Best Forex Traders In France

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

The Best Forex traders in France:

Philippe Lhermie - well-known technical analysis expert.

Pascal Trichet - combines both technical and fundamental analysis.

Benoist Rousseau - expert in day trading and scalping.

Stéphane Ceaux-Dutheil - technical analyst, professional trader.

Sébastien Dubois - trader known for his contributions to financial education.

In the world of Forex trading, France boasts several skilled individuals who have made a mark in the industry. These traders have honed their craft through years of experience and have developed unique trading strategies.

We have prepared an overview of the success stories of the best Forex traders in France. Check out the article to learn some tips for beginners and some of the secrets to managing money.

Most successful Forex traders in France

Here are the most successful Forex traders in France:

Philippe Lhermie

Philippe Lhermie is a celebrated Forex trader and author, renowned for his technical analysis expertise and trend-following strategies. With a background in market finance from the Institute of Market Techniques and the National Conservatory of Arts and Crafts in Paris, he has built a reputation for his methodical approach and sharp ability to identify market trends. Throughout his career, he has authored several books to help traders enhance their skills and decision-making capabilities.

Lhermie began as a professional money market trader, quickly managing futures contracts for US Treasury Notes. He later traded privately in EDF's trading room before spending 12 years overseeing a $10 billion options portfolio as a senior Forex trader.

His expertise earned him a three-year tenure as Chief Trader of a central bank's Forex and Gold Desk. Over the years, he has trained hundreds of professionals across various roles in finance, including traders, auditors, wealth managers, and IT specialists, imparting valuable knowledge to elevate their expertise.

Pascal Trichet

Pascal Trichet is a seasoned Forex trader with a career spanning over four decades, beginning his journey in the financial markets in 1981. His unique approach integrates both technical and fundamental analysis, with a particular emphasis on macroeconomic factors. This dual methodology has enabled him to adeptly navigate market fluctuations and identify pivotal trading opportunities. Notably, Trichet has accurately anticipated significant market reversals, including those in September 2000, March 2003, July 2007, March 2009, August 2011, and August 2015. His comprehensive understanding of market dynamics has been instrumental in these successful forecasts.

In 2000, Trichet transitioned to proprietary trading, further honing his skills and strategies. By 2010, he expanded his role to become a coach and trainer in trading and stock exchange operations, earning the status of Financial Investment Advisor (Conseiller en Investissement Financier - CIF). His commitment to the trading community is further exemplified by his position as Treasurer of the French Association of Technical Analysts (AFATE). Through his coaching and mentoring initiatives, Trichet has guided numerous traders, offering insights into risk management and effective trading methodologies. His dedication to education and his active involvement in professional organizations underscore his influence and respect within the trading community.

Benoist Rousseau

Benoist Rousseau is a well-known French trader specializing in day trading and scalping, particularly in the Forex and futures markets. He holds a master's degree in contemporary economic history from the Sorbonne University in Paris and has obtained the AMF's professional certification for financial market actors. Transitioning from a teaching career, Rousseau became an independent trader and founded Andlil, a widely recognized French trading community. Through this platform, he provides educational resources, market analyses, and a space for traders to exchange insights and strategies.

Rousseau is also an author, having written a comprehensive guide for traders looking to develop personalized trading methods. His approach emphasizes the importance of creating individualized strategies, managing risk effectively, and maintaining discipline in trading. Additionally, he shares his expertise through instructional videos and has been featured in financial media outlets, where he discusses market trends and trading techniques. His ability to combine technical skills with strong risk management has established him as one of France's most respected traders.

Stéphane Ceaux-Dutheil

Stéphane Ceaux-Dutheil is a technical analyst, professional trader, and consultant. is a well-known trader and the founder of Technibourse, a popular French financial analysis platform. He offers market analysis, trading strategies, and technical analysis tools to help traders make informed decisions in various financial markets.

He currently manages the Technibourse.com website and co-manages the Robbo.fr website, which offers algorithm rentals to both individuals and businesses. He trades and instructs in day trading, scalping, and investment strategies. In addition, he has written several books, including "Le scalping" and "Bourse et Analyze Technique." At the Paris Technical Analysis Fair, he won the Gold Trophy in 2012 and the Bronze Trophy in 2007, 2011, and 2014.

Sébastien Dubois

The last on our list is a young trader named Sébastien Dubois. He is a 37-year-old prominent French trader known for his contributions to financial education. He founded FX Cartel, a platform that provides educational resources, market analysis, and trading insights, and has been trading for nine years now. Dubois learned how to trade by himself. Dubois puts considerable time and effort into learning the intricacies of Forex trading and developing a winning trading strategy.

His persistence and forbearance have paid off because he now concentrates on Forex trading, which is extremely volatile and constantly impacted by news that can result in significant price changes. Dubois is among the most successful and youthful French Forex traders.

After creating a successful trading strategy, he committed himself to educating traders about the intricacies of the financial markets and advancing their trading abilities. He hopes to equip people with the knowledge they need to make wise trading decisions through his articles, webinars, and tutorials.

Rules and regulation

Here are some rules and regulations of Forex trading in France:

Licensing

Forex trading in France is regulated by the Autorité des Marchés Financiers (AMF), which enforces strict requirements for brokers. These include maintaining sufficient capital, ensuring proper qualifications, implementing effective risk management, maintaining business transparency, and safeguarding client funds. The AMF ensures that brokers operate ethically and in compliance with industry standards.

Investor protection

Trading in Forex, stocks, and other assets in France is governed by the French commercial code and adheres to the Markets in Financial Instruments Directive (MiFID) II. This directive sets minimum standards for brokers across the EU. Additionally, in cases of broker bankruptcy, traders are protected by the ESPIS, which provides compensation for losses up to €20,000, ensuring a safety net for investors.

Taxation

Profits from Forex trading in France are subject to the Prélèvement Forfaitaire Unique (PFU), commonly known as the flat tax, set at 30%. This rate comprises 12.8% income tax and 17.2% social contributions. It's important for traders to accurately report their gains and consult with tax professionals to ensure compliance with French tax laws.

How to become a successful Forex trader in France

Every Forex trader develops a unique strategy, but successful traders in France prioritize effective risk management. Traders Union analysts emphasize key tips such as diversifying investments, setting stop-loss orders, and staying informed about market trends to reduce risks and enhance profit potential.

Use a well-regulated broker

It is a common misconception that only a few new traders fall victim to Forex trading scams or unlicensed brokers. In reality, the number of such cases is quite high. Thus, it is crucial to use a well-regulated Forex broker to minimise the risk of losing money.

A licensed broker will ensure that your funds are secure and that you have access to a range of trading instruments. By choosing a regulated broker, you can ensure that your trading experience is safe and profitable.

| Available in France | Currency pairs | Demo | Min. deposit, $ | Min Spread EUR/USD, pips | Max Spread EUR/USD, pips | Negative balance protection | Investor protection | Max. Regulation Level | Open an account | |

|---|---|---|---|---|---|---|---|---|---|---|

| Yes | 40 | Yes | 100 | 0,4 | 1,5 | Yes | £85,000 €20,000 | Tier-1 | Open an account Your capital is at risk. |

|

| Yes | 57 | Yes | 5 | 0,7 | 1,2 | Yes | £85,000 €20,000 | Tier-1 | Open an account Your capital is at risk. |

|

| Yes | 60 | Yes | 10 | 0,8 | 1,4 | Yes | No | Tier-1 | Open an account Your capital is at risk. |

|

| Yes | 61 | Yes | No | Not supported | Not supported | Yes | No | No | Open an account Your capital is at risk. |

|

| Yes | 55 | Yes | 100 | 0,4 | 1,2 | Yes | No | Tier-1 | Open an account Your capital is at risk. |

Test your trading strategy before you apply it

By utilising a demo account, you can hone your trading skills in a secure setting without putting your trading capital at risk. Moreover, a demo account enables you to evaluate a broker's services and verify the authenticity of their trading conditions. This way, you can gain valuable experience and knowledge without any financial consequences.

Keep your leverage low

When starting to trade with a real account, it is crucial to comprehend the leverage you are utilising. Even though a few brokers offer leverage of 1:1000 or even 1:2000, which seems like a great opportunity to double your trading capital, it is essential to note that the compounding effect of leverage also extends to any losses you experience. Therefore, you must be cautious and utilise leverage wisely, considering the risk associated with it.

Trade the major pairs

The world's most actively traded currencies are included in the "major" Forex pairings, all of which feature the US Dollar. Some of these pairings include EUR/USD, USD/JPY, GBP/USD, USD/CHF, and several others.

Make use of a stop-loss

To minimise potential losses in Forex trading, it is advisable to place a stop-loss order when initiating trades. This order instructs the broker to close the transaction automatically when the price of the currency reaches a predetermined level, limiting the trader's exposure to further losses.

By setting a stop-loss order, traders can protect their investments and avoid significant losses if the market moves against them. It is essential to set the stop-loss at a reasonable level based on market trends and the trader's risk tolerance.

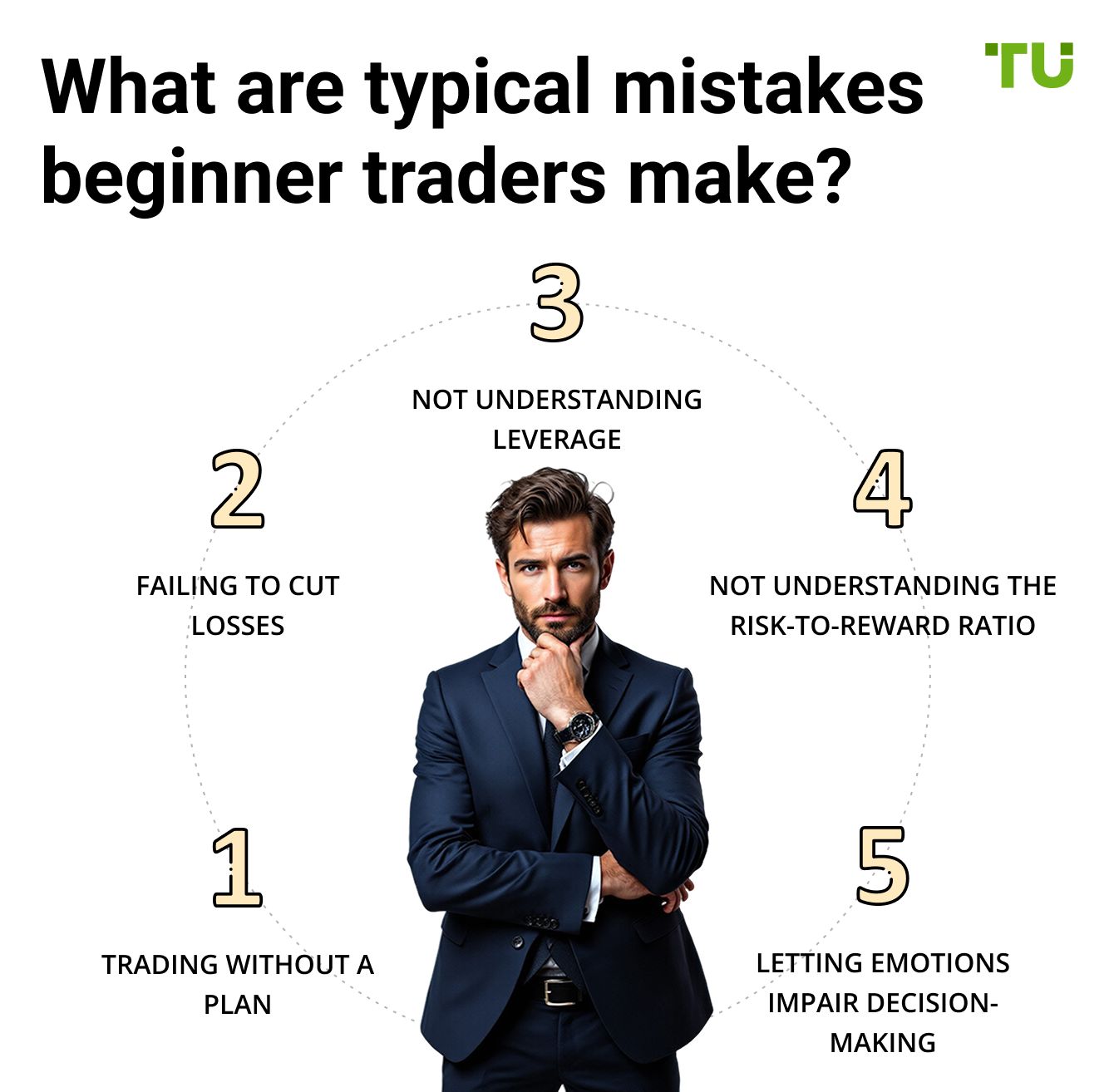

As a beginner trader, it is inevitable to make some mistakes. However, it is crucial to avoid repeating them and to analyse both profitable and unprofitable trades to learn from them. To help you in this regard, TU has listed the top five trading mistakes that beginners tend to make:

Trading without a plan

Trading plans are an essential tool for traders, as they provide a roadmap for their activities in the markets. An efficient trading plan should comprise a comprehensive strategy, a clear timeline, and a predetermined investment amount.

Failing to cut losses

As a trader, it's crucial to resist the urge to keep losing trades open with the expectation that the market will eventually shift in your favour. Failing to cut losses can result in a significant loss of profits that may have been accumulated through successful trades.

Not understanding leverage

In Forex trading, leverage refers to the borrowing of funds from a broker to open a position. To gain market exposure equal to the full value of a position, traders are required to pay a deposit, also known as a margin. Although leverage can lead to higher profits, it can also magnify potential losses.

Not understanding the risk-to-reward ratio

Considering the risk-to-reward ratio is crucial for any trader since it enables them to determine if the potential profit justifies the risk of losing their investment.

Letting emotions impair decision-making

Trading based on emotions is not wise. Emotions, including elation after a successful day or dismay after an unfavourable day, can obscure judgment and cause traders to stray from their strategy. In the aftermath of a loss or an unsatisfactory profit, traders may resort to opening positions without conducting any analysis to support their decisions.

This impulsive behaviour can result in more losses and a further deviation from the initial plan. Traders must remain vigilant and disciplined to avoid the pitfalls of emotional trading.

Is Forex trading a good career in France?

Yes, Forex trading can be a good career in France, offering opportunities for substantial earnings with the right skills, knowledge, and discipline. Many traders in France have successfully built profitable careers, with some even achieving millionaire status through Forex trading.

Forex trading's flexibility and accessibility, thanks to online platforms, make it an appealing option for those seeking financial independence. French traders can earn from $1,000 to millions, depending on their expertise and investment strategies. However, success requires dedication, continuous learning, and staying updated on market trends.

To thrive as a Forex trader in France, it's essential to focus on risk management and maintain a balanced risk-to-reward ratio. With a disciplined approach and adherence to the guidelines set by regulators like the AMF, Forex trading can offer financial security and stability, making it a viable career path for those willing to put in the effort.

Another key strategy is leveraging local economic indicators

If you're starting your Forex trading journey in France, focusing on the EUR/USD pair during the European trading session can give you an edge. This period sees the highest liquidity and volatility, creating better opportunities for strategic trades. Instead of spreading yourself thin across multiple currency pairs, mastering the market movements during this session allows you to develop a deep understanding of price action, order flow, and institutional behavior. By refining your strategy within a predictable market window, you increase your chances of consistent profitability.

Another key strategy is leveraging local economic indicators, such as France’s GDP growth, employment reports, and European Central Bank announcements. These factors influence the euro’s strength, often setting the tone for major price movements. By incorporating fundamental analysis into your trading plan, you can anticipate shifts in sentiment before they reflect in price action. Many traders overlook regional economic data, but understanding how these indicators impact currency trends can give you an advantage over those who rely solely on technical analysis.

Conclusion

France is home to some of the most talented and successful Forex traders, known for their strategic approach, deep market knowledge, and disciplined risk management. Whether they trade independently or manage large portfolios, these traders have made a significant impact on the Forex market, leveraging advanced analysis, expert advisors (EAs), and cutting-edge technology.

For aspiring Forex traders, studying the techniques and strategies of France’s top traders can provide valuable insights into market dynamics and profitable trading approaches. However, consistent success in Forex requires more than just learning from others — it demands patience, continuous improvement, and a strong trading plan.

As the Forex industry continues to evolve, French traders will remain at the forefront, adapting to new market trends and setting high standards in global currency trading.

FAQs

How is Forex trading regulated in France?

Forex trading in France is regulated by the Autorité des Marchés Financiers (AMF) and the Banque de France. It also follows European regulations such as MiFID II and ESMA guidelines.

What qualities contribute to the success of French Forex traders?

Successful traders in France possess deep market knowledge, discipline, effective risk management strategies, and a commitment to continuous learning and improvement.

Where can one receive Forex trading education in France?

Many successful traders offer courses and coaching. There are also online platforms, communities, and broker-provided educational resources for traders.

What are the risks associated with Forex trading in France?

Forex trading carries risks such as market volatility, leverage, and potential capital loss. Having an effective risk management strategy is crucial.

Related Articles

Team that worked on the article

Alamin Morshed is a contributor at Traders Union. He specializes in writing articles for businesses that want to improve their Google search rankings to compete with their competition. With expertise in search engine optimization (SEO) and content marketing, he ensures his work is both informative and impactful.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).