Best Solana DEXs For Efficient Trading: Fees, Speed, And Liquidity

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Best Solana DEXs:

Solana is a high-performance blockchain optimized for decentralized finance (DeFi), with fast transaction speeds and low fees. These advantages have made it a popular platform for decentralized exchanges (DEX), providing fast and efficient trading. Unlike Ethereum, Solana offers a cheaper and more scalable solution, which attracts traders and developers. In this article, we will look at the best DEXs on Solana, compare them in terms of fees, speed, and liquidity. We will also analyze their key advantages, possible risks, and factors influencing the choice of a platform.

Best decentralized exchanges (DEXs) on Solana

The Solana blockchain has become a major hub for decentralized finance (DeFi), offering a range of decentralized exchanges (DEXs) that cater to different trading needs. Here’s a detailed look at the top DEXs on Solana as of 2025.

1. Orca

Orca is known for its simple and efficient trading experience. Launched in 2021, it has grown into one of the most popular DEXs on Solana.

Fair price indicator helps users execute trades at better prices, reducing the risk of bad swaps.

Whirlpools allow liquidity providers to concentrate their funds in specific price ranges, increasing their earnings.

Orca has maintained a strong market presence with billions in weekly trading volume, making it one of the top choices for both new and experienced traders.

2. Raydium

Raydium combines an automated market maker (AMM) model with an order book system, giving traders deep liquidity and fast execution.

AMM and order book integration provides users with the benefits of both liquidity pools and traditional trading tools.

Yield farming and staking offer passive income opportunities through liquidity provision and staking rewards.

AcceleRaytor launchpad helps launch new crypto projects, allowing early investment opportunities.

Raydium continues to play a major role in Solana’s DeFi ecosystem, with strong trading volume and liquidity.

3. Jupiter

Jupiter is a liquidity aggregator that sources liquidity from multiple DEXs to give users the best swap rates.

Optimal trade routing finds the most efficient trading paths, reducing slippage and improving execution.

Wide token support provides access to a large range of cryptocurrencies for trading.

With billions in total value locked and consistent trading volume, Jupiter is one of the key platforms for liquidity aggregation on Solana.

4. Meteora

Meteora focuses on algorithmic liquidity management and optimized yield strategies.

Algorithmic liquidity provision uses smart tools to manage liquidity efficiently, ensuring stable returns for liquidity providers.

Yield optimization gathers liquidity from different sources to maximize earnings.

Meteora has established itself as an important player in DeFi, offering a structured approach to liquidity management.

5. Lifinity

Lifinity is a concentrated liquidity DEX that improves capital efficiency by lowering slippage and offering better prices for traders.

Concentrated liquidity lets liquidity providers focus funds within specific price ranges for better efficiency.

Lower slippage ensures better execution for trades, reducing losses due to market fluctuations.

Lifinity has gained traction as a reliable platform for efficient trading strategies.

These platforms help shape Solana’s DeFi space by providing better access to liquidity, smoother trade execution, and innovative ways to earn. Traders benefit from efficient routing, low-cost transactions, and deep liquidity. Liquidity providers gain access to tools that improve capital efficiency and maximize rewards.

How to choose the best DEX on Solana

Selecting a decentralized exchange (DEX) on Solana requires evaluating several factors to ensure secure and efficient trading of digital assets.

Platform security and reliability

A DEX should have robust security measures, including regular smart contract audits and transparent security protocols. For example, Raydium is a leading Solana DEX known for integrating with Serum and utilizing an automated market maker (AMM), which enhances both security and trading efficiency.

Liquidity depth

High liquidity ensures fast order execution with minimal slippage. DEX platforms with deep liquidity pools allow traders to execute large transactions without significant price fluctuations. Raydium, for instance, offers deep liquidity through its integration with the OpenBook central limit order book.

Available trading pairs

A wide selection of supported tokens gives traders more flexibility when diversifying their portfolios. DEX platforms with extensive trading pairs allow users to explore different market opportunities. Raydium supports numerous trading pairs, making it an attractive option for various trading strategies.

Staking and farming opportunities

Additional features like staking and yield farming allow users to generate passive income. Platforms offering these functionalities provide incentives for active participation. Raydium, for example, enables users to earn rewards by providing liquidity or staking RAY, the platform’s native token.

We also recommend that you check out the best DEX exchanges in the world:

| zondacrypto | BitcoinTry | Camelot | Uniswap V3 | AscendEX | OpenOcean | |

|---|---|---|---|---|---|---|

|

DEX |

Yes | Yes | Yes | Yes | Yes | Yes |

|

Min. Deposit, ₿ |

0,015 | No | No | No | 0,0001 | No |

|

Futures leverage |

Not supported | Not supported | Not supported | Not supported | 100 | Not supported |

|

Spot leverage |

1:1 | 1:1 | 1:1 | 1:1 | 1:25 | 1:1 |

|

Coins Supported |

70 | 59 | 137 | 282 | 435 | 1000 |

|

Withdrawal fee |

Up to 2,99% | Network fees apply | Network fees apply | No | 0,0005 BTC 0,005 ETH 10 USDT | No |

|

Staking |

Yes | Yes | Yes | Yes | Yes | Yes |

|

Yield farming |

Yes | No | Yes | No | Yes | Yes |

|

NFT |

Yes | No | No | Yes | No | No |

|

Open an account |

Open an account Your capital is at risk.

|

Study review | Study review | Study review | Open an account Your capital is at risk. |

Study review |

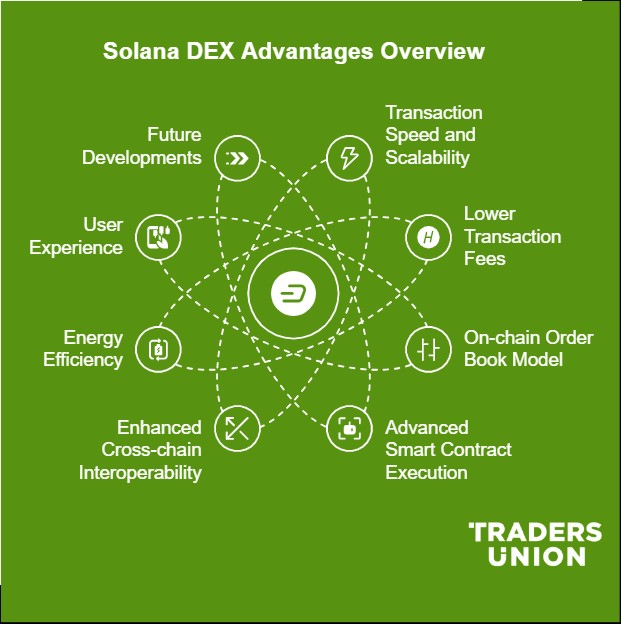

Advantages of Solana DEX over Ethereum and other blockchains

Decentralized exchanges (DEXs) built on Solana have several advantages over those on Ethereum and other blockchains. Solana’s unique network architecture, low fees, and high scalability make it an attractive choice for traders and liquidity providers. Here’s a detailed breakdown of why Solana DEXs stand out.

1. Transaction speed and scalability

Solana operates with a hybrid proof-of-stake (PoS) and proof-of-history (PoH) mechanism, allowing it to process over 65,000 transactions per second (TPS). Ethereum, in contrast, currently processes around 15-30 TPS on the base layer. Even with Ethereum’s layer 2 solutions, Solana’s single-layer architecture ensures consistent speed and minimal latency.

Fast order execution. Traders on Solana DEXs experience near-instant transaction settlements, reducing price fluctuations and slippage.

Scalability without congestion. Unlike Ethereum, where network congestion leads to slow transaction times, Solana’s high throughput keeps DEX operations smooth even during peak trading hours.

2. Lower transaction fees

Transaction fees on Solana are significantly lower than those on Ethereum. Solana’s average transaction cost is less than $0.0025, whereas Ethereum’s gas fees can range between $5 to $50 per transaction, depending on network congestion.

Affordable trading. Traders can execute multiple transactions without worrying about high costs, making Solana an ideal choice for high-frequency trading and arbitrage strategies.

Better returns for liquidity providers. Lower fees mean that liquidity providers (LPs) keep more of their earnings instead of losing a large portion to transaction costs.

3. On-chain order book model

Ethereum’s AMM-based DEXs like Uniswap rely on liquidity pools, which can result in impermanent loss for liquidity providers. Solana’s DEXs, such as Raydium and Serum, integrate on-chain order book models that offer several advantages.

More precise trade execution. Unlike AMMs that rely on slippage, order books allow traders to set specific buy and sell prices.

Lower spread and reduced slippage. The order book model enables traders to access deeper liquidity, leading to better price efficiency.

4. Advanced smart contract execution

Ethereum’s smart contracts run on Solidity, which, while widely used, has limitations in processing high-speed transactions. Solana uses Rust and C programming languages, allowing for more efficient execution of smart contracts.

Lower resource consumption. Solana smart contracts process transactions more efficiently without requiring high computational power.

Reduced risk of failed transactions. Unlike Ethereum, where failed transactions still incur gas fees, Solana transactions only execute when confirmed, eliminating unnecessary costs.

5. Enhanced cross-chain interoperability

Interoperability is becoming a key requirement in DeFi. Solana supports cross-chain bridges that allow assets to be transferred between blockchains, enhancing liquidity and usability.

Seamless asset transfer. Solana bridges enable users to move assets from Ethereum, Binance Smart Chain (BSC), and other blockchains with minimal cost and time.

Wider trading opportunities. Users can access a diverse range of assets beyond the Solana ecosystem, increasing trading volume and market depth.

How to trade on SolanaDEX: step-by-step guide

To trade on decentralized exchanges (DEXs) within the Solana ecosystem, follow these steps:

1. Install a Phantom or Solflare wallet

A compatible cryptocurrency wallet is required to interact with Solana-based DEX. Phantom and Solflare are among the most popular options, providing secure storage and seamless integration with decentralized applications.

Phantom: Visit the official Phantom website and install the browser extension. Create a new wallet by following the setup instructions. Store your recovery phrase securely, as it is essential for regaining access to your funds.

Solflare: Go to Solflare and choose between the web, browser extension, or mobile app. The setup process is similar — follow the instructions and ensure your recovery phrase is stored safely.

2. Fund your wallet with SOL tokens

To cover transaction fees on the Solana network, you need SOL tokens. You can buy SOL on centralized exchanges like KuCoin and transfer them to your Phantom or Solflare wallet. Ensure you have enough balance to process transactions smoothly.

3. Connect to a Solana DEX

After setting up and funding your wallet, you can connect to a Solana-based DEX. Here’s how to do it on Raydium:

Go to the official.

Click "Connect Wallet" in the top right corner.

Select Phantom or Solflare from the list of wallet options.

Confirm the connection request in your wallet interface.

Once connected, you can start trading.

4. Execute your first trade

To swap tokens on Raydium:

Navigate to the "Swap" section.

Select the token you want to swap and the token you wish to receive.

Enter the swap amount.

Review the trade details, including the exchange rate and transaction fees.

Click "Swap" and confirm the transaction in your wallet.

Transactions are completed within seconds due to Solana’s high-speed processing.

5. Provide liquidity for passive income

For users looking to earn rewards, liquidity provision is an option:

Go to the "Pools" section.

Select a liquidity pair you want to contribute to.

Deposit an equal value of both tokens into the liquidity pool.

Confirm the transaction in your wallet.

By providing liquidity, you earn a share of trading fees generated within that pool.

Future prospects of the Solana DEX ecosystem

The Solana decentralized exchange (DEX) ecosystem has grown significantly, establishing itself as a major player in decentralized finance. As of early 2025, Solana's DEXs have set new records in trading volume, liquidity, and user adoption. The future of this ecosystem depends on its ability to scale, innovate, and maintain security.

Current performance and market dominance

Trading volume growth. In late 2024, Solana’s DEX ecosystem recorded over $200 billion in monthly trading volume, the highest across any blockchain. However, trading activity fluctuated, with recent reports indicating a 94% decline from its peak, bringing volume down to $258 million per month.

Market position. Solana’s DEXs accounted for 50% of the total trading volume across decentralized exchanges at their peak. Despite high trading activity, the total value locked (TVL) on Solana DEXs was still lower than Uniswap’s, highlighting liquidity challenges.

Stablecoin supply increase. The amount of USDC on Solana grew fivefold over the past year, representing 80% of the network’s stablecoin market. This increase in stablecoin adoption strengthens Solana’s financial infrastructure.

Key trends shaping the future

Institutional interest. Large financial institutions, including Franklin Templeton, have started building financial products on Solana, boosting its credibility in traditional markets.

Cross-chain interoperability. Bridges between Solana and other blockchains are improving, making it easier for users to transfer assets and trade seamlessly across different networks.

Decentralized finance expansion. New DeFi applications, including liquidity aggregation, yield farming innovations, and lending platforms, are being developed on Solana to attract more users.

Avoid costly mistakes when trading on Solana DEXs

If you're using a Solana DEX, don’t just go for the one with the lowest fees — look at how much liquidity is available for the token you’re trading. Many new traders assume that low fees mean better profits, but if you place a big order in a low-liquidity pool, you could end up paying more due to slippage. Before you trade, check the bid-ask spread and market depth to see how much price movement your order will cause. Orca and Jupiter usually have deeper liquidity for big pairs, but if you’re trading lesser-known tokens, Meteora or Lifinity might actually give you a better price, even with slightly higher fees.

Another mistake beginners make is placing a big order all at once on a single exchange. If the order is too large, it moves the price and causes you to lose money on slippage. Instead, break the trade into smaller chunks and place them on different platforms. Jupiter does this automatically, spreading your order across multiple DEXs so you get a better overall price. If you’re using Raydium or Orca, try manually breaking your trade into smaller parts and executing them at different times or on different platforms. This small change can save you a lot of money over time.

Methodology for compiling our ratings of crypto exchanges

Traders Union applies a rigorous methodology to evaluate crypto exchanges using over 100 quantitative and qualitative criteria. Multiple parameters are given individual scores that feed into an overall rating.

Key aspects of the assessment include:

-

User reviews. Client reviews and feedback are analyzed to determine customer satisfaction levels. Reviews are fact-checked and verified.

-

Trading instruments. Exchanges are evaluated on the range of assets offered, as well as the breadth and depth of available markets.

-

Fees and commissions. All trading fees and commissions are analyzed comprehensively to determine overall costs for clients.

-

Trading platforms. Exchanges are assessed based on the variety, quality, and features of platforms offered to clients.

-

Extra services. Unique value propositions and useful features that provide traders with more options for yield generation.

-

Other factors like brand popularity, client support, and educational resources are also evaluated.

Conclusion

Solana’s DEX ecosystem offers a variety of platforms tailored to different trading needs. Jupiter excels as a liquidity aggregator, ideal for traders seeking the best swap rates, while Raydium provides deep liquidity and AMM functionality for more active participants. Orca stands out with its user-friendly interface and low fees, making it suitable for beginners. To trade securely, users should choose platforms with audited smart contracts, verify liquidity depth, and remain cautious of high-risk projects. Keeping funds in a trusted non-custodial wallet like Phantom or Solflare enhances security. By considering these factors, traders can efficiently navigate Solana DEX while minimizing risks.

FAQs

What is the best way to assess the reliability of a DEX on Solana?

Before trading, check smart contract audits, past vulnerabilities, and total value locked (TVL). Blockchain analytics platforms provide insights into platform security and potential risks.

How can traders avoid high volatility when using a DEX?

Use stable trading pairs with pegged assets or apply partial profit-taking strategies. Setting limit orders (if supported) helps control entry and exit points to minimize price fluctuations.

What additional passive income opportunities are available on DEX?

Beyond standard liquidity provision, traders can use automated yield farming strategies or dynamic asset management, which reallocates funds to pools with the highest returns.

What are the risks of long-term asset storage in liquidity pools?

Key risks include impermanent loss due to price shifts and potential protocol rule changes. Before adding funds, review the pool mechanics and possible scenarios that may reduce profitability.

Related Articles

Team that worked on the article

Maxim Nechiporenko has been a contributor to Traders Union since 2023. He started his professional career in the media in 2006. He has expertise in finance and investment, and his field of interest covers all aspects of geoeconomics. Maxim provides up-to-date information on trading, cryptocurrencies and other financial instruments. He regularly updates his knowledge to keep abreast of the latest innovations and trends in the market.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Diversification is an investment strategy that involves spreading investments across different asset classes, industries, and geographic regions to reduce overall risk.

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

Yield refers to the earnings or income derived from an investment. It mirrors the returns generated by owning assets such as stocks, bonds, or other financial instruments.

Forex leverage is a tool enabling traders to control larger positions with a relatively small amount of capital, amplifying potential profits and losses based on the chosen leverage ratio.

Trade execution is knowing how to place and close trades at the right price. This is the key to turning your trading plans into real action and has a direct impact on your profits.