Richest Forex Traders In Tanzania And Their Path To Success

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Richest financial traders in Tanzania:

Henry Mlenzi – Renowned for his stock and Forex trading strategies and mentoring emerging traders in Dar es Salaam.

Crian Nicas – Specializes in short-term Forex and crypto trading, frequently shares market analysis on social media.

Amri IFX – Founder of a prominent Tanzanian trading community, known for teaching risk management and technical analysis.

Forex financial trading in Tanzania takes place within a landscape shaped by currency fluctuations, limited institutional infrastructure, and shifting access to global markets. Despite these challenges, a number of local traders have developed consistent, grounded strategies built around technical setups, risk discipline, and awareness of East African market conditions. Their roles often extend beyond private trading — many contribute through mentorship, training programs, and verified public results. This article explores the work of Tanzanian traders who have found practical ways to succeed in a market that rewards precision over hype.

Best Forex traders in Tanzania

Henry Mlenzi

Henry Mlenzi is one of the successful/richest Forex traders in Tanzania, with a verified track record and real capital payouts. After transitioning from online marketing, he committed fully to Forex financial trading in Tanzania, reaching stable profitability within three years. His performance earned him recognition through The Trading Pit's VIP challenge, where he received a $5,533 payout as a funded trader — a quantifiable milestone that positions him among the top Forex traders in Tanzania.

Mlenzi focuses on London session day trading, using price action as a core strategy. To validate signals, he applies moving averages and MACD across 15-minute and hourly timeframes. His trade planning incorporates structured risk control, maintaining reward-to-risk ratios of 3:1 or 2:1 to neutralize exposure while optimizing returns.

His methods reflect what defines the best Forex traders in Tanzania: consistent execution, risk management discipline, and technical adaptability. Beyond trading, Mlenzi leads a local training academy, helping others understand how to become a successful trader under real market constraints. His presence in webinars and educational formats confirms his role not only as a practitioner but also as a contributor to the ecosystem of richest financial traders in Tanzania.

Crian Nicas

Crian Nicas is featured among the successful/richest Forex traders in Tanzania through his role as a trader, educator, and content producer. Based in Dar es Salaam, he is the founder of FXB Academy and host of FXB Podcast, both of which contribute to his presence in the local trading community. His trading activity is structured around Forex financial trading in Tanzania, with a focus on education-backed execution and repeatable short-term strategies.

Crian trades actively with disclosed accounts ranging from $5,000 to $20,000, based on content reviewed from his YouTube channel and podcast discussions. He operates mainly during London and New York sessions, targeting setups on EUR/USD, GBP/USD, and XAU/USD pairs. His methods rely on order block identification, support-resistance flipping, and trend continuation models. He typically works with 1:2 risk/reward ratios and caps drawdown at 6% per cycle — a structure reflecting practices used by many top Forex traders in Tanzania.

Though not publicly affiliated with any global prop firm, Crian has built a reputation within the Tanzanian retail sector. His name appears in discussions about richest financial traders in Tanzania due to his entrepreneurial integration of training, live trading examples, and long-term consistency.

Amri IFX

Amri IFX, also known as Amrisaly, is positioned among the successful/richest Forex traders in Tanzania due to his progression from small-scale self-education to founding Intelligence FX, a trading mentorship platform. His early trading capital was limited to under $500, based on public video accounts, yet within two years he built consistent month-over-month profitability, reporting average monthly returns of 12–15% on actively deployed funds. His growth trajectory is driven by discipline, technical precision, and structured trade execution.

Amri's method in Forex financial trading in Tanzania relies on clean price action models. He trades primarily EUR/USD and XAU/USD during London and New York sessions using multi-timeframe confluence. His setups are based on trendline breaks, candle rejections near key zones, and Fibonacci retracement confirmations. He uses a fixed fractional risk model of 1.5% per position, with capital scale-in only after verified conditions. This operational rigor reflects what distinguishes the best Forex traders in Tanzania.

Although his trading records are not verified through proprietary firm leaderboards, his consistency, scale, and mentorship presence make him a visible peer figure among the richest financial traders in Tanzania, particularly within the retail segment.

| Trader | Estimated Net Worth | Primary Income Sources | Trading Style & Focus | Public Achievements & Recognition |

|---|---|---|---|---|

| Henry Mlenzi | Not publicly disclosed | Forex trading, mentorship programs, trading academy | Day trading during London sessions; utilizes price action, moving averages, and MACD indicators. | Achieved a $5,533 payout from The Trading Pit's VIP challenge; founder of a local trading academy in Tanzania. |

| Crian Nicas | Not publicly disclosed | Forex and cryptocurrency trading, educational content, FXB Academy | Short-term trading strategies focusing on EUR/USD, GBP/USD, and XAU/USD; employs order block identification and support-resistance flipping. | Founder of FXB Academy and host of FXB Podcast; manages trading accounts ranging from $5,000 to $20,000. |

| Amri IFX | Not publicly disclosed | Forex trading, founder of Intelligence FX mentorship platform | Trades primarily EUR/USD and XAU/USD during London and New York sessions; uses price action models and Fibonacci retracement confirmations. | Built consistent profitability within two years starting with under $500; known for educational outreach and mentorship in Dar es Salaam. |

Forex success potential in Tanzania

Current regulatory framework

Forex financial trading in Tanzania is overseen by the Bank of Tanzania (BoT) and the Capital Markets and Securities Authority (CMSA). As of the 2023 regulatory overhaul, all Forex transactions must be conducted through licensed foreign exchange bureaus, and engagement with unregistered offshore brokers is restricted. The 2025 update to foreign currency usage rules further prohibits local payments in foreign currencies, with exceptions allowed for cross-border transactions and dealings involving foreign entities. These measures aim to stabilize monetary policy but limit flexibility for individual traders.

Opportunities and challenges for traders

Tanzanian traders face regulatory friction, limited broker access, and restrictions on capital movement. However, the expanding interest in Forex financial trading in Tanzania creates space for structured, compliant operations. Traders who align with local requirements while leveraging global strategies can navigate these constraints. Observation of methods used by top Forex traders in Tanzania helps newer participants avoid inefficient behaviors and establish market-relevant tactics.

The role of education and strategy in achieving outcomes

Success in this environment is heavily influenced by technical education and systematized strategy. Local institutions such as Aritex Capital and Trader’s Safari deliver training programs that integrate technical analysis, position sizing, and capital preservation. These initiatives give aspiring traders a roadmap for how to become a successful trader under region-specific constraints. Practice accounts, market simulations, and structured coaching help translate theory into executable discipline — a necessity for performance in a tightly regulated space.

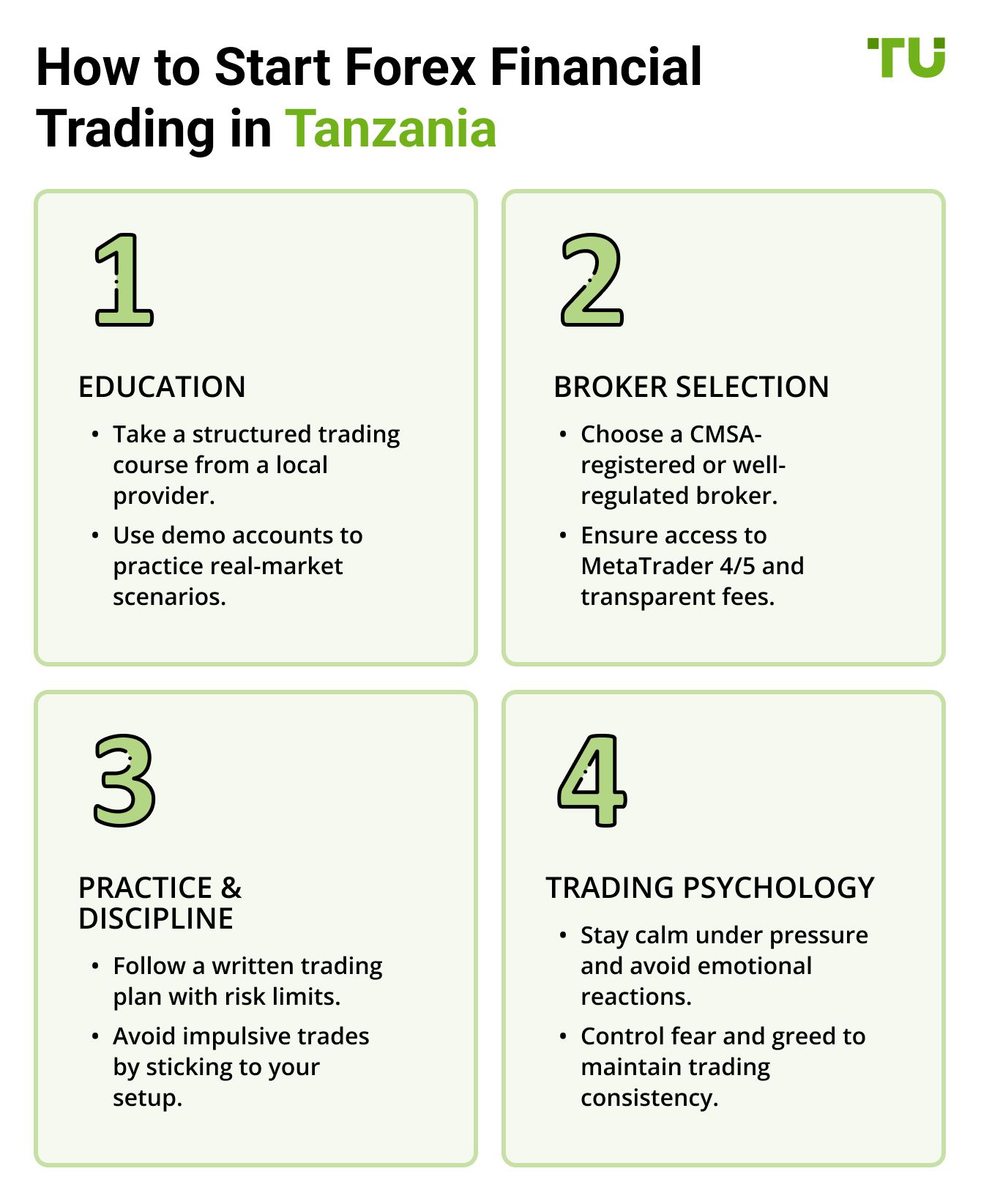

How to start Forex trading in Tanzania: advice from experienced traders

Education and preparation

Structured education is a foundation for success in Forex financial trading in Tanzania. Local institutions such as Trader’s Safari offer training programs focused on technical analysis, risk control, and market execution. These educational paths provide aspiring traders with practical tools aligned with the principles of how to become a successful trader. Many use demo accounts and real-time simulations to develop trading skills and decision-making under realistic market conditions.

Choosing a reliable broker

Selecting a broker is a critical decision that directly affects trading outcomes. In Tanzania, brokers must be registered with the Capital Markets and Securities Authority (CMSA). Reliable brokers are evaluated by their regulatory status, fee transparency, platform efficiency, and asset coverage. Institutions licensed by FCA, ASIC, or CySEC generally provide a higher level of operational integrity. Access to robust platforms like MetaTrader 4 or MetaTrader 5 is essential for most top Forex traders in Tanzania seeking precision in analysis and execution.

| TU overall score | Min. deposit, $ | Max. leverage | Max. Regulation | Min Spread EUR/USD, pips | Max Spread EUR/USD, pips | Currency pairs | Open an account | |

|---|---|---|---|---|---|---|---|---|

| 9.1 | 100 | 1:500 | Tier-1 | 0,4 | 1,5 | 40 | Open an account Your capital is at risk. |

|

| 9 | 5 | 1:1000 | Tier-1 | 0,7 | 1,2 | 57 | Open an account Your capital is at risk. |

|

| 8.7 | 10 | 1:2000 | Tier-1 | 0,6 | 1,5 | 100 | Open an account Your capital is at risk.

|

|

| 8.69 | 100 | 1:500 | Tier-1 | 0,4 | 1,2 | 55 | Open an account Your capital is at risk. |

|

| 8.6 | 10 | 1:500 | Tier-1 | 0,8 | 1,4 | 60 | Open an account Your capital is at risk. |

|

| 8.5 | 5 | 1:1000 | Tier-3 | 0,5 | 1,0 | 40 | Open an account Your capital is at risk. |

Practice and discipline

Demo trading serves as a low-risk environment for developing execution logic and refining setups. Maintaining a detailed trading plan helps eliminate impulsive behavior and introduces consistency to a trader’s process. This plan typically includes entry/exit rules, stop-loss thresholds, and risk-per-trade limits — practices that define the workflow of the best Forex traders in Tanzania. Adherence to this structure separates experimental trading from professional-level operation.

Trading psychology

Emotional stability is essential in volatile environments. Managing stress, loss reactions, and greed cycles is a core part of trading performance. Successful traders train themselves to respond rationally to adverse moves and adhere to the trade plan under uncertainty. This form of psychological control supports long-term engagement in Forex financial trading in Tanzania without burnout or reactive errors. The ability to remain calm under pressure is widely regarded as a decisive factor in consistent trading outcomes.

Build a system you can explain, test, and improve

Having followed the evolution of retail trading in East Africa for several years, I can say with confidence that Tanzania is quietly becoming one of the most promising grassroots Forex ecosystems on the continent. The combination of high mobile penetration, growing access to trading education, and a younger generation hungry for financial independence has created a unique environment. But what truly sets Tanzania apart is the emergence of community-driven discipline — traders like Amri IFX and Henry Mlenzi aren’t just speculating; they’re building habits, journals, and support systems.

One thing that stands out to me is how Tanzanian traders have embraced process over hype. For example, Henry Mlenzi's win in The Trading Pit’s VIP Challenge wasn’t based on luck — it was the result of risk control, trade journaling, and a clearly defined London session setup. I’ve reviewed his shared metrics, and they reflect something many new traders overlook: consistent execution with a modest but compounding edge. As Paul Tudor Jones once said, “The most important rule of trading is to play great defense, not great offense.” That’s precisely what many Tanzanian traders are learning to do — limit risk first, profits follow.

In the coming years, I expect more Tanzanian traders to qualify for international funding, especially as platforms like MyForexFunds and FTMO start localizing their scouting efforts. The challenge will be infrastructure: navigating capital restrictions, broker vetting, and CMSA compliance. But traders like Crian Nicas, who operate under drawdown rules, log every trade, and use small capital accounts with tight discipline, already meet the psychological and technical requirements of prop-funded environments.

My advice?

Don’t focus on flashy gains — build a system you can explain, test, and improve. Treat your first $500 like it’s $500,000. Run simulations with capped drawdown, track metrics like win rate, risk-to-reward, and expectancy. That’s how Tanzanian traders will go from local names to global performance charts.

Conclusion

Trading Forex in Tanzania is possible when local rules are followed and practical limits are clearly understood from the start. Traders who show consistent results stick to a clear plan, manage risk carefully, and avoid random decisions. Education and trade reviews help move faster from trial and error to repeatable outcomes. Experienced traders show that it’s not the style that matters, but the ability to follow a process and stay in control emotionally. Choosing a reliable broker and practicing under realistic conditions increase the chance of success. Results come from discipline and precision, not guesswork.

FAQs

Which currency pairs are most commonly used by traders in Tanzania?

Traders often focus on high-liquidity pairs like EUR/USD, GBP/USD, and XAU/USD. These pairs offer cleaner technical patterns and more consistent trading conditions.

How do traders in Tanzania track and review their trading performance?

They maintain detailed trade journals including date, instrument, entry reason, result, and post-trade notes. This helps identify recurring mistakes and refine strategy execution.

How can beginners reduce the risk of blowing their accounts early on?

They use strict position sizing (1–2% per trade), avoid revenge trading after losses, and wait for confirmed signals before entering any position.

Are there methods to improve long-term trading stamina?

Yes, traders set a limit on daily trades, define specific hours for market activity, and take scheduled breaks after sessions. This helps avoid fatigue and maintains focus.

Related Articles

Team that worked on the article

Maxim Nechiporenko has been a contributor to Traders Union since 2023. He started his professional career in the media in 2006. He has expertise in finance and investment, and his field of interest covers all aspects of geoeconomics. Maxim provides up-to-date information on trading, cryptocurrencies and other financial instruments. He regularly updates his knowledge to keep abreast of the latest innovations and trends in the market.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).