The Truth About Forex Trading With No Fees

Best low-cost Forex broker - RoboForex

The top low-cost Forex brokers are:

RoboForex - RAW spread account commission $2 per side, spread from 0.2 pips;

Tickmill – ECN account commission $2 per side, spread from 0.2 pips;

AvaTrade – $3 per side, tight spreads from 0.2 pips;;

IC Markets – $3 per side, average EURUSD spread from 0.1 pips;

Exness - $3.5 per side, average EURUSD spread from 0.1 pips

Forex transactions are not entirely fee-free, as traders may face various costs, including spreads, commissions, and swap fees.These costs can add up and seriously impact the profitability of trades, creating problems for traders looking to optimize their trading strategies while minimizing costs.

While it may be challenging to eliminate all fees in Forex trading, some can be avoided. This guide takes you through the strategies and choices that traders can make to mitigate these costs.

Completely you cannot trade Forex without commissions, as then Forex brokers would do their job for free. However, you can utilize the services of low-cost Forex brokers so that the commissions they apply to have the least impact on the bottom line of your trades:

-

Why do you need a Forex broker?

A Forex broker is necessary for individual traders and institutions to access the foreign exchange market. Brokers facilitate currency trading by providing a platform, market analysis, and order execution services. Forex Brokers act as intermediaries, connecting traders with the interbank Forex market.

-

How does a zero-spread Forex broker earn money?

A zero-spread Forex broker typically charges a commission per trade instead of widening the spread. While the spread is technically zero, traders pay each transaction a fixed or variable commission. This commission serves as the primary source of revenue for zero-spread brokers.

-

Can you trade Forex without money?

Yes, you can practice trading without risking real money with a demo account. Brokers provide demo accounts and simulate live market conditions.

-

How do I avoid swap fees in Forex?

Swap fees, also known as rollover or overnight financing fees, are incurred when holding a position overnight. To avoid swap fees, you can close positions before midnight and reopen them after midnight. Or open a special account for Muslims, where there are no swap commissions on religious grounds.

Is there a fee for Forex trading?

If a Forex broker says trading is free, it doesn't mean they are doing everything for nothing. Trading without fees might sound great, but it is tricky because there are still other indirect costs you might not see upfront.

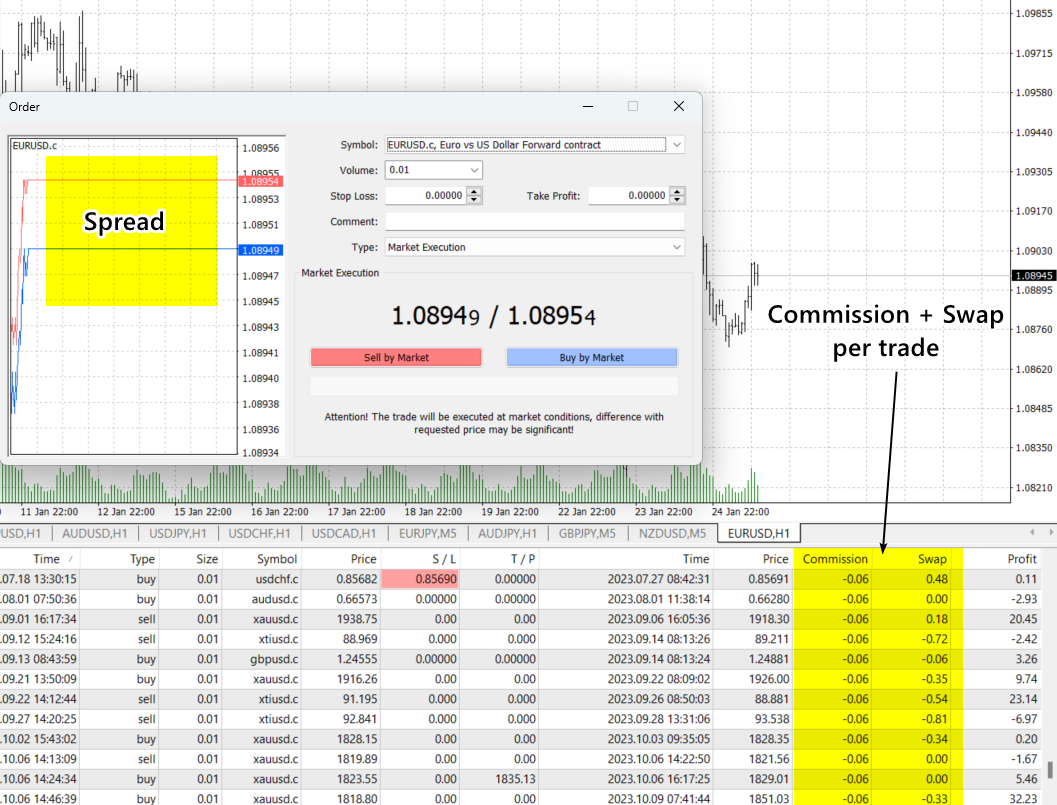

Commissions, swaps and spreads are explained in this screenshot from MT4

Here are the fees charged by the Forex brokers:

-

Commissions

Traditional Forex brokers charge commissions per trade, typically a percentage of the trade value. For instance, if you trade $10,000 and the commission is 0.1%, you pay $10 as a fee.

Now, some brokers say they are "commission-free," meaning they don't charge this explicit fee. But they might still make money from the bid-ask spread, which is the difference between buying and selling prices of a currency.

-

Bid-ask spread

The bid-ask spread is the gap between the buying price (the rate at which the broker is ready to purchase a currency pair) and the selling price (the rate at which the broker is ready to sell a currency pair). A larger spread means higher trading costs. For instance, if the spread for EUR/USD is 1 pip (0.0001), trading $10,000 of EUR/USD would cost you $10.

-

Inactivity Fees - Inactivity fees are charges imposed when an account remains dormant or unused for a specified period. For example, a broker may charge $10 per month if there is no trading activity for six consecutive months.

-

Swap Fees - They are also known as overnight or rollover fees, which occur when a trader holds a position overnight. It's an interest payment or charge for borrowing or lending currencies.

-

Account Maintenance Fees - Account maintenance fees are regular charges for managing and servicing your trading account. This could include access to research tools, customer support, and other account-related services.

-

Deposit/Withdrawal Fees - Deposit and withdrawal fees are charges associated with adding funds to or taking funds out of your trading account. These fees vary among brokers and can be a fixed amount or a percentage of the transaction.

Can you trade for free for Forex?

While some brokers may advertise commission-free trading in the Forex market, it's essential to know that traders might not escape paying the bid-ask spread. So, while you might not pay explicit commissions, there may still be costs associated with the spread.

Traders can trade Forex for free using the demo accounts but to explore more Forex trading, traders can consider opting for Forex Brokers With Low Commissions And Tight Spreads:

| Name | Min deposit | Commissions | Spreads |

|---|---|---|---|

$10 |

20 per 1 million USD trade/2 per side |

0.2 pip |

|

$100 |

2 per side per 100,000 traded. |

0.2 pip |

|

$100 |

$6 per 1.0 standard round lot |

0.2 pip |

|

$200 |

$3.0 ($6 per lot round turn) |

0.1 pip |

|

$200 |

3.5 per side per 100,000 traded |

0.1 pip |

Tips for finding Forex brokers with low fees

-

Compare spreads - Check the bid-ask spreads when comparing brokers; tighter spreads are better for the currency pairs you plan to trade.

-

Ask about other fees - Inquire about additional fees before opening an account to ensure you're aware of all associated costs.

-

Consider commission-free brokers - For those who trade a lot, consider commission-free brokers as they can be a cost-effective choice compared to those charging high commissions.

To get more alternatives to start Forex trading with minimal costs, take advantage of this special review: Top Low (Tight) Spread Forex Brokers

Conclusion

Selecting the best Forex broker is based on what suits your specific needs and how you prefer to trade. Make sure to thoroughly research and compare various brokers before you decide to open an account. Try trading on a demo account to understand how the commission structure affects the performance of your strategy.

Team that worked on the article

Upendra Goswami is a full-time digital content creator, marketer, and active investor. As a creator, he loves writing about online trading, blockchain, cryptocurrency, and stock trading.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Tobi Opeyemi Amure is an editor and expert writer with over 7 years of experience. In 2023, Tobi joined the Traders Union team as an editor and fact checker, making sure to deliver trustworthy and reliable content. The topics he covers include trading signals, cryptocurrencies, Forex brokers, stock brokers, expert advisors, binary options.

Tobi Opeyemi Amure motto: The journey of a thousand miles begins with a single step.