Key Trading Tips and Habits of Successful Millionaire Traders

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Plus500 - Best Forex broker for 2025 (United States)

10 habits of successful traders that will push you on your way to a million, include:

- Managing Your Feelings: Successful traders keep their emotions in check, ensuring decisions are based on logic and not on impulse.

- Lifelong Education: They commit to continuous learning to stay ahead of market trends and refine their trading strategies.

- Utilizing Technical Indicators: Technical indicators are used to make informed trading decisions by analyzing market data effectively.

- Keeping a Trading Journal: Documenting each trade helps in reflecting on decisions and improving future strategies.

- Risk Control: Implementing solid risk management strategies to protect trading capital and ensure sustainability.

- Embracing Flexibility: Adapting strategies in response to changing market conditions to capture new opportunities.

- Persistence and Patience: Successful traders exercise patience, waiting for the most opportune moments to trade.

- Routine Analysis: Regular review of past trades to understand what works and what doesn’t, refining strategies over time.

- Maintaining Consistency: They maintain a consistent approach to trading, avoiding haphazard decisions and ensuring steady performance.

- Building Discipline: Developing a disciplined approach to trading, sticking to strategies and plans even under market pressures.

As someone who’s spent years in the trading and investing world, I can tell you that a few key habits often separate successful traders from the rest. We’re talking about things like managing emotions, embracing continuous learning, effectively using technical indicators and a few others. It seems simple, but if you were truly able to stick to these habits perfectly, there’s potential to even become a millionaire. The fact that most people don’t become millionaires from trading should tell you that adopting these habits is hard.

But how do these habits actually work in action and what makes them so crucial? Well, why don’t we take a closer look and find out?

Top 10 daily habits of the best traders

I’ll be honest, I don’t always stick to all 10 of these myself. It’s hard, especially considering that there’s money, your money, on the line.

Still, it’s always good to know what we should strive for, and hopefully, what we’ll one day achieve. These 10 trading tips and habits are a collection of my own experiences, as well as experiences of other successful traders who were kind enough to share. Of course, there are way more than just 10 tips from various traders, but I’ve compiled the 10 that seem to be recurrent among many. They are, in no particular order:

Managing your feelings

Lifelong education

Utilizing technical indicators properly

Keeping a trading journal

Risk control

Building Discipline

Embracing flexibility

Persistence and patience

Routine analysis

Maintaining consistency

Your habits tomorrow are the result of the work you do today

Your habits tomorrow are the result of the work you do todayManaging Your Feelings: Keep your emotions in check to make objective decisions

In trading, keeping your emotions in check is crucial for making objective decisions. Let’s explore how to master this skill.

I’ve learned that emotional management begins with self-awareness. During trading, I pay attention to my feelings, resisting the urge to make impulsive decisions. If I’m agitated or anxious, I take a step back to assess my emotions critically. Deep breathing exercises and meditation techniques have become part of my routine, helping me stay calm and focused.

Broad candles on a chart can actually have an impact on emotional stability

Broad candles on a chart can actually have an impact on emotional stabilityEmotions are the enemy of rational, calculated decision making, and even though meditation and trading aren’t often used in the same sentence, I don’t think we should discard anything that can help us be better traders.

Lifelong Education: Commit to continual improvement and education in trading

Just as managing emotions plays a pivotal role in trading, so does committing to ongoing learning and improvement. Adopt a mindset of continuous learning, stay updated with market trends and news and never become so arrogant to think that you know everything, or even enough.

Engaging in regular improvement activities can help refine trading skills over time. It’s also a good idea to access educational resources such as courses, seminars, and workshops. Hell, even free videos on platforms like Youtube can be very eye-opening.

Experimentation with different trading strategies is another key facet of continual education. Just because you have a strategy that has worked, doesn’t mean there isn’t another that would work even better.

Trading on indicator patterns helps you form habits. Evaluate which of the indicators for technical analysis may be the best for you in the article: Top 6 Essential MT4 Indicators For Forex Traders

Utilizing Technical Indicators: Understand and apply technical indicators to guide your trading decisions

Harnessing the power of technical indicators allows you to analyze historical price data, predict future trends, and make informed trading decisions. These indicators offer a quantitative approach, providing objective data to aid my strategy.

Still though, don’t spread yourself too thin either. As a general rule, the more you know the better, but sometimes depth is more important than width. Better to master a few indicators before moving to the new ones.

Understanding technical indicators isn’t just about knowing what they are, but interpreting their signals to make well-timed trades. Customize indicators to fit your strategy. It will hone your decision-making process and improve your trading performance.

Keeping a Trading Journal: Document your trades and thoughts in a journal to reflect on your progress and mistakes

Keeping a trading journal sounds boring. It is. It’s also been a game-changer for me, as it allows me to meticulously document each trade, including my entry and exit points, for later analysis. It’s a reliable tool that keeps me accountable and disciplined.

I record my:

Trading notes

Thoughts

Emotions

End result of a trade

This practice provides valuable insights and helps me reflect on my progress and mistakes. Reviewing these notes, I can identify patterns, avoid repeating past errors, and fine-tune my strategies.

It’s a commitment that demands time, effort and honesty, but the payoff is worth it. It promotes consistent improvement. Bonus points for writing by hand (I used to do this, nowadays I unfortunately don’t anymore, I keep a journal on my computer). Still, whether you write digitally or by hand, keeping a trading journal is an essential habit to adopt.

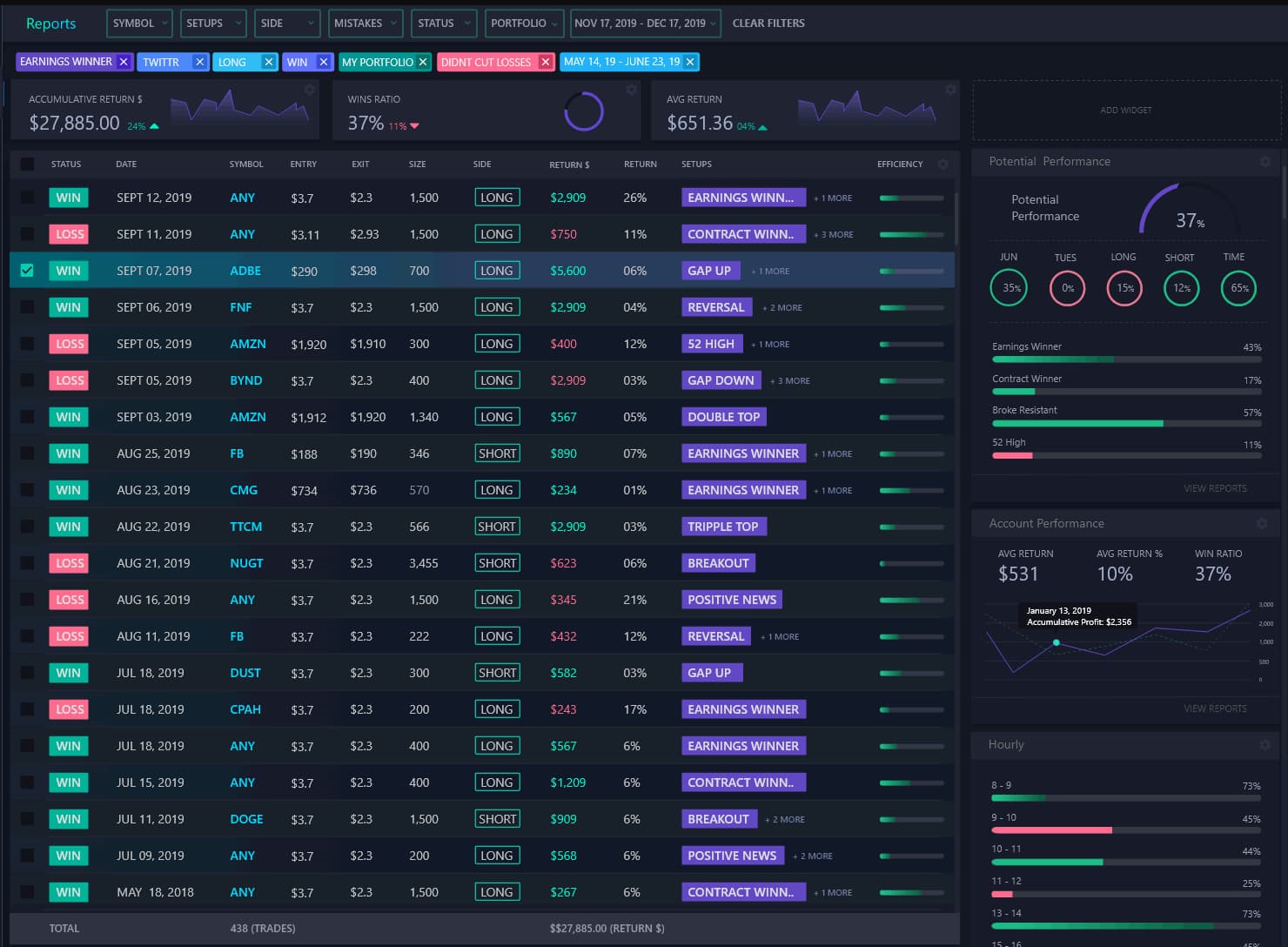

Using paid programs to automatically track your own trading activity will help provide important insights in analyzing your strengths and weaknesses

Using paid programs to automatically track your own trading activity will help provide important insights in analyzing your strengths and weaknessesRisk Control: Implement strategies to manage and mitigate risks effectively

While maintaining a trading journal helps me identify patterns and refine strategies, it’s equally important to have solid risk control measures in place to protect my trading capital and ensure long-term success.

Here’s my three-step risk management approach:

Set stop-loss orders: This move limits potential losses and safeguards my capital.

Diversify my portfolio: Spreading risk across different assets reduces overall exposure.

Implement risk-reward ratios: I ensure potential profits outweigh potential losses.

It’s nothing fancy, but that’s okay. Successful trading doesn’t have to be fancy. You can be a master of the fundamentals and still be very profitable.

Building Discipline: Develop a disciplined approach to trading, sticking to your strategies and plans

Developing a disciplined approach to trading isn’t something that happens overnight. It requires consistent adherence to your strategies and plans, even when the market puts you to the test. Discipline in trading is all about sticking to your guns, avoiding impulsive decisions, and managing your emotions. It’s unavoidable if you want better decision-making, effective risk management, and long-term success.

| Building Discipline | Why It’s Important | How to Develop |

|---|---|---|

| Consistent Adherenceq | Avoids deviating from plans | Establish routine, prioritize tasks |

| Avoid Impulsive Decisions | Prevents emotional trading | Practice patience, stick to the plan |

| Manage Emotions | Ensures logical decisions | Meditate, stay calm in volatile markets |

Embracing Flexibility: Stay flexible and ready to adapt to changing market conditions

Flexibility and adaptability can be very beneficial, allowing you to adapt your strategies in the face of changing market conditions. While sticking to your guns can be a good thing, being too rigid can lead to missed opportunities and higher risks. Here’s how flexibility aids in trading:

It allows you to capitalize on new opportunities that emerge amidst market volatility.

It enables swift response to unexpected events, preventing potential losses.

It helps in staying ahead of market trends, making informed decisions for profitable trades.

If discipline and flexibility seem to conflict with one another, think of it as a matter of balance. Embracing flexibility isn’t about changing your entire strategy, but subtly tweaking it as per market dynamics.

For example, if you did your analysis and decided to open a buy position on a stock, put a stop loss and take profit, only to feel that you made a mistake and now think you should close that and open a sell position instead because the price went 0.5% down? That’s taking it too far. But if you decide to slightly move the stop loss and take profit? That can be a sign of flexibility.

Remember, being adaptable could be your key to sustained success in trading.

Persistent Patience: Exercise patience, waiting for the right trading opportunities

As a trader, patience is a strategic necessity, paving the way for high-probability trading opportunities. Patient traders understand that waiting for the right market conditions is key to avoiding impulsive decisions. Being hasty can lead to chasing trades and missing out on quality setups.

I take pride in my patience as a trader. It allows me to maintain discipline and steer clear of unnecessary risks. I don’t jump the gun and instead wait for a confirmation before entering a trade. This practice helps me avoid or at least mitigate losses.

Also, don’t think that trading will make you a millionaire in a month. Not only is that line of thinking wrong, but it will also make you a worse trader.

Expert Advice

I heard a story from a professional trader who interned at Goldman Sachs. There is a special assistant in the trading room there who makes sure that traders are in a calm state, so that emotions do not interfere with decision-making. But if you don't have an assistant, here's a simple tip: to form a successful habit, put a rubber band around your arm. As soon as you make a mistake, pull back and release the rubber band to hurt yourself. You may not want to repeat the mistake next time.

Routine Analysis: Regularly analyze and review your trades to refine your strategies

Every successful trader knows that routine analysis of past trades helps refine strategies and improve outcomes (this is another reason I recommended keeping a trading journal, analyzing past trades is easier).

It’s not simply about making trades. You need to understand why certain trades worked and others didn’t if you want to improve.

Tracking Performance Metrics : Keep a keen eye on your performance metrics. It’ll allow you to see what’s working and make necessary adjustments.

Reviewing Trade Data : Make it a habit to review your trade data regularly. This’ll refine your strategies over time.

Reflecting on Trades : Think about why you made certain decisions, why you made that trade, what made you put stop loss and/or take profit there, and ultimately, whether it worked or not, and why.

Maintaining Consistency: Aim for consistency in your trading approach to achieve long-term success

It’s no different than the gym, it’s better to go 4 times a week for 30 minutes, than to go once a month for 8 hours. I’ve learned that successful traders’ habits revolve around maintaining a steady routine and making well-considered decisions rather than impulsive ones.

Part of this consistency also means protecting your capital with unwavering adherence to risk management practices. A steady performance, regardless of market fluctuations, leads to long-term profitability and sustainability.

It’s not just about making successful trades, it’s also about learning, tweaking your system, and adapting to the dynamic market conditions. Emulating these habits, you can build a successful trading career over time.

I personally believe that consistency is the true secret to long-term trading success.

Best Forex brokers

What are the bad behaviors of traders?

While adopting successful habits is crucial for a trading career, it's equally important to recognize and steer clear of detrimental behaviors.

Take a bad habit and do the opposite of it

Take a bad habit and do the opposite of itHere are some bad trading habits that can not only destroy your trading account but also potentially end your trading career:

Overtrading: Jumping into too many trades without solid reasoning can lead to significant losses and unnecessary risks.

Ignoring Stop-Loss Orders : Failing to set stop-loss orders exposes traders to potentially unlimited losses. Overconfidence in a position can lead to catastrophic financial damage.

Chasing Losses : Trying to recover losses by increasing trade volumes or taking riskier positions often leads to further losses, compounding the problem.

Lack of a Trading Plan : Trading without a clear trading plan or strategy is akin to navigating without a map, leading to confused and inconsistent decision-making.

Letting Emotions Control Decisions : Allowing fear, greed, or hope to drive trading decisions can cloud judgment and lead to poor trading outcomes.

Neglecting Risk Management : Not paying attention to the overall exposure of your trading account or failing to understand the risk-reward ratio can erode capital over time.

Failure to Learn from Mistakes : Repeating the same mistakes without learning or adjusting your strategy ensures continued failure and stunts growth as a trader.

Over-reliance on Leverage : Using excessive leverage can amplify gains but also magnifies losses, which can wipe out an account swiftly.

Conclusion

In conclusion, adopting successful trading habits can significantly enhance your performance. Surprisingly, 80% of traders fail within the first two years, often due to poor emotional control and lack of consistent learning.

So, manage your emotions, commit to lifelong education, make use of technical indicators, document your trades, and always control risks. Stay patient, flexible, and consistent. Remember, trading is a marathon, not a sprint.

FAQs

What is a trader mentality?

A trader mentality involves a disciplined, patient, and analytical approach to making trading decisions, with a strong focus on risk management and emotional control.

What is trading behavior?

Trading behavior refers to the actions and strategies a trader employs in the markets, including how they manage risk, analyze market data, and make trading decisions based on predefined plans and systems.

What are the golden rules for a trader?

The golden rules for a trader include always using a stop-loss order to limit potential losses, consistently adhering to a trading plan, maintaining discipline in all market conditions, and never letting emotions drive trading decisions.

Which type of trader is most successful?

The most successful traders are typically those who are disciplined, well-educated in market analysis, adaptable to changing market conditions, and meticulous about managing risks and maintaining consistent trading practices.

Related Articles

Team that worked on the article

Vuk stands at the forefront of financial journalism, blending over six years of crypto investing experience with profound insights gained from navigating two bull/bear cycles. A dedicated content writer, Vuk has contributed to a myriad of publications and projects. His journey from an English language graduate to a sought-after voice in finance reflects his passion for demystifying complex financial concepts, making him a helpful guide for both newcomers and seasoned investors.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Options trading is a financial derivative strategy that involves the buying and selling of options contracts, which give traders the right (but not the obligation) to buy or sell an underlying asset at a specified price, known as the strike price, before or on a predetermined expiration date. There are two main types of options: call options, which allow the holder to buy the underlying asset, and put options, which allow the holder to sell the underlying asset.

Risk management in Forex involves strategies and techniques used by traders to minimize potential losses while trading currencies, such as setting stop-loss orders and position sizing, to protect their capital from adverse market movements.

Risk management is a risk management model that involves controlling potential losses while maximizing profits. The main risk management tools are stop loss, take profit, calculation of position volume taking into account leverage and pip value.

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.

Diversification is an investment strategy that involves spreading investments across different asset classes, industries, and geographic regions to reduce overall risk.