustainability indexes, Dow Jones sustainability indices, S&P 500 ESG index, NASDAQ OMX CRD Global sustainability index, etc.

Best socially responsible investments

As earlier noted, responsible investing is one of the subtle ways of promoting social changes for a safer environment. Hence, socially responsible funds are becoming more popular in modern investment practices, especially among investors who care about safe and better environmental practices.

J.P. Morgan noted that “ESG investing is fast growing in every geography and assets indicated as following ESG principles may soon represent 44% of the global asset under management (AUM).” Also, a survey reveals that “70% of Americans believe it’s either “somewhat” or “very important” for companies to make the world a better place.” These trends suggest that SRI holds great potential for investors as the global economy favors environmentally-friendly products.

Now, let’s explore some of the top socially responsible investment funds that enable SRI investing.

Comparison of SRI funds

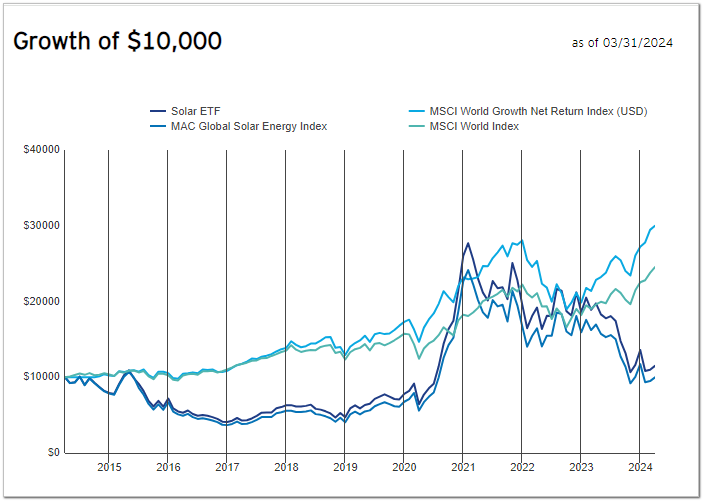

Image from Invesco.com

Image from Invesco.comThe above image shows the hypothetical performance of a $10,000 investment in Invesco Solar ETF from 2015 to March 31, 2024, assuming cash and assets were not withdrawn from the index.

iShares ESG Aware MSCI USA ETF (ESGU)

The iShares ESG Aware MSCI USA ETF ( ESGU) is also an exchange-traded fund (ETF) that tracks the performance of the MSCI USA Extended ESG Focus Index while maintaining similar risk and returns of the parent index. It exposes investors to stocks within the U.S. Market, particularly stocks backed by favorable environmental, social, and government (ESG) metrics.

ESGU is a good choice for investors whose interest aligns with building a long-term portfolio of assets backed by ethical and social considerations. As of May 2024, ESGU has a total asset under management of $12.71B, a net expense ratio of 0.15, a management fee of 0.155, and a total return of 28.97%.

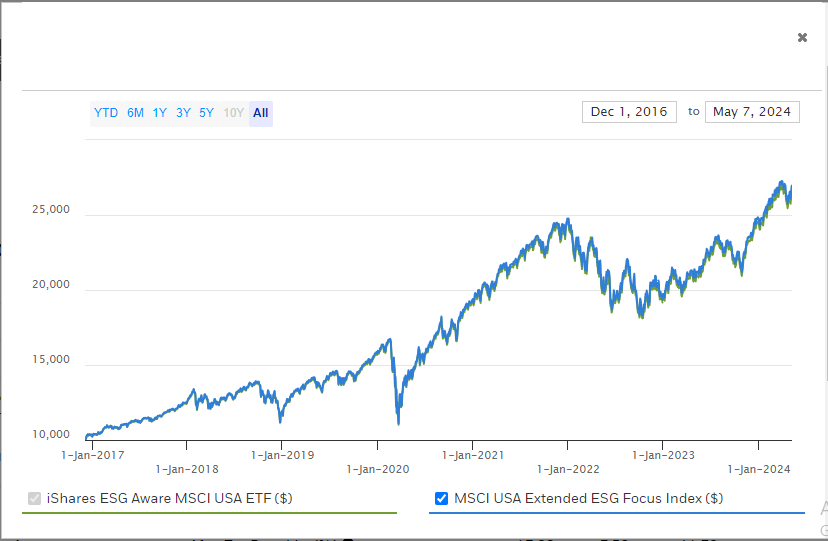

Image from ishares.com

Image from ishares.comThe above chart depicts a hypothetical growth of investing $10,000 in ESGU from December 01, 2016, to May 07, 2024, assuming dividends and capital were reinvested.

Putnam Sustainable Leaders (PNOPX)

Putnam Sustainable Leaders ( PNOPX) is a mutual fund established in 2009 with headquarters in Boston, Massachusetts, USA. The company aims to provide investors with sustainable investment opportunities with the potential for long-term capital appreciation. PNOPX has a total asset under management of 6.3B, an expense ratio of 0.92%, and a trailing twelve-month yield of 0.16% as of May 08, 2024. Besides, the fund has done a turnover (fiscal year end) of 25%.

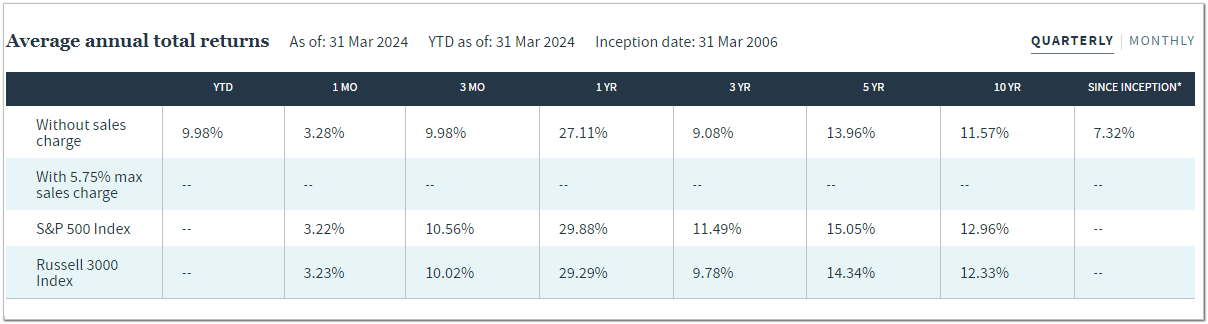

Image from Putnam.com

Image from Putnam.comThe above image shows the hypothetical growth of a $10,000 investment, assuming cash and assets were not withdrawn from the index.

TIAA-CREF Social Choice Equity (TICRX)

The TIAA-CREF Social Choice Equity is another recommended fund for investors interested in socially responsible investing. TICRX’s inception date was on March 31, 2006; it invests up to 80% of its assets in large-cap equity securities whose activities align with environmental, social, and governance (ESG) criteria. It has a total asset under management of $6.0B, a net expense ratio of 0.46%, a gross expense ratio of 0.46%, total holdings of 65, and a turnover of 15%, as of April 30, 2024.

Image from nuveen.com

Image from nuveen.comThe above image shows the performance data of the investment returns since the fund’s inception.

Parnassus Mid Cap Fund (PARMX)

Parnassus Mid Cap Fund was established on April 29, 2005. It invests up to 80% of its net assets in small and mid-cap companies with potential for capital appreciation. PARMX requires a minimum initial investment of $2,000 and a minimum of $50 for subsequent investment. As of May 08, 2024, the fund has $3.359M as the total asset under management, an expense ratio of 0.96%, a gross expense ratio of 0.98%, and a turnover of 42%.

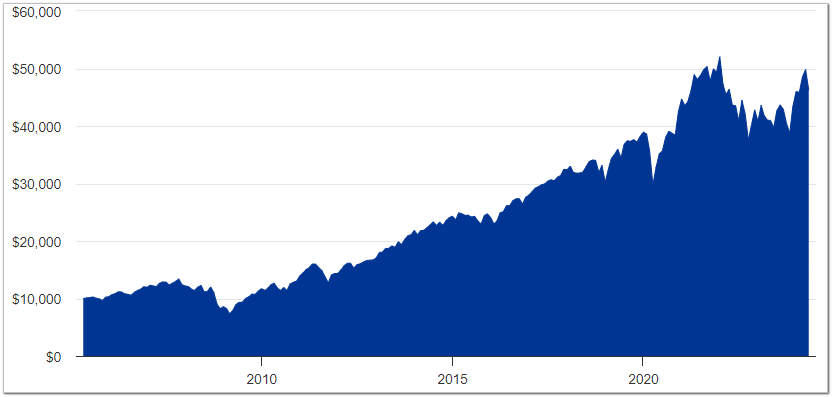

Image from Parnassus.com

Image from Parnassus.comThe above chart depicts the hypothetical growth of $10,000 since the fund’s inception from April 29, 2005, to April 30, 2024, assuming dividends and capital gains were reinvested.

iShares ESG Aware MSCI EAFE ETF (ESGD)

iShares ESG Aware MSCI EAFE ETF seeks to track the performance of the MSCI EAFE ETF index composed of large and mid-cap stocks. It invests in stocks with positive environmental, social, and governance practices from developed markets, usually outside the U.S. and Canada. ESGD has a total asset under management of $8.2B, an expense ratio of 0.20%, and a daily volume of 213,384.00, as of May 08, 2024.

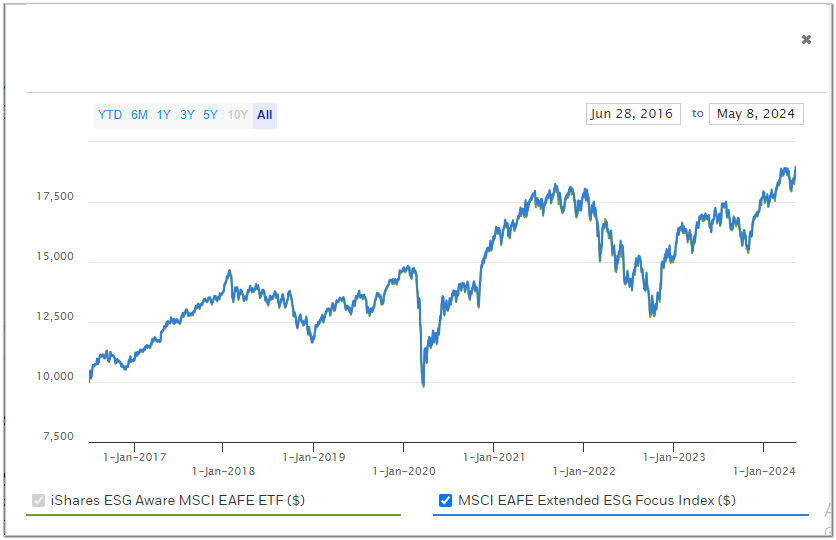

Image from ishares.com

Image from ishares.comThe above chart depicts a hypothetical growth of a $10,000 investment from the fund from June 28, 2016, to May 08, 2024, assuming capital gain and dividend were reinvested.

iShares Global Clean Energy ETF (ICLN)

iShares Global Clean Energy ETF exposes investors to global companies involved in clean energy production from solar, wind, and other environmentally friendly technologies. ICLN seeks to track the investment performance of the index in the clean energy sector around the world. It has a total asset under management of $ 2.2B, an expense ratio of 0.41%, a daily volume of 3.2M, and a closing price of 13.91, as of May 08, 2024.

Image from ishares.com

Image from ishares.comThe above chart shows the hypothetical growth of a $10,000 investment from June 24, 2008, to May 09, 2024, assuming dividends and capital gains were reinvested.

| ETF | Assets under management | Cost | Expense ratio |

|---|---|---|---|

Invesco Solar ETF (TAN) | $1.040B | $43.20 | 0.67% |

iShares ESG Aware MSCI USA ETF (ESGU) | $12.71B | $114.40 | 0.15% |

Putnam Sustainable Leaders (PNOPX) | 6.3B | $122.16 | 0.92% |

TIAA-CREF Social Choice Equity (TICRX) | $6.0B | $24.25 | 0.46% |

Parnassus Mid Cap Fund (PARMX) | $3.359M | $38.46 | 0.96% |

iShares ESG Aware MSCI EAFE ETF (ESGD) | $8.2B | $80.59 | 0.20% |

iShares Global Clean Energy ETF (ICLN) | $ 2.2B | $13.85 | 0.41% |

Top-3 brokers for SRI

How to build an SRI Portfolio?

Follow the steps below to build an SRI portfolio:

Identify Your Values: The first step towards building an SRI portfolio is identifying companies that align with your values (e.g., climate change, human rights, etc.)

Research SRI Investment Options: Research and invest in a company’s SRI funds, ETFs (Exchange-traded funds), individual stocks, or bonds that align with your value. Evaluate companies based on their reputation, mission, and performance over time

Diversify Your Portfolio: Maintain a diversified SRI portfolio to reduce risk

Monitor Performance and Impact: Continually monitor the performance of your SRI investments. Also, keep a tab on the social and environmental impact of the company

Is socially responsible investing profitable?

Yes, socially responsible investing can be a profitable investment. Different studies have shown that investing with ethical considerations is a smart way to support a good course and earn financial returns. For example, a report by BlackRock in 2022 revealed that sustainable investment not only aligns with investors' values but also generates higher financial returns. Besides, in 2023, a study by MSCI conducted on over 3,000 companies shows that those with ESG ratings outperform their counterparts.

Expert opinion

The stock market can be volatile, and the value of your holdings may fluctuate. Stay informed about the companies you’ve invested in and keep an eye on market trends. Remember that investing is a long-term endeavor, and it’s essential to review and adjust your portfolio periodically based on your financial goals and risk tolerance.

By following these steps and staying informed, you can start your journey into the world of online stock investing. Remember that investing involves risks, and it’s crucial to do thorough research and seek professional advice if needed. Happy investing!

Summary

Socially Responsible Investing (SRI) has morphed from a mere investment strategy to a movement toward a more ethical and sustainable feature. Today, investors can make a meaningful impact while pursuing financial success by investing in companies with Environmental, Social, and Government (ESG) criteria. Investors can build an SRI portfolio by identifying and researching investment options that align with their values. Moreover, as the awareness and evidence of profitability in SRI investing grows, the better the society and environment.

FAQs

What is SRI in ESG?

Socially Responsible Investing (SRI) in Environmental, Social, and Governance (ESG) implies selecting investments that align with the ethical, social, and environmental criteria.

How does SRI work in practice?

Socially Responsible Investing (SRI) is an investment pattern where investors seek financial returns by strictly investing in companies that adhere to ethical, social,l and environmental-friendly practices.

Are SRI's good investments?

Yes, Socially Responsible Investing (SRI) can offer potential financial returns, depending on the market conditions of the securities.

Why do we use SRI?

Socially Responsible Investing (SRI) is a subtle way of promoting ethical practices and sustainable goals while making financial returns.

Related Articles

Team that worked on the article

Joshua Francis is a professional Forex trader with 4+ years of experience in the financial industry. He trades the XAU/USD and GBP/JPY pairs. He is also a ghostwriter and author for Indicatorspot and Traders Union, where he puts his intensive research skills and deep knowledge of the financial markets into freelance writing.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

A Robo-Advisor is a digital platform using automated algorithms to provide investment advice and manage portfolios on behalf of clients, often with lower fees than traditional advisors.

Diversification is an investment strategy that involves spreading investments across different asset classes, industries, and geographic regions to reduce overall risk.

SIPC is a nonprofit corporation created by an act of Congress to protect the clients of brokerage firms that are forced into bankruptcy.

Index in trading is the measure of the performance of a group of stocks, which can include the assets and securities in it.