dYdX Review: Key Insights

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

dYdX is a decentralized exchange (DEX) on Ethereum, specializing in perpetual contracts with up to 25x leverage. Unlike traditional exchanges, it lets you fully manage your assets without intermediaries. The platform uses Layer-2 technology to reduce gas fees and speed up transactions, making it ideal for frequent traders. It also offers margin trading, staking, and yield farming, with a focus on governance through its DYDX token.

dYdX is a decentralized exchange (DEX) built on the Ethereum blockchain, specializing in perpetual contracts and margin trading. Owing to its decentralized nature, users can trade cryptocurrencies without the need for intermediaries, ensuring complete control over their funds. It integrates advanced financial products such as perpetual contracts, which enable users to trade with leverage up to 25x, and supports features like spot trading, lending, and borrowing.

What is dYdX?

dYdX has rapidly gained popularity for its advanced trading capabilities. Unlike traditional centralized exchanges, dYdX empowers users with complete control over their funds while offering sophisticated financial products like perpetual contracts, margin trading, and more.

The platform leverages Layer-2 scaling technology via StarkWare, reducing gas fees and transaction times, which enhances the trading experience. dYdX's governance is driven by its native token, DYDX, which is used for voting on protocol upgrades and improvements, as well as for staking and earning rewards.

In essence, dYdX combines the security and decentralization of blockchain technology with sophisticated trading tools typically found on centralized platforms, making it a popular choice among experienced traders looking for a non-custodial trading environment.

When compared to centralized exchanges (CEXs), dYdX offers greater control and privacy but lacks the broad asset selection of centralized exchanges.

Key features of dYdX

Perpetual contracts. dYdX allows trading perpetual contracts without owning the underlying asset. Traders can go long or short with leverage up to 25x.

Layer-2 scaling. Integration with StarkWare’s Layer-2 solution enables gasless trading, reducing costs and improving speed.

Non-custodial trading. Users maintain full control over their assets, with trades executed directly from their wallets.

Product offerings:

Perpetual trading. Offers a wide range of trading pairs with high leverage.

Margin trading. Borrow assets to trade with leverage, using collateral to secure loans.

Staking and yield farming. Earn rewards by staking DYDX tokens or providing liquidity.

Supported assets: dYdX supports various trading pairs, including popular ones like ETH/USDC, BTC/USDC, and others. The platform regularly updates its asset list based on community votes and market demand.

Step-by-step guide to using dYdX

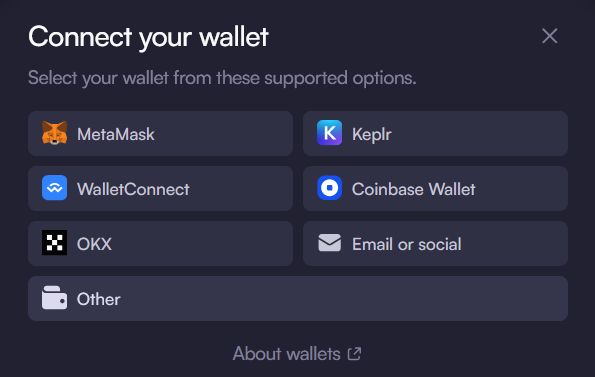

Creating an account. dYdX does not require traditional account creation. Instead, you connect your wallet (like MetaMask, Ledger, or Trezor) directly to the platform. This ensures that you retain control over your private keys, enhancing security and privacy.

Navigating the interface. The dYdX platform offers a user-friendly dashboard with sections for your portfolio, open positions, and market data. Traders can easily switch between perpetual trading, margin trading, and staking options.

Placing your first trade:

Deposit funds. Transfer USDC or any ERC-20 token to your dYdX account.

Open a position. Choose the market (e.g., ETH/USDC) and set your leverage. Use the “Limit” or “Market” order type based on your trading strategy.

Monitor and adjust. Keep an eye on your position using the positions tab. Adjust leverage or close positions as needed.

Withdrawing funds. Withdrawing funds is straightforward. Go to the portfolio section, select the asset, and specify the amount. Note that you’ll need to cover gas fees, which can vary based on network congestion.

Detailed platform analysis

Trading features:

Perpetual contracts. These contracts allow you to speculate on asset prices without expiration dates, making them ideal for both short-term and long-term strategies.

Leverage options. Traders can use leverage up to 25x, but it's crucial to use it cautiously due to the amplified risks.

Fees and costs. dYdX operates on a maker-taker fee model. For most users, the fee is 0.05% for makers and 0.1% for takers. There are no fees for deposits or withdrawals, but users must cover gas costs. Staking DYDX tokens can reduce trading fees by up to 50%.

Security measures. Smart contracts on dYdX have been audited by top security firms, and the platform offers extensive documentation and transparency. Users are encouraged to use hardware wallets for added security.

Governance and DYDX token. The DYDX token plays a key role in the platform's governance. Token holders can propose and vote on changes to the protocol, such as adding new trading pairs or modifying fees.

Staking and yield farming opportunities. Users can stake DYDX tokens to earn rewards and participate in governance. Staking pools are available, providing passive income opportunities.

NFT integration and rewards

dYdX has introduced the Hedgies NFT collection, which offers unique benefits like trading fee discounts and exclusive community perks. Each NFT is tied to specific achievements and milestones on the platform, making them more than just collectibles.

Liquidity and trading volume

The liquidity on dYdX is comparable to top centralized exchanges, thanks to its innovative market maker partnerships and active community of traders. This ensures minimal slippage and tight spreads, even for large orders.

dYdX for traders

dYdX For beginners

Getting started safely. Beginners should start with small trades to get familiar with the platform's interface and trading mechanics. dYdX Academy offers a range of tutorials and resources to help new users understand trading concepts and strategies.

Understanding risks and leverage. Leverage can significantly increase potential profits but also magnify losses. Beginners should use minimal leverage and always set stop-loss orders to manage risk.

Educational resources. dYdX Academy provides in-depth guides and videos on topics like order types, leverage, and risk management.

dYdX for advanced traders

Advanced trading strategies. Advanced traders can utilize complex strategies like hedging, scalping, and automated trading using dYdX’s API. The platform’s integration with TradingView also allows for advanced technical analysis.

Portfolio management. The portfolio tab provides a detailed overview of your holdings, positions, and performance metrics, enabling effective portfolio management and strategy adjustments.

Using dYdX APIs and integrations. dYdX’s API allows for automated trading and integration with third-party analytics tools, providing advanced traders with the tools they need for high-frequency and algorithmic trading.

Pros and cons of dYdX

- Pros:

- Cons:

- Full control over funds without intermediaries.

- Competitive fees and zero gas costs on Layer-2.

- High leverage options and diverse trading pairs.

- Complex interface may be challenging for beginners.

- Limited asset offerings compared to some centralized exchanges.

- Restrictions for US users due to regulatory concerns.

Risks and warnings

Market volatility. Cryptocurrency markets are highly volatile, and using leverage can result in substantial losses.

Regulatory risks. The evolving regulatory environment could impact dYdX’s operations, especially in jurisdictions with strict crypto regulations.

Custodial risks. While dYdX is non-custodial, users must manage their private keys securely to avoid loss of funds.

Security concerns and protocol risks. Although dYdX has robust security measures, users should be aware of potential smart contract vulnerabilities and use hardware wallets for added protection.

Focus on a few key strategies

If you're starting fresh on dYdX, a lesser-known but highly effective approach is getting familiar with how their Layer 2 setup works, especially with Starkware. Most beginners worry about gas fees, but here's the trick: focus on how StarkEx gives you lightning-fast trade execution and minimizes costs. This isn’t just a small win — it can actually make a big difference when the market is moving fast. Learn how to open and close trades quickly using this, because when things get volatile, that speed can be your biggest ally.

Another handy move for beginners is taking advantage of dYdX’s cross-margin feature when handling multiple trades. Many newbies stick to isolated trades, but cross-margin lets you manage your capital more smartly. By pooling your balance across different positions, you're less likely to get knocked out by sudden market swings. It gives you room to ride out temporary dips, which is key when the market is unpredictable. Just remember to diversify your trades so you're not putting all your eggs in one basket, and you’ll stay safer while using this tool.

Conclusion

dYdX is a powerful platform for those looking to trade in a decentralized, non-custodial environment. Its advanced features and robust security make it an excellent choice for experienced traders, while beginners can benefit from its educational resources and supportive community.

FAQs

Can I use dYdX without a hardware wallet?

Yes, you can use dYdX with software wallets like MetaMask, but for added security, a hardware wallet is recommended.

Why is my dYdX withdrawal taking so long?

Withdrawal times can vary depending on network congestion and gas fees. Make sure you’ve covered the required gas fee and check if you’re using the correct Layer-2 to Layer-1 withdrawal method.

Can I trade on dYdX if I’m in the U.S.?

No, dYdX currently restricts U.S. users from trading due to regulatory concerns. Using a VPN to bypass this is against their terms of service and not recommended.

Why did my position get liquidated so quickly on dYdX?

Liquidations occur when your collateral falls below the maintenance margin. Using high leverage increases the risk of quick liquidation during volatile price swings.

Related Articles

Team that worked on the article

Oleg Tkachenko is an economic analyst and risk manager having more than 14 years of experience in working with systemically important banks, investment companies, and analytical platforms. He has been a Traders Union analyst since 2018. His primary specialties are analysis and prediction of price tendencies in the Forex, stock, commodity, and cryptocurrency markets, as well as the development of trading strategies and individual risk management systems. He also analyzes nonstandard investing markets and studies trading psychology.

Also, Oleg became a member of the National Union of Journalists of Ukraine (membership card No. 4575, international certificate UKR4494).

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Ethereum is a decentralized blockchain platform and cryptocurrency that was proposed by Vitalik Buterin in late 2013 and development began in early 2014. It was designed as a versatile platform for creating decentralized applications (DApps) and smart contracts.

Scalping in trading is a strategy where traders aim to make quick, small profits by executing numerous short-term trades within seconds or minutes, capitalizing on minor price fluctuations.

Algorithmic trading is an advanced method that relies on advanced coding and formulas based on a mathematical model. However, compared to traditional trading methods, the process differs by being automated.

Volatility refers to the degree of variation or fluctuation in the price or value of a financial asset, such as stocks, bonds, or cryptocurrencies, over a period of time. Higher volatility indicates that an asset's price is experiencing more significant and rapid price swings, while lower volatility suggests relatively stable and gradual price movements.

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.