Tether Marks 10th Anniversary | Key Milestones And Achievements

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Tether, now a decade old innovation, has faced numerous controversies over its reserve backing but remained resilient, becoming the most widely used stablecoin. While Bitcoin’s wild price swings attract speculation, USDT crypto provides the steady value of a dollar-backed asset, making it a staple for traders. Unlike its competitors, Tether’s global reach is unmatched, though it’s currently navigating regulatory hurdles in the EU.

Tether, the company behind USDT, celebrates a decade of success this year, making waves as the most popular stablecoin in the crypto space. Since its inception in 2014, Tether has faced a variety of challenges, from fraud allegations to regulatory scrutiny, yet it remains a pivotal player in the digital currency world. In this article, we’ll explore Tether’s journey, how it tackled criticism, and why USDT is still relevant today.

Tether’s origins and early history

USDT 10th anniversary

USDT 10th anniversary Tether was launched on October 6, 2014, originally branded as Realcoin, before being rebranded to Tether shortly after. Founded by Brock Pierce, Reeve Collins, and Craig Sellars, Tether was the first stablecoin designed to maintain a 1:1 peg with the U.S. dollar, allowing for smoother transactions across the burgeoning cryptocurrency market.

Built initially on Bitcoin’s OmniLayer protocol, Tether later expanded to other blockchains, including Ethereum, Tron, and The Open Network, ensuring wide adoption across various platforms. Today, USDT boasts a market cap of over $120 billion, making it not just the largest stablecoin, but also the third-largest cryptocurrency overall.

| Fact | Description |

|---|---|

| Launch year | Tether was launched in 2014 under the name Realcoin before being rebranded. |

| Type of cryptocurrency | Tether is a stablecoin pegged to the value of fiat currencies, primarily the US Dollar (1 USDT = 1 USD). |

| Primary use case | USDT is used for stability in crypto markets, allowing traders to hedge against volatility in other cryptocurrencies. |

| Blockchain | Tether operates on multiple blockchains, including Ethereum (ERC-20), Tron, Bitcoin (Omni Layer), and more. |

| Market cap | Tether is the largest stablecoin by market capitalization, consistently ranking in the top 3 cryptocurrencies globally by market cap. |

| Reserves | Tether claims that USDT is backed by reserves, including cash, cash equivalents, and other assets. |

| Controversies | Tether has faced regulatory scrutiny regarding the transparency of its reserves and was fined by the New York Attorney General (NYAG) in 2021. |

| Use in trading | Tether is widely used as a trading pair on exchanges, providing liquidity for thousands of crypto assets. |

| Audits and transparency | Tether provides periodic reports on its reserves, but has been criticized for delayed or incomplete audits. |

Surviving fraud allegations: the road to transparency

Tether has had its fair share of controversy, most notably being accused of not having enough reserves to back the issued USDT tokens. Critics questioned whether Tether truly held a 1:1 reserve in U.S. dollars, the most fundamental backing of the stablecoin’s value proposition.

In 2021, Tether admitted that not all of its reserves were held in cash. A significant portion was invested in commercial paper, raising further concerns about the liquidity and safety of its backing.

Here’s a table outlining the key accusations against Tether, with dates and sources:

| Date | Accusation | Accuser | Details |

|---|---|---|---|

| 2017 | Tether allegedly issued USDT without sufficient reserves. | Anonymous critics and crypto analysts | Critics claimed that Tether was minting more USDT than it had in reserves, artificially inflating the crypto market. |

| January 2018 | Market manipulation and lack of transparency | Bloomberg,crypto experts | Accusations arose that Tether was manipulating the market by issuing unbacked USDT, leading to investigations. |

| April 2019 | Partial reserve disclosure | New York Attorney General (NYAG) | NYAG accused Tether of covering up an $850 million loss by claiming that Tether is not fully backed by USD reserves. |

| October 2021 | Misrepresentation of reserves | Commodity Futures Trading Commission (CFTC) | The CFTC fined Tether $41 million, stating that the company falsely claimed USDT was fully backed by reserves from 2016 to 2019. |

| February 2021 | Settlement over false reserve claims | New York Attorney General (NYAG) | Tether agreed to pay an $18.5 million fine to settle charges that it lied about its reserves. |

Despite these fraud allegations, Tether continued to grow, supported by market demand and increased transparency. In response to the criticism, Tether began publishing quarterly reports (for example attestation report for Q2 2024), though the transparency of its audits is still debated among financial analysts.

Tether’s strategic Bitcoin reserves

Tether’s decision to buy Bitcoin came as part of a strategic move in 2021 to diversify its reserves. Instead of relying solely on traditional assets like U.S. Treasury bills, Tether started allocating up to 15% of its net realized operating profits to Bitcoin. This approach aims to strengthen its reserves and reinforce its position in the market. The company opted for Bitcoin due to its reputation as a store of value and its limited supply, which made it an appealing asset for long-term stability amidst volatile markets

One unique aspect of Tether’s Bitcoin purchases is its strict use of only realized profits for these acquisitions. Unlike speculative investors who rely on potential future gains, Tether deliberately ignores unrealized gains from price increases. This conservative approach minimizes risk while supporting its core mission of providing stable financial infrastructure. By holding Bitcoin, Tether also signals confidence in the asset's future growth and aligns itself with the broader crypto community’s aspirations of a decentralized financial ecosystem.

Regulatory issues and risks

Tether has faced increasing scrutiny from regulators worldwide. In particular, recent developments in the European Union have raised alarms. The EU's MiCA regulation aims to create a comprehensive framework for crypto regulation across Europe. However, this has led to complications for Coinbase, which may be forced to delist major stablecoins like Tether’s USDT due to compliance challenges.

This situation highlights the ongoing regulatory risks that Tether and other stablecoins face. In an ever-changing regulatory environment, staying compliant is a significant challenge that could affect USDT’s availability on certain platforms.

Why USDT is needed?

As a stablecoin, USDT serves a crucial function in the crypto ecosystem. While cryptocurrencies like Bitcoin are known for their volatility, USDT’s value is pegged to the U.S. dollar, providing stability in an otherwise unpredictable market. This makes USDT an ideal asset for crypto traders who need a stable asset to hedge against price swings.

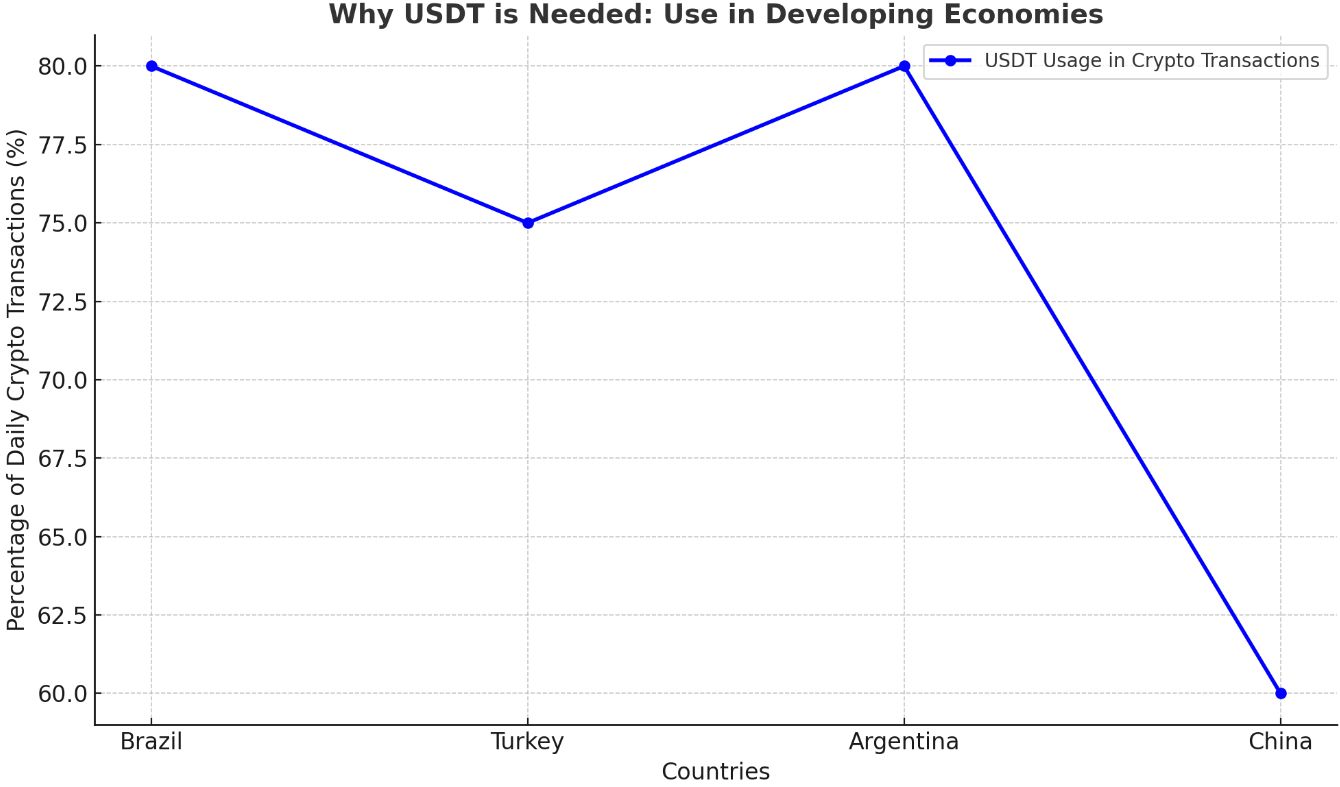

Beyond the trading world, USDT has had a profound impact in developing economies where local currencies are prone to inflation. In countries like Brazil, Turkey, and Argentina,Tether is used daily as an alternative to traditional fiat currencies. In Brazil alone, USDT accounts for nearly 90% of all daily crypto transactions, highlighting its utility as a safe and stable form of money.

How USDT differs from Bitcoin

While both Bitcoin and USDT are cryptocurrencies, they serve very different purposes. Bitcoin is seen primarily as a store of value and an investment vehicle, prone to significant price volatility. On the other hand, USDT is a stablecoin, designed to hold its value consistently at $1.00, making it ideal for transactions and trading in a way that Bitcoin is not.

USDT’s stable nature allows users to exit volatile positions without needing to cash out into fiat, maintaining liquidity and transaction efficiency within the crypto ecosystem.

How USDT differs from other stablecoins

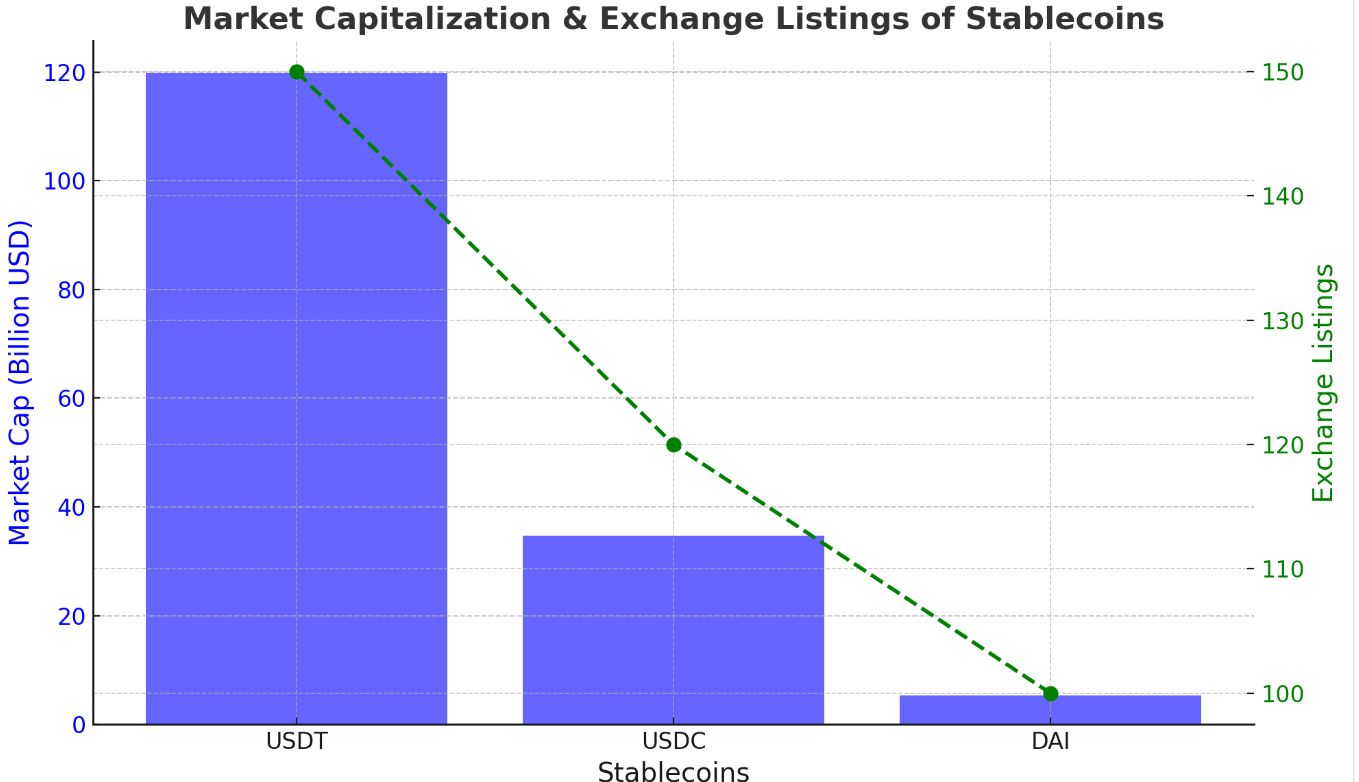

Tether faces stiff competition from other stablecoins, such as USDC and DAI, but it maintains its dominance for several reasons. First, USDT’s liquidity and market reach are unparalleled, with more exchange listings and higher trading volumes than any other stablecoin. However, USDC often highlights its transparency and auditing practices, positioning itself as a more trustworthy option for cautious investors.

Despite the competitive scenario, Tether's multi-blockchain support and strong adoption in regions where financial systems are less developed keep it as the top choice for many users.

For example, here are Market cap & exchange listings:

USDT leads with a market cap of $119.6 billion, followed by USDC at $26.2 billion, and DAI at $4.8 billion (data sourced from CoinMarketCap).

USDT also has more exchange listings compared to its competitors, enhancing its liquidity and market reach.

We have studied the conditions of the best cryptocurrency exchanges for trading USDT and other cryptocurrencies and offer you to familiarize yourself with the comparison table:

| Demo account | Min. Deposit, $ | Spot Maker Fee, % | Spot Taker fee, % | Foundation year | Open account | |

|---|---|---|---|---|---|---|

| Yes | 10 | 0,08 | 0,1 | 2017 | Open an account Your capital is at risk. |

|

| No | 10 | 0,25 | 0,4 | 2011 | Open an account Your capital is at risk. |

|

| No | 1 | 0,25 | 0,5 | 2016 | Open an account Your capital is at risk. |

|

| Yes | 1 | 0,1 | 0,2 | 2018 | Open an account Your capital is at risk. |

|

| No | No | 0 | 0 | 2004 | Open an account Your capital is at risk. |

Pros and cons of USDT

- Pros:

- Cons:

- Liquidity. USDT is the most liquid stablecoin on the market, making it easy to trade across multiple exchanges.

- Stability. Its peg to the U.S. dollar provides users with a reliable store of value in volatile markets.

- Global adoption. USDT is widely used in countries where local currencies are unstable, providing a critical financial service.

- Regulatory scrutiny. Tether has faced, and continues to face, significant scrutiny regarding its reserve backing and transparency.

- Potential delisting. With regulatory changes such as MiCA, there’s a risk of USDT being delisted from major platforms, particularly in Europe.

Expert opinion

Tether, founded in 2014, marks its 10th anniversary this year, reflecting on a decade of growth and challenges. Despite regular scrutiny and debates around its reserve backing, Tether has managed to survive the crypto space and remains the leading stablecoin by market cap. Even the likes of JAN3 CEO Samson Mow have tweeted about the crucial role played by USDT: “In my travels around the world, I’ve seen firsthand how much of a positive impact $USDt has on people suffering from inflation and financial exclusion”. In places like Argentina, where access to the dollar is limited, USDT has emerged as a lifeline, providing a safe haven for people looking to protect their savings.

Tether’s strategy to stay resilient includes using only net realized profits to buy Bitcoin, rather than speculative investments. This conservative approach allows Tether to diversify its reserves while maintaining a stable backing for USDT, which is essential for its function as a stablecoin. By focusing on stability and accessibility, Tether continues to support the broader crypto ecosystem, with a steady eye on both financial inclusion and innovative financial technologies.

Conclusion

As Tether celebrates its 10th anniversary, it has grown from a niche product to an important component of the global financial system. Despite facing fraud allegations and regulatory scrutiny, USDT has maintained its dominance, offering a stable, reliable currency for millions of people worldwide. With its expansion into Bitcoin reserves and continued innovation, Tether is poised to remain a key player in the crypto space for years to come. However, regulatory risks remain a looming challenge that could shape its future trajectory.

Tether’s journey has been filled with challenges, but its ability to evolve while maintaining its market leadership shows the resilience of both the company and USDT itself.

FAQs

Can USDT lose its peg to the dollar?

While USDT is designed to maintain a stable value of $1, it has temporarily lost its peg during times of market volatility, though it has always regained it quickly.

How does USDT handle inflation in countries with unstable currencies?

In countries like Brazil and Argentina, USDT is used as a hedge against inflation, offering a stable currency alternative when local currencies devalue.

Can Tether freeze or block my USDT transactions?

Yes, Tether has the ability to freeze USDT tokens if they are linked to illegal activity, as seen in several cases related to fraud and hacking.

Is holding USDT safe during crypto market crashes?

USDT is generally considered safer than volatile cryptos during market crashes, but concerns over Tether’s reserves and regulatory risks remain.

Related Articles

Team that worked on the article

Parshwa is a content expert and finance professional possessing deep knowledge of stock and options trading, technical and fundamental analysis, and equity research. As a Chartered Accountant Finalist, Parshwa also has expertise in Forex, crypto trading, and personal taxation. His experience is showcased by a prolific body of over 100 articles on Forex, crypto, equity, and personal finance, alongside personalized advisory roles in tax consultation.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.

Fundamental analysis is a method or tool that investors use that seeks to determine the intrinsic value of a security by examining economic and financial factors. It considers macroeconomic factors such as the state of the economy and industry conditions.

Options trading is a financial derivative strategy that involves the buying and selling of options contracts, which give traders the right (but not the obligation) to buy or sell an underlying asset at a specified price, known as the strike price, before or on a predetermined expiration date. There are two main types of options: call options, which allow the holder to buy the underlying asset, and put options, which allow the holder to sell the underlying asset.

Forex leverage is a tool enabling traders to control larger positions with a relatively small amount of capital, amplifying potential profits and losses based on the chosen leverage ratio.

Bitcoin is a decentralized digital cryptocurrency that was created in 2009 by an anonymous individual or group using the pseudonym Satoshi Nakamoto. It operates on a technology called blockchain, which is a distributed ledger that records all transactions across a network of computers.