What Is The Best Time Of Day To Trade S&P 500?

The New York Stock Exchange (NYSE) is open Monday through Friday from 9:30 AM to 4:00 PM Eastern Time (ET). In the first 30 minutes the market is especially active, this time can be considered as the best time to profit from price differences.

The "SPX" in Forex refers to the S&P 500 Index which means a stock market index measuring the performance of 500 of the biggest companies that are listed on stock exchanges in the United States. It is not a currency pair, as is common in Forex trading, but an equity index that is used as a benchmark for the complete performance of the U.S. stock market. Traders often follow the S&P 500 to gauge the health and trends of the U.S. economy and stock market.

Trading the S&P 500, like any other financial instrument, has risks, and it's essential to have a good understanding of market dynamics and risk management strategies if you plan to trade it.

How do I trade the S&P 500 index?

SPX is traded in futures, CFDs, ETFs and other instruments. You will most likely need to open an account with a broker.

You can check out the best brokers to trade S&P 500 before making a decision.

Here's a step-by-step guide:

-

1

Choose a Broker: Select a reputable broker that offers access to S&P 500 trading.

-

2

Open an Account: Sign up for an account with the chosen broker and complete any necessary identity verification.

-

3

Deposit Funds: Fund your trading account with the amount you want to trade.

-

4

Analyze the Market: Study the S&P 500 index's recent trends and news that may impact it.

-

5

Place a Trade: Use your broker's trading platform to buy or sell.

-

6

Set Stop-Loss and Take-Profit: Implement risk management by setting stop-loss and take-profit levels when placing your trade.

-

7

Monitor and Close the Trade: Keep an eye on your trade's progress and close it when it reaches your desired profit or stop-loss point.

The best times to trade SPX

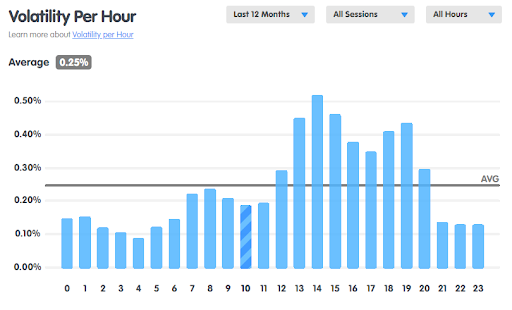

On average, the price of the S&P 500 index can change by 0.25% per hour. However, when US financial markets are open, the SPX can change by 0.5% per hour or more.

Volatility per hour - Source: Babypips.com, GMT Time Zone

As you can see in the image, the best times to trade it aligns with the opening and closing hours of the New York Stock Exchange (NYSE).

Here are some key times to consider:

-

1

Opening Bell (9:30 AM EST): The first 30 minutes to an hour of trading often see higher volatility and trading volumes as traders react to overnight news and economic data releases.

-

2

Lunchtime Lull (12:00 PM - 1:00 PM EST): Trading activity tends to slow down during the lunch hour, and spreads may widen.

-

3

Closing Bell (4:00 PM EST): The last hour of trading can be quite active, with increased volatility as traders make final decisions.

-

4

After-Hours Trading (4:00 PM - 8:00 PM EST): While the official market hours end at 4:00 PM, electronic trading continues after hours, allowing for extended trading opportunities, though with less liquidity.

-

5

News Events and Economic Releases: Pay attention to economic reports, earnings announcements, and other news events that can impact the SPX. Trading around these events can be both risky and potentially rewarding.

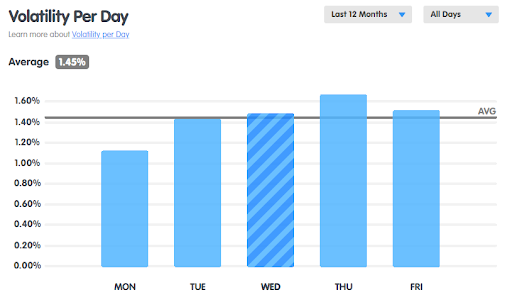

What is the daily volatility of SPX?

The daily volatility of the Standard & Poor's 500 Index (SPX) can vary significantly from day to day. It's typically measured using indicators such as the Average True Range (ATR) or historical price movements.

On average, SPX index values can change by 1.45% per day.

Volatility per hour - Source: Babypips.com, GMT Time Zone

The day-to-day volatility of the S&P 500 Index (SPX) is not constant; it fluctuates due to a range of factors.

Lowest Volatility: Monday is the day with the lowest volatility for SPX, due to the impact of the weekend and the relatively infrequent publication of important economic news stories.

Highest Volatility: Due to the frequent publication of important news (e.g. inflation or Fed related), the volatility of the SPX market reaches its highest levels on Thursday.

Furthermore, daily volatility can shift for various reasons, underscoring the importance of taking into account the prevailing economic and market conditions at any given moment.

Tips for choosing the best time to trade SPX

-

1

Track the VIX: The Volatility Index (VIX) is usually referred to as the "fear gauge" and measures the expected volatility of the SPX over the next 30 days. High VIX levels can indicate more market uncertainty and may suggest better opportunities for trading, while low VIX levels might imply a calmer market.

-

2

Track Futures: Monitoring E-mini S&P-500 (ES) futures contracts can provide insights into after-hours and pre-market trading sentiment, helping you anticipate potential market direction and intraday opportunities.

-

3

Track Options: Analyzing options data can help you identify key support and resistance levels, as well as gain insights into market sentiment. Pay attention to open interest, implied volatility, and large option trades.

-

4

Analyze Volumes: Monitoring trading volumes can give you an idea of market participation. Higher volumes often indicate efforts to change the price.

-

5

Follow Analytics: Staying informed with market analysis and expert opinions can help you make more informed trading decisions. Analysts often provide insights into market trends, economic events, and potential catalysts.

To learn the current SPX value and analysts' estimates on possible future trends, please visit the page: S&P 500 Price Prediction.

👍 Pros of SPX trading

Trading the Standard & Poor's 500 Index offers several advantages:

• Huge Liquidity: SPX is one of the most liquid indices globally, with a substantial trading volume. This liquidity means that you can enter and exit positions with relative ease, potentially minimizing slippage and transaction costs.

• Abundant Information: The SPX is closely watched by analysts, and there is a wealth of news, fundamentals, and statistics available. This information can help you make more informed trading decisions and be updated on market trends and developments.

• Funded Account Opportunities: Prop trading firms offer opportunities for traders to access funded accounts. This can be advantageous for those who may not have the capital to trade the SPX on their own.

• Technical Analysis Tools: The availability of advanced technical analysis tools allows traders to perform in-depth analysis of SPX price movements, patterns, and trends. This can help in developing effective trading strategies.

👎 Cons of SPX trading ns

Certainly, there are cons and risks associated with trading the Standard & Poor's 500 Index (SPX):

• Market Volatility: The SPX can experience significant price fluctuations, which can result in both substantial gains and losses. Volatility can make it challenging to predict market movements accurately.

• Leverage Risk: Many traders use leverage to amplify their positions. While this can magnify profits, it also increases the potential for significant losses. It's crucial to use leverage cautiously and understand its risks.

• Overnight Risk: SPX trading can be affected by events that occur outside regular trading hours, such as overnight news or international market movements. This can lead to price gaps when the market opens, potentially causing unexpected losses.

• High Capital Requirement: Trading the SPX typically requires a significant amount of capital due to the value of the index. This can limit access to the market for some traders.

Summary

Focusing your active trading during specified hours, often aligned with peak market activity, can help you stay alert and reduce exhaustion. It allows you to concentrate on the most liquid and volatile periods, potentially leading to more efficient and effective trading.

You must choose trading hours that align with your personal schedule and preferences while considering the market's characteristics.

FAQs

What time is the SPX trading?

The SPX trades during regular market hours from 9:30 AM to 4:00 PM Eastern Standard Time (EST) on most trading days.

Can you trade SPX overnight?

No, you cannot trade SPX overnight during regular market hours. However, you can trade derivatives. For example, E-mini S&P 500 futures or CFDs, which are available for trading 24/5 with a 1 hour break between the American and Asian sessions.

Can you trade SPX 24 hours a day?

No, you cannot trade SPX 24 hours a day. Consider trading E-mini S&P 500 futures or CFDs. When U.S. stock exchanges are closed, these financial instruments allow trades based on the price of the S&P 500, albeit with reduced volatility and liquidity.

What is SPX in forex?

The SPX (S&P 500) is not a forex (foreign exchange) instrument. It is a stock market index representing the performance of 500 of the biggest publicly traded companies in the United States. SPX is traded on stock exchanges, not in the forex market.

Glossary for novice traders

-

1

Trading

Trading involves the act of buying and selling financial assets like stocks, currencies, or commodities with the intention of profiting from market price fluctuations. Traders employ various strategies, analysis techniques, and risk management practices to make informed decisions and optimize their chances of success in the financial markets.

-

2

Volatility

Volatility refers to the degree of variation or fluctuation in the price or value of a financial asset, such as stocks, bonds, or cryptocurrencies, over a period of time. Higher volatility indicates that an asset's price is experiencing more significant and rapid price swings, while lower volatility suggests relatively stable and gradual price movements.

-

3

Index

Index in trading is the measure of the performance of a group of stocks, which can include the assets and securities in it.

-

4

Broker

A broker is a legal entity or individual that performs as an intermediary when making trades in the financial markets. Private investors cannot trade without a broker, since only brokers can execute trades on the exchanges.

-

5

CFD

CFD is a contract between an investor/trader and seller that demonstrates that the trader will need to pay the price difference between the current value of the asset and its value at the time of contract to the seller.

Team that worked on the article

Upendra Goswami is a full-time digital content creator, marketer, and active investor. As a creator, he loves writing about online trading, blockchain, cryptocurrency, and stock trading.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).