Ray Dalio Crypto Portfolio: A Deep Dive Into His Holdings and Market Influence

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Ray Dalio holds a small percentage of Bitcoin in his portfolio as part of a diversified investment strategy. While he acknowledges Bitcoin’s role as digital gold, he remains cautious about broader cryptocurrency investments due to regulatory and market risks.

Ray Dalio, the mastermind behind Bridgewater Associates and a widely respected investor, has shown curiosity about crypto while keeping a cautious approach. He has always leaned towards gold when it comes to preserving wealth but sees Bitcoin as having a role in modern investing. Some investors consider it a digital alternative to gold, and Dalio has admitted to owning a bit of Bitcoin. However, he still questions whether the crypto market can survive in the long run.

Breakdown of Ray Dalio cryptocurrency holdings

Ray Dalio’s approach to cryptocurrency isn’t just about holding assets — it’s about understanding the underlying economic shifts that make them valuable. His strategy isn’t for casual investors but for those who want to integrate crypto into a broader, well-balanced portfolio while considering long-term global trends. Here are the key takeaways from his stance on crypto investments:

Treat Bitcoin as an asymmetric hedge, not just an investment. Most people view Bitcoin as a speculative asset, but Dalio sees it as an asymmetric hedge against central bank policies, especially in times of extreme monetary expansion. If a beginner wants to apply this approach, they should allocate a portion of their portfolio to Bitcoin while carefully studying global liquidity cycles, inflation trends, and government debt-to-GDP ratios. Timing the market isn't the goal here — it’s about understanding when fiat instability makes Bitcoin’s value proposition stronger.

Think beyond Bitcoin and Ethereum — analyze crypto like a macro investor. While many beginners only focus on Bitcoin and Ethereum, Dalio’s methodology emphasizes broader macroeconomic trends. Study how central banks are testing CBDCs, how stablecoins impact global trade, and how decentralized financial structures challenge traditional banking. Look at how emerging markets adopt crypto as an alternative to unstable currencies, and think of these assets as part of a shifting monetary system rather than standalone speculative bets.

Bridgewater associates and cryptocurrency

One of Bridgewater’s core principles is balancing risk rather than chasing high returns. Beginners can use this insight by allocating their crypto portfolio based on risk exposure rather than just asset type. Instead of going all in on volatile altcoins or Bitcoin alone, consider structuring your portfolio using a risk-weighted approach.

For example, you might allocate 50% to stablecoins, 30% to blue-chip cryptos like Bitcoin and Ethereum, and only 20% to high-risk, high-reward assets like DeFi tokens or emerging Layer 2 projects. This way, you mirror Bridgewater’s approach by adjusting exposure dynamically based on market conditions rather than reacting emotionally to price swings.

Leveraging liquidity cycles and macro trends like a hedge fund. Bridgewater’s global macro strategy revolves around understanding liquidity cycles, which also play a crucial role in crypto. Instead of blindly following social media hype, study macroeconomic indicators like central bank policies, interest rates, and global liquidity trends. During high-liquidity phases, riskier assets like crypto tend to surge as investors seek higher returns.

Conversely, during tightening cycles, crypto often underperforms as capital moves to safer assets. As a beginner, you should track these cycles and adjust your exposure accordingly. For example, when liquidity is abundant, consider rotating some stablecoin holdings into strong-performing cryptos. When liquidity contracts, de-risk by moving funds back into safer assets or yield-generating stablecoin protocols.

Financial impact and market reactions

Ray Dalio’s support for Bitcoin in a balanced portfolio has caught the attention of everyday traders and big-money investors alike. He sees Bitcoin as a backup plan against inflation, helping push it further into the mainstream. However, he’s not all-in on crypto, keeping expectations in check. He reminds investors that while crypto has promise, it’s far from risk-free.

People often speculate on how much Bitcoin Dalio actually owns, but one thing he’s made clear time and time again — Bitcoin is just a safety net, not the main bet.

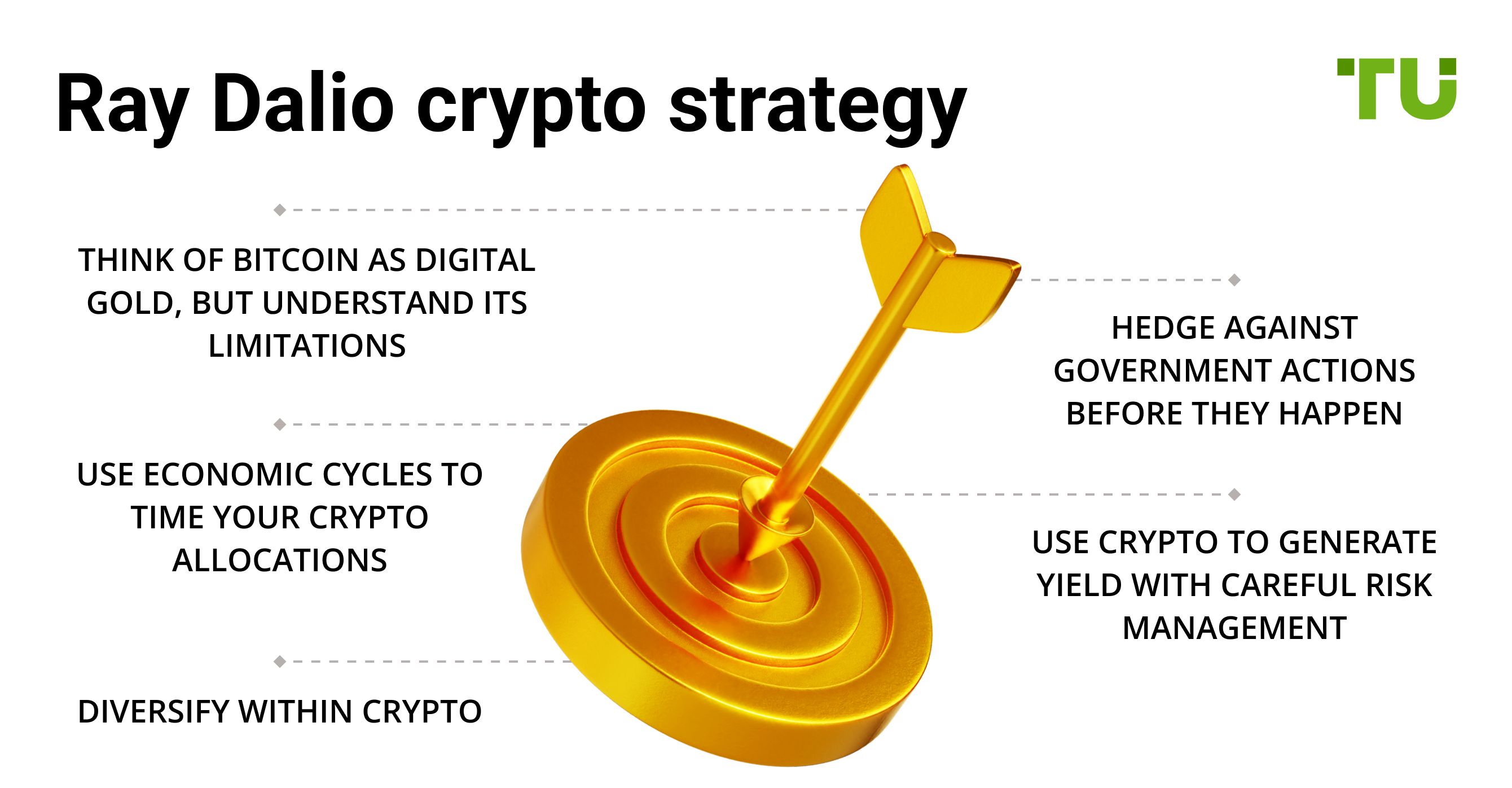

Ray Dalio cryptocurrency strategy

Ray Dalio approaches cryptocurrency with the same risk-management principles he applies to traditional investments, but he also understands the nuances that make digital assets different. Here are five unique insights that a beginner can use to build a strong foundation.

Think of Bitcoin as digital gold, but understand its limitations. While Bitcoin shares similarities with gold, such as scarcity and decentralized value storage, it lacks the historical trust and universal acceptance of precious metals. Dalio advises treating it as a small part of a diversified portfolio rather than an all-in bet.

Hedge against government actions before they happen. Regulatory crackdowns on crypto can hit suddenly and hard. Instead of reacting to bans or restrictions, position yourself early by considering jurisdictions with clear regulations and by holding assets in self-custodied wallets rather than exchanges.

Use economic cycles to time your crypto allocations. Dalio emphasizes how macroeconomic conditions drive investment cycles. During times of high liquidity and stimulus, risk assets like crypto surge. When central banks tighten policies, markets contract. Understanding these cycles can help you enter and exit positions strategically.

Don’t just hold — use crypto to generate yield with careful risk management. Unlike traditional assets, crypto offers opportunities beyond appreciation. You can lend, stake, or use decentralized finance (DeFi) strategies to generate passive income. However, Dalio’s principles stress understanding counterparty risk, liquidity, and contract security before committing funds.

Diversify within crypto by understanding the ‘economic machine’ behind different assets. Just as Dalio categorizes traditional investments into risk parity models, approach crypto in a similar way. Bitcoin serves as a store of value, Ethereum powers decentralized applications, and stablecoins provide liquidity. By balancing these elements in your portfolio, you avoid overexposure to a single asset class.

Future outlook: What’s next for Ray Dalio in crypto?

Ray Dalio’s evolving stance on cryptocurrency signals potential strategic moves that go beyond mere diversification. Here’s what a beginner should focus on if they want to follow in his footsteps.

Understanding macro-driven crypto cycles. Dalio doesn’t just invest in assets; he times them based on global macroeconomic shifts. Instead of blindly buying Bitcoin, study how central bank policies, inflation expectations, and capital flows affect crypto. For example, when governments tighten monetary policies, liquidity shrinks, and crypto usually struggles. However, during periods of quantitative easing, crypto assets thrive as investors seek alternative stores of value. If Dalio were to engage more in crypto, he would likely use his macro expertise to predict entry and exit points instead of holding long-term without a strategy.

Positioning crypto as an alternative to sovereign bonds. Traditional bonds are losing appeal due to rising debt levels and diminishing real yields. Dalio has repeatedly warned about the risks of holding cash and government bonds. If he were to integrate crypto further into his strategy, he’d likely treat Bitcoin and stablecoins as a hedge against failing bond markets. Beginners should look at how institutional players are gradually shifting portions of their fixed-income portfolios into digital assets, using stablecoins for liquidity and Bitcoin as digital gold. Understanding this trend can help investors identify moments when large capital allocators enter the space, leading to price appreciation.

Risks and warnings

Regulatory uncertainty. Governments may introduce restrictive policies that impact crypto markets.

Market volatility. Bitcoin and other cryptocurrencies are highly volatile, leading to potential losses.

Security risks. Hacking, fraud, and exchange failures remain concerns for crypto investors.

Government crackdowns. Dalio has warned that excessive government control could threaten the future of cryptocurrencies.

Ray Dalio times his crypto investments using debt cycles and risk parity

Ray Dalio doesn’t view cryptocurrency as just another asset class — he assesses it through the same lens he applies to macroeconomic cycles, debt crises, and shifting financial paradigms. One key aspect of his approach is analyzing Bitcoin through the lens of his "beautiful deleveraging" framework. In times of economic instability, governments either print more money or raise interest rates, both of which create ripple effects.

Instead of chasing hype, Dalio would likely invest in crypto when debt cycles peak and central banks are forced to inject liquidity back into the system. Beginners should study how global debt and liquidity influence Bitcoin’s demand rather than focusing solely on price charts.

Another area where Dalio’s strategy stands out is his potential use of crypto within a risk-parity model. He has long advocated for balanced portfolios that adjust based on volatility rather than simple asset allocation. If he expands his crypto investments, it won’t be in isolation — it will be part of a broader strategy that dynamically shifts between Bitcoin, gold, and inflation-resistant assets.

Beginners should not only buy crypto but also monitor how professional investors rebalance between traditional safe-haven assets and digital assets, as these shifts signal institutional movements before the mainstream catches on.

Conclusion

Ray Dalio’s crypto portfolio reflects a measured and strategic approach to digital assets. While he acknowledges Bitcoin’s potential role as a store of value, he remains cautious about broader cryptocurrency adoption due to regulatory and macroeconomic risks. Investors looking to follow Dalio’s approach should focus on diversification, risk management, and staying informed about the evolving crypto landscape. Despite his caution, Dalio’s interest in Bitcoin signals a growing institutional acknowledgment of cryptocurrency’s role in modern finance.

FAQs

What cryptocurrencies are in Ray Dalio’s portfolio?

Ray Dalio has confirmed that he holds a small amount of Bitcoin but has not disclosed any other crypto holdings.

How much is Ray Dalio’s crypto portfolio worth?

Dalio has described his Bitcoin holdings as a "tiny percentage" of his overall portfolio, indicating a conservative allocation.

Does Ray Dalio support Bitcoin as an investment?

Dalio sees Bitcoin as an alternative store of value and believes it should be part of a diversified portfolio but does not advocate for significant exposure to it.

What is Bridgewater Associates’ stance on crypto?

Bridgewater Associates has explored crypto investments but has not made significant public moves into digital assets, maintaining a cautious approach in line with Dalio’s views.

Related Articles

Team that worked on the article

Mikhail Vnuchkov joined Traders Union as an author in 2020. He began his professional career as a journalist-observer at a small online financial publication, where he covered global economic events and discussed their impact on the segment of financial investment, including investor income. With five years of experience in finance, Mikhail joined Traders Union team, where he is in charge of forming the pool of latest news for traders, who trade stocks, cryptocurrencies, Forex instruments and fixed income.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Ethereum is a decentralized blockchain platform and cryptocurrency that was proposed by Vitalik Buterin in late 2013 and development began in early 2014. It was designed as a versatile platform for creating decentralized applications (DApps) and smart contracts.

Economic indicators — a tool of fundamental analysis that allows to assess the state of an economic entity or the economy as a whole, as well as to make a forecast. These include: GDP, discount rates, inflation data, unemployment statistics, industrial production data, consumer price indices, etc.

Bitcoin is a decentralized digital cryptocurrency that was created in 2009 by an anonymous individual or group using the pseudonym Satoshi Nakamoto. It operates on a technology called blockchain, which is a distributed ledger that records all transactions across a network of computers.

A day trader is an individual who engages in buying and selling financial assets within the same trading day, seeking to profit from short-term price movements.

Volatility refers to the degree of variation or fluctuation in the price or value of a financial asset, such as stocks, bonds, or cryptocurrencies, over a period of time. Higher volatility indicates that an asset's price is experiencing more significant and rapid price swings, while lower volatility suggests relatively stable and gradual price movements.