How To Choose The Right Time Frame For Scalping?

The best time frame for scalping varies by individual preference and market conditions. However, shorter intervals, such as the 1-minute or 5-minute time frames, are commonly utilized for their immediacy in reflecting price action.

In the high-stakes arena of Forex trading, scalping stands as a strategy favored by many for its potential for rapid gains. The key to mastering this approach lies not solely in keen market sense but also in selecting the optimal time frame. This article aims to unravel this critical aspect, paving the way for traders to enhance their scalping efficacy.

Why is the timeframe a pivotal element in scalping? It dictates the pace of trading, the volume of transactions, and, most crucially, the trader's ability to capitalize on fleeting market opportunities. A well-chosen time frame aligns with one's trading style and can significantly amplify the success rate of each scalp.

-

What are the best time frames in Forex trading?

The best time frames in Forex trading depend on the trader's strategy and goals. Short-term traders often prefer timeframes like the 1-minute to 15-minute charts for quick trades, while long-term traders may opt for daily to weekly charts for broader market trends.

How to choose the best time frame for scalping

Scalping is a trading strategy that involves making numerous trades over very short periods, capitalizing on small price movements created by bid-ask spreads or order flows. For an in-depth understanding of scalping's nuances, consider reading our article which explains its main advantages and disadvantages: Top Scalping Pros and Cons.

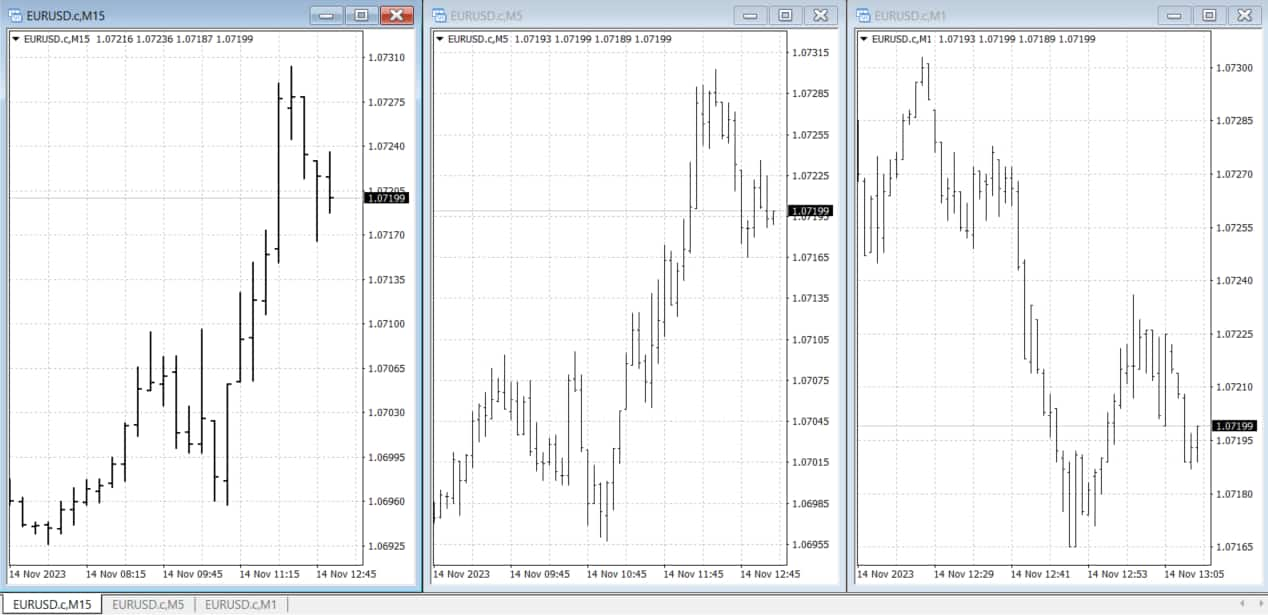

The time frames for scalping can range from mere seconds to several minutes. The image below showcases different scalping time frames.

Metatrader4

Platforms that permit trading in seconds cater to the most aggressive scalpers, seeking to exploit every tick of the market. The 1-minute and 5-minute time frames are the most balanced and cater to the majority, offering a rapid turnover and the potential for quick profits.

On the other hand, the 10-minute and 15-minute time frames serve as a good option for beginners. They present a more manageable pace, allowing:

-

Ample time for thorough analysis

-

A reduction in market 'noise' that could lead to misinterpretation

Now, what stands in favor of the 1-minute time frame? It’s the immediacy. This frame offers real-time insights into market movements, enabling swift decisions and the possibility to execute a higher volume of trades. The adrenaline-fueled arena of minute-by-minute trading can be demanding, but it also offers the exhilaration of instant outcomes.

Best Forex brokers in 2024

7 tips on choosing the best time frame for scalping

Selecting the most suitable time frame for scalping is a decision that should not be taken lightly. It is the foundation which the rapid-fire strategy of scalping is built on. Here are some guiding tips for traders to consider when determining the best fit for their scalping endeavors:

-

Align with your trading style and risk tolerance: Your personal trading style should guide the timeframe you choose. Whether you thrive on the thrill of high-speed trading or prefer a more measured approach, select a timeframe that complements these preferences. Risk tolerance also plays a crucial role. Shorter time frames generally mean higher risk. It's essential to operate within your comfort zone to maintain decision-making clarity.

-

For new traders, start broad: Starting with a larger time frame, such as the 15-minute chart, can be advantageous. It offers a more forgiving environment to learn the ropes without the pressure of rapid movements. This time frame allows for more deliberate decision-making and helps in acclimating to the pace of market changes.

-

Dual time frame dynamics: Employing two time frames simultaneously can be a powerful strategy. Scalping on a 1-minute timeframe while monitoring the 15-minute chart for overarching trends provides a dual lens for decision-making. It combines the best of both worlds - the ability to act on immediate opportunities and the insight to discern longer-term patterns.

-

Gradual transition to shorter time frames: As your proficiency in scalping grows, you can start experimenting with shorter timeframes. This progression should be methodical and based on your increasing comfort with the frenetic pace of the markets. Mastery over shorter time frames can lead to maximizing trade opportunities.

-

Seek liquidity and volatility: The ideal time frame for scalping is one that exhibits high liquidity and volatility. These conditions ensure that trade orders can be executed swiftly and that there is enough movement in price to generate profit. Periods of strong market activity, typically coinciding with the overlap of major market sessions, are prime for scalping.

-

Steer clear of low-liquidity periods: Scalping relies on the ability to enter and exit positions quickly. During periods of low liquidity, such as overnight sessions for certain currencies, the spread can widen, and slippage can become more prevalent. This can erode the potential for profit, making such times less ideal for scalping strategies.

-

Backtesting: Before committing to a specific timeframe, backtest your strategy across various intervals. This process will help you identify the most profitable and consistent timeframe for your trading style. Historical data can provide a wealth of insight into how a strategy might perform under real market conditions.

For those looking to refine their scalping strategy with the support of a suitable broker, consider this curated list of top scalping brokers: 10 Best Scalping Forex Brokers in 2024.

Choosing a broker that accommodates the nuances of scalping can be as critical as selecting the right time frame.

Conclusion

Scalping is a high-frequency trading strategy that involves taking small profits on multiple trades throughout the day. The best time frame for scalping depends on your individual trading style and risk tolerance. However, the most common time frames used for scalping are the 1-minute, 5-minute, and 15-minute charts.

Team that worked on the article

Vuk stands at the forefront of financial journalism, blending over six years of crypto investing experience with profound insights gained from navigating two bull/bear cycles. A dedicated content writer, Vuk has contributed to a myriad of publications and projects. His journey from an English language graduate to a sought-after voice in finance reflects his passion for demystifying complex financial concepts, making him a helpful guide for both newcomers and seasoned investors.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).