Winklevoss Brothers Crypto Portfolio: A Deep Dive Into Their Holdings

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

The Winklevoss crypto portfolio includes investments in:

Bitcoin. Own large BTC reserves (70,000+ BTC).

Gemini exchange. Operate a regulated crypto platform.

NFT and metaverse. Backed Nifty Gateway and Web3 projects.

Blockchain venture funding. Invest in early-stage crypto startups.

The Winklevoss brothers aren’t just early Bitcoin investors — they’ve built an entire ecosystem around crypto. From their massive Bitcoin holdings to founding Gemini, a regulatory-first exchange, their impact goes beyond personal wealth. They’ve backed NFT marketplaces, pumped funds into blockchain startups, and actively lobby for crypto-friendly regulations. While many investors ride trends, the Winklevoss twins focus on long-term plays, positioning themselves as key architects of the digital asset economy. This article dives into their holdings, strategic moves, and how their influence shapes the broader crypto market.

Breakdown of the Winklevoss cryptocurrency holdings

The Winklevoss twins aren’t just early Bitcoin investors — they built a diversified crypto empire that provides key insights into smart portfolio strategies. On the Winklevoss Capital portfolio page, the brothers showcase a comprehensive list of companies and assets in which they hold substantial investments.

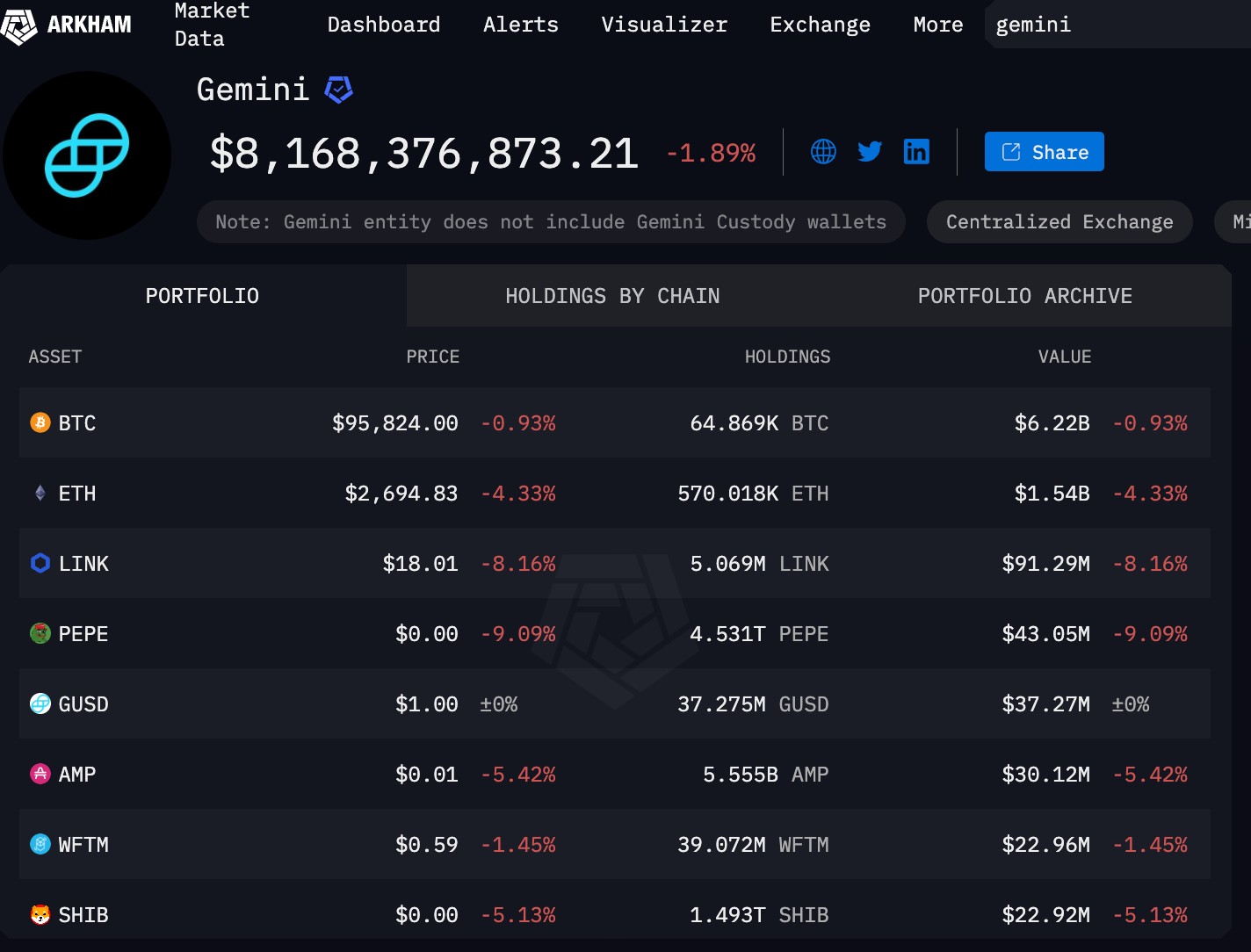

Bitcoin is still their backbone. Despite owning various crypto assets, the twins hold an estimated 70,000+ BTC, reinforcing the idea that even seasoned investors rely on Bitcoin as a store of value. Their strategy highlights how long-term conviction in BTC can outperform constant trading.

Their Ethereum holdings aren’t just for investment. Unlike many institutional holders, the twins use Ethereum not just as an asset but to support projects in the DeFi and NFT sectors. This shows that real wealth in crypto often comes from ecosystem involvement rather than passive holding.

They have exposure beyond traditional crypto. The twins invest in tokenized assets, metaverse projects, and blockchain startups, proving that diversifying beyond simple crypto holdings can create stronger long-term gains. This approach reduces reliance on market cycles and opens up unique revenue streams.

Gemini exchange plays a hidden role. Their exchange isn’t just a business — it allows them to control liquidity, capture trading fees, and influence market trends, which indirectly strengthens their portfolio. Owning infrastructure in crypto can be more valuable than just holding assets.

Gemini exchange: the Winklevoss twins crypto venture

Getting started on Gemini isn’t just about buying and selling — it’s about leveraging its unique features to maximize gains and security.

Use Gemini’s ActiveTrader for lower fees. Most beginners stick to the default interface, but Gemini’s ActiveTrader offers significantly lower fees, with taker fees as low as 0.35% compared to the standard 1.49% on the regular platform. Switching to this mode gives you access to advanced trading tools while saving on costs, making it ideal for frequent traders.

Take advantage of Gemini’s regulated custody services. Unlike many exchanges, Gemini offers $200 million in insurance coverage on digital assets stored in its custody. If you’re holding large amounts of crypto, moving funds into Gemini Custody adds an extra layer of security that even cold wallets can’t provide, as funds remain protected against hacking and loss.

Earn passive income with Gemini Earn, but monitor APY fluctuations. While many traders overlook Gemini Earn, it allows you to earn interest on crypto holdings. However, interest rates change frequently, and returns can drop unexpectedly. A smart move is to compare Gemini Earn’s APY with competitors and adjust your holdings accordingly to maximize returns.

Leverage Gemini’s dollar-backed GUSD for seamless crypto-to-fiat moves. Unlike Tether (USDT), Gemini’s GUSD is audited monthly and fully backed by USD reserves. Using GUSD within Gemini allows for near-instant transfers between crypto and fiat without the risks associated with unverified stablecoins.

Financial impact and market reactions

The Winklevoss twins' investments have influenced the broader crypto market, particularly during Bitcoin bull runs. Their public endorsements of digital assets have driven adoption, and their strong regulatory focus has helped build institutional trust in cryptocurrency. However, like all crypto investors, they have faced challenges during market downturns and regulatory changes.

Winklevoss cryptocurrency strategy

The Winklevoss twins built their crypto empire with a calculated approach, using strategies that go beyond simple buy-and-hold investing. Here are some key takeaways for beginners who want to follow in their footsteps.

Build conviction by studying regulatory trends. Unlike most traders who only watch price charts, the Winklevoss twins focus on long-term regulatory developments. Gemini, their exchange, was among the first to get a trust charter from the New York Department of Financial Services, giving it a regulatory edge. Beginners should follow legal updates from agencies like the SEC and CFTC because knowing where regulations are headed can help predict which coins will thrive or struggle.

Allocate part of your portfolio to crypto infrastructure. Instead of just holding Bitcoin and Ethereum, the Winklevoss strategy includes investing in blockchain infrastructure. They backed companies like BlockFi and Tezos, knowing that as crypto adoption grows, demand for infrastructure will skyrocket. Beginners can apply this by looking into tokens linked to DeFi, Layer 2 scaling, and Web3 development instead of just mainstream cryptocurrencies.

Use stablecoins strategically to protect capital. The Winklevoss twins launched Gemini Dollar (GUSD) to integrate stability into crypto markets. Instead of keeping funds in fiat or volatile assets, they use stablecoins as a flexible bridge between investments. Beginners should consider using regulated stablecoins for yield farming, liquidity pools, or as a hedge during market downturns instead of sitting on unstable assets.

Leverage the power of branding in crypto. The Winklevoss twins didn’t just build Gemini as an exchange — they built a brand known for trust and compliance. In crypto, credibility matters. Whether you’re launching a project, investing in NFTs, or trading, focus on assets that have strong community trust and institutional backing. Beginners should research projects not just by their tech, but by their leadership, transparency, and how well they communicate with the public.

Future outlook: What’s next for the Winklevoss twins in crypto?

What’s next for the Winklevoss Twins in crypto? Their strategy is shifting toward decentralized finance, Bitcoin ETFs, and regulatory battles that could reshape the industry.

Pushing for Bitcoin ETF approval. The Winklevoss Twins were among the first to apply for a Bitcoin ETF in 2013, but regulators blocked their efforts. With Bitcoin ETFs now gaining traction, expect them to re-enter the race aggressively. If they succeed, Gemini could capture a major slice of the institutional investment market, pushing its valuation significantly higher.

Expanding Gemini’s reach beyond the U.S. Regulations have been a major hurdle for Gemini, but the twins are now focusing on global expansion. They’ve already launched Gemini Earn in select countries despite SEC crackdowns and are eyeing jurisdictions with clearer crypto rules, such as Singapore and the UAE.

Investing heavily in DeFi and Web3. Instead of just running an exchange, the Winklevoss Twins are quietly backing decentralized finance projects that challenge traditional banking. They’ve invested in platforms that integrate AI with blockchain, focusing on automated trading and decentralized lending.

Building a Bitcoin-first financial ecosystem. Unlike exchanges that promote altcoins for short-term gains, Gemini remains Bitcoin-focused. The twins are pushing for Bitcoin-based payment solutions, including partnerships with companies that enable BTC payroll and lending options for businesses looking to hold crypto on their balance sheets.

Winklevoss twins focus on Bitcoin infrastructure and AI-powered DeFi

The Winklevoss Twins don’t just invest in crypto — they shape its future. Instead of spreading funds across countless altcoins, they focus on Bitcoin-first strategies and infrastructure plays. They’ve consistently backed projects that reinforce BTC’s dominance, like mining operations, Bitcoin-based financial products, and Layer 2 scaling solutions. This approach sets them apart from typical venture capitalists chasing short-term gains. If you’re looking to mirror their strategy, focus on Bitcoin’s ecosystem rather than speculative tokens.

Beyond Bitcoin, the twins are quietly betting on the next wave of decentralized finance and Web3. They’re funding AI-powered DeFi platforms that automate lending, trading, and asset management, removing the need for middlemen. They’re also investing in NFT and metaverse projects that integrate financial tools, rather than just digital collectibles. If you want to stay ahead, follow their lead — look for projects that blend crypto, AI, and real-world finance instead of just riding hype cycles.

Conclusion

The Winklevoss brothers have cemented themselves as pioneers in the crypto space, with a well-diversified portfolio and a focus on regulation and long-term growth. Their commitment to Bitcoin, Ethereum, and blockchain startups continues to shape the future of the digital asset industry. While challenges like market volatility and regulatory scrutiny persist, their influence remains strong, making them key figures in the evolution of cryptocurrency.

FAQs

What cryptocurrencies are in the Winklevoss crypto portfolio?

Bitcoin (BTC), Ethereum (ETH), Gemini Dollar (GUSD), various DeFi projects, and NFT investments.

How much is the Winklevoss crypto portfolio worth?

Estimates suggest their Bitcoin holdings alone are worth billions, but the total portfolio value fluctuates with the market.

What is Winklevoss Capital?

It is the twins’ investment firm that funds blockchain startups, DeFi projects, and tech innovations.

What cryptocurrency does Gemini own?

Gemini holds Bitcoin, Ethereum, Gemini Dollar (GUSD), and several altcoins to maintain market liquidity and trading functionality.

Related Articles

Team that worked on the article

Rinat Gismatullin is an entrepreneur and a business expert with 9 years of experience in trading. He focuses on long-term investing, but also uses intraday trading. He is a private consultant on investing in digital assets and personal finance. Rinat holds two degrees in Economy and Linguistics.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

Ethereum is a decentralized blockchain platform and cryptocurrency that was proposed by Vitalik Buterin in late 2013 and development began in early 2014. It was designed as a versatile platform for creating decentralized applications (DApps) and smart contracts.

Forex leverage is a tool enabling traders to control larger positions with a relatively small amount of capital, amplifying potential profits and losses based on the chosen leverage ratio.

Yield refers to the earnings or income derived from an investment. It mirrors the returns generated by owning assets such as stocks, bonds, or other financial instruments.