What is a Forex bonus? Definition

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

All other conditions being equal, the traders often pay consideration to bonuses, when choosing a broker. Indeed, the possibility of receiving additional funds for trading looks rather enticing. Novice traders, who have not yet accumulated a large volume of capital for trading, are particularly fond of forex bonuses.

Brokers with bonus programs have various offers to their clients. These could be regular promotions, for example bonus for funding your account for any amount, or temporary promo campaigns.

It is important to know the types of bonuses and understand that there are often rather tough conditions for getting the bonus behind the advertising slogans. So, let’s take a closer look at this.

What is important to know about bonuses?

What is important to know about bonuses?Forex bonus definition

Forex bonus is a special promotion of a broker that has the objective of introducing the clients to the services offered by the broker, attracting new clients, supporting high trading activity and encouraging new deposits.

As a rule, the bonuses are awarded for the following:

Registration and verification of data on the broker’s website;

Making initial deposit;

Making a deposit for a specific amount;

High trading activity.

The majority of brokers request that the traders meet rather tough conditions to receive the bonus. These conditions may include the following:

Limited period of using the bonus;

Awarding trading credits increase of real funds;

Minimum required trading volume;

The possibility of withdrawal of only profit earned from trading using the bonus funds, but not the bonus principal.

Forex bonuses pros and cons

- Pros

- Cons

- Additional capital increases profit potential

- In case of no deposit bonus, a trader can test the broker’s conditions without spending their own money and risk free.

- Tough conditions for getting the bonus.

- The amount of no deposit bonus is often quite modest – $5-$100.

- Overtrading due to the necessity to meet the conditions of the bonus program.

Forex bonus classification

Depending on conditions of awarding forex bonuses, they are divided into three big groups:

Forex No deposit bonuses – can be awarded without making a deposit;

Forex deposit bonuses – awarded for depositing a specific amount to your account;

Forex Welcome bonuses – designed for new clients, and, as a rule, are awarded for the first deposit.

Those are the three bonus types we will review in detail.

However, for advertising purposes, brokers can also use other promotions:

Cashback – compensation for a part of trading expenses, for example, from paid commissions and unprofitable trades;

Rebate – compensation for a part of the spread;

Reload Bonus – incentive for regular deposits on the account.

Forex no deposit bonus

No deposit bonuses are particularly popular among novice traders. The brokers use these promotions to attract new clients, giving them an opportunity to familiarize themselves with the broker’s services, trading conditions and trading platform. This offer is particularly beneficial for the clients who want to try trading without the risk of losing money.

Bonus amount

As a rule, the amount of the welcome bonus is rather modest – from $5 to $150. Some brokers do offer larger bonuses, but the general rule is that the higher the amount the tougher are the conditions for claiming it.

Withdrawal conditions

Everything depends on the amount. If the amount is small – up to $30, the broker may allow to withdraw it once a specific minimum number of trades is reached and, accordingly, the amount of paid commissions. If the amount is big, as a rule, it is awarded as a trading credit. In order to withdraw it, a trader will have to meet the trading volume requirements and also deposit their own funds to the account.

Forex no-deposit bonuses 2025

| # | Broker | Bonus | Conditions for obtaining | Regulation | Bonus |

|---|---|---|---|---|---|

| 1 | FBS | $100 | How to get FBS no deposit bonus: Open a new MT5 account and request it.

Withdrawal: Yes, after trading 5 lots during 30 days. | CySEC (Cyprus) | Open an account Your capital is at risk. |

| 2 | Tickmill | $30 | How to get Tickmill no deposit bonus

● Register an account with Tickmill; ● The welcome bonus account will be added automatically after the application is approved; ● The welcome bonus account will have $30 in it. Trading Limitations: ● EA trading is not allowed; ● The bonus is valid for 90 days. How to withdraw the profit: ● A minimum of $30 and a maximum of $100 profit can be transferred to a live mt4 trading account; ● One client is limited to one request for profit transfer only; ● Open a live mt4 account with at least $100 deposited into it. | FCA (UK), CySEC (Cyprus), FSCA (South Africa), LFSA (Labuan), SFSA (Seychelles) | Open an account Your capital is at risk. |

| 3 | FXOpen | $10 | How to get FXOpen no deposit bonus: Register an FXOpen eWallet, verify your phone number, register an STP account

Withdrawal: Trade over 2 lots to withdraw profits. The bonus is not withdrawable. | ASIC (Australia), FCA (UK) | Open an account Your capital is at risk. |

| 4 | FreshForex | $2023 | How to get FreshForex no deposit bonus:

● Traders need to register with FreshForex. ● Open Classic, Market Pro, or ECN account in MetaTrader 4/MetaTrader 5 platforms in USD, EUR, or RUB. ● There is no need for personal data verification to receive the no deposit bonus. ● The bonus should be credited automatically Trading Limitations: ● To save the profit received, traders have to fund the account with the amount of received profit. ● Trading period: 7 calendar days upon receiving a bonus. How to withdraw the profit: ● Save the earned profit by funding your trading account with an amount equal to or more than the profit earned within 7 days after receiving a bonus. ● Complete 1 lot per $5 of saved profit within 30 days. ● Contact Fresh Forex manager via feedback form to transfer your profit into account balance. Withdraw the profit earned or use it back in trading. | FCA (Saint Vincent and the Grenadines) | Open an account Your capital is at risk. |

| 5 | InstaForex | $1000 | How to get IstaForex no deposit bonus: Open a new account using the promotional form online and fully verify it.

Withdrawal: Bonus, cannot be withdrawn, only profits can be withdrawn after trading X * 3 InstaForex-lots, where X — is profit volume(1 InstaForex-lot = 0,1 forex lot) Also, as per paragraph 6: "The Client agrees that in some cases the Company can ask him/her to replenish his/her account with real funds". | BVI FSC | Open an account Your capital is at risk. |

How to get FBS No Deposit bonus: step by step guide

As an example, let’s review the no deposit bonus provided by FBS. The bonus itself is rather big at $140, which is one of the best offers in the market.

Conditions for claiming the bonus from FBS are quite simple:

To receive the bonus you need to:

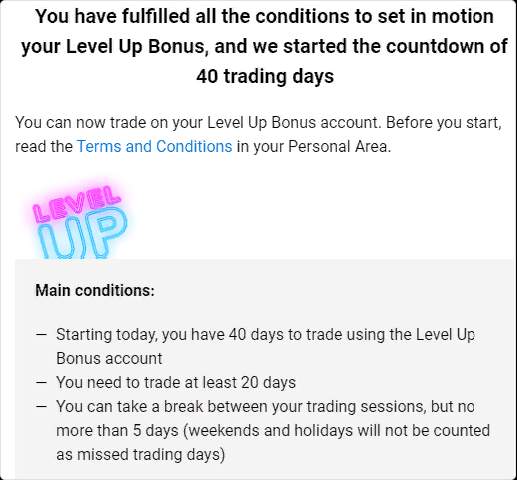

Register with the broker and select Promotions and Level Up Bonus in your personal account;

The broker will send you a confirmation email. Confirm and receive the no deposit bonus in the amount of $70;

Download and install FBS app and double the bonus.

Withdrawal conditions

You can trade with bonus funds for only 40 after opening of the account. Of these 40 days, at least 20 must be active (with open trades). In this case you will be able to withdraw profit. The trading volume must be at least 5 lots. You can withdraw the earned profit in the amount of up to $70 (if you are trading on your desktop) or up to $140 (if you downloaded the mobile app and doubled your bonus).

Forex Welcome bonus

Welcome bonus is awarded to new clients upon their completion of registration and funding the account. As a rule, this type of bonus is a type of a trading credit. The broker may also impose time limits on the use of the bonus.

Amount

In the majority of cases, the welcome bonus amount ranges from 30% to 100% of the deposit amount. In some rare cases, the broker may offer up to 200%, but then the additional conditions and company’s reliability must be closely considered.

Withdrawal conditions

The bonus is a trading credit in the majority of cases, so the brokers only allow you to withdraw the profit earned from trading with bonus funds. In some cases, bonuses can be withdrawn upon completion of a specific number of trades.

XM Welcome bonus example

XM offers a 100% welcome bonus with the maximum threshold of $5,000.

Open a real account;

Deposit any amount to the account;

Perform trades;

The bonus is credited at a rate of $10 per one traded lot.

Forex Deposit bonus

The difference between a deposit bonus and a welcome bonus is that the former can be awarded not only for the first deposit, but for any deposit. The brokers are thus encouraging the clients to deposit large amounts to their accounts and trade more actively.

Amount

The typical bonus amount ranges from 10% to 100% and can exceed this amount only in some cases.

Withdrawal conditions

Withdrawal conditions are also usually similar to those for the welcome bonus. As a rule, the money is awarded as a trading credit and only the profit earned from trading with bonus funds can be withdrawn. In some cases, the withdrawal amount is linked to the traded volume.

Deposit bonus example

RoboForex offers a 120% Deposit bonus or up to $50,000.

Open and verify an account on RoboForex;

Get up to 120% deposit bonus upon completion of a deposit;

Withdrawal is possible only if the requirements for the trading volume are met.

How to choose right forex bonus program

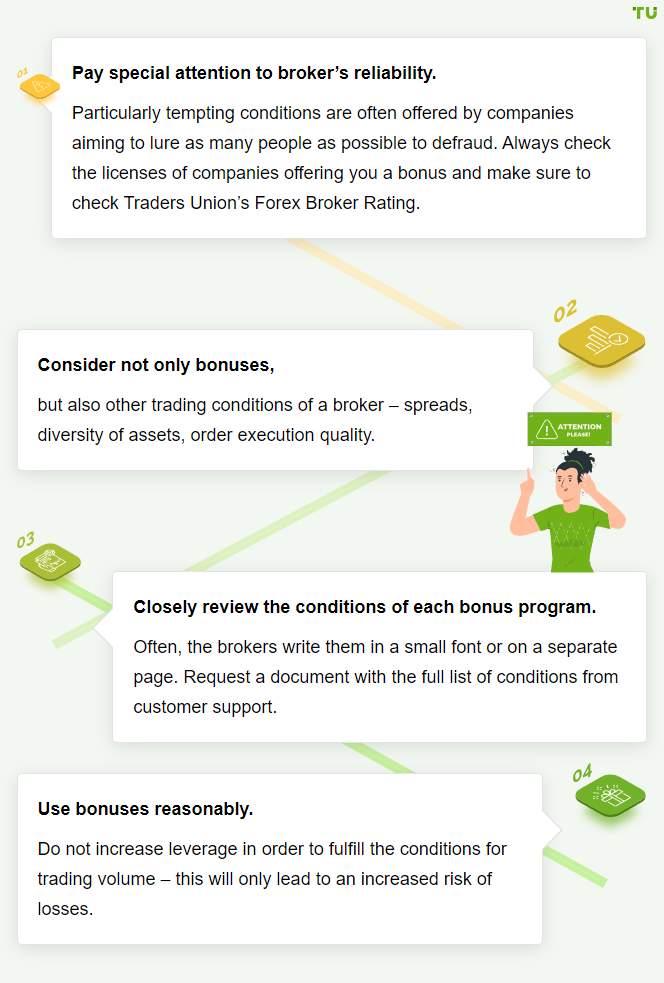

Choosing a forex bonus may turn out to be a difficult task for a novice trader, as the majority of brokers have their own unique conditions. Often, there is a catch behind the ‘shiny sign’.

Traders Union experts recommend following these rules that will help you make a reasonable choice:

Can I earn money by Forex bonus?

If you use Forex bonuses reasonably, they can indeed help you earn more. For example, a welcome bonus will help increase capital, and, accordingly, the return from profitable trades. No deposit bonus provides an excellent opportunity to gain the first experience of working with a broker risk free.

However, one must also keep in mind that the brokers use bonuses to increase their own returns and make the rules for claiming them as safe and beneficial for themselves as possible. This is why it is very important to observe risk management rules – avoid overtrading or using excess margin.

Why some brokers don’t propose bonuses?

In the U.S., EU countries and a number of other regions, the regulators impose strict limitations to the promotional activities of brokers. Direct financial incentives for the clients to make them trade more actively are prohibited, as Forex and CFD trading are considered a highly risky type of investment. Therefore, the regulators are trying to protect inexperienced investors.

The brokers with the licenses issued by the EU, UK, US regulators and regulatory authorities of some other countries often do not offer any bonuses. There is also a wide-spread situation, when bonuses are only available for the clients of the broker’s offshore branch, where the regulators do not control this kind of activity.

Expert opinion about Forex brokers bonuses

Bonuses have become commonplace in the financial market. The attitudes towards them are mixed. They certainly do serve as a good incentive for the novice traders, if the deposit amount is modest. However, traders need to keep a cool head and understand that forex bonuses are only a promotion.

Bonus can turn out to be a nice addition to the services offered by the broker, but it should not be the only criteria of evaluation of the broker. Close attention should be paid to reliability and trading conditions of the company. If you are offered a 100% deposit bonus, while the spread of the broker skyrockets at any volatility, it is best not to accept this offer. After all, a bonus is often a one-time offer, while the goal of any trader is a long-term profit.

FAQs

What is the maximum deposit bonus amount usually offered?

Some brokers offer up to 200% but more commonly it ranges from 30-100%. Amounts over 100% should be researched very carefully.

Can I withdraw the no deposit bonus?

No, the no deposit bonus itself usually cannot be withdrawn, only any profits generated from trading with the bonus funds.

How long do I have to complete bonus trading requirements?

Timeframes vary by broker but commonly 30-90 days to meet trading volume or lot requirements to withdraw profits.

How many trades do I need to complete the bonus?

Requirements vary but commonly brokers demand 20-100 trades or trading volume 2-10 times the bonus amount before profits can be withdrawn.

Related Articles

Team that worked on the article

Glory is a professional writer for the Traders Union website with over 5 years of experience in creating content in the areas of NFT, Crypto, Metaverse, Blockchain, or Web3 in general. Over the last couple of years, Glory has also traded on different cryptocurrency and NFT platforms including Binance, Coinbase, Opensea, and others.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

Volatility refers to the degree of variation or fluctuation in the price or value of a financial asset, such as stocks, bonds, or cryptocurrencies, over a period of time. Higher volatility indicates that an asset's price is experiencing more significant and rapid price swings, while lower volatility suggests relatively stable and gradual price movements.

Forex indicators are tools used by traders to analyze market data, often based on technical and/or fundamental factors, to make informed trading decisions.

CFD is a contract between an investor/trader and seller that demonstrates that the trader will need to pay the price difference between the current value of the asset and its value at the time of contract to the seller.

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.