Note:

Remember, achieving daily pip goals requires discipline, patience, and aligning your trading style with your personality.

Realizing daily earnings of 20 to 100 pips is within reach in Forex trading. However, the concrete amount varies based on strategy, effective risk management, and the prevailing market conditions. Attaining success hinges on a thoughtful approach, emphasizing key steps:

Open a Broker Account. Prioritize trusted brokers, where you can get rebates (spread refunds)

Choose Your Strategy. We suggest you look at a strategy called "50 pips a day"

Practice on Demo → Switch to Real. Don't be in a hurry to get rich easily

Forex trading popularity has surged, drawing numerous individuals seeking to profit from the market. A common inquiry from beginners revolves around the feasibility of making 20 pips a day in Forex. The answer is affirmative but necessitates a robust trading strategy, discipline, and effective risk management. This article explores the steps, strategies, and tips for achieving this goal.

Can you make 100 pips a day in Forex?

Yes, it is possible, but only theoretically. In practice, professional traders tend to follow their trading plan rather than aiming for big profits or setting a goal of 100 pips per day.

How much money do Forex traders make a day?

According to data published in Moneyzine, 97% of traders lose their capital in the first year. And "surviving" action traders in the US earn an average of $56.2 per hour.

How many trades do Forex traders make a day?

The professional traders that Traders Union website works with typically make between 1 and 10 trades per day. However, the increase in the number of trades is not necessarily proportional to the increase in the amount of the final profit.

Do Forex traders trade every day?

Professional traders only trade when they receive a signal to enter a trade from their trading strategy. Accordingly, if they use scalping strategies in multiple markets - yes, they trade every day (which can be exhausting). If they are tracking only a few markets and the strategy does not give them frequent signals - they can spend all day at their desk and not make a single trade.

Practically, a pip represents one-hundredth of one percent (1/100 x 0.01) and typically resides in the fourth decimal place of a currency pair's price quote (e.g., 1.1234 vs. 1.1235). When the Euro shifts against the Dollar by 0.0001, that equates to one small pip.

However, the impact of these subtle market movements should be considered. Accumulate pips strategically through trades, and you'll observe your capital growing steadily over time.

The picture below helps you understand what 5.1 pips looks like on the chart of the GBP/USD currency pair:

What 5,1 pips looks like the chart of the GBP/USD currency pair

That is, trading with a minimum lot of 0.01 you can get 58 cents of profit from a small movement of more than 5.1 pips. Such fluctuations can take only a few minutes.

By trading 1 lot and taking movements of 50 pips every day, you can earn approximately $500 per day.

As mentioned, a pip represents the slightest price movement a currency pair can make, typically equivalent to 0.0001 or 1/100th of a percent. For instance, trading the EUR/USD pair and the price moves from 1.2000 to 1.2010 constitutes a 10-pip movement.

Regarding monetary value, the specific profit or loss per pip relies on your position's size. For example, trading one standard lot (100,000 units) of the EUR/USD pair makes each pip worth $10, while trading one mini lot (10,000 units) values each pip at $1.

Targeting 100 pips daily in Forex may seem enticing, with a daily 1% profit as a step towards financial freedom. However, it's not a magical figure. Picture ascending 100 small steps in the market, each representing a 0.01% shift. Although individually modest, consistent gains can accumulate over time. Daily victories translate to a 7% weekly boost, a 30% monthly surge, or even a potential doubling of your capital within a year.

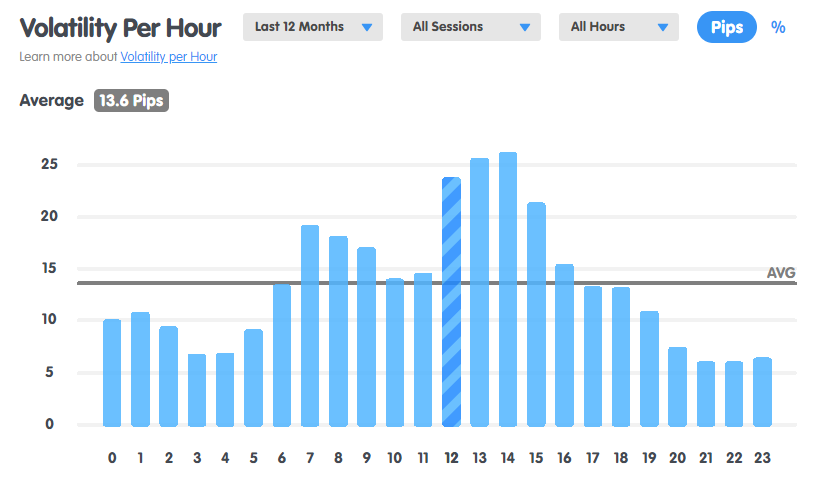

EUR/USD hourly volatility in pips

The picture above shows that during an active US session, the EUR/USD exchange rate can fluctuate within 25 pips per hour on average.

The potential earnings in the Forex market, particularly targeting 20 to 100 pips a day, depend on factors such as leverage, deposit size, and the number of trades executed. Let's explore three scenarios to illustrate possible outcomes:

A trader employs a 1:10 leverage with a modest $1,000 deposit in this cautious strategy. Executing one trade per day, aiming for a 20-pip gain, the potential profit is calculated as follows:

Profit = (20 pips x 1 lot x $1) x 1 trade = $200

Opting for a moderate risk level, the trader uses a 1:50 leverage and increases the deposit to $5,000. With three trades per day and an average gain of 50 pips, the potential profit becomes:

Profit = (50 pips x 1 lot x $1) x 3 trade = $1500

The trader employs a higher 1:100 leverage for a more aggressive approach and boosts the deposit to $10,000. Engaging in five trades daily and targeting a substantial 100-pip gain, the potential profit is calculated as follows:

Profit = (100 pips x 1 lot x $1) x 5 trade = $5000

It's crucial to recognize that these calculations are simplified and don't consider transaction costs or potential losses. Real-world trading involves inherent risks, and success hinges on a well-crafted strategy and effective risk management.

For a comprehensive analysis and deeper insights into earning potentials, refer to the detailed article on - The 1% Daily Profit Myth in Forex.

What are the advantages and disadvantages of implementing the idea of making money on trading by taking movements of 20 to 50 or 100 pips per day?

👍 Pros

• High Potential Returns: Forex presents the opportunity for substantial profits with even small price movements. Achieving 100 pips a day consistently could transform your capital over time

• 24/5 Market Access: Trade at any time, day or night, thanks to the continuous operation of the global Forex market

• Leverage Capabilities: Amplify your trading power with leverage, potentially generating more significant returns with smaller initial investments. Exercise caution, as leverage can magnify losses

• Skill Development: Mastering Forex strategies and technical analysis can enhance financial literacy and provide transferable skills applicable to other market

• Personal Growth: Forex trading challenges you to develop discipline, emotional control, and adaptability—valuable personal and professional growth traits

👎 Cons

• Market Volatility: Currency prices fluctuate constantly, influenced by global events, economic data, and shifting sentiment. Prepare for unexpected swings and potential losses

• Leverage Risks: While leverage can boost gains, it can also accelerate losses. Mismanaged leverage can lead to rapid capital depletion

• Emotional Pitfalls: Fear, greed, and overconfidence can cloud judgment and trigger impulsive decisions. Maintaining emotional discipline is paramount

• Time Commitment: Trading success requires ongoing analysis, research, and strategy refinement. Allocate sufficient time to learn and execute effectively

• Educational Curve: Mastering Forex requires dedication to learning technical analysis, understanding market dynamics, and implementing effective risk management strategies

The first step to initiating your trading venture is to open a broker account. You can consider the recommendations at Forex Brokers List — the Reliable & Licensed for a reliable and well-rated broker.

Selecting a suitable strategy is paramount in forex trading. For insights into how the Pips Forex strategy operates, refer to this informative article - How does 50 Pips Forex Strategy Work.

Before diving into actual trading, it's prudent to hone your skills and test your chosen strategy on a demo account. This allows you to familiarize yourself with the market dynamics without risking actual funds.

You can transition to real trading once you've gained confidence and proficiency through demo trading. Remember the principles of your chosen strategy and apply what you have learned to navigate the live market.

Avoid these common pitfalls when aiming to make 20-100 pips per day in Forex trading:

Overleveraging: Avoid overleveraging your account. Excessive leverage can lead to substantial losses on a single trade. Use leverage that aligns with your account size

Excessive Trading: Trading too frequently to reach a specific pip target may result in overtrading. It can lead to higher transaction fees and poor decision-making. Exercise patience and wait for high-probability setups

Lack of Trading Plan: A well-defined trading plan with precise entry and exit rules is crucial for consistent pip gains—trade based on your plan rather than succumbing to emotions

Poor Risk/Reward Ratios: Aim for trades with favorable risk/reward ratios, with potential rewards at least twice as large as the risk. This strategy contributes to positive expectancy over time

Neglecting Stop Losses: Always use stop losses to limit losses on unsuccessful trades. Resist the temptation to move stops in the hope of a market turnaround

Overtrading After Hitting Targets: Once you reach your daily pip target, refrain from overtrading. Greed can lead to unnecessary risks and potential losses

Trading Fatigue and Emotions: Avoid trading when tired or emotional. Focus is essential for making sound decisions; fatigue or emotions can impair judgment

Neglecting Trading Statistics: Analyze your trading performance regularly. Identify mistakes and successful strategies to improve continually

Lack of Proper Risk Management: Implement proper risk management practices. Without a well-defined plan, significant losses may occur

Note:

Remember, achieving daily pip goals requires discipline, patience, and aligning your trading style with your personality.

Achieving 20 to 100 pips daily in Forex is feasible but demands a robust trading strategy, discipline, and effective risk management. Traders need to select appropriate currency pairs, implement a suitable trading strategy, and maintain discipline for consistent success.

Recognizing the inherent risks in forex trading is crucial, and there's no guarantee of making profits. However, by adhering to the tips and strategies, traders can enhance their likelihood of attaining a daily target of 20-100 pips and potentially securing long-term success in the Forex market.

A broker is a legal entity or individual that performs as an intermediary when making trades in the financial markets. Private investors cannot trade without a broker, since only brokers can execute trades on the exchanges.

Trading involves the act of buying and selling financial assets like stocks, currencies, or commodities with the intention of profiting from market price fluctuations. Traders employ various strategies, analysis techniques, and risk management practices to make informed decisions and optimize their chances of success in the financial markets.

Forex leverage is a tool enabling traders to control larger positions with a relatively small amount of capital, amplifying potential profits and losses based on the chosen leverage ratio.

Forex trading, short for foreign exchange trading, is the practice of buying and selling currencies in the global foreign exchange market with the aim of profiting from fluctuations in exchange rates. Traders speculate on whether one currency will rise or fall in value relative to another currency and make trading decisions accordingly.

Risk management is a risk management model that involves controlling potential losses while maximizing profits. The main risk management tools are stop loss, take profit, calculation of position volume taking into account leverage and pip value.

Upendra Goswami is a full-time digital content creator, marketer, and active investor. As a creator, he loves writing about online trading, blockchain, cryptocurrency, and stock trading.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Tobi Opeyemi Amure is an editor and expert writer with over 7 years of experience. In 2023, Tobi joined the Traders Union team as an editor and fact checker, making sure to deliver trustworthy and reliable content. The topics he covers include trading signals, cryptocurrencies, Forex brokers, stock brokers, expert advisors, binary options.

Tobi Opeyemi Amure motto: The journey of a thousand miles begins with a single step.