Best Crypto Tax Software in 2025

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

OKX - Best crypto exchange for 2025 (United States)

For the best crypto tax software in 2024, consider the following options:

- Koinly: Simplified tax reporting for crypto transactions

- TurboTax Premium: Seamless integration with tax filing

- CoinTracker: Comprehensive tracking and tax reporting

- ZenLedger: Easy tax calculation and TurboTax integration

- TokenTax: Accurate tax calculations and multiple integrations

- TaxSlayer: Minimal help with efficient tax filing

- H&R Block: Simplified tax preparation with expert assistance

As cryptocurrencies continue to gain mainstream adoption, understanding the tax implications can feel overwhelming. With a growing number of transactions, wallets, and DeFi protocols to consider, finding the best crypto tax software in 2024 is crucial. This software can save you time and frustration by automating data import, ensuring accurate calculations, and even helping you optimize your tax bill. Let's explore some of the top contenders in the crypto tax software arena and find the perfect fit for your needs.

Best crypto tax software review

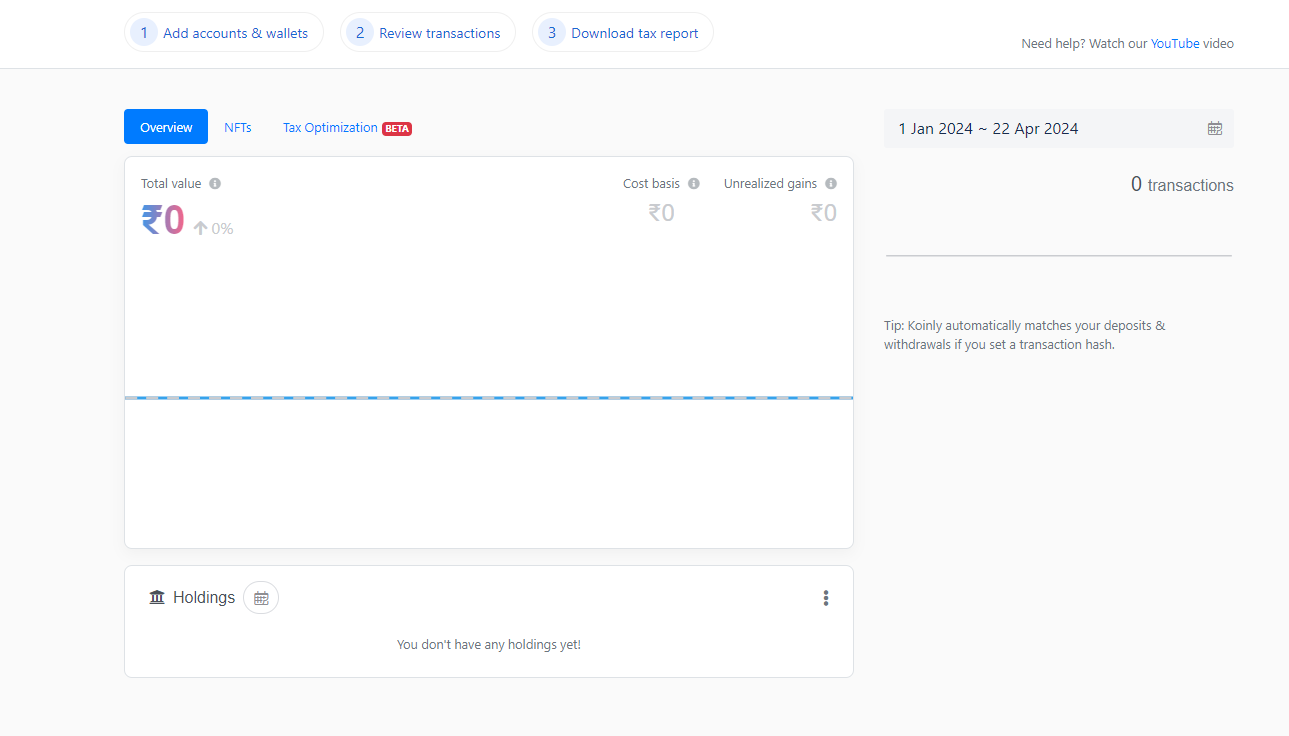

Koinly

Koinly offers a user-friendly interface suitable for beginners. Its extensive free version provides tax reports and supports up to 10,000 transactions. With generic tax reports available for 34 countries and support for various cost-basis methods, Koinly caters to a global audience. US customers benefit from seamless integration with tax filing software like TurboTax and TaxACT. Koinly supports over 20,000 cryptocurrencies, multiple exchanges, wallets, and blockchains, including compatibility with DeFi and futures trading. Notable features include error reconciliation tools and basic NFT support for popular blockchains. The annual subscription costs range from $49 for 100 transactions to $279 for more than 10,000, making it accessible for users with different transaction volumes.

Best for: Beginner-friendly interface and seamless tax reporting for global users.

Koinly dashboard

Koinly dashboardTurboTax Premium

TurboTax Premium is a tax preparation software offered by a leading company in the industry. It caters to individuals looking to report their cryptocurrency transactions, particularly those with complex tax situations. The software features a user-friendly interface, helpful tooltips, easy navigation, and access to customer support services. Notably, TurboTax Premium allows users to import their crypto sales data directly into the software from third-party crypto accounts for accurate tax filing. It is the only crypto tax product that offers filing of the full tax return directly through its platform. Cost for this platform is $129, including tax filing services.

Best for: Individuals with complex tax situations seeking easy tax filing capabilities.

CoinTracker

CoinTracker is a versatile crypto tax software that allows users to track their cryptocurrency transactions across multiple platforms in one convenient location. With a user-friendly interface, it offers tax reporting on trades, which can be uploaded into popular tax preparation software like TurboTax and TaxAct. CoinTracker stands out for its free tier, offering essential features such as tax reports, auto-sync with unlimited exchanges and wallets, and basic portfolio tracking for users with up to 25 transactions. It supports over 300 exchanges and 8,000 cryptocurrencies, with the ability to connect to tax filing platforms for seamless e-filing in the US. Country-specific tax support is available for several countries, and users can share their tax reports with professionals for further guidance. Pricing is transaction-based, starting at $59 annually for up to 100 transactions, with higher tiers available for larger transaction volumes.

Best for: Individuals with up to 25 transactions seeking a free tier option for basic tax reporting.

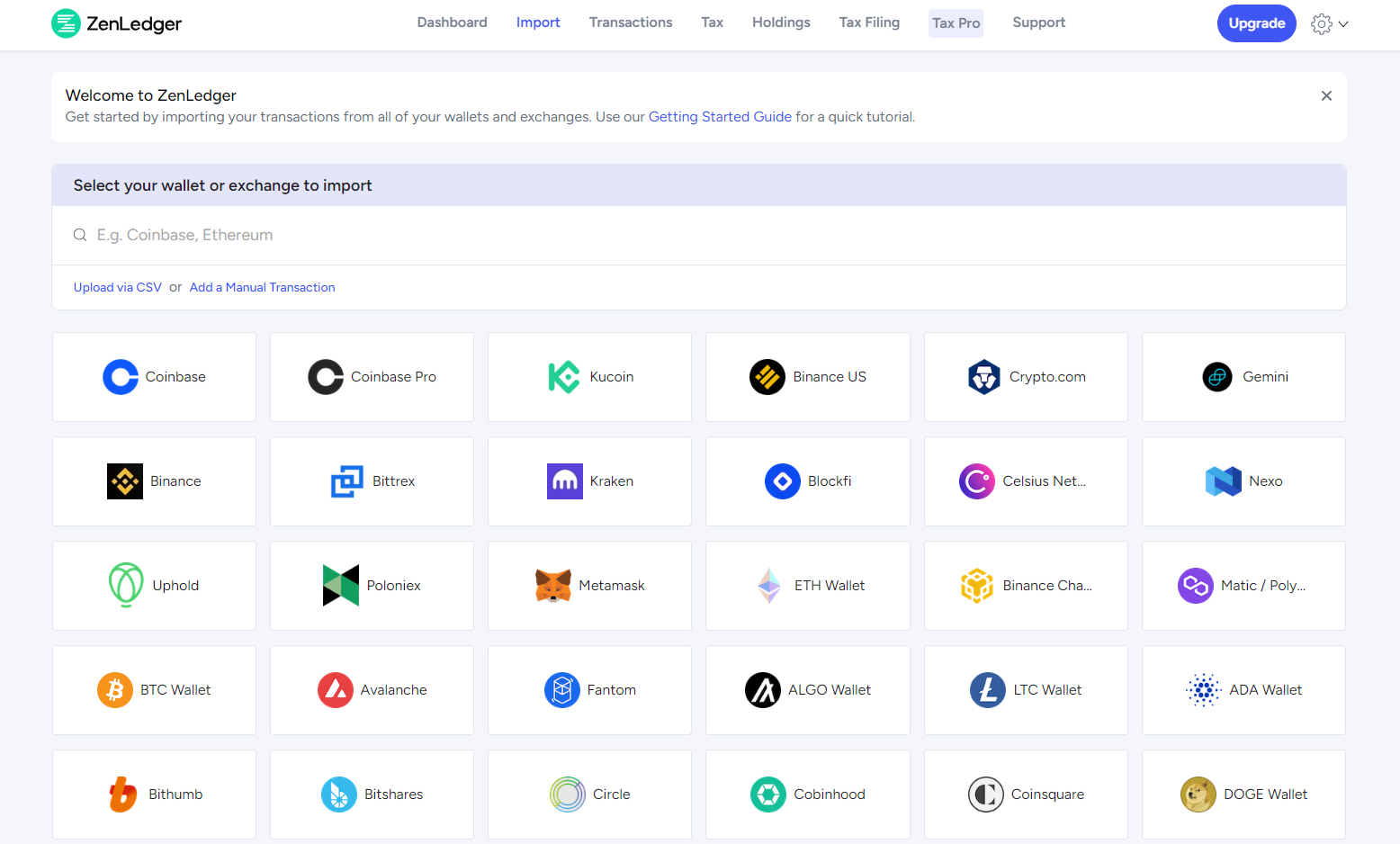

ZenLedger

ZenLedger is a straightforward and effective platform for calculating cryptocurrency, DeFi, and NFT-related taxes. It seamlessly integrates with TurboTax, making it a suitable choice for individuals familiar with the platform. Supported by significant funding and positive reviews, ZenLedger offers robust support for over 400 exchanges, 50 blockchains, and 100 DeFi and NFT protocols. It imports transaction history from exchanges and automatically populates tax documents, including capital gains, donations, and income from cryptocurrencies. ZenLedger's IRS-friendly reports can be submitted directly or used alongside other tax reporting solutions. It offers various pricing tiers based on transaction volumes, ranging from $49 to $999 per tax year.

Best for: Users seeking seamless integration with TurboTax and support for a wide range of exchanges and protocols.

Available cryptocurrency wallets in ZenLedger

Available cryptocurrency wallets in ZenLedgerTokenTax

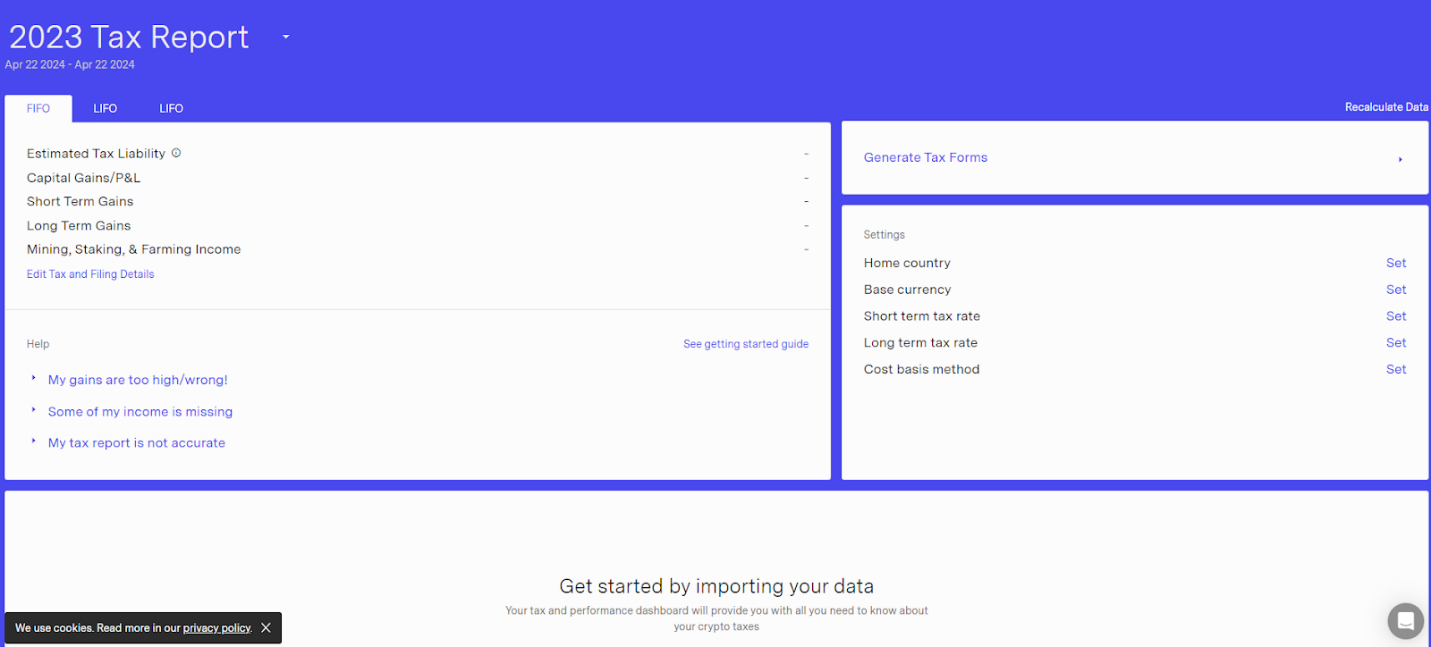

TokenTax is a comprehensive crypto tax software that caters to a wide range of users, from novice to advanced traders. It syncs with all wallets and accounts, streamlining data entry and analysis. With support for DeFi, NFT, margin, and futures trading, TokenTax offers FIFO, LIFO, Minimization, and average cost tax liability calculations, along with tax loss harvesting features and customized enterprise reports. While it lacks a free trial, TokenTax provides an intuitive interface and the option to file taxes independently or with assistance from crypto-savvy tax professionals. Pricing starts at $65 per tax year for up to 500 transactions, with higher tiers offering additional features and transaction limits.

Best for: Individuals and businesses requiring comprehensive tax reporting and support for advanced trading strategies.

TokenTax dashboard

TokenTax dashboardTaxSlayer

TaxSlayer offers a straightforward approach to tax filing, catering to individuals who prefer minimal assistance. Its software streamlines the process, allowing users to access relevant sections directly without unnecessary interview screens. While it lacks synchronization with bank and brokerage accounts, TaxSlayer provides personalized tax guidance and offers one of the most affordable options for complex tax situations. Active-duty military personnel can file federal tax returns for free, and there's an option to upgrade for professional tax advisor assistance. Additional features include audit defense and identity protection services for added peace of mind. The Classic package costs $37.95, with an additional $44.95 for state returns.

Best for: Individuals seeking affordable tax filing solutions with minimal assistance.

H&R Block

H&R Block simplifies tax preparation with its user-friendly interface, providing clear instructions and explanations through interview-style questions. It offers various options, from DIY preparation with expert review to full-service filing by a virtual tax pro. This flexibility makes it suitable for users who prefer to file independently but want access to professional help if needed. The Deluxe package, priced at $54.99 for federal returns and $44.99 per state, allows for itemized deductions, health savings account contributions, and freelance income reporting.

Best for: Individuals looking for a user-friendly tax software with options for both DIY and professional assistance.

| Crypto tax software | Cost | Can help with (Tax declaration, Personal analysis, etc) | Available in countries |

|---|---|---|---|

| Koinly | $49 | Beginner-friendly interface and seamless tax reporting for global users | Over 20 countries, including the U.S., Australia, and Canada |

| TurboTax Premium | $129 | Individuals with complex tax situations seeking comprehensive tax filing capabilities | Available in the United States, Australia, Canada, and the UK |

| CoinTracker | $59 | Individuals with up to 25 transactions seeking a free tier option for basic tax reporting | Available in over 100 countries worldwide |

| ZenLedger | $49 | Users seeking seamless integration with TurboTax and support for a wide range of exchanges and protocols | Available globally with support for nearly 150 currencies |

| TokenTax | $65 | Individuals and businesses require comprehensive tax reporting and support for advanced trading strategies | Available in many countries including the United States |

| TaxSlayer | $37.95 | Individuals seeking affordable tax filing solutions with minimal assistance | Available in multiple countries, including the USA |

| H&R Block | $44.99 | Individuals looking for a user-friendly tax software with options for both DIY and professional assistance | Available in multiple countries, including the USA |

What is crypto tax software?

A Crypto tax software simplifies the process of calculating and filing taxes related to cryptocurrency transactions for individuals and businesses. These transactions include buying and selling cryptocurrencies, receiving rewards from staking or mining, making purchases with cryptocurrencies, and exchanging one cryptocurrency for another. The software typically integrates with popular cryptocurrency exchanges and wallets to import transaction data automatically, track performance, and generate tax reports. It may also identify opportunities for tax optimization, like tax loss harvesting.

As governments worldwide increase scrutiny on crypto-related income, traders now have to focus more on choosing the right software for compliance and avoiding costly mistakes or audits. Tax regulations vary widely between countries, with some having detailed frameworks for different asset classes and others adopting a broader approach. Keeping accurate records and staying informed about tax laws is essential for traders, miners, and enthusiasts alike.

Top 3 crypto exchanges

Why use crypto tax software?

Using a crypto tax software offers several key benefits that make it a valuable tool for managing cryptocurrency taxes effectively. Here are the main advantages: time-saving, efficiency, cost-effectiveness, reduced risk of penalties.

Time-saving

Crypto tax software automates many tedious and time-consuming tasks associated with tax preparation, such as importing transaction data, calculating gains and losses, and generating tax forms. This automation saves users a significant amount of time and effort.

Reduced risk of penalties

TU expert Oleg Pylypenko has observed that by accurately calculating taxes, identifying deductions, and ensuring compliance with tax laws, crypto tax software helps users minimize errors that could lead to penalties. They provide accurate and up-to-date tax calculations, reducing the risk of mistakes that could result in penalties or audits.

Efficiency

Crypto tax software is designed to be consistent and accurate, using algorithms to calculate tax obligations based on the latest tax laws. This consistency reduces the risk of human error, making it particularly beneficial for those with high transaction volumes or frequent trading activities.

Cost-effective

Compared to hiring an accountant, using a crypto tax software is generally more cost-effective. It can save users money in the long run by helping them avoid costly errors, penalties, and the high fees associated with hiring a professional accountant.

Accuracy

Even a single mistake in your crypto tax calculations can lead to trouble with the taxman. Crypto tax software helps minimize errors by automating calculations and ensuring your crypto tax reports are accurate.

Tax optimization features

Some crypto tax software offer features like tax loss harvesting identification. This can help you strategically sell crypto at a loss to offset capital gains and potentially reduce your overall tax liability.

How is crypto taxed around the world in 2024?

In the United States, cryptocurrencies are classified as property by the Internal Revenue Service (IRS), subjecting them to taxation as either Capital Gains Tax or Income Tax. When an individual buys, sells, or exchanges cryptocurrencies, they trigger taxable events, but no tax is incurred when simply holding or transferring crypto between wallets. Gifts of cryptocurrency are generally tax-free, although exceeding certain thresholds may require additional reporting.

The tax rates on crypto gains in the US depend on various factors, including the duration of asset holding and the individual's income tax bracket. Short-term capital gains, generated from assets held for less than a year, are taxed at rates aligned with the taxpayer's ordinary income tax bracket, ranging from 10% to 37%. In contrast, long-term capital gains, arising from assets held for over a year, are subject to reduced tax rates of 0%, 15%, or 20%, depending on the taxpayer's income level.

Australia, like the US, treats cryptocurrencies as property and subjects them to Capital Gains Tax or Income Tax. Individuals in Australia are taxed based on the duration of asset holding and their income tax brackets. Capital gains from cryptocurrencies are eligible for a 50% discount if held for over a year. Losses can be carried forward indefinitely to offset future gains, offering taxpayers a means to mitigate their tax liabilities over time.

In the United Kingdom, cryptocurrency taxation aligns with the treatment of property, with Capital Gains Tax or Income Tax applied to gains derived from digital assets. The UK offers tax-free allowances for capital gains up to specific thresholds, with rates varying based on the taxpayer's income level. Similarly, Canada views cryptocurrencies as commodities, subjecting them to Capital Gains Tax or Income Tax based on the individual's tax bracket and the duration of asset holding.

How to choose the best crypto tax software?

To choose the best crypto tax software you need to follow these steps:

Identify your needs

Firstly, take some time to consider what exactly you need from a crypto tax software. Think about how complex your crypto portfolio is and how many different exchanges, wallets, and blockchain addresses you use. Understanding your specific requirements will help you narrow down your options and find the software that best fits your needs.

Determine the complexity of your portfolio and the number of exchanges, wallets, and blockchain addresses you need to track. The more comprehensive your portfolio is, the more robust the software you'll require to manage it effectively.

Check compatibility

Before making a decision, it's important to ensure that the crypto tax software you're considering is compatible with the tax regulations in your country. Different countries have different tax laws when it comes to cryptocurrency, so you'll want to make sure that the software you choose can generate reports that align with the specific requirements of your country's tax authorities.

Importing capabilities

One of the most important features to look for in crypto tax software is the ability to automatically import transaction data from your exchanges, wallets, and blockchains. Manually entering all of your transactions can be time-consuming and prone to errors, so choosing software that can streamline this process for you will save you a lot of time and hassle in the long run.

Dedicated customer support

Even with the most user-friendly software, you may still encounter questions or issues along the way. That's why it's important to choose a crypto tax software that offers dedicated customer support. Whether you have a technical question or need assistance with a particular feature, having access to knowledgeable support staff can make all the difference.

Review features

Not all crypto tax software are created equal, so it's essential to carefully review the features offered by each option before making a decision. Some key features to look for include the ability to calculate gains, report tax-free coins, and provide suggestions for tax optimization.

Integration capabilities

If you use tax filing services like TurboTax, you'll also want to consider whether the crypto tax software you're considering integrates with these services. Integration capabilities can streamline the tax filing process by allowing you to easily transfer your data from your crypto tax software to your tax filing software.

Security and data protection

When dealing with sensitive financial information like cryptocurrency transactions, security is a non-negotiable concern. Be sure to choose a crypto tax software that employs robust security measures to protect your data from hackers and other threats.

Value for money

Consider the pricing model of the crypto tax software you're considering and whether it offers good value for your money. While it's essential to choose software that meets your needs in terms of features and functionality, you'll also want to make sure that you're getting a fair price for what you're getting.

Ease of use

Finally, consider the ease of use of the crypto tax software options. Tax reporting can be complicated enough without having to navigate through a clunky or confusing interface, so choose software that offers an intuitive user experience and simple workflows.

Expert Opinion

I am sure that cryptocurrency tax software provides an easy solution for individuals and businesses dealing with crypto taxation. Beyond the basic features of tracking transactions and generating tax reports, these platforms offer advanced functionalities that supercharge their utility. One such feature is scenario modeling, which allows users to simulate different tax scenarios based on their financial activities. By inputting various parameters such as buying, selling, and holding strategies, users can assess the tax implications of different scenarios before making actual transactions. Additionally, some platforms offer tax planning tools that provide personalized recommendations for minimizing tax liabilities. These tools analyze historical data and current tax laws to offer proactive tax-saving strategies tailored to individual circumstances. Moreover, integration with financial planning software enables users to incorporate crypto assets into their overall financial strategy seamlessly.

Conclusion

In conclusion, selecting the right crypto tax software helps in effectively managing cryptocurrency taxes. With the increasing complexity of tax regulations and the growing popularity of cryptocurrencies, these platforms offer invaluable assistance in accurately tracking transactions, calculating tax liabilities, and ensuring compliance with tax laws. CoinTracker, ZenLedger, and TokenTax are among the top contenders in this space, offering a range of features such as automatic transaction imports, tax optimization tools, and integration with popular tax filing services. By following a step-by-step guide to choose the best software and considering factors such as compatibility, features, security, and value for money, individuals and businesses can streamline their tax reporting process and mitigate the risk of costly errors or audits.

FAQs

What is a crypto tax software?

Crypto tax software is a tool designed to help individuals and businesses calculate and report taxes related to cryptocurrency transactions.

Can I do my own crypto taxes?

Yes, you can use crypto tax software to calculate and report your taxes on your own, but seeking professional advice may also be beneficial depending on your situation.

How do I get crypto tax information?

You can obtain crypto tax information by using specialized crypto tax software, which can automatically import transaction data from exchanges and wallets, calculate gains and losses, and generate tax reports.

Is sending crypto to another wallet taxable?

Sending crypto to another wallet is typically not taxable, as it is considered a transfer between your own wallets and does not involve a sale or exchange of cryptocurrency.

Related Articles

Team that worked on the article

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Xetra is a German Stock Exchange trading system that the Frankfurt Stock Exchange operates. Deutsche Börse is the parent company of the Frankfurt Stock Exchange.

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

Bitcoin is a decentralized digital cryptocurrency that was created in 2009 by an anonymous individual or group using the pseudonym Satoshi Nakamoto. It operates on a technology called blockchain, which is a distributed ledger that records all transactions across a network of computers.

A futures contract is a standardized financial agreement between two parties to buy or sell an underlying asset, such as a commodity, currency, or financial instrument, at a predetermined price on a specified future date. Futures contracts are commonly used in financial markets to hedge against price fluctuations, speculate on future price movements, or gain exposure to various assets.

Ethereum is a decentralized blockchain platform and cryptocurrency that was proposed by Vitalik Buterin in late 2013 and development began in early 2014. It was designed as a versatile platform for creating decentralized applications (DApps) and smart contracts.